Common menu bar links

Breadcrumb Trail

ARCHIVED - Agriculture and Agri-Food Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Minister's Message

With deep roots in our history and heritage, Canada's agriculture industry has evolved into a modern, dynamic, export-oriented sector that excels in a highly competitive environment.

Canada's agriculture industry is a powerful engine for economic growth. Our innovative, competitive farmers and food processors drive a value supply chain that last year generated $154 billion in domestic food and beverage consumer sales, exported $35 billion in agriculture and food products, and employed more than 2 million Canadians, while contributing 8% to our GDP.

Long term, the outlook for Canada's agriculture sector is bright, with a growing world population and increasing demand for high-quality products. Blessed with an abundance of natural resources and a keen business sense, the Canadian agriculture industry is well positioned to thrive in this new dynamic global marketplace.

To get there, our Government remains focused on driving sustainable opportunities with targeted, strategic investments under Canada's Economic Action Plan. By investing in innovation through programs that encourage adaptability, competitiveness, and deliver real results to the farm gate, we are making the entire value chain stronger for the long term. A stronger industry will, in turn, entice younger farmers to get established, develop capacity and skills and become even more entrepreneurial leaders.

Together with industry, we continue to reinvigorate our trade opportunities and secure new market access. While defending Canada's system of supply management, we are aggressively pursuing bilateral and multilateral free trade agreements to make sure Canadian farmers have a level playing field in global markets.

Here at home, Canadian farmers are benefiting from flexible, proactive programs under the Growing Forward agriculture policy framework. These investments are helping farmers remain competitive and increase their profitability while managing their business risks. We are now sitting down with industry to shape a new policy framework for agriculture by 2013, when the current suite of programs concludes.

Agriculture and Agri-Food Canada and the entire Portfolio remain committed to helping farmers deal with immediate pressures of today, while capturing the exciting opportunities of tomorrow. I know that by continuing to work together we can make a difference for our farmers, rural communities and all Canadians.

The Honourable Gerry Ritz

Minister of Agriculture and Agri-Food and

Minister for the Canadian Wheat Board

Section I - Departmental Overview

Raison d'être

The Department of Agriculture and Agri-Food Canada (AAFC) was created in 1868 — one year after Confederation — because of the importance of agriculture to the economic, social and cultural development of Canada. Today, the Department helps ensure the agriculture, agri-food and agri-based products industries can compete in domestic and international markets, deriving economic returns to the sector and the Canadian economy as a whole. Through its work, the Department strives to help the sector maximize its long-term profitability and competitiveness, while respecting the environment and the safety and security of Canada’s food supply.

Responsibilities

AAFC provides information, research and technology, and policies and programs to help Canada's agriculture, agri-food and agri-based products sector increase its environmental sustainability, compete in markets at home and abroad, manage risk, and embrace innovation. The activities of the Department extend from the farmer to the consumer, from the farm to global markets, through all phases of producing, processing and marketing of agriculture and agri-food products. In this regard, and in recognition that agriculture is a shared jurisdiction, AAFC works closely with provincial and territorial governments.

AAFC's mandate is based upon the Department of Agriculture and Agri-Food Act. The Minister is also responsible for the administration of several other Acts, such as the Canadian Agricultural Loans Act.

The Department is responsible for ensuring collaboration among the organizations within the Agriculture and Agri-Food Portfolio; this means coherent policy and program development and effective cooperation in meeting challenges on cross-portfolio issues. The other portfolio organizations include: the Canadian Dairy Commission; the Canadian Food Inspection Agency; the Canadian Grain Commission; Farm Credit Canada; Canada Agricultural Review Tribunal; and the Farm Products Council of Canada. AAFC also includes the Canadian Pari-Mutuel Agency, a special operating agency that regulates and supervises pari-mutuel betting on horse racing at racetracks across Canada.

AAFC provides the overall leadership and coordination on federal rural policies and programs through Canada's Rural Partnership, and supports co-operatives to promote economic growth and social development of Canadian society. Through the Rural and Co-operatives Development program activity, AAFC coordinates the Government's policies towards the goal of economic and social development and renewal of rural Canada. This program activity also facilitates the development of co-operatives which help Canadians and communities capture economic opportunities.

The Department also supports the Minister in his role as Minister for the Canadian Wheat Board.

