ARCHIVED - Northern Pipeline Agency Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2007-08

Departmental Performance Report

Northern Pipeline Agency

The original version was signed by

The Honourable Lisa Raitt, P.C.,M.P.

Minister responsible for the Northern Pipeline Agency

Table of Contents

Section I: Commissioner's Message

Management Representation Statement

3.2.2 Fixed and Variable Costs

Table 1 - Summary of Voted Appropriations

Table 2 - Comparison of Total Planned Spending to Actual Spending

Table 3 - Historical Comparison of Total Planned Spending to Actual Spending

Table 4 - Non-Respendable Revenues

Table 5 - External Charging Information for NPA

Appendix C: History/Chronology

Appendix D: Auditor’s Report and Financial Statements

Section I: Commissioner's Message

It is my pleasure to present the Performance Report for the Northern Pipeline Agency (NPA).

The NPA was created by the Northern Pipeline Act (the Act) in 1978 to oversee the planning and construction by Foothills Pipe Lines Ltd. (Foothills) of the Canadian portion of the Alaska Highway Gas Pipeline Project (pipeline), also referred to as the Alaska Natural Gas Transportation System. The pipeline was certificated in 1978 and is intended to transport Alaskan and possibly northern Canadian natural gas to southern markets in Canada and the United States.

The portion of the pipeline south of Caroline, Alberta (Phase I), was constructed in the early 1980's and presently transports Canadian gas sourced primarily from south of the 60thparallel. Unfavourable economic conditions led to indefinite delays in the completion of the northern portion of the pipeline (Phase II), and consequently, the Agency's activities in the 1990's were limited to overseeing the expansion of the southern portion of the pipeline.

Recently, perception of a growing North American market for natural gas, combined with concerns about limitations on supply from traditional sources, and strong natural gas prices has resulted in renewed interest in the pipeline as an option for bringing northern gas to market. In response, the Agency has taken measures to address the commitments of the Government of Canada that are embodied in the Act and legislative changes that have occurred since the pipeline was certificated.

___________________________

Cassie J. Doyle

Management Representation Statement

I submit for tabling in Parliament, the 2008 Departmental Performance Report (DPR) for Northern Pipeline Agency.

This document has been prepared based on the reporting principles contained in the Treasury Board of Canada Secretariat’s Guide for the preparation of 2007-2008 Departmental Performance Reports:

- it adheres to the specific reporting requirements;

- it uses an approved Program Activity Architecture;

- it presents consistent, comprehensive, balanced and accurate information;

- it provides a basis of accountability for the results pursued or achieved with the resources and authorities entrusted to it; and

- it reports finances based on approved numbers from the Estimates and the Public Accounts of Canada.

________________________________________

Name: Cassie J. Doyle

Title: Commissioner

Section II: Agency Context

2.1 Agency Overview

2.1.1 Mandate and Mission

In 1977, following extensive regulatory hearings in both countries, the governments of Canada and the United States executed an Agreement on Principles Applicable to a Northern Natural Gas Pipeline. This agreement provided a framework for the construction and operation of the Alaska Highway Gas Pipeline Project.

In 1978, Parliament enacted the Northern Pipeline Act to:

- give effect to the agreement; and

- establish the NPA to oversee the planning and construction of the Canadian portion of the project by Foothills.

Implementing legislation was also passed by the United States in the form of the Alaska Natural Gas Transportation Act.

Prior to the commencement of construction of any particular section of the pipeline, Foothills is required to obtain a series of specific approvals from the Agency pursuant to the Act and the terms and conditions specified under the Act. These approvals relate to socio-economic and environmental factors, routing issues, technical design, and other matters such as demonstration of financing. Approval authority rests with the Agency's Commissioner and Designated Officer, the latter being a member of the National Energy Board (NEB). In some cases, approval from the Board is also necessary.

The Agency also monitors the actual construction by Foothills for compliance with its various undertakings and for sound environmental and engineering practices.

2.1.2 Strategic Outcome

The Agency has one strategic outcome as listed below. The Agency will cease to exist one year after the date on which leave to open the last section or part of the pipeline is given by the NEB. The operation of the pipeline is regulated by the Board pursuant to the National Energy Board Act.

Facilitate the planning and construction of the Canadian portion of the Alaska Highway Gas Pipeline Project while maximizing social and economic benefits and minimizing adverse social and environmental effects.

Key Partners:

Agency demands were primarily managed through an arrangement that the Agency has with Natural Resources Canada (NRCan) for financial and administrative services. Agency staff have worked closely with federal departments to develop strategies for environmental and socio economic assessments. The Yukon Territorial Government monitored the easement agreement as discussed in Section 3.2. The Agency also worked closely with other federal departments, primarily NRCan and Justice Canada, on issues relating to Alaska pipeline development.

Key Targets and Overall Results:

The objectives of the Act, establishing the Agency and certifying the pipeline, are to:

- carry out and give effect to the 1977 agreement between Canada and the United States underpinning the project;

- carry out, through the Agency, federal responsibilities in relation to the pipeline;

- facilitate the efficient and expeditious planning and construction of the pipeline;

- facilitate consultation and co-ordination with the governments of the provinces and territories traversed by the pipeline;

- maximize the social and economic benefits of the pipeline while minimizing any adverse social and environmental impacts; and

- advance national economic and energy interests and to maximize related industrial benefits by ensuring the highest possible degree of Canadian participation.

