ARCHIVED - Patented Medicine Prices Review Board - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2010-11

Departmental Performance Report

Patented Medicine Prices Review Board

The original version was signed by

The Honourable Leona Aglukkaq

Minister of Health

Table of Contents

Section I: Organizational Overview

- Raison d'être

- Responsibilities

- Strategic Outcome(s) and Program Activity Architecture (PAA)

- Organizational Priorities

- Risk Analysis

- Summary of Performance

- Expenditure Profile

- Estimates by Vote

Section II: Analysis of Program Activities by Strategic Outcome

- Strategic Outcome

- Program Activity 1

- Performance Summary and Analysis of Program Activity 1

- Lessons Learned

- Program Activity 2

- Performance Summary and Analysis of Program Activity 2

- Lessons Learned

- Program Activity 3

- Performance Summary and Analysis of Program Activity 3

Section III: Supplementary Information

Section IV: Other Items Of Interest

Chairperson’s Message

I am pleased to present the 2010-2011 Departmental Performance Report for the Patented Medicine Prices Review Board (PMPRB).

The PMPRB is an independent, quasi-judicial body established by Parliament in 1987 under the Patent Act. Its mandate is two-fold: regulatory — to ensure that prices charged by patentees for patented medicines sold in Canada are not excessive; and reporting — to report on pharmaceutical trends of all medicines, and on R&D spending by patentees. The PMPRBcontributes to the broader objective of improving the health of Canadians by protecting consumers and the Canadian health care system from excessive patented drug prices and by contributing to informed drug policy decision-making.

In 2010 there were 1,196 patented drug products under the Board’s jurisdiction, including 68 new patented drugs reported that year.

The Board has affirmed enhancing its engagement with stakeholders and bolstering its outreach to patentees as priorities following the implementation of its renewed Guidelines in January 2010. Monitoring the short- and long-term impacts of changes has provided additional opportunities for dialogue with patentees and allowed the Board to make adjustments rapidly in the field. The recent publication of the Monitoring and Evaluation Plan for the Major Changes in the Guidelines is part of the Board’s long-standing commitment to a regulatory regime that is relevant, responsive, and appropriate.

The PMPRB’s capacity to carry out its regulatory mandate is not only dependent on relevant and effective Guidelines but also on the ability to conduct hearings when required. While public hearings are time sensitive, resource intensive, and require thoughtful deliberation, they provide patentees with an opportunity to be heard. While these proceedings may result in judicial reviews in the Federal Court, they provide all parties with vital clarifications on the intent of the law. An important clarification came in the Celgene matter in 2011 from the Supreme Court of Canada, which upheld key aspects of the Board’s jurisdiction and affirmed the PMPRB’s role as protecting consumers.

The Board has also focused on a comprehensive review of its Rules of Practice and Procedure for Hearings. It is expected that through codifying its current practices and procedures as well as taking into consideration the current practices of other federal administrative tribunals and Federal Court Rules as they apply in the context of the Board, the process will be more transparent and expeditious.

Through the National Prescription Drug Utilization Information System (NPDUIS), the PMPRB pursued its partnership with the Canadian Institute for Health Information, Health Canada and the provinces and territories. The NPDUIS initiative provides critical analyses of price, utilization and cost trends to facilitate informed, efficient and cost-effective policy making. Publishing the results of NPDUIS studies brings the benefits of this work to the broader health care community.

The PMPRB has also aligned its human resource planning and business planning to remain responsive to operational priorities and supportive of evolving organizational needs.

In 2010-2011, the PMPRB finalized a performance measurement strategy framework (PMSF) which was expanded to include its second Program Activity – Pharmaceutical Trends Analysis. As the PMPRB prepares for the upcoming evaluation of its programs, its remains committed to predictability, fairness and transparency in the fulfillment of its regulatory and reporting responsibilities and to ongoing engagement with its key stakeholders.

The original version was signed by

Mary Catherine Lindberg

Chairperson

Section I : Organizational Overview

Raison d’être

The Patented Medicine Prices Review Board (PMPRB) has a dual role:

Regulatory — To ensure that prices charged by patentees for patented medicines sold in Canada are not excessive.

Reporting — To report on pharmaceutical trends of all medicines, and on R&D spending by pharmaceutical patentees.

Responsibilities

The PMPRB is an independent, quasi-judicial body created by Parliament as a result of revisions to the Patent Act (Act) in 1987 (Bill C-22). The Act was further amended in 1993 (Bill C-91). The revisions were intended to balance the extension of patent protection with the need to protect consumers from possible excessive patented medicine prices.