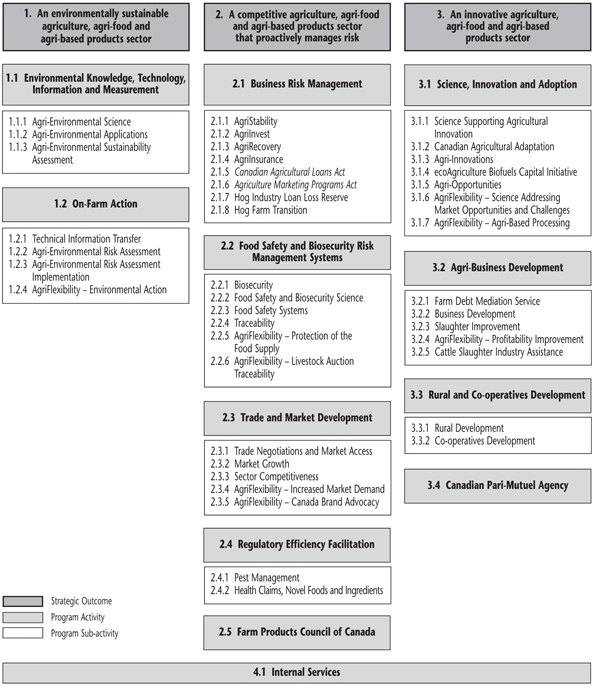

Strategic Outcomes and Program Activity Architecture

Strategic Outcomes

To effectively pursue its mandate and make a difference to Canadians, AAFC’s policies and programs are designed to achieve the following three Strategic Outcomes (SO):

-

SO 1 - An environmentally sustainable agriculture, agri-food and agri-based products sector

AAFC supports an economically and environmentally sustainable agriculture, agri-food and agri-based products sector that ensures proper management of available natural resources and adaptability to changing environmental conditions. Addressing key environmental challenges in Canada, including agriculture's impact on water quality and water use, adaptation to the impact of climate change, mitigation of agriculture's greenhouse gas emissions and the exploration of new economic opportunities, will contribute to a cleaner environment and healthier living conditions for the Canadian public, while enabling the sector to become more profitable.

-

SO 2 - A competitive agriculture, agri-food and agri-based products sector that proactively manages risk

Canada’s capacity to produce, process and distribute safe, healthy, high-quality and viable agriculture, agri-food and agri-based products is dependent on its ability to proactively manage and minimize risks and to expand domestic and global markets for the sector by meeting and exceeding consumer demands and expectations. Proactive risk management to ensure food safety, market development and responsiveness, and improved regulatory processes contribute directly to the economic stability and prosperity of Canadian farmers and provide greater security for the Canadian public regarding the sector.

-

SO 3 - An innovative agriculture, agri-food and agri-based products sector

Sector innovation includes the development and commercialization of value-added agricultural-based products, knowledge-based production systems, processes and technologies, and equipping the sector with improved business and management skills and strategies to capture opportunities and to manage change. Such innovation is vital for ongoing growth and improvement in the productivity, profitability, competitiveness, and sustainability of Canada's agriculture, agri-food and agri-based products sector and its rural communities.

Program Activity Architecture

The graphic below displays AAFC's Program Activities and Program Sub-Activities that comprise its Program Activity Architecture (PAA). This PAA reflects how the Department allocates and manages its resources and makes progress toward its Strategic Outcomes.

Planning Summary

The following table provides a summary of total planned spending for AAFC over the next three fiscal years. For an explanation of the annual variation in spending displayed in this table, please refer to the discussion of the departmental spending trend in the Expenditure Profile subsection.

| 2011-12 | 2012-13 | 2013-14 |

|---|---|---|

| 3,099.0 | 1,989.9 | 1,508.2 |

The following table provides a summary of total planned human resources for AAFC over the next three fiscal years, which is based on the Department's existing workforce.

| 2011-12 | 2012-13 | 2013-14 |

|---|---|---|

| 6,223 | 6,212 | 6,201 |

Planning Summary Tables

The following tables present: a summary of performance indicators and targets by Strategic Outcome; forecasted spending for 2010-11 by program activity; and planned spending over the next three fiscal years by program activity.

