Common menu bar links

Breadcrumb Trail

ARCHIVED - Canada Revenue Agency - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Message from the Minister

Most Canadians give little thought to tax collection, other than at tax time each spring, yet every day the work of the Canada Revenue Agency (CRA) has a direct impact on our lives and livelihoods. Governments across Canada depend on the CRA to collect revenue needed to pay for a vast range of social and economic programs and benefits that sustain our high standard of living and quality of life.

Through its unparalleled service to Canadians, the CRA helps us understand and meet our tax responsibilities. Along with firm enforcement measures that discourage non-compliance, such as those aimed at individuals and businesses participating in the underground economy or attempting to avoid taxes through aggressive tax planning, the CRA works to ensure that everyone pays their fair share. Protecting Canada’s revenue base is particularly important in these economically challenging times, when governments must exercise fiscal restraint while continuing to meet the needs and expectations of Canadians.

The Government of Canada is committed to helping hard-working Canadians save money wherever they can. We have introduced important new tax relief measures under the next phase of our Economic Action Plan. These measures, aimed at individuals, families and businesses, include the Children's Arts Tax Credit, the Working Income Tax Benefit, the Canada Employment Credit, the First Time Home Buyers Tax Credit, and the Volunteer Firefighter Tax Credit. Thanks to these and ongoing tax relief programs, the average family of four now receives $3,000 in extra tax savings. In fact, the federal tax burden is at an all-time low in Canada, the lowest level in more than a half a century. I encourage people to visit the CRA Web site to learn more about these tax savings so they can take full advantage of them.

The CRA Departmental Performance Report 2010‑2011 highlights the many ways the organization is constantly improving, evolving and expanding its core business to secure the ongoing economic and social well-being of Canadians. Since being named Minister of National Revenue, I have had the pleasure to witness this progress for myself. The CRA consistently demonstrates that it is a world-class tax and benefit administrator that provides value to its government clients, and a fair and accessible revenue collector in whom Canadian taxpayers can confidently put their trust.

As Minister of National Revenue, I am pleased to present the Departmental Performance Report 2010‑2011 for tabling.

Message from the Commissioner and Chief Executive Officer

The Canada Revenue Agency (CRA) makes a major contribution to Canada’s economy and the social well-being of Canadians. We administer taxes for federal, provincial, territorial, and First Nations governments, and also help to advance governments’ social goals through our administration of benefit programs that increase the standard of living of many Canadians. Our reputation as a world-class tax and benefits administration is well-earned and we are proud of our accomplishments over the past year.

During 2010-2011, the CRA continued to focus on ensuring the integrity of Canada’s tax and benefits systems through initiatives designed to promote compliance with tax legislation, to strengthen services for individuals and business to make compliance easier, and to put in place ways that make non-compliance more difficult. Our work to expand outreach to selected groups of Canadians through electronic means is an important step toward improved voluntary compliance while increased opportunities for taxpayers to interact with the CRA through electronic means is a way that we are strengthening our services. To ensure that individuals were aware of, and could apply or register for, their entitlements to benefits and credits, we ensured that taxpayers had access to information they needed.

To make non-compliance more difficult, we undertook actions to counter aggressive tax planning schemes and underground economic activity. Among our most notable achievements this past year was our timely and efficient implementation of the Harmonized Sales Tax (HST) for the provinces of Ontario and British Columbia. The CRA will continue to administer the HST in BC until the transition back to GST in that province. Another noteworthy undertaking during 2010-2011 was our participation in an international tax benchmarking exercise, which saw selected CRA results compared with nine other Western tax administrations. This study revealed that the CRA has in place many of the leading practices in tax administration, and is often in the top ranking for cost effectiveness. I was particularly pleased to see that the CRA’s debt collection function achieved top results. We will carefully review opportunities revealed to further enhance our effectiveness.

As we move forward, we are cognizant of the evolving economic environment; in particular, the government’s priority to restore budgetary balance, in part by asking all federal government departments and agencies to contain costs. We have set in motion a plan to respond quickly and responsibly to this directive in order to maintain our core business while making prudent investments to sustain our operations over the longer term.

I would like to extend my sincere thanks for the dedication, knowledge, and professionalism of the staff of the CRA, qualities that will enable us to continue to deliver quality results that matter to Canadians.