As discussed in Section III, during this reporting period, Agency staff focused on the development of socio-economic assessment strategies, in anticipation of a filing by Foothills in the fall of 2005. Actual implementation of these plans depends upon details of the Foothills filing.

Program, resources and results linkages:

The Agency examined key environmental, socio-economic and First Nations concerns to ensure it would be able to effectively regulate a Foothills project. The Agency had no active programs or initiatives related to the strategic outcome during the reporting period. The Agency engaged a skeletal staff (3 to 5 persons) to ensure preparedness in the event of a decision to continue with the pipeline.

Management Practices:

The Agency relies on the management practices implemented by NRCan, (www.nrcan.gc.ca) as well as administrative arrangements to maximize efficiencies in respect of financial management and reporting requirements.

2.2 Societal Context

2.2.1 External Factors

Perception of a growing North American market for natural gas, combined with concerns about limitations on supply from traditional sources, and strong natural gas prices, has resulted in strong interest in the pipeline as an option for bringing northern gas to market. Before the construction of the pipeline can begin, the NPA is responsible for ensuring that the regulatory system in Canada is in a state of readiness to respond to any request from Foothills Pipe Lines Ltd. to resuscitate the pipeline project. The awarding of the Alaska Gasline Inducement Act license to TransCanada/Foothills is helping build momentum for an Alaska Highway Pipeline under the Northern Pipeline Act. However, the Alaskan gas leaseholders are advancing a competing pipeline proposal. Before taking any decision to proceed with construction under the NPA, Foothills Pipe Lines Ltd. still needs to resolve a number of commercial issues.

2.3 Challenges

During 2007-2008, the primary challenge for the Agency continued to be ensuring a state of readiness in an environment of uncertainty. In the absence of Foothills initiating an action or formal request of the Agency, responses to questions as to how Phase II of the pipeline would be regulated after a 20-year hiatus were largely speculative. The difficulty in addressing these was compounded during the reporting period by the need to utilize the limited resources of the Agency to maintain and increase awareness of obligations under the Act.

The longer-term challenge for the Agency is to be in a position to regulate pipeline construction effectively if industry decides to proceed with Phase II of the pipeline.

Section III: Performance

In light of the low-level of activity in the Agency, there are no specific RPP commitments or parliamentary committee recommendations to be implemented.

On December 12, 2003, responsibility for the Agency was transferred from the Minister for Foreign Affairs and International Trade to the Minister of Natural Resources Canada. The Deputy Minister of Natural Resources Canada was appointed Commissioner.

3.1 Output Performance

In working toward realization of its strategic outcome, the Agency's principal task for

2007-2008 fiscal year was to maintain preparedness to respond to regulatory filings by Foothills and to make sure that the Actis properly administered. With the renewed interest in northern pipelines the Agency was called on to provide information in the event that the balance of the pipeline (Phase II) proceeded, including an examination of the commitments of the Government of Canada that are embodied in the Actand legislative changes that have occurred since the pipeline was certificated.

The agreements that are currently in place with NRCan and other government departments continued to facilitate efficiencies in the administration of the Act. An easement agreement exists among the Yukon Territory Government and the Agency to facilitate the collection of an easement fee related to land access rights on Indian Reserves and Crown land granted to Foothills for the pipeline. The Agency collected the annual fee of $30,400 on behalf of Indian and Northern Affairs Committee (INAC) and redistributed an appropriate share to the Yukon Territory Government. These transactions are excluded from the calculations of recoverable costs mentioned in Section 3.2 Financial Performance.

3.2 Financial Performance

3.2.1 Overview

In 2007-2008, the Agency had spending authority of $266,000. The spending authority was established in anticipation of a significant increase in the work of the Agency to support a high level of planning activity of the pipeline. All costs incurred are fully recovered from Foothills through a cost recovery mechanism. The company is in the process of resolving its commercial issues and has requested that the NPA clarify regulatory framework so that it may proceed quickly once commercial issues have been clarified. Foothills Pipe Lines Ltd. has not yet formally indicated its intention to act on its existing certificates, and the Agency’s expenditures fell far short of expectations.

Resources Used – Table 1

| Planned Spending | $266,000 |

|---|---|

| Total Authorities | $289,357 |

| 2007-2008 Actual | $136,467 |

Each year, the Agency's operating budget includes contingencies to mitigate any requirement to return to Parliament for increased funding in the event activity occurs related to either the existing portion of the pipeline, or construction of the balance of the pipeline. Agency operating expenditures are kept to a minimum unless Foothills initiates some action or formal request of the Agency, in which case operating expenditures may increase proportionately. As reported in the 2007-2008 RPP, an allotment was obtained for the second half of 2007-2008 to retain additional staff in response to an anticipated increase in activity by Foothills. This increase in activity did not occur and as a result these funds were not required and were not fully released.

3.2.2 Fixed and Variable Costs

The Agency's operating budget is comprised of fixed and variable cost elements.

