ARCHIVED - Department of Finance Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2011-12

Report on Plans and Priorities

Department of Finance Canada

The original version was signed by

The Honourable James M. Flaherty

Minister of Finance

Table of Contents

Section I: Departmental Overview

- Raison d'être and Responsibilities

- Contribution to the Federal Sustainable Development Strategy

- Strategic Outcome and Program Activity Architecture

- Planning Summary

- Contribution of Priorities to the Strategic Outcome

- Risk Analysis

- Expenditure Profile

- Estimates by Votes

Section II: Analysis of Program Activities by Strategic Outcome

- Strategic Outcome

- Program Activity 1.1: Economic and Fiscal Policy Framework

- Program Activity 1.2: Transfer and Taxation Payment Programs

- Program Activity 1.3: Treasury and Financial Affairs

- Program Activity 1.4: Internal Services

Section III: Supplementary Information

- Financial Highlights

- Future-Oriented Condensed Statement of Financial Position

- Supplementary Information Tables

Section IV: Other Items of Interest

Minister's Message

I am pleased to present the 2011–12 Report on Plans and Priorities for the Department of Finance Canada, which reflects both the broad challenges and opportunities facing the country as it emerges from the global economic recession.

Canada's fiscal situation remains one of the strongest among the industrialized countries, and our economic prospects are very encouraging. Through the success of Canada's Economic Action Plan, we have created jobs, supported small and medium-sized businesses, and helped families during the worst of the global economic downturn.

However, while Canada's economic prospects are positive, particularly in relation to other nations, we cannot rest on our laurels. The recovery in the world economy remains uneven, and many challenges remain to securing the enduring prosperity that Canadians have worked hard to achieve.

To meet these challenges, we will complete the stimulus phase of Canada's Economic Action Plan to ensure that the economic recovery is sustained. As our recovery strengthens, we will implement the next phase of the Economic Action Plan, which will continue to lay the foundation for long-term, sustainable growth by maintaining the government's focus on the economy, jobs and growth and by returning Canada's books to balance.

Accordingly, during the year ahead, the Department will focus its efforts on four key priorities.

The first, sound fiscal management, focuses on implementing the plan to return to balance set out in Budget 2010. Sound fiscal management will help maintain a competitive, efficient tax system, ensure sustainability of our social infrastructure, and enable the Government of Canada to deal with future economic challenges. The Department will also work with the Bank of Canada, Crown corporations and market participants to effectively manage operations and provide advice on a prudent debt management strategy.

To address our second priority, sustainable economic growth, we will focus on developing and implementing sound macroeconomic, tax and structural policies that support the drivers of productivity and growth. In addition, the Department will maintain its efforts in promoting the competitiveness, efficiency, safety and soundness of Canada's financial sector.

The Department's third priority for the year ahead is strengthening Canada's social policy framework through such initiatives as programs related to employment insurance and pensions and assistance for seniors, persons with disabilities, veterans and children.

Our fourth priority will be achieving effective international influence. The Department will continue its active engagement with other G20 countries, working toward a more stable and secure international financial system and promoting Canada's trade and investment interests.

This Report on Plans and Priorities provides key details on the Department's strategies to ensure that Canada's recovery from the recession continues, and that our country emerges even stronger, with a competitive, efficient and fair tax system, higher levels of business investment, renewed infrastructure and skills, and a more prominent voice as a global financial sector leader.

James M. Flaherty

Minister of Finance

Section I: Departmental Overview

The Report on Plans and Priorities is a key accountability document that presents the Department of Finance Canada's financial and non-financial plans for the 2011–12 fiscal year.

Raison d'être and Responsibilities

The Department of Finance Canada is committed to making a difference for Canadians by helping the Government of Canada develop and implement strong and sustainable economic, fiscal, tax, social, security, international and financial sector policies and programs. It plays an important role in ensuring that government spending is focused on results and delivers value for taxpayer dollars. The Department interacts extensively with other federal organizations and plays a pivotal role in the analysis and design of public policy across a wide range of issues affecting Canadians.

The Department's responsibilities include the following:

- Preparing the federal budget and the fall updating of economic and fiscal projections;

- Developing tax and tariff policy and legislation;

- Managing federal borrowing on financial markets;

- Administering major transfers of federal funds to the provinces and territories;

- Developing financial sector policy and legislation; and

- Representing Canada in various international financial institutions and groups.

The Department also plays an important central agency role, working with other departments to ensure that the government's agenda is carried out and that ministers are supported with first-rate analysis and advice.

The Minister of Finance is accountable for ensuring that his responsibilities are fulfilled both within his portfolio and with respect to the authorities assigned through legislation.

Contribution to the Federal Sustainable Development Strategy

The Department of Finance Canada is a participant in the Federal Sustainable Development Strategy. The Federal Sustainable Development Strategy was tabled by the Government of Canada in October 2010, in accordance with the Federal Sustainable Development Act. The Strategy represents a major step forward for the Government of Canada by including environmental sustainability and strategic environmental assessment as an integral part of its decision-making processes. The Strategy identifies four priority themes, which are supported by goals, targets and implementation strategies.

The Department contributes to three of the four themes outlined in the Strategy: Addressing Climate Change and Air Quality, Protecting Nature, and Shrinking the Environmental Footprint – Beginning with Government.

For additional details on the Department's activities that support sustainable development, please visit the Department's website.[1] For complete details on the Federal Sustainable Development Strategy, please visit Environment Canada's website.[2]

The following symbols are used in this Report on Plans and Priorities to indicate the Department's activities that contribute to the themes of the Strategy:

![]() Theme I: Addressing Climate Change and Air Quality

Theme I: Addressing Climate Change and Air Quality

![]() Theme II: Maintaining Water Quality and Availability

Theme II: Maintaining Water Quality and Availability

![]() Theme III: Protecting Nature

Theme III: Protecting Nature

![]() Theme IV: Shrinking the Environmental Footprint – Beginning with Government