Regulatory Role

The PMPRB is responsible for regulating the factory-gate prices that patentees charge for prescription and non-prescription patented medicines products sold in Canada to wholesalers, hospitals, pharmacies or others, for human and veterinary use, to ensure that they are not excessive. The PMPRB regulates the price of each patented medicine (each strength of an individual, final dosage form of a medicine). This is normally the level at which Health Canada assigns a Drug Identification Number (DIN) as part of the Notice of Compliance process. However, the Board’s mandate also includes medicines available under the Special Access Programme; medicines available through a Clinical Trial Application; and Investigational New Drug Products.

The Federal Court of Appeal articulated the legal requirement as to when a patent will “pertain” to the medicine. In this regard, the Court established the “merest slender thread” requirement, which is wide in scope. The Board’s jurisdiction is not limited to medicines for which the patent is on the active ingredient. Rather, the Board’s jurisdiction also covers medicines for which the patents relate, but are not limited, to the processes of manufacture, the delivery system, the dosage form, the indication/use, and/or any formulation. Patented medicines are not limited to brand name drug products. A number of generic companies fall under the Board’s jurisdiction by virtue of being licensees (i.e. authorized to sell the same medicine as the brand-name company is selling) or due to their own patents (e.g. related to processes of manufacture).

The PMPRB has no authority to regulate the prices of non-patented medicines and does not have jurisdiction over prices subsequently charged by wholesalers or retailers or over pharmacists’ professional fees. In addition, matters such as whether drugs are reimbursed by public drug plans, distribution channels and prescribing are outside the purview of the PMPRB.

Under the Act, patentees are required to inform the PMPRB of their intention to sell a new patented medicine. Upon the sale of such patented medicines, as per the Patented Medicines Regulations, patentees are required to file price and sales information for the first day’s sales and, thereafter, twice a year for six month periods (January to June and July to December) for each strength of each dosage form of each patented medicine sold in Canada for price review purposes, for the duration of the patent(s).

Although patentees are not required to obtain the PMPRB’s approval of the price of a patented medicine before it is sold, they are required to comply with the Act to ensure that prices of patented medicines sold in Canada are not excessive. If a patented medicine is sold before the patent issues, the PMPRB will review the price of the product as of date of first sale, as long as this is after the date on which the patent application was laid open for public inspection.

In the event that the Board finds, after a public hearing, that a price is or was excessive in any market, it may order the patentee to reduce the price and take measures to offset any excess revenues it may have received.

Reporting Role

The PMPRB reports annually to Parliament, through the Minister of Health, on its activities, on pharmaceutical trends relating to all patented medicines, and on the R&D spending by pharmaceutical patentees. In addition to these reporting responsibilities, under section 90 of the Act, the Minister of Health has the authority to direct the PMPRB to inquire into any other matter. Under this provision, the Minister has directed the PMPRB to undertake two initiatives: the National Prescription Drug Utilization Information System (NPDUIS), and monitoring and reporting on Non-Patented Prescription Drug Prices (NPPDP).

National Prescription Drug Utilization Information System (NPDUIS)

Since 2001, pursuant to an agreement by federal, provincial and territorial ministers of health, the PMPRB has been conducting research under the NPDUIS initiative. The purpose of the NPDUIS initiative is to provide critical analyses of price, utilization and cost trends so that Canada´s health system has more comprehensive and accurate information on how prescription drugs are being used and on sources of cost drivers.

Non-Patented Prescription Drug Prices (NPPDP)

In 2005, the Minister of Health, on behalf of federal, provincial and territorial Ministers of Health, directed the PMPRB to monitor and report on non-patented prescription drug prices. This function is aimed at providing a centralized, credible source of information on non-patented prescription drug prices. Since April 2008, NPPDP studies are conducted under the umbrella of the NPDUIS initiative.

Strategic Outcome(s) and Program Activity Architecture (PAA)

The PMPRB has one Strategic Outcome (SO) and two program activities (PAs), which are illustrated in the following chart:

Organizational Priorities

Priority Status Legend

Exceeded: More than 100 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

Met All: 100 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

Mostly Met: 80 to 99 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

Somewhat Met: 60 to 79 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

Not Met: Less than 60 per cent of the expected level of performance for the priority identified in the corresponding RPP was achieved during the fiscal year.

