ARCHIVED - Canada Revenue Agency

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2008-09

Departmental Performance Report

Canada Revenue Agency

The original version was signed by

The Honourable Jean-Pierre Blackburn, P.C., M.P.

Minister of National Revenue

Table of Contents

- Section I: Agency Overview

- Section II: Analysis of Program Activities by Strategic Outcome

- Section III: Supplementary Information

Section I: Agency Overview

Message from the Minister

The Canada Revenue Agency (CRA) makes a difference in the lives of Canadians every day. We do this by providing a strong, equitable, and responsive tax system that has become the cornerstone of our country’s prosperity and the foundation of our social structure.

This year, the CRA celebrates 10 years as a government agency, a period marked by innovation and continuous improvement in services to Canadians and businesses.

I am proud of the tremendous collaboration demonstrated by the CRA and Finance Canada, who together worked with financial institutions across the country on the recent launch of the Tax-Free Savings Account (TFSA), the most important tax innovation in a generation.

We are providing excellence in program delivery by working to ensure that Canadians pay their fair share of taxes on behalf of federal, provincial, and territorial governments. In particular, our compliance work includes actions to counter aggressive tax planning, that is, arrangements that cross the boundary of acceptable tax planning.

The CRA is working to encourage Canadian business and the Canadian economy. We are reducing the paperwork burden that impacts business profitability and productivity. This is an important effort, especially in these difficult economic times.

“Together, we are ensuring that Canadians enjoy a flexible and innovative tax regime that is accessible, equitable to taxpayers, and keeps our business solidly competitive in the global marketplace.”

As the administrator of the Scientific Research and Experimental Development (SR&ED) investment tax credit, which is considered one of the best incentives for research and development in the world, the CRA is contributing to Canada’s international business competitiveness. In addition to providing more than $4 billion in tax credits to over 18,000 claimants, we are strengthening our administrative resources to increase SR&ED accessibility to more Canadian businesses.

The steps we are taking to assist individual Canadians and businesses will help maintain the high level of confidence that Canadians have in the CRA. As we move into our second decade as an agency, we will continue to improve our services and respond to the diverse needs of taxpayers and benefit recipients.

It is my privilege and honour to present the Departmental Performance Report 2008-2009 for the Canada Revenue Agency.

The Honourable Jean-Pierre Blackburn, P.C.,

M.P.

Minister of National Revenue and

Minister of State (Agriculture and Agri-Food)

Message from the Commissioner and Chief Executive Officer

As the Commissioner and Chief Executive Officer of the Canada Revenue Agency (CRA), I take pride in being a part of such an outstanding public service organization as it celebrates its tenth anniversary. Looking back, I am inspired by how far we have come and how much we have accomplished during the past decade. We embarked on a program of change to inject fresh ideas into the way we operate and provide service to Canadians. Even though we have been recognized for our innovation and our commitment to service excellence, we know that we cannot simply rely on our past achievements—we can always do better.

Achieving Our Vision

Our vision is to be the model for trusted tax and benefit administration, providing unparalleled service and value to our clients and offering our employees outstanding career opportunities.

“The Canada Revenue Agency is one of the largest service organizations in the country. We do business with more Canadians than any other department or agency of government.”

To achieve our vision, we have pursued two overarching objectives—excellence in program delivery and excellence in the workplace. In terms of excellence in program delivery, we met or exceeded many of our targets. For example, we made it easier for callers to reach us through our telephone service; we worked in close partnership with our provincial counterparts in Alberta, Ontario, and Quebec to recover more than half a billion dollars in taxes from unacceptable aggressive tax planning arrangements that crossed provincial boundaries; we expanded electronic options for business users to include GST/HST NETFILE; and we again achieved very strong results related to the delivery of benefit programs.

In terms of the second overarching objective—excellence in the workplace—we have developed and acted upon the first iteration of our Agency Workforce Plan, which fully integrated human resources and business planning. Several initiatives have been acted upon to address challenges identified in the plan. On March 31, 2009, the second iteration of our Agency Workforce Plan (2009-2010 to 2011-2012) was published, aligned with our Corporate Business Plan, which covered the same period.

Overall, our 2008-2009 results related to the administration of tax and benefit programs remain strong. Most taxpayers met the deadline for filing their returns and for paying amounts owing, and most taxable corporations paid amounts due on time.

We need to ensure, however, that more taxable corporations file their returns on time, and that more employers remit source deductions on behalf of employees on time. Taking all these results into consideration, I remain confident that we can overcome the challenges in key high-risk areas over the long term with a view to achieving our vision.

Progress on Priorities

We have in place an ambitious change agenda to respond to the many challenges we face. During 2008-2009, we made important progress in our commitment to excellence, including the following.

Strengthening service – In December 2008, we launched our comprehensive Service Strategy. This strategy is the result of extensive collaboration with internal stakeholders across the country, with the common objective of working in an integrated and horizontal fashion to develop and deliver our products and services.

Enhancing our efforts to address non-compliance – We conducted our second compliance review this past year. Similar to our first review, this compliance review process resulted in identifying five key high-risk priority areas: aggressive tax planning, the underground economy, payment compliance, wilful non-compliance, and contraband tobacco. As well, we undertook further work to implement our Benefits Compliance Strategy Action Plan by researching and analyzing enforcement and deterrence issues in an effort to understand and evaluate the benefits and credits at risk.

Reinforcing trust – Our service complaints framework has recently made redress more comprehensive. This framework has, at its foundation, the Taxpayer Bill of Rights which has been expanded to include eight service rights. Furthermore, we implemented our Service Complaints Program, to provide taxpayers with a formal resolution process for complaints about mistakes, undue delays, and other issues related to service.

