Common menu bar links

Breadcrumb Trail

Institutional links

Expenditure Management

Departmental Performance Reports

2012-13

Organizational Overview

Analysis of Programs by Strategic Outcome

Supplementary Information

ARCHIVED - Treasury Board of Canada Secretariat - 2012–13 Departmental Performance Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Expenditure Profile

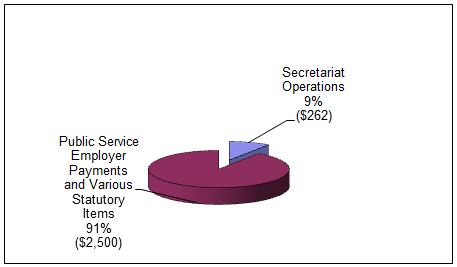

Figure 1: Treasury Board of Canada Secretariat 2012–13 Actual Spending ($ millions)

Figure 1: Treasury Board of Canada Secretariat 2012–13 Actual Spending - Text version

The Secretariat spent a total of $2.76 billion toward achieving its strategic outcome. Approximately 9 per cent of total spending represents expenditures for its operations. The remainder relates to funds for public service employer payments that the Secretariat manages centrally on the government's behalf.

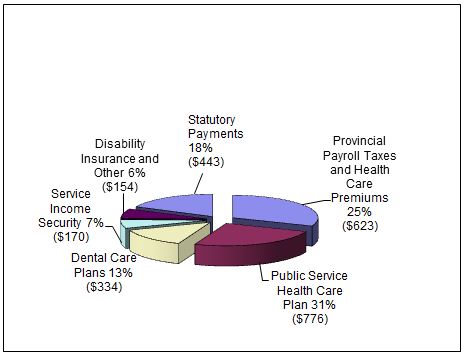

Figure 2: Treasury Board of Canada Secretariat Public Service Employer Payments 2012–13 Actual Spending ($ millions)

Total spending for public service employer payments was $2.50 billion in 2012–13. This included statutory payments and payments under 16 public service benefit plans and associated expenditures.

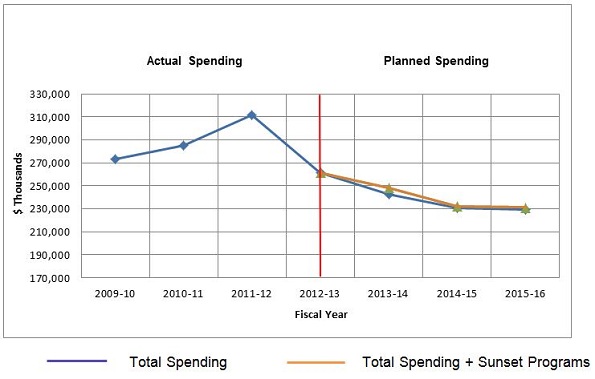

Figure 3: Spending Trend for Program Expenditures (Vote 1)

Figure 3: Spending Trend for Program Expenditures (Vote 1) - Text version

The Secretariat’s program expenditures include salaries, non-salary costs that support its operations, and contributions to employee benefit plans for its own employees, as well as other statutory payments.

The increase in spending from 2009–10 to 2011–12 is largely due to one-time expenditures related to professional service costs for external experts to support the review of departmental spending across government, and to payouts to employees resulting from the revision of specific collective agreements.

Decreases from 2011–12 to 2015–16 are mostly a result of Strategic Review 2010 reductions, transfers to Shared Services Canada and Public Works and Government Services Canada, and Economic Action Plan 2012 cost-containment measures.

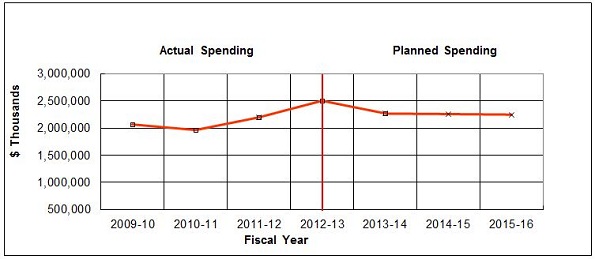

Figure 4: Spending Trend for Public Service Employer Payments and Various Statutory Items (Vote 20)

Expenditures for public service employer payments and statutory items include the payment of the employer’s share of contributions required under the various insurance plans sponsored by the Government of Canada. These amounts also include statutory items for payments under the Public Service Pension Adjustment Act (PSPAA); pay equity settlements, pursuant to section 30 of the Crown Liability and Proceedings Act; and employer contributions made under the Public Service Superannuation Act (PSSA), other retirement Acts and the Employment Insurance Act.

Net public service employer payments increased by approximately $224 million from 2010–11 to 2011–12 as a result of a one-time lump sum payment for improvement of long-term disability benefits provided under the Service Income Security Insurance Plan, and increased payments under the various other public service health benefit plans. These increases were offset by the transfer of the management of pension, insurance and social security programs for locally engaged staff to Foreign Affairs and International Trade Canada See footnote [2] and to National Defence.

Public service employer payments increased by $307.5 million from 2011–12 to 2012–13, mostly as a result of a $443 million actuarial adjustment to employer contributions made under the PSSA. The actuarial adjustment was offset by a decrease of $112.4 million due to a one-time payment under the Service Income Security Insurance Plan and by savings in the Public Service Health Care Plan and payroll taxes. This actuarial adjustment is not reflected in planned spending as it was not known at the time. It will be included in planned and actual spending in future years.

Planned spending between 2013–14 and 2015–16 will decrease by $19.1 million; the figures are based on approved authorities and are relatively stable over the planning horizon.

Estimates by Vote

For information on the Secretariat’s organizational votes and statutory expenditures, please see the Public Accounts of Canada 2013 (Volume II).

Contribution to the Federal Sustainable Development Strategy (FSDS)

The Federal Sustainable Development Strategy (FSDS) outlines the Government of Canada's commitment to improving the transparency of environmental decision making by articulating its key strategic environmental goals and targets.

The Secretariat ensures that consideration of these outcomes is an integral part of its decision-making processes. The Secretariat contributes to Theme IV of the FSDS, Shrinking the Environmental Footprint – Beginning with Government, as denoted by the following visual identifier.

During 2012–13, the Secretariat reviewed the environmental effects of initiatives subject to the Cabinet Directive on the Environmental Assessment of Policy, Plan and Program Proposals. Based on this review, it was determined that for 2012–13, there were no Strategic Environmental Assessments (SEAs) required for any initiatives led or co-led by the President of the Treasury Board under Theme IV of the FSDS, Shrinking the Environmental Footprint – Beginning with the Government.

For additional details on the Secretariat's activities to support sustainable development and SEAs, please consult the Secretariat's website. For complete details on the FSDS, see the Environment Canada website.