| Priority: Implement and monitor the revised Excessive Price Guidelines (Guidelines), policies and procedures. | Type1: New | Strategic Outcome and/or Program Activity(ies): The PMPRB has only one Strategic Outcome (SO) and all priorities are linked to that SO. This priority is linked to PA 1. |

|---|---|---|

|

Status: Met All The revised Guidelines represent direction from the Board, to patentees and Board Staff, on how to comply with the Patent Act and the Patented Medicines Regulations. They came into effect on January 1, 2010. The price reviews for all new patented drug products sold on or after January 1, 2010, and where appropriate, new drug products sold prior to that date for which the price was still under review at January 1, 2010, and the patentee filings for the reporting period from January 1st to June 30th, 2010 were conducted using the revised Guidelines. The Patented Medicine Prices Review Board (PMPRB) developed the Monitoring & Evaluation Plan for Major Changes in the Guideline (Plan) to assess, on an ongoing basis, the application and impact of the major changes made to the Guidelines. The Plan includes information on the indicators (both qualitative and quantitative) which have been developed to measure the impact of Guideline changes. Responsibility centres have already begun to develop the tools and collect the information they will require to evaluate and report on the application and impact of the changes to the Guidelines. The initial monitoring results produced a number of clarifications on certain aspects of the Guidelines. These clarifications were communicated to patentees and other stakeholders via the PMPRB’s NEWSletter2 as well as through proactive educational outreach sessions3. Most notably, the review of prices in any market and the DIP Methodology for existing patented drug products were identified as needing further consideration.4 A DIP Methodology Working Group was established in cooperation with industry representatives to assist Board Staff in developing recommendations for workable solutions for applying the DIP Methodology. The final report of the working group was presented to the Board at its quarterly meeting on March 4, 2011. The Board decided to implement the recommendations of the Working Group on a pilot basis until December 31, 2011, at which time their effectiveness will be evaluated5. As the PMPRB and patentees continue to gain experience with the revised Guidelines, additional amendments and/or clarifications may be made. These changes will be published in the quarterly NEWSletter as required and incorporated into the Guidelines. The Compendium of Policies, Guidelines and Procedures will be updated annually in June. |

||

| Priority: Redevelop the Compliance Database. | Type1: Previously committed to | Strategic Outcome and/or Program Activity(ies): The PMPRB has only one Strategic Outcome (SO) and all priorities are linked to that SO. This priority is linked to PA 1, 2 and 3. |

|---|---|---|

|

Status: Mostly Met The Compliance Database is a key tool for the conduct of regulatory activities, and as such, is essential to the Compliance and Enforcement Program Activity. Strengthening the database will contribute to the timeliness of the price review process. In addition, the use of newer technologies will facilitate interoperability and information exchange making it easier for patentees to report, as well as enhance the integrity and security of the data used for both the Compliance and Enforcement Program and the Pharmaceutical Trends Program. The increased data security will allow the PMPRB to move towards secure online filing. In 2010-2011 the PMPRB defined the business requirements and designed the database architecture, built a prototype and developed the new database using an iterative design process which included ongoing design consultations with subject-matter experts. An extensive cleansing and data conversion process was challenged by the complex nature of this database, which automates price review calculations that have changed over time, most recently due to the introduction of the revised Guidelines. As a result of these challenges, the old and new database were run in parallel for slightly longer than originally planned and it was necessary to extend the timeline for the project by approximately six months. The new database is now being rigorously tested and employees have been trained. The July 2011 patentee filings will be processed in both the old and new systems, any resulting anomalies will be addressed and full implementation is expected in September 2011. Further efficiencies and reporting capabilities will continue to evolve over the lifecycle of the database. |

||

| Priority: Ensure hearing processes are transparent and more efficient. | Type1: Previously committed to | Strategic Outcome and/or Program Activity(ies): The PMPRB has only one Strategic Outcome (SO) and all priorities are linked to that SO. This priority is linked to PA 1. |

|---|---|---|

|

Status: Mostly met Ensuring that the hearing process is transparent and more efficient will improve the timeliness of decisions with respect to excessive prices thereby ensuring that Canadians and their health care system are protected from excessive pricing for patented drug products. To increase the transparency of the hearing process the PMPRB posts all decisions of the Board on its website within 3 days of their issuance. In addition, the quarterly NEWSletter includes a status report on hearings before the Board. The most recent status report can be found in the latest volume of the NEWSletter which is available on the home page of the PMPRB website: www.pmprb-cepmb.gc.ca. As well, quasi-judicial activities are reported in the Annual Report. The Board’s Rules of Practice and Procedure (Rules) constitute a published standard set of procedures for all parties to follow in proceedings before the Board. The rules set out the Board’s procedures in accordance with the requirements under the Patent Act to resolve matters before it as informally and expeditiously as the circumstances and considerations of fairness permit. In December 2010, the Board decided to expand its pre-consultation on the Rules to include comments from selected lawyers with experience before administrative tribunals such as the PMPRB. The final proposed revision of the Rules codifying the Board’s current practices and procedures, and taking into consideration current practices in other federal administrative tribunals as well as the Federal Court Rules was approved by the Board in March 2011 and submitted through its Notice and Comments process for wider consultation. As a result, publication of the final revision of the Rules in the Canada Gazette, Part 1, for formal consultation, was delayed to the last quarter of 2011-2012. |

