Common menu bar links

Breadcrumb Trail

ARCHIVED - Treasury Board of Canada Secretariat

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section III: Supplementary Information

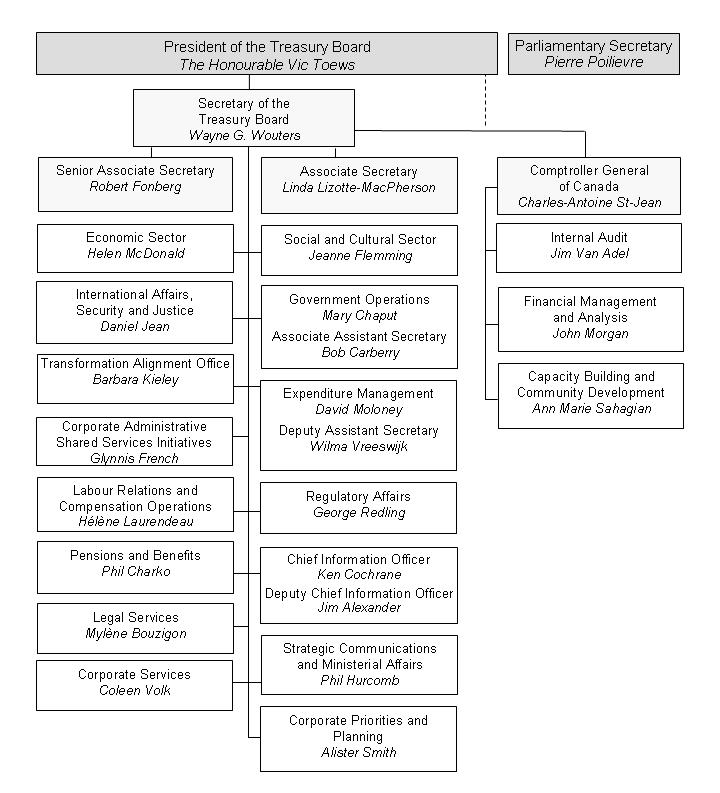

Organizational Information

Treasury Board of Canada Secretariat Organization

Table 1: Comparison of Planned to Actual Spending (including Full-Time Equivalents)

|

|

|

2006–07 |

||||

|

($ thousands) |

2004–05 Actual |

2005–06 Actual |

Main Estimates |

Planned Spending |

Total Authorities |

Actual |

|

Program Activity |

|

|

|

|

|

|

|

Management and Expenditure Performance |

119,134 |

131,202 |

129,512 |

134,649 |

142,470 |

138,797 |

|

Comptrollership |

22,553 |

23,259 |

41,894 |

41,711 |

43,898 |

32,580 |

|

Centrally Managed Funds1 |

1,433,386 |

1,423,799 |

2,426,820 |

2,427,986 |

2,281,742 |

1,537,987 |

|

Revitalization of the Toronto Waterfront2 |

- |

- |

- |

- |

115,937 |

35,049 |

|

|

||||||

|

Total |

1,575,073 |

1,578,260 |

2,598,226 |

2,604,346 |

2,584,047 |

1,744,413 |

|

|

||||||

|

Less: Non-respendable Revenue |

(10,513) |

(11,909) |

- |

(10,000) |

(26,935) |

(26,935) |

|

Plus: Cost of services received without charge |

12,395 |

12,672 |

- |

11,500 |

12,550 |

12,550 |

|

|

||||||

|

Net Cost of the Secretariat |

1,576,955 |

1,579,023 |

2,598,226 |

2,605,846 |

2,569,662 |

1,730,027 |

|

|

||||||

|

Full-time Equivalents |

996 |

1,048 |

1,341 |

1,351 |

1,385 |

1,179 |

|

|

||||||

|

1. Total Authorities for Centrally Managed Funds include Secretariat Votes 5, 10, and 20, as well as other statutory votes related to public service pension and benefits. Votes 5 and 10 are special TB Votes that consist of funds used to supplement other appropriations. These transfers reduce the Secretariat's Authorities, and the departmental performance reports of recipient departments and agencies report an increase in Authorities, as well as actual expenditures. 2. In accordance with the February 6, 2006, changes in ministers' responsibilities, this authority was transferred from Citizenship and Immigration Canada to the Treasury Board of Canada Secretariat through the 2006–07 Supplementary Estimates. Subsequently, in accordance with the January 4, 2007, changes in ministers' responsibilities, this authority will be transferred from the Treasury Board of Canada Secretariat to Environment Canada through the 2007–08 Supplementary Estimates. |

||||||

Table 2: Resources by Program Activity

($ thousands)

|

2006–07 |

|||||

|

Program Activity |

Budgetary |

||||

|

Operating |

Contributions and other Transfer Payments |

Total: Gross Budgetary Expenditures |

Less: Respendable Revenues |

Total: Net Budgetary Expenditures |

|

|

Management and Expenditure Performance |

|

|

|

|

|

|

Main Estimates |

132,722 |

- |

132,722 |

3,210 |

129,512 |

|

Planned Spending |

137,859 |

- |

137,859 |

3,210 |

134,649 |

|

Total Authorities |

145,660 |

20 |

145,680 |

3,210 |

142,470 |

|

Actual Spending |

141,511 |

20 |

141,531 |

2,734 |

138,797 |

|

Comptrollership |

|

|

|

|

|

|

Main Estimates |

41,894 |

- |

41,894 |

- |

41,894 |

|

Planned Spending |

41,711 |

- |

41,711 |

- |

41,711 |

|

Total Authorities |

43,668 |

230 |

43,898 |

- |

43,898 |

|

Actual Spending |

32,350 |

230 |

32,580 |

- |

32,580 |

|

Centrally Managed Funds |

|

|

|

|

|

|

Main Estimates |

2,558,500 |

520 |

2,559,020 |

132,200 |

2,426,820 |

|

Planned Spending |

2,559,666 |

520 |

2,560,186 |

132,200 |

2,427,986 |

|

Total Authorities |

2,446,477 |

515 |

2,446,992 |

165,250 |

2,281,742 |

|

Actual Spending |

1,702,899 |

338 |

1,703,237 |

165,250 |

1,537,987 |

|

Revitalization of the Toronto Waterfront1 |

|

|

|

|

|

|

Main Estimates |

- |

- |

- |

- |

- |

|

Planned Spending |

- |

- |

- |

- |

- |

|

Total Authorities |

1,194 |

114,743 |

115,937 |

- |

115,937 |

|

Actual Spending |

598 |

34,450 |

35,049 |

- |

35,049 |

|

|

|||||

|

Total |

|

|

|

|

|

|

|

|||||

|

Main Estimates |

2,733,116 |

520 |

2,733,636 |

135,410 |

2,598,226 |

|

Planned Spending |

2,739,236 |

520 |

2,739,756 |

135,410 |

2,604,346 |

|

Total Authorities |

2,636,999 |

115,508 |

2,752,507 |

168,460 |

2,584,047 |

|

Actual Spending |

1,877,359 |

35,038 |

1,912,397 |

167,984 |

1,744,413 |

|

|

|||||

|

1. In accordance with the February 6, 2006, changes in ministers' responsibilities, this authority was transferred from Citizenship and Immigration Canada to the Treasury Board of Canada Secretariat through the 2006–07 Supplementary Estimates. Subsequently, in accordance with the January 4, 2007, changes in ministers' responsibilities, this authority will be transferred from the Treasury Board of Canada Secretariat to Environment Canada through the 2007–08 Supplementary Estimates. |

