Archived [2023-12-13] - Guidelines on Fleet Management, Chapter 1: Light-Duty Vehicles

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

1. Introduction

1.1 Purpose

This chapter of the guidelines is intended to assist directors and managers in implementing the government’s policy and directives related to materiel management and more specifically the management of light-duty vehicles.

Organized around a life cycle approach, this chapter provides guidelines and best practices that complement the mandatory direction provided in the Policy on Management of Materiel and the Directive on Fleet Management: Light Duty Vehicles. In some cases, this chapter also details procedures to be followed stemming from the application of other Treasury Board directives. This format enables directors and managers to adhere to a common set of procedures and to ensure their decision-making and management practices are consistent with the full range of best practices and guidelines relevant to the management of light-duty vehicles.

1.2 Scope

Flowing from the Policy on Management of Materiel, which provides policy direction on the management of all departmental assets, and the Directive on Fleet Management: Light Duty Vehicles, which provides direction related to the management of light-duty fleets, this chapter sets out guidelines and best practices for the management of light-duty vehicles.

Whereas the government’s fleet of light-duty motor vehicles represents a significant capital and ongoing operational and maintenance expense to the government, it is critical that departments not only manage and operate fleets according to a common set of mandatory requirements but also consider a wide range of guidelines and best practices.

This chapter’s content highlights and expands on some mandatory policy direction, as well as providing guidance and additional information on the management of light-duty vehicles. Some content directly links to the government’s policy requirements, while other content reflects good managerial practices that go beyond the requirements of Treasury Board policy.

The content of this chapter and its associated directives and policy, should be read in conjunction with other policies and requirements that, although they have an impact on the management of light-duty vehicles, are outside the scope of this document. The reader is encouraged to review the references included in the Policy on Management of Materiel.

Treasury Board Policy Highlight

Departments shall develop capital acquisition, operations and maintenance, and disposal strategies based on the findings of an ongoing and systematic assessment of the physical condition, functionality, utilization, and financial performance of these assets against established targets based on appropriate benchmarks.

1.3 The Materiel Management Life Cycle

Tip

The life cycle cost (LCC) of materiel assets can be expressed by the simple formula:

LCC = planning costs

plus acquisition costs

plus use and operating costs

plus disposal costs

minus residual value

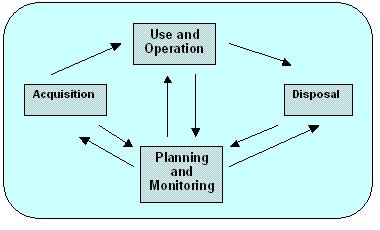

The extended life of materiel assets has important implications for decision makers. For instance, an acquisition decision that is based on the lowest purchase price but that ignores potential operating and maintenance costs may result in a higher overall cost. Therefore, it is important to understand all phases in the materiel management life cycle. Managing effectively requires that an appropriate level of management interest and control be maintained through all phases in the materiel asset’s life cycle. These phases are summarized in the following diagram:

1.3.1 Management Control

Management Control - Text version

“Chart illustrates the relationship between the four asset life cycle management phases. The four phases include: planning and monitoring, acquisition, use and operation, and disposal. Planning and monitoring feeds into and incorporates processes from all three of the other phases. The final three phases follow a logical approach where acquisition related management processes feed into use and operation, while use and operation processes feed into disposal.”

Materiel management strategies should always take into consideration the full life cycle costs and benefits of alternatives to meeting program requirements.

By using life cycle costing techniques, the total costs to the Crown of owning or leasing materiel assets can be evaluated prior to acquisition. This is accomplished by taking into account such factors as operation and maintenance costs, and possible future disposal costs in addition to capital costs. Estimating life cycle costs also creates standards by which costs can be monitored and controlled after acquisition. By adopting this approach throughout, departments can move towards ensuring that their materiel management decisions are financially prudent and represent the best value to the Crown.

1.4 Chapter Organization

This chapter of the guidelines is organized into sections consistent with the four phases of the life cycle of materiel: planning; acquisition; operation, use, and maintenance; and disposal. Within these phases, and where applicable, additional subheadings are used to clearly distinguish subject matter.

- Section 2 provides an overview of the management structure for light-duty fleets in the federal government.

- Section 3 discusses the planning phase of the materiel life cycle as it relates to light-duty vehicles.

- Section 4 sets out guidelines for the acquisition of light-duty vehicles.

- Section 5 provides guidelines for the operation, use, and maintenance phase of the life cycle of light-duty vehicles.

- Section 6 lays out guidelines for the disposal of light-duty vehicles.

2. Light Duty Vehicle Management in the Federal Government

2.1 Roles and Responsibilities

The following is an overview of the management and accountability structure for light-duty vehicles in the federal government.

Consult the Treasury Board of Canada Secretariat’s Materiel and Fleet Management website for direction and guidance on fleet management and for links to websites of interest to fleet managers.

2.1.1 Federal Departments and Agencies

Departments and agencies are responsible for the management of light-duty vehicles.

Light-duty vehicles are purchased using departmental budgets and, although central agency direction can influence purchasing decisions, departments and agencies are fundamentally responsible for deciding how many vehicles they require and the composition of vehicles necessary to fulfil their operational duties.

Departments and agencies are essentially responsible for all phases of the light-duty vehicle life cycle; however, they are guided by the policy direction provided by the Treasury Board of Canada Secretariat. Most departments and agencies have in place their own internal policy related to the ownership, use, maintenance, and disposal of light-duty fleets, while other departments and agencies may simply refer to the applicable Treasury Board policies, directives, and regulations.

Additional detail on the roles and responsibilities of departments and agencies related to light-duty vehicles is contained in the Policy on Management of Materiel.

2.1.1 Central Agencies

2.1.1.1 Treasury Board of Canada Secretariat

The Treasury Board of Canada Secretariat (TBS) is responsible for providing departments and agencies with leadership for the overall management of light-duty vehicles. In carrying out its mandate, the Real Property and Materiel Policy Division maintains the Policy on Management of Materiel, the Directive on Fleet Management: Light Duty Vehicles, and the Directive on Fleet Management: Executive Vehicles, which these guidelines accompany.

Treasury Board policy on materiel management and directives on light-duty vehicles provide direction and guidance to ensure that this asset group is managed at the lowest possible overall cost, in a manner that allows for informed strategic decision making and cost-effective and efficient delivery of government programs and services. Furthermore, TBS direction seeks to ensure the light-duty vehicles are selected, acquired, used, maintained, and disposed of in ways that provide the best possible support to government operations, the environment, and other government objectives.

Within and among the federal light-duty fleet community, TBS also assumes an ongoing consultation role in order to encourage communication among the members, provide additional policy interpretation, and provide leadership in the fleet community.

Additional details on the roles and responsibilities of TBS are contained in the Policy on Management of Materiel.

2.1.1.2 Public Works and Government Services Canada

Public Works and Government Services Canada (PWGSC) provides key mandatory and optional services to federal departments and agencies in support of the management of the light-duty vehicle fleets.

A primary mandatory service is the management of the vehicle procurement process, which requires PWGSC to conduct an assessment of light-duty vehicles to identify the lowest-cost candidates with the most favourable environmental profile. Departments and agencies are then required to select vehicles from this pool of candidates to the extent it is feasible.

Consult the Public Works and Government Services Canada Government Motor Vehicle Ordering Guide website for information on vehicle procurement.

PWGSC also negotiates all standing offers for vehicle-related services and products that can be accessed, on an optional basis, by all departments and agencies. These standing offers may include, but are not limited to, the following: fleet management services; tires and tubes; vehicle leases; vehicle conversions; vehicle markings; etc.

