Common menu bar links

Breadcrumb Trail

ARCHIVED - Office of the Superintendent of Financial Institutions Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

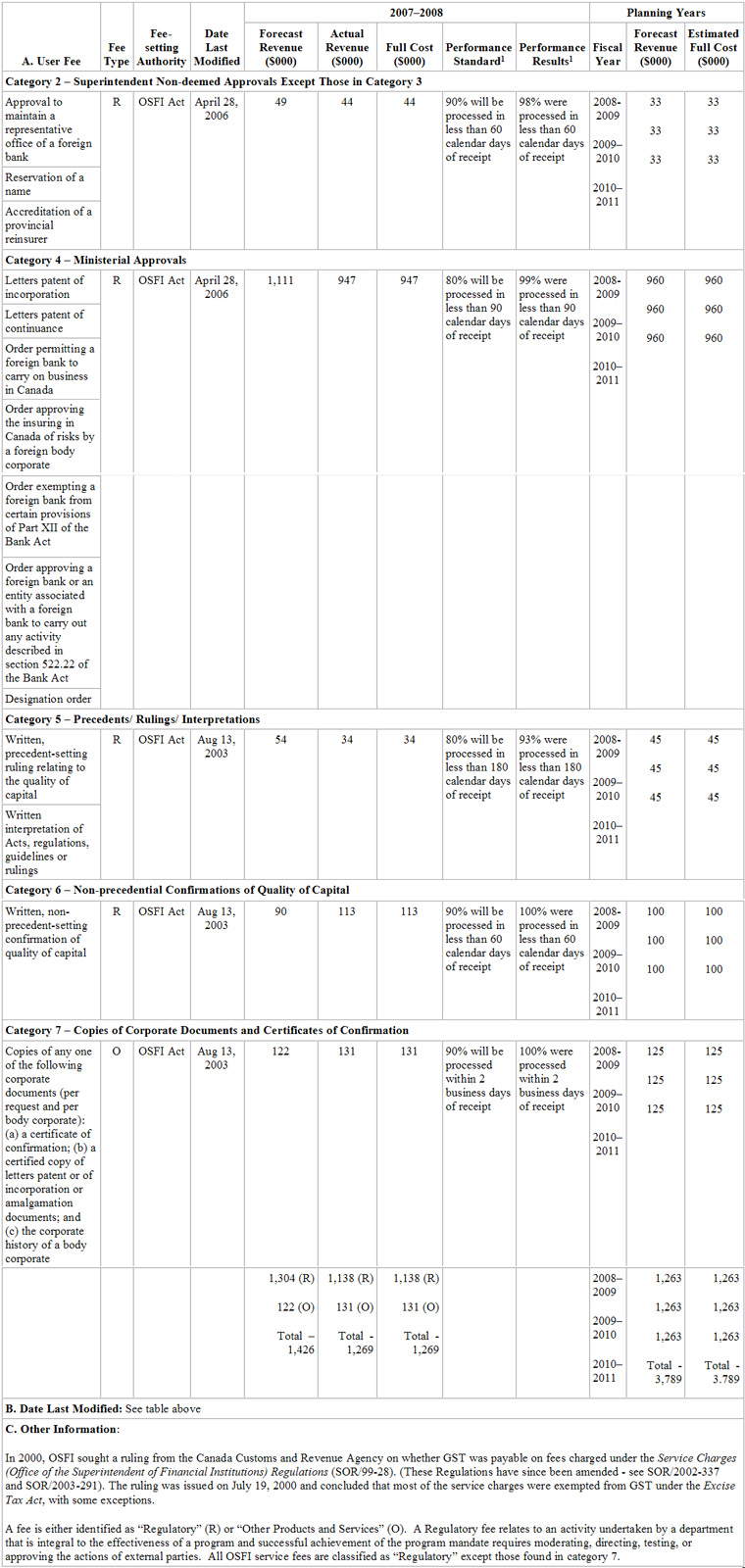

Table 4-A: User Fee Reporting

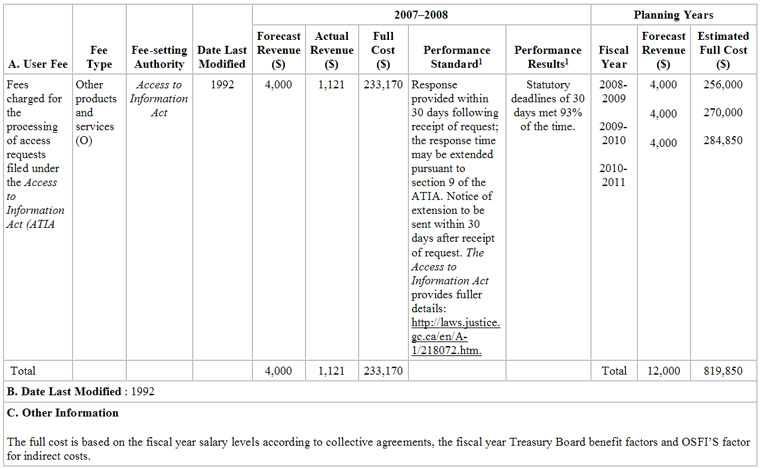

Access to Information User Fees

1 According to prevailing legal opinion, where the corresponding fee introduction or most recent modification occurred prior to March 31, 2004:

- the performance standard, if provided, may not have received parliamentary review; and

- the performance standard, if provided, may not respect all establishment requirements under the User Fee Act (e.g. international comparison; independent complaint address).