“No longer are we just the federal government’s tax collector—we have become a broad-based tax and benefit administration providing services and support to a wide range of public sector clients.”

Maintaining effective relationships – The strength of our collaborative efforts was demonstrated most recently in the successful conclusion of the Memorandum of Agreement for the harmonization of the Ontario sales tax, the second harmonization initiative that we have undertaken with Ontario. The implementation of corporate tax administration proceeded as planned—on time and within budget.

Meeting our mandate

The overall goal of the CRA is to administer tax, benefits, and related programs and to ensure compliance on behalf of governments across Canada, thereby contributing to the ongoing economic and social well-being of Canadians.

Our employees are known for carrying out their duties with integrity and professionalism. We are an organization that is highly visible—one that touches the lives of all Canadians—and we are very proud of the excellent reputation we’ve earned. The fact that we have once again quickly and accurately delivered on government priorities speaks to the professionalism and dedication of our workforce.

“The CRA is known as a modern and vibrant organization, with a tradition of innovation and technological change.”

Going forward, we will strive to further our working relationships with federal departments, provinces, and territories to forge links between the social responsibility inherent in paying taxes and the civic rights and benefits enjoyed in Canada. We will sustain our strong international presence in organizations such as the Organisation for Economic Co-operation and Development (OECD) and the Inter-American Centre of Tax Administration to advance protocols and practices to guide the work of tax administrations around the world.

We will seek opportunities to reduce the administrative burden and overall cost of government and we will build on our position as an innovative service leader and a separate employer to create a workplace culture of intelligent risk management and innovation.

William V. Baker

Commissioner and Chief Executive Officer

Canada Revenue Agency

Our Raison d’être

The Canada Revenue Agency (CRA) has the mandate to administer tax, benefit and other programs on behalf of the Government of Canada and provincial, territorial and First Nations governments.

Parliament created the CRA so we could meet the mandate by:

- providing better service to Canadians;

- offering more efficient and more effective delivery of government programs; and

- fostering closer relationships with provinces and other levels of government for which the CRA delivers programs, and providing better accountability.

The CRA’s mandate reflects the broad role that the Agency plays in the lives of Canadians. The CRA contributes to two of the Government of Canada’s Strategic Outcomes: Federal organizations that support all Government of Canada outcomes and Income Security and Employment for Canadians.

The Canada Revenue Agency (CRA) exercises its mandate within a framework of complex laws enacted by Parliament, as well as by provincial and territorial legislatures. The CRA collected more than $366 billion in 2008-2009 on behalf of Canada, the provinces (except Quebec), territories, and First Nations.

Benefit to Canadians

No other public organization touches the lives of more Canadians on a daily basis than the Canada Revenue Agency (CRA). Each year we administer billions of dollars in tax revenue and distribute timely and accurate benefit payments to millions of Canadians. We deliver income-based benefits, credits, and other services that assist families and children, low and moderate-income households, and persons with disabilities, programs that contribute directly to the economic and social well-being of Canadians.

Our ability to deliver efficient, timely, and accurate high-volume programs and services makes us a valuable partner for government clients.

The following two strategic outcomes summarize the CRA’s contribution to Canadian society.

- Taxpayers meet their obligations and Canada’s revenue base is protected; and

- Eligible families and individuals receive timely and correct benefit payments.

In addition to the administration of income tax and benefit programs, the CRA administers sales tax for three provinces and verifies taxpayer income levels in support of a wide variety of federal, provincial, and territorial programs, ranging from student loans to health care initiatives. We also provide other services, such as the Refund Set-off Program, through which we aid other federal departments, as well as provincial and territorial governments, in the collection of debts that might otherwise become uncollectible.

This Performance Report assesses the extent to which we achieved these outcomes during the 2008-2009 fiscal year. On balance, our results show that we met both our strategic outcomes.

Risk Analysis

The purpose of Enterprise Risk Management (ERM) Program is to ensure that the Agency develops and implements a systematic, comprehensive approach to managing risks as a management function that is fully integrated into the Agency’s decision-making, planning and reporting processes and mechanisms.

In support of corporate risk management, the two key ERM products are the Corporate Risk Inventory (CRI) and the CRA Risk Action Plan. The CRI presents a strategic, high-level snapshot of the Agency’s risk status. The Agency’s response to each risk in the CRI is captured in a companion document, the CRA Risk Action Plan.

In addition to efforts to align corporate risk information with the Agency’s planning and resource allocation cycles, the Agency is making strides to embed risk information and commitments in other key products and processes including the Corporate Business Plan, the Corporate Audit and Evaluation Plan, and the Executive Cadre’s Accountability Regime.

Rating our Results

We use qualitative and quantitative indicators to determine the results achieved in terms of our strategic outcomes and expected results. Survey results, statistical sampling, and operational data inform our assessments. Although we have made progress in developing robust indicators for each of our strategic outcome measures and expected results, we need to make some of them more concrete and measurable.

We also rate our strategic results and those of our program activities in terms of whether the targets identified in our 2008-2009 Report on Plans and Priorities were met, mostly met, or not met.

Our targets identify the percentage or degree we expect to attain for a performance level. Where targets are numeric in nature, they are listed beside each indicator. Performance targets are established by our management teams through analysis of affordability constraints, historical performance, the complexity of the work involved, and the expectations of Canadians.

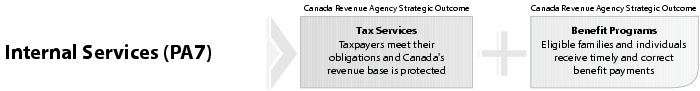

Our Program Activity Architecture

The Program Activity Architecture depicted below, identifies our program activities (PAs) and demonstrates how they link to our strategic outcomes. This framework is based on the Management, Resources and Results Structure established by the Treasury Board of Canada Secretariat on April 1, 2005.