Additional detail on the roles and responsibilities of PWGSC is contained in the Policy on Management of Materiel.

3. Planning

3.1 Planning Transportation Requirements

3.1.1 Considering Alternatives Before Acquisition

Before acquiring a new vehicle, departments should consider whether a new requirement could be met using the existing fleet. They should examine current vehicle utilization to determine whether pooling is feasible, particularly if some vehicles are being underutilized. For example, if two vehicles with low annual kilometres or low daily use are parked near each other, perhaps one of them could be pooled and the other one disposed of.

When it has been determined that the existing fleet cannot meet a requirement, departments should consider using alternative methods of transportation to meet the requirement. These may include, but are not limited to the following:

- Vehicle rentals (short-term or seasonal),

- Taxis,

- Privately owned vehicles,

- Public transit,

- Shuttles,

- Car-sharing services, and

- Outsourcing (e.g., courier services)

For information on the use of privately owned vehicles and rentals, consult the National Joint Council Travel Directive. For information on rentals, consult Public Works and Government Services Canada’s Accommodation and Car Rental Directory.

Operational needs in some departments may require that the department own the vehicle (e.g., the Royal Canadian Mounted Police’s dog master) because alternative methods of transportation such as rentals are not practical.

Additional annual utilization benchmarks are contained in Appendix B to this chapter.

3.2 Planning For Vehicle Acquisition

When a department has ascertained that a particular transportation requirement cannot be met using the existing fleet or one or more alternative methods of transportation, the following should be considered in planning for vehicle acquisition.

3.2.1 Establishing Guidelines to Justify the Acquisition of a Light-Duty Vehicle

Departments should establish annual utilization guidelines to justify the acquisition of a Crown-owned light-duty vehicle.

In general, ownership is not cost-effective for light-duty vehicles that will travel less than 20,000 km per year or that will be used less than 200 days per year. It depends on the category, type, use and location of the vehicle. For example, annual travel and utilization may be much higher for a police cruiser than for a farm research pick-up truck.

Departmental fleet policies should require that ownership of light-duty vehicles that travel less than 20,000 km per year or that are used less than 200 days per year be formally justified. The justification should specify the operational requirements that dictate the low usage (e.g., specialty vehicle, emergency vehicle, vehicle operating in a remote location and/or confined area, vehicle that is used seasonally).

Appendix A describes the four main categories of light-duty vehicles and lists the subcategories of functions for each category.

Appendix B sets out the benchmarks for annual utilization, by vehicle category.

3.2.2 Understanding Procurement Timelines

Estimated requirements for light-duty vehicles should be sent to Public Works and Government Services Canada as early as possible each fiscal year to allow for better planning and more cost-effective ownership.

To manage transportation effectively, departments should understand the potential length of time between ordering a vehicle and receiving a vehicle.

Ordering a vehicle in September allows departments to use the vehicle for an additional six to eight months when compared with a vehicle of the same model year that is ordered near build-out. As a result, because both vehicles are of the same model year, departments may obtain a similar residual value for both vehicles although they will have owned and used one for a longer time.

3.2.3 Selecting Vehicle Class and Type

Prior to selecting a vehicle class to meet operational requirements, departments should consider opportunities to rationalize either the overall fleet size or the class they are considering.

In considering a rationalization of the overall fleet size, departments may want to consider whether one new vehicle, e.g., a minivan, would be able to meet the range of transportation requirements previously satisfied by two vehicles, e.g., a mid-size sedan and a full-size van.

In assessing opportunities to rationalize a particular vehicle class, departments may want to consider the following:

- The smallest vehicle class practical should be selected by evaluating the regular transportation requirements. Vehicle size should not be based on occasional requirements (such as towing and four-wheel drive capability or carrying additional passengers), which may be more cost-effectively met using alternative transportation modes.

- Consideration should be given to whether a smaller vehicle or engine can meet the transportation requirement previously or currently met by a larger vehicle. For example, a newer model year full-size half-ton pickup with a smaller but more efficient engine may satisfy the transportation requirement previously met using a full-size three-quarter-ton pickup truck with a larger engine.

Tip

Today’s vehicles and engines are very efficient. Fleet managers should look closely at the performance and capacity of new vehicles in comparison with the vehicles that they replace. It is quite possible that a new smaller engine will outperform an old larger engine. In addition, some new light-duty trucks may carry heavier loads than previous models.

4. Acquisition

4.1 Accessing Public Works and Government Services Canada Procurement Arrangements

Departments and agencies should consider making call-ups for vehicle purchases using electronic purchasing tools such as the Government of Canada e-Purchasing system.

4.2 Methods of Supply for the Acquisition of Light-Duty Vehicles

Four methods of supply are presently used by PWGSC for light-duty vehicle acquisitions. Each method has its benefits, although the departmental individual standing offer (DISO) method is the most appropriate and widely used. The four methods are as follows:

4.2.3 Departmental Individual Standing Offers

A competitive request for standing offer is issued every year around June, in which manufacturers are requested to provide prices for new model year vehicles in accordance with specifications and popular option combinations contained in the Government Motor Vehicle Ordering Guide. DISOs are then issued (effective September 1) to those manufacturers offering the lowest responsive price on each specific item, including all alternative fuel vehicles available from these manufacturers.

The evaluation of bids takes into consideration the fuel consumption and greenhouse gas emissions for all vehicles with a gross vehicle weight rating of up to 3,856 kg (8,500 lbs.). Vehicles can be ordered until the expiry date of the standing offer, which is usually July 31.

The specifications, options, and prices of the vehicles offered at the lowest responsive or a lower responsive cost are identified in the document entitled DISO Prices on the PWGSC vehicle procurement website. PWGSC clients across Canada can use this information to order the vehicles that best meet their requirements.

4.2.4 Manufacturers’ Vehicle Inventory

The manufacturers’ vehicle inventory (MVI) method of supply was introduced to supersede the dealer stock method of supply.

Urgent vehicle requirements often arise as a result of accidents, theft, fire, program changes, etc. At one time, these vehicles could be supplied only through dealer stock purchases. However, the vehicles on the dealers’ inventories were mostly outfitted with options tailored for the consumer retail market, making them more expensive than the fleet vehicles normally required to meet the federal government’s operational needs. In addition, discount levels from dealerships were not and are still not as significant as those provided to the federal government for vehicles ordered from the DISO. The MVI method is designed primarily to assist PWGSC client departments with urgent vehicle requirements.

MVI consists of PWGSC ordering vehicles through the DISO several times per year, for a variety of typical government vehicles to be held in manufacturers’ storage lots until needed. Should a client department require a vehicle on an urgent basis, the PWGSC vehicle procurement officer quickly issues a contract to the manufacturer with shipping instructions, and the delivery is effected anywhere in Canada from the storage lot to the appropriate local dealership.

Departments should consult with PWGSC vehicle procurement officials in order to confirm the availability of MVI vehicles and to reserve them.

4.2.5 Dealer Stock Purchases

As indicated under "manufacturers’ vehicle inventory," urgent vehicle requirements often arise as a result of accidents, theft, fire, program changes, etc. Most of these urgent requirements are filled through PWGSC’s MVI program. However, some vehicles cannot be provided through MVI and should be purchased from local dealers’ stocked inventories. The dealer stock method is the least desirable and the most costly of the vehicle procurement methods of supply, but it is still a necessary tool in the complete supply system.

PWGSC regional offices can handle dealer stock purchases of passenger cars and light-duty trucks, provided that the authority to proceed has been granted by PWGSC headquarters. Executive vehicles are to be purchased exclusively by the vehicle procurement officials at PWGSC headquarters.

