Common menu bar links

Breadcrumb Trail

ARCHIVED - Industry Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

How to read this report

This Report on Plans and Priorities (RPP) presents Industry Canada’s 2012–13 plans for making progress toward its strategic outcomes through its program activities. The report contains an introductory message from the Minister, which summarizes the Department’s plans for serving Canadians and for contributing to government-wide objectives, followed by the four sections detailed below.

Section I, Departmental Overview, provides a brief overview of the department’s raison d’être and structure, summary information on Industry Canada’s financial and human resources, and details on the Department’s organizational priorities, including their links to the Department’s strategic outcomes; contextual information and a risk analysis explaining the effects of internal and external factors on the Department’s plans and priorities.

The Federal Sustainable Development Strategy (FSDS) outlines the Government of Canada’s commitment to improving the transparency of environmental decision-making by articulating its key strategic environmental goals and targets. The government has created visual identifiers to identify activities which contribute toward achieving the goals and targets of the FSDS, two of which can be found throughout this report:

Section II, Analysis of Program Activities by Strategic Outcome, provides detailed information on Industry Canada’s plans at the program activity level organized by strategic outcome, including planned spending and human resources, expected results, performance indicators, targets, planning summaries, and highlights of challenges and risk areas.

Section III, Supplementary Information, includes highlights of Industry Canada’s financial position and provides a link to its future-oriented financial statements on the departmental website. This Section also itemizes the Department’s supplementary information tables, which are available on the TBS website.

Finally in Section IV, Other Items of Interest, provides links to Industry Canada’s website and a summary of Industry Canada’s plans at the program sub-activity level.

In our continuing effort to provide Canadians with online access to information and services, we are including web links to more information and highlights. These links are numbered and presented as endnotes.

It should be noted that throughout this report, technical background information and methodologies have been excluded to improve the readability. The results for the performance indicators outlined in this report will be detailed in the corresponding Departmental Performance Report (DPR) and will include references to this information.

Industry Canada’s financials include a series of programs that are renewed on a three to five year basis depending on the program. As a result, the departmental spending can drop over time when a program is up for renewal, however, this is only a reflection of the approved funding at the time this report was prepared and is not a statement on the future funding of any program. The financial information will be revised on an annual basis and will reflect program renewal and announcements based on the Government of Canada’s annual budget.

Minister’s Message

Over the past year, the Canadian economy has proven to be resilient despite continued

fiscal uncertainty in other parts of the world. Since our government introduced Canada's Economic Action Plan in 2009 to respond to the global recession, Canada has recovered not only all of the jobs lost during the recession but also all of our economic output.

As Minister of Industry, I am confident that the Industry Portfolio will play a key role in our government's plan to strengthen Canada's knowledge-based economy. Our efforts will focus on promoting innovation and modernizing Canada's marketplace policies, among other areas.

A significant part of the Portfolio's activities will involve developing Canada's digital economy by updating copyright and privacy laws and building a world-class digital infrastructure for next-generation wireless technologies and services. We will also put in place conditions that allow small businesses to grow and create jobs. This will mean reducing red tape, improving access to credit and focusing programs to promote more effective research and development.

Since coming to office, our government has made science and innovation a priority. We will leverage our past investments and continue to develop and recruit world-leading research talent. We will also take measures to encourage the private sector to increase research and development investments and improve commercialization outcomes.

In our government's pursuit to improve the well-being of Canadians, we will continue to work to secure the recovery, eliminate the deficit and invest in the drivers of long-term economic growth. We will also implement our plan to find savings in government expenditures to return to fiscal balance in the medium term.

This year's Report on Plans and Priorities for Industry Canada and its portfolio partners delivers a comprehensive approach to promote and maintain Canada's strong and competitive economy. I look forward to working with my Cabinet and departmental colleagues, as well as with the private sector and other levels of government, to achieve our common goal of creating jobs and growth for all Canadians.