Fixed costs relate to salaries for the NPA staff, the administration of the Leasehold Agreement by INAC and the office accommodations and area for information archives managed by Public Works and Government Services Canada.

As a consequence of the changes in the fixed cost portion, the variable costs of the Agency which relate to costs of service provided by NRCan increased slightly. NRCan’s cost of technical advice and administrative services can vary substantially depending upon the timing and magnitude of Foothills' activities.

3.2.3 Cost Recovery

Agency expenditures related to the administration of the Actare fully recoverable, including those costs related to services provided by other government departments and NRCan.

In accordance with Section 29(1) of the Act, the Agency recovers 100% of its costs based on the NEB's Cost Recovery Regulations. Cost recovery is based on an estimate and adjusted in future years upon completion of an audit of the actual costs. Foothills is responsible for full cost recovery based on quarterly billings from NRCan on behalf of the Agency. Details of cost recovery and the respective adjustments can be found in Table 2.

| 2005 | 2006 | 2007 | 2008 | 2009 | |

|---|---|---|---|---|---|

| Estimated recoverable costs(1) | 1,357 | 1,048 | 0 | 265 | 265 |

| Actual recoverable costs(2) | (597) | (445) | (198) | - | - |

| Adjustment in future year | 760 | 603 | (198) | - | - |

| Estimated recoverable costs | 1,357 | 1,048 | 0 | 265 | 265 |

| Adjustment for prior year | (382) | (291) | (760) | (603) | 198 |

| Total cost recovery(3) | 975 | 757 | (760) | (338) | 463 |

(1) a. Cost recovery – Table 2 is calculated on a calendar year basis.

b. Estimated recoverable costs are determined in accordance with section 6 of the National Energy Board Cost Recovery Regulations.

c. The estimated recoverable costs for 2007 are 0 as the billing adjustment to be applied in 2007 exceeded the estimated recoverable costs.

(2) Based on information available as of 15 August 2008. The Northern Pipeline Act stipulates that an audit be performed annually by the Auditor General of Canada. Information is not available until the completion of the audits for the corresponding calendar year.

(3) Figures for 2007 and 2008 represent amounts that will not be recovered from Foothills Pipe Lines Ltd. Future expenses will be credited against these amounts before future invoices are made.

Appendix A: Financial Tables

The following list and financial tables represent an overview of the Northern Pipeline Agency's 2007-2008 financial performance.

Table 1 - Summary of Voted Appropriations

Table 2 - Comparison of Total Planned Spending to Actual Spending

Table 3 - Historical Comparison of Total Planned Spending to Actual Spending

Table 4 - Non-respendable Revenues

Table 5 - External Charging

Table 1 - Summary of Voted Appropriations

| 2007-2008 | |||||

|---|---|---|---|---|---|

| Vote | Northern Pipeline Agency | Main Estimates |

Planned Spending |

Total Authorities |

Actual |

| 35 | Operating Expenditures | 244 | 244 | 287 | 136 |

| S | Contribution to Employee | ||||

| Benefit Plans | 22 | 22 | 2 | 1 | |

| Total NPA | 266 | 266 | 289 | 137 | |

Table 2 - Comparison of Total Planned Spending to Actual Spending

| 2007-08 | ||||

|---|---|---|---|---|

| Northern Pipeline Agency | Main Estimates |

Planned Revenue |

Total Authorities |

Actual |

| FTEs | 2.0 | 2.0 | 2.0 | 2.0 |

| Operating | 266 | 266 | 289 | 137 |

| Capital | - | - | - | - |

| Voted Grants and Contributions | - | - | - | - |

| Total Gross Expenditures | 266 | 266 | 289 | 137 |

| Less: Respendable Revenue | - | - | - | - |

| Total Net Expenditures | 266 | 266 | 289 | 137 |

| Other Revenues & Expenditures | ||||

| Non Respendable Revenues(1) | (266) | (290) | (313) | (28) |

| Cost of Services Received Without Charge | - | 24 | 24 | 49 |

| Net Cost of the Secretariat | - | - | - | 158 |

(1) The $28K does not represent revenue to the NPA. It is an amount collected from Foothills Pipelines Ltd. and remitted directly to the Government of Canada by the Agency.

Table 3 - Historical Comparison of Total Planned Spending to Actual Spending

| 2007-2008 | ||||||

|---|---|---|---|---|---|---|

| Actual 2005-06 |

Actual 2006-07 |

Main Estimates |

Planned Revenue |

Total Authorities |

Actual | |

| Northern Pipeline Agency | 627 | 391 | 266 | 266 | 289 | 137 |

| Total | 627 | 391 | 266 | 266 | 289 | 137 |

Table 4 - Non-Respendable Revenues

| 2007-2008 | |||||

|---|---|---|---|---|---|

| Actual 2005-06 |

Actual 2006-07 |

Planned Revenue |

Total Authorities |

Actual | |

| Northern Pipeline Agency | 951 | 595 | 290 | 313 | 28 |

| Unplanned | - | - | - | - | - |

| Total Non-Respendable Revenue | 951 | 595 | 290 | 313 | 28 |

| Total Revenues(1) | 951 | 595 | 290 | 313 | 28 |

(1) Refer to Note 1 on page 10.