Theme IV: Shrinking the Environmental Footprint – Beginning with Government

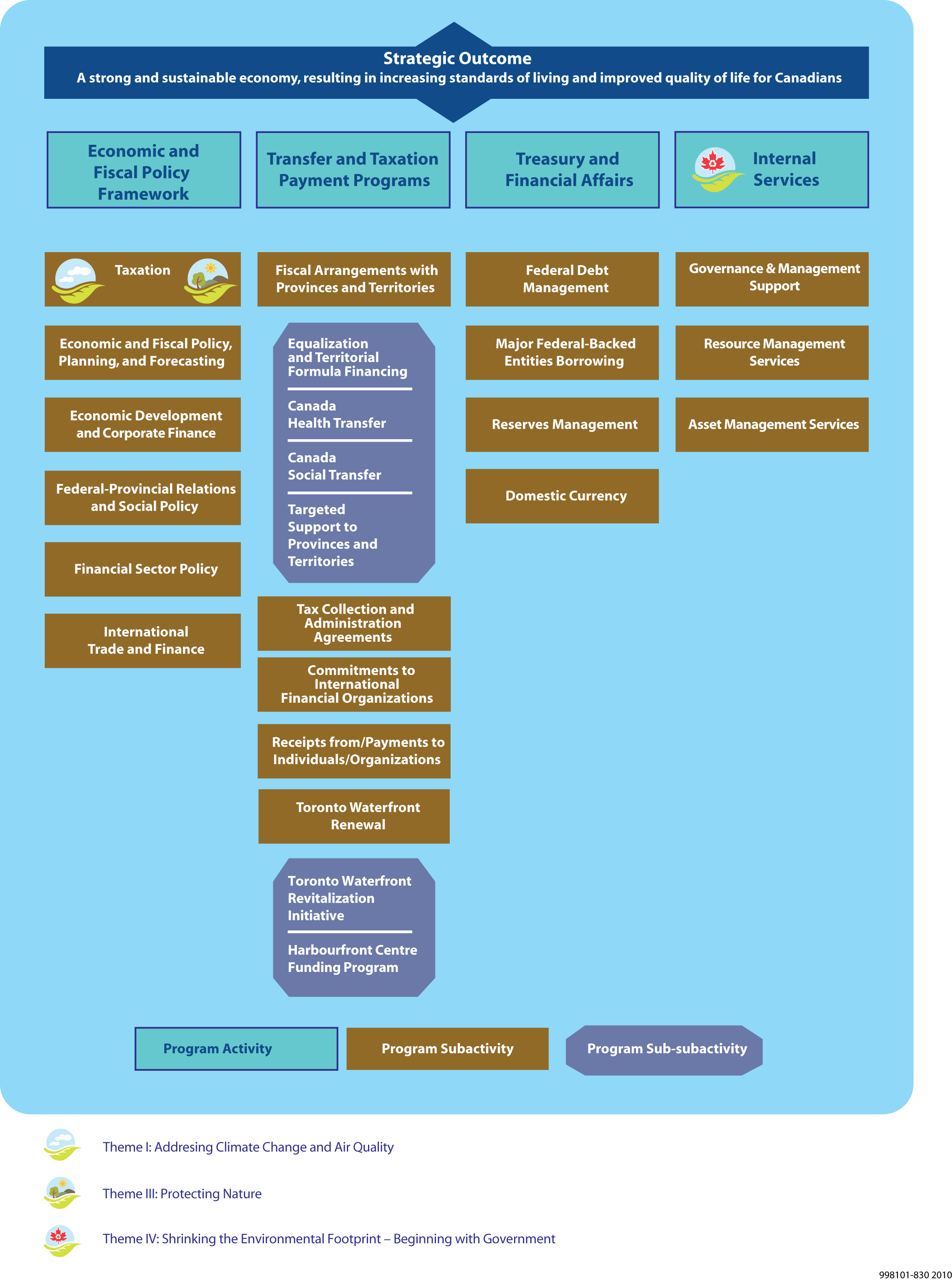

Strategic Outcome and Program Activity Architecture

The Department of Finance Canada provides effective economic leadership with a clear focus on one strategic outcome, which expresses a long-term and enduring benefit for Canadians:

A strong and sustainable economy, resulting in increasing standards of living and improved quality of life for Canadians

The Report on Plans and Priorities describes how plans and commitments for 2011–12 are linked to the Department's Program Activity Architecture (PAA), for which expected results and performance indicators were developed as part of the performance measurement framework.

The PAA provides an overview of how all of the Department's program activities and subactivities aim to contribute to the achievement of the Department's strategic outcome.

The Department has four program activities, which each contain a varying number of program subactivities. The four program activities are Economic and Fiscal Policy Framework, Transfer and Taxation Payment Programs, Treasury and Financial Affairs, and Internal Services.

The Economic and Fiscal Policy Framework program activity aims to maintain a competitive and efficient tax system, and provides for the management of expenditures in line with the Budget Plan and the financial operations of the Government of Canada.

The Transfer and Taxation Payment Programs program activity supports provinces and territories with funding for health, social programs and other shared priorities. This program activity also enables less prosperous provincial governments to provide their residents with public services that are reasonably comparable to those in other provinces, at reasonably comparable levels of taxation, and provides territorial governments with funding to support public services, in recognition of the higher cost of providing programs and services in the North.

The Treasury and Financial Affairs program activity supports the government's effort to manage its operating budgets and other financial operations of the Government of Canada.

The Internal Services program activity includes a number of functions and resources that support the Department as a whole in achieving its strategic outcome. As such, it supports each program activity within the PAA.

The Department's PAA is presented below.

Planning Summary

Financial Resources ($ thousands)

The financial resources presented below represent the total funds available to the Department of Finance Canada to deliver its mandate. They are composed of statutory votes and voted amounts.

| 2011–12 | 2012–13 | 2013–14 |

|---|---|---|

| 85,657,400.4 | 88,975,260.7 | 92,733,791.7 |

Budget 2010 included measures to restrain the growth of federal program expenses. First, for 2010–11, departments will be required to absorb the cost of negotiated wage increases by reallocating funds from within existing operating budgets. Additional funds will not be provided to departments for this type of expenditure. Second, for 2011–12 and 2012–13, the salary and operating budgets of departments will be frozen at 2010–11 levels.

The Department of Finance Canada is working to finalize an action plan for managing its resources under the operating freeze announced in Budget 2010.[3] The Department will be able to manage within existing resources through personnel attrition, by identifying efficiencies elsewhere in its operating budget and by using other existing control mechanisms, such as those related to executive staffing. A more detailed discussion of this action plan, including a progress report, will be included in the Department's 2010–11 Departmental Performance Report.