($ millions - Net)

| Performance Indicators | Targets |

|---|---|

| * The indices listed measure agri-environmental progress in each of the four key areas of soil, water, air, and biodiversity. The scale for these indices is: 0-20 = Unacceptable; 21-40 = Poor; 41-60 = Average; 61-80 = Good; and 81-100 = Desired. A target of 81-100, with a stable or improving trend, represents the desired value for the sector’s performance. | |

| Soil Quality Agri-Environmental Index* | 81 by Mar 31, 2030 |

| Water Quality Agri-Environmental Index* | 81 by Mar 31, 2030 |

| Air Quality Agri-Environmental Index* | 81 by Mar 31, 2030 |

| Biodiversity Quality Agri-Environmental Index* Note: Biodiversity Quality Agri-Environmental Index based on a single Agri-Environmental Indicator (Wildlife Habitat Capacity Change on Farmland) |

81 by Mar 31, 2030 |

| Program Activity | Forecast Spending 2010-112 |

Planned Spending3 | Alignment to Government of Canada Outcomes |

||

|---|---|---|---|---|---|

| 2011-12 | 2012-13 | 2013-14 | |||

| Environmental Knowledge, Technology, Information and Measurement | 62.7 | 59.8 | 56.2 | 28.5 | A Clean and Healthy Environment |

| On-Farm Action | 156.1 | 156.8 | 134.8 | 59.0 | |

| Total for SO 1 | 218.8 | 216.6 | 191.0 | 87.5 | |

($ millions - Net)

| Performance Indicators | Targets |

|---|---|

| Percentage increase in Gross Domestic Product (GDP) in constant dollars (2002) for the agriculture and agri-food sector (consisting of primary agriculture and food, beverage and tobacco processing, including seafood processing) |

10% increase by Mar 31, 2013 from the 2009 baseline |

| Program Activity | Forecast Spending 2010-112 |

Planned Spending3 | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2011-12 | 2012-13 | 2013-14 | |||

| Business Risk Management | 2,318.5 | 1,899.2 | 878.6 | 879.2 | Strong Economic Growth |

| Food Safety and Biosecurity Risk Management Systems | 158.2 | 101.2 | 87.0 | 20.5 | |

| Trade and Market Development | 126.0 | 139.1 | 114.9 | 60.9 | |

| Regulatory Efficiency Facilitation | 26.9 | 35.9 | 36.0 | 12.8 | |

| Farm Products Council of Canada | 2.9 | 2.7 | 2.7 | 2.8 | |

| Total for SO 2 | 2,632.4 | 2,178.1 | 1,119.3 | 976.2 | |

($ millions - Net)

| Performance Indicators | Targets |

|---|---|

| Increase in the development of food and other agriculture-derived products and services as measured by the percentage increase in total Research and Development (R&D) expenditures by business enterprises in food manufacturing | 10% increase by Mar 31, 2014 from the 2009 baseline |

| Increase in the development of food and other agriculture-derived products and services as measured by the percentage increase of revenues from bioproducts | 10% increase by Mar 31, 2014 from the 2006 baseline |

| Program Activity | Forecast Spending 2010-112 |

Planned Spending3 | Alignment to Government of Canada Outcomes | ||

|---|---|---|---|---|---|

| 2011-12 | 2012-13 | 2013-14 | |||

| Science, Innovation and Adoption | 390.1 | 285.4 | 304.4 | 159.8 | An Innovative and Knowledge-Based Economy |

| Agri-Business Development | 107.1 | 87.9 | 51.3 | 7.8 | |

| Rural and Co-operatives Development | 25.4 | 25.0 | 20.2 | 5.2 | |

| Canadian Pari-Mutuel Agency | 0.4 | 0.0 | (0.1) | (0.0) | A Fair and Secure Marketplace |

| Total for SO 3 | 522.9 | 398.3 | 375.8 | 172.8 | |

($ millions - Net)

| Program Activity | Forecast Spending 2010-112 |

Planned Spending3 | ||

|---|---|---|---|---|

| 2011-12 | 2012-13 | 2013-14 | ||

| Internal Services | 333.3 | 306.0 | 303.8 | 271.7 |

($ millions - Net)

| Forecast Spending 2010-112 |

Planned Spending3 | |||

|---|---|---|---|---|

| 2011-12 | 2012-13 | 2013-14 | ||

| Total Departmental Spending | 3,707.4 | 3,099.0 | 1,989.9 | 1,508.2 |

1The FTEs do not include students or staff funded through respendable revenue sources. For example, in 2010-11, there were 33 FTEs employed by AAFC funded by respendable revenue sources from collaborative research projects with industry, and other activities not funded through AAFC appropriations. Also, 480 FTEs were employed as students.

2Forecast spending 2010-11 reflects the authorized funding levels to the end of the fiscal year 2010-11 (not necessarily forecast expenditures).