||

| Priority: Enhance the profile and uptake of the research and analysis conducted by the PMPRB. | Type1: New | Strategic Outcome and/or Program Activity(ies): The PMPRB has only one Strategic Outcome (SO) and all priorities are linked to that SO. This priority is linked to PA 2. |

|---|---|---|

|

Status: Met All PMPRB staff conducts a comprehensive analysis of pharmaceutical industry trends both internationally and nationally. Price, utilization and research and development (R&D) expenditure trends are part of the regular briefings provided to the Board and senior management. The PMPRB’s Annual Report provides analyses of the prices of patented medicines, information on price trends of all medicines, and reports on pharmaceutical R&D spending of pharmaceutical patentees. In addition to its Annual Report, the PMPRB reports on its activities through its quarterly NEWSletter and various studies. In 2010-2011, the PMPRB was involved in an Industry Canada led initiative to explore the nature of pharmaceutical R&D and other investments in Canada6. The PMPRB was part of a technical working group established to assist in the development of the survey questionnaire and to provide advice on the scope of the data to be collected and on potential measurement and collection issues, to ensure that the results were not duplicative of existing government measures as well as informative and useful for policy makers. As a member of the Steering Committee, the PMPRB provided guidance given its statutory mandate to report annually to Parliament on R&D spending by patentees under the Patent Act. The results of the survey, Summary of Pharmaceutical Survey Findings on R&D Spending and Investments by Rx&D Members - 2010 that came out of this initiative are available on the Canadian Institutes of Health Research website. The PMPRB also completed work to update its study of international R&D levels as well as its foreign price verification study; both studies are planned for publication in 2011. On December 15, 2010, the PMPRB released four new analytical reports:

The two reports on generic drugs, in particular, were of interest to a wide audience. The PMPRB provided the Health Council of Canada, the Canadian Generic Pharmaceutical Association, and other key stakeholders with advance notice of their release. The Health Council of Canada referenced the PMPRB’s work in its report and requested an update of the report. The updated studies will provide a snapshot in time and a better baseline for evaluating current and future public policy changes aimed at generic pricing in Canada. Information on the NPDUIS publications and status updates are provided to a wide stakeholder community in the PMPRB NEWSletter and the Annual Report. Further information is also provided at appropriate speaking venues (e.g., 2010 Annual Conference of CAHSPR). The NPDUIS Steering Committee7 has signalled a desire to develop a more global NPDUIS communication strategy. A communication strategy to enhance the profile and uptake of NPDUIS research within a broader stakeholder community is on the agenda for the Fall 2011 face-to-face meeting of the Steering Committee. In addition, in March 2011, the Board approved a Non-Industry Stakeholder Engagement Policy in an effort to develop and maintain ongoing engagement with non-industry stakeholders.8 The Policy and subsequent engagement plan is aimed at fostering awareness of the PMPRB’s reporting role among non-industry stakeholders. In 2011-2012, the PMPRB will revise the approach and style of its E-Bulletin and begin publishing Analysis Briefs (one or two page high-level summaries of recent research analyses undertaken by the PMPRB). These Briefs will summarize the most important or interesting findings and will be disseminated electronically to stakeholders. |

||

| Priority: Strengthen internal capacity of Board Staff and the Board by staffing vacant positions. | Type1:New | Strategic Outcome and/or Program Activity(ies): The PMPRB has only one Strategic Outcome (SO) and all priorities are linked to that SO. This priority is linked to PA 1 and 2. |

|---|---|---|

|

Status: Met All The PMPRB, like most small organizations, has difficulty attracting and retaining highly specialized subject matter experts. It is essential that human resource planning and business planning remain in alignment through regular reviews of resourcing plans in order to ensure capacity to carry out all program activities. Throughout 2010-2011 Human Resources plans were discussed regularly at Management Committee and formal reviews were conducted quarterly. Capacity in the Human Resources area was enhanced to ensure operational staffing activities were equipped to support evolving organizational needs. Staffing of positions provided through increased funding in 2008-2009 was completed with the exception of those identified to remain vacant to address the recent government-wide cost containment measures. A new Executive Director joined the PMPRB in September 2010 and a new Chairperson and Vice-Chairperson were appointed by the Governor-in-Council in March 2011. |