Section I: Agency overview

Our raison d’�tre

Canada’s tax system is based on voluntary compliance and self-assessment. A well-functioning tax system is critical to the ability of federal, provincial, territorial, and First Nation governments to deliver programs and services that are important to Canadians and Canadian businesses.

The Canada Revenue Agency (CRA) has the mandate to administer tax, benefit, and other programs on behalf of the Government of Canada and provincial, territorial, and First Nations governments.

Parliament created the CRA so we could meet the mandate by:

- providing better service to Canadians;

- offering more efficient and more effective delivery of government programs; and

- fostering closer relationships with provinces and other levels of government for which the CRA delivers programs, and providing better accountability.

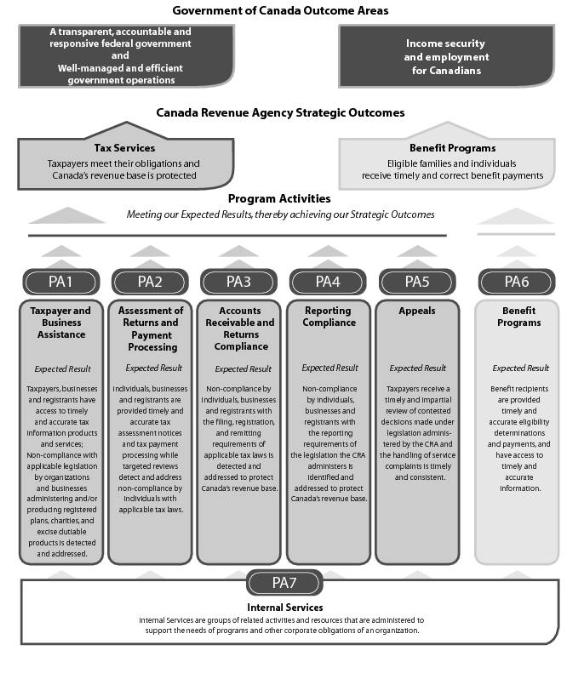

The CRA’s mandate reflects the broad role that the CRA plays in the lives of Canadians. The CRA contributes to three of the Government of Canada’s outcome areas:

- A transparent, accountable and responsive federal government;

- Well-managed and efficient government operations; and

- Income security and employment for Canadians.

Responsibilities

The CRA exercises its mandate within a framework of complex laws enacted by Parliament, as well as by provincial and territorial legislatures.

No other public organization touches the lives of more Canadians on a daily basis. Each year, we collect billions of dollars in tax revenue and deliver income-based benefits, credits, and other services that help families and children, low- and moderate-income households, and persons with disabilities. These programs contribute directly to the economic and social well-being of Canadians.

The following two strategic outcomes summarize our contribution to Canadian society.

- Taxpayers meet their obligations and Canada’s revenue base is protected; and

- Eligible families and individuals receive timely and correct benefit payments.

In July 2010, the CRA implemented the harmonized sales tax (HST) in Ontario and British Columbia Footnote 1.

The CRA also verifies taxpayer income levels in support of a wide variety of federal, provincial, and territorial programs, ranging from student loans to health care initiatives. In addition, we provide other services, such as the Refund Set-Off Program, through which we aid other federal agencies and departments, as well as provincial and territorial governments, in the collection of debts that might otherwise become uncollectible.

Strategic outcome(s) and program activity architecture (PAA)

Organizational priorities

The CRA is responsible for administering, assessing, and collecting billions of dollars in taxes annually. We deliver tax services and benefit programs that support the economic and social well-being of Canadians, including families and children, low- and moderate income households, and persons with disabilities.

The CRA’s mandate sets out two strategic outcomes that summarize its contribution to Canadian society. The achievement of these outcomes demonstrates that we are fulfilling our mandate from Parliament.

We are continually evolving our strategic direction and refining our vision to meet challenges within our changing environment. We have increased our emphasis on mitigating risk factors which may impact our capacity to deliver services to Canadians.

We have introduced five overarching strategic elements to guide our work over the planning period. Our tax and benefit operational and management focus will be on building trust to promote compliance, strengthening service to make compliance easier, making non-compliance more difficult, making it easier to receive the right social benefits, and maintaining business sustainability.