In accordance with the Directive on Fleet Management: Light Duty Vehicles, dealer stock purchases should be avoided whenever possible. They should be made only on an exceptional basis, with the approval of PWGSC, and only if there is absolutely no other alternative available to meet the customer requirements.

Requisitions are allocated by PWGSC headquarters to regional offices. The Vehicles Team forwards an authorization form along with the requisition to the appropriate regional office with instructions to send a copy of the contract to the Vehicles Team in order to input the pertinent data into the Vehicle Statistical Information System (VSIS). This is also a follow-up system to ensure that the contract has been issued.

Section 4.5 of these guidelines provides details on the procedures to follow if the need to acquire vehicles through dealer stock occurs.

4.2.6 Special Production

On occasion, vehicle requirements might not be appropriate for the above-mentioned methods of supply, whereas individual purchases for particular vehicles are more suitable to meet particular needs.

For example, Foreign Affairs, Trade and Development Canada requires some vehicles for export to various countries worldwide. The vehicles in question should meet motor vehicle safety standards that are in effect in the countries where the vehicles will be utilized. Many provisions should be considered for these vehicles, such as the preparation for overseas shipping, the shipping costs, and the availability of dealer services in particular countries, etc.

Departments considering the "special production" method of supply should consult with PWGSC vehicle procurement officials for further advice.

4.3 Purchasing Environmentally Preferable Vehicles

Departments may consider the acquisition of environmentally preferable vehicles and may emphasize leadership principles in vehicle selection to the extent considered acceptable within their organization by recognizing the environmental benefit to be gained in relation to the cost of the vehicle.

4.4 Purchasing Additional Vehicle Options

In deciding whether to purchase additional options on vehicles, departments should consider the following:

- employees’ need of the option to carry out their duties;

- the public’s perception regarding what could be considered luxury options for government vehicles;

- the effect on life cycle cost;

- the efficiency, health, and safety of the employees using the vehicle;

- normal fleet practice for the type of work being carried out; and

- the location where the vehicle will be used.

4.5 Seeking Deviations from the Government Motor Vehicle Ordering Guide

To obtain approval from TBS for deviations from the Government Motor Vehicle Ordering Guide (GMVOG) related to vehicle options, minimum features, and vehicle class, the procedure below should be applied:

- A department provides PWGSC headquarters (HQ) with a written justification along with a requisition (where applicable);

- PWGSC HQ forwards the justification (and requisition) to TBS for consideration;

- TBS provides a ruling to PWGSC HQ; and

- if approved by TBS, and where additional options are requested or a vehicle class outside the GMVOG is requested, PWGSC may seek competitive bids from appropriate sources.

4.6 Acquiring Vehicles Through Dealer Stock

Departments are reminded that purchases of light-duty vehicles through dealer stock are on an emergency basis only, and are not justifiable on grounds of planning difficulties, year-end surplus spending, or the length of the procurement process.

PWGSC has the authority to rule against any dealer stock justification that demonstrates poor planning.

To obtain separate approval from PWGSC for dealer stock purchases, departments should follow the procedure below:

- A department provides PWGSC HQ with a justification for the dealer stock request along with the requisition;

- PWGSC HQ reviews the justification and may discuss the requirement with TBS;

- PWGSC HQ provides the department with a ruling within a reasonable time (usually within 72 hours); and

- if approved, PWGSC proceeds with the purchase from local dealers, while respecting all trade agreements and contracting policy requirements.

4.7 Selecting Alternative Fuel Vehicles

4.7.1 Criteria for Selecting an Alternative Fuel Vehicle

To ensure compliance with the Alternative Fuels Act, departments should meet the following criteria prior to selecting an alternative fuel vehicle:

- Vehicles in a rationalized fleet should first be identified as good candidates for using alternative fuels based on operational feasibility considerations.

- A vehicle should also meet the cost-effectiveness test. If the proposed vehicle is cost-effective, it is then confirmed as a cost-effective candidate for use of alternative fuels. It can be replaced with an alternative fuel vehicle purchased from a manufacturer, converted in the aftermarket, or rented as a vehicle capable of operating on an alternative fuel.

Appendix C to this chapter contains additional information on these criteria.

4.7.2 Purchasing a Manufactured Alternative Fuel Vehicle

The following should be considered prior to purchasing a manufactured alternative fuel vehicle:

- Consider whether the vehicle is a dedicated alternative fuel vehicle or a flex-fuel or bi-fuel vehicle capable of operating on gasoline and an alternative fuel. Operational feasibility considerations will also determine this choice.

- Alternative fuel vehicles that are certified to Environment Canada emission standards will not require testing.

Guidelines for assessing cost-effectiveness and operational feasibility of alternative fuel vehicles are contained in Appendix C to this chapter.

4.7.3 Aftermarket Conversions of Gasoline Vehicles

Departments should consider the following prior to converting a gasoline vehicle to alternative fuel capability:

- The integrity of the basic vehicle warranty should not be affected by converting a gasoline vehicle to use an alternative fuel. Departments will use the same source of supply to purchase and install fuel conversion equipment to avoid conversion warranty problems. Conversion contractors should provide a minimum one-year written warranty on the performance of equipment and the quality of installation. PWGSC issued standing offers for vehicle conversions until September 2005. These standing offers specified emission standards and emissions monitoring guidelines associated with converted vehicles; departments should still comply with such standards.

- Emissions associated with vehicles converted to alternative transportation fuel do not fall under Environment Canada’s jurisdiction, as they are no longer new vehicles. Instead, converted vehicles are subject to in-use vehicle emission standards. In Canada, in-use emissions testing programs are administered provincially and are in place only in Ontario with the Drive Clean program and in British Columbia with the AirCare program. Both programs target only areas of increased transportation-based air pollution and are not province-wide. Both are based on the Environmental Protection Agency’s regulations for in-use vehicle emissions.

4.7.4 Reusing Conversion Equipment

Moving conversion equipment from one vehicle to another is not recommended. However, when conversion equipment is reused, it should comply with the requirements in the paragraph above and renewed warranty provisions should exist for the installation and use of the alternative fuel equipment in a second vehicle.

4.7.5 Maintenance of Alternative Fuel Vehicles

An effective alternative fuel vehicle should meet emission standards throughout the vehicle’s useful life cycle. Departments should maintain their vehicles regularly in accordance with the manufacturer’s specifications.

4.7.6 Emission Monitoring for All Alternative Fuel Vehicles

Departments are to maintain the Transport Canada fuel consumption rating for each vehicle in the fleet, and the dates and kilometre readings when the emission tests are conducted in the fleet database. Copies of all emission test results (and corrective action taken in the case of failed tests) are to be retained on file for any audit or inquiry from internal auditors or TBS.

4.8 Vehicle Rental and Leasing

4.8.1 Long-Term Rental and Leasing

Departments should consider the following prior to entering into a vehicle lease:

- Long-term leasing is not cost-effective and should not be used as a means of expanding the departmental fleet.

- It is highly recommended that rentals be used to meet temporary, short-term, and seasonal requirements. Leases or rentals should not be used to meet ongoing program-related transportation requirements.

- Regular renewals of leases or rentals should be avoided. Departments should consider vehicle ownership if the requirement for transportation is ongoing.

- Departments should carry out a buy-versus-lease/rental study prior to entering into a lease or rental arrangement to ensure the most cost-effective mode of transportation is acquired.

- Leased or rented vehicle classes, engines, options, and minimum features should be consistent with those contained in the Government Motor Vehicle Ordering Guide .

- Vehicle leases and rentals are contracts and should be entered into in compliance with the Treasury Board Policy on Managing Procurement .

