ARCHIVED - Human Resources and Social Development Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2007-08

Departmental Performance Report

Human Resources and Social Development Canada

The original version was signed by

The Honourable Diane Finley, P.C., M.P.

Minister of Human Resources and Skills Development

The Honourable Rona Ambrose, C.P., député

Minister of Labour

Table of Contents

Messages

Section I Overview

- Departmental Overview

- Introduction

- Mandate

- Expenditure Profile

- Socio-Economic Year in Review

- Summary of Departmental Program Performance by Strategic Outcome

- Corporate Risk

Section II Performance Discussion by Strategic Outcome

- Policies and Programs that Meet the Human Capital and Social Development Needs of Canadians

- Enhanced Canadian Productivity and Participation Through Efficient and Inclusive Labour Markets, Competitive Workplaces and Access to Learning

- Safe, Healthy, Fair, Stable, Cooperative, Productive Workplaces and Effective International Labour Standards

- Enhanced Income Security, Access to Opportunities and Well-Being for Individuals, Families and Communities

- Achieve Better Outcomes for Canadians Through Service Excellence

Section III Supplementary Information

- Financial Performance Overview

- Electronic Tables

- Specified Purpose Accounts

- Statutory Annual Reports

- Consolidated Report on Canada Student Loans Program

Section IV Other Items of Interest

Website References

Ministers' messages

Message from the Minister of Human Resources and Skills Development

Preparing for the future means helping Canadians acquire the best education and the right skills for quality jobs, helping them participate actively in the workforce and in their communities. The Departmental Performance Report for 2007-2008 for Human Resources and Social Development Canada (HRSDC)* outlines key measures that support Canadians in realizing their potential.

Education is vital in helping Canadians acquire skills, adapt to change and improve their quality of life. That is why the Government of Canada introduced significant enhancements to student financial assistance such as the new Canada Student Grant to help students from low- and middle-income families and a new repayment plan to help students pay back their student loans.

Being competitive in today's economy means having the skills and training to adapt to a changing global market. To this end, we have also been working with the provinces and territories on labour market agreements to help individuals who are unable to access training under current Employment Insurance programs, and encourage employers to provide more training to their workers.

We continue to support parents in balancing their work and family responsibilities through the Universal Child Care Benefit. As well, we are providing funding to the provinces and territories to help support the creation of tens of thousands of new child care spaces across the country.

I am proud of these measures. And I care deeply that we are helping raise awareness of elder abuse and fraud. Thanks to investments under Budget 2008, we are supporting community-based programs for seniors, through projects such as New Horizons for Seniors.

Last year, through 620 points of service, we served more than 32 million Canadians and provided more than $78 billion in Employment Insurance benefits, seniors' pensions and other direct benefits to Canadians

The policies, programs and services of HRSDC provide the tools Canadians need to make the right choices for their families, helping them face life's challenges and build a better and stronger future.

* On October 30, 2008, the name of the department was changed to Human Resources and Skills Development Canada.

The Honourable Diane Finley, P.C., M.P.

Minister of Human Resources and Skills Development

Message from the Minister of Labour

A healthy workplace lays the foundation for a productive workforce and strong economy. It also ensures that employees and employers enjoy positive working environments in which they can thrive.

The Labour Program plays an integral role in ensuring Canada's workplaces are fair, safe and productive. We deliver programs and services to improve workplaces and to protect the well-being of employees and employers, helping these groups to foster positive relations. Beyond Canada's borders, we work with our international partners to support and promote fundamental labour rights and standards globally.

In the past year, continued efforts brought positive change and progress to Canadian work environments. The Departmental Performance Report for 2007-2008 describes the Labour Program's most recent successes in improving the workplace.

Some of the most notable accomplishments in the past year include the introduction of the new job-protection legislation to support Canadian reservists and the coming-into-force of the Wage Earner Protection Program, which will ensure employees are compensated when an employer declares bankruptcy or is subject to receivership.

In support of our commitment to making workplaces safer, the Labour Program has taken steps to prevent workplace injury and illnesses through new regulatory provisions related to ergonomic hazards. New violence prevention regulations were adopted, making it clear that acts of violence will not be tolerated in the workplace. In support of fostering positive relations between employees and employers, mediators and conciliators have continued to assist these groups in achieving constructive settlements to labour disputes, helping to prevent costly and disruptive work stoppages.

Internationally, the Labour Program has continued to reach out to global partners, encouraging improved living and working conditions through Labour Cooperation Agreements and other accords. Here at home, ongoing collaboration with provincial and territorial partners is helping to improve the workplace for all Canadians.

In the coming year, the Labour Program will continue to strive towards our goal of advancing Canada's social and economic development, ensuring Canada continues to be both competitive and prosperous in a global economy.

The Honourable Rona Ambrose, P.C., M.P.

Minister of Labour

Management Representation Statements

Human Resources and Social Development Canada

I submit for tabling in Parliament, the 2007-2008 Departmental Performance Report for Human Resources and Social Development Canada.

This document has been prepared based on the reporting principles contained in the Guide for the Preparation of Part III of the 2007-2008 Estimates: Reports on Plans and Priorities and Departmental Performance Reports.

- It adheres to the specific reporting requirements outlined in the Treasury Board Secretariat guidance;

- It is based on the Department's Strategic Outcomes and Program Activity Architecture that were approved by the Treasury Board;

- It presents consistent, comprehensive, balanced and reliable information;

- It provides a basis of accountability for the results achieved with the resources and authorities entrusted to it; and

- It reports finances based on approved numbers from the Estimates and the Public Accounts of Canada.

__________________________________________________

Janice Charette

Deputy Minister

Human Resources and Social Development

Labour and Service Canada

To the best of my knowledge, the results achieved in support of the Labour Program and Service Canada are presented in a complete, accurate and balanced manner in the 2007-2008 Departmental Performance Report for Human Resources and Social Development Canada.

__________________________________________________

H�l�ne Gosselin

Deputy Minister of Labour

Deputy Head of Service Canada and Associate Deputy Minister

of Human Resources and Social Development

Section I Overview

Human Resources and Social Development Canada

Departmental Overview

Introduction

This document reports on the performance of Human Resources and Social Development Canada for the period from April 1, 2007 to March 31, 2008. It reports on the Department's achievements related to the commitments set out in the 2007-2008 Report on Plans and Priorities.

This section provides a departmental overview, including a brief description of the socio-economic environment, and a summary of departmental performance. Section II includes detailed performance results information by strategic outcome. The financial tables and information concerning the specified purpose accounts are in Section III, and Section IV provides more details on programs and the consolidated financial statements.

To deliver on its mandate, the Department provides programs and services to millions of Canadians. This includes providing income support through legislated pension benefits, temporary income support during periods of unemployment, and employment programs that enable Canadians to prepare for, find and keep employment. The Department promotes lifelong learning by encouraging skills development in workplaces and by developing and disseminating information about the labour market. Human Resources and Social Development Canada also financially invests in learning to facilitate access to post-secondary education and adult learning opportunities, and reduce barriers to adult learning and literacy and early childhood development. The Department's social and labour market policies and programs help to ensure that children and families, seniors, persons with disabilities, homeless persons, communities, and others who face barriers have the support and information they need to maintain their well-being and participate fully in society and the workplace.

The Labour Program works to ensure safe, fair and productive workplaces and cooperative workplace relations, as well as effective international labour standards. To achieve these ends, it promotes occupational health and safety, respect for labour standards, and workplace equity through a coast to coast network of labour affairs officers. It also administers fire protection services on behalf of Treasury Board of Canada and conducts research and analysis on labour and workplace issues. As well, the Labour Program publishes a full range of industrial relations data, information, and developments in labour law; and manages Canada's international labour affairs.