Table 5 - DPR 2008 - External Charging Information for NPA

| Regulation of construction of the Alaska Highway Gas Pipeline | The NPA regulates the planning and construction of the Canadian portion of the Alaska Highway Gas Pipeline. | |

|---|---|---|

| Fee Type | Regulatory | |

| Fee Setting Authority (e.g. Legislative, Regulatory) | The NPA external charging is in accordance with section 29 of the Northern Pipeline Act and section 24.1 of the National Energy Board Act and the National Energy Board Cost Recovery Regulations. | |

| Date Last Modified | See section B below for fees amended in fiscal year 2003-04. | November 6, 2002 |

| 2007-2008 | ||

| Forecast Revenue ($000) |

Regulatory | 290.0 |

| Actual Revenue (1) ($000) |

Regulatory | 28.0 |

| Estimated Full Cost ($000) |

Regulatory

|

186.0 |

| Service Standard | The construction of Phase II of the Alaska Highway Gas Pipeline has been put on hold due to adverse market conditions. The NPA has shrunk to a skeleton organization but in a state of readiness in the event Phase II of the pipeline project is reactivated. There are no formally developed measurable service standards at this time. | |

| Performance Results | Please refer to notes regarding service standards. | |

(1) Refer to Note 1 on page 10.

| Planning Years | ||

|---|---|---|

| Fiscal Year | 2008-09 | |

| 2009-10 | ||

| 2010-11 | ||

| Forecast Revenue ($000) |

Sub-Total (2008-09) | 289.0 |

| Sub-Total (2009-10) | 289.0 | |

| Sub-Total (2010-11) | 289.0 | |

| Total | 867.0 | |

| Estimated Full Cost ($000) |

Sub-Total (2008-09) | 289.0 |

| Sub-Total (2009-10) | 289.0 | |

| Sub-Total (2010-11) | 289.0 | |

| Total | 867.0 | |

B: Date Last Modified

The NPA cost recovery is determined in accordance with section 24.1 of the National Energy Board Act. Although amendments were made to the NEB Cost Recovery Regulations on November 6, 2002, they do not affect the calculation of the NPA cost recovery charges.

C: Other Information:

1) Cost Recovery and Revenue Accrual:

In accordance with Section 29 of the Northern Pipeline Act and with the National Energy Board Cost Recovery Regulations, the Agency is required to recover all its annual operating costs from the companies holding certificates of public convenience and necessity issued by the Agency. Currently, Foothills Pipe Lines Ltd. is the sole holder of such certificates. The NPA corresponds with Foothills regularly on the level of and expected activities of the Agency including its operating costs.

Program appropriation for each planning year is presented on a fiscal year basis while cost recovery charges, according to the regulations, are calculated on a calendar year basis and billed quarterly. In addition, forecast revenue figures are presented on an accrual basis. As a result, the program appropriation and the forecast revenue amounts do not reconcile although the NPA recovers 100% of its operating costs.

2) Dispute Management:

Due to the current level of activities, a dispute management policy, a pre-requisite for the implementation of the External Charging Policy, has not been developed. However, frequent consultation with Foothills on changes to activities and the associated costs precludes disputes affecting cost recovery. A dispute management policy will be developed to support increased operational requirements.

Appendix B: Organization

The NPA has been designated as a department for the purposes of the Financial Administration Act. The Agency reports to Parliament through the Minister of NRCan who is responsible for the management and direction of the Agency. The Agency has two senior officers, namely a Commissioner and an Assistant Commissioner and Comptroller. The Commissioner of the Agency, currently the Deputy Minister for NRCan, is appointed by the Governor in Council.

Given the continued low level of Agency activity, arrangements are in place whereby the Agency relies largely on NRCan for administrative and technical assistance. This assistance is provided on a cost-recoverable basis. In addition, NRCan also provides policy advice to the Agency.

To further assist the Minister responsible for the Agency in carrying out the Agency's mandate, there is provision for two federally appointed advisory councils. The Councils consist of Aboriginal, business and other interested parties representing communities in northern British Columbia and the Yukon Territory. Membership in these Councils has lapsed over the years in view of the dormant state of Phase II of this project.

As a separate employer, the Agency conforms closely with the principles of personnel administration that apply in the Public Service of Canada and has developed various systems to implement policy appropriate to the Agency's operating requirements.

Figure 3 provides a schematic of the reporting relationships of the key officers of the Agency.

Figure 3: Organization Chart

Appendix C: History/Chronology

The Agency's activities are dictated by the timing and pace of the construction of the pipeline. The following provides a brief description and chronology of the pipeline.