|||||

Table 3: Voted and Statutory Items

($ thousands)

|

|

|

2006–07 |

|||

|

Vote or Statutory Item |

Truncated Vote or Statutory |

Main Estimates |

Planned Spending |

Total Authorities |

Actual |

|

1 |

Program Expenditures |

150,649 |

155,434 |

177,738 |

156,963 |

|

2 |

Contributions1 |

- |

- |

114,993 |

34,700 |

|

(S) |

President of the Treasury Board—Salary and motor car allowance |

73 |

73 |

73 |

73 |

|

(S) |

Contributions to employee benefit plans |

20,684 |

20,853 |

14,689 |

14,689 |

|

(S) |

Spending proceeds from the disposal of surplus Crown assets |

- |

- |

17 |

- |

|

5 |

Government Contingencies2 |

750,000 |

750,000 |

594,031 |

- |

|

10 |

Government-wide Initiatives3 |

13,000 |

10,220 |

3,503 |

- |

|

15 |

Collective Bargaining4 |

- |

- |

- |

- |

|

20 |

Public Service Insurance5 |

1,663,800 |

1,667,746 |

1,666,846 |

1,525,831 |

|

(S) |

Public Service Pension Adjustment Act |

20 |

20 |

15 |

15 |

|

(S) |

Unallocated employer contributions made under the Public Service Superannuation Act and other retirement acts and the Employment Insurance Act. |

- |

- |

10,557 |

10,557 |

|

(S) |

Payments for the pay equity settlement pursuant to section 30 of the Crown Liability and Proceedings Act |

- |

- |

1,584 |

1,584 |

|

|

|||||

|

|

Total Treasury Board of Canada Secretariat |

2,598,226 |

2,604,346 |

2,584,047 |

1,744,413 |

|

|

|||||

|

1. In accordance with the February 6, 2006, changes in ministers' responsibilities, this authority was transferred from Citizenship and Immigration Canada to the Treasury Board of Canada Secretariat through the 2006–07 Supplementary Estimates. Subsequently, in accordance with the January 4, 2007, changes in ministers' responsibilities, this authority will be transferred from the Treasury Board of Canada Secretariat to Environment Canada through the 2007–08 Supplementary Estimates. 2. Vote 5, Government Contingencies, supplements other appropriations to provide the government with the flexibility to meet unforeseen expenditures until parliamentary approval can be obtained and to meet additional pay list costs, such as severance pay and parental benefits, that are not provided for in departmental estimates. These transfers reduce the Treasury Board of Canada Secretariat's Authorities, and the departmental performance reports of recipient departments and agencies show an increase in Authorities. 3. Vote 10, Government-wide Initiatives, supplements other appropriations in support of the implementation of strategic management initiatives in the public service of Canada. These transfers reduce the Treasury Board of Canada Secretariat's Authorities, and the departmental performance reports of recipient departments and agencies show an increase in Authorities. 4. Vote 15 supplements other appropriations to provide funding for the increased personnel costs of collective agreements between the Treasury Board and collective bargaining units representing public servants, as well as collective agreements signed by separate employers. Authorities are initially increased in Secretariat Vote 15 through Supplementary Estimates and then subsequently transferred to Operating Votes of recipient departments. 5. Vote 20, Public Service Insurance, covers the payment of the employer's share of health, income maintenance, and life insurance premiums; payments to or in respect of provincial health insurance plans; provincial payroll taxes; pension, benefit, and insurance plans for employees engaged locally outside Canada; and the return to certain employees of their share of the unemployment insurance premium reduction. |

|||||

Table 4: Services Received Without Charge

|

($ thousands) |

2006–07 Actual Spending |

|

Accommodation provided by Public Works and Government Services Canada |

9,211 |

|

Salary and associated expenditures of legal services provided by the Department of Justice Canada |

3,338 |

|

|

|

|

Total 2006–07 Services received without charge |

12,550 |

|

|

|

Table 5: Sources of Respendable and Non-respendable Revenue

Respendable Revenue

|

|

|

|

2006–07 |

|||

|

($ thousands) |

Actual |

Actual |

Main |

Planned |

Total |

Actual |

|

Management and Expenditure Performance |

|

|

|

|

|

|

|

Revenue related to the administration of the Public Service Superannuation Act (PSSA)1 |

2,192 |

2,535 |

3,210 |

3,210 |

3,210 |

2,734 |

|

Comptrollership |

|

|

|

|

|

|

|

Centrally Managed Funds |

|

|

|

|

|

|

|

Revenue related to Public Service Insurance2&3 |

174,235 |

157,726 |

132,200 |

132,200 |

165,250 |

165,250 |

|

|

||||||

|

Total Respendable Revenue |

176,427 |

160,261 |

135,410 |

135,410 |

168,460 |

167,984 |

|

|

||||||

|

1. Respendable revenue is used to cover salaries and operating costs from Public Service Superannuation in respect of chargeable costs associated with administering the Public Service Superannuation Act. 2. Respendable revenue is used to cover health care insurance plan costs from revolving funds and from departments and agencies that pay for employee benefit plans from a non-statutory appropriation. The recovery is based on 8 per cent of the total monthly personnel costs. This account is also used to record the pensioner's share of Pensioners' Dental Services Plan (PDSP) contributions. 3. Planned revenue is forecast based on historical payroll costs. In accordance with government revenue respending policy, Total Authorities may be increased by up to 125 per cent of planned revenue to compensate for higher than forecast payroll costs. Any revenue above the 125 per cent is frozen and is deposited to the Consolidated Revenue Fund. |

||||||

|

|

||||||

Non-respendable Revenue

|

|

|

|

2006–07 |

|||

|

($ thousands) |

Actual |

Actual |

Main |

Planned |

Total |

Actual |

|

Recovery of health benefits costs in excess of respendable amount3 |

- |

- |

- |

- |

14,229 |

14,229 |

|

Revenue from parking fees4 |

10,512 |

11,168 |

- |

10,000 |

11,325 |

11,325 |

|

External revenue from Access to Information requests |

1 |

1 |

- |

- |

3 |

3 |

|

Revenue related to the administration of the Public Service Superannuation Act (PSSA)5 |

- |

549 |

- |

- |

576 |

576 |

|

Refunds of previous years expenditures |

- |

157 |

- |

- |

772 |

772 |

|

Disciplinary penalties |

- |

33 |

- |

- |

18 |

18 |

|

Proceeds from the disposal of surplus Crown assets |

- |

- |

- |

- |

10 |

10 |

|

Other |

- |

- |

- |

- |

3 |

3 |

|

|

||||||

|

Total Non-respendable Revenue |

10,513 |

11,909 |

- |

10,000 |

26,935 |

26,935 |

|

|

||||||

|

4. This represents revenue from monthly remittances of parking fees from Health Canada and the Payroll System General Ledger. Parking fees are collected from public servants in government-owned or -leased facilities. As the Treasury Board of Canada Secretariat is responsible for the parking policy, it became the repository for the fees. 5. This represents the non-respendable revenue portion received from Public Service Annuation in respect of chargeable costs associated with administering the Public Service Superannuation Act, and covers the costs of employee benefit plans, health, and accommodation. |