The Department's planned operating expenses from 2010–11 to the end of 2013–14 are presented below. The actual spending amounts for 2009–10 are included for reference.

| 2009–10 Actual |

2010–11 Forecast |

2011–12 Planned |

2012–13 Planned |

2013–14 Planned |

|

|---|---|---|---|---|---|

| Operating expenditures | 121,646 | 127,653 | 100,884 | 91,452 | 91,421 |

The financial data presented in the Planning Summary section of the 2011–12 Report on Plans and Priorities outline the Department's total planned financial resources. These financial resources include operating expenses — such as wages, telecommunications, leases, utilities, materials and supplies — as well as other expenses, such as grants, contributions, loans, investments, payments to Crown corporations, and advances. These other expenses are not subject to the requirements of the Budget restraint measures.

Human Resources (Full-Time Equivalent, FTE)

The following table summarizes the total planned human resources for the Department for the next three fiscal years. Human resources are presented as the number of full-time equivalents (FTEs).

| 2011–12 | 2012–13 | 2013–14 |

|---|---|---|

| 787 | 780 | 780 |

| Performance Indicators | Targets |

|---|---|

| Real gross domestic product (GDP) growth | No target. The goal is to compare favourably with G7 counterparts |

| Unemployment rate | No target. The goal is to compare favourably with G7 counterparts |

| Annual fiscal balance as a share of GDP and debt-to-GDP ratio | No target. The goal is to compare favourably with G7 counterparts |

| Program Activity (PA)[4] | Forecast Spending 2010–11 |

Planned Spending | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| PA 1: Economic and Fiscal Policy Framework | 99,353.1 | 231,374.0 | 61,272.0 | 61,074.0 | Strong economic growth |

| PA 2: Transfer and Taxation Payment Programs | 55,999,833.1 | 55,002,295.4 | 55,720,453.7 | 58,476,184.7 | All outcomes |

| PA 3: Treasury and Financial Affairs | 28,572,000.0 | 30,381,000.0 | 33,151,000.0 | 34,154,000.0 | Strong economic growth[5] |

| PA 4: Internal Services | 51,195.5 | 42,731.0 | 42,535.0 | 42,533.0 | |

| Total Planned Spending | 85,657,400.4 | 88,975,260.7 | 92,733,791.7 | ||

Contribution of Priorities to the Strategic Outcome

This subsection identifies the operational and management priorities of the Department of Finance Canada.

The Department helps shape and deliver the Government of Canada's agenda, particularly its fiscal and economic priorities. As a central agency, it plays a key role in assisting other government departments and agencies on a wide range of policies to ensure that government outcomes are met, particularly with respect to expenditures and financial management.

In accordance with broader government priorities and plans established in the Speech from the Throne and in the last federal budget, over the planning period the Department will continue to focus on the achievement of its overarching priority, which is to return the budget back to balance as the economy recovers.

The Department will also tackle its four key ongoing operational priorities: sound fiscal management, sustainable economic growth, sound social policy framework, and effective international influence. In addition, the Department will focus on its identified management priority, namely, sound financial and human resources management. All of the Department's priorities are linked to its single strategic outcome.

Operational Priorities

Sound Fiscal Management

Type of priority: Ongoing

Over the planning period the Department of Finance Canada will continue to play a major role in ensuring that the government continues to manage spending responsibly, maximizes the benefits of government assets to Canadians and takes measures to reduce the cost of government operations while ensuring their effectiveness.

The Department will work to protect Canada's macroeconomic and fiscal framework and to ensure the sustainability of Canada's social infrastructure and its competitive, efficient and fair tax system. Maintaining a sound economic and fiscal framework is critical in the context of global economic uncertainty.

Finally, the Department will continue to manage the government's funds in accordance with the guiding principles of transparency, regularity, liquidity and prudence.

Why is sound fiscal management a priority for the Department of Finance Canada?

- To preserve Canada’s social infrastructure and competitive, efficient and fair tax system;

- To give the government the flexibility to deal with unforeseen economic and fiscal developments;

- To ensure that the costs of investments and services are not passed on to future generations; and

- To maintain Canada’s economic and fiscal performance at a level that compares favourably with other major industrialized countries.

To meet this priority, the Department plans to:

- Ensure effective management of the fiscal framework by returning the budget to balance over the medium term;

- Provide sound analysis and advice on fiscal and economic developments and on expenditure and tax requests;

- Work with the Bank of Canada, Crown corporations and market participants to effectively manage operations and to provide advice on a prudent debt management strategy; and

- Maintain the integrity of the tax system to protect the government’s revenue base while ensuring tax fairness.

Sustainable Economic Growth

Type of priority: Ongoing

Strong sustainable growth requires sound macroeconomic, tax and structural policies that support the drivers of productivity and growth: business investment and innovation, human capital formation, renewed public infrastructure and prudent financial market governance. Recent government initiatives have contributed to some of these drivers of growth by reducing taxes on individuals; by improving business tax competitiveness, efficiency and fairness; and by reducing red tape, lowering tariffs and modernizing regulation.

Why is sustainable economic growth a priority for the Department of Finance Canada?

- To put in place sound policies and effective programs that help create the conditions necessary for both sustainable long-term economic growth and medium-term fiscal balance, thereby increasing Canadians’ standard of living; and

- To improve consumer and business access to financing and to strengthen the financial system.

To meet this priority, the Department plans to:

- Continue to facilitate government partnerships with the provinces and territories and the private sector in areas that contribute to a strong economy;

- Provide high-quality research and effective and sound analysis and advice on economic and policy issues;

- Maintain its efforts in promoting competitiveness, efficiency, safety and soundness of Canada's financial sector to ensure that domestic financial markets function well; and

- Continue its effort to ensure the competitiveness, efficiency and fairness of the tax system to encourage investment and entrepreneurship, labour force participation, and skills and knowledge development.

Sound Social Policy Framework

Type of priority: Ongoing

A sound social policy framework requires managing current and emerging pressures related to social policy and major transfer programs to ensure that those programs remain accessible, sustainable and effective for all Canadians.

Why is a sound social policy framework a priority for the Department of Finance Canada?

- To support the government’s efforts to promote equality of opportunity for all citizens across the country; and

- To help the government meet its objectives for the quality of life in Canada’s communities and to help ensure sustainable and accessible health care, post-secondary education and social safety net programs.