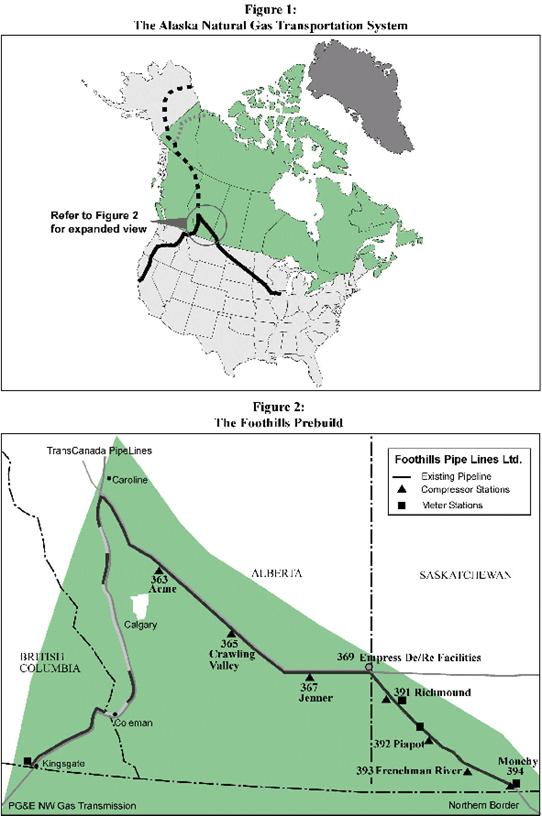

The project is the largest proposed pipeline in North America, encompassing approximately 7 700 kilometres (4,800 miles) of large-diameter mainline pipe, about 42 percent of which would be located in Canada. The route for the project in Canada and the United Sates is depicted in Figure 1. Once in full operation, the pipeline would be capable of initially transporting 68 million cubic meters (2.4 billion cubic feet) per day of Alaskan gas, and the system could be expanded to transport additional volumes subject to regulatory approval. The system, as designed, could also accommodate the receipt and onward delivery of 34 million cubic meters (1.2 billion cubic feet) per day of northern Canadian gas via a connecting pipeline from the Mackenzie Delta/Beaufort Sea region.

As far back as 1977, the concept of prebuilding the southern portions of the pipeline was identified as a benefit of the project, providing Canadian natural gas producers with additional export opportunities and supplying U.S. consumers with much-needed gas. This prebuild, which constituted Phase I of the pipeline, included a western leg to transport Canadian gas to markets in California and the Pacific northwest and an eastern leg to serve primarily the U.S. midwest market. At the same time it was contemplated that Phase II of the pipeline, consisting of the northern portions and the remaining sections to be constructed in southern Canada and the lower 48 regions, would follow in the near term.

The construction of the prebuild went ahead as planned and Canadian gas started flowing through the system for export in the 1981-1982 time frame. The Agency's activity level reached its peak during the construction of the prebuild, with a corresponding staff complement of over 100 employees.

In 1982, at about the same time the prebuild was completed, adverse market conditions led the sponsors of the pipeline to put a hold on Phase II. The adverse market conditions were a result of:

- a decline in demand for natural gas due to economic recession and energy conservation measures;

- an increase in U.S. supply in response to higher wellhead prices; and

- escalating forecast costs of construction due to inflation and rising interest rates.

It was originally anticipated that the completion of the project would be delayed by only about two years, however, Phase II of the pipeline remains on hold to this day. In response, the Agency shrank to a skeleton organization in the mid-1980's. Arrangements

are in place whereby the Agency relies largely on NRCan for administrative, technical assistance and policy advice.

There have been five expansions completed since 1988, all of which were designed to either increase system capacity or enhance system reliability. The most significant of these expansion projects involved (i) the addition of two new compressor stations on the eastern leg in Alberta and of an additional compressor station and a further compressor unit in Saskatchewan, (ii) the completion of the western leg mainline in southeastern British Columbia, and (iii) a further expansion of the eastern leg in 1998.

The flow capacity of the prebuild continues to approach the 102 million cubic meters (3.6 billion cubic feet) per day rate provided for in the underlying agreement between Canada and the U.S. The fifth and latest expansion of the prebuild, which came into service in 1998, raised its capacity to about 94 million cubic meters (3.3 billion cubic feet) per day.

On behalf of the Government of Canada, the Agency coordinates implementation of the agreement reached with the United States in 1980 respecting the procurement of certain designated items such as compressors and large-diameter line pipe, valves, and fittings for the construction of the pipeline. This agreement provides that both Canadian and American suppliers be afforded the opportunity to bid on a generally competitive basis. Canada suspended implementation of the agreement for the latest Foothills expansion due to the lack of U.S. reciprocity.

Appendix D: Auditor’s Report and Financial Statements

Statement of Management Responsibility

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2008 and all information contained in these statements rests with the Agency’s management. These financial statements have been prepared by management in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management's best estimates and judgment and gives due consideration to materiality. To fulfil its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of the Agency’s financial transactions. Financial information submitted to the Public Accounts of Canada and included in the Agency’s Departmental Performance Report and Annual Report is consistent with these financial statements.

Management maintains a system of financial management and internal control designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are in accordance with the Financial Administration Act, are executed in accordance with prescribed regulations, within Parliamentary authorities, and are properly recorded to maintain accountability of Government funds. Management also seeks to ensure the objectivity and integrity of data in its financial statements by careful selection, training and development of qualified staff, by organizational arrangements that provide appropriate divisions of responsibility, and by communication programs aimed at ensuring that regulations, policies, standards and managerial authorities are understood throughout the Agency.