||||||

Table 6: Resource Requirements by Branch or Sector

|

2006–07 |

|||||

|

Organization ($ thousands) |

Management |

Comptrollership |

Centrally Managed |

Revitalization |

Total |

|

Office of the Comptroller General |

|||||

|

Planned Spending |

|

28,065 |

|

|

28,065 |

|

Actual Spending |

|

21,016 |

|

|

21,016 |

|

Expenditure Management Sector |

|||||

|

Planned Spending |

15,4681 |

|

750,000 |

|

765,468 |

|

Actual Spending |

22,636 |

|

-2 |

|

22,636 |

|

Labour Relations and |

|||||

|

Planned Spending |

10,386 |

|

|

|

10,386 |

|

Actual Spending |

10,862 |

|

|

|

10,862 |

|

Pensions and Benefits Sector |

|

|

|

|

|

|

Planned Spending |

7,001 |

|

1,667,766 |

|

1,674,767 |

|

Actual Spending |

7,293 |

|

1,525,831 |

|

1,533,125 |

|

Chief Information Officer Branch |

|||||

|

Planned Spending |

23,412 |

|

|

|

23,412 |

|

Actual Spending |

24,581 |

|

|

|

24,581 |

|

Social and Cultural Sector |

|

|

|

|

|

|

Planned Spending |

4,887 |

|

|

|

4,887 |

|

Actual Spending |

4,216 |

|

|

|

4,216 |

|

Economic Sector |

|

|

|

|

|

|

Planned Spending |

5,328 |

|

|

|

5,328 |

|

Actual Spending |

4,442 |

|

|

|

4,442 |

|

Government Operations Sector |

|

|

|

|

|

|

Planned Spending |

9,342 |

|

|

|

9,342 |

|

Actual Spending |

10,316 |

|

|

|

10,316 |

|

International, Security and |

|||||

|

Planned Spending |

5,248 |

|

|

|

5,248 |

|

Actual Spending |

4,412 |

|

|

|

4,412 |

|

Other Sectors3 |

|||||

|

Planned Spending |

4,2374 |

|

|

|

4,237 |

|

Actual Spending |

10,484 |

849 |

|

|

11,333 |

| Branches under Corporate Strategy and Services5 |

|||||

|

Planned Spending |

49,340 |

13,646 |

10,220 |

|

73,206 |

|

Actual Spending |

39,556 |

10,715 |

12,156 |

35,049 |

97,475 |

|

|

|||||

|

Total |

|

|

|

|

|

|

Planned Spending |

134,649 |

41,711 |

2,427,986 |

- |

2,604,346 |

|

Actual Spending |

138,797 |

32,580 |

1,537,987 |

35,049 |

1,744,413 |

|

|

|||||

|

1. Planned Spending did not include funding of $7.3 million received in Supplementary Estimates for the Expenditure Management Information System.

2. Vote 5 shows no actual expenditures because funds are transferred to other departments, reducing the Secretariat's Authorities. Funds totalling $156 million were transferred to other departments from Vote 5 in 2006–07 to cover pay list costs such as severance pay and parental benefits that are not provided for in departmental estimates. 3. Includes Regulatory Affairs, Corporate Administrative Shared Services, Transformation Alignment Office, Blue Ribbon Panel (Federal Accountability Act), and Climate Change Review. 4. Planned Spending did not include funding of $8.5 million received in Supplementary Estimates for the Corporate Administrative Shared Services Initiative. 5. Includes the President's Office, Secretary's Office, Associate Secretary's Office, Legal Services, Strategic Policy and Communications, Corporate Services, and other central costs. |

|||||

|

|

|||||

Table 7-A: User Fees—User Fees Act

(Access to Information and Privacy Office, Treasury Board of Canada Secretariat)

|

|

|

|

|

2006–07 |

Planning Years |

||||||

|

A. User Fee |

Fee Type |

Fee-setting |

Date Last |

Forecast Revenue |

Actual Revenue |

Full Cost |

Performance |

Performance Results |

Fiscal Year |

Forecast Revenue |

Estimated Full Cost |

|

Fees charges for the processing of access requests filed under the Access to Information Act |

Other products and services |

Access to Information Act (ATIA) |

1992 |

1.8 |

2.4 |

384.1 |

Response provided within 30 days following receipt of request; the response time may be extended pursuant to section of the ATIA. Notice of extension to be sent within 30 days after receipt of request. The ATIA provides fuller details; see http://laws.justice.gc.ca/en/showtdm/cs/A-. |

Statutory deadlines met 98% of the time |

2007–08 2008–09 2009–10 |

2.0 2.2 2.3 |

400.0 410.0 420.0 |

|

Subtotal (R) Subtotal (O) Total |

Subtotal (R) Subtotal (O) Total |

Subtotal (R) Subtotal (O) Total |

Subtotal Subtotal Subtotal |

2007–08 2008–09 2009–10 Total |

2007–08 2008–09 2009–10 Total |

||||||

|

B. Date Last Modified: N/A |

|||||||||||

|

C. Other Information It is the Department's practice to waive fees where the total owing per request amounts to less than $25.00, when the request has not been answered within the legislated time frames and additional costs would normally have been incurred, or there is a public interest in disclosure. There was a significant increase in the number of times fees were waived in 2006–07, due to the informal processing of monthly requests for the reports generated by the Coordination of Access to Information Requests System (CAIRS). It was also due to a new electronic disclosure service that we are now able to offer. In order to reduce costs and increase efficiency, documents released are occasionally provided on CD-ROM, which means that no reproduction fees are charged to the applicant. |

|||||||||||

Table 7-B : User Fees—Policy on Service Standards for External Fees

(Access to Information and Privacy Office, Treasury Board of Canada Secretariat)

Supplementary information on user fees can be found at

http://www.tbs-sct.gc.ca/rma/dpr3/06-07/index_e.asp.

Table 8: Details on Project Spending

Supplementary information on project spending can be found at

http://www.tbs-sct.gc.ca/rma/dpr3/06-07/index_e.asp.

Table 9: Details on Transfer Payment Programs (TPPs)

During the 2006–07 reporting period, the Secretariat was responsible for one TPP: the Toronto Waterfront Revitalization Initiative.

Supplementary Information on TPPs can be found at http://www.tbs-sct.gc.ca/rma/dpr3/06-07/index_e.asp.

Table 10: Financial Statements of Departments and Agencies (including Agents of Parliament)

Statement of Management Responsibility for Financial Statements

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2007, and all information contained in these statements rests with the management of the Treasury Board of Canada Secretariat. These financial statements have been prepared by management in accordance with Treasury Board accounting policies, which are consistent with Canadian generally accepted accounting principles for the public sector.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management's best estimates and judgment, and gives due consideration to materiality. To fulfil its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of the Secretariat's financial transactions. Financial information submitted in the preparation of the Public Accounts of Canada and included in the Secretariat's Departmental Performance Report is consistent with these financial statements.

Management maintains a system of financial management and internal control designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded, and that transactions are in accordance with the Financial Administration Act, are executed in accordance with prescribed regulations, within parliamentary authorities, and are properly recorded to maintain accountability of government funds. Management also seeks to ensure the objectivity and integrity of data in its financial statements through careful selection, training, and development of qualified staff, through organizational arrangements that provide appropriate divisions of responsibility, and through communication programs aimed at ensuring that regulations, policies, standards, and managerial authorities are understood throughout the Secretariat.

The system of internal control is augmented by Internal Audit, which conducts periodic audits and reviews of different areas of the department's operations. In addition, the Chief Audit Executive has free access to the Audit Committee, which oversees management's responsibilities for maintaining adequate control systems and the quality of financial reporting, and which recommends the financial statements to the Secretary of the Treasury Board.