3Planned spending reflects funds already brought into the Department's reference levels as well as amounts to be authorized through the Estimates process (for the 2011-12 through to 2013-14 planning years) as presented in the Annual Reference Level Update. It also includes adjustments in future years for funding approved in the government fiscal plan, but yet to be brought into the Department's reference levels. Planned spending has not been adjusted to include new information contained in Budget 2011. More information will be provided in the 2011-12 Supplementary Estimates.

For an explanation of the annual variation in planned spending displayed in the above table, please refer to the discussion of the departmental spending trend in the Expenditure Profile subsection.

The figures in the above tables have been rounded. Figures that cannot be listed in millions of dollars are shown as 0.0. Due to rounding, figures may not add to the totals shown.

Contribution of Priorities to Strategic Outcomes

Driven by innovation, today’s agriculture and agri-food sector is an important engine for economic growth in Canada. While primary agriculture remains a significant part of the agri-food system, food processing is a growing contributor in most provinces.

Through work on its priorities, AAFC supports the competitiveness and profitability of the sector. In 2008, federal, provincial and territorial (FPT) governments launched the Growing Forward policy framework to foster an innovative and competitive sector that can proactively manage its risks. Growing Forward included investments in key areas including science and innovation, food safety systems, business and skills development, and risk management programming.

In 2010-11, AAFC will continue delivering Growing Forward programs and initiatives in partnership with the provinces and territories. Growing Forward is the cornerstone of the FPT relationship for agriculture and agri-food and ensures that governments work collaboratively to address the challenges and opportunities facing the sector.

The current framework is scheduled to expire in March 2013. FPT governments are now developing a successor policy framework to position the industry to meet the challenges in the decade ahead. The development of the next policy framework will take into account, among other things, the results of planned evaluations of existing programming where applicable.

Ongoing AAFC priorities complement efforts on Growing Forward and contribute to the competitiveness in the sector. The Department coordinates initiatives between governments and stakeholders on an ambitious trade agenda, targeting priority markets and conducting promotional activities in key markets. Furthermore, the Department is implementing its science and innovation agenda, as well as leading and participating in scientific discovery, research and knowledge transfer to support innovative products and processes that will improve the competitiveness and profitability of the sector. This will be enhanced by the modernization of the federal regulatory framework on food safety through AAFC's collaboration with Health Canada and the Canadian Food Inspection Agency (CFIA). The Department also recognizes that young farmers represent the future of the sector and is helping develop tools and resources so these producers can be viable and competitive over the long term.

Additionally, the Clerk of the Privy Council asked the Deputy Minister to oversee the implementation of the 57 recommendations of the Report of the Independent Investigator into the 2008 Listeriosis Outbreak (the Weatherill Report). To maintain independence, the Deputy reports directly to the Clerk, and his oversight and coordination role entails accountability outside of his portfolio responsibilities. AAFC will continue to provide secretariat support to the Deputy Minister in his role as chair of the special committee of Deputy Heads responsible for CFIA, Health Canada and Public Health Agency of Canada (the Food Safety Review Special Committee of Deputy Heads). The committee is overseeing actions by federal food safety partners that will harmonize roles, improve communication and the sharing of information, and enhance the ways the organizations work together to deliver their food safety mandates. This action is in support of federal efforts to improve Canada's food safety system, which includes an investment of $75 million in funding to CFIA, Health Canada and the Public Health Agency of Canada to strengthen Canada’s ability to prevent, detect and respond to future food-borne illness outbreaks. In 2011-12, the secretariat will continue to ensure horizontal coordination; influence the direction, scope and speed of implementation through its monitoring activities; ensure regular reporting to Canadians, and engage industry representatives in a dialogue aimed at further improving Canada's ability to prevent, detect, and respond to future food-borne illness outbreaks.

AAFC remains committed to management excellence in delivering its policies and programs to achieve the best results for the agriculture and agri-food sector and all Canadians. Of particular importance is enhancing the delivery of programs and services and strengthening human resources capacity. Additional information on these and other departmental priorities is provided in the following table.