Program activities are groups of related activities that are designed and managed to meet a specific public need and reflect how we allocate and manage our resources in order to achieve intended results.

Performance Summary

Alignment to Government of Canada Outcomes

|

Main Estimates[Footnote 1]

|

Planned Spending[Footnote 1]

|

Total Authorities[Footnote 2]

|

Actual Spending[Footnote 2]

|

|||

|---|---|---|---|---|---|---|

|

Taxpayer and Business Assistance (PA1)[Footnote 3]

|

||||||

|

Assessment of Returns and Payment Processing (PA2)[Footnote 4]

|

||||||

|

Accounts Receivable and Returns Compliance (PA3)[Footnote 5]

|

||||||

|

Main Estimates[Footnote 1]

|

Planned Spending[Footnote 1]

|

Total Authorities[Footnote 2]

|

Actual Spending[Footnote 2]

|

|||

|---|---|---|---|---|---|---|

|

Benefit Programs (PA6)[Footnote 3]

|

||||||

|

Main Estimates[Footnote 1]

|

Planned Spending[Footnote 1]

|

Total Authorities[Footnote 2]

|

Actual Spending[Footnote 2]

|

||

|---|---|---|---|---|---|

2008-2009 Financial Resources (thousands of dollars)

2008-2009 Human Resources Full Time Equivalents (FTE)

Contribution of Priorities to Strategic Outcomes

As identified in our 2008-2009 Report on Plans and Priorities, our tax and benefit focus over the planning period was on strengthening service, enhancing efforts to address non-compliance, reinforcing trust, and maintaining effective relationships.

The following table identifies the strategic priorities we pursued in 2008-2009, our results, and how these priorities support our Strategic Outcome(s).Additional details concerning individual program activity achievements related to these strategic priorities are provided in Section II: Analysis of Program Activities by Strategic Outcome.

Our Strategic Outcome Measures

We use our strategic outcome measures to gauge the compliance behaviour of Canadian taxpayers. Using data from internal and external sources as a baseline of compliance information, we group these indicators into the following four broad categories of taxpayer obligations to help us measure and assess our results against our Tax Services strategic outcome.

- Registration Compliance estimates the proportion of Canadian businesses that have registered as required by law to collect the GST/HST.

- Filing Compliance indicators estimate the proportion of the Canadian population who file their returns on time.

- Reporting Compliance indicators contribute to our assessment of the degree to which taxpayers report complete and accurate information.

- Remittance Compliance indicators estimate the proportion of taxpayers who owed taxes and paid the full amount on time.

To facilitate further analysis of compliance behaviour, we partition the Canadian taxpayer population into the following types: individuals, self-employed individuals, corporations, GST/HST registrants, and employers. Also included are macro-indicators, which we use to evaluate reporting compliance trends.

Our Tax Services Strategic Outcome Measures

|

Our Indicators[Footnote 1]

|

|||||||

|---|---|---|---|---|---|---|---|

|

Corporations – taxable incorporated businesses that filed their returns

on time[Footnote 2]

|

|||||||

|

Our Indicators[Footnote 1]

|

|||||||

|---|---|---|---|---|---|---|---|

|

Percentage of taxable corporations that paid their reported taxes

on time[Footnote 2]

|

|||||||

|

Businesses that collected

GST/HST[Footnote

3]

|

|||||||

Through the progress we have made during 2008-2009 in implementing major components of our innovation agenda, we believe we have made significant gains towards improving our capacity to protect Canada’s revenue base. Our estimates of taxpayers’ filing, registration, and remittance compliance indicate that overall levels of voluntary compliance with Canada’s tax laws continued to be high in 2008-2009.

Our estimates of reporting compliance, however, indicate the incidence of non-compliance may be slowly increasing. There are indications that the dollars at risk for some taxpayer sectors may be increasing. Although performance results provide evidence that non-compliance is at relatively low levels, the results of our program activities demonstrate that such non-compliance is, in total, financially significant. In 2008-2009, our programs to address reporting non-compliance identified a total dollar value of over $17.8 billion, exceeding our estimates, which we based on historical results combined with available resource levels.

We anticipate the results from the action plans we develop related to our Compliance Review II will have a positive impact on levels of reporting compliance over the long term.

In light of our overall measurement and given that a significant proportion of Canada’s revenue base is subject to third-party reporting, it is our assessment that, for the majority of Canadians, the incidence and magnitude of non-compliance is relatively low, though financially significant. Consequently, it is our assessment that we met our Tax Services strategic outcome in 2008-2009.

Our Benefit Programs Strategic Outcome Measures

It is our assessment that we met our Benefit Programs strategic outcome. Through our efforts in administering benefit programs, eligible families and individuals received timely and correct benefit payments, and our government clients were afforded reliable services, enjoyed lower administration costs and more effective compliance. Benefit recipients can rely on the CRA to administer a better-integrated benefits system of high integrity and be assured that the CRA contributes to reducing the overall cost of government in Canada.

Our Macro Indicators

We also analyze various macro-indicators to evaluate reporting compliance trends. As graphically depicted below, our macro indicators provide us with assurance that taxpayers, in general, are complying with their obligations and that levels of reporting non-compliance are relatively low.