Christian Paradis

Minister of Industry and Minister of State (Agriculture)

Section I: Organizational Overview

Raison d’être

Mission

Industry Canada’s mission is to foster a growing, competitive, knowledge-based Canadian economy.

The Department works with Canadians throughout the economy, and in all parts of the country, to improve conditions for investment, improve Canada’s innovation performance, increase Canada’s share of global trade and build an efficient and competitive marketplace.

Mandate

Industry Canada’s mandate is to help make Canadian industry more productive and competitive in the global economy, thus improving the economic and social well-being of Canadians.

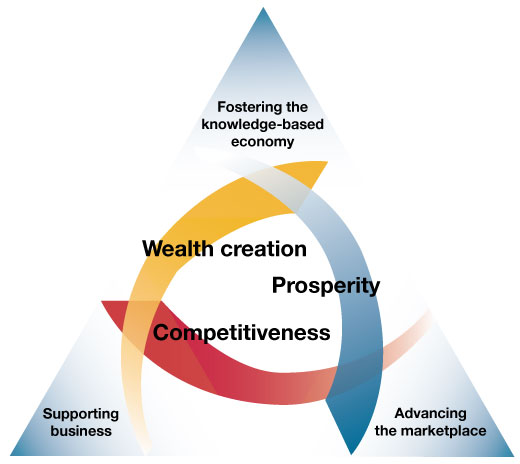

The many and varied activities Industry Canada carries out to deliver on its mandate are organized around three interdependent and mutually reinforcing strategic outcomes. Each outcome is linked to a separate key strategy, as outlined below. The key strategies are shown in the adjacent figure.

The Canadian marketplace is efficient and competitive

The Canadian marketplace is efficient and competitive

Advancing the marketplace

Industry Canada fosters competitiveness by developing and administering economic framework policies that promote competition and innovation; support investment and entrepreneurial activity; and instill consumer, investor and business confidence.

Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy

Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy

Fostering the knowledge-based economy

Industry Canada invests in science and technology to generate knowledge and equip Canadians with the skills and training they need to compete and prosper in the global knowledge-based economy. These investments help ensure that discoveries and breakthroughs happen here in Canada and that Canadians can realize the social and economic benefits.

Canadian businesses and communities are competitive

Canadian businesses and communities are competitive

Supporting business

Industry Canada encourages business innovation and productivity because businesses are the organizations that generate jobs and wealth creation. Promoting economic development in communities encourages the development of skills, ideas and opportunities across the country.

Responsibilities

Industry Canada is the Government of Canada’s centre for micro-economic policy expertise. The Department’s founding legislation, the Department of Industry Act, established the Ministry to foster a growing, competitive and knowledge-based Canadian economy.

Industry Canada is a Department with many entities that have distinct mandates, with program activities that are widely diverse and highly dependent on partnerships. Industry Canada works to improve a broad range of matters related to industry, science and technology (S&T), trade and commerce, consumer affairs, corporations and corporate securities, competition, weights and measures, bankruptcy and insolvency, intellectual property, investment, small business and tourism.

Strategic Outcomes and Program Activity Architecture

This Report on Plans and Priorities is aligned with Industry Canada’s Management, Resources and Results Structure (MRRS). The MRRS provides a standard basis for reporting to parliamentarians and Canadians on the alignment of resources, program activities and results.

Industry Canada’s strategic outcomes are long-term, enduring benefits to the lives of Canadians that reflect our mandate and vision, and are linked to Government of Canada priorities and expected results.

Industry Canada’s Program Activity Architecture (PAA) is an inventory of all of its programs. The programs are depicted in a logical and hierarchical relationship to each other and to the strategic outcome to which they contribute. The PAA also provides a framework through which to clearly link financial and non-financial resources to each program activity.

2011–12 and 2012–13 PAA crosswalk

The PAA structure for 2012–13 remains unchanged from 2011–12. A number of program titles and descriptions were modified to better reflect how they contribute to the strategic outcomes and allow Industry Canada to report its performance more clearly.