To meet this priority, the Department plans to:

- Ensure that agreements with provinces, territories and Aboriginal governments meet policy and administrative objectives;

- Provide, in collaboration with other central agencies, advice and analysis on the fiscal and economic implications of the government's social policies and programs related to health care, immigration, employment insurance and pensions, and post-secondary education; its Aboriginal and cultural programs; and its programs for seniors, persons with disabilities, veterans and children; and

- Maintain collaborative, productive relations with provincial and territorial governments.

Effective International Influence

Type of priority: Ongoing

Effective international influence requires active engagement with key economic partners on bilateral, regional and multilateral issues to leverage Canada’s strengths and to promote Canadian interests. This effort includes promoting Canada's trade and investment interests, fostering effective and innovative aid policies aimed at reducing global poverty, and working toward a more stable and secure international financial system.

Why is effective international influence a priority for the Department of Finance Canada?

- To support the stability of the global financial system; and

- To maintain secure and open borders, to strengthen global growth and stability, and to contribute to creating a more stable global economy, which will support Canadian prosperity.

To meet this priority, the Department plans to:

- Continue to develop and support policies and measures designed to maintain secure and open borders and further Canada’s trade and investment interests;

- Participate in negotiations on market access, trade rules and investment to support the implementation of the Global Commerce Strategy;

- Advance Canada’s leadership in a wide range of international financial institutions and economic organizations;

- Continue efforts to negotiate international tax treaties and tax information exchange agreements;

- Continue to assist in the government’s efforts to reduce global poverty; and

- Advance international standards to prevent abuses to the international financial system, including anti-terrorist financing measures.

Management Priority

Sound and Efficient Financial and Human Resources Management

Type of priority: Ongoing

Sound and efficient financial and human resources management helps the Department of Finance Canada effectively carry out its mandate and provides the necessary support to the Department in this period of budgetary restraint.

Why is sound and efficient financial and human resources management a priority for the Department of Finance Canada?

- Continued fiscal restraint creates a greater need for sound and efficient management of the Department’s operational budget and its human resources, including strategic recruitment, strengthening of the workplace, knowledge transfer and succession planning.

To meet this priority, the Department plans to:

- Focus on strategic recruitment and retention;

- Implement new government-wide financial management policies, including internal control, quarterly financial reporting, future-oriented financial statements, and investment planning; and

- Continue to ensure the effective alignment and implementation of the Clerk of the Privy Council’s Public Service Renewal priorities.

To effectively support the achievement of its management agenda, the Department has established an integrated planning process to ensure a systematic, transparent and fully documented approach to senior management decision making. This process assists in priority setting, commitment setting, business planning and performance reporting by establishing the necessary linkages between people, resources and actions to manage risks and achieve results. The Department’s integrated planning process fully integrates human resources planning as part of the annual planning cycle. The Report on Plans and Priorities and the Departmental Performance Report are products of the Department’s integrated planning process.

The achievement of the Department’s mandate depends significantly on the knowledge and expertise of its employees. The Department continually needs to recruit individuals with specific skills, high potential and strong commitment, while retaining corporate memory through knowledge transfer and succession planning. To achieve this goal, the Department has developed and communicated to all managers, in the context of the Integrated Planning Cycle, a forward-looking document entitled Department of Finance 2011–12 Human Resources Strategic Outlook. This document contains detailed human resources analysis, including an internal and external environmental scan, to help managers keep in mind medium- and long-term considerations affecting the Department’s workforce when conducting the integrated planning exercises. The Department is confident that it has appropriate recruitment and retention strategies and tools in place to address its current and future human resources needs, and the capacity to deliver on its priorities and plans.

Risk Analysis

The Canadian economy continues to recover from the worst global recession since the 1930s. The Canadian economy has fared much better than other major advanced economies throughout the recession and over the recovery to date, reflecting significant policy stimulus and Canada's solid economic fundamentals. Going forward, private sector economists expect that economic growth in Canada will continue to be moderate. Nevertheless, the uncertainty surrounding the global economic outlook remains elevated, posing risk to the Canadian outlook.

The Department of Finance Canada must manage the risks related to the economic recovery. It must have in place the infrastructure, resources and authorities needed to respond to an evolving economic and financial sector environment. It must manage the increased requirement for coordinated international decision making to deal with uncertain world economic conditions. It must also ensure that responsible agencies take effective coordinated action to support the soundness, integrity and reputation of the Canadian financial system.

In addition, the Department must respond to a range of challenges given the significant workload associated with implementing the government's plan to bring the budget back to balance, as well as following through on the exit strategy of Canada's Economic Action Plan. The Department must continue to assess and prioritize its operations and activities by allocating existing resources in the most effective and efficient manner possible.

Under these circumstances, the primary risks that the Department will be facing are associated with access to the highly skilled staff and tools needed to fulfill the Department's mandate. Given the nature of the Department's work and the need to respond quickly to evolving and emerging policy priorities, maintaining access to professional expertise will require vigilant priority setting and the implementation of appropriate recruitment, development and retention strategies within the context of constrained operating budgets.

The Department must also continue to have processes in place to ensure that accurate information is provided in budget documentation and other publications and to manage the risks of potential security breaches and potential failures in supporting systems and processes. The departmental Business Continuity Plan will help respond effectively to any events affecting business to ensure that the Department's core responsibilities can be carried out.

Risk management is an ongoing process that helps the Department better manage potential risks and prepare mitigation measures.

Expenditure Profile

For the 2011–12 fiscal year, the Department of Finance Canada plans to spend $85.7 billion to meet the expected results of its program activities and to contribute to its strategic outcome. The figures below illustrate the Department's spending trend by program activity from 2008–09 to 2013–14.

Spending in the Economic and Fiscal Policy Framework program activity includes the establishment of a Canadian Securities Regulation regime and a Canadian Regulatory Authority as well as departmental operating expenditures and employee benefits.

The temporary increase in 2011–12 planned spending is mainly due to compensation to provinces and territories of up to $150 million for matters relating to the transition to a Canadian securities regulator provided under the Budget Implementation Act, 2009.

Payments to the Canadian Securities Regulation Regime Transition Office of $5.4 million, $11 million, and $11 million are reflected in the 2009–10 actual expenditures, the 2010–11 forecast, and the 2011–12 planned spending respectively.