Figure 1: Growth in Personal Income Reported to the CRA Compared With Personal Income Estimated by Statistics Canada

Figure 2: Growth in corporate income taxes that we have assessed tracks favourably with growth in corporate profits before tax estimated by Statistics Canada

Figure 3: Growth in net income of unincorporated businesses reported to us tracks favourably with National Accounts Estimates of the growth in net income of unincorporated Businesses

Figure 4: Due to a variety of factors, including recent reductions in GST rate, trending information related to GST revenue is no longer clear and we can draw no conclusions from this data

Our reporting compliance indicators provide us with a mixed view of taxpayer behaviour. Although our studies of limited populations show material levels of non-compliance, our macro-indicators provide a sense of assurance that levels of reporting non-compliance are relatively low. For these reasons, it is our assessment that, during 2008-2009, we mostly met our reporting compliance expectations.

Expenditure Profile

The trend in the Canada Revenue Agency’s (CRA) reference levels since 2005-2006 is attributable to three main factors, namely, receipt of increased operating resources, contributions to Government-wide expenditure reduction initiatives and fluctuations in the Agency’s statutory authorities. New operating resources were received as a result of collective bargaining settlements and for additional administration activities associated with new initiatives announced in various Federal Budgets and Economic Statements, including the Corporate Tax Administration for Ontario initiative and the Softwood Lumber Products Export Charge Act, 2006. Reference levels have also increased as a result of the transfer from Public Works and Government Services Canada to the CRA to fund accommodation and real property costs. These increases have been offset by the Agency’s contribution to various Government-wide expenditures reduction initiatives. Lastly, fluctuations in the Agency’s statutory authorities related to Children’s Special Allowance payments, employee benefit plan contributions, the spending of revenues received through the conduct of operations pursuant to Section 60 of the Canada Revenue Act, payments to private collection agencies and payments to the provinces under the Softwood Lumber Products Export Charge Act, 2006, have also contributed to the trend in Agency spending over the past four years.

In 2008-2009, of the $4,370.7 million total authority, CRA’s actual spending totalled $4,198.7 million resulting in $172.0 million remaining unexpended at year-end. After deducting unused resources related to the proposed Offshore Trusts initiative and Public Opinion Research savings, the remaining $147.1 million is available for use by the Agency in 2009-2010. This amount represents 3.4% of the total authority.

Voted and Statutory Items

Authorities approved after tabled Main Estimates

The following table details the authorities approved for the Agency after the

Main Estimates and reconciles with the Total Authorities shown on

.

.

Section II: Analysis of Program Activities by Strategic Outcome

Taxpayer and Business Assistance (PA1)

Benefit to Canadians

Our Taxpayer and Business Assistance area assists taxpayers, businesses, and registrants in meeting their obligations under Canada’s self-assessment system by providing accurate and timely responses to their enquiries. Taxpayers have access to the information they need through a variety of channels (e.g. our Web site, telephones, paper publications, in-person, and outreach). In addition, we provide rulings and interpretations to clarify and interpret tax laws, and administer federal tax legislation governing registered plans and charities.

We carry out this program activity to achieve the following Expected Results:

Taxpayers, businesses and registrants have access to timely and accurate information and services and are ensured fair administration of the tax system through responsible enforcement.

A Snapshot of Taxpayer and Business Assistance (PA1)

- Enquiries and Information Services – We handled more than 17.8 million public enquiries and over 32.7 million visits to taxpayer services web based information products pages.

- Excise and GST/HST Rulings and Interpretations – We processed 3,908 written enquiries for rulings and interpretations, and handled almost 101,000 GST/HST-related technical telephone enquiries.

- CPP/EI Rulings – We processed over 71,000 requests for rulings.

- Registered Plans – We administered over 33,000 plans, and conducted 444 audits.

- Charities – We administered more than 84,000 registered charities, processed over 86,000 returns, and conducted 853 audits.

In 2008-2009, spending for this program activity totalled $605 million (4,844 FTEs) or 14.4% of the CRA’s overall expenditures.* Of this $605 million, $483 million was net program expenditures* and $122 million was allocated to this program activity for internal services.

* Spending figures for sub-activities may not add up to this total due to rounding.

Contribution to Agency Priority

Strengthening Service

Performance Report Card

|

Respond to written requests for

GST/HST rulings and interpretations

within 45 working days of receipt of request[Footnote 1]

|

87%[Footnote 2]

|

||||||

For supplementary information on this Program Activity, please visit: www.cra.gc.ca/annualreport

Performance Report Card

For supplementary information on this Program Activity, please visit: www.cra.gc.ca/annualreport

Assessment of Returns and Payment Processing (PA2)

Benefit to Canadians

Our programs contribute to individuals and businesses meeting their filing, reporting, and payment obligations. We undertake a wide range of activities to process individual and business tax returns and payments, including the use of risk assessment, third-party data matching, and information validation to detect and address non-compliance.

We carry out this program activity to achieve the following Expected Result:

Taxfilers receive timely and accurate assessment notices and payment processing for Individual Income Tax, Corporation Income Tax and GST/HST Returns, Excise and Other Levies and adequate checks and balances exist to ensure compliance with applicable tax laws.

A Snapshot of Assessment of Returns and Payment Processing (PA2)

- Individual Returns Processing – We processed more than 27 million individual returns; refunded $26.6 billion to nearly 17.9 million individual taxpayers; and processed over 210,000 T3 trust returns. There were almost 321,000 individuals enrolled and over 3.8 million visits to My Account.

- Business Returns Processing – We processed almost 1.6 million information returns, more than 1.8 million corporate returns and more than 34.7 million payments, totalling almost $366 billion.

In 2008-2009, spending for this program activity totalled $885 million (8,772 FTEs) or 21.1% of the CRA’s overall expenditures.* Of this $885 million, $646 million was for net program expenditures, and $239 million was allocated to this program activity for internal services.

* Spending figures for sub-activities may not add up to this total due to rounding.