Industry Canada's 2012–13 Program Activity Architecture (approved by Treasury Board)

Strategic Outcome: The Canadian marketplace is efficient and competitive

Program Activities: Marketplace Frameworks and Regulations

Sub-Activities

- Trade Measurement

- Bankruptcy and Insolvency

- Federal Incorporations

- Investment Review

- Intellectual Property

- Internal Trade Secretariat

Program Activities: Spectrum, Telecommunications and the Online Economy

Sub-Activities

- Spectrum Management and Telecommunications

- Electronic Commerce

Program Activities: Consumer Affairs

Program Activities: Competition Law Enforcement

Strategic Outcome: Advancements in science and technology

knowledge and innovation strengthen the Canadian economy

Program Activities: Science, Technology and Innovation Capacity

Program Activities: Science, Technology and Innovation Capacity

Sub-Activities

- Government Science and Technology Policy Agenda

- Science and Technology Partnerships

Information and Communication Technologies Research and Innovation

Program Activities: Industrial Research and Development Financing

Program Activities: Industrial Research and Development Financing

Sub-Activities

- Automotive Innovation

- Aerospace Innovation

- Strategic Aerospace and Defence Initiative

- Technology Partnerships Canada

Strategic Outcome: Canadian businesses and communities are competitive

Program Activities: Small Business Research Advocacy and Services

Subactivities

- Canada Small Business Financing

- Canada Business Network

- Small Business Internship

- Small Business Growth and Prosperity

Program Activities: Industrial Competitiveness and Capacity

Subactivities

- Industry-Specific Policy and Analysis

- Shipbuilding Capacity

- Industrial and Regional Benefits

Program Activities: Community Economic Development

Subactivities

- Community Futures

- Northern Ontario Development

- Computers for Schools

- Community Internet Access

- Economic Development Initiative for

Official Language Minority Communities

Internal Services

Legend:

Organizational Priorities

| Priority 1: Advancing the marketplace |

Type: Ongoing |

Strategic Outcome(s) and/or Program Activity(ies): The Canadian marketplace is efficient and competitive |

|---|---|---|

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority 2: Fostering the knowledge-based economy |

Type: Ongoing |

Strategic Outcome(s) and/or Program Activity(ies): Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy |

|---|---|---|

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority 3: Supporting business |

Type: Ongoing |

Strategic Outcome(s) and/or Program Activity(ies): Canadian businesses and communities are competitive |

|---|---|---|

|

Why is this a priority?

Plans for meeting the priority

|

||

| Priority 4: Ensuring sound management |

Type: Ongoing |

Strategic Outcome(s) and/or Program Activity(ies): All strategic outcomes |

|---|---|---|

|

Why is this a priority?

Plans for meeting the priority

|

||

Risk Analysis

Industry Canada has implemented a tailored integrated risk management approach that proactively addresses the key risks that may impede the Department’s overall ability to deliver on its mandate. This approach meets the Department’s needs for sound risk management and allows it to monitor the mitigation strategies and action plans for its corporate risks. Industry Canada’s 2012–13 Corporate Risk Profile includes nine corporate risks. These risks are identified by Program Activity and grouped into two risk categories: Reputational and Stakeholder Expectations and Organizational Adaptability. Risks are also reviewed as part of the Quarterly Financial Report.

Additional risks were identified and are monitored at the program level. These additional risks are detailed in Section II of this report in the highlights of challenges and risks section under each program activity.

Industry Canada will continue to update its Corporate Risk Profile as well as identify, monitor and mitigate corporate risks that may affect the Department’s ability to achieve its expected results and deliver its mandate.

Operating Environment

Canada’s economy has been resilient since the recession. The unemployment rate has been declining, as economic growth and job creation are being buoyed by strong commodity prices, more sustained private sector demand, increased business investment, and timely investments under Canada’s Economic Action Plan. While Canada’s medium-term growth prospects are healthy, there is uncertainty about the trajectory of the broader global economic recovery.