Departmental operating expenditures and employee benefits decrease from $70 million in 2011–12 to $61 million in subsequent years due to the expiry of time-limited funding related to various initiatives, including government advertising programs and the 2010 Muskoka G8 Summit.

*Most spending in this program activity relates to transfer payments from the federal government to other levels of government.

Spending in the Transfer and Taxation Payment Programs program activity includes transfer payments to the provinces and territories and transfers to international financial institutions for the purposes of debt relief, and financial and technical assistance to developing countries. In addition, the program activity administers taxation payments to the provinces and territories and to Aboriginal governments.

The increase from actual to forecast and planned spending is mainly due to increased transfer payments for the Canada Health Transfer, the Canada Social Transfer, Fiscal Equalization, and Territorial Formula Financing, which are forecast to grow as legislated until 2013–14. The Canada Health Transfer will grow by 6 per cent annually, and the Canada Social Transfer by 3 per cent annually. Territorial Formula Financing will grow in line with its legislated funding framework, and the Equalization program will grow in line with the economy. Transitional assistance payments to Ontario and British Columbia related to the harmonized value-added tax framework started in 2009–10 and will continue to 2011–12.

Spending in the Treasury and Financial Affairs program activity includes loans to Crown corporations, interest and other costs related to the public debt, and expenditures related to domestic coinage.

In Budget 2007 the government announced that the domestic borrowing needs of Farm Credit Canada, the Business Development Bank of Canada, and the Canada Mortgage and Housing Corporation would be met through direct lending beginning April 1, 2008. Actual expenditures reflect loans to these organizations of $133.9 billion and $116.4 billion in 2008–09 and 2009–10 respectively. There is no forecast and planned spending for 2010–11 and subsequent years for direct lending to these Crown corporations.

Interest and other costs related to the public debt vary depending on changes to debt levels and interest rates. Actual expenditures reflect public debt costs of $29.9 billion and $27.0 billion in 2008–09 and 2009–10 respectively. Forecast spending includes an amount of $28.4 billion in 2010–11 and $30.3 billion in 2011–12.

Costs for the production and distribution of domestic coinage vary based on metal composition, production volumes and distribution. Actual expenditures reflect costs of $126 million and $133 million in 2008–09 and 2009–10 respectively. Forecast spending includes an amount of $140 million in 2010–11 and $130 million in 2011–12.

The Internal Services program activity involves a group of related activities and resources that support program activities and other corporate obligations of the Department.

Spending for the Internal Services program activity mostly includes operating expenditures and employee benefits. The increase in forecast spending and the subsequent decrease in planned spending are mainly due to time-limited funding of various initiatives.

Estimates by Vote

For information on the Department of Finance Canada's organizational votes and statutory expenditures, please see the 2011–12 Main Estimates publication. An electronic version of the Main Estimates is available at http://www.tbs-sct.gc.ca/est-pre/2011-2012/me-bpd/info/info-eng.asp.

Section II: Analysis of Program Activities by Strategic Outcome

Strategic Outcome

The Department of Finance Canada provides effective economic leadership with a clear focus on one strategic outcome, which all program activities support.

This section presents the Department's four program activities, their expected results and performance indicators, and the financial and non-financial resources that will be dedicated to each. This section also identifies how the Department plans to meet the expected results.

Program Activity 1.1: Economic and Fiscal Policy Framework

| Human Resources (FTEs) and Planned Spending ($ thousands) | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 517 | 231,374.0 | 510 | 61,272.0 | 510 | 61,074.0 |

| Program Activity Expected Results | Performance Indicators | Targets |

|---|---|---|

| An economic, social and fiscal framework that supports financial stability, sustainable growth, productivity, competitiveness and economic prosperity | Debt-to-GDP ratio | No target. The goal is to compare favourably with G7 counterparts. |

| Competitiveness and efficiency of Canada’s tax system | No target. The goal is to continue to propose changes to the tax system that improve incentives to work, save and invest. | |

| Stability of financial services sector | No target. The long-term goal is to contribute to low and stable interest rates. |

Description Summary

This program activity is the primary source of advice and recommendations to the Minister of Finance in exercising his portfolio responsibilities and regarding issues, policies and programs of the Government of Canada related to the areas of economic and social policy, federal-provincial fiscal relations, financial affairs, tax matters, and international trade and finance. The work conducted by this program activity involves extensive research, analysis, and consultation and collaboration with partners in both the public and private sectors to develop a sound and sustainable fiscal and economic framework. It also involves advice and support to the Minister of Finance in exercising his portfolio responsibilities. In addition, it involves the negotiation of agreements and drafting of legislation.

Planning Highlights

Supporting sound economic growth and fiscal management

In 2011–12 the Department of Finance Canada will continue to ensure the effective management of the fiscal framework and will implement the government's plan to bring the budget back to balance over the medium term. This effort includes continuing the systematic review of the government's corporate assets, including enterprise Crown corporations, real property and other holdings. The Department will also continue to identify additional savings following the comprehensive review of government administrative functions and overhead costs.

The Department will continue to work with other departments on the reporting and assessment of Canada's Economic Action Plan.

Improving tax competitiveness, efficiency and fairness

Over the planning period, the Department of Finance Canada will continue to play a central role in supporting the government’s initiatives to ensure a competitive, efficient and fair tax system. This effort will include exploring options for the taxation of corporate groups and continuing to analyze the international tax system to identify opportunities for improving its fairness and competitiveness. The Department will also provide support to the Expert Panel undertaking a review of all federal support for research and development, including the Scientific Research and Experimental Development Tax Incentive Program.

To maintain the integrity of the tax system, the Department will ensure that the government can proceed with the implementation of anti-avoidance measures announced in Budget 2010. It will also negotiate international tax treaties and tax information exchange agreements to combat tax avoidance and tax evasion. In addition, it will address the backlog of outstanding legislation.

The Department will also support the government in ensuring the appropriateness and integrity of the various benefits and tax assistance provided to individuals through the Income Tax Act, including support for retirement and other savings, families, caregivers, charities, education, and savings and entrepreneurship.

Supporting the government’s economic agenda

In the planning period, the Department of Finance Canada will work toward the implementation of the government’s economic agenda in several economic sectors, including manufacturing, agriculture, fisheries, and forestry, as well as in the areas of energy and the environment, innovation, regional economic development, infrastructure, and defence and public safety.