Contribution to Agency Priorities

Strengthening Service and Enhancing our Efforts to Address Non-Compliance

|

In response to items identified in the Report of the Canada Revenue

Agency’s Action Task Force on Small Business Issues, we issued a Final Report

on Action Items to the action task force members in November 2008. Of the 61 identified actions items, 31

items were completed and the remaining 30 represent ongoing activities. The report can be viewed at

www.cra.gc.ca/atfreport.

|

|

|

The Performance Measurement Framework

for Compliance Burden Reduction, which measures compliance costs in time and money, will be used to

report on future progress in burden reduction measures. This framework can be viewed at

www.cra.gc.ca/atfreport. |

Performance Report Card

|

Service Standards[Footnote 1]

|

|||||||

|

Processing T1 individual income tax returns: paper within 4-6 weeks2

|

|||||||

|

Processing T1 individual income tax returns: electronic within 2

weeks[Footnote 2]

|

|||||||

|

Percentage of

GST/HST returns processed within

30 days[Footnote 3]

|

|||||||

For supplementary information on this Program Activity, please visit: www.cra.gc.ca/annualreport

Accounts Receivable and Returns Compliance (PA3)

Benefit to Canadians

Our Accounts Receivable and Returns Compliance area manages the largest debt collection service in Canada, including receivables arising from income tax, GST/HST, the Canada Pension Plan, Employment Insurance, and defaulted Canada student loans. In addition, this area promotes compliance with Canada’s tax legislation covering employers, payroll, and the GST/HST.

We carry out this program activity to achieve the following Expected Result:

Non-compliance with the filing, registration, and remitting requirements of the Income Tax Act, the Excise Tax Act and other legislation are identified and addressed and the level of debt is managed to ensure that taxpayers pay their required share.

A Snapshot of Accounts Receivable and Returns Compliance (PA3)

- Accounts Receivable – TSO cash collections totalled $16 billion, which includes cash collections from National Pools of more than $1.0 billion and from large accounts totalled over $8.3 billion.

- Trust Accounts – More than 787,000 returns were obtained from individuals and corporate taxpayers who had not filed their returns, more than 7,000 GST/HST non-registrants were identified, and 647,320 payroll exams and reviews were completed. Our Contract Payment Reporting Initiative secured a total of over 61,000 additional individual and corporate tax returns.

In 2008-2009, spending for this program activity totalled $724 million (9,238 FTEs) or 17.2% of the CRA’s overall expenditures.* Of this $724 million, $498 million was for net program expenditures, and $226 million was allocated to this program activity for internal services.

* Spending figures for sub-activities may not add up to this total due to rounding.

Contribution to Agency Priority

Enhancing our Efforts to Address Non-Compliance

Performance Report Card

For supplementary information on this Program Activity, please visit: www.cra.gc.ca/annualreport

Reporting Compliance (PA4)

Benefit to Canadians

We undertake examinations, audits, and investigations to ensure compliance with Canada’s tax laws. This includes verification and enforcement activities at the domestic and international level, including the administration of international tax agreements. We also provide information to taxpayers to help them comply. We conduct research to improve identification of non-compliance and develop strategies to address it.

We carry out this program activity to achieve the following Expected Result:

Audits, examinations, mandatory reviews, investigations, prosecutions and voluntary disclosures detect and address non-compliance with the reporting requirements of the Acts administered by the CRA.

A Snapshot of Reporting Compliance (PA4)

- International and large businesses – We conducted over 41,000 audits, resulting in a fiscal impact of $5.2 billion.

- Small and medium-sized enterprises – We conducted over 323,000 audits and examinations, resulting in a fiscal impact of $2.2 billion.

- Enforcements and disclosures – We conducted 874 audits under the Special Enforcement Program, resulting in a fiscal impact of $187 million. Under the Criminal Investigations Program, we referred 164 income tax and GST/HST investigations for prosecution.

- Scientific Research and Experimental Development Program – This program provided more than $4 billion in tax assistance to over 18,000 claimants.

In 2008-2009, spending for this program activity totalled $1.4 billion (13,332 FTE’s) or 33.6% of the CRA’s overall expenditures. * Of this $1.4 billion, $1.038 billion was net program expenditures and $375 million was allocated to this program activity for internal services.

* Spending figures for sub-activities may not add up to this total due to rounding.

Contribution to Agency Priorities

Strengthening Service and Enhancing our Efforts to Address Non-Compliance

Performance Report Card

For supplementary information on this Program Activity, please visit: www.cra.gc.ca/annualreport

Appeals ( PA5)

Benefit to Canadians

We strive to make fair and timely dispute resolution available to taxpayers and benefit recipients. Taxpayers can dispute assessments and determinations pertaining to income tax and commodity taxes, as well as CPP/EI assessments and rulings.

Our Service Complaints Program provides taxpayers with a formal resolution process for complaints. We also administer taxpayer relief provisions, which help taxpayers who are unable to meet their tax obligations because of extraordinary circumstances.

We carry out this program activity to achieve the following Expected Result:

Taxpayers receive a timely and impartial review of contested decisions made under the Income Tax Act, the Excise Tax Acts, the Canada Pension Plan and the Employment Insurance Act, and timely updates to service complaints.

- Appeals – We resolved over 67,000 disputes, representing over $2.6 billion in taxes. Over 109,000 disputes remain in workable and non-workable inventory, totalling more than $12.2 billion in taxes.

- Taxpayer Relief Provisions – Over 63,000 requests for relief from interest and penalties were processed by the CRA. Approximately 39,000 of these requests were allowed in full or in part, in favour of the taxpayer. The total value of all cancellations and waivers was more than $913 million.

- Service Complaints – More than 2,500 service complaints were processed.