||

| Priority: Develop and implement IM plans and policies that will enhance capabilities to meet operational and reporting needs for information. | Type1: New | Strategic Outcome and/or Program Activity(ies): The PMPRB has only one Strategic Outcome (SO) and all priorities are linked to that SO. This priority is linked to PA 1 and 3. |

|---|---|---|

|

Status: Met All In 2010-2011, the PMPRB staffed a more senior level information management position to provide IM policy capacity, formulate longer-term plans and begin the introduction of technology improvements. The PMPRB also undertook a review of the Government of Canada information management policies and guidelines to ensure that it was compliant; provided information management training to staff; and selected two new systems to assist with the management of corporate records. An electronic document management solution is in the process of being implemented, with a pilot scheduled for introduction in the Corporate Services Branch in the coming Fiscal Year. In addition, software was purchased to facilitate the management of documents related to the PMPRB’s adjudicative function; roll-out of this software is scheduled for the summer of 2011. A review of Access to Information and Privacy (ATIP) policies and procedures will be initiated upon implementation of the electronic document management solution. |

||

| Priority: Prepare for evaluation of Compliance and Enforcement Program in 2011-2012. | Type1: New | Strategic Outcome and/or Program Activity(ies): The PMPRB has only one Strategic Outcome (SO) and all priorities are linked to that SO. This priority is linked to PA 3. |

|---|---|---|

|

Status: Met All As part of its commitment to transparency and ensuring value in the expenditure of public funds, the PMPRB committed to undertake an evaluation to assess the extent to which the supplementary resources provided in 2008-2009 have helped the PMPRB achieve its strategic objective of protecting Canadians and their health care system from excessive pricing for patented drug products sold in Canada and informing them on pharmaceutical trends. In 2010-2011, the PMPRB finalized a performance measurement strategy framework (PMSF) which was expanded to include its second Program Activity – Pharmaceutical Trends Analysis. The strategy includes an evaluation framework including performance indicators, data sources and data collection methods. Branches have begun collecting data to meet the reporting requirements and contribute to internal performance tracking. Good data on the performance of the program activities will assist managers in guiding resources to where they will be best used. An evaluation of the entire program is scheduled to take place during the last two quarters of 2011-2012. |

||

Risk Analysis

In 2005-2006, the PMPRB initiated a comprehensive review of its Guidelines, including consultations with key stakeholders as required by the Patent Act (Act). This review concluded with the release of the Board’s new Excessive Price Guidelines in June 2009. The implementation date for the new Guidelines was January 1, 2010

As anticipated, the PMPRB has experienced some challenges related to the operationalization of the revised Guidelines. During the implementation phase, certain areas of the new Guidelines were identified as requiring clarification and/or further discussion. In response, the Board has been quick to clarify the interpretation and application of the Guidelines and to adopt approaches to facilitate efficient implementation of the new elements of the Guidelines. Communiqués, NEWSletter articles and face-to-face workshops (“outreach sessions”) have been used throughout this period to improve understanding of and compliance with the revised Guidelines. In addition, a working group9 which included external members was formed to develop guidance with respect to the “DIP methodology”.10

In March 2011, the Board also approved the Monitoring and Evaluation Plan for the Major Changes in the Guidelines which is intended to be an internal management tool that will assist the Board in assessing the impact and application of major changes to the Guidelines. These impacts may not be immediately apparent because of the lag time between implementation and reporting by patentees, and the fact that it may take several reporting periods before any discernable trends become evident. As a result, the impact of the new Guidelines will continue to be closely monitored and assessed, which will allow adjustments and changes to be made as needed, and Board Staff will report annually to the Board at its fall meeting (beginning in October 2011).

Efficiencies have been adopted in the price review process to address workload demands. The number of investigations started in 2010-2011 has decreased in comparison to the last reporting period. The Board has noted changes in distribution and pricing models that have presented, and can be expected to continue to present, challenges to the current regulatory framework and Guidelines. Over this past period, the Board has become concerned that the high prices of certain new drug products may call into question whether or not current approaches to introductory price reviews are effective. The Board will continue to evaluate its program and the results it achieves.