Service Canada provides one stop access to services of Human Resources and Social Development Canada and a number of other federal departments. It builds on best practices in service excellence found within Canada and abroad and builds on over a decade of work within the Government of Canada to improve the delivery of service to Canadians. The Service Canada delivery network brought together close to 620 points of service in communities throughout Canada; a national 1 800 O-Canada telephone service providing Canadians with information about federal government services and 23 other networked call centres; benefits processing infrastructure and, a range of on-line services at http://www.servicecanada.gc.ca/en/home.html.

Human Resources and Social Development Canada's programs and services are designed to achieve results across a broad range of social and labour market outcomes. Five strategic outcomes form the structure for reporting plans, priorities and resources in this report:

"Policies and programs that meet the human capital and social development needs of Canadians"

"Enhanced Canadian productivity and participation through efficient and inclusive labour markets, competitive workplaces and access to learning"

"Safe, healthy, fair, stable, cooperative, productive workplaces and effective international labour standards"

"Enhanced income security, access to opportunities, and well-being for individuals, families and communities"

"Achieve better outcomes for Canadians through service excellence"

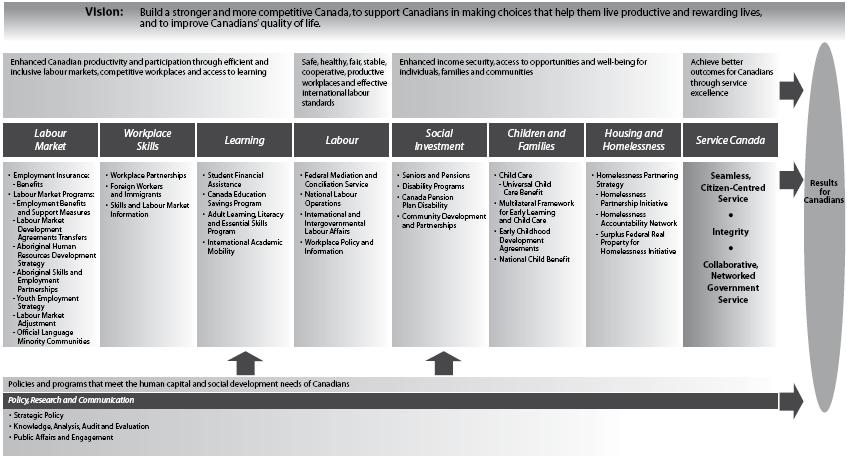

DEPARTMENT OF HUMAN RESOURCES AND SOCIAL DEVELOPMENT - PROGRAM ACTIVITY ARCHITECTURE

Click on image to enlarge

| Vision: Build a strong and more competitive Canada, to support Canadians in making choices that help them live productive and rewarding lives. | ||||||||

| Enhanced Canadian productivity and participation through efficient and inclusive labour markets, competitive workplaces and access to learning | Safe, healthy, fair, stable, cooperative, productive workplaces and effective international labour standards | Enhanced income security, access to opportunities and well-being for individuals, families and communities | Achieve better outcomes for Canadians through service excellence | |||||

| Labour Market | Workplace Skills | Learning | Labour | Social Investment | Children and Families | Housing and Homelessness | Service Canada | |

|

|

|

|

|

|

|

Seamless, Citizen-Centred Service ● Integrity ● Collaborative, Networked Government Service |

Results for Canadians |

| Policies and programs that meet the human capital and social development needs of Canadians | ||||||||

| Policy, Research and Communication | ||||||||

|

||||||||

Mandate

On February 6, 2006, Human Resources and Skills Development Canada and the former Social Development Canada were consolidated into the Department of Human Resources and Skills Development to be styled Human Resources and Social Development. The powers, duties and functions of the Minister of Social Development were transferred to the Minister of Human Resources and Skills Development, and the Minister was styled as Minister of Human Resources and Social Development. The Minister was also made responsible for the Canada Mortgage and Housing Corporation. Further, a Secretary of State for Seniors was appointed on January 4, 2007.

Until new legislation is enacted, the Minister will rely on the provisions of the Department of Human Resources and Skills Development Act and the Department of Social Development Act for specific authorities.

The Department of Human Resources and Skills Development Act defines the powers, duties and functions of the Minister of Human Resources and Skills Development, the Minister of Labour, and of the Canada Employment Insurance Commission. The legislative mandate of Human Resources and Skills Development is to improve the standard of living and quality of life of all Canadians by promoting a highly skilled and mobile labour force and an efficient and inclusive labour market. The Minister of Human Resources and Skills Development has overall responsibility for the employment insurance system, while the administration of the Employment Insurance Act is the responsibility of the Canada Employment Insurance Commission.

The Department of Human Resources and Skills Development Act provides for the appointment of a Minister of Labour who is responsible for the Canada Labour Code and the Employment Equity Act, as well as other legislation on wages and working conditions. The departmental statute provides that the Minister of Labour make use of the services and facilities of the Department. The Act also sets out the mandate of the Minister of Labour to promote safe, healthy, fair, stable, cooperative and productive workplaces.

The Department of Social Development Canada Act defines the powers, duties and functions of the Minister of Social Development. The mandate of Social Development Canada is to promote social well-being and security. In exercising the power and performing the duties and functions assigned by this Act, the Minister is responsible for the administration of the Canada Pension Plan, the Old Age Security Act, and the National Council of Welfare, and the Universal Child Care Benefit Act.

Service Canada operates within the legislative mandate and framework of the current departmental legislation. Its mandate is to work in collaboration with federal departments, other orders of government and community service providers to bring services and benefits together in a single service delivery network.

On June 1, 2006, the Policy Research Initiative was integrated into the Human Resources and Social Development Canada portfolio. It leads horizontal research projects in support of the medium-term policy agenda of the Government of Canada and identifies data needs and priorities for future policy development.

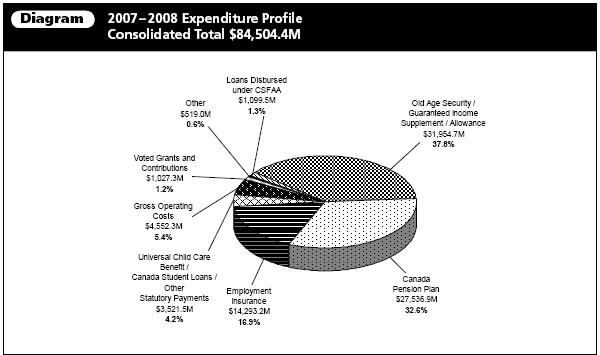

2007-2008 Expenditure profile

Human Resources and Social Development Canada expenditures on programs and services total more than $84 billion, of which $78 billion, or almost 93%, directly benefits Canadians through Employment Insurance, the Canada Pension Plan, Old Age Security, Universal Child Care Benefit, loans disbursed under the Canada Student Financial Assistance Act and other statutory transfer payment programs. Departmental expenditures were $1.0 billion in voted grants and contributions; $35.4 billion in statutory grants and contributions; and $2.1 billion for Employment Insurance Part II.