The Canadian economy faces several risks. The strong Canadian dollar could constrain the growth prospects of non-resource-related industries and high household debt could hold back private consumption. The volatility of the markets will continue to create challenges in the merger context, in particular, where there may be a rise in mega-mergers and hostile merger transactions. Global risks include weak domestic demand in most advanced economies, particularly the United States, global trade imbalances, uncertainty in European sovereign debt markets, and inflation in emerging economies.

Over the medium to long term, the Canadian economy will face pressures from an aging population and the changing global economic environment. These will challenge the Canadian economy to sustain strong growth in Canadian living standards, unless Canada’s productivity performance strengthens significantly.

In addition, Canadian industries will be challenged to respond to intensifying global competition, rising demand for resource commodities, and growing environmental considerations. Key strategies will likely include expanding their global reach, integrating into global supply chains, and adopting cutting-edge new technologies.

For Industry Canada, this means a continued pressure to support Canadian businesses and industries, including small and medium-sized enterprises (SME), by helping them understand, exploit and adapt to a changing economic landscape; by promoting skills development and sector-specific knowledge growth; by fostering business innovation, competitiveness and productivity; and by supporting a fair and competitive marketplace upon which Canadian businesses can grow and expand.

The Department’s business imperatives will be driven by two main objectives: preserving Canada’s economic health in light of the continued instability in global economic conditions; and helping businesses and communities enhance their productivity and innovation so Canada is well positioned to deal with the impact of an aging population and changing global economy.

Internal Environment

To restore fiscal balance, the government has implemented a number of measures to improve efficiency while lowering the rate of growth in the size and operations of the public service, including the absorption of collective bargaining agreements and continued controls on spending for travel, conferences and hospitality. Over the next five years, total employment at Industry Canada is expected to decline. The department will continue its effective management practices to ensure the sound stewardship of resources and that it retains the people, knowledge and skills necessary to deliver on its mandate.

Planning Summary

Industry Canada’s financial and human resources

The following two tables present Industry Canada’s financial resources and human resources, expressed as full-time equivalents (FTE), for the next three fiscal years.

| 2012–13 | 2013–14 | 2014–15 |

|---|---|---|

| 1,445.4 | 1,131.2 | 1,004.6 |

| 2012–13 | 2013–14 | 2014–15 |

|---|---|---|

| 5,395 | 5,305 | 5,293 |

| Performance Indicators | Targets |

|---|---|

| Canada’s rank among G7 countries in “Integrated Product Market Regulation” | 3rd |

| Canada’s rank among G7 countries in “starting a business” indicator | 1st |

| Canada’s rank among G7 countries for “competition legislation is efficient in preventing unfair competition” | 2nd |

| Program Activity | Forecast Spending 2011–12 | Planned Spending ($ millions)* |

Alignment to Government of Canada Outcomes |

||

|---|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | |||

| * minor differences due to rounding | |||||

| Marketplace Frameworks and Regulations | 63.0 | 49.6 | 45.6 | 49.0 | Economic Affairs: A Fair and Secure Marketplace |

| Spectrum, Telecommunications and the Online Economy |

90.2 | 88.7 | 82.5 | 81.5 | Economic Affairs: A Fair and Secure Marketplace |

| Consumer Affairs | 4.7 | 4.5 | 4.5 | 4.5 | Economic Affairs: A Fair and Secure Marketplace |

| Competition Law Enforcement |

48.4 | 47.1 | 47.1 | 47.1 | Economic Affairs: A Fair and Secure Marketplace |

| Total Planned Spending |

206.4 | 189.9 | 179.8 | 182.2 | |

Spending plans under this strategic outcome are generally stable. The main variable is in the Marketplace Frameworks and Regulations program activity, and reflects changes in spending and revenue plans for the Canadian Intellectual Property Office in response to expected volume of patent applications. For details, please see the explanations by program activity under Section II.