The financial statements of the Secretariat have not been audited.

| The paper version was signed by | The paper version was signed by | |

|

Wayne G. Wouters |

Coleen Volk |

Treasury Board of Canada Secretariat

Statement of Operations (Unaudited)

For the year ended March 31

($ thousands)

|

|

|

2007 |

2006 |

|

EXPENSES (Note 5) |

|||

|

Centrally Managed Funds (Note 4) |

1,523,483 |

1,423,797 |

|

|

Management and Expenditure Performance |

150,428 |

147,180 |

|

|

Comptrollership |

35,974 |

25,117 |

|

|

Revitalization of Toronto Waterfront |

35,048 |

- |

|

|

|

|||

|

TOTAL EXPENSES |

1,744,933 |

1,596,094 |

|

|

|

|||

|

REVENUES (Note 6) |

|

|

|

|

Centrally Managed Funds |

11,325 |

11,168 |

|

|

Management and Expenditure Performance |

3,336 |

3,695 |

|

|

Comptrollership |

7 |

79 |

|

|

|

|||

|

TOTAL REVENUES |

14,668 |

14,942 |

|

|

|

|||

|

NET COST OF OPERATIONS |

1,730,265 |

1,581,152 |

|

|

|

|||

| The accompanying notes form an integral part of these financial statements. | |||

Treasury Board of Canada Secretariat

Statement of Financial Position (Unaudited)

As at March 31

($ thousands)

|

|

|

2007 |

2006 |

|

|

ASSETS |

||||

|

Financial assets |

||||

|

Accounts receivable (Note 7) |

184,124 |

194,736 |

||

|

Non-financial assets |

|

|

||

|

Tangible capital assets (Note 8) |

4,020 |

649 |

||

|

|

||||

|

TOTAL ASSETS |

188,144 |

195,385 |

||

|

|

||||

|

LIABILITIES |

|

|

||

|

Accounts payable and accrued liabilities (Note 9) |

598,190 |

385,233 |

||

|

Vacation pay and compensatory leave |

5,204 |

4,317 |

||

|

Employee severance benefits (Note 10) |

20,531 |

17,245 |

||

|

|

||||

|

623,925 |

406,795 |

|||

|

|

||||

|

EQUITY OF CANADA |

(435,781) |

(211,410) |

||

|

|

||||

|

TOTAL |

188,144 |

195,385 |

||

|

|

||||

|

Contingent liabilities (Note 11) |

||||

Treasury Board of Canada Secretariat

Statement of Equity of Canada (Unaudited)

For the year ended March 31

($ thousands )

|

|

|

2007 |

2006 |

|

Equity of Canada, beginning of year |

(211,410) |

(545,599) |

|

|

Net cost of operations |

(1,730,265) |

(1,581,152) |

|

|

Current year appropriations used (Note 3) |

1,744,413 |

1,578,259 |

|

|

Revenue not available for spending |

(26,163) |

(12,400) |

|

|

Change in net position in the Consolidated Revenue Fund (Note 3) |

(224,906) |

336,810 |

|

|

Services provided without charge (Note 12) |

12,550 |

12,672 |

|

|

|

|||

|

Equity of Canada, end of year |

(435,781) |

(211,410) |

|

|

|

|||

| The accompanying notes form an integral part of these financial statements. | |||

Treasury Board of Canada Secretariat

Statement of Cash Flow (Unaudited)

For the year ended March 31

($ thousands)

|

|

|

2007 |

2006 |

|

|

Operating activities |

||||

|

Net cost of operations |

1,730,265 |

1,581,152 |

||

|

Non-cash items: |

|

|

||

|

Amortization of tangible capital assets (Note 8) |

(344) |

(668) |

||

|

Gain on disposal of tangible capital asset |

10 |

7 |

||

|

Services provided without charge (Note 12) |

(12,550) |

(12,672) |

||

|

Variations in Statement of Financial Position: |

|

|

||

|

Increase (decrease) in accounts receivable |

(10,612) |

111,459 |

||

|

Decrease (increase) in accounts payable: |

|

|

||

|

Accounts payable and accrued liabilities |

(212,957) |

225,473 |

||

|

Vacation pay and compensatory leave |

(887) |

36 |

||

|

Employee severance benefits |

(3,286) |

(2,715) |

||

|

Decrease in deferred revenues |

- |

551 |

||

|

|

||||

|

Cash used by operating activities |

1,489,639 |

1,902,623 |

||

|

|

||||

|

Capital investment activities |

|

|

||

|

Acquisition of tangible capital assets |

3,893 |

53 |

||

|

Transfer-in of tangible capital assets |

26 |

- |

||

|

Proceeds from disposition of tangible capital assets |

(214) |

(7) |

||

|

|

||||

|

Cash used by capital investment activities |

3,705 |

46 |

||

|

|

||||

|

Financing activities |

|

|

||

|

Net cash provided by the Government of Canada |

(1,493,344) |

(1,902,669) |

||

|

|

||||

| The accompanying notes form an integral part of these financial statements. | ||||

1. Authority and Objectives

Under the broad authority of sections 5 to 13 of the Financial Administration Act, the Treasury Board of Canada Secretariat supports the Treasury Board as a committee of ministers in its role as the general manager and employer of the public service. It is headed by a secretary, who reports to the president of the Treasury Board.

The mission of the Secretariat is to ensure that the rigorous stewardship of public resources achieves results for Canadians.

The core business of the Secretariat is currently organized into the following key areas of program activity:

a) Centrally Managed Funds

This program activity provides sound management and administration of central funds related to government contingencies; government-wide initiatives; and public service pensions, benefits, and insurance.

b) Management and Expenditure Performance

This program activity seeks to promote sound public management by defining clear and achievable management expectations for the use of resources, supporting collaborative labour relations, monitoring expenditure performance, aligning resources with government priorities, and reporting results to Parliament.

c) Comptrollership

This program activity aims to put in place effective audits, financial and management controls, and oversight and reporting mechanisms, and to provide assurance that value for money is being achieved through investments made with public funds.

Another activity was under the responsibility of the Secretariat for the 2006–07 fiscal year only:

d) Revitalization of the Toronto Waterfront

The Toronto Waterfront Revitalization Initiative (TWRI) is both an infrastructure and urban renewal investment. The purpose of the TWRI is to revitalize the Toronto waterfront through investments in both traditional city-building infrastructure, such as local transportation and sewers, and more contemporary urban development, including parks, green spaces, tourism-related facilities, and the redevelopment of underutilized post-industrial areas.

2. Significant Accounting Policies

The financial statements have been prepared in accordance with Treasury Board accounting policies, which are consistent with Canadian generally accepted accounting principles for the public sector.