Diagram 2007 - 2008

Expenditure Profile

| Human Resources and Social Development Canada - Gross Expenditures | Statutory Transfer Payments | ||||

| Budgetary | Grants and Contributions | ||||

| Net operating costs | 2,862.7 | Old Age Security | 24,029.8 | ||

| Add recoveries in relation to: | Guaranteed Income Supplement | 7,406.7 | |||

| Canada Pension Plan | 247.4 | Allowances | 518.2 | ||

| Employment Insurance Account | 1,342.8 | Other Statutory Payments: | |||

| Workers' Compensation | 96.4 | Universal Child Care Benefit: | 2,474.3 | ||

| Other Government Departments | 3.0 | 1,689.6 | Canada Education Savings Grant | 579.7 | |

| Gross Operating Costs | 4,552.3 | Canada Student Loans | 386.4 | ||

| Voted Grants and Contributions | 1,027.3 | Canada Learning Bond | 35.8 | ||

| Total Gross Expenditures | 5,579.6 | Energy Cost Benefits | 0.1 | 3,476.3 | |

| Sub-Total | 35,431.0 | ||||

| Other - Workers' Compensation and EI/CPP Charges and Recoveries |

519.0 | Canada Pension Plan Benefits | 27,536.9 | ||

| Employment Insurance Benefits | |||||

| Non-Budgetary | Part I | 12,197.2 | |||

| Loans disbursed under Canada Student Financial Assistance Act (CSFAA) | 1,099.5 | Part II | 2,096.0 | 14,293.2 | |

| Other Specified Purpose Accounts | 45.2a | ||||

| Total Statutory Transfer Payments | 77,306.3 | ||||

| a This amount includes payments related to Government Annuities Account and Civil Service Insurance Fund. | |||||

Socio-Economic Year in Review

This section provides an overview of the socio-economic context for 2007, covering the broad macroeconomic and social indicators that are of interest to Human Resources and Social Development Canada. The issues that were facing the Canadian economy and labour market in 2006 became even more pronounced during 2007. Economic growth was strong, with that growth coming from strong employment gains and modest productivity growth. The sources of growth have been shifting west in response to high commodity (especially energy) prices, and the capacity of the economy to grow is becoming constrained by available labour supply, despite inter-provincial migration towards fast-growing provinces.

The Canadian economy performed well in 2007

Canada's economy grew by 2.7 percent in 2007, slightly slower than in 2006 but still a robust pace. In contrast, in 2007, the real Gross Domestic Product the United States grew by 2.2 percent, down markedly from a gain of 2.9 in 2006. In both countries, growth slowed considerably in the last quarter of 2007. Economic growth in Canada continued to be supported by strong domestic demand, led by consumer spending on goods and services and business investment, and combined with a higher Canadian dollar, helped imports to grow much faster than exports and led to a deteriorating trade balance in goods and services. The Canadian dollar broke parity with the American dollar for the first time since 1976. On November 6, the Canadian dollar closed at 108.52 cents U.S., the highest in recent years and subsequently has hovered about parity.

Employment continued to advance strongly

Employment advanced at a rate of 2.3 percent (380,000 jobs) in 2007, outpacing growth in 2006. Despite more pronounced concerns about growth being constrained by labour force availability, the labour force responded to the demand in the short term. The participation rate for those aged 15-64 reached an all-time record of 78.4 percent and the labour force advanced at a healthy 2.0 percent in 2007. The unemployment rate declined to a 33-year low of 6.0 percent, and people unemployed a year or more fell to 7.1 percent of all unemployed in 2007, its lowest share since 1982. Canada has had the lowest share of long-term unemployed among the G-7 countries for several years.

Alberta and British Columbia led the employment growth, while unemployment rates were at their lowest in almost all provinces

Overall, the economy benefited from high commodity and energy prices. However, these major price changes have had quite different impacts on particular sectors and regions. While all provinces experienced employment gains in 2007, and most had unemployment rates at or near their lowest levels on record, large provincial differences in unemployment rates persisted, from 3.5 percent in Alberta to 13.5 percent for Newfoundland and Labrador. The combination of the high energy and material input costs, the high value of the Canadian dollar, and the high level of competition from emerging economies led to another cycle of considerable weakness in the manufacturing sector. Canada has joined the almost world-wide trend of economies losing manufacturing jobs.

Despite substantial job declines, the unemployment rate in the manufacturing sector has remained low over the last few years, indicating that many displaced workers have been able to adjust. Employment data indicate that for every manufacturing job lost over the last five years, five jobs have been created in growth sectors of the economy such as mining, oil and gas extraction and construction.

Standard of living of Canadians continued to rise, but the gap with the United States persisted

The standard of living of Canadians, measured by real Gross Domestic Product per person, rose by 1.7 percent during 2007, the lowest rate of growth since 2003. In 2007, Gross Domestic Product per capita stood at about $40,070 (2002 constant Canadian dollars), up from $31,900 in 1997. Sluggish labour productivity growth has resulted in Canada's real Gross Domestic Product per capita falling behind the U.S., especially since 2000.

The low-income rate remains unchanged for most family types

Earnings gains were not evenly distributed and poverty was an ongoing issue, often best measured by how many families fall below a particular income level and by how much. In 2006, an estimated 633,000, or 7.0 percent, of all Canadian families were below the Statistics Canada after-tax 'Low-Income Cut-Off '. Families in low-income needed an average of $7,000 to bring their income above the cut-off. Female lone-parent families experienced an 11.2 percentage point decline in their low-income rate between 2002 and 2006, reflecting sustained increases in the earnings and in the proportion of earners among lone mothers. Despite these gains, the incidence of low-income among female lone-parent families remains more than four times as high as that of two-parent families with children.

But the gap between the lowest- and highest-income families and between the ones with the lowest and highest net worth is wider

The difference in post-income tax income (adjusted for family size and composition) between the top and bottom 20 percent of families widened during the past decade. While this gap fluctuated between 1990 and 1996, by 2006 it had reached $60,300. Though all income groups benefited from the positive economic conditions that have prevailed since the mid 1990s, the largest dollar gains were for the top 20 percent since they started from a much higher base. But, evidence suggests that most of the gains observed among the top 20 percent of families benefited only the top 1 percent. The median net worth of families in the top 20 percent of the wealth distribution also increased — by 19 percent between 1999 and 2005 — while the net worth of their counterparts in the bottom 20 percent remained virtually unchanged.

The make up of Canadian communities

The latest Census data confirm that Canadians are becoming more urbanized and diverse. In particular, according to the 2006 Census more than 81 percent of the Canadian population lived in urban centres of 10,000 people or more, up from 76 percent in 1971, and about 68 percent lived in communities located within the nation's 33 census metropolitan areas. International migration continued to be the major population driver of large urban centres with nearly 63 percent of all immigrants living in Toronto, Montreal or Vancouver in 2006 compared to 52 percent in 1981. With increased immigration and the tendency of most recent immigrants to have a mother tongue other than English or French, the share of this sector of the population has also grown from 18% in 2001 to 20% in 2006.

| Financial Resources (Gross) (millions of dollars) | ||

| Planned Spending | Authorities | Actual |

| 84,700.4 | 84,867.4 | 84,504.4 |

| Human Resources (Full-time Equivalents) | ||

| Planned Spending | Actual | Difference |

| 23,437 | 23,168 | 269 |

| Name | Type* |

| Our Commitment to Canadians: Support children, families and seniors Promote skills and learning Provide service excellence |