In addition, the Department will fulfill its central agency role by identifying and analyzing major policy issues and proposals under development in the economic departments, as well as by providing policy advice to the Minister about the financial implications and relevance of proposals to the government’s microeconomic policies. The Department will also continue to oversee Crown corporations under the Minister’s responsibility, including PPP Canada Inc.

Ensuring accessibility, sustainability and effectiveness of federal transfers and social programs

The Department of Finance Canada will manage current and emerging issues related to social policy and major transfer programs to ensure that federal transfers and social programs remain accessible, sustainable and effective for Canadians. Also, in support of the Minister of Finance’s commitment to his provincial and territorial counterparts at their June 2010 meeting in Prince Edward Island, the Department will continue to engage with provincial and territorial officials in preparation for the renewal of major transfers in 2014–15.

Supporting a sound social policy framework

In collaboration with other departments and central agencies, the Department of Finance Canada will continue to work to develop policy proposals that are consistent with, and deliver on, the government’s priorities in areas such as justice and public safety, labour markets, income security and aboriginal issues.

The Department will continue to work with provinces and territories to strengthen the retirement income system. Specifically, the Department will work with provincial and territorial officials to implement Pooled Registered Pension Plans (PRPPs), taking into account the perspectives of employers, employees and those that may offer PRPPs, in developing legislation to implement these plans. The Department will also develop modifications to the tax rules to accommodate PRPPs, with the objective of ensuring that such plans fit within the basic system of rules and limits for Registered Pension Plans and Registered Retirement Savings Plans. In addition, the Department will review the report of the Task Force on Financial Literacy, which will be released in early 2011, and will work collaboratively with the provinces and territories to respond to the recommendations in the report. Finally, the Department will continue to work on options and considerations for a modest, fully funded and phased-in expansion of the Canada Pension Plan.

Improving efficiency and effectiveness of the financial system

To address issues regarding the competitiveness and efficiency of the Canadian financial system and the effectiveness of financial sector regulatory initiatives, the Department of Finance Canada will continue to assess Canada’s financial framework against key internationally recognized standards to ensure that the Canadian financial sector policy framework fosters confidence and supports stable, efficient and competitive financial services delivery. The Department will continue working toward the establishment of a Canadian securities regulator, strengthening the assessment of systemic risk vulnerabilities and evaluating the resolution framework for large financial institutions.

To refine the existing financial sector frameworks, the Department will continue to work on updating the financial institutions statutes, developing options for an effective national strategy on financial literacy and developing an effective and efficient payment system as well as an effective anti-money laundering policy and laws. The Department will continue to be involved in a partnership with several organizations in Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime, to detect and deter money laundering and financing of terrorist activities.

The Department will also continue to ensure access to financing for individuals and businesses in Canada by monitoring credit conditions, developing a covered bond legislative framework, and formulating an action plan for securitization market reform.

The Department will continue to support work relating to the Financial Action Task Force, the Financial Stability Board, and G7/G8, G10, G20 and other international meetings. It will also continue to lead the negotiation of financial services elements in trade agreements and will advance bilateral relationships.

Supporting global finance and trade environment

In the wake of the global financial crisis and ensuing recession, in 2011–12 the Department of Finance Canada will continue to provide high-quality advice and leadership in international efforts to develop a global framework for strong, sustainable and balanced growth and to help prevent future crises from occurring.

The Department will deliver advice to support Canada’s engagement on international economic cooperation matters in the G7 and G20 and the International Monetary Fund. The Department will also advance innovative financing tools in the international community that balance fiscal restraint with Canada’s support for global development goals.

The Department will continue to work to further liberalize international markets through the conclusion of the World Trade Organization Doha Round of Multilateral Trade Negotiations, and regional and bilateral trade agreements. The Department will also continue to support the competitiveness of Canadian manufacturers with appropriate tariff and customs policies.

Contributing to the Federal Sustainable Development Strategy

Contributing to the Federal Sustainable Development Strategy

A number of tax policies for which the Department of Finance Canada is responsible contribute to the Federal Sustainable Development Strategy. The Strategy's theme of Addressing Climate Change and Air Quality is supported by the accelerated capital allowance for clean energy generation equipment, the Green Levy on certain fuel-inefficient passenger vehicles, and the Public Transit Tax Credit. In addition, the Ecological Gift Program supports the theme of Protecting Nature.

Further details relating to the activities of the Department that support the Federal Sustainable Development Strategy are available on the Department's website.[6]

Benefits for Canadians

Through sound fiscal management, the government ensures that Canada’s social infrastructure is sustainable over the long term. Returning to balanced budgets will allow the government to invest in areas that are vital to Canada’s long-term growth and to ensure fairness and equity toward future generations by avoiding future tax increases or reductions in government services in the context of an aging population.

The effective design of transfer payment programs providing support for the provinces and territories, and improvements to the social policy framework, contribute to improved public services for Canadians; support the quality of life in Canada's communities; help ensure accessible and quality health care, education, and social safety net programs; and promote equality of opportunity for all citizens.

A sound, efficient and competitive Canadian financial sector will support the savings and investment needs of Canadians.

Canadian leadership and influence on international economic, financial, development, and trade issues contribute to increased financial and economic stability.

Program Activity 1.2: Transfer and Taxation Payment Programs

| Human Resources (FTE) and Planned Spending ($ thousands) | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs* | Planned Spending | FTEs* | Planned Spending | FTEs* | Planned Spending |

| — | 55,002,295.4 | — | 55,720,453.7 | — | 58,476,184.7 |

*Only transfer payments are reflected in this program activity.

| Program Activity Expected Results | Performance Indicators | Targets |

|---|---|---|

| Design and administration of the provision of payments to Canadian provinces and territories in support of providing their residents with public services, and to international organizations to help promote the economic advancement of developing countries | Regulations amended to reflect changes made to the Equalization program in Budget legislation | According to statutory requirements, or as determined by environment |

| Timely provision of information for Government of Canada reports | No target, as materials are generated on an as-needed basis according to environment | |

| Percentage of reporting requirements met, including reporting to Parliament, the Office of the Auditor General of Canada, internal auditors, the International Monetary Fund and the Organisation for Economic Co-operation and Development, etc. | 100% of requests fulfilled on time and in an accurate manner |

Description Summary

This program activity administers transfer and taxation payments to provinces and territories, and taxation payments to Aboriginal governments. In accordance with legislation and negotiated agreements, the Department of Finance Canada provides fiscal equalization and support for health and social programs and other shared national priorities. The program activity also covers commitments and agreements with international financial institutions aimed at aiding the economic advancement of developing countries.

