Common menu bar links

Breadcrumb Trail

ARCHIVED - Canada Revenue Agency - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Message from the Minister

The Canada Revenue Agency (CRA) plays an important role in implementing our government's commitments with regards to administering Canada's tax laws; assessing and collecting taxes and levies; delivering social and economic benefits, such as the GST/HST credit and the Canada Child Tax Benefit; and ensuring that this is all done with the transparency and integrity Canadians have come to expect.

This Report on Plans and Priorities 2011-2012 outlines how the CRA will fulfil this role, while ensuring that it operates within our means.

Our government's Economic Action Plan has brought much needed tax relief to Canadians and I am proud of the role the CRA had in implementing these measures. Going forward, we will continue to keep focused on priorities, including fairness to taxpayers. We will work to close loopholes, enter into more tax treaties to combat international tax evasion, and continue with efforts to combat the underground economy.

As we look to the future, Canadian taxpayers can continue to have confidence that the CRA will maintain strong stewardship of our tax and benefits system.

The Honourable Gail Shea, P.C., M.P.

Minister of National Revenue

Message from the Commissioner

The Canada Revenue Agency (CRA) has a key role to play in Canada's economy by administering taxes for federal, provincial, territorial, and First Nations governments; we also contribute to the government's social outcomes through our benefit programs. Our Report on Plans and Priorities is an annual opportunity for us to state the challenges and opportunities we see over the planning period, and how we will respond so that the Agency continues to be a world leader in tax and benefit administration.

Over the last two years, the CRA has played a key role in the delivery of the government's Economic Action Plan: our timely and efficient implementation of tax measures ensured that vital sectors of our economy received the support that they needed to survive through difficult economic times. We will continue to support government priorities over the following year, through responsible allocation of resources, to ensure that we sustain our core business while respecting the need for fiscal restraint.

Addressing non-compliance with tax and benefits legislation is an important element of our core business and essential to protecting Canada's revenue base. Providing services that help taxpayers and benefit recipients fulfil their obligations and receive their entitlements is also core to our mandate. This plan outlines some key compliance initiatives to address the highest risk areas of non-compliance, renews our commitment to online, secure self-service, and outlines steps to maintain Canadians' trust and confidence in the CRA as a fair and effective organization.

The challenges ahead present an opportunity for the CRA to demonstrate once again that we are a resilient and reliable organization that continues to deliver on its mandate and achieves results for Canadians.

Linda Lizotte-MacPherson

Commissioner and Chief Executive Officer

Canada Revenue Agency

Section I: Agency Overview

Our raison d'être

The Canada Revenue Agency (CRA) is responsible for administering, assessing, and collecting hundreds of billions of dollars in taxes annually. The tax revenue it collects is used by federal, provincial, territorial, and First Nations governments to fund programs and services that contribute to the quality of life of Canadians.

No other public organization touches the lives of more Canadians on a daily basis. The CRA uses its federal infrastructure to deliver benefits, tax credits, and other services that support the economic and social well‑being of Canadian families, children, and persons with disabilities.

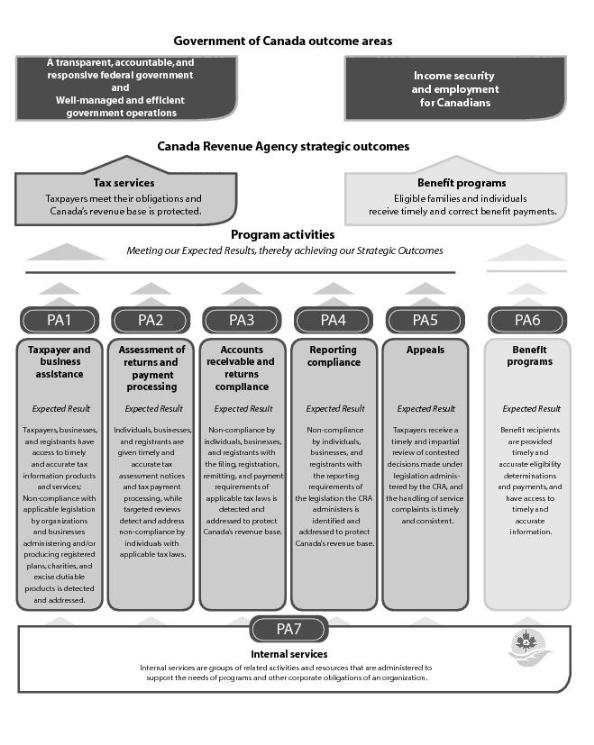

The CRA contributes to three of the Government of Canada's outcome areas:

- a transparent, accountable, and responsive federal government;

- well-managed and efficient government operations; and

- income security and employment for Canadians.

Our mandate

The CRA is mandated to administer tax, benefit, and other programs for the Government of Canada and provincial, territorial, and certain First Nations governments.

In carrying out its mandate the CRA strives to make sure that Canadians:

- pay their required share of taxes;

- receive their rightful share of entitlements; and

- are given an impartial and responsive review of contested decisions.

The following two strategic outcomes summarize the CRA's contribution to Canadian society.

- Taxpayers meet their obligations and Canada's revenue base is protected.