| Operational Priorities |

Type | Links to Strategic Outcomes |

Description |

|---|---|---|---|

|

Enable and enhance science and innovation |

Ongoing |

SO 1 |

Science generates knowledge that drives innovation in the agriculture, agri-food and agri-based products sector to enhance competitiveness and sustain profitability. Knowledge generation and its resulting innovation and commercialization in the agriculture, agri-food and agri-products sector require a blend of scientific disciplines that are seldom available in one organization. Creating a strong culture of partnerships between public and private stakeholders, both within Canada and internationally, is necessary to strengthen and build capabilities and capacities for the benefit of the sector. Management tools for science including an HR plan, a collaboration framework, an investment framework, an enhanced performance management framework for science, and input into the Department's plan for the management of capital assets were implemented in 2010-11. In 2011-12 AAFC will continue to monitor and update these tools needed to support the effective management of science. Improvements will also be made to strengthen the research project selection process for AAFC-funded research, to ensure that key results and activities under AAFC science priorities are better communicated throughout the Department, and that documentation and tools for assessing research proposals are updated and enhanced to ensure transparency in decision-making. |

|

Enhance trade and market interests |

Ongoing |

SO 2 |

As the fourth largest exporter of agriculture and agri-food products in the world, trade is very important to the profitability of Canada's agriculture sector. Increasing the competitiveness of this sector results in increased exports, which translates in strong employment opportunities for Canadians in agriculture and food industries. AAFC will coordinate government initiatives with producers and industry to aggressively and strategically go after priority markets to keep pace with international competitors. The Department will do this work through bilateral and regional trade negotiations, international standard setting bodies, advocacy efforts with key trading partners, resolution of market access issues, high-level missions and trade dispute/trade remedy actions, including the promotion of science-based rules. |

|

Develop the successor policy framework to Growing Forward |

New |

SO 1 |

The new framework will govern the Government of Canada's policies and programs in the agricultural sector. It is necessary to help ensure that enterprises in the industry, notably farms, be competitive and profitable in markets over the long term and capable of adapting to changing circumstances and maintaining sustainable productive capacity. As part of developing the successor policy framework, in 2011-12, FPT governments will place increasing focus on engagement sessions with agricultural stakeholders aimed at helping ensure the sector's long-term success. AAFC and provincial and territorial partners will continue consultations begun in 2010-11 with a wide range of stakeholders on developing policies and programs to help ensure the sector can meet challenges and take advantage of opportunities. Stakeholders include: industry associations and grass roots producers, with special emphasis on young producers; and their associations, processing, retail and food service industries; consumers; and experts from academia and think tanks. |

| Enable and enhance the sector’s environmental performance | Ongoing | SO 1 |

AAFC continues to contribute to a cleaner and healthier environment for all Canadians by helping the agricultural sector minimize its impact on the environment. Drawing on a solid foundation of past efforts, the Department's approach to key agri-environmental challenges will be twofold:

|

| Management Priorities |

Type | Links to Strategic Outcomes |

Description |

|

Foster Public Service Renewal |

Ongoing |

SO 1 |

Public Service Renewal is an ongoing, overarching strategy aimed at equipping public servants to better serve the Canadian public, using new tools and approaches but fulfilling the same mission of excellence in service to Canadians. The government-wide commitment to Public Service Renewal is set out in the 2010-11 Public Service Renewal Action Plan. AAFC shares this commitment and will continue to improve people management through: enhanced integrated planning; improvements to talent management of the executive group; building a strong middle management community and network; continuing to create new opportunities for employee development and knowledge-sharing across the Department; and initiatives to promote workplace wellness. |

|

Enhance the management and delivery of programs and services |

Ongoing |

SO 1 |

AAFC's highly complex programs and broad range of clients require a dedicated, comprehensive and sustained effort to reach and maintain a high standard of program delivery in support of a profitable and sustainable agriculture and agri-food sector. AAFC will continue to refine its organization-wide approach to service management and delivery as follows:

|

AAFC’s three-year Integrated Human Resources Plan is a key component of the Department’s integrated planning approach, taking into account existing elements of the business planning process and corporate accountabilities for business delivery. The Plan supports departmental Strategic Outcomes and the priorities described above, by identifying key human resources issues facing the Department over the next three years and setting out the strategies to address them. During this final year of the three-year plan, a new 2012-16 Integrated Human Resources Plan will be developed based on emerging or changing business and HR priorities.