The financial statements of the Agency have been audited by the Auditor General of Canada, the independent auditor for the Government of Canada.

|

Cassie J. Doyle Commissioner Ottawa, Canada |

Kevin Stringer Acting Assistant Commissioner and Comptroller |

AUDITOR'S REPORT

To the Minister of Natural Resources

I have audited the statement of financial position of the Northern Pipeline Agency as at March 31, 2008 and the statements of operations, equity of Canada and cash flow for the year then ended. These financial statements are the responsibility of the Agency’s management. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with Canadian generally accepted auditing standards. Those standards require that I plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

In my opinion, these financial statements present fairly, in all material respects, the financial position of the Agency as at March 31, 2008 and the results of its operations and its cash flows for the year then ended in accordance with Canadian generally accepted accounting principles.

Further, in my opinion, the transactions of the Agency that have come to my notice during my audit of the financial statements have, in all significant respects, been in accordance with the Financial Administration Act and regulations, the Northern Pipeline Act and regulations, the National Energy Board Cost Recovery Regulations and the by-laws of the Agency.

Crystal Pace, CA

Principal

for the Auditor General of Canada

Ottawa, Canada

August 22, 2008

| 2008 | 2007 | |

|---|---|---|

| ASSETS | ||

| Financial assets | ||

| Due from Consolidated Revenue Fund | $911,763 | $991,541 |

| Accounts receivable and advances (Note 7) | 26,785 | 82,394 |

| 938,548 |

1,073,935 |

|

| Non-financial assets | ||

| Tangible capital assets (Note 6) | 6,894 | 11,963 |

| TOTAL ASSETS | $945,442 |

$1,085,898 |

LIABILITIES |

||

| Accounts payable and accrued liabilities (Note 7) | 4,444 | 7,449 |

| Deferred revenue (Note 4) | 940,998 | 1,078,449 |

| TOTAL LIABILITIES | 945,442 | 1,085,898 |

Equity of Canada |

- | - |

TOTAL LIABILITIES AND EQUITY OF CANADA |

$945,442 | $1,085,898 |

Contractual obligations (Note 8)

Approved by:

|

Cassie J. Doyle Commissioner |

Kevin Stringer Acting Assistant Commissioner and Comptroller |

| 2008 | 2007 | |

|---|---|---|

| REVENUE | ||

| Regulatory revenue | $137,451 | $381,286 |

OPERATING EXPENSES |

||

| Professional and special services | 88,965 | 248,134 |

| Rentals | 27,337 | 43,422 |

| Salaries and employee benefits | 7,708 | 68,285 |

| Transportation and communication | 7,607 | 11,317 |

| Amortization | 5,069 | 5,069 |

| Information | 716 | 2,899 |

| Utilities, materials and supplies | - | 1,396 |

| Other | 49 | 764 |

TOTAL RECOVERABLE EXPENSES |

137,451 | 381,286 |

NON-RECOVERABLE SERVICES PROVIDED WITHOUT CHARGE (Note 7) |

48,888 | 52,963 |

NET COST OF OPERATIONS |

$48,888 | $52,963 |

| 2008 | 2007 | |

|---|---|---|

| Equity of Canada, beginning of the year | $- | $- |

| Net cost of operations | (48,888) | (52,963) |

| Change in due from Consolidated Revenue Fund | (79,778) | (84,358) |

| Non-recoverable services received without charge | 48,888 | 52,963 |

| Net cash provided by Government | 79,778 | 84,358 |

| Equity of Canada, end of the year | $- | $- |

| 2008 | 2007 | |

|---|---|---|

| Operating Activities | ||

| Net cost of operations | $48,888 | $52,963 |

| Adjustment for non-cash items | ||

| Services received without charge (Note 7) | (48,888) | (52,963) |

| Amortization of tangible capital assets | (5,069) | (5,069) |

| (5,069) | (5,069) | |

| Variations in the Statement of Financial Position | ||

| (Decrease) increase in accounts receivable and advances | (55,609) | 8,019 |

| Decrease in accounts payable and accrued liabilities | 3,005 | 150,532 |

| Decrease (increase) in deferred revenue | 137,451 | (69,124) |

| Cash used by operating activities | 79,778 | 84,358 |

Financing Activities |

||

| Net cash provided by Government of Canada | $(79,778) | $(84,358) |

Northern Pipeline Agency

Notes to the Financial Statements

Year ended 31 March 2008

-

Authority, Objectives and Operations

In 1978, Parliament enacted the Northern Pipeline Act to:

- give effect to an Agreement on Principles Applicable to a Northern Natural Gas Pipeline (the Agreement) between the Governments of Canada and the United States of America;

- establish the Northern Pipeline Agency (the Agency) to oversee the planning and construction of the Canadian portion of the project.

The Agency is designated as a department and named under Schedule I.1of the Financial Administration Act, reporting to Parliament through the Minister of Natural Resources.

The objectives of the Agency are to:

- carry out and give effect to the Agreement of September 20, 1977 between Canada and the United States underpinning the project;

- carry out, through the Agency, federal responsibilities in relation to the pipeline;

- facilitate the efficient and expeditious planning and construction of the pipeline, taking into account local and regional interests;

- facilitate consultation and coordination with the governments of the provinces and the territories traversed by the pipeline;

- maximize the social and economic benefits of the pipeline while minimizing any adverse social and environmental effects; and

- advance national economic and energy interests and to maximize related industrial benefits by ensuring the highest possible degree of Canadian participation.