4.8.2 Vehicle Operating Leases

Departments opting to lease vehicles should note that only operating leases are permitted. The Financial Administration Act prohibits capital leases. The most recent operating leases were available through the PWGSC standing offers for vehicle leases until the end of September 2006.

5. Operation, Use, and Maintenance

5.1 Fuel Issues

5.1.1 Purchasing Low-level Ethanol Fuel

The Directive on Fleet Management: Light Duty Vehicles requires federal government employees to purchase low-level ethanol fuel (commonly referred to as E-10) for gasoline-powered vehicles, whenever available, when travelling for government purposes. This includes travel in a rented, leased, or government-owned vehicle.

The Ethanol Expansion Program (EEP) aims to increase domestic production and use of ethanol, a renewable transportation fuel, and reduce transportation-related greenhouse gas (GHG) emissions. The current strategy is to promote and encourage the use of ethanol-blended gasoline, in both low-level (up to 10 per cent ethanol) and high-level (up to 85 per cent ethanol, E-85) blends. Most vehicles can use low-level blends today, and flexible-fuel vehicles can use E-85. For more information, visit Natural Resources Canada’s alternative fuels website.

While E-10 fuel consists of a blend of 10% ethanol and 90% gasoline, low-level ethanol-blended fuel is defined as gasoline blended with ethanol in low concentrations. In Canada, low-level ethanol-blended fuel is manufactured and available in a range of concentrations from 5% to 10% ethanol content.

Although the Directive on Fleet Management: Light-Duty Vehicles relates to the purchase of E-10 fuel, the intent of the requirement is to increase the purchase of low-level ethanol blends in general. As such, purchasing a fuel containing up to 10% ethanol is consistent with the requirement.

Low-level ethanol blends are available at service stations across Canada.

Departments are encouraged to develop guidelines to assist drivers of departmental vehicles to identify conveniently located fuel stations that supply E-10 fuel. Such guidelines should also emphasize the requirements of this directive and provide clear instructions for drivers on measures to be taken to ensure compliance with these requirements.

For more information on low-level ethanol blends, visit the Canadian Renewable Fuels Association’s website.

5.1.2 Purchasing Alternative Transportation Fuels

Departments and agencies should take reasonable measures to increase access to alternative fuel for departmental vehicles, including:

- identifying and communicating to drivers the location of accessible alternative fuel refuelling sites within range of departmental motor vehicles;

- establishing practical guidelines for drivers of government motor vehicles to purchase alternative fuel (and E-10) at sites that may not be as conveniently located as conventional refuelling sites;

- maximizing current owned fuelling infrastructure, e.g., by installing vehicle refuelling appliances (VRAs) for natural gas; and

- building alternative refuelling facilities at a departmental site, where appropriate.

5.1.3 Fuel Loyalty Cards

The Values and Ethics Code for the Public Sector states that public servants should at all times act in such a way as to uphold the public trust. Public servants shall perform their duties and arrange their private affairs so that public confidence and trust in the integrity, objectivity, and impartiality of government are conserved and enhanced. Public servants shall act at all times in a manner that will bear the closest public scrutiny.

In accordance with the principles of the Values and Ethics Code, government employees are not permitted to accumulate rewards and/or points on their own personal loyalty cards (e.g., Air Miles, Petrol-Points, or other types of reward points) for fuel purchases made using the government fleet credit card while operating a government vehicle for government business. Further, government employees are not permitted to receive cashbacks for fuel purchases and/or repairs made using the Government of Canada fleet card.

The Policy on Conflict of Interest and Post-Employment provides specific guidance on avoiding and preventing situations that could give rise to a potential, apparent, or real conflict of interest. These measures are key to helping ensure that the public service can and will be seen to be carrying out its responsibilities in an objective and impartial manner. The conflict of interest measures prohibit the solicitation of gifts, hospitality, or other benefits for personal gain.

Fraudulent use of a fleet credit card (e.g., receipt of kickbacks, theft, etc.) is a criminal offence against the Crown and may result in severe penalties. Departments are reminded to ensure that they have control measures in place to avoid improper practices and illegal acts related to the use of the fleet credit card. Any improprieties and allegations of offences against the Crown should be reported and investigated, and departments should take appropriate action.

5.1.4 Safety Issues with Refuelling

Departments should ensure that any and all safety issues associated with refuelling are communicated to users of departmental vehicles. Basic safety procedures should be followed when refuelling vehicles. Departments should consult with their departmental Occupational Health and Safety coordinator for additional information.

Information on the potential danger posed by the discharge of static electricity during refuelling can be found on the Stop Static website of the Petroleum Equipment Institute.

5.2 Risk Management Issues

5.2.1 Defining an Authorized Driver

Departments should consider that a common definition of authorized driver includes:

- departmental employees on authorized duty and authorized by a responsibility centre manager to operate departmental vehicles to conduct departmental business; and contractors, when authorized by the term of a contract defining the usage of a departmental vehicle to carry out their responsibilities.

Departments should also consider that a common definition of employee includes:

- full-time, part-time, casual, seasonal, term, and indeterminate employees and students.

5.2.2 Authorizing an Authorized Driver

To ensure all employees acknowledge the terms of use of a departmental vehicle, departments may consider requiring employees to review and sign a form detailing authorized and appropriate use of a government vehicle.

The authority to use a departmental motor vehicle would be valid until the form is withdrawn, but should be reviewed at least annually by a manager.

Content of such an authorization form may include:

- a requirement to possess a valid driver’s licence for the province or territory that employee resides in;

- a requirement to inform the manager immediately if a driver’s licence is revoked, suspended, or restricted for any reason;

- understanding that departmental vehicles can be used only for official government purposes;

- an understanding that unauthorized use of a government vehicle may result in disciplinary action and that, in the event of a motor vehicle accident, the employee may be responsible for reimbursing all costs;

- an understanding that prior approval should be obtained to transport non-federal passengers in a departmental vehicle;

- an understanding of requirements under the Income Tax Act; and

- an understanding that the employee is responsible for all traffic violations (e.g., speeding, illegal parking, etc.), as well as damage from accidents due to driver negligence while in possession of, or driving, a departmental vehicle.

Departments should obtain, and retain a record of, proof of insurance, including an indemnification to the Crown, from authorized drivers who are not government employees before such drivers are permitted access to a departmental vehicle. Access to departmental vehicles should be withdrawn once the proof of insurance coverage expires.

5.2.3 Defining an Authorized Passenger

Departments should consider that a common definition of authorized passenger includes:

- a person authorized to travel in departmental vehicles by the responsibility centre manager, including any departmental employee on authorized duty; any employee of another federal, provincial, territorial, or municipal government working with the department; and any official visitor designated as such by the vehicle custodian.

Only authorized passengers may be carried in departmental motor vehicles; however, a motor vehicle operator may provide emergency transportation without prior authorization under the following circumstances:

- medical emergencies;

- at the request of law enforcement officers; or

- when necessary for security or other operational reasons.

Such instances should be documented by the driver as soon as possible following completion of the trip and documentation should be provided to the appropriate manager.

An emergency situation does not include transporting relatives, family, or friends to school, daycare, work, or appointments. Family members should not travel in a departmental vehicle when employees are on travel status and a departmental vehicle is the approved mode of transportation.

5.2.4 An Approach to Managing Risk to the Crown

In deciding on the most appropriate manner of underwriting the risk to the Crown for damage to the vehicle, driver injury, or third-party claims, departments should consider the following:

- Non-government employees (i.e., contractors) should not purchase insurance (and conversely, the government should not pay for contractors’ insurance) on risks that are clearly the responsibility of the government unless the respective responsibilities are so commingled that they are indistinguishable.