Ongoing |

| Our Commitment to Taxpayers: Accountability and effective spending |

Ongoing |

| Our Commitment to Employees: Workplace of opportunity |

Ongoing |

| *Type: The priority is identified as either new; ongoing; or previously committed to | |

| Expected Results | 2007-2008 | |

| (millions of dollars) | Planned Spending |

Actualc |

| Strategic Outcome: Policies and programs that meet the human capital and social development needs of Canadians | ||

| Program Activity - POLICY, RESEARCH AND COMMUNICATION |

197.5 | 199.3 |

| Strategic Outcome: Enhanced Canadian productivity and participation through efficient and inclusive labour markets, competitive workplaces and access to learning | ||

|

Program Activity - LABOUR MARKET

|

15,406.7 | 14,908.3 |

|

Program Activity - WORKPLACE SKILLS

|

213.7 | 139.4 |

|

Program Activity - LEARNING

|

2,100.0 | 2,283.8 |

| Sub-Total | 17,720.4 | 17,331.5 |

| Strategic Outcome: Safe, healthy, fair, stable, cooperative, productive workplaces and effective international labour standards | ||

|

Program Activity - LABOUR

|

271.5 | 239.3 |

| Strategic Outcome: Enhanced income security, access to opportunities, and well being for individuals, families and communities | ||

|

Program Activity - SOCIAL INVESTMENT

|

59,971.1 | 59,902.7 |

|

Program Activity - CHILDREN AND FAMILIES

|

2,481.2 | 2,482.1 |

|

Program Activity - HOUSING AND HOMELESSNESS

|

144.5 | 116.6 |

| Sub-Total | 62,596.8 | 62,501.4 |

| Strategic Outcome: Achieve better outcomes for Canadians through service excellence (Service Canada) | ||

|

Program Activity - SEAMLESS, CITIZEN-CENTRED SERVICE

|

2,479.6 | 2,581.6 |

|

Program Activity - INTEGRITY

|

1,029.6 | 903.9 |

|

Program Activity - COLLABORATIVE, NETWORKED GOVERNMENT SERVICE

|

228.4 | 228.4 |

| Sub-Total | 3,737.6 | 3,713.9 |

| TOTAL | 84,523.8 | 83,985.4 |

| aA new program, the Homelessness Partnering Strategy, was announced in December 2006 and is funded for two years (2007-2008 and 2008-2009) bThis amount includes Common Experience Payments to former Indian residential school students ($1,900M in planned spending and $1,817.4M in actual). cOther costs of $519.0M such as Workers' Compensation and EI/CPP charges and recoveries are excluded from the Actual expenditures presented. |

||

Summary of Departmental Performance by Strategic Outcome

This section summarizes achievements of Human Resources and Social Development Canada by strategic outcome and provides a report card on the Department's performance against specific indicators and objectives outlined in the 2007-2008 Report on Plans and Priorities.

Policies and programs that meet the human capital and social development needs of Canadians.

During the year, the Department provided strategic policy, research, and communication expertise in support of the government's efforts to improve the standard of living and quality of life of Canadians, and promote their social well-being and security. A major focus of this work was supporting the government's commitments contained in the 2007 Budget and economic and fiscal update, including supporting the principle of creating new opportunities and choices for people that was announced in Advantage Canada: Building a Strong Economy for Canadians.

The Department continued to implement several strategic initiatives aimed at achieving excellence throughout the organization. These included further refining the Department's ongoing medium-term policy planning process to identify emerging trends and challenges, as well as working through the development of an integrated policy framework.

Significant progress was made during the year on integrating the Department's extensive knowledge capacity to better inform its policy and program development functions. A departmental Knowledge Management Strategy was developed and specific initiatives were identified for the creation, maintenance, dissemination and use of data, research and knowledge.

Enhanced Canadian productivity and participation through efficient and inclusive labour markets, competitive workplaces and access to learning.

During 2007-2008, Human Resources and Social Development Canada worked with provincial and territorial governments, educational institutions, employers, community groups and other stakeholders to improve the quality of life of Canadians. Programs within the Department continue to improve Canada's competitive position by helping Canadians gain access to opportunities including post-secondary education, workplace skills development and work experience. This in turn, helps ensure that Canada develops the best educated, most skilled and flexible labour force in the world. Together, these all contribute to the competitiveness of workplaces and improved Canadian productivity.

Through its programs and services, Human Resources and Social Development Canada contributes to a number of Government of Canada outcomes: stronger economic growth; an innovative and knowledge-based economy; reliable income security; employment for Canadians including targeted groups and those facing barriers; and a fair and secure marketplace. Departmental efforts under this strategic outcome and its major program activities are consistent with the principle of creating new opportunities and choices for people that is outlined in the Government's Economic Plan: Advantage Canada: Building a Strong Economy for Canadians.

Labour Market and Workplace Skills

During 2007-2008, the Department integrated the programs under the labour market and workplace skills program activities within the Skills and Employment Branch in order to more effectively promote a skilled, adaptable and inclusive labour force, and an efficient labour market. The suite of programs assist employers in finding and retaining qualified and skilled workers and they ensure that workers are skilled, self-reliant and adaptable to labour market change. Provinces and territories and other stakeholders are critical partners that allow the Department to effectively plan and implement programs and policies that improve the state of the labour market and promote training and skills development opportunities for Canadians in institutions and workplaces.

To these ends, Human Resources and Social Development Canada worked with key partners and stakeholders to implement targeted strategies to increase the skills, competencies and the workforce participation of Canadians, including traditionally under-represented groups and vulnerable workers. For example, the Department worked with Aboriginal organizations and other partners to extend and expand the Aboriginal Skills and Employment Partnership initiative to maximize Aboriginal employment on major economic developments projects across Canada. This initiative promoted the labour market inclusiveness of Aboriginal Canadians, and helped employers to meet their skills and labour requirements. Other examples include the Targeted Initiative for Older Workers which assisted displaced older workers in vulnerable communities remain active in the labour force through the provision of new skills and training opportunities.

The Department has worked to ensure our programming continues to remain responsive to labour market challenges, and to afford employed and unemployed Canadians the skills training they need to pursue employment opportunities and the temporary financial assistance they need during transitions. The Department negotiated the transfer of several existing co-managed Labour Market Development Agreements to provincial and territorial governments during 2007-2008. In addition to supporting Employment Insurance-eligible clients through the Labour Market Development Agreements, new Labour Market Agreements were also negotiated during the year with provincial governments. Through these new agreements, low-skilled employed and unemployed Canadians who are not eligible for Employment Insurance benefits or programs will receive employment benefits and services.

The Workplace Skills program activity contributed to the Government of Canada's objective to increase the quality of labour market participants by working with the provinces and territories and other workplace partners to improve essential skills levels, and supporting the creation, testing and sharing of promising tools and approaches to workplace skills development. Through the Sector Council Program, for instance, sector councils worked to imbed industry-developed occupational standards and training materials into school curriculum.

The Department also continued to improve the efficiency of the labour market and to foster a better balance between national labour supply and demand. Collaborative efforts were undertaken with provinces, territories and other key partners to improve the recognition of the credentials of immigrants and to reduce barriers to labour mobility. For example, the Temporary Foreign Worker Program responded to the needs of employers seeking to hire temporary foreign workers through measures aimed at ensuring timely processing of Labour Market Opinions and enhanced protection of workers. In support of these objectives, the Expedited Labour Market Opinion Pilot and new information products for stakeholders, employers and foreign workers were successfully launched and a number of information sharing agreements with provincial governments were advanced or signed.

Human Resources and Social Development Canada also supports apprentices and skilled trades workers in Canada. For example, the Department continued to implement the Apprenticeship Incentive Grant, and also worked with provinces and territories under the Trades and Apprenticeship Strategy to strengthen and harmonize apprenticeship systems better enabling them to meet the demands of the growing economy.

Learning

Canada's continued prosperity depends on maintaining and improving our competitiveness and productivity. One of the key strategies that enable Canadians to do this is by creating the best educated, most skilled, and most flexible workforce in the world. This was identified as a key priority in Advantage Canada. Learning programs supported this strategy by helping hundreds of thousands of Canadians attend college, university, or trade schools. It did this by encouraging Canadians to save for, and by providing loans and grants to students to participate in, post-secondary education.