In 2008-2009, spending for this program activity totalled $169 million (1,521 FTE’s) or 4.0% of the CRA’s overall expenditures. * Of this $169 million, $132 million was for net program expenditures, and $37 million was allocated to this program activity for internal services.

* Spending figures for sub-activities may not add up to this total due to rounding.

Contribution to Agency Priorities

Strengthening Service and Reinforcing Trust

Performance Report Card

For supplementary information on this Program Activity, please visit: www.cra.gc.ca/annualreport

Benefit Programs (PA6)

Benefit to Canadians

Our Benefit Programs contribute directly to the economic and social well-being of Canadians by delivering income-based and other benefits, credits, and services to eligible residents for federal, provincial, and territorial governments. We administer the Canada Child Tax Benefit, the Goods and Services Tax/Harmonized Sales Tax credit, and the Children’s Special Allowances, which are three core federal programs that issue benefit payments. We also deliver the Universal Child Care Benefit (UCCB) on behalf of Human Resources and Skills Development Canada and numerous ongoing and one-time benefit and credit programs and services on behalf of provincial, territorial, and other federal government clients.

We carry out this program activity to achieve the following Expected Result:

Benefit recipients receive eligibility determinations and payments, and have access to information, that is timely and accurate.

A Snapshot of Benefit Programs (PA6)

- Benefit Programs Client Services – We handled over 6.9 million telephone enquiries.

- Benefit Programs Administration – We issued almost 91 million benefit payments, totalling more than $16 billion to 11 million recipients. We determined $703 million in Disability Tax Credit entitlements for over 510,000 individuals. We processed over 735,000 applications and marital status change forms, over 688,000 account maintenance adjustments, and over 1.1 million in-year GST/HST credit account redeterminations.

- Direct transfer payments under statutory programs – We issued more than $211 million under the Children’s Special Allowances (CSA) program and over $488,000 under the Energy Cost Benefit program.

In 2008-2009, spending for this program activity totalled $403 million (2,050 FTE’s) or 9.6% of the CRA’s overall expenditures.* Of this $403 million, $342 million were net program expenditures, and $61 million was allocated to this program activity for internal services.

* Spending figures for sub-activities may not add up to this total due to rounding.

Contribution to Agency Priorities

Ensure timely benefit payments

Ensure accurate benefit payments and strengthening compliance

Ensure that CRA is a key service provider

Performance Report Card

For supplementary information on this Program Activity, please visit: www.cra.gc.ca/annualreport

Internal Services (PA7)

Benefit to Canadians

The CRA delivers high-quality tax, benefit, and related services on behalf of governments across Canada. In support of our two strategic themes, our human resources, information technology, and other horizontal management areas must be fully integrated to ensure that our tax and benefit services have the guidance, infrastructure, and resources needed for successful delivery.

Contribution to Agency Priorities

This program activity supports all priorities within this organization.

For supplementary information on this Program Activity, please visit: www.cra.gc.ca/annualreport

Section III: Supplementary Information

Statement of Management Responsibility

We have prepared the accompanying financial statements of the Canada Revenue Agency according to accounting principles consistent with those applied in preparing the financial statements of the Government of Canada. Significant accounting policies are set out in Note 2 to the financial statements. Some of the information included in the financial statements, such as accruals and the allowance for doubtful accounts, is based on management’s best estimates and judgments, with due consideration to materiality. The Agency’s management is responsible for the integrity and objectivity of data in these financial statements. Financial information submitted to the Public Accounts of Canada and included in the Agency’s Annual Report is consistent with these financial statements.

To fulfill its accounting and reporting responsibilities, management maintains sets of accounts which provide records of the Agency’s financial transactions. Management also maintains financial management and internal control systems that take into account costs, benefits, and risks. They are designed to provide reasonable assurance that transactions are within the authorities provided by Parliament, and by others such as provinces and territories, are executed in accordance with prescribed regulations and the Financial Administration Act, and are properly recorded to maintain the accountability of funds and safeguarding of assets. Financial management and internal control systems are reinforced by the maintenance of internal audit programs. The Agency also seeks to assure the objectivity and integrity of data in its financial statements by the careful selection, training, and development of qualified staff, by organizational arrangements that provide appropriate divisions of responsibility, and by communication programs aimed at ensuring that its regulations, policies, standards, and managerial authorities are understood throughout the organization.

The Board of Management is responsible for ensuring that management fulfills its responsibilities for financial reporting and internal control and exercises this responsibility through the Audit Committee of the Board of Management. To assure objectivity and freedom from bias, these financial statements have been reviewed by the Audit Committee and approved by the Board of Management. The Audit Committee is independent of management and meets with management, the internal auditors, and the Auditor General of Canada on a regular basis. The auditors have full and free access to the Audit Committee.

The Auditor General of Canada conducts an independent audit and expresses opinions on the accompanying financial statements.

William V. Baker

Commissioner and Chief Executive Officer

James Ralston

Chief Financial Officer and Assistant Commissioner, Finance and Administration

Introduction

This section of the CRA Departmental Performance Report 2008-2009 provides the details of the Agency’s resource management performance for the purpose of reporting to Parliament on the use of appropriations in 2008-2009. This complements the information provided in the spending profile sections under each Program Activity and satisfies the reporting requirements set for departmental performance reports.