| Performance Indicators | Targets |

|---|---|

| Canada’s rank among G7 countries in public performed research and development as a percentage of gross domestic product | 1st |

| Canada’s rank among G7 countries in business performed research and development as a percentage of gross domestic product | 6th |

| Canada’s labour productivity (real gross domestic product per hour worked) | $45.15 |

| Program Activity | Forecast Spending 2011–12 | Planned Spending ($ millions)* |

Alignment to Government of Canada Outcomes |

||

|---|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | |||

| * minor differences due to rounding | |||||

| Science, Technology and Innovation Capacity | 503.8 | 350.6 | 239.8 | 156.1 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Information and Communication Technologies Research and Innovation | 41.7 | 36.6 | 36.7 | 36.6 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Industrial Research and Development Financing | 420.7 | 483.0 | 327.5 | 282.4 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Total Planned Spending | 966.2 | 870.3 | 603.9 | 475.1 | |

Spending plans for this strategic outcome will decline significantly from 2011–12 levels, after the 2011–12 completion of the Knowledge Infrastructure Program under the Science, Technology and Innovation Capacity program activity and the termination of the associated budget of $246 million. Planned spending in 2012–13 remains relatively high compared to the following two years due to the overlap in old and new agreements for the Canada Foundation for Innovation (CFI) and Genome in that year. Decreases in following years reflect the ending of older agreements for the CFI and Genome. For details, please see explanations by program activity under Section II.

| Performance Indicators | Targets |

|---|---|

| Canada’s rank among G7 countries for the “Small and medium-size enterprises are efficient by international standards” criterion | 3rd |

| Canada’s rank among G7 countries for the “Large corporations are efficient by international standards” criterion | 4th |

| The difference between the unemployment rate of Northern Ontario compared to the unemployment rate of Canada | 1.16% |

| Program Activity | Forecast Spending 2011–12 | Planned Spending ($ millions)* |

Alignment to Government of Canada Outcomes |

||

|---|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | |||

| * minor differences due to rounding | |||||

| Small Business Research, Advocacy and Services |

121.4 | 136.0 | 128.5 | 129.8 | Economic Affairs: Strong Economic Growth |

| Industrial Competitiveness and Capacity | 48.2 | 53.1 | 37.5 | 37.5 | Economic Affairs: Strong Economic Growth |

| Community Economic Development | 168.4 | 73.0 | 67.5 | 67.2 | Economic Affairs: Strong Economic Growth |

| Total Planned Spending | 337.9 | 262.2 | 233.5 | 234.5 | |

Total planned spending in this strategic outcome decreases from 2011–12 levels largely due to the completion of the infrastructure phase of Broadband Canada ($65 million) and the changes in funding for the Community Access Program which currently ends in March 2012 ($23.7 million) under the Community Economic Development program activity. In addition, planned spending for 2012–13 includes $12 million for the Structured Financing Facility Program, under Industrial Competitiveness and Capacity program, which currently ends in March 2013. For details, please see the explanations by program activity under Section II.

| Program Activity | Forecast Spending 2011–12 | Planned Spending ($ millions) | ||

|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | ||

| Internal Services | 162.1 | 123.1 | 114.0 | 112.9 |

Forecast spending for Internal Services in 2011–12 includes $21 million deferred funding from the previous year. In addition, the creation of Shared Services Canada, established by Order in Council on August 4, 2011 to consolidate existing resources from across government resulted in a transfer of $23 million for IT infrastructure along with associated internal services. Finally, under the Department’s funding model, $66 million or approximately 15 percent of its core budget has come from revenues generated by repayments received under former contribution programs. These revenues are declining due to decreasing sales of the products that were developed under these programs. This results in a projected decrease of $13 million in 2013–14.