The tables below links our priorities to the achievement of our strategic outcomes.

|

Type

Table note 1 |

||

|---|---|---|

|

We continually seek to build on the trust and confidence of our stakeholders in the CRA. Our objective is to make sure that Canadians have access to the information they need to voluntarily comply with Canada’s tax laws as well as impartial and timely review of contested decisions. We work to build and

maintain the trust and confidence of Canadians and our stakeholders through a range of activities and by treating their personal information confidentially. Our tax system works best when individuals and businesses believe that the CRA can be trusted to be fair, efficient, and impartial.

|

||

|

Type Table note 1

|

||

|---|---|---|

|

Type

Table note 1 |

||

|---|---|---|

|

Although instances of non-compliance are not frequent, they have a significant fiscal impact and erode the integrity of the tax and benefit system. We must continue to apply innovative strategies to remove the remaining opportunities for non-compliance.

Non-compliance is the failure, for whatever reason, to register as required under the law, file returns on time, report complete and accurate information to determine tax liability, and pay all amounts when due. It takes many forms, from errors and omissions to deliberate tax evasion. We are constantly assessing non-compliance risks and taking steps to focus

our resources on areas of highest risk in order to make non-compliance more difficult. Ensuring compliance with Canada’s tax and benefit legislation is essential to protecting Canada’s tax revenue.

|

||

|

||

|

Type

Table note 1 |

||

|---|---|---|

|

The CRA supports the efforts of federal, provincial, and territorial governments by administering benefits to families, low- and moderate-income households, and persons with disabilities. Our objective in administering benefits is to make sure that Canadians have access to the benefits and credits to which they

are entitled, and that related payments are timely and correct.

|

||

|

Type Table note 1

|

||

|---|---|---|

|

We must ensure that we have in place the modern and innovative management practices and sound infrastructure necessary to maintain the sustainability of the high-quality tax, benefit, and related services we deliver on behalf of governments across Canada.

We invest resources each year to make sure that we can comply with the accountability requirements of financial and administrative legislation, regulations, and government policies and directives, and to sustain and advance our core information technology (IT) functions, which are critical to the delivery of

all our programs. In addition, we use effective human resources practices that keep us competitive in the labour market.

|

||

|

||

- Table note 1

- Type is defined as follows: Previously committed to—committed to in the first or second fiscal year before the subject year of the report; Ongoing—committed to at least three fiscal years before the subject year of the report; and New—newly committed to in the reporting year of the DPR.

Risk analysis

The Enterprise Risk Management program is designed to effectively manage risks through a systematic and comprehensive approach that is methodically integrated into CRA’s decision-making, planning, and reporting processes.

An update to Our Corporate Risk Inventory 2009 was completed in 2010. The 2010 edition of the Inventory was developed by conducting interviews that provided a broad perspective on shifts in the internal and external environments that drove changes to the risks presented in the 2009 Inventory. The conclusion drawn from these interviews was that no significant changes to the enterprise risks have been identified that warrant additional action. Consequently, we are continuing to implement strategies for already identified risks requiring mitigation.

During 2010-2011, we consulted with national and international organizations from the public and private sectors as well as communities of expertise on leading practices. Based on our research findings, we adopted an improved enterprise risk management cycle. This multi-year approach will eliminate cycle overlap and process fatigue, provide a more horizontal outlook, and reduce inefficiencies while increasing the availability of more timely and relevant risk information.

Through an updated methodology and approach, we began the development of our Corporate Risk Profile 2011. We are using environmental scans, risk interviews and risk analysis to support risk responses and action plans. We have increased the level of risk management training throughout the organization, while improving the efficiency and content of our training programs. Additional work continues to develop a more agile and robust enterprise risk management regime.