Planning Highlights

Fiscal arrangements with provinces and territories

In the context of changing demographics and ongoing uncertainty surrounding the global and domestic economic outlooks, it is important that federal transfers and social programs remain accessible, sustainable and effective for Canadians.

The Department of Finance Canada commits to continue to provide timely, accurate and transparent administration of major transfer programs. It will also provide effective management of transfer programs, including the calculation of entitlements based on formulas established in legislation and regulations, the provision of payments, the provision of information to provincial and territorial officials, including auditors, and the provision of information for Government reports and to federal auditors.

The Department will continue to update legislation and regulations where required, and to enhance the transparency of the federal transfer system.

Improving tax agreements with provinces, territories and Aboriginal governments

The Department of Finance Canada will continue to administer its tax agreements with provinces and territories to ensure accurate and timely information, including the calculation of tax payments.

To support self-government, the Department will also participate in negotiations with Aboriginal governments for new Tax Administration Agreements and will work with provinces and territories to facilitate similar arrangements between them and Indian bands.

Supporting international development

At the international level, Canada will continue to exert international influence in supporting multilateral development banks in fulfilling their renewed mandates, and will ensure that transfer payments to international organizations are processed appropriately and in a timely manner.

Toronto waterfront renewal

In 2011–12, the Department of Finance Canada will continue to be responsible for leading federal participation in the Toronto Waterfront Revitalization Initiative (TWRI), including managing the associated TWRI funding.

Federal participation in the TWRI has been extended by three years to 2013–14 to allow for the completion of the remaining federally funded projects prior to the end of 2011–12, and for the administrative windup of the program by the federal TWRI Secretariat, no later than March 31, 2014.

Benefits for Canadians

The transfer payment programs administered by the Department of Finance Canada provide significant financial support to provincial and territorial governments on an ongoing basis to assist them in the provision of important programs and services.

Agreements with provinces, territories and Aboriginal governments regarding tax payments allow the government to streamline service and reduce compliance and administrative costs for taxpayers by having common forms and a single tax administrator. Tax Administration Agreements with Aboriginal governments also allow the federal government to support self-government by vacating and sharing a negotiated portion of its goods and services tax and personal income tax room with Aboriginal governments and to administer Aboriginal tax regimes.

Sustainable urban development and infrastructure renewal in the Toronto waterfront area create and enhance employment and cultural opportunities for Canadians, and provide positive economic spinoffs while improving the existing environmental conditions.

Program Activity 1.3: Treasury and Financial Affairs

| Human Resources (FTEs) and Planned Spending ($ Thousands) | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 25 | 30,381,000.0 | 25 | 33,151,000.0 | 25 | 34,154,000.0 |

| Program Activity Expected Results | Performance Indicators | Targets |

|---|---|---|

| Prudent and cost-effective management of the government’s treasury activities and financial affairs | Achievement of operational and strategic objectives | 100% of program line targets achieved |

| Control of financial and operational risks | Risk events do not disrupt program operations |

Description Summary

This program activity provides direction for Canada's debt management activities, including the funding of interest costs for the debt and service costs for new borrowing. In addition, it manages investments in financial assets needed to establish a prudent liquidity position. This program activity supports the ongoing refinancing of government debt coming to maturity, the execution of the budget plan, and other financial operations of the government, including governance of the borrowing activities of major government-backed entities, such as Crown corporations. This program activity is also responsible for the system of circulating Canadian currency (bank notes and coins) to meet the needs of the economy.

Planning Highlights

Supporting the management of treasury and financial affairs

In the 2011–12 planning period, the Department of Finance Canada will take action to ensure sufficient funding for government debt management operations while providing appropriate flexibility to adapt to changing circumstances, and ensure timely, cost-effective and well-managed funding for Crown corporations.

The Department will ensure effective cost of borrowing for Crown corporations, perform analysis and provide advice to the Minister on the medium-term debt strategy and on the prudential liquidity position of the Government of Canada. The Department will also provide advice on governance arrangements for Crown corporations and on the scope of their activities.

In the area of circulating currency, the Department will support the introduction of new bank notes by the Bank of Canada. The Department will also review and amend its Memorandum of Understanding with the Royal Canadian Mint and will support measures to reduce the cost of coinage.

In conjunction with the Bank of Canada, the Department will continue to oversee the implementation of the Debt Strategy plan announced in Budget 2010 and to manage the Retail Debt Program to support key activities and reduce administrative costs.Benefits for Canadians

Through its work in managing treasury and financial affairs, the Department of Finance Canada contributes to the Government of Canada's effective debt and other cost management on behalf of Canadians.

An effective system of circulating coinage also ensures efficient trade and commerce across Canada.

Program Activity 1.4: Internal Services

| Human Resources (FTEs) and Planned Spending ($ millions) | |||||

|---|---|---|---|---|---|

| 2011–12 | 2012–13 | 2013–14 | |||

| FTEs | Planned Spending | FTEs | Planned Spending | FTEs | Planned Spending |

| 245 | 42,731.0 | 245 | 42,535.0 | 245 | 42,533.0 |

*Measures within this program activity contribute to the Federal Sustainable Development Strategy. For further details, please see http://www.fin.gc.ca/purl/susdev-eng.asp.

Description Summary

This program activity enables the Department of Finance Canada to deliver its management agenda through related activities and resources that support the needs of departmental programs and the organization's corporate obligations. These activities are legal services, public affairs and communications, internal audit and evaluation, and corporate services, which include human resources, financial management, procurement, facilities and asset management, and information management and information technology services.

Planning Highlights

The Department of Finance Canada faces several challenges over the planning period given the significant workload associated with bringing the Budget back to balance and completing the implementation of Canada's Economic Action Plan, as well as effectively managing restraint measures and implementing the recommendations from the review of government administrative functions and overhead costs.