Contribution to the Federal Sustainable Development Strategy (FSDS)

The Federal Sustainable Development Strategy (FSDS) outlines the Government of Canada’s commitment to improving the transparency of environmental decision-making by articulating its key strategic environmental goals and targets. Industry Canada ensures that consideration of these outcomes is an integral part of its decision-making processes. In particular, through the federal Strategic Environmental Assessment (SEA) process, any new policy, plan, or program undergoes an SEA preliminary scan analysis of its impact on attaining the FSDS goals and targets. The results of full SEAs are made public when an initiative is announced, demonstrating the department’s commitment to achieving the FSDS goals and targets.

The Department recognizes the interconnectedness of the economic, social and environmental policy dimensions. As such, it supports further integration of sustainable development principles into departmental policies, programs and operations as a way to improve efficiency, decrease costs and enhance competitiveness of Canadian industry. In the coming fiscal year (2012–13), Industry Canada will work to align its sustainable development vision with the new FSDS framework, and, in collaboration with stakeholders and other federal departments, to integrate economic considerations into this framework. The Department will also continue to implement its commitments under two of the four FSDS themes. The two themes are: Theme I: Addressing Climate Change and Air Quality and Theme IV: Shrinking the Environmental Footprint—Beginning with Government as denoted by the visual identifiers below:

These contributions are components of the following Program Activities and are further explained in Section II:

Science, Technology and Innovation Capacity

Science, Technology and Innovation Capacity

Industrial Research and Development Financing

Industrial Research and Development Financing

Industrial Competitiveness and Capacity

Industrial Competitiveness and Capacity

Internal services

Internal services

For additional details on Industry Canada’s activities to support sustainable development please see Section II of this RPP and the Industry Canada website. For complete details please see the Federal Sustainable Development Strategy website.

Expenditure Profile

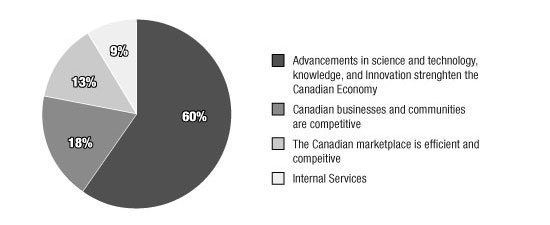

Industry Canada’s total planned spending for 2012–13 is $1445.4 million. The majority of planned spending is directed at Industry Canada’s three strategic outcomes, with a cost-effective 9% allocated to Internal Services.

Industry Canada will continue to implement strategies to ensure efficient use of its operating budget to deliver benefits to Canadians.

Sound stewardship and effective management practices in planning, setting priorities and allocating resources will allow Industry Canada to continue to deliver its mandate, with a reduced operating budget, in the coming years and adapt to evolving government priorities.

Breakdown of 2012-13 Planned Spending by Strategic Objective

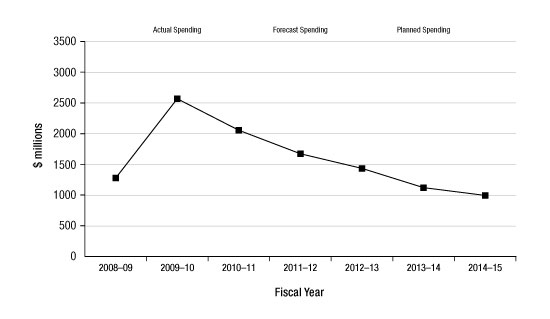

Departmental Spending Trend ($ millions)

The figure below illustrates Industry Canada’s spending trend from 2008–09 to 2014–15.

The increase in spending in 2009–10 and 2010–11 was primarily related to Canada’s Economic Action Plan. The decrease in planned spending in 2013–14 is due to the sunsetting of programs, as well as decreases in the current funding for the Aerospace Innovation Program and the Canada Foundation for Innovation.

Estimates by Vote

For information on Industry Canada’s appropriations, please see the 2012–13 Main Estimates publication. An electronic version of the Main Estimates is available at http://www.tbs-sct.gc.ca/est-pre/20122013/p2-eng.asp.