- Non-government employees (i.e., contractors) should not be indemnified by the government against the risks to which only the contractors are exposed.

- Departmental legal advisers should be consulted whenever there is any question as to the type of risk involved.

For situations where contractors may be required to use departmental vehicles, there are four basic options available to departments to ensure appropriate use of insurance and the appropriate approach to risk management:

5.2.4.1 Contractor-Controlled Insurance

Under this option, the contractor provides proof of insurance to cover the risk and, at the department’s option, provides a limited or unlimited indemnification of the Crown against damage to the vehicle and third-party risks.

This method should be the general rule in most contractual circumstances, as it puts the onus on contractors to arrange their own insurance in accordance with the customs of the trade. Contracting authorities should ensure that contractors make prudent use of insurance commensurate with their financial capability, and their legal and contractual liability.

5.2.4.2 Government Insurance

This method may be appropriate when there are specific advantages to be gained such as insuring against high-risk activity, preserving an arm’s length relationship, gaining economy, and getting insurer provided services such as claims settlement.

5.2.4.3 Government Assumes Full Risk

Under this approach, the government assumes all the risk under the self-underwriting policy, just as is done for vehicles operated by employees.

5.2.4.4 Government Assumes Partial Risk

Under this method, the government assumes the risk of damage to the vehicle where negligence is not involved and requires an indemnification from the contractor against third-party risks.

Departments are encouraged to develop an appropriate and reasonable approach to managing risk as it relates to motor vehicle operation and use in consultation with their legal advisors.

5.3 Vehicle Management and Allocation

Departments should pool vehicles internally (within the department) to the fullest possible extent. In complexes where there are two or more departments, departments should also consider sharing a pool of vehicles.

Assignment of a vehicle to one individual is strongly discouraged unless justified by operational requirements (e.g., the Dog Master at the RCMP).

5.4 Vehicle Use and Operation

5.4.1 Personal Use of Vehicles

Departments should ensure that users of federal vehicles are aware of interpretations of personal use in the Income Tax Act by reading the Canada Revenue Agency’s Automobile and motor vehicle benefits and Chapter 2 of the Employer’s Guide T4130 on Taxable Benefits.

Departments should comply with the requirements of the Income Tax Act by establishing a system to ensure personal use of vehicles is declared and the taxable benefit is properly applied.

5.4.2 Complying With the Federal Identity Program Policy

The corporate signature ("Government of Canada" or departmental name, in both languages, with the Canadian flag) and the Canada wordmark should appear on all motor vehicles, including vehicles on long-term leases, in accordance with requirements of the TBS Federal Identity Program Policy (FIP).

To identify vehicles on short-term rentals, departments may consider using temporary markings such as a placard displayed on the vehicle or a magnetic-backed marking, instead of the more permanent standard markings.

In the case of designated leadership vehicles, additional FIP-approved marking is acceptable.

The purpose of standard markings on motor vehicles, in accordance with the Federal Identity Program Policy, is as follows:

- to protect the corporate identity of the government;

- to identify the institution operating the vehicle; and

- to indicate the vehicle’s function, as required.

5.4.3 Seeking Exemption From the Federal Identity Program Policy

Departments citing concerns of safety for vehicles bearing standard markings may consider temporary markings, such as a magnetic-backed marking or placard, for such situations.

Departments seeking exemption from the FIP Policy should contact the FIP policy centre directly.

5.4.4 Idling of Departmental Vehicles

Measures departments should employ to eliminate unnecessary idling may include:

- issuing a formal policy or directive on idling in departmental vehicles;

- educating drivers of government vehicles on the cost and environmental impacts of idling; and

- identifying and considering alternatives to idling to ensure driver comfort in specific situations such as auxiliary power units.

Departments should consult Natural Resources Canada’s Transportation website for further information or visit its Welcome to the Idle-Free Zone website to obtain information on developing an anti-idling campaign.

5.4.5 Smoking in Departmental Vehicles

Smoking is not permitted in government vehicles as they are considered part of the workplace. In accordance with the Non-Smokers’ Health Act, employers have an obligation to promote a safe and healthful working environment that is free, to the extent possible, of tobacco smoke and they should ensure that no person smokes in the workplace.

While this Regulation does not specifically prohibit smoking in motor vehicles when occupied by only one employee, departments are required to promote vehicle sharing and pooling to the maximum extent possible. Employees that are sharing motor vehicles should not be exposed to the effects of smoking in a motor vehicle.

5.4.6 Use of Cellular Telephones in Departmental Vehicles

Departments should take measures to discourage the use of cellular telephones (handheld and hands-free) while operating a departmental vehicle. Departments should emphasize and communicate all of the safety issues associated with using a cellular telephone while operating a departmental vehicle.

All federal and provincial laws and regulations governing the use of cellular telephones should be observed and override any information contained in this directive in the event of a discrepancy between those laws and regulations, and this directive.

Departments may choose to seek recovery of any motor vehicle accident costs resulting from cellular telephone use and a failure to observe any applicable federal and provincial laws and regulations on the part of the driver.

The Canada Safety Council website on Driving with cell phones provides useful information on how to safely operate a vehicle while using a cellular telephone.

5.4.7 Registration of Departmental Vehicles

Departments should comply with provincial legislation and regulations for vehicles by:

- registering vehicles, including paying for compulsory inspections, driver examinations, or other requirements, unless specific agreements exist to the contrary; and

- paying environmental levies on tires or batteries that may be payable to these provinces under federal-provincial reciprocal taxation agreements.

Where possible, departments should arrange for bulk registration of vehicles to reduce administrative costs. The first line of all addresses on vehicle registrations should include consistent wording to refer to the department, such as the department’s applied title.

5.4.8 Green Defensive Driving Courses

Departments should provide, or participate in, driver training courses where appropriate and required, including:

- green defensive driving courses ;

- refresher training to acquaint personnel with changes in equipment or operating conditions;

- remedial training to offset specific weaknesses indicated by accident records, traffic violations, or other instances of inadequate operating performance;

- appropriate procedures for refuelling propane tanks; and

- vehicle operator awareness programs for reducing fuel consumption and emissions.

While this course focusses on safe driving practices, it also highlights the environmental benefits associated with defensive driving. This course is available as a one-day classroom course or a two-hour online course.

Departments interested in this course should contact the Canada Safety Council.

5.4.9 Using Snow Tires on Departmental Vehicles

For additional safety, departments may want to consider the use of snow tires on all vehicles during the winter season. These guidelines promote this as a good practice on all existing vehicles in the fleet, where appropriate, and not necessarily at the time of vehicle acquisition.

All federal and provincial laws and regulations governing the use of snow tires on motor vehicles should be observed and override any information contained in these guidelines in the event of a discrepancy between the laws and regulations, and these guidelines.

5.4.10 Safe Operation of Departmental Vehicles

Part XVI of the National Joint Council Occupational Health and Safety Directive emphasizes the importance of safety in the operation of government vehicles. It is essential that vehicles remain mechanically safe and they should be operated in a prudent manner. Employees are not required to operate a vehicle that is deemed unsafe or that is loaded in a hazardous manner.

Buses and motor vehicles used for transporting flammable substances should be equipped with a dry chemical fire extinguisher. Information on the rating, standards, and location of the fire extinguisher is provided in Part XVI of the National Joint Council Occupational Health and Safety Directive.

Motor vehicles shall be equipped with first aid kits in accordance with the requirements of Part XVI, Schedule I, subsection 16.7(1), of the Canada Labour Code.

