Common menu bar links

Breadcrumb Trail

ARCHIVED - Public Service Commission of Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section III – Supplementary Information

Financial Highlights

The future-oriented financial highlights presented within this Report on Plans and Priorities are intended to serve as a general overview of the Public Service Commission (PSC)’s operations. These future-oriented financial highlights are prepared on an accrual basis to strengthen accountability and improve transparency and financial management.

| For the Year Ended March 31 | 2012 Forecast |

|---|---|

| Financial Assets | 7,395 |

| Non-financial Assets | 16,148 |

| Total Assets | 23,543 |

| Liabilities | 30,349 |

| Equity | (6,896) |

| Total | 23,543 |

| For the Year Ended March 31 | 2012 Forecast |

|---|---|

| Expenses | |

| Total Expenses | 129,665 |

| Revenues | |

| Total Revenues | 15,800 |

| Net Cost Of Operation | 113,865 |

Expenses

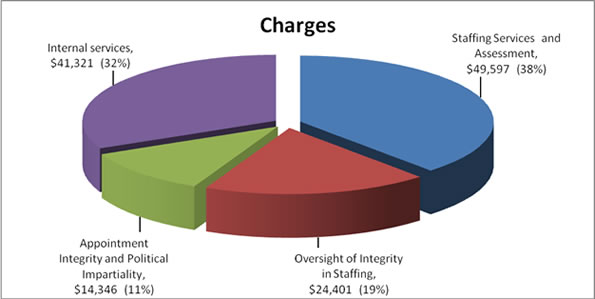

A total of $49.6M in expenses will be used to meet the PSC’s mandate to provide integrated, professional staffing and assessment services, adapted to the needs of clients and the public service. Through the provision of assessment services to other government organizations, the PSC expects to generate $14M in re-spendable revenues to offset expenses.

A total of $24.4M in expenses will be used to support the PSC’s strategic priority of Oversight of Integrity in Staffing. This includes providing objective information, advice and assurance to Parliament, and ultimately Canadians, about the integrity and effectiveness of the appointment process, including the protection of merit and non-partisanship.

A total of $14.3M in expenses will be used to ensure Appointment Integrity and Political Impartiality through establishing policies and standards, providing advice, interpretation and guidance and administering delegated and non-delegated appointment authorities.

A total of $41.3M in expenses will be used to provide the PSC with central services and systems in support of corporate management and all PSC program activities. These services include the activities of the President and Commissioners, business planning, management systems and policies, finance, human resource management, information technology, internal audit, and other administrative and support services.

Future Oriented Financial Statements

The Public Service Commission – Future Oriented Financial Statements as of March 31, 2012 Supplementary information can be found in the publications sections of the PSC Web site at www.psc-cfp.gc.ca.

Supplementary information tables

Supplementary information on the following tables can be found on the Treasury Board of Canada Secretariat (TBS) Web site at www.tbs-sct.gc.ca/rpp/st-ts-eng.asp.

- Greening government operations

- Upcoming internal audits and evaluations over the next three fiscal years

- Sources of respendable and non-respendable revenue

Section IV - Other Items of Interest

Supplementary information on the following subjects can be found in the publications section of the PSC Web site at www.psc-cfp.gc.ca.

- Information by sub-activities

- Corporate Risk Profile and Mitigation Strategies

- Public Service Commission - Future-Oriented Financial Statements as of March 31, 2012

This document is available on the TBS Web site at www.tbs-sct.gc.ca and in the publications section of the PSC Web site at www.psc-cfp.gc.ca.

[1] The Forecast spending figures for 2010-2011 have been reduced by $10,663K and the Planned spending figures for 2011-2012 to 2013-2014 by $14,000K respectively. These reductions reflect the revenues related to net voting activities for assessment and counselling services offered on a cost-recovery basis.

[2] The variance explanations are provided on page 11.

[3] Ibid

[4] New activity for 2011-2012. Comparative baseline data from previous years is not available for this planning cycle.