Learning programs provided Canadians with a more equitable opportunity to participate in post-secondary education by reducing the financial barriers to learning. These programs target under-represented groups such as people with low-income, single parents, Canadians from rural and remote communities and persons with disabilities. Participation in post-secondary education enables Canadians to be more successful in the labour market and to participate more fully in the economy as well as society. Research has clearly shown that individuals with post-secondary education are more productive, earn higher income, experience less unemployment and stay in the labour market longer.1

During 2007-2008, the Department consulted Canadians, provincial and territorial governments and other stakeholders to review financial assistance to students. This resulted in Budget 2008 announcements such as introducing a series of Student Financial Assistance measures, including a new student grant and changes to modernize and streamline the Canada Student Loan Program.2 The Department also implemented the changes announced in Budget 2007 to the Canada Education Savings Program to make it easier for Canadians to save for post-secondary education.3

The Department invested $1.1 billion during 2007-2008 in Canada Student Loans, and $161.5 million in Canada Access Grants and Canada Study Grants to help students attend post-secondary education institutions. Approximately, 460,000 post secondary students benefited from the Canada Student Loans Program. Around 58,500 Canada Study Grants and more than 34,700 Canada Access Grants were awarded to students. Based on a 2008 survey, 69% of Canada Student Loans Program borrowers surveyed reported that they would have been severely impacted had they not received a government student loan. The Canada Student Loans Program also successfully completed the transition to a new Service Provider and at the same time made significant progress in reducing the level of defaulted student loans. The Department also continued its efforts to modernize the delivery of student financial assistance to Canadians.

In addition, in 2007, the Canada Millennium Scholarship Foundation supplied $358.0 M in bursaries and scholarships, for a total investment of $ 382.8 M (including operating costs). The Canada Millennium Scholarship Foundation also awarded 3,135 millennium excellence entrance and national in-course excellence awards, valued at $4,000 or $5,000, depending on the type of award.

Also during 2007-2008, the Department invested a total of $627 million to help Canadians save for their children's post-secondary education. Moreover, the average age at which children received their first Canada Education Savings Grant is now 4.2 years and Canadians now have $23.5 billion in savings for the post-secondary education of their children in Registered Education Savings Plans. Furthermore, in 2007 more than 215,000 Canada Education Savings Grant beneficiaries attended post-secondary education institutions with the assistance of $1.3 billion ($1.07 billion in 2006) from their Registered Education Savings Plans.

In 2006-20074, around 36% of post-secondary students in Canada used the Canada Student Loans Program, and by December 2007, 37% of Canadians under the age of 18 had savings in a Registered Education Savings Plan and 11.8% of eligible children had a Canada Learning Bond (which only started in 2004).

During 2007-2008, the Department increased access to international education, by assisting 271 Canadian students to participate in international learning opportunities. The Department also worked to reduce non-financial barriers to adult learning and increase awareness of the benefits of lifelong learning amongst Canadians. It established the Office of Literacy and Essential Skills to improve the literacy and essential skills of Canadians and promote an understanding of the importance of the integration of literacy and essential skills into policies and programs. It also launched a new CanLearn website which contains a section to help Canadians explore lifelong learning. The Department also developed a new survey which will enable it to measure Canadians' awareness of the benefits of lifelong learning and their attitudes towards adult learning, education and training. Finally, it promoted awareness of the importance of, and informed and encouraged Canadians to, save for post-secondary education.

Safe, healthy, fair, stable, cooperative, productive workplaces and effective international labour standards.

Labour

Throughout the year, the Labour Program administered labour related legislation governing federally regulated industries, fostered cooperation within the network of labour jurisdictions in Canada, and managed Canada's international labour affairs.

This work covered a broad spectrum of labour issues: maintaining a fair balance in the relationship between employers and employees; creating competitive workplaces; supporting Canada's productivity; and promoting international respect for labour rights. For example, mediation and conciliation assistance provided to employers and unions led to over 92 percent of collective bargaining disputes being settled without a work stoppage. As well, planning was undertaken for a new Industrial Relations Internship Program in order to build capacity for the industrial relations community and analysis was carried out on the recommendations emanating from a review of Part III (Labour Standards) of the Canada Labour Code. The Wage Earner Protection Program Act came into force and established a program to compensate workers for unpaid wages and vacation pay owed to them by employers who are declared bankrupt or are subject to receivership. In addition, a Comprehensive Reinstatement Strategy was developed in cooperation with the Department of National Defence to secure job and education protections for military reservists volunteering on full time deployment with the Canadian Forces. Also, the Minister of Labour launched a focussed study on the causes and impact of work stoppages in the private sector under federal jurisdiction.

Recent high profile work stoppages in the private sector under federal jurisdiction led officials of the Federal Mediation and Conciliation Service to examine its program delivery services to better address the needs of the industrial relations community. The difficulty experienced by parties in resolving the many issues raised by major structural changes in corporate organizations was identified as a key contributor to industrial strife. The merger of bargaining units resulting from the streamlining of bargaining structures, the acquisition and integration of a competitor, and the creation of a single regional company, featured prolonged negotiations, costly litigation and, in some cases, work stoppages. Notably, these work stoppages differed from others in terms of length and person days lost. A closer examination of these disputes revealed that corporate decisions had primarily been based on business imperatives and that insufficient attention had been paid to the impact of organizational changes on employees, their working conditions and their unions. Major corporate changes often lead to major changes in union representational structures. Normal avenues for addressing employee concerns are disrupted as long established unions are themselves faced with representational and organizational issues that complicate and, in some cases, impede their ability to respond to major structural change of their respective employers.

The Labour Cooperation Agreement with Peru, the negotiations for which were concluded in January 2008, is the strongest labour agreement ever negotiated by Canada. It includes effective provisions that commit the signatories to ensuring that their labour laws embody internationally recognised fundamental rights and principles and enforcing their labour legislation. This agreement is also complemented with a technical assistance program to help Peru implement its obligations under the Labour Cooperation Agreement and other international labour related commitments. The Labour Program has learned that while countries like Peru have the political will to improve the working conditions and living standards of their workers and their families, they lack the resources for improving the labour situation in their country. The Labour Program has learned that the best approach to promoting sustainable changes with respect to the labour dimension of international trade is to integrate cooperation, as well as financial and technical support, with strong labour commitments through our Labour Cooperation Agreements.

Successful employment equity involves the application of complex problem identification and resolution techniques. As this is applied in the area of human resource management, a discipline that remains one of the most complex and evolving corporate challenges, employers have frequently found it difficult to do well and to achieve tangible results. The lack of tools, techniques, templates and supporting software result in inconsistency between the Federal Contractors Program for Employment Equity and the Legislated Employment Equity Program, and among the Labour Program's five regions. Compliance review results and employer input attested to this conclusion. In response, the Labour Program began the development of a four step process that provides step by step guidance supported by a full range of tools and templates. The final release of the initial four steps for employers subject to the Federal Contractors Program for Employment Equity was completed in the winter of 2007.

The Labour Program's efforts contributed to numerous Government of Canada outcomes: a fair and secure marketplace; safe and secure communities; a safe and secure world through international cooperation; and a strong and mutually beneficial North American partnership.

Enhanced income security, access to opportunities and well-being for individuals, families and communities.

The Department continued to help individuals, families and communities maximize their potential in contributing to Canadian society and sharing in the opportunities it provides. At times this involved providing direct assistance, such as the pension benefits paid to over 5 million people to provide income security and the financial benefits paid to parents to help them choose the kind of care they want for their young children. Other activities addressed particular circumstances or vulnerabilities, such as working with community groups in providing facilities and services to meet the needs of homeless people, or investing in communities through the New Horizons for Seniors Program, Social Development Partnerships Program.

Social Investment

The Department continued to administer Canada's national pension programs, which constituted important sources of secure income for seniors, surviving spouses and people with disabilities. In 2007-2008, Canada Pension Plan benefits were paid to over 4.8 million individuals while more than 4.4 million individuals received Old Age Security program benefits. Furthermore, approximately 1.6 million low income seniors received the Guaranteed Income Supplement. As an illustration of how important such pensions are to low income seniors, Old Age Security program and Guaranteed Income Supplement benefits accounted for more than half of this segment of the population's total post-retirement income. In addition, the Canada Pension Plan Disability benefit provided income to people with disabilities who were unable to work due to a severe, prolonged disability. Other Canada Pension Plan benefits provided income security to surviving spouses or common-law partners and their dependent children. In total, approximately $59.5 billion in Canada Pension Plan and Old Age Security program benefits were paid to individuals in 2007-2008 (up from $56.4 billion in 2006-2007).