Refining the planning process, management of risks and performance measurement

The government's requirements to continue to improve the integration of business and human resources planning, and considerations of fiscal restraint, will require further refinements of the Department's integrated planning process to ensure that available financial and human resources are deployed to the highest-priority areas. As well, continued government focus on management, accountability and results will require enhanced performance measurement and risk management activities to support effective departmental performance and reporting.

The main objective of the communication strategy contained in the Department's Corporate Risk Profile will be to develop a common understanding of the Department's risk management approach across the organization to ensure that existing and emerging risks are identified and managed within acceptable risk tolerances.

Also, the Department will refine its performance measurement framework to ensure appropriate, accurate, evidence-based and balanced portrayals of departmental performance.

Supporting departmental initiatives

Legal officers will continue to offer quality advisory, drafting, and litigation services in support of departmental initiatives and business priorities. It is expected that particular attention will be focused on matters such as the establishment of the proposed Canadian securities regulator and on the implementation and ongoing administration of various tax policy initiatives, including comprehensive and integrated tax coordination agreements, tax collection agreements, budgets and other measures.

Moreover, the Department of Finance Canada will continue to advance initiatives undertaken in previous years, including the following:

- Developing and implementing a Code of Conduct for the Department that is consistent with the provisions of the Values and Ethics Code for the Public Service, to ensure that departmental employees continue to meet the highest standards of professional ethics and conduct;

- Continuing to administer the Conflict of Interest Code for the Department of Finance and to review mandatory employee submissions;

- Promoting sound management of Access to Information and Privacy requests, including the appropriate handling and protection of personal information and the timely provision of information to Canadians;

- Encouraging innovation, employee development and career aspirations, and the use of both official languages;

- Developing the departmental Evaluation Plan and Risk-Based Audit Plan to support the effective management of the Department;

- Strengthening the integration of departmental business and human resources planning to ensure the optimal deployment of resources to the highest-priority areas;

- Assessing and preparing for implementation of new government-wide policies in financial management;

- Improving the key components of the Departmental Security Program, including the Departmental Business Continuity Planning Program, physical security safeguards, and up-to-date security awareness;

- Ensuring that roles, responsibilities and activities relating to Information Management and Information Technology (IT) are aligned with departmental plans and priorities; and

- Investigating alternative methods of IT service provision to improve service and reduce costs.

Contributing to the Federal Sustainable Development Strategy

Contributing to the Federal Sustainable Development Strategy

The Department of Finance Canada is a participant in the Federal Sustainable Development Strategy. In 2011–12 the Department will contribute to the fourth priority theme area, Shrinking the Environmental Footprint – Beginning with Government, and to other areas related to Greening Government Operations (GGO), through the Internal Services program activity. The Department will contribute to the GGO areas by:

- Integrating environmental considerations into procurement processes and controls;

- Integrating environmental performance into the procurement of information technology, furniture, and other commodities as appropriate;

- Ensuring reuse, recycling, or environmentally sound and secure disposal of surplus materiel;

- Promoting environmentally aware meetings by incorporating environmental considerations into the planning of meetings and events; and

- Monitoring and reporting initiatives such as the reuse and donations of surplus materiel, acquisition cardholder training and green stewardship.

For additional details on the Department's GGO activities, please see the GGO table on the Treasury Board Secretariat of Canada's website.[7]

Benefits for Canadians

The Department of Finance Canada plays an important role in developing and implementing strong and sustainable advice, policies and programs that will make a difference for Canadians. Efficient and effective internal services support the Department's operational and management priorities to ensure that financial and material resources, which Parliament provides to the Department, are used appropriately and that competent personnel are in place to carry out the Department's mandate. To that end, a strong internal audit capacity will help ensure that the Department is well managed to meet the needs of Canadians. A robust integrated planning, risk management and performance framework will better support planning, reporting and decision-making processes that deliver results to Canadians.

Section III: Supplementary Information

Financial Highlights

| Future-Oriented 2011–12 |

Future-Oriented 2010–11 |

|

|---|---|---|

| Expenses | 83,790,881 | 80,724,580 |

| Revenues | 4,205,929 | 4,205,929 |

| Net Cost of Operations | 79,584,952 | 76,518,651 |

Future-Oriented Condensed Statement of Financial Position

The Department of Finance Canada's future-oriented statement of operations for the Year Ended March 31, 2011, can be found on the Department's website.[8]

Supplementary Information Table

All electronic supplementary information tables for the 2011–12 Report on Plans and Priorities can be found on the Treasury Board of Canada Secretariat’s website at http://www.tbs-sct.gc.ca/rpp/st-ts-eng.asp.

- Details on Transfer Payment Programs

- Greening Government Operations

- Horizontal Initiatives

- Upcoming Internal Audits and Evaluations over the next three fiscal years

- Sources of Respendable and Non-Respendable Revenue

Section IV: Other Items of Interest

Sustainable Development

As a participant in the Federal Sustainable Development Strategy, the Department of Finance Canada commits to:

- Providing specific information on departmental sustainable development activities appropriate to the Department’s mandate; and

- Strengthening the application of Strategic Environmental Assessments by ensuring that the government’s environmental goals are taken into account when pursuing social and economic goals.

In addition, the Department has developed its own vision for sustainable development:

Economic and fiscal policy frameworks and decisions that promote equity and enhance the economic, social and environmental well-being of current and future generations

For additional information on the Department’s contribution to the Federal Sustainable Development Strategy and activities that support sustainable development, please see the Department’s website.[9] For complete details on the Strategy, please see Environment Canada’s website.[10]

[1] http://www.fin.gc.ca/purl/susdev-eng.asp

[2] http://www.ec.gc.ca/dd-sd/default.asp?lang=En&n=E19EE696-1

[3] http://www.budget.gc.ca/2010/home-accueil-eng.html

[4] http://www.tbs-sct.gc.ca/est-pre/20112012/p2-eng.asp

[5] In accordance with input received from the Treasury Board of Canada Secretariat, the Treasury and Financial Affairs program activity has been aligned to the "Strong economic growth" outcome area.

[6] http://www.fin.gc.ca/purl/susdev-eng.asp

[7] http://www.tbs-sct.gc.ca/RPP/2011-2012/index-eng.asp

[8] http://www.fin.gc.ca/afc/pp-pr-eng.asp

[9] http://www.fin.gc.ca/purl/susdev-eng.asp

[10] http://www.ec.gc.ca/dd-sd/default.asp?lang=En&n=E19EE696-1