Financial reporting methodologies

The CRA’s funding is provided by Parliament through annual appropriations (modified cash accounting basis) and the CRA reports its expenditures and performance to Parliament, together with details on the management of Parliamentary appropriations on the same basis. In addition to the above reporting requirements, the CRA is also required to prepare its annual financial statements in accordance with the accounting principles applied in preparing the financial statements of the Government of Canada (full accrual accounting basis). Accordingly, the audited Statement of Operations – Agency Activities that can be found on the Canada Revenue Agency website at http://www.cra-arc.gc.ca/gncy/nnnl/menu-eng.html includes certain items such as services received without charge from other government departments and federal agencies. A reconciliation can be found on the CRA website at http://www.cra-arc.gc.ca/gncy/nnnl/menu-eng.html.

Activities of the Agency

The Financial Statements – Agency Activities reports $3,804.9 million as total Parliamentary appropriations used (Note 3 b in the CRA Annual Report to Parliament 2008-2009 shows the reconciliation to the net cost of operations). The difference from the $4,198.7 million reported in this section is explained by four items reported in the Financial Statements – Administered Activities: the payments to provinces under the Softwood Lumber Products Export Charge Act, 2006, $180.5 million; the Children’s Special Allowance, $211.8 million; the payments under the Energy Costs Assistance Measures Act, $0.5 million, and the Relief For Heating Expenses, $0.9 million (part of Vote 1, Program Expenditures).

Overview

For 2008-2009, Parliament approved $3,737.4 million through the Main Estimates, as shown in CRA’s 2008-2009 Report on Plans and Priorities.

The 2008-2009 Main Estimates were adjusted to include:

- $180.5 million for the Statutory Payments related to the 2006 Canada/US Softwood Lumber Agreement;

- $134.9 million for the carry-forward from 2007-2008;

- $84.0 million for maternity and severance payments;

- $74.5 million for the single administration of corporate tax for the Province of Ontario;

- $58.3 million for increased Respendable Revenue mainly for information technology services provided to Canada Border Services Agency (CBSA);

- $46.0 million for Collective Agreements;

- $33.1 million for Budget measures arising from the 2007 and 2008 Federal Budgets;

- $22.0 million transferred from Public Works and Government Services Canada (PWGSC) for accommodation services;

- $19.9 million for Budget measures arising from the 2007 Economic Statement;

- $7.1 million for the Foreign Convention and Tour Incentive Program;

- $6.0 million for the Government advertising programs;

- $2.7 million for Court Awards and Crown Assets Disposal;

- $1.2 million transferred from Public Health Agency for the advertising campaign on the Children’s Fitness Tax Credit;

- $0.5 million for the payments under the Energy Costs Assistance Measures Act;

- $1.1 million for Crown Agents across Canada – Office of the Director of Public Prosecutions; and

- $0.2 million for other minor adjustments.

These increases were offset by the following reductions:

- $17 million for the employee benefit plans costs;

- $14.2 million for private collection agencies;

- $7.1 million for statutory Children’s Special Allowance payments; and

- $0.4 million transferred to the Treasury Board Secretariat for the continued implementation of the Public Service Modernization Act and to the Public Service Human Resources Management Agency to support the National Managers’ Community.

This resulted in total approved authorities of $4,370.7 million for 2008-2009, representing an in-year increase of 16.9% over the Main Estimates.

Of the $4,370.7 million total authority, CRA’s actual spending totalled $4,198.7 million resulting in $172.0 million remaining unexpended at year-end. After deducting unused resources related to the proposed Offshore Trusts initiative and Public Opinion Research savings, the remaining $147.1 million is available for use by the Agency in 2009-2010. This amount represents 3.4% of the total authority.

The $147.1 million carry forward to 2009-2010 will be directed primarily to selected strategic investments related to:

- Major project and infrastructure spending (Compliance Systems Redesign, Tax Free Savings Account, Major Tenant Services and Information Technology Infrastructure);

- Special purpose funding (Softwood Lumber, Charities Partnership and Outreach Program, Corporate Tax Administration for Ontario, Ministère du Revenu du Québec for the Administration of the GST); and

- Other operational and workload pressures.

Revenues administered by the Agency

Total revenues administered by the CRA totalled some $287.5 billion, a decrease of 1.8% from the $292.9 billion administered in 2007-2008.

Financial Highlights

For the period ending March 31, 2009

Statement of Financial Position

For the period ending March 31, 2009

Statement of Operations

There are three significant program administration changes which have influenced the results in the Financial Statements.

1. Corporate Tax Administration for Ontario

Under the Memorandum of Agreement Concerning a Single Administration of Ontario Corporate Tax signed on October 6, 2006, the Governments of Canada and Ontario agreed to transfer the administration of Ontario corporate income taxes from the Ontario Ministry of Revenue (OMoR) to the Canada Revenue Agency (CRA) starting in the 2009 taxation year. The CRA received $210.5 million of Federal Government funding over four years (2006-07 to 2009-10) for developmental and transitional costs relating to this initiative. Of this amount, $61.3 million was spent in fiscal year 2008-2009.

To date, the Corporate Tax Administration for Ontario initiative has met all its key milestones. The CRA began receiving blended federal and provincial installment payments from corporations in February 2008. On April 3, 2008, the majority of the administration of Ontario’s corporate income tax was transferred to the CRA for taxation years prior to 2008. The CRA started providing integrated audits and other related activities, such as rulings, interpretations, objections and appeals for 2008 and prior taxation years. Over 300 OMoR employees transferred to the CRA to assist with this additional workload.

All necessary agreements are now in place for the CRA to administer the harmonized T2 Corporation Income Tax Returns, starting in 2009.

2. Investment in Information Technology (IT) systems

Over the course of fiscal year 2009, the CRA had several large-scale projects that required substantial investments in the development of IT systems. Combined with the acquisition of IT hardware, the Agency has invested $144 million in IT related capital assets this fiscal year.