To ensure Canada's national pension programs remain responsive to the current and future needs of Canadians, the Department implemented a number of improvements. These improvements included implementing legislative amendments intended to simplify access to and delivery of Canada Pension Plan and Old Age Security benefits. Meanwhile, the Department continued its outreach efforts to inform individuals of Canada's retirement income system, particularly vulnerable segments of the population who often experience barriers to receiving information and assistance through traditional government channels.

The Department also focused on helping the most vulnerable groups improve their well-being and participation in communities through programs such as the New Horizons for Seniors Program, the Social Development Partnerships Program and Understanding the Early Years Initiative. The community-based New Horizons for Seniors Program invested in 1,771 projects to encourage seniors to share their knowledge and skills with others in their communities and reduce their social isolation. An additional $10 million per year was also invested in the Program to help raise awareness of elder abuse and fraud and to provide capital assistance toward facilities and equipment required for the delivery of programs for seniors.

In an effort to strengthen the ability of the not-for-profit sector to respond to existing and emerging social development issues, investments were made in 59 projects under the Social Development Partnerships Program. These investments support new and enhanced services, innovative delivery models, and product development such as how-to manuals, training materials and best practice guidebooks. This work has had a direct impact in strengthening communities' front-line programs; particularly those services relied upon by children and families, people with disabilities, and other vulnerable populations.

Children and Families

Recognizing the priority that families place on child care and the diversity of challenges this presents to parents, the Government of Canada, started in 2007-2008 to transfer $250 million annually, to provinces and territories to help support the creation of new child care spaces. The federal government also provided substantial financial assistance through the Canada Social Transfers to support early childhood development using such federal, provincial and territorial initiatives as the Multilateral Framework on Early Learning and Child Care, and the Early Childhood Development Agreement.

As well, the Children and Families Program activity managed the Universal Child Care Benefit, which provided financial assistance to parents in a way that allows them to decide for themselves on the form of child care that best suits their circumstances. Each month 1.5 million families with young children received the Universal Child Care Benefit. Financial assistance and services were provided to low-income families through the National Child Benefit, a partnership among federal, provincial and territorial governments, including a First Nations component.

Housing and Homelessness5

People become homeless through a variety of circumstances, so the homeless population has many faces in many communities. The Department therefore invested in community-based efforts to develop tools and effective means of intervention to help homeless people move towards self-sufficiency. The housing and homelessness program activity led work in this area in collaboration with numerous partners and stakeholders. The Homelessness Partnering Strategy enhanced partnerships across government to improve access to services and programs for individuals and families struggling with homelessness. The Strategy shifted the emphasis from remedial interventions toward prevention and reduction of homelessness through longer-term solutions such as transitional and supportive housing. The Strategy relied on partnerships, improved collaboration, and better alignment of investments by the various partners to implement local solutions to local problems.

Achieve better outcomes for Canadians through service excellence.

In its third year, Service Canada continued to make progress towards the goals of providing one-stop client service, improved program integrity, and stronger collaboration and partnership with other federal departments and agencies, provinces and territories. The organization focussed on improving the delivery of its core foundational programs, while new services were provided and others expanded, new points of service opened, and work continued to ensure appropriate stewardship of public funds. Service Canada proactively sought advice from a range of external organizations that offered valuable information on the needs of various client groups and supported the development of strategies to serve specific client segments. Access to service was improved with 33 new points of service to reach 620 points across Canada, outreach visits to smaller communities and increased use of the Service Canada website. Service Canada continued to expand its range of services, including the ecoAUTO rebate program and Common Experience Payments, administration of the Ice Compensation payments, and continued to improve service delivery capacity in areas such as passport applications. Service Canada's focus on sound stewardship of public funds and safeguarding client privacy continued through efforts to protect the personal information of Canadians and to ensure that benefits are issued correctly.

Seamless, Citizen-Centred Service

During 2007-2008, Service Canada increased the familiarity of Canadians with the Government of Canada programs and services that it made available to them. National, regional and community-based advertising made the public aware of both new and program-specific service offerings. Public awareness of Service Canada was further heightened through improved signage that featured the Service Canada brand, and the participation of Service Canada staff in community events, information sessions, career fairs and other off-site activities. Together, these efforts resulted in increased usage of 1 800 O-Canada and the Service Canada website, and visits to Service Canada Centres for advertised services and programs. Canadians increasingly turned to Service Canada as the service network of choice; results included more than 51 million calls to Service Canada call centres; over 90,000 Common Experience Payment applications; 267,000 passport applications; almost 53,000 Apprenticeship Incentive Grant applications; over 113 million visits to the Job Bank site; and over four million more visits to the Service Canada website than in 2006-2007. Thirty-three new Service Canada points of service were added, reaching 95.4 percent of Canadians who reside within 50 kilometres of a Service Canada point of service. Service Canada increased the range of available programs by expanding its partnerships with other federal government departments and orders of government stakeholders and volunteer organizations to deliver services on their behalf.

Integrity

Protecting the personal information of Canadians continued to be a high priority with measures taken to safeguard such information, improve management controls, develop a risk analysis and integrity review framework for new service offerings, and prioritize and streamline the investigation of Employment Insurance claims. Service Canada implemented measures that further strengthened the protection of Canadians' personal information, helped ensure that the right benefits were provided to the right client and for the intended purpose. The organization initiated a proof of concept to establish enhanced data analysis capability to detect, investigate and prevent Social Insurance Number related abuse. Initial benchmark studies undertaken on Old Age Security and Canada Pension Plan payments demonstrated that payment is highly accurate. With respect to the goal of ensuring integrity of the Social Insurance Number, Service Canada implemented a Quality Management strategy to provide rigorous systematic controls at each step in the issuance of Social Insurance Numbers. High rates of accuracy were achieved in both Social Insurance Number issuance to the right person (over 99.9 percent) and in recording the Social Insurance Register's vital events dates for births and deaths. A range of integrity strategies and proactive and preventative interventions were undertaken to ensure that payments were issued only to eligible individuals. To provide secure access to Employment Insurance, Canada Pension Plan and Old Age Security services online, Service Canada validated client identity against the Social Insurance Register, which resulted in 13.7 million authentication transactions. Protecting the integrity of public funds included conducting a total of 772,357 investigations of suspected fraud or abuse of the Canada Pension Plan, Old Age Security, Social Insurance Number and Employment Insurance.

Collaborative, Networked Government Service

Stronger partnerships developed with other federal government departments and agencies, as well as other orders of government allowed Service Canada to expand the array of benefits and services it provided to Canadians. Effective working relationships established with other organizations during the year helped to simplify procedures for clients seeking assistance from the Government of Canada and improved timeliness in getting needed benefits to those faced with pressing economic circumstances. Seven new formal agreements were signed with six departments and agencies (Department of Human Resources and Social Development, Department of Fisheries and Oceans, Passport Canada, Department of Canadian Heritage, Department of National Defence, and Department of Transport) that will facilitate the delivery of benefits and services on their behalf. Vital events management improvement was facilitated through arrangements with provinces, which permitted the authentication and validation of personal identity. The "My Service Canada Account" eliminated the need for duplicate online client accounts to access Service Canada products and services. Client service capacity was further increased through enhancements of the "Read to Me" feature for visually and mobility impaired users of the Service Canada website as evidenced through the 172,000 times the read speaker was activated. Business volumes recorded during 2007-2008 provided concrete evidence of Service Canada's increased service capacity.