- Eligible families and individuals receive timely and correct benefit payments.

The achievement of these outcomes shows that we are fulfilling our mandate from Parliament.

Delivering results

In addition to the administration of income tax and benefit programs, the CRA now administers harmonized sales tax for five provinces. The CRA also verifies taxpayer income levels in support of a wide variety of federal, provincial, and territorial programs, ranging from student loans to health care initiatives. In addition, we provide other services, such as the Refund Set‑Off Program, through which we aid other federal agencies and departments, as well as provincial and territorial governments, in the collection of debts that might otherwise become uncollectible.

Our contribution to the Federal Sustainable Development Strategy (FSDS)

The Federal Sustainable Development Act establishes environmental sustainability as a long-term government-wide priority. It requires the Government of Canada to develop and table an FSDS that makes environmental decision-making more transparent.

The first FSDS sets a clear direction for environmental sustainability. It articulates four themes that establish common sustainable development (SD) goals and targets across government. The CRA is implicated by Theme IV: Shrinking the Environmental Footprint – Beginning with Government. The CRA's contributions are further explained in Section II, under Internal Services (PA7).

This icon is used throughout the CRA Report on Plans and Priorities (RPP) to indicate activities that

contribute to Theme IV of the FSDS.

This icon is used throughout the CRA Report on Plans and Priorities (RPP) to indicate activities that

contribute to Theme IV of the FSDS.

The CRA has prepared a detailed internal SD strategy that accounts for all interventions that support SD within the CRA. We also prepared an SD National Action Plan that will move us towards achieving our long-term SD outcomes. This Plan is articulated under two broad headings and three goals, namely:

- Goal 2–Deliver sustainable programs and services to Canadians

- Goal 3–Improve business sustainability

As part of its compliance with the Federal Sustainable Development Act, the CRA will table the CRA SD Strategy 2011-2014 through its 2011-2012 RPP and report on performance through the corresponding CRA Departmental Performance Report.

For more information on the CRA SD Strategy 2011-2014. Complete details on the Federal Sustainable Development Strategy.

CRA program activity architecture

Planning summary

Agency resources

Alignment to Government of Canada outcomes

| Performance indicators | Targets |

|---|---|

| Program activity (thousands of dollars) | Forecast spending | Planned spending | Alignment to Government of Canada outcome areas | ||

|---|---|---|---|---|---|

| 2010-2011 | 2011-2012 Footnote 1 | 2012-2013 Footnote 1 Footnote 2 | 2013-2014 Footnote 1 Footnote 2 | ||

| Strategic outcome: Eligible families and individuals receive timely and correct benefit payments. We assess our results against our benefits strategic outcome by measuring timelines and accuracy of payments and eligibility determination. We also monitor the number of government clients that rely on us as a service provider. Our targets vary between indicators. For information about CRA service standard targets please see our Web site. | |||||

| Benefit programs (PA6) | 338,978 | 356,806 | 351,618 | 355,196 | Income security and employment for Canadians |

| The following program activity supports all strategic outcomes within this organization. | |||||

|

|

|||||

|

|

|||||

| Strategic outcome: Taxpayers and benefit recipients receive an independent and impartial review of their service-related complaints. | |||||

|

Taxpayers' ombudsman Footnote 3

|

|||||

|

Total Planned Spending Footnote 4

|

|||||

Contribution of priorities to strategic outcomes

This CRA report on plans and priorities describes the results we expect to achieve over the next three years. It sets out our strategic and operational course during this period and identifies the resources needed to effectively and responsibly fulfil our mandate. It was developed in response to identified risks in our environment, global and domestic. Our objective is to make sure that we have in place effective strategies to deal with these risks.

Our plans are aligned with the following operational and management priorities for the Agency: promoting compliance, meeting service needs, addressing non-compliance, administering benefits, and enabling core business operations.

Implementing the initiatives over the period covered by this plan in the pursuit of our priorities will enhance our ability to achieve our strategic outcomes.

Our operating environment

An integral part of the strategic planning process involves a scan of the CRA's external and internal environment over the planning period. This assessment informs the decisions taken and underlies our priorities. The scan allows us to take stock of significant developments in the economic and social landscape, and determine whether priorities need to be adjusted in response.

A key feature of the current environment is the need for federal departments and agencies to contain costs as part of restoring the country to fiscal balance.

The CRA has moved proactively to ensure that the Agency will be able to continue delivering on its mandate while managing within a contained budget.

Globalization

Globalization and its associated powerful trends, such as the increasing pace of technological advancement, are also significant influences on the future of tax administration. The borderless nature of modern commerce allows companies to expand operations beyond their home country to establish global competitive advantage, but also creates increasing complexity for tax administrations as it becomes less clear where income is earned and where tax should be paid. The ability to move large amounts of money rapidly from one country to another helps those who want to avoid higher tax jurisdictions.

Tax administrations internationally are already responding to this new reality through increased collaboration–such as the move to joint audits of multinational corporations by two or more countries–and bilateral and multilateral information exchange is receiving unprecedented attention and support.

Over the next few years, we can expect globalization to increasingly influence the CRA as governments adapt taxation approaches to be effective in a global economy.