5.4.11 Reporting Accidents

Every motor vehicle accident is to be investigated, the cause or causes determined, and appropriate corrective action taken. Additionally, a hazardous occurrence accident report shall be completed in compliance with section 15.3 of Part XV, "Hazardous Occurrence Investigation, Recording and Reporting," of the Canada Labour Code.

In order to be consistent with section 15.11 of Part XV identified above, departments shall maintain a written record of vehicle repairs or replacement as a result of accidents for a period of 10 years.

In addition, departments should complete a copy of the Motor Vehicle Accident Report (GC 46) form and maintain it, along with the vehicle’s history file.

5.5 Data Collection, Credit Cards, and Fleet Information Systems

5.5.1 Obtaining the Services of a Fleet Management Service Provider

Departments and agencies may obtain the services of a fleet management service provider by either issuing a call-up against a standing offer for fleet management support services (PDF document) negotiated by the federal government or engaging in a separate competitive process if warranted.

5.5.2 Appropriate Use of Fleet Database

Departments and agencies should monitor fuel consumption and vehicle operating and maintenance records to ensure that they are up to date. Regular monitoring of these data will ensure accuracy and integrity of data and better data for internal and external reporting purposes.

Departments should track data related to all alternative transportation modes, including daily rentals, vehicle leases, personal motor vehicle use, and taxis to enable effective management of transportation within the organization. Essential data to be collected include the duration and distance of trips taken, the total number of trips, and the associated cost.

Departments are not obligated to report and/or enter fleet-related information in the vehicle management database on ancillary equipment that can be transferred from one vehicle to another and that will be removed prior to disposal (e.g., safety screens, weight tie-downs, light bars, winches, aftermarket electronic equipment, etc.).

A Recommended Practice

Warranty work is not normally reported to a fleet management service provider by the manufacturer’s dealerships, as the work is performed on a "no charge" basis.

Departments should ensure that vehicle operators request and obtain a copy of the dealership work order when the repaired vehicle is picked up. The work order should then be forwarded to the fleet management service provider where it can be added to the vehicle’s database history.

5.5.3 Reporting Vehicle Odometer Readings

Odometer readings should be reported regularly—at the very least, on a monthly basis—to ensure the fleet information system is current.

5.5.4 Appropriate Use of Fleet Credit Cards

Departments ensure the following best practices are followed:

- A separate electronic credit card should be assigned to capture transactions for each individual vehicle. A vehicle-assigned fleet credit card should not be used for purchases for other vehicles or equipment.

- Use of non-specific fleet cards should be discouraged.

- Work covered by warranty should be allocated against a specific vehicle by contacting the appropriate authority for manual entry into the vehicle management database.

- Any fleet-related transactions not paid using a fleet credit card (i.e., fuel, maintenance, and repairs) should be reported to the appropriate authority for manual entry into the vehicle management database.

- Expenses paid with a fleet credit card are limited to those needed for the operation and maintenance of government vehicles and equipment. They include the following:

- from oil companies - fuel, oil, lubricants, antifreeze, filters, windshield washing fluid, solvent, de-icing fluid; routine services such as tire repairs, battery charging, washing, towing, lubrication, and emergency repairs;

- from maintenance and repair firms - all normal maintenance and repair services and parts essential to the operation of government vehicles or equipment; and

- from tire outlets - the purchase of tires in accordance with the pricing structure in the tire and tube standing offer or agreement.

- Supplies and services not specified above cannot be purchased with a fleet credit card.

- Routine procurement of supplies for the sole purpose of accumulating an inventory of items such as batteries, tires, antifreeze, windshield washing fluid, oil, filters, spare parts, etc. cannot be paid with the fleet credit card. However, the cost of the individual items should be entered in the fleet management database once they are installed and/or once the service has been performed.

- In exceptional cases only , there may be instances where vendors do not accept the fleet credit card for vehicle-related purchases or services. They include small vendors located in remote areas, retail stores, some equipment installers, vehicle licence bureaus, etc., where only cash, cheques, or major credit cards (e.g., VISA, Mastercard, etc.) are accepted. These may be the only options available to the fleet credit card user at the time. In these instances, the following steps should be taken:

- The fleet management services provider should be informed by the department of the non-acceptance of its fleet credit card by this vendor, and attempts should be made by the service provider to qualify the vendor; and

- all vehicle-related transactions not paid using the fleet credit card should be reported and/or entered in the vehicle fleet management database.

5.6 Fleet Liability and Insurance

5.6.1 Proof of Insurance While Travelling in Canada

Proof of ownership or leasehold interest by the federal government should suffice as proof of insurance for federal government vehicles. Departments may, however, obtain proof of insurance cards from the TBS website if deemed necessary.

5.6.2 Commercial Insurance

While the federal government self-underwrites travel in government-owned vehicles, departments should consider obtaining commercial insurance for leased vehicles in the following circumstances:

- in provincial jurisdictions with regulations requiring minimum insurance coverage for long-term vehicle leases—in this instance, the department assumes any risks not covered by the insurance; and

- for leases and rentals in remote areas if there are offsetting advantages, such as easier claim settlement.

5.6.3 Vehicles Driven to the U.S.

PWGSC arranges a contract annually to provide commercial insurance to cover third-party liability risks and personal injury for travel to the U.S. Damage to a federal vehicle registered in Canada while on official business outside Canada is covered by the self-underwriting policy.

Departments should provide the insurer, through PWGSC, with estimates of travel to the U.S. based on the prior year’s data. The insurer arrives at an annual charge for insurance and provides proof of insurance documents for vehicles on a request basis.

6. Disposal

6.1 Planning for Disposal

Departments should consider the following best practices in planning for vehicle disposal:

- To accommodate the requirement for seasonal use of a vehicle, vehicles should be disposed of at the end of a season.

- At the time of vehicle disposal, departments should ensure that a mechanism is in place to assess the ongoing need for transportation and to consider whether needs can be met within the current fleet or through alternative transportation options.

- Departments should review and understand the fiscal year and manufacturers’ production timelines associated with the procurement process to facilitate planning for vehicle replacement.

6.2 Disposal of Vehicles

6.2.1 Establishing Guidelines for Vehicle Disposal

At the time a vehicle is purchased, departments should determine when it will likely be disposed of, estimate the cost of potential replacement and ensure that budgets take into account that cost.

Departments are encouraged to establish life-cycle guidelines for their light-duty fleets to support effective disposal planning. An appropriate life cycle for light-duty vehicles can vary widely across departments. This section provides the recommended benchmarks for departments to use in establishing their own life-cycle guidelines.

In general, departments should use 20,000 km per year as the basis when establishing life cycle guidelines for their light-duty fleet vehicles. Departments may use the following guidelines, which are based on that annual usage figure, when planning how long to keep a vehicle:

- Passenger cars (i.e., sedans and wagons) should be kept for a minimum of 6 years or 120,000 km before being disposed of.

- Light-duty trucks (i.e., pick-ups, vans and utility vehicles) should be kept for a minimum of 7 years or 140,000 km before being disposed of.

Departments can extend the life of their light-duty vehicles beyond the recommended guidelines when it is cost-effective to do so, provided that:

- The vehicles are not underutilized;

- Maintenance and repair costs are monitored and controlled; and

- The vehicles are safe and reliable.

For the disposal of government surplus assets, departments should be familiar with the Treasury Board Directive on Disposal of Surplus Materiel.

Appendix B provides additional benchmarks by vehicle category that may also be useful.

6.2.2 Disposal Methods

Departments should use the disposal services of the Crown Assets Disposal Directorate at PWGSC for vehicle disposals.

Trade-ins are not permitted for light-duty vehicles.

Transfers of vehicles between departments are permitted and should be consistent with TB policy on asset disposal and government accounting practices.