As anticipated, in 2010-2011, adjudication matters before the Board have focused on the scientific and price issues related to brand name patented drug products. However, some have also centred on the breadth of the Board’s jurisdiction vis-a-vis the definition of a “patentee” and whether certain activities are considered to be sales in Canada. While proceedings before the Board are time sensitive, resource intensive, and require dedication and thoughtful deliberation, they also provide patentees with an opportunity to be heard by the Board on issues vital to their operations. In 2010, the Board issued one Notice of Hearing with respect to a failure to file, decisions and/or orders which effectively completed three hearings, and a Supplementary Order to a prior decision. 11

In recent years more Board proceedings seem to be resulting in judicial review applications before the Federal Court and the Federal Court of Appeal. While judicial reviews ultimately provide both the Board and patentees with clarification on key legal issues, they challenge the PMPRB’s resources (both financial and human). In January 2011, the Supreme Court of Canada upheld the Board’s decision that the PMPRB has jurisdiction over patented drug products sold through Health Canada’s Special Access Programme.12 As at March 31, 2011 the PMPRB had one Board decision before the Federal Court; the Federal Court decision was released on July 12, 2011. As a result of the inherent complexity of the Board’s jurisdiction, it is expected that patentees will continue to make applications to the Federal Court and the Federal Court of Appeal in areas where the Board’s jurisdiction is not clearly defined in legislation and/or precedents.

The PMPRB, much like other small organizations, has difficulty attracting and retaining highly specialized subject-matter experts and engaging new staff in a timely manner. In an effort to address these challenges, the PMPRB has aligned its human resource planning and business planning and, in so doing, has remained responsive to operational priorities and staffing needs. The PMPRB’s integrated business and human resources planning framework ensures the identification, review and documentation of human resources requirements on a quarterly basis, and frequent review of the status of staffing activities. Furthermore, to address the expected departure due to retirement of experienced and knowledgeable staff, the PMPRB has identified succession planning as a key management priority for the 2011-2012 fiscal year.

Summary of Performance

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| $12,181.6 | $12,623.5 | $9,470.7* |

* The variance between Total Authorities and Actual Spending is due to a lapse of $2.3 million from the Special Purpose Allotment (SPA) and a lapse in salaries as a result of not being fully staffed. The SPA can only be used to cover the costs of public hearings such as, external legal counsel, expert witnesses, etc. Any unspent amount is returned to the Consolidated Revenue Fund (CRF).

| Planned | Actual | Difference |

|---|---|---|

| 76.0 | 66.7 | 9.3* |

* The variance between Planned and Actual FTE utilization is due to delays in finding skilled professionals, an increased number of employees on maternity leave and a decision to manage the risk of increasing salary costs by not staffing some positions.

| Performance Indicators | Targets | 2010-11 Performance |

|---|---|---|

| Canada’s prices on average are in line with the seven comparator countries listed in the Regulations. | Canada’s prices on average are at or below the median of international prices. |

In 2010, Canada’s prices were on average slightly less than the median of international prices.13 Further information is available in the PMPRB’s Annual Report 2010, Comparison of Canadian Prices to Foreign Prices |

| (000's) Program Activity |

2009-10 Actual Spending |

2010-11 | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total14 Authorities |

Actual Spending |

|||

| Compliance and enforcement of non-excessive prices for patented drug products | $4,724.2 | $7,648.8 | $7,648.8 | $7,041.7 | $4,232.0 | Healthy Canadians |

| Pharmaceutical trends reporting | $670.7 | $1,624.8 | $1,624.8 | $1,307.9 | $890.4 | |

| Total | $5,394.9 | $9,273.6 | $9,273.6 | $8,349.6 | $5,122.4 | |

| Program Activity | 2009-10 Actual Spending |

2010-11 | |||

|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total15 Authorities |

Actual Spending |

||

| Internal Services | $3,704.9 | $2,908.0 | $2,908.0 | $4,273.9 | $4,348.3 |

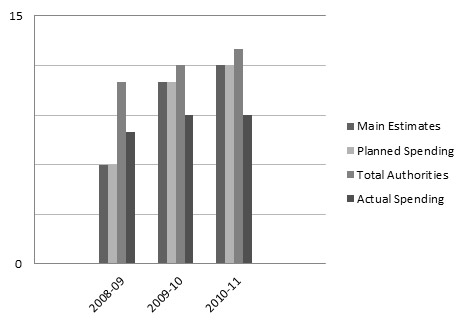

Expenditure Profile

Treasury Board Submission 834516, approved in September 2008, gave the PMPRB the authority to include an item in the Supplementary Estimates B in the amount of $4.7 million (excluding EBP), in addition to the core A-base of $5.8 million, to enable the PMPRB to meet its workload pressures and continue ongoing initiatives related to the delivery of its mandate. Reference levels were increased in Vote 35 (Program expenditures) by $5.6 million for 2009-2010, $6.2 million for 2010-2011, and $5.8 million for 2011-2012 and future years (including EBP and excluding Public Works and Government Services Canada accommodation charges).