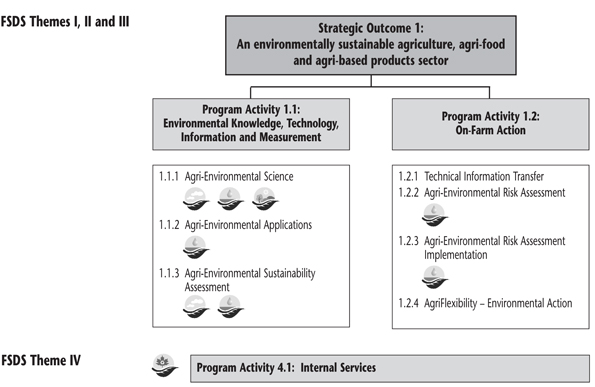

Contribution to the Federal Sustainable Development Strategy

AAFC is a participant in the Federal Sustainable Development Strategy (FSDS). The FSDS represents a major step forward for the Government of Canada in providing an overarching framework for making environmental decision-making more transparent and accountable to Parliament. The FSDS, together with revised Guidelines for Implementing the Cabinet Directive on the Environmental Assessment of Policy, Plan and Program Proposals (Strategic Environmental Assessment), also enables the integration of the Government's environmental goals and targets into strategic environmental assessments applied by departments and agencies.

The goals and targets of the FSDS are organized under four themes as follows:

Theme I: Addressing Climate Change and Air Quality

Theme I: Addressing Climate Change and Air Quality

![]() Theme II: Maintaining Water Quality and Availability

Theme II: Maintaining Water Quality and Availability

![]() Theme III: Protecting Nature

Theme III: Protecting Nature

![]() Theme IV: Shrinking the Environmental Footprint - Beginning with

Theme IV: Shrinking the Environmental Footprint - Beginning with

Government

The following extract from AAFC's PAA indicates the program activities where the Department contributes to the four themes of the FSDS.

AAFC’s contributions to the first three themes of the FSDS are highlighted in Section II in respect of those targets for which the Department is the lead. Also highlighted in Section II are AAFC’s contributions to Greening Government Operations (GGO), the goal of the fourth theme. Details on AAFC’s contribution to GGO targets are provided in the Supplementary Table on Greening Government Operations, which is listed in Section III and housed on the TBS website.

An overview of AAFC’s activities in support of sustainable development is provided in Section IV. For further information on these activities and AAFC’s contribution to the FSDS, please refer to the details of AAFC’s Departmental Sustainable Development Strategy. For complete details on the FSDS, visit http://www.ec.gc.ca/dd-sd/default.asp?lang=En&n=C2844D2D-1.

Risk Analysis

Canada's agriculture, agri-food and agri-based product sector is a modern, dynamic, export-oriented industry that operates in a highly competitive and volatile global environment. Changing world supply and demand conditions, which continue to impact global and domestic agriculture and food markets, pose significant challenges as well as opportunities for Canadian producers and other players in the agriculture and agri-food system.

Although grains and oilseeds prices recently spiked upwards after years of low prices, the future path of commodity prices is uncertain due to volatility in variables such as the price of energy, cost of fertilizer and other inputs, weather and climatic conditions, and fluctuations in exchange rates. There are pressures on profit margins in Canada's red meat industry, particularly hogs, which is facing challenges such as increased competition from other major exporters and reduced market access in key markets, such as the U.S., the primary destination for Canada's agriculture and agri-food products. The reduction in access to the U.S. market for the red meat industry is largely due to country of origin labelling.

On the other hand, global demand, particularly for higher value food items, is being driven upward by increasing income and populations in emerging economies and developing countries. Despite the recent global recession that slowed income growth, demand for these higher value-added products continues to grow.

The global food system is evolving whereby restructuring and consolidation in retail supermarkets and the emergence of new business models and global supply chains are transforming global markets. At the same time, changing consumer demands for food safety and specific food attributes such as consideration of environmental impact, animal welfare, and organic products are leading to the rise in private standards by food processors and retailers, providing them with the opportunity to differentiate their products and assure consumers of the attributes they desire.

In the years ahead, breakthrough technologies will be needed as natural resource constraints (e.g. land and water) place limitations on future agricultural production around the world. Successful agricultural nations will be those that make optimum use of their productive resource capacity and invest in new technologies and practices that reduce production risks, and improve the sustainability of the sector. Technological advances in agriculture, such as precision farming and new crop varieties, can lead to lower production costs and increased productivity. Technological advances can also lead to new products with attributes that respond to market needs, such as canola with new health traits and non-food crops for biofuel production. Public and private investments in research and development will be required to enhance the competitiveness and productivity of Canada's agricultural, agri-food and agri-products industry.

Efforts to be more competitive on costs, product attributes and market development are also essential for the competitiveness of the agriculture and food and beverage processing industry, a key market for Canadian primary agricultural products. Canada's agriculture, agri-food and agri-based product sector is dynamic and in a constant state of transition as it adapts to changing economic conditions and consumer preferences to remain competitive and profitable. To provide relevant and effective support, AAFC must be similarly adaptive.