7. Enquiries

Please direct enquiries about this policy instrument to the organizational unit in your department responsible for this subject matter. For interpretation of this policy instrument, the responsible organizational unit should contact: TBS Public Enquiries.

A. Appendix A: Categories of Light-Duty Vehicles

This appendix describes the four main categories of light duty vehicles and lists the subcategories of functions for each category.

A.1 Category 1: Law Enforcement / Security Vehicles

Light-duty vehicles in this category should have specialty equipment installed to support public safety or security operations or have official markings that identify them as official public safety vehicles. They are primarily used for public safety, front line security, law enforcement and military applications; and they should be readily available at all times. They are essential to the department’s mandate and have a high standard of functionality. There may be opportunities for pooling certain vehicle subcategories, such as police cruisers, within a department.

Subcategory 1: Functions

- Public safety/national security (e.g.: police car, any light duty vehicle with a weapon/firearm, light bar and/or equipment for military/tactical applications)

- Fire/emergency (e.g.: fire truck, search and rescue vehicle, ambulance)

- Other (specify in drop down menu from database)

A.1 Category 2: Specialty Vehicles – Modified

Light-duty vehicles in this category are specialty vehicles that are not suitable for general use and that are assigned to a specific function. They have been specially modified to perform specific tasks in support of essential departmental programs and mandates. In most instances, these vehicles should be available on short notice. Their specific function and specialty equipment makes them unique so pooling opportunities may be limited to within a department.

Subcategory 2: Functions

- Specialized technical/scientific/inspection/investigation services (e.g.: mobile laboratory, telecommunications unit)

- Specialized maintenance/repair services (e.g.: snow plow, cherry picker, mobile workshop)

- Specialized transportation (e.g.: hazardous goods, liquids, dog cage, shelves/separators, fifth wheel, heavy/special towing)

- Prisoner transportation (requirements differ from other specialized transportation)

- Driver training

- Other (specify in drop down menu from database)

A.1 Category 3: Specialty Vehicles – Standard

Light-duty vehicles in this category are specialty vehicles that do not have any special equipment installed. Although they may be suitable for general use, they are assigned to a specific function. They are usually allocated to a limited user group and are essential in the support of departmental programs and mandates. In most instances, they should be readily available on short notice. Although these vehicles generally perform a specific, dedicated function, they may potentially be available for pooling under certain conditions, because they do not have any specialty equipment installed.

Subcategory 3: Functions

- General technical/scientific/inspection/investigation services (e.g.: food inspection, research)

- General maintenance/repair services (e.g.: transportation of tools, equipment, workers)

- General transportation (e.g.: urban shuttle bus, mail/courier, light/general towing)

- General surveillance (e.g.: patrol vehicle NOT equipped with weapon/firearm and/or light bar)

- Vehicle required in remote location (e.g.: limited transportation available)

- Other (specify in drop-down menu from database)

A.1 Category 4: General Administrative Vehicles

Light-duty vehicles in this category are standard vehicles (e.g., compact sedans, minivans) that are suitable for general use. They should have no high-dollar value options. Although they support departmental programs and mandates, they have no special equipment or features. Their only function is general transportation. These vehicles are primarily used to transport people and cargo in the conduct of routine government business. They can be located just about anywhere, including remote locations. In some instances, they may be used as back-up vehicles to provide transportation for unforecasted requirements. In most instances, they should be readily available. Because they have no special equipment or features, they may be candidates for pooling within a department or between departments.

Subcategory 4: Functions

- Pooled

- General administration

- Spare / back-up

- Vehicle required in remote location (e.g.: limited transportation available)

- Other (specify in drop down menu from database)

Appendix B of the Treasury Board Directive on Fleet Management: Light-Duty Vehicles lists the mandatory data collection fields for Crown-owned vehicles. At present, it does not include fields for the four categories of light-duty vehicles listed above. These four new fields, along with their subcategories, will be added to the federal fleet database during the 2014–15 fiscal year. Once the fields are available, departments are to select one of the four categories in the fleet database. The subcategories will be available from a drop-down menu. Use of subcategories is preferred, but not required, to justify ownership, particularly on vehicles that may not meet utilization benchmarks.

B. Appendix B: Benchmarks for Annual Utilization and Disposal

This appendix outlines good practices and provides some examples of benchmarks for minimum annual utilization to justify the acquisition of a light-duty vehicle and on disposal cycles to optimize their use.

Although these benchmarks may be helpful to departments in establishing their own guidelines, they are not mandatory because of the variability associated with vehicle function and location.

Departments should, however, establish their own benchmarks and key performance indicators to help them optimize their light duty fleet. For example, they might set minimum criteria for utilization and replacement, and measure actual fleet data against these criteria in order to make more informed decisions on the life cycle management of their fleet.

A.1 Recommended Benchmarks

Departments should establish benchmarks for minimum annual utilization (to help in determining whether they need to acquire a new light-duty vehicle) and for minimum replacement time (to help in effective disposal planning).

The following general principles apply in acquisition and disposal planning:

- Acquisition planning : Ownership may not be cost effective if the vehicle will be travelling less than 20,000 km per year or will be used less than 200 days per year;

- Disposal planning : Most passenger cars (i.e., sedans and wagons) should be kept for a minimum of 6 years or 120,000 km, and most light-duty trucks (i.e. pick-ups, vans and utility vehicles) should be kept for a minimum of 7 years or 140,000 km before being removed from the departmental fleet.

Notwithstanding those general principles, the federal government’s wide ranging transportation needs may require departments to adjust the recommended benchmarks for certain vehicles to match their function, use and location.

For example, a pooled compact sedan (Category 4) operating primarily in a metropolitan area and performing general administrative tasks may not meet the same benchmarks as a dedicated light-duty truck (Category 3) used for patrolling a correctional facility in a confined, remote location. Similarly, two vehicles in the same category may have very different benchmarks. For example, a Category 1 police cruiser, typically used extensively, may quickly exceed the recommended benchmark, and a Category 1 search and rescue vehicle, typically on standby, may never reach any of the recommended benchmarks.

Variations in a vehicle’s functions (e.g., security, maintenance, general administration) and location (e.g., metropolitan, suburban or remote) will affect its life cycle management and may sometimes require departments to not follow the general benchmarks.

For those reasons, this appendix does not provide specific benchmarks for each vehicle function and location. Rather, it provides guidance to help departments adjust their benchmarks, when appropriate, based on some of these functions, using the four main vehicle categories identified in Appendix A.

A.1 Recommended Benchmarks for Minimum Annual Utilization

A.1.1 Category 1: Law Enforcement / Security Vehicles

Police and security vehicles should travel at least 20,000 km per year or be used for at least 200 days. Most vehicles in the other subcategories will not meet that benchmark, mostly because they are on standby 365 days a year for emergency and rescue response. They are nevertheless essential.

A.1.1 Category 2: Specialty Vehicles – Modified

Passenger cars and light-duty trucks should travel at least 20,000 km per year or be used for at least 200 days. Vehicles used for specialized transportation, snow removal, patrolling, maintenance and field work may not meet that benchmark. Justification should be provided.

A.1.1 Category 3: Specialty Vehicles – Standard

Passenger cars and light-duty trucks should travel at least 20,000 km per year or be used for at least 200 days. In cases where a vehicle does not meet the benchmark, justification should be provided (e.g. when there are few other transportation options to meet a specialized transportation requirement or when the vehicle will be operating in a remote location).

A.1.1 Category 4: General Administrative Vehicles

Passenger cars and light-duty trucks should travel at least 20,000 km per year or be used for at least 200 days. However, adequate justification in not meeting the benchmark should be provided on a vehicle by vehicle basis, e.g. when there are few other transportation options for the program need, such as when operating in a remote location.