The PMPRB’s funding includes a Special Purpose Allotment (SPA) to conduct Public Hearings, in Vote 35 (Program expenditures) of $3.1 million. The SPA can only be used to cover the costs of public hearings such as, external legal counsel, expert witnesses, etc. Any unspent amount is returned to the Consolidated Revenue Fund (CRF).

In 2010-2011, the PMPRB is reporting expenditures of $9.5 million. There were fewer hearings than anticipated in due in part to the submission of VCUs. As a result, the PMPRB lapsed $2.3 million from the SPA.

In addition, the PMPRB lapsed $0.7 million of its operating budget which does not include $0.3 million for paylist expenditures that organizations were asked to cash manage as a result of the dissolution of Parliament. The PMPRB was able to include this amount in the calculation of its Operating budget carry forward. The total lapse of 1.0 million was due to vacant positions, some positions being staffed late in the fiscal year and an increased number of employees on maternity leave.

Departmental Spending Trend ($ millions)

Estimates by Vote

For information on our organizational votes and/or statutory expenditures, please see the 2010–11 Public Accounts of Canada (Volume II) publication. An electronic version of the Public Accounts is available at http://www.tpsgc-pwgsc.gc.ca/recgen/txt/72-eng.html.

Section II : Analysis of Program Activities by Strategic Outcome

Performance Status Legend

Exceeded: More than 100 per cent of the expected level of performance (as evidenced by the indicator and target or planned activities and outputs) for the expected result identified in the corresponding RPP was achieved during the fiscal year.

Met All: 100 per cent of the expected level of performance (as evidenced by the indicator and target or planned activities and expected outputs) for the expected result identified in the corresponding RPP was achieved during the fiscal year.

Mostly Met: 80 to 99 per cent of the expected level of performance (as evidenced by the indicator and target or planned activities and expected outputs) for the expected result identified in the corresponding RPP was achieved during the fiscal year.

Somewhat Met: 60 to 79 per cent of the expected level of performance (as evidenced by the indicator and target or planned activities and outputs) for the expected result identified in the corresponding RPP was achieved during the fiscal year.

Not Met: Less than 60 per cent of the expected level of performance (as evidenced by the indicator and target or planned activities and outputs) for the expected result identified in the corresponding RPP was achieved during the fiscal year.

Strategic Outcome

Canadians and their health care system are protected from excessive pricing for patented drug products sold in Canada and are informed on pharmaceutical trends.

Program Activity 1:

Compliance and enforcement of non-excessive prices for patented drug products

Program Activity 1 Description:

The Patented Medicine Prices Review Board (PMPRB) is responsible for regulating the prices that patentees charge for patented drug products sold in Canada for human and veterinary use. Through this program activity, the PMPRB reviews the prices that patentees charge for patented drug products, based on the price review factors in the Patent Act, to ensure that these prices are not excessive. In the event that the Board finds, following a public hearing, that a price is excessive in any market, it may order the patentee to reduce the price and take measures to offset any excess revenues it may have received as a result of excessive prices.

| Planned Spending |

Total Authorities16 |

Actual Spending |

|---|---|---|

| $7,648.8 | $7,041.7 | $4,232.0 |

| Planned | Actual | Difference |

|---|---|---|

| 44 | 37.0 | 7.0 |

| Expected Results |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Prices charged by patentees for patented drug products in Canada are not excessive according to the factors of the Patent Act. | Percentage of patented drug products that are within the Guidelines | 95% of patented drug products are within the Guidelines. | Mostly met |

Performance Summary and Analysis of Program Activity 1

The Compliance and Enforcement Policy provided for the Board to establish criteria for identifying cases for investigation. The criteria balance the need for pricing flexibility on the part of patentees with the PMPRB’s mandate of protecting consumers by ensuring that the prices of patented drug products are not excessive. In accordance with Schedule 5 of the old Compendium – Criteria for Commencing an Investigation17, a price was considered to be within the Guidelines unless it met the criteria for commencing an investigation.

With the introduction of the revised Guidelines, the Policy for When a Price May be Considered Excessive was incorporated. In summary, the policy states that if the patentees price exceeds the Maximum Average Potential Price or National Non-Excessive Average Price, but does not trigger the criteria for commencing an investigation18, the price of the patented drug product will be reported on the PMPRB website as “Does Not Trigger Investigation” not “Within the Guidelines” as in the past.