In 1982, the sponsors of the Pipeline announced that the target date for completion had been set back until further notice and all parties scaled down their activities. Work continues to prepare the Agency to meet commitments set out in the Northern Pipeline Act should Foothills Pipe Lines Ltd. decide to proceed with the second stage of the Alaskan Natural Gas Transportation System.

In accordance with Section 29 of the Northern Pipeline Act and with the National Energy Board Cost Recovery Regulations, the Agency is required to recover all of its annual operating costs from the companies holding certificates of public convenience and necessity issued by the Agency. Currently, Foothills is the sole holder of such certificates. The Government of Canada provides funds for working capital through an annual Parliamentary appropriation.

-

Significant Accounting Policies

These financial statements have been prepared in accordance with Treasury Board accounting policies and year-end instructions issued by the Office of the Comptroller General, which are consistent with Canadian generally accepted accounting principles for the public sector.

-

Parliamentary appropriations:

The Agency is financed by the Government of Canada through Parliamentary appropriations. Appropriations provided to the Agency do not parallel financial reporting according to generally accepted accounting principles since appropriations are primarily based on cash flow requirements. Consequently, items recognized in the statement of operations and the statement of financial position are not necessarily the same as those provided through appropriations from Parliament. Note 3 provides a high-level reconciliation between the bases of reporting.

-

Net cash provided by Government:

The Agency operates within the Consolidated Revenue Fund (CRF), which is administered by the Receiver General for Canada. All cash received by the Agency is deposited to the CRF and all cash disbursements made by the Agency are paid from the CRF. The net cash provided by the Government is the difference between all cash receipts and all cash disbursements including transactions between the Agency and departments of the federal government.

-

Due from the Consolidated Revenue Fund:

Due from the Consolidated Revenue Fund (CRF) represents the amount of cash that the Agency is entitled to draw from the Consolidated Revenue Fund without further appropriations, in order to discharge its liabilities.

-

Revenue/Deferred revenue:

Revenues from regulatory fees recovered from Foothills are recognized in the accounts based on the services provided in the year.

Revenues that have been received but not yet earned are recorded as deferred revenues. Deferred revenues represent the accumulation of excess billings over the actual expenses for the last two fiscal years. -

Expenses:

Expenses are recorded on the accrual basis.

Vacation pay and compensatory leave are expensed as the benefits accrue to employees under their respective terms of employment.Services received without charge from other government departments are recorded as operating expenses at their estimated cost.

-

Accounts receivable:

Receivables are stated at amounts expected to be ultimately realized. A provision is made for receivables where recovery is considered uncertain.

-

Employee future benefits:

Future benefits for employees, including pension benefits, providing services to the Agency are funded by the employee’s home-base department. Estimated costs are included in the employee benefits charged to the Agency.

-

Tangible capital assets:

All tangible capital assets and leasehold improvements having an initial cost of $1,000 or more are recorded at their acquisition cost. Tangible capital assets owned by the Agency are valued at cost, net of accumulated amortization. Amortization is calculated using the straight-line method, over the estimated useful life of the assets as follows:

- Office furniture and equipment 10 years

- Informatics hardware 4 years

-

Measurement uncertainty:

The preparation of these financial statements in accordance with Treasury Board accounting policies and year-end instructions issued by the Office of the Comptroller General, which are consistent with Canadian generally accepted accounting principles for the public sector, requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses reported on the financial statements. At the time of preparation of these statements, management believes the estimates and assumptions to be reasonable. Deferred revenue, salaries and employee benefits are the most significant items where estimates are used. Actual amounts could differ significantly from those estimated. These estimates are reviewed annually and as adjustments become necessary, they are recognized in the financial statements in the year in which they become known.

-

Parliamentary appropriations:

-

Parliamentary Appropriations

The Government of Canada funds the expenses of the Agency through Parliamentary appropriations. Items recognized in the statement of operations and the statement of financial position in one year may be funded through Parliamentary appropriations in prior, current or future years. Accordingly, the Agency has different net results of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled as follows:

-

Reconciliation of net cost of operations to current year parliamentary appropriations used:

2008 2007 Net cost of operations $48,888 $52,963 Adjustments for items affecting net cost of operations but not affecting appropriations: Add (Less): Services received without charge (48,888) (52,963) Amortization of tangible capital assets (5,069) (5,069) Revenue not available for spending 137,451 381,286 Other 4,085 14,647 136,467

390,864

Current year appropriations used $136,467 $390,864

-

Appropriations provided and used:

2008 2007 Vote 35 - Program expenditures $287,500 $932,600 Statutory amounts 1,857 8,654 Lapsed appropriations (152,890) (550,390) Current year appropriations used $136,467 $390,864

-

Reconciliation of net cash provided by Government to Parliamentary appropriations used:

2008 2007 Net cash provided by Government $79,778 $84,358 Revenue not available for spending 137,451 381,286 Change in net position in the Consolidated Revenue Fund: Variation in accounts receivable & advances 55,609 (8,019) Variation in accounts payable & accrued liabilities (3,005) (150,532) Variation in deferred revenue / other liabilities (137,451) 69,124 Other 4,085 14,647 Current year appropriations used $136,467 $390,864

-

Reconciliation of net cost of operations to current year parliamentary appropriations used:

-

Deferred Revenue

Deferred revenue, calculated on a fiscal year basis, includes the billing adjustments.