A.1 Recommended Benchmarks for Minimum Disposal or Replacement

A.1.1 Category 1: Law Enforcement / Security Vehicles

- Passenger cars: 6 years or 120,000 km

- Light-duty trucks: 7 years or 140,000 km

A.1.1 Category 2: Specialty Vehicles – Modified

- Passenger cars: 6 years or 120,000 km

- Light-duty trucks: 7 years or 140,000 km

- On a life cycle basis, due to the additional costs of modifying/upfitting vehicles and in some cases, removing the ancillary equipment, some trucks may be kept for more than 7 years before being disposed of.

A.1.1 Category 3: Specialty Vehicles – Standard

- Passenger cars: 6 years or 120,000 km

- Light-duty trucks: 7 years or 140,000 km

- Some vehicles used for patrolling; maintenance; transporting tools, equipment and/or workers; field work; and in remote locations may reach the 6 or 7 year threshold before they reach the kilometre threshold because their function may require them to travel short distances regularly.

A.1.1 Category 4: General Administrative Vehicles

- Passenger cars: 6 years or 120,000 km

- Light-duty trucks: 7 years or 140,000 km

- Regular monitoring of the utilization of vehicles in this category is essential to ensure maximum value to the Crown. Underutilized vehicles should be pooled or disposed of if they are not being optimized.

A.1.1 Key Performance Indicators

Once departments have developed benchmarks, they can establish key performance indicators to help them analyze their actual fleet utilization and make more informed decisions.

A.1.1 Examples of Key Performance Indicators

For minimum annual utilization:

- Percentage of vehicles not meeting the benchmark, by type (e.g. passenger cars, light-duty trucks)

Or

- Percentage of vehicles not meeting the benchmark, by category

For minimum disposal or replacement:

- Percentage of vehicles not meeting or substantially exceeding the benchmark, by type (e.g., passenger cars, light-duty trucks)

Or

- Percentage of vehicles not meeting or substantially exceeding the benchmark, by category

Depending on the benchmark, departments can compare the vehicles that do not meet or that exceed the benchmarks with those that qualify in the same category or class and use this information for decision-making and, over time, for performance reporting.

Departments should follow up on the vehicles that are not meeting the minimum annual utilization benchmark and determine the following:

- Can the user justify the need for the vehicle? (e.g., remote location, essential need)

- Can the vehicle be pooled? If not, should it be disposed of?

Departments may notice that the higher the percentage of vehicles that exceed the benchmark for minimum replacement cycle, the more likely the following will occur:

- Increase in downtime, productivity loss and repair costs;

- Underutilization; and

- Loss of revenue from resale because of low residual value.

C. Appendix C: Guidelines for Assessing Cost-Effectiveness and Operational Feasibility of Alternative Fuel Vehicles

This appendix provides a consistent approach for determining whether a vehicle would be capable of operating cost-effectively on alternative fuels over its useful life in the federal fleet. It also provides further guidance on what constitutes operational feasibility.

A.1 Assessing Operational Feasibility

Some change in operational procedure should be expected to accommodate using and refuelling alternative fuel vehicles. In specific cases, in spite of best efforts, it may not be operationally feasible to use alternative fuels in some locations or for specific vehicles.

Tip

Departments should ensure the manufacturer has qualified the local service dealership to service the type of alternative fuel vehicle being purchased or leased. Not all original equipment manufacturer dealerships may be qualified or equipped to service the alternative fuel vehicles sold by the manufacturer.

All of the following should be in place to make the use of alternative fuels operationally feasible:

- fuel should be available for the area of operation and range of the vehicle;

- vehicle service and maintenance support should be in place;

- the vehicle should meet operational and tailpipe emission requirements while operating on an alternative fuel;

- the vehicle should be durable in the operating environment;

- certification and an adequate warranty for conversion work should be available; and

- the manufacturer’s vehicle warranty should not be affected.

A.1 Assessing Life Cycle Cost-Effectiveness

In assessing the life cycle cost-effectiveness of using alternative fuel vehicles, departments are encouraged to use the Alternative Fuels Guide to conduct the cost-effectiveness test.

This software package was developed by Natural Resources Canada to provide purchasers of alternative fuel vehicles with an easy-to-use tool to determine the cost-effectiveness of purchasing original equipment manufacturer vehicles capable of operating on the following alternative fuels: natural gas; propane; and E85.

Cost-effectiveness of alternative fuel vehicles is calculated using the price differential between the gasoline and ATF prices based on gasoline-equivalent volumes. These volumes are determined using conversion factors that account for the energy content of each fuel. These conversion factors are incorporated into the software package.

D. Appendix D: Green Fleet Management Checklist

Following is a checklist of best environmental practices related to the management of light-duty vehicles. This checklist has been organized according to the four phases of the materiel life cycle. An additional category has also been included to address procedure and policy issues.

A.1 Procedure and Policy

Sound procedures and policies lay the groundwork for good fleet management practices that not only reduce fleet costs but also minimize the environmental impact of operating a fleet. Following are some relevant best practices related to procedure and policy:

- Establish and document departmental objectives, goals, and targets related to green fleet management.

- Develop a departmental work plan and/or action plan for achieving fleet management, and environmental targets and objectives.

- Establish and document departmental roles and responsibilities for achieving green fleet targets and objectives.

- Communicate green fleet management objectives, goals, and targets to individuals with relevant roles and responsibilities.

- Ensure that appropriate tracking and monitoring systems are in place and up to date across the department (including a fleet management database and vehicle use logbook or sign-out sheet) and ensure procedures are in place to monitor and analyze data.

A.1 Planning

During the planning stage, departments should consider the following best green practices:

- Assess vehicle utilization through a review of the fleet management database, logbooks, and/or sign-out sheets to identify underutilized assets and/or a pattern of transportation use that may be better met using alternative transportation sources.

- Assess the opportunity to meet new transportation requirements through the use of existing fleet assets and/or with alternative transportation modes.

- Assess whether alternative transportation fuels (ethanol, biodiesel, natural gas, propane, hydrogen) and fuel-efficient vehicles (hybrid or best in class) are being used to the greatest extent possible.

A.1 Acquisition

During the acquisition stage, departments should consider the following best green practices:

- Select the appropriate vehicle class to meet and not exceed operational requirements.

- Select the smallest size vehicle class practical to meet operational requirements.

- Select an alternative fuel vehicle when it is cost-effective and operationally feasible.

- When converting a vehicle to alternative fuel capability, use only aftermarket conversion kits that are certified to ensure that they meet federal and provincial emission regulations.

- Consider the selection of vehicles with advanced vehicle technology, including hybrids.

For your information

The U.S. Environmental Protection Agency and California Air Resource Board provide an emission certification program for aftermarket conversion kits.

A.1 Operation, Use, and Maintenance

For your information

Low-level ethanol is covered by manufacturer warranty on any vehicle produced since the 1970s.

During the operation, use, and maintenance phase, departments should consider the following best green practices:

- Consider acquisition of bulk ethanol and biodiesel for bulk fuel facilities to fuel gasoline and diesel vehicles respectively.

- Purchase alternative transportation fuel when driving an alternative fuel vehicle.

- Use low-level (under 10 per cent) ethanol blended gasoline to refuel gasoline vehicles.

- Purchase environmentally labelled vehicle products such as windshield washing fluid, cleaning products, coolants, and re-refined oil.

- Plan travel and routing to maximize vehicle use efficiency and minimize mileage driven, especially during peak travel times.

- Encourage vehicle operators to avoid speeding and idling in order to enhance fuel efficiency.