AAFC is committed to making policy and program decisions based on the examination of the Department's operating environment, strategic priorities, resource capacity, and existing or emerging key corporate risks. The goal of the Department is to foster an environment where risks and opportunities are not only identified but they are managed and mitigated or pursued. Effective risk management helps AAFC meet its commitment to continuous improvement and learning, and to foster innovation and risk management in support of the sector.

Risk management practices, tools and guides such as AAFC's Corporate Risk Profile and Guide to Risk Management in Integrated Business Planning contribute to a consistent approach to implementing integrated risk management. AAFC's Corporate Risk Profile is updated annually and associated risk mitigation strategies assessed to determine residual risk that could impact the achievement of the Department's strategic outcomes. Departmental priority setting integrates the current Corporate Risk Profile information.

The following chart provides an overview of the most significant risks and the corresponding mitigation strategies identified in the 2011-12 Corporate Risk Profile. Given the cross-cutting, horizontal nature of the Department's 2011-12 corporate risks, each risk, to varying degrees, is directly linked to all strategic outcomes and program level activities.

| Risk* | Key Mitigation Strategies |

|---|---|

| *Shown alphabetically | |

|

Catastrophic Crisis A large-scale event could present a severe risk to the sector and/or Canadians at large. |

Mitigation strategies include: Continued input, as required, into: federal and provincial emergency plans, Public Safety Canada and Canada Border Services Agency policy documents and plans, and North Atlantic Treaty Organization agriculture planning documents; and Continued work on the economic analysis, financial program impact and economy recovery strategy scenarios for animal or crop disease outbreaks (groundwork for Animal Disease Project Plan and Crop Disease Plan Project Proposal). |

|

IM/IT Disaster Recovery Readiness IM/IT business tools are used to deliver critical services to the public. Since services are provided by various sites, the loss of any data centre location (Ottawa, Winnipeg and Regina) would severely impede AAFC's ability to deliver those services. AAFC also provides numerous services to other government departments from these sites. |

Mitigation strategies include: Development of disaster recovery plans for AAFC critical services and functions (0-48 hours); Provision of an alternate recovery site; and Implementation of recovery infrastructure and training of recovery business processes and services (0-48 hours) at alternate recovery site. |

|

Infrastructure Aging of infrastructure and assets could impair AAFC's significant moveable assets and physical infrastructure holdings, impeding achievement of strategic outcomes. |

Mitigation strategies include: Alignment of 2011-12 funded infrastructure investments to the 2010-15 Investment Plan; Continued infrastructure condition monitoring and dam safety management system rejuvenation; and Continued improvement of project management in line with the Treasury Board Secretariat Organizational Project Management Capacity Assessment tool. |

|

Knowledge and Information Management Significant loss of key knowledge and information impeding reuse and effective decision making if concrete action is not taken to: capture/document, transfer, share and protect the expertise and unique knowledge of individuals and groups. |

Mitigation strategies include: Improved document management; Improved information searches; Refinement and implementation of the Knowledge Management, Innovation and Collaboration Support Strategy; Increased availability of knowledge management, transfer tools and processes; and Increased knowledge transfer learning and development via the AAFC Mentoring Program, a targeted executive and management development approach, and a new Leadership Development Program. |

|

People Work Environment People management strategies and activities not fully implemented and embedded in management practice will affect the Department's ability to recruit, develop and retain the expertise and competencies required to deliver on departmental obligations and pursue its goals for excellence and innovation. |

Mitigation strategies include: Continued enhancement of integrated business/human resources planning and sub-strategies (staffing and recruitment, learning and development) and their implementation. This includes specific areas or issues identified as requiring attention such as a leadership development strategy for the research community and professional development support for Engineering and Scientific Support, and General Labour and Trades occupational groups. |

|

Program Risk Managing complex programs in a shared jurisdiction such as agriculture, with a multiplicity of service delivery points and multiple responsibility centres, presents three key challenges: program and management control impacting accountability; third-party program delivery impacting monitoring and assessing program effectiveness; and the need to improve policy design and program development. |

Mitigation strategies include: Continued refinement of program service standards; Implementation of Privacy Management Framework; Revised performance measurement approach via internal Performance Measurement Peer Review Committee; Periodic re-evaluation of program specific risks; Oversight by Associate Deputy Minister and Assistant Deputy Minister governance board for approving and implementing program and service excellence initiatives including policy, procedures, tools and training; Implementation of an updated Recipient Risk Management Framework based on lessons drawn from the first year of use; Implementation of common business processes and technology to support program delivery, and ongoing monitoring of common business processes; Enhanced engagement of the Centre of Program Excellence to look at terms and conditions development to ensure consistency and standardization where possible; Early identification of funding issues to implement the Annual Reference Level Update process to reprofile funds; and Annual risk-based recipient audit plans and follow-up. |