Summary of performance

2010-2011 Financial resources (thousands of dollars)

|

Taxpayer and business assistance (PA1) Table note 2

|

||||||

|

Assessment of returns and payment processing (PA2) Table note 3

|

||||||

|

Benefit programs (PA6) Table note 4

|

||||||

|

Internal services (PA7) Table note 5

|

||||||

|

|

||||||

|

|

||||||

- Table note 2

- Includes the Softwood Lumber statutory disbursements ($205.5 million in 2009-2010 and $220.7 million in 2010-2011). Return to Table note 2 source text

- Table note 3

- Includes payments to the Minist�re du Revenu du Qu�bec for the administration of the Goods and Services Tax in that province ($148.4 million in 2009-2010 and $142.2 million in 2010-2011). Return to Table note 3 source text

- Table note 4

- Includes a) Relief for Heating Expenses (program announced in 2000) ($500.0 thousand in 2009-2010 and $4.0 thousand in 2010-2011); b) Energy Costs Assistance Measures expenses (program announced in the Fall of 2005) ($21.2 thousand in 2009-2010 and $4.7 thousand in 2010-2011); and c) Statutory Children’s Special Allowance payments ($215.3 million in 2009-2010 and $222.4 million in 2010-2011). Return to Table note 4 source text

- Table note 5

- For planning purposes, the budget for real property accommodations is shown in Internal Services, however, at year-end the actuals are attributed to all other program activities. Return to Footnote 5 source text

Expenditure profile

Canada’s Economic Action Plan

In 2010-2011, the CRA was provided with $9.6 million in action plan funding to administer the Home Renovation Tax Credit and First-Time Home Buyers Tax Credit. Additional monies were also provided for late filing and incorrect format penalties and for the simplification of GST/HST for the direct selling industry. These supplementary funds enabled the CRA to augment its capacity to deal satisfactorily with the increased information requirements presented by these initiatives.

Figure 1 Spending Trends

For the period 2006-2007 to 2010-2011, total spending amounts include all Parliamentary appropriations and revenue sources: Main Estimates, Supplementary Estimates, funding associated with the increased personnel costs of collective agreements, maternity allowances and severance payments, as well as funding to implement Federal Budget initiatives and the Agency’s carryforward adjustments from the prior year. It also includes spending of revenues received through the conduct of CRA’s operations pursuant to Section 60 of the Canada Revenue Agency Act, Children’s Special Allowance payments, payments to private collection agencies pursuant to Section 17.1 of the Financial Administration Act and disbursements to the provinces under the Softwood Lumber Products Export Charge Act, 2006.

Since 2006-2007 the Canada Revenue Agency’s reference levels have changed primarily as a result of: collective agreements/contract awards; policy and operational initiatives arising from various Federal Budgets and Economic Statements; transfers from the Department of Public Works and Government Services Canada for accommodations and real property services; the Softwood Lumber Agreement; and the commencement of responsibilities related to the administration of corporate tax in Ontario and the harmonization of sales tax in Ontario and British Columbia. Over the same period, there have also been a number of decreases as a result of various government-wide budget reduction exercises.

Expenditures pursuant to the Agency’s Statutory Authorities have fluctuated over the course of the 2006-2007 to 2010-2011 period as a result of: adjustments to the Children’s Special Allowance payments for eligible children in the care of specialized institutions; adjustments to the rates for the contributions to employee benefit plans; increases to the spending of revenues received through the conduct of operations pursuant to Section 60 of the Canada Revenue Agency Act; the introduction from 2007-2008 to 2009-2010 of payments to private collection agencies pursuant to Section 17.1 of the Financial Administration Act; and finally, the introduction in 2006, and annual adjustments to, disbursements to the provinces under the Softwood Lumber Products Export Charge Act, 2006.

In 2010-2011, of the $4,596.7 million total authority, CRA’s actual spending totalled $4,418.5 million resulting in $178.2 million remaining unexpended at year-end. After deducting unused resources to be returned to the Treasury Board related to advertising campaigns, the remaining $178.0 million is available for use by the Agency in 2011-2012. This amount represents 3.9% of the total authority.

Authorities approved After Main Estimates

The following table details the additional authorities approved for the Agency after the tabling in Parliament of Main Estimates and reconciles with the Total Authorities shown here.

- Table note 6

- Numbers may not add due to rounding. Return to Table note 6 source text

Estimates by vote

For information on our organizational votes and/or statutory expenditures, please see the 2010-11 Public Accounts of Canada (Volume II) publication. An electronic version of the Public Accounts is available at

http://www.tpsgc-pwgsc.gc.ca/recgen/txt/72-eng.html.