Significant accounting policies are as follows:

a) Parliamentary appropriations

The Secretariat is financed by the Government of Canada through parliamentary appropriations. Appropriations provided to the Secretariat do not parallel financial reporting according to generally accepted accounting principles, since appropriations are primarily based on cash flow requirements. Consequently, items recognized in the Statement of Operations and the Statement of Financial Position are not necessarily the same as those provided through appropriations from Parliament. Note 3 to these financial statements provides a high-level reconciliation between the bases of reporting.

b) Net cash provided by the Government of Canada

The Secretariat operates within the Consolidated Revenue Fund (CRF), which is administered by the Receiver General for Canada. All cash received by the Secretariat is deposited to the CRF and all cash disbursements made by the Secretariat are paid from the CRF. Net cash provided by the Government of Canada is the difference between all cash receipts and all cash disbursements, including transactions between departments and agencies of the Government of Canada.

c) Change in net position in the Consolidated Revenue Fund

The change in net position in the CRF is the difference between net cash provided by the government and appropriations used in a year, excluding the amount of non-respendable revenue recorded by the Secretariat. It results from timing differences between when a transaction affects appropriations and when it is processed through the CRF.

d) Revenues

Funds received from external parties for specified purposes are recorded upon receipt as deferred revenues. These revenues are recognized in the period in which the related expenses are incurred.

Other revenues are accounted for in the period in which the underlying transaction or event occurred that gave rise to the revenues.

e) Expenses

Expenses are recorded on the accrual basis:

- Grants are recognized in the year in which the conditions for payment are met. In the case of grants that do not form part of an existing program, the expense is recognized when the government announces a decision to make a non-recurring transfer, provided the enabling legislation or authorization for payment receives parliamentary approval prior to the completion of the financial statements.

- Contributions are recognized in the year in which the recipient has met the eligibility criteria or fulfilled the terms of a contractual transfer agreement.

- Vacation pay and compensatory leave are expensed as the benefits accrue to employees under their respective terms of employment.

- Services provided without charge by other government departments for accommodation and legal services are recorded as operating expenses at their estimated cost.

f) Government-wide employee benefits

Eligible public service employees participate in the Public Service Pension Plan sponsored by the Government of Canada. Contributions to the Plan for all departments and agencies, including additional contributions in respect of any actuarial deficiencies, are funded by the Secretariat as centrally managed funds, and they are expensed in the year incurred. The Secretariat recovers a portion of the pension contributions from other departments and agencies.

The Government of Canada also sponsors a variety of other benefit plans that the Secretariat is responsible for administering and/or fund through its centrally managed funds. These benefits are recognized to expenses when they become due. A portion of these benefits is also recovered from other departments and agencies.

For the pension benefits and other future employee benefits covered by these plans, actuarially determined liabilities and related disclosure are presented in the financial statements of the Government of Canada, the ultimate sponsor of these benefits. As administrator of the centrally managed funds, the Secretariat expenses these benefits or contributions as they become due and records no accruals for future benefits. This accounting treatment corresponds to the funding provided to the department through parliamentary appropriations.

g) Departmental employee future benefits

Pension benefits: Eligible employees of the Secretariat participate in the Public Service Pension Plan. The Secretariat's share of contributions pertaining to the current service cost of its employees is allocated to the expenses of the program activities of Management and Expenditure Performance, and Comptrollership in the year incurred.

Severance benefits: Employees are entitled to severance benefits, as provided for under labour contracts or conditions of employment. These benefits are accrued as employees render the services necessary to earn them. The obligation relating to the benefits earned by employees of the Secretariat is calculated using information derived from the results of the actuarially determined liability for employee severance benefits for the Government of Canada as a whole.

h) Accounts receivable

Accounts receivable are stated at the amount expected to be ultimately realized. A provision is made for receivables where recovery is considered uncertain.

i) Tangible capital assets

All tangible capital assets having an initial cost of $10,000 or more are recorded at their acquisition cost. The Secretariat does not capitalize intangibles, works of art, and historical treasures that have cultural, aesthetic, or historical value. Amortization of tangible capital assets is done on a straight-line basis over the estimated useful life of the asset as follows:

|

Asset class |

Amortization period |

|

Machinery and equipment |

3 to 5 years |

|

Motor vehicles |

3 years |

|

Leasehold improvements |

Term of lease |

|

Assets under construction |

Once in service, in accordance with asset class |

|

|

|

j) Contingent liabilities

Contingent liabilities are potential liabilities that may become actual liabilities when one or more future events occur or fail to occur. To the extent that it is likely that the future event will occur or will fail to occur, and a reasonable estimate of the loss can be made, an estimated liability is accrued and an expense recorded. If the likelihood is not determinable or an amount cannot be reasonably estimated, the contingency is disclosed in the notes to the financial statements.

k) Measurement uncertainty

The preparation of these financial statements in accordance with Treasury Board accounting policies that are consistent with Canadian generally accepted accounting principles for the public sector requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, and expenses reported in the financial statements. At the time of preparation of these statements, management believes the estimates and assumptions to be reasonable.

The most significant items where estimates are used are contingent liabilities, the liability for employee severance benefits, and the useful life of tangible capital assets. Actual results could differ significantly from those estimated. Management's estimates are reviewed periodically and, as adjustments become necessary, they are recorded in the financial statements in the year they become known.

3. Parliamentary Appropriations

The Secretariat receives most of its funding through annual parliamentary appropriations. Items recognized in the Statement of Operations and the Statement of Financial Position in one year may be funded through parliamentary appropriations in a prior, current, or future year. Accordingly, the Secretariat has different net results of operations for the year on a funding basis than on an accrual basis. The differences are reconciled in the following tables:

a) Reconciliation of net cost of operations to current year appropriations used:

|

|

2007 |

Restated |

|

|

|

($ thousands) |

||

|

Net cost of operations |

1,730,265 |

1,581,152 |

|

|

Adjustments for items affecting net cost of operations but not affecting appropriations: |

|||

|

Amortization of tangible capital assets |

(344) |

(668) |

|

|

Gain on disposal of tangible capital assets |

10 |

7 |

|

|

Services provided without charge |

(12,550) |

(12,672) |

|

|

Vacation pay and compensatory leave |

(887) |

36 |

|

|

Employee severance benefits |

(3,286) |

(2,715) |

|

|

Revenue not available for spending |

26,153 |

12,400 |

|

|

Other |

1,068 |

693 |

|

|

|

|||

|

10,164 |

(2,919) |

||

|

|

|||

|

Adjustments for items not affecting net cost of operations but affecting appropriations: |

|||

|

Advances |

91 |

(27) |

|

|

Acquisitions of tangible capital assets |

3,893 |

53 |

|

|

|

|||

|

3,984 |

26 |

||

|

|

|||

|

Current-year appropriations used |

1,744,413 |

1,578,259 |

|

|

|

|||

b) Appropriations provided and current-year appropriations used

|

|

2007 |

2006 |

||

|

|

($ thousands) |

|||

|

Voted authorities: |

||||

|

|

Vote 1—Program expenditures |

177,739 |

152,312 |

|

|

|

Vote 2—Contributions |

114,993 |

|

|

|

|

Vote 5—Government contingencies |

594,031 |

- |

|

|

|

Vote 10—Government-wide initiatives |

3,503 |

- |

|

|

|

Vote 20—Public service insurance |

1,666,846 |

1,653,700 |

|

|

|

||||

|

2,557,112 |

1,806,012 |

|||

|

|

||||

|

Statutory authorities: |

|

|

||

|

President of the Treasury Board—salary and motor car allowance |

73 |

72 |

||

|

Contributions to employee benefit plans |

14,689 |

14,946 |

||

|

Payments under the Public Service Pension Adjustment Act |

15 |

6 |

||

|

Payments for the pay equity settlement pursuant to section 30 of the Crown Liability and Proceedings Act |

1,584 |

269 |

||

|

Unallocated employer contributions made under the Public Service Superannuation Act and other retirement acts, and the Employment Insurance Act |