Technology and service

Although it is true that technological change offers the potential to increase overall productivity, it also results in an increased appetite by Canadians for real-time, integrated, cutting-edge service delivery. The CRA has made significant investments over the last 10 years to develop and implement a suite of tools, systems, and information-technology-enabled solutions in order to achieve maximum productivity. Information technology has enabled the CRA to automate many business transactions. We have already proven to be a leader in the Government of Canada in online service delivery. Over the planning period, we expect that demands for technology-enabled services will only increase. A critical success factor will be our ability to respond nimbly, building on our investments so far, while still safeguarding the reputation of the CRA and government for security and reliability.

IT sustainability

Over the years, we have managed our IT infrastructure by investing strategically to enable us to keep pace with our objectives for delivering affordable services and effective compliance activities. The aging of legacy applications is a concern that the CRA continues to guard against.

A changing workforce

The CRA's strategic direction will move the CRA to a growing reliance on knowledge workers as our processing activities become increasingly automated and interactions are conducted more and more on a self-service basis. The aging of Canada's population will introduce new challenges for the CRA as an employer. We recognize that the competition for talent will be a major factor for the CRA over the next 5 to 10 years as baby boomers leave the workforce.

Immigration is already the major contributor to the growth in Canada's working-age population and this trend is generally expected to increase over time. We will need to consider how best to attract and develop a workforce of even greater cultural and linguistic diversity representative of the citizens we serve. The Agency strategic workforce plan is updated annually to respond to these challenges and make sure that we develop a workforce that meets our future requirements.

Taxpayer attitudes and behaviour

In common with other tax administrations around the world, we recognize that voluntary compliance is underpinned by fundamental social norms regarding compliance with the law and contribution to society. Some of our most persistent and difficult challenges, such as the underground economy, are exacerbated by citizens' willingness to participate in cash transactions for immediate gain without an awareness of, or concern for, the impact on Canadian society. As we search for compliance solutions that will ensure a sustainable tax system, it is important to not assume that all solutions will be technology-based. We will continue to encourage approaches that educate and influence Canadians (including those new to our country), to see responsible tax and benefit practices as key to Canada's success, and to willingly comply.

Expenditure profile

For the period 2007-2008 to 2010-2011, total spending amounts include all Parliamentary appropriations and revenue sources: Main Estimates, Supplementary Estimates, funding associated with the increased personnel costs of collective agreements, maternity allowances and severance payments, as well as funding to insure implementation of Federal Budget initiatives and the Agency's carry forward adjustments from the prior year. It also includes spending of revenues received through the conduct of CRA's operations pursuant to Section 60 of the Canada Revenue Agency Act, Children's Special Allowance payments, payments to private collection agencies pursuant to Section 17.1 of the Financial Administration Act and disbursements to the provinces under the Softwood Lumber Products Export Charge Act, 2006. For the period 2011-2012 to 2013-2014, planned spending excludes carry forward adjustments which are only finalized once Public Accounts are completed and it also does not include any amounts for maternity allowances and severance payments. Finally, for the period 2012-2013 and 2013‑2014 planned spending amounts do not yet include a forecast for disbursements to the provinces under the Softwood Lumber Products Export Charge Act, 2006 (estimated at $140M in 2011-2012).

Since 2007-2008 the Canada Revenue Agency's Operating Expenditures reference levels have changed primarily as a result of: collective agreements/contract awards; policy and operational initiatives arising from various Federal Budgets and Economic Statements; transfers from the Department of Public Works and Government Services Canada for accommodations and real property services; and the commencement of responsibilities related to the administration of corporate tax in Ontario and the Softwood Lumber Agreement. Over the same period, there have also been a number of decreases as a result of various government-wide budget reduction exercises. The Operating Expenditures Vote was also reduced to create the Agency's new Capital Expenditures Vote.

The Agency Statutory Authorities have fluctuated over the course of the 2007-2008 to 2013-2014 period as a result of: adjustments to the Children's Special Allowance payments for eligible children in the care of specialized institutions; adjustments to the rates for the contributions to employee benefit plans; increases to the spending of revenues received through the conduct of operations pursuant to Section 60 of the Canada Revenue Agency Act; the introduction from 2007-2008 to 2009-2010 of payments to private collection agencies pursuant to Section 17.1 of the Financial Administration Act; and finally, the introduction in 2006, and adjustments to disbursements to the provinces under the Softwood Lumber Products Export Charge Act, 2006.

For information on our organisational votes and/or statutory expenditures, please see the 2011–12 Main Estimates publication.

Analysis of Program Activities by strategic outcome

In Section 1 of this report we have articulated the environment and strategic context in which the CRA plans to operate over the next three years. We have highlighted the longer-term strategic agenda we will pursue that will enable us to meet the challenges we are facing. This strategic agenda also informs the activities we carry out on a daily basis on behalf of Canadians.

These day to day activities are described in further detail throughout the next Section: Analysis of Program Activities by Strategic Outcome. For each program activity, we present a high-level discussion on our plans and priorities, our expected results, and associated indicators and targets that will enable us to measure our success in achieving our strategic outcomes.