The value of these new capital assets has been offset by slightly higher depreciation in the year. Large-scale IT projects, by nature, generally require multi-year investments. These incremental investments add to the overall capital assets of the CRA as they occur, however, the associated depreciation of these assets only commences once a project is completed and the system enters production. This contributed to the increase of CRA’s depreciation in fiscal year 2009 as completed systems entered production mode and became eligible for depreciation. The total depreciation claimed by CRA in 2009 was $88 million.

The following figure outlines investments in information technology that have been accounted for as capital assets in the last four years.

Figure 12: Information Technology Investment in Capital Assets

3. Increase in non-tax revenue

The CRA financial statements demonstrate a noticeable increase in non-tax revenue of $58 million. The increase is attributable to the provision of IT services to the Canada Border Services Agency and administration fees charged to the province of Ontario relating to the Corporate Tax Administration for Ontario and to the province of British Columbia for the British Columbia Climate Action Tax Credit and Dividend.

Analysis of Net Cost of Operations

The Agency’s 2008-2009 net cost of operations increased by $348 million from 2007-2008. Agency expenses totalled $4,434 million in 2008-2009 (2007-2008 – $4,028 million). When adjusting for non-tax revenue of $538 million (2007-2008 – $480 million), the net cost of operations amounts to $3,896 million, as illustrated below:

Table 1: Details on the net cost of operations

Financial Highlights Chart

The Agency’s expenses are composed of 73% in personnel expenses (salaries, other allowances and benefits) and 27% in non-personnel expenses, as illustrated in the figure below.

Personnel expenses are the primary drivers for the Agency. A number of factors contributed to the net increase of $322 million for this type of expenses in 2008-2009. These include salary revisions pursuant to collective agreements provisions, the cost of other allowances and benefits, and increases in the staff complement due to new initiatives, such as the Corporate Tax Administration for Ontario and others announced in recent Federal Budgets.

In total, non-personnel expenses increased by $84 million. Significant elements of non-personnel expenses are made up of accommodations, transportation and communications expenses, which are, for the most part, linked to personnel expenses. The growth of $45 million in information technology costs are linked to increased amortization charges, investment projects, and infrastructure growth and renewal. Federal Goods and Services Tax administration costs by the Province of Québec have returned to more normal levels compared to the previous fiscal year in which the Province incurred higher costs related to the upgrade of their information technology systems.

Figure 13: Total Expenses by Type

Audited and Unaudited Financial Statements

For supplementary information on the Agency’s Audited and Unaudited Financial Statements, please visit www.cra-arc.gc.ca/gncy/nnnl/menu-eng.html

Electronic Tables

The following tables can be found on the TBS web site at http://www.tbs-sct.gc.ca/dpr-rmr/st-ts-eng.asp.

Table 1: Sources of Respendable and Non-Respendable Revenue

Table 2: User Fees / External Fees

Table 3: Details on Project Spending

Table 5: Details on Transfer Payment Programs (TPPs)

Table 8: Sustainable Development Strategy

Table 10: Response to Parliamentary Committees and External Audits

Table 11: Internal Audits and Evaluations

Rating Our Data Quality

In conjunction with the performance results ratings, we also assign each indicator a data quality rating.

For each indicator we use consistent approaches in evaluating the information derived from our data collections systems and all other sources. We rely upon CRA managers to vouch for the completeness of the records for data integrity purposes (i.e., data belongs to the same category, is collected for the same period, and by the same method). We examine data for relevance, formulas for accuracy, and other factors that must be considered. We also use comparable information from prior years for the purpose of historical comparison, which often appears in the CRA Departmental Performance Report. To ensure consistency, we perform the following tasks to verify that the information reported in our numerous reports is valid, reliable, and is accompanied by appropriate evidence:

- Validation: This is a process of verification to ensure that the data meets the requirements for its intended purposes. We review and evaluate data for completeness and plausibility (accuracy, timeliness, interpretability, coherence). We also identify contact information, check calculations, confirm system reliability (verifying the source of information), and note and address any errors.

- Data quality assessment: We apply a data quality checklist and review prior years’ data to assess the quality of data for each indicator.

- Electronic filing system: We store data in a database for easy reference and further analysis for other purposes.

- Physical filing system: We maintain physical files of the evidence collected from all sources to provide validation and assurance that our data quality ratings are accurate and supported.

We always endeavour to use the most appropriate and reliable data when evaluating our results. There are mainly two data sources for the CRA Departmental Performance Report: administrative data (normally communicated in aggregate or after some simple calculations are performed on them) and survey data. All data sources are validated for accuracy and a data quality rating of good, reasonable or weak as categorized below is applied to each indicator.

We believe that these three levels of data quality ratings provide a reasonable assessment of the reliability of the data. Generally, our data sources provide reliable information. In situations where the supporting data is too imprecise to draw firm conclusions, it is reflected in the data quality rating.

Data Quality Ratings

Service Standards at the CRA

Our service standards regime is a vital and integral part of our planning, reporting, and performance management processes. Meeting our service standards targets demonstrates that we are responsive to the needs of taxpayers and benefit recipients. This helps establish credibility in our operations and contributes to increasing the level of confidence that Canadians can place in government.

For supplementary information on the Agency’s Service Standards, please visit www.cra-arc.gc.ca/gncy/nnnl/menu-eng.html

The CRA Governance Structure

Board Membership

The Board of Management of the Canada Revenue Agency comprises 15 members appointed by the Governor in Council. They include the Chair, the Commissioner and Chief Executive Officer, a director nominated by each province, one director nominated by the territories, and two directors nominated by the federal government. Members of the Board bring a private-sector perspective and business approach to management and, in this regard, have been championing a significant agenda for change within the CRA.

The following list shows the Board membership as of March 31, 2009.

Organizational Structure