10,557 |

42,208 |

||

|

Spending of proceeds from the disposal of surplus Crown assets |

17 |

- |

||

|

|

||||

|

26,935 |

57,501 |

|||

|

|

||||

|

Lapsed authorities: |

|

|

||

|

Vote 1—Program expenditures |

(20,775) |

(12,870) |

||

|

Vote 2—Contributions |

(80,293) |

|

||

|

Vote 5—Government contingencies |

(594,031) |

- |

||

|

Vote 10—Government-wide initiatives |

(3,503) |

- |

||

|

Vote 20—Public service insurance |

(141,015) |

(272,384) |

||

|

Spending of proceeds from the disposal of surplus Crown assets |

(17) |

- |

||

|

|

||||

|

(839,634) |

(285,254) |

|||

|

|

||||

|

Current-year appropriations used |

1,744,413 |

1,578,259 |

||

|

|

||||

c) Reconciliation of net cash provided by government to current-year appropriations used

|

|

2007 |

Restated |

|

|

|

($ thousands) |

||

|

Net cash provided by government |

1,493,344 |

1,902,669 |

|

|

Revenue not available for spending |

26,163 |

12,400 |

|

|

Change in net position in the Consolidated Revenue Fund: |

|

|

|

|

Variation in accounts receivable |

10,612 |

(111,459) |

|

|

Variation in accounts payable and accrued liabilities: |

|

|

|

|

Accounts payable and accrued liabilities |

212,957 |

(225,473) |

|

|

Vacation pay and compensatory leave |

887 |

(36) |

|

|

Other adjustments |

450 |

158 |

|

|

|

|||

|

|

224,906 |

(336,810) |

|

|

|

|||

|

Current-year appropriations used |

1,744,413 |

1,578,259 |

|

|

|

|||

4. Centrally Managed Funds

The Government of Canada sponsors defined benefit pension plans covering substantially all employees. The Secretariat funds the employer's contributions to the Public Service Pension Plan and Retirement Compensation Arrangement, including additional contributions in respect of actuarial deficiencies.

The Secretariat also funds payments to or in respect of:

- the employer's share of contributions to the Public Service Death Benefit Account;

- the employer's share of Canada/Quebec Pension Plan contributions and Employment Insurance premiums;

- the employer's share of health, disability, and life insurance premiums and related Quebec sales tax;

- claims and related costs under the Public Service Dental Care Plan and the Pensioners' Dental Services Plan;

- provincial payroll taxes;

- pension, benefit, and insurance plans for employees engaged locally outside Canada by Canadian missions abroad; and

- returns to certain employees of their share of the Employment Insurance premium reduction.

Generally, Public Service Pension Plan contributions, Public Service Death Benefit Account contributions, Canada/Quebec Pension Plan contributions, and Employment Insurance premiums are recovered from all departments, agencies, and revolving funds pro-rata, based on salaries and wages incurred. Contributions to health care plans are recovered from certain departments and agencies, and all revolving funds based on 7.5 per cent (8 per cent in 2006) of salaries and wages incurred.

A breakdown by major category is as follows:

|

|

|

2007 |

2006 |

|

|

|

($ thousands) |

|

|

Expenses |

|||

|

Public Service Pension Plan and Retirement Compensation Arrangement contributions |

2,110,191 |

2,235,456 |

|

|

Public Service Pension Plan and Retirement Compensation Arrangement contributions in respect of actuarial deficits |

9,500 |

16,200 |

|

|

Public Service Death Benefit Account contributions |

9,595 |

9,568 |

|

|

Canada/Quebec Pension Plan contributions |

512,102 |

445,152 |

|

|

Employment Insurance premiums |

236,083 |

296,490 |

|

|

Employment Insurance premium reduction |

1,214 |

1,776 |

|

|

Quebec Parental Insurance Plan premiums |

22,194 |

5,333 |

|

|

Public Service Health Care Plan premiums |

549,845 |

495,080 |

|

|

Public Service Dental Care Plan claims |

207,833 |

194,491 |

|

|

Pensioners' Dental Services Plan claims |

94,562 |

77,077 |

|

|

Provincial health insurance plan premiums |

36,511 |

38,812 |

|

|

Provincial payroll taxes |

419,201 |

398,717 |

|

|

Group disability and life insurance premiums |

313,791 |

288,736 |

|

|

Pension and other government employee benefits in respect of locally engaged staff employed in Canadian missions abroad |

43,904 |

38,721 |

|

|

Pension and similar payments to former government employees |

338 |

304 |

|

|

Miscellaneous special payments, e.g. court awards |

1,584 |

269 |

|

|

Operating expenses |

1,428 |

- |

|

|

|

|||

|

Total Expenses |

4,569,876 |

4,542,182 |

|

|

|

|||

|

Recoveries |

|

|

|

|

Contributions to government employee benefit plans recovered from other government departments and agencies |

2,866,914 |

2,960,659 |

|

|

Contributions to health care plans recovered from other government departments and agencies |

138,051 |

112,626 |

|

|

Pensioners' contributions to the Pensioners' Dental Services Plan |

41,428 |

45,100 |

|

|

|

|||

|

Total Recoveries |

3,046,393 |

3,118,385 |

|

|

|

|||

|

Net Expenses |

1,523,483 |

1,423,797 |

|

|

|

|||

5. Expenses

The following table presents details of expenses by category:

|

|

|

2007 |

2006 |

|

|

|

($ thousands) |

|

|

Transfer payments |

34,700 |

87 |

|

|

Operating expenses: |

|

|

|

|

Centrally Managed Funds (Note 4) |

1,523,483 |

1,423,797 |

|

|

Departmental salary and employee benefits |

119,339 |

103,915 |

|

|

Professional and special services |

43,258 |

43,984 |

|

|

Accommodation |

9,211 |

8,312 |

|

|

Transportation and telecommunications |

5,002 |

4,514 |

|

|

Machinery and equipment |

3,470 |

6,052 |

|

|

Repairs and maintenance |

1,639 |

1,285 |

|

|

Information |

1,481 |

1,286 |

|

|

Utilities, materiel, and supplies |

1,478 |

1,249 |

|

|

Rentals |

895 |

777 |

|

|

Other subsidies and payments |

633 |

168 |

|

|

Amortization |

344 |

668 |

|

|

|

|||

|

Total operating expenses |

1,710,233 |

1,596,007 |

|

|

|

|||

|

Total Expenses |

1,744,933 |

1,596,094 |

|

|

|

|||

6. Revenues

|

|

2007 |

2006 |

|

|

|

($ thousands) |

||

|

Parking fees |

11,325 |

11,168 |

|

|

Recovery of pension administration costs |

3,313 |

3,214 |

|

|

Other revenues |

30 |

560 |

|

|

|

|||

|

Total Revenues |

14,668 |

14,942 |

|

|

|

|||

7. Accounts Receivable

The following table presents details of accounts receivable:

|

|

2007 |

2006 |

|

|

($ thousands) |

|

|

Receivables from other government departments and agencies |

183,923 |

194,620 |

|

Receivables from external parties |

162 |

72 |

|

Advances to employees |

39 |

33 |

|

Deposits in transit to the Receiver General |

- |

11 |

|

|

||

|

Total Accounts Receivable |

184,124 |

194,736 |

|

|

||

8. Tangible Capital Assets

|

|

Cost |

||||

|

|

($ thousands) |

||||

|

|

Opening Balance |

Acquisitions |

Transfers-in |

Disposals |

Closing Balance |

|

Machinery and equipment |

837 |

131 |

- |

(26) |

942 |

|

Motor vehicles |

82 |

35 |

24 |

(52) |

89 |

|

Leasehold improvements |

1,893 |

- |

59 |

- |

1,952 |

|

Assets under construction |

160 |

3,727 |

- |

(160) |

3,727 |

|

|

|||||

|

|

2,972 |

3,893 |

83 |

(238) |

6,710 |

|

|

|||||

|

|

Accumulated Amortization |

||||

|

|

($ thousands) |

||||

|

|

Opening Balance |

Amortization |

Transfers-in |

Disposals |

Closing Balance |

|

Machinery and equipment |

576 |

149 |

|

(1) |

724 |

|

Motor vehicles |

37 |

37 |

10 |

(33) |

51 |

|

Leasehold improvements |

1,710 |

158 |

47 |

- |

1,915 |

|

Assets under construction |

- |

- |

- |

- |

- |

|

|

|||||

|

2,323 |

344 |

57 |

(34) |

2,6900 |

|

|

|

|||||

|

|

Net book value 2006 |

Net book value 2007 |

|

|

($ thousands) |

($ thousands) |

|

Machinery and equipment |

261 |

218 |

|

Motor vehicles |

45 |

37 |

|

Leasehold improvements |

183 |

37 |

|

Assets under construction |

160 |

3,728 |

|

|

||

|

649 |

4,020 |

|

|

|

||

Amortization expense for the year ended March 31, 2007, is $344,155 ($667,818 in 2006).

9. Accounts payable and accrued liabilities

The following table presents the details of accounts payable and accrued liabilities:

|

|

2007 |

2006 |

|

|

($ thousands) |

|

|

Accounts payable to other government departments and agencies |

466,607 |

267,477 |

|

Accounts payable to external parties |

131,583 |

117,756 |

|

|

||

|

Total accounts payable and accrued liabilities |

598,190 |

385,233 |

|

|

||

10. Employee Benefits

a) Pension benefits

Eligible public service employees participate in the Public Service Pension Plan, which is sponsored and administered by the Government of Canada. Pension benefits accrue up to a maximum period of 35 years at a rate of 2 per cent per year of pensionable service times the average of the best five consecutive years of earnings. The benefits are integrated with the Canada/Quebec Pension Plan benefits and they are indexed to inflation.

The Secretariat funds the employer contributions to the Public Service Pension Plan, including additional contributions in respect of actuarial deficiencies, on behalf of all government departments and agencies, and recovers a portion of those costs. During the year, the Secretariat contributed $10,826 thousand ($11,060 thousand in 2006) in respect of its own employees, which represents approximately 2.2 times (2.6 times in 2006) the contributions made by its employees.

b) Severance benefits

The Secretariat provides severance benefits to its employees based on eligibility, years of service, and final salary. These severance benefits are not pre-funded. Benefits will be paid from future appropriations. Information about the severance benefits, measured as at March 31, is as follows:

|

|

2007 |

2006 |

|

($ thousands) |

||

|

Accrued benefit obligation, beginning of year |

17,245 |

14,530 |

|

Expense for the year |

1,455 |

1,365 |

|

Benefits paid during the year |

1,831 |

1,350 |

|

|

||

|

Accrued benefit obligation, end of year |

20,531 |

17,245 |

|

|

||

11. Contingent liabilities

Claims have been made against the Secretariat in the normal course of operations. Legal proceedings for claims totalling approximately $64 billion ($34 billion in 2006) were still pending at March 31, 2007. Some of these potential liabilities may become actual liabilities when one or more future events occur or fail to occur. To the extent that the future event is likely to occur or fail to occur, and a reasonable estimate of the loss can be made, an estimated liability is accrued and an expense recorded on the department's financial statements. No accrual for these contingent liabilities has been made in the financial statements.

The most significant of these legal actions is described as follows:

In September 1999, the Public Sector Pension Investment Board Act (Bill C-78) was passed by Parliament, providing for improvements in the financial management of federal public service pension plans, including the Public Service (PSSA), RCMP (RCMPSA), and Canadian Forces (CFSA) superannuation plans. The new Act authorized the president of the Treasury Board to debit the accounts in order to reduce the amount of certain excess balances in the superannuation accounts. In late 1999, the major public service unions and pensioner associations launched three lawsuits against the Crown challenging the validity of the legislation. A trial of the issue was held in the spring of 2007. A decision has not been rendered to date.

12. Related-party transactions

Services provided without charge

The Secretariat is related as a result of common ownership to all Government of Canada departments, agencies, and Crown corporations. The Secretariat enters into transactions with these entities in the normal course of business and on normal trade terms.

During the year, the Secretariat received without charge from other departments accommodation and legal services. The services without charge have been recognized in the Statement of Operations as follows:

|

|

2007 |

2006 |

|

($ thousands) |

||

|

Accommodation |

9,212 |

8,312 |

|

Legal services |

3,338 |

4,360 |

|

|

||

|

Total |

12,550 |

12,672 |

|

|

||

The government has structured some of its administrative activities for efficiency and cost-effectiveness purposes so that one department performs these on behalf of all departments without charge. The costs of these services, which include payroll and cheque issuance services provided by Public Works and Government Services Canada, are not included as an expense in the Statement of Operations.

13. Comparative information

Comparative figures have been reclassified to conform to the current year's presentation.

Table 11: Response to Parliamentary Committees, and Audits and Evaluations

|

Response to Parliamentary Committees |

|

Government Response to the First Report of the Standing Committee on Public Accounts In her observations on the 2005 Public Accounts, the Auditor General of Canada said she was pleased that the government had passed legislation in July 2005 enabling her to conduct performance audits of foundations and most Crown corporations. She also pointed to the relatively small amount of foundation transfers—$535 million in 2004–05 versus more than $2 billion in some earlier years—as justification for her positive assessment of the government's efforts to improve the accountability of foundations http://cmte.parl.gc.ca/cmte/CommitteePublication.aspx?COM=10466&Lang=1&SourceId=171829 Government Response to the Fourth Report of the Standing Committee on Public Accounts Since the time of the 10th Report of the Standing Committee on Public Accounts of the 38th Parliament (the "10th Report"), the government has introduced the Federal Accountability Act (the Act) and Action Plan. The Bill was passed by the House of Commons in June 2006 and is currently before the Senate Standing Committee on Legal and Constitutional Affairs. The government recognizes the concerns raised in the 10th Report and believes that this response addresses those concerns regarding the management responsibilities of deputy ministers and their accountability before committees of Parliament by designating heads of departments and other federal government organizations as accounting officers. The government is committed to working with the Committee on matters of accountability and recognizes the dedication of all members of the Committee to improve those issues. Government Response to the Ninth Report of the Standing Committee on Public Accounts The Firearms Act was passed in 1995 and shortly thereafter the Canadian Firearms Program was established. Since its inception, this program has attracted considerable attention from parliamentarians. This attention was heightened when, in December 2002, the Auditor General of Canada tabled a report on the Canadian Firearms Program. At that time, the Auditor General found that Parliament was not kept informed about the dramatic cost increases of the Program. Parliament was thereby not given sufficient information to effectively scrutinize the Program and ensure accountability. In October 2003, the Public Accounts Committee reviewed this report and recommended that the government provide Parliament with more detailed information on the costs of the Program. In May 2006, the Auditor General released her Status Report, which contains follow-up audits of previous audits. In this report, the Auditor General followed up on the audit of the Canadian Firearms Program. During the course of this audit, officials at the Office of the Auditor General of Canada uncovered issues of significance to Parliament. Hence, the Auditor General decided to table a special report entitled Government Decisions Limited Parliament's Control of Public Spending. This report outlines how two accounting "errors," one made by the Department of Justice Canada in 2002–03 and the other by the Canada Firearms Centre in 2003–04, undermine the ability of the House of Commons to exercise control over government expenditures.[1] It also discusses how the accounting treatment of an ongoing contract may be inappropriate, as well as how key decisions taken within government regarding these accounting issues were not documented. http://cmte.parl.gc.ca/cmte/CommitteePublication.aspx?COM=10466&Lang=1&SourceId=195149 |