Table 2: Departmental Report Card for Program Indicators

Program indicators are among several sources used for evaluating departmental performance. Program evaluations, audits and various monitoring reports are also tools to provide a comprehensive understanding of performance.

The Report Card displays results information for the Department's program performance indicators that were published in the 2007-2008 Report on Plans and Priorities. For indicators that have an established target, the Report Card provides a rating in terms of whether expectations were met, mostly met, or not met. No rating is provided for indicators that do not have established targets. Brief comments are included for indicators where required. More detailed comments on indicator results are included in the section of the document that discusses performance by strategic outcome.

Overall, the Department met or exceeded 37 of its 45 targets.

Rating Data Sources

Human Resources and Social Development Canada has implemented an additional control on all performance information gathered and included it in the Performance Report to identify the data source and data quality.

The assessment of quality of data found in this Performance Report is based upon this preliminary assessment of the system controls. The table below provides a summary of ratings for data quality for the targeted data reviewed. The Department will continue to review certain data systems and improve upon management controls and present those findings in future performance reports.

Key findings of this review include that 76% of the targeted data had controls rated as "good". The balance of targeted data reviewed was, for the most part, rated as "reasonable".

| Rating Summary of Data Systems and Process Controls | ||

| Data Systems and Controls Rating | Definition | Number of Data Systems and Controls |

| Good | Has clearly defined policies and procedures in place | 90 |

| Reasonable | Has compensating controls in place to make up for lack of defined policies/procedures | 26 |

| Weak | Has no defined policies/procedures or compensating controls in place | 2 |

| Summary of Departmental Program Performance by Strategic Outcome | |||

| Legend | ●Target met or exceeded |  Target mostly met Target mostly met |

|

| ○ Target not met | N/A Not applicable | ||

| Rating | Program Indicators | 2007-2008 Target | Results |

| Enhanced Canadian productivity and participation through efficient and inclusive labour markets, competitive workplaces and access to learning | |||

| Clients Employed | |||

| ● | Number of clients employed and / or returns to school following an employment program intervention and as a proportion of the total number of clients who complete their employment program intervention (s). | Number Range: 205,000-225,000 Proportion: 55%-60% |

Number: 221,787 Proportion: 60.76% Data Systems and Controls Rating: Reasonable |

| Job Ready/ Job Search | |||

| ● | Number of Job Ready/Job Search a clients employed or returned to school following an employment program intervention a Job Ready / Job Search: support programs that help clients find a good job match as quickly as possible. |

Number Range: 87,000-95,000 |

105,296 Data Systems and Controls Rating: Reasonable |

| Developmental | |||

| ● | Number of clients who become employed or returned to school following a developmentalb employment program intervention. b Developmental: benefit programs that help clients gain work experience, improve job skills or start a new business. |

Number Range: 118,000-130,000 |

123,845 Data Systems and Controls Rating: Reasonable |

| ○ | Number of clients participating in Skills Development and as a proportion of the total number of clients who participate in a developmental employment program intervention. | 85,000-94,000 68% |

75,203 65% Data Systems and Controls Rating: Reasonable |

| Comments: A variety of economic factors influence these individual indicators. For example, the indicators were affected by the continued strength of demand for labour across the country, strong economic growth resulting from strong employment gains and modest productivity growth, record high participation and employment rates for those 15 to 64, and near-record low unemployment rates in most provinces for 2007-2008. | |||

| ● | Number of apprenticeship clients who received benefits provided through EI Part I or II. | 50,000-56,000 | 58,195 Data Systems and Controls Rating: Reasonable |

| ● | Percentage of Sector Councils that meet or exceed expected level of performance. | 90% | 95% Data Systems and Controls Rating: Good |

| ● | Increase in the number of trades people who are fully mobile in Canada through Red Seal endorsement. | 17,000 | 21,087 Data Systems and Controls Rating: Good |

| ● | Portion of skilled immigrants in occupations targeted by systemic Foreign Credential Recognition interventions. | 53% | 53.7% Data Systems and Controls Rating: Good |

|

Percentage of Canada Student Loan borrowers who would have been severely impacted if it were not for the loan. | 71% | 69% Data Systems and Controls Rating: Good |

| ● | Client satisfaction with the overall quality of services provided by the Canada Student Loans Program. | 75% | 75% Data Systems and Controls Rating: Good |

| ● | Percentage of children 0-17 who have ever received a Canada Education Savings Incentive. | 36% | 37% Data Systems and Controls Rating: Good |

| Safe, healthy, fair, stable, cooperative, productive workplaces and effective international labour standards | |||

| ● | Percentage of collective bargaining disputes settled under Part I (Industrial Relations) of the Canada Labour Code without work stoppage. | 90% | 92.1% Data Systems and Controls Rating: Good |

| ● | Percentage of unjust dismissal complaints settled by inspectors (Part III of the Canada Labour Code). | 75% | 76% Data Systems and Controls Rating: Good |

| ● | Disabling Injury Incidence Rate measuring the change in the rate of lost time injuries, illnesses and fatalities within federal jurisdiction industries from year to year. | Reduce the Disabling Injury Incidence Rate by 10% over five years (by 2008-2009) in those high-risk industries where we are targeting proactive interventions |

Data Systems and Controls Rating: Good |

| ○ | Percentage of money collected in relation to the amount found to be owed for complaints under Part III (Labour Standards) of the Canada Labour Code (excluding unjust dismissal complaints). | 75% | 57.93% Data Systems and Controls Rating: Good |

| Comments: The target was not met due to the unusually high numbers/amounts not settled because of bankruptcies (especially two large ones in Ontario, amounts which are largely unrecoverable), and from claims filed in Federal Court. If these two categories were excluded, the result would be 84.79%. | |||

| ● | Client satisfaction with the quality of Workplace Information Directorate data. | 80% | 2006 - 2007 Result - 96.4% Data Systems and Controls Rating: Good |

| Comments: A survey was not carried out in 2007-2008. | |||

| Enhanced income security, access to opportunities and well-being for individuals, families and communities | |||

| ● | Number and percentage of clients with enhanced employability. | 2,200 clients or 40% | 2,600 clients or 74% Data Systems and Controls Rating: Good |

| ● | Number of new community-based social development projects or initiatives that have been supported to promote the participation of children and families, persons with disabilities or other vulnerable populations. | 30 projects | 59 projects Data Systems and Controls Rating: Reasonable |

| ● | Number of persons participating in New Horizons for Seniors community projects. | 50,000 participants | 91,700 participants* *Based on an estimate of 100 participants per project. Data Systems and Controls Rating: Reasonable |

| ● | Percentage of families who are receiving the Universal Child Care Benefit for their children under age 6. | 100% of eligible families | 99.2% Data Systems and Controls Rating: Good |

| ● | Amount invested in communities by external partners (not-for-profit groups, private sector organizations and other government departments) for every dollar invested by the Homelessness Partnership Initiative. | $1.50 | $3.18** **Transition year full results not available. Results represent carry-over projects from Phase II of the National Homelessness Initiative (predecessor of the Homelessness Partnership Strategy ). Data Systems and Controls Rating: Good |

| ● | Percentage of all Homelessness Partnership Initiative investments targeted to long-term stable housing and related services. | 65% | 73.9% Data Systems and Controls Rating: Good |

| Achieve better outcomes for Canadians through service excellence | |||

| ○ | Specialized calls answered by an agent within 180 seconds-information and transaction. | 95% | 58.5% Data Systems and Controls Rating: Good |