January to December 2008 2007 Actual Expenses: One quarter of prior fiscal year’s expenses $95,321 $158,871 Three quarters of current fiscal year’s expenses 103,088 285,964 198,409 444,835 Less provisional billings - (1,048,250) Billing Adjustment $198,409 $(603,415)

The billing adjustments, calculated on a calendar year basis, represent the difference between the provisional billings and the actual recoverable operating costs, in accordance with Section 19 of the National Energy Board Cost Recovery Regulations. The recoverable operating costs for the calendar year are calculated using three quarters of the current fiscal year and one quarter of the previous fiscal year’s operating costs. The billing adjustments of $198,409 for 2007 and $(603,415) for 2006 will be applied to the provisional billings of 2009 and 2008 respectively and used in the calculation of the 2008 and 2007 deferred revenue respectively.

2008 2007 Prior year's billing adjustment $1,173,770 $570,355 Current fiscal year billing adjustment (198,409) 603,415 Last quarter billing of current fiscal year - - One quarter of current fiscal year’s expenses (34,363) (95,321) Deferred Revenue $940,998 $1,078,449

-

Easement Fee

In 1983, the Government of Canada, pursuant to Subsection 37(3) of the Northern Pipeline Act, granted Foothills Pipe Lines Ltd. a twenty-five year easement upon and under lands in the Yukon Territory. For the right of easement, Foothills Pipe Lines Ltd. is to pay the Agency an annual amount of $30,400; of this annual amount, $2,806 (2007 - $2,806) is collected on behalf of and forwarded directly to the Government of the Yukon Territory. The balance of $27,594 (2007 - $27,594) was remitted to the Government of Canada by the Agency. This fee is not accounted for in these financial statements.

-

Tangible Capital Assets

There were no acquisitions or disposals of tangible capital assets in 2008.

Cost Accumulated Amortization Net book value 2008 Net book value 2007 Office furniture and equipment $7,527 $2,668 $4,859 $5,612 Informatics hardware 17,266 15,231 2,035 6,351 Total $24,793 $17,899 $6,894 $11,963

Amortization expense for the year ended March 31, 2008 is $5,069 (2007 - $5,069)

-

Related Party Transactions

The Agency is related as a result of common ownership to all Government of Canada departments, agencies and Crown corporations. The Agency enters into transactions with these entities in the normal course of business and on normal trade terms applicable to all individuals and enterprises except that certain services, as defined previously, are provided without charge.

-

Services provided without charge:

These services without charge have been recognized in the Agency’s Statement of Operations as follows:

2008 2007 Audit services provided by the Office of the Auditor General of Canada $43,509 $45,522 Management services provided by Natural Resources Canada $5,379 $7,441 Total $48,888 $52,963

-

Receivables and payables outstanding at year-end with related parties:

2008 2007 Accounts receivable with other government departments and agencies $26,385 $81,994 Accounts payable to other government departments and agencies - -

-

Services provided without charge:

-

Contractual Obligations

The nature of the Agency’s activities can result in some large multi-year contracts and obligations whereby the Agency will be obligated to make future payments when the services/goods are received. Significant contractual obligations that can be reasonably estimated are summarized as follows:

2009 2010 2011 2012 Total Operating leases $17,386 $7,286 $7,286 $1,214 $33,172

-

Comparative Figures

Comparative figures have been reclassified to conform to the current year’s presentation.

Appendix E: Other Information

A. Contacts for Further Information

Northern Pipeline Agency

580 Booth Street

Ottawa, Ontario K1A 0E4

Telephone: (613) 992-9612

Fax: (613) 995-1913

B. Legislation and Associated Regulations Administered Acts

Northern Pipeline Act

RSC 1977-78, c. 20,s.1

National Energy Board Cost Recovery Regulations

SOR/91-7

C. Socio-Economic and Environmental Terms and Conditions (1980-1981)

Northern Pipeline Socio-Economic and Environmental Terms and Conditions for the Province of Alberta (Order NP-MO-1-80 dated 12 June 1980)

Northern Pipeline Socio-Economic and Environmental Terms and Conditions for Southern British Columbia (Order NP-MO-2-80 dated 12 June 1980)

Northern Pipeline Socio-Economic and Environmental Terms and Conditions for the Swift River Portion of the Pipeline in the Province of British Columbia (Order NP-MO-11-80 dated 29 August 1980)

Northern Pipeline Socio-Economic and Environmental Terms and Conditions for Northern British Columbia (Order NP-MO-12-80 dated 29 August 1980)

Northern Pipeline Socio-Economic and Environmental Terms and Conditions for the Province of Saskatchewan (Order NP-MO-13-80 dated 29 August 1980)

Listing of Statutory and Departmental Reports

2008 Annual Report