- the performance result, if provided, is not legally subject to section 5.1 of the User Fee Act regarding fee reductions for unachieved performance.

Table 4–B: Policy on Service Standards for External Fees

Table 4-B is a standard reporting form developed to meet the reporting requirements of the Policy. As the requirements of the User Fee Act and the Policy are very similar, much of the information contained in this table is also found in table 4-A.

| A. External Fee | Service Standard2 | Performance Results3 | Stakeholder Consultation |

| Category 2 – Superintendent Non-deemed Approvals Except Those in Category 3 |

In March 2005, paying and non-paying stakeholders were asked to review and comment on the proposed service standards that were developed based on the analysis and research. Comments were received over a three month period and feedback on the comments was provided to each stakeholder who took the opportunity to provide input. Stakeholders were generally supportive of the initiative, especially with regard to OSFI’s early implementation of the government’s policy. OSFI received some queries with regard to the increased administrative costs associated with monitoring compliance with these new standards. We noted that, as OSFI has monitored application processing time for a number of years, OSFI does not expect to incur additional costs associated with monitoring compliance with these service standards. This expectation has proven to be the case. OSFI continues to review the standards on an ongoing basis and, once experience with the application of the standards has developed, some modifications may be made. |

||

| Approval to maintain a representative office of a foreign bank | 90% will be processed in less than 60 calendar days of receipt | 98% were processed in less than 60 calendar days of receipt | |

| Reservation of a name | |||

| Accreditation of a provincial reinsurer | |||

| Category 4 – Ministerial Approvals | |||

| Letters patent of incorporation | 80% will be processed in less than 90 calendar days of receipt | 99% were processed in less than 90 calendar days of receipt | |

| Letters patent of continuance | |||

| Order permitting a foreign bank to carry on business in Canada | |||

| Order approving the insuring in Canada of risks by a foreign body corporate | |||

| Order exempting a foreign bank from certain provisions of Part XII of the Bank Act | |||

| Order approving a foreign bank or an entity associated with a foreign bank to carry out any activity described in section 522.22 of the Bank Act | |||

| Designation order | |||

| Category 5 – Precedents/ Rulings/ Interpretations | |||

| Written, precedent-setting ruling relating to the quality of capital | 80% will be processed in less than 180 calendar days of receipt | 93% were processed in less than 180 calendar days of receipt | |

| Written interpretation of Acts, regulations, guidelines or rulings | |||

| Category 6 – Non-precedential Confirmations of Quality of Capital | |||

| Written, non-precedent-setting confirmation of quality of capital | 90% will be processed in less than 60 calendar days of receipt | 100% were processed in less than 60 calendar days of receipt | |

| Category 7 – Copies of Corporate Documents and Certificates of Confirmation | |||

| Copies of any one of the following corporate documents (per request and per body corporate): (a) a certificate of confirmation; (b) a certified copy of letters patent or of incorporation or amalgamation documents; and (c) the corporate history of a body corporate | 90% will be processed within 2 business days of receipt | 100% were processed within 2 business days of receipt | |

| B. Other Information: | |||

Access to Information Requests Policy on Service Standards for External Fees

| A. External Fee | Service Standard2 | Performance Results3 | Stakeholder Consultation |

| Fees charged for the processing of access requests filed under the Access to Information Act (ATIA). |

Response provided within 30 days following receipt of request; the response time may be extended pursuant to section 9 of the ATIA. Notice of extension to be sent within 30 days after receipt of request. The Access to Information Act provides fuller details: http://laws.justice.gc.ca/en/A-1/index.html

|

Statutory deadlines met 93% of the time | The service standard is established by the Access to Information Act and the Access to Information Regulations. Consultations with stakeholders were undertaken by the Department of Justice and the Treasury Board Secretariat for amendments done in 1986 and 1992. |

|

B. Other Information

None |

|||

2 As established pursuant to the Policy on Service Standards for External Fees:

- service standards may not have received parliamentary review; and

- service standards may not respect all performance standard establishment requirements under the User Fee Act (e.g. international comparison; independent complaint address).

3 Performance results are not legally subject to section 5.1 of the UFA regarding fee reductions for unachieved performance.