| Comments: Result for the Canada Student Loans Program: 94.5% Result for Canada Pension Plan and Old Age Security: 75% Result for Employment Insurance: 41% Service Canada continues to make improvements to its specialized call centres by transforming the current program-silo network to an integrated network. When fully implemented, this means that workload can be managed nationally, eventually enabling agents to respond to Canadians across programs and from any geographic location. |

|||

| ● | General calls answered by an agent within 18 seconds (1 800 O-Canada). | 85% | 88% Data Systems and Controls Rating: Good |

| ● | Access to automated telephone information services. | 95% | 95.4 % Data Systems and Controls Rating: Good |

| ● | 24/7 availability of Internet-information and transaction. | 98% | 99.3% Data Systems and Controls Rating: Good |

| ● | Number of forms online in formats accessible for people with disabilities. | 10 | 11 Data Systems and Controls Rating: Good |

| ● | Percentage of Canadians with access within 50 kms of where they live. | 90% | 95.4% Data Systems and Controls Rating: Good |

| ● | Number of Service Canada Centres with extended hours of service. | 60 | 62 Data Systems and Controls Rating: Good |

| ● | Number of established points of service for Official Language Minority Community Groups. | 17 | 37 Data Systems and Controls Rating: Good |

| ● | Languages offered other than English and French. | 10 | 20 Data Systems and Controls Rating: Good |

| ○ | Notifications sent within seven days of receipt of applications. | 80% | 65.8% Data Systems and Controls Rating: Good |

| Comments: When Canadians apply on-line, they are immediately notified of the receipt of their application. At this time notification within 7 days for paper-based claimant applications cannot be guaranteed. Result for Employment Insurance: 97.6% of initial applications and 85.5% of renewal applications are received electronically through the Internet and are instantly acknowledged. for the Canada Pension Plan: 24% of Canada Pension Plan retirement applications were received on line and acknowledged instantly. for Old Age Security: Old Age Security and Guaranteed Income Security applications are not automated bringing the overall indicator result down to 65.8%. Old Age Security applications on-line is planned for 2009-2011. |

|||

| ● | Canada Pension Plan retirement benefit payment or non-payment notification issued within first month of entitlement. | 85% | 91.8% Data Systems and Controls Rating: Good |

| ● | Employment Insurance benefit payment or non-payment notification issued within 28 days of filing. | 80% | 80.3% Data Systems and Controls Rating: Good |

| ● | Employment Insurance Umpire Appeals sent to the Office of the Umpire within 60 days. | 100% | 98.3% Data Systems and Controls Rating: Good |

|

Employment Insurance Board of Referee Appeals scheduled within 30 days. | 90% | 78.1% Data Systems and Controls Rating: Good |

| ● | Old Age Security basic benefit payment or non-payment notification issued within first month of entitlement. | 90% | 93.7% Data Systems and Controls Rating: Good |

| ● | Pleasure craft licences issued in a visit. | 90% | 89.8% Data Systems and Controls Rating: Reasonable |

| ● | SINs issued in a visit. | 90% | 93% Data Systems and Controls Rating: Good |

| ● | Accuracy rate of payments (includes Employment Insurance and Old Age Security) (Canada Pension Plan under development). | 95% (EI)a | 94.4% Employment Insurance Data Systems and Controls Rating: Good |

| Client satisfaction in relation to services provided. | 80% b | N/A Data Systems and Controls Rating: Good |

|

| Comments: a A combined indicator for Employment Insurance and Old Age Security payments will be implemented in 2008-2009. b Refers to biannual client satisfaction survey which will be supplemented by a range of client feedback and related mechanisms. A survey was not carried out in 2007-2008. |

|||

| Human Resources and Official Languages Indicators | |||

| Legend | |||

| ●Target met or exceeded |  Target mostly met Target mostly met |

○ Target not met | N/A Not applicable |

| Rating | Program Indicators | 2007-2008 Target | Results |

| Employment Equity | |||

|

Representation of visible minority persons | 9.4% | 9.0% |

| ● | Representation of Aboriginal persons | 3.1% | 3.9% |

| ● | Representation of people with disabilities | 3.4% | 7.2% |

| ● | Representation of women | 59% | 70.7% |

| Data Systems and Controls Rating: Reasonable | |||

| Comments: Under representation of members of a visible minority is an identified problem in the Federal government. At Human Resources and Social Development Canada with an employee population of 22,034, the under-representation gap for members of a visible minority is .4%. As well, there are only a few occupation groups for this designated

group were under representation is significant. These occupational groups are Computer Systems and Program Management. Employee Equity gaps are being aggressively addressed in the Human Resources Planning process. Statistical reports and analysis are being provided to branches, business lines and regions so they can identify and address any localized under representation for any group within their Human Resources plan. |

|||

| Official Language Complaints | |||

| N/A | Communications with and services to the public | Actual results to be reported | 33 |

| N/A | Language of work | Actual results to be reported | 15 |

| Data Systems and Controls Rating: Reasonable | |||

| Management Priorities | |

| Plan | 2007-2008 Achievements |

| Priority: Strengthen and ensure effective management in the Department | |

| Ensure effective and efficient corporate services | Reviewed the Department's governance structure to strengthen accountability and coherent decision-making. Reviewed Corporate Services functions to assess problems and improve performance. Established a Corporate Secretariat to provide ministerial and executive support and coordination across the Human Resources and Social Development Canada portfolio. |

| Strengthen information and knowledge management systems | Advanced a corporate Knowledge Management Strategy based on Web-based tools, products and dialogue fora to facilitate the storage, dissemination and transfer of the knowledge necessary to inform policy and program development and analysis. Developed the HRSDC Knowledge Portal Pilot intended to provide employees with centralized and rapid access to a comprehensive set of departmental knowledge resources, including data holdings, published and unpublished research reports and papers, evaluation and audit reports, newsletters, indicators, statistic information and public opinion research. The Electronic Records Management Initiative was launched. This initiative included the introduction of the Record, Documents, and Information Management System that integrates records management, document management, imaging, optical character recognition, full-text indexing search and retrieval, workflow, an on-line document viewer and reporting capabilities in order to enhance service delivery, provide better support to decision-makers, make knowledge workers more productive, and promote information sharing. |

| Address issues identified in the Management Accountability Framework assessment. | In the 2006 Round IV Management Accountability Framework assessment, Treasury Board Secretariat identified a total of 7 areas that would benefit from departmental attention. These areas concerned values-based leadership and organizational culture, Treasury Board submissions, performance reporting, information technology, asset management, financial management and control, and internal audit. In response, the Department developed and implemented a detailed action plan containing concrete activities. While no formal monitoring and reporting process was applied, progress was reported periodically at senior management meetings. Efforts, activities and initiatives undertaken to respond to identified concerns were used to populate the departmental self-assessment for Management Accountability Framework Round V and subsequently reported to Treasury Board. The Treasury Board Secretariat acknowledged and commended the Department on the significant progress it has made in all areas identified in Round IV through a much improved rating as a result of the Round V assessment. |

| Ensure effective governance relationship among policy development, program design and service delivery through Service Canada | Established a Portfolio wide Senior Management Board, single Audit Committee, and implemented a review of governance structures and processes. Medium-term policy planning capacity was deepened with a focus on sectoral and integrated diagnostics and broad engagement with policy and research on the development of the medium-term policy agenda. Significant progress has been made in linking evaluation to policy development. For the third consecutive year, evaluation received a strong rating in the Treasury Board Secretariat Management Accountability Framework assessment. |

| Priority: Maintain and enhance financial stewardship in all areas of the department | |

| Enhance and sustain transparency and oversight functions through accountability measures, including implementation of the Federal Accountability Act | Assessed problems and risks, developed alternative models for strengthened accountability and improved performance, and completed analysis of options for realignment of corporate services and management of grants and contributions, including development of the appropriate management and accountability structure, in support of stronger linkages to policy and priorities and