|

Response to the Auditor General of Canada, including to the Commissioner of the Environment and Sustainable Development (CESD) |

|

May 2006 Report of the Auditor General of Canada Chapter 1: Managing Government Financial Information Chapter 6: Management of Voted Grants and Contributions Chapter 7: Acquisition of Leased Office Space November 2006 Report of the Auditor General of Canada http://www.oag-bvg.gc.ca/domino/reports.nsf/html/06menu_e.html Chapter 1: Expenditure Management System at the Government Centre Chapter 2: Expenditure Management System in Departments Chapter 3: Large Information Technology Projects Chapter 5: Relocating Members of the Canadian Forces, RCMP and Federal Public Service Chapter 11: Protection of Public Assets—Office of the Correctional Investigator Chapter 12: Role of Federally Appointed Board Members—Sustainable Development Technology Canada October 2006 Report of the Commissioner of the Environment and Sustainable Development (CESD) http://www.oag-bvg.gc.ca/domino/reports.nsf/html/c2006menu_e.html Chapter 1: Managing the Federal Approach to Climate Change Chapter 4: Sustainable Development Strategies Chapter 5: Environmental Petitions |

|

Internal Audits or Evaluations |

|

Internal audits Audit of Accounts Payable (Preliminary Survey completed. Detailed Examination Phase deferred until 2008–09) Other projects Review of Translation and Editing Services (to be tabled for approval in the fall of 2007) Development of the Secretariat's Risk-based Audit Plan (completed) Evaluations Evaluation of Foundations As Instruments of Public Policy (completed) |

In response to the Treasury Board Policy on Internal Audit and changes brought about by the Federal Accountability Act, measures have been taken to strengthen the capacity of the internal audit function, including extensive recruitment of audit staff and establishment of key processes and infrastructure.

Table 12: Sustainable Development Strategy

The following table outlines the results of the Secretariat's third Sustainable Development Strategy (SDS)—for the calendar years (CYs) 2004–06—and beginning the implementation of its fourth SDS (for CYs 2007–09).

|

Department |

|

|

Points to Address |

Departmental Input |

|

1. What are the key goals, objectives, and/or long-term targets of the SDS? |

The departmental long-term SDS goals are:

|

|

2. How do your key goals, objectives, and/or long-term targets help achieve your department's strategic outcomes? |

In fiscal year (FY) 2006–07, the Secretariat revised its priorities as a department to focus on the priority issues for the Government of Canada—on ways to improve accountability in public-sector management and deliver on commitments to Canadians. With this focus, the Secretariat approaches the management board issues relating to SD through its functions as a central agency, its responsibilities as a policy lead in areas designated as federal priorities for SD, and as a department responsible for managing its own operations. |

|

3. What were your targets for the reporting period? |

The reporting targets for the first part of FY 2006–07 were established by the Secretariat's SDS for 2004–06 (available at http://www.tbs-sct.gc.ca/report/sds-sdd/0406/sds-sdd_e.asp) with the primary target being to develop and table in December 2006 an updated SDS for the CY 2007–09 period. |

|

4. What is your progress (this includes outcomes achieved in relation to objectives and progress on targets) to date? |

The Secretariat developed and tabled its updated SDS for the CY 2007–09 period. (Progress on the last year of the 2004–06 SDS is captured in the Appendix of the Secretariat's 2007–09 SDS available at http://www.tbs-sct.gc.ca/report/orp/2006/sds_e.asp). The implementation of the updated SDS began in the last quarter of FY 2006–07 and progress was made. This included working with Environment Canada to explore approaches to improve reporting on SD (one of the short-term outputs of that work was an enhanced template for departmental reporting on SD in the DPRs); incorporating reference to SD in the guidance for policy suite renewal; participating in the development of a government-wide course on SD; continuing work on the policy management for federal fleet and contaminated sites; and greening Secretariat operations through green procurement initiatives (e.g. green furniture purchases), and support for green stewardship (e.g. increased membership in the Green Citizenship Network). |

|

5. What adjustments have you made, if any? (To better set the context for this information, discuss how lessons learned have influenced your adjustments.) |

The Secretariat's SDS was adjusted to follow the guidance for the fourth round of SDS provided by Environment Canada and the Office of Greening Government Operations at Public Works and Government Services Canada. This guidance set out targets and measures linked to federal SD goals and federal priorities for greening government operations. The Secretariat improved its internal management of SDS commitments by:

|

Table 13: Procurement and Contracting

Supplementary information on procurement and contracting can be found at http://www.tbs-sct.gc.ca/rma/dpr3/06-07/index_e.asp.

Table 14: Travel Policies

The Secretariat adheres to travel policies and parameters as established by the Special Travel Authorities and the Travel Directive, Rates and Allowances.

[1]. In 2006–07, the Treasury Board of Canada Secretariat amended its PAA to better reflect its management board and budget office functions. The Secretariat's 2006–07 commitments were aligned to this new PAA.

[2]. Some figures in this document may not add to totals shown or some totals may differ from one table to another due to the rounding of the figures.

[3]. Performance status:

- "Met all expectations" indicates that all 2006–07 performance milestones identified in the Report on Plans and Priorities (RPP) were fully met.

- "Met most expectations" indicates that most 2006–07 performance milestones identified in the RPP were met.

- "Met some expectations" indicates that some 2006–07 performance milestones identified in the RPP were met.

- "Not met" indicates that the result statement was not achieved in the time frame specified and/or significant work remains.

[4]. The Secretariat's strategic outcome was revised in 2006–07, effective for 2007–08, to better reflect its management board and budget office responsibilities. The previous outcome, provided above, was too narrowly focussed on the Secretariat's resource allocation activities and did not adequately reflect the Secretariat's increasing responsibilities for promoting accountable government, and effective and efficient management. The new strategic outcome—Government is well managed and accountable, and resources are allocated to achieve results–better reflects the full range of Secretariat activities.

[5]. In accordance with the January 4, 2007, changes in ministers' responsibilities, this authority will be transferred from the Treasury Board of Canada Secretariat to Environment Canada through the 2007–08 Supplementary Estimates.

[6]. The expected results outlined in this performance report were identified as "subcommitments" in the 2006–07 RPP.

[7]. On a case-by-case basis, departments and agencies may be able to eliminate or amalgamate certain reports if the information is provided to Parliament through the Public Accounts or the Estimates.

[8]. Note that no priorities were identified for management of these funds in 2006–07. For further details on these funds, please see Table 3 in Section III of this report.

[9]. The expected results outlined in this performance report were identified as "subcommitments" in the 2006–07 RPP.

[10]. The expected results outlined in this performance report were identified as "subcommitments" in the 2006–07 RPP.