AAFC is committed to ensuring robust mitigation strategies in order to appropriately respond to departmental risks identified for 2011-12. The Department is well positioned to meet new Treasury Board Secretariat risk management requirements and has already implemented changes in its Corporate Risk Profile reporting to include risk performance indicators. This will result in a more comprehensive risk performance report of progress against corporate risk reduction strategies.

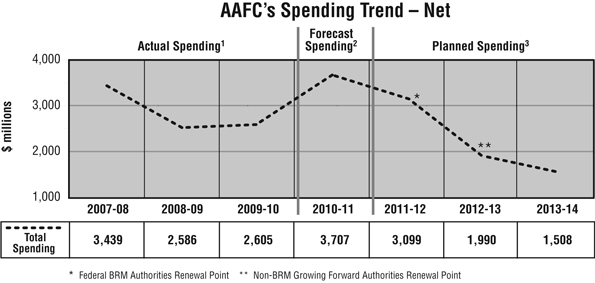

Expenditure Profile

AAFC departmental spending varies from year to year in response to the circumstances in the agriculture, agri-food and agri-based products sector in any given period. Programming within AAFC is in direct response to industry and economic factors which necessitate support to this vital part of the economy. Much of AAFC's programming is statutory (i.e. for programs approved by Parliament through enabling legislation) and the associated payments fluctuate according to the demands and requirements of the sector.

Departmental Spending Trend

The figure below illustrates AAFC's spending trend from 2007-08 to 2013-14.

Notes:

1 Actual spending represents the actual expenditures incurred during the respective fiscal year, as reported in Public Accounts.

2 Forecast spending reflects the authorized funding levels to the end of the fiscal year (not necessarily forecast expenditures).

3 Planned spending reflects funds already brought into the Department's reference levels as well as amounts to be authorized through the Estimates process as presented in the Annual Reference Level Update. It also includes funding approved in the government fiscal plan, but yet to be brought into the Department's reference levels. Planned spending has not been adjusted to include new information contained in Budget 2011. More information will be provided in the 2011-12 Supplementary Estimates.

Over the period 2007-08 to 2013-14, actual and planned spending varies from a high of $3.7 billion in 2010-11 to a low of $1.5 billion currently planned for 2013-14. This variability is the result of a number of factors outlined below.

For 2007-08, spending included Budget 2007 funding of $1 billion for the Cost of Production and AgriInvest Kickstart programs (one-year programs). Following the delivery of these one-year programs in 2007-08, spending for 2008-09 and 2009-10 returned to levels generally required to support the industry. In addition, they reflect a reduction in the requirement for Business Risk Management program funding as a result of a strong rise in crop receipts, mainly in the grains and oilseeds sector, over 2007.

The increase in forecast spending in 2010-11 is largely the result of emergency assistance provided to Prairie crop producers who were affected by excess moisture/flooding in the spring/summer of 2010. This also affected Business Risk Management (BRM) spending, which is forecasted to increase above 2009-10 levels.

The decrease in planned spending from 2010-11 to 2011-12 is due primarily to the fact that program authorities for: emergency advances for livestock under the Advance Payments Program, the control of diseases in the hog industry program, the New Opportunities for Agriculture Initiatives, the Agricultural Bioproducts Innovation program, and the Orchards and Vineyards Transition Program are currently set to expire at the end of 2010-11. In addition, payments to producers under the $75 million Hog Farm Transition Program will end in 2010-11.

The reduction in planned spending from 2011-12 to 2013-14 reflects the federal authorities renewal point associated with the current suite of statutory BRM programs at the end of 2011-12 and the current non-BRM Growing Forward programs at the end of 2012-13. AAFC, in consultation with provinces and territories, continues to work on the strategic review of the BRM suite of programs and the development of an industry engagement strategy, which will guide the next phase of BRM programming to meet evolving needs. In addition, FPT governments are now developing a successor Growing Forward policy framework to position the industry to meet challenges in the decade ahead.

Estimates by Vote

For information on AAFC’s votes and statutory expenditures, please see the http://www.tbs-sct.gc.ca/est-pre/20112012/me-bpd/toc-tdm-eng.asp.