As a result of this change reporting on this performance indicator presents a challenge. Under the revised Guidelines only 79.8% of the prices of new and existing patented drug products are within the Guidelines. However, under the old Guidelines 91% of the prices of new and existing patented drug products in 2010 would be considered to be within the Guidelines as compared to 89.5% compliance in 2009.

In conclusion, both calculations result in a performance status of “Mostly Met”.

Lessons Learned

While both calculations result in a performance status of “Mostly Met”, the difference in the rate of compliance is significant. As a result the PMPRB will need to review its target for this indicator in 2011-2012.

Program Activity 2:

Pharmaceutical trends reporting

Program Activity 2 Description:

Through this program activity, the PMPRB provides analysis of pharmaceutical price trends and research and development spending by pharmaceutical patentees. It also provides critical analyses of price, utilization and cost trends for prescription drugs, and information on non-patented prescription drug prices. The PMPRB reports on these analytical studies and its price review and enforcement activities as they relate to excessive pricing for patented drug products, annually to Parliament through the Minister of Health.

| Planned Spending |

Total Authorities19 |

Actual Spending |

|---|---|---|

| $1,624.8 | $1,307.9 | $890.4 |

| Planned | Actual | Difference |

|---|---|---|

| 13.0 | 7.4 | 5.6 |

| Expected Results |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Stakeholders are more aware of pharmaceutical trends and cost drivers. |

Number of requests for PMPRB publications Number of presentations by PMPRB at external meetings |

5% increase in requests over previous year 10 events per year |

See Lessons Learned – page 20 Exceeded |

Performance Summary and Analysis of Program Activity 2

All PMPRB publications, including studies, Board decisions and reference documents, are available on the PMPRB’s website. The PMPRB has focussed its efforts on increasing the visibility of its website through a comprehensive review and update of the site architecture and its content. The review introduced a monitoring system that measures access to Web pages, with a view to enabling a more focussed approach to the changes being made. The new architecture will be presented to management for approval early in 2011-2012, enhancements are proceeding and the launch of the enhanced site is scheduled for September 2011. A more user-friendly website, in conjunction with the implementation of the Board’s new Stakeholder Engagement Strategy, will enhance all PMPRB external communication activities, increasing general awareness of its role and overall activities, including pharmaceutical trends and information on pharmaceutical cost drivers.

In addition, the PMPRB has stepped up publication of its reports and studies under the National Prescription Drug Utilization Information System (NPDUIS). On December 15, 2010, the PMPRB released four new analytical reports:

- Use of the World Health Organization Defined Daily Dose in Canadian Drug Utilization and Cost Analyses (PDF)

- Baby-Boomer Effect on Prescription Expenditures and Claims (PDF)

- Generic Drugs in Canada: Market Structure — Trends and Impacts (PDF)

- Generic Drugs in Canada: Price Trends and International Price Comparisons, 2007(PDF)

These reports and future reports will contribute to informed decision-making in the pharmaceutical area.

In 2010-2011, the PMPRB participated in 20 external events and addressed a variety of audiences, including the PMPRB’s main stakeholders: patentees, provinces, third party payers and patient advocacy groups. The PMPRB also explored new mediums, including videoconference and webinar, to reach a greater number of stakeholders.

Lessons Learned

Stakeholders rely on the PMPRB website to access information with, on average, 13,000 visitors per month. It is likely that requests for printed publications will continue to decrease due to the enhanced accessibility of the website. As a result this indicator will need to be reviewed in the near future.

Program Activity 3:

Internal Services

Program Activity 3 Description:

Internal Services are groups of related activities and resources that are administered to support the needs of programs and other corporate obligations of an organization. These groups are: Management and Oversight Services; Communications Services; Legal Services; Human Resources Management Services; Financial Management Services; Information Management Services; Information Technology Services; Real Property Services; Materiel Services; Acquisition Services; and Travel and Other Administrative Services. Internal Services include only those activities and resources that apply across an organization and not to those provided specifically to a program.

| Planned Spending |

Total Authorities20 |

Actual Spending |

|---|---|---|

| $2,908.0 | $4,198.3 | $4,348.3 |

| Planned | Actual | Difference |

|---|---|---|

| 19.0 | 22.3 | (3.3) |

Performance Summary and Analysis of Program Activity 3

This program activity continued to be devoted largely to ongoing activities designed to support program areas in the provision of their programs. Highlights of the Internal Services program activity over the planning period include:

- the continued re-development of the Compliance Database containing drug product pricing information in support of the compliance and enforcement functions of the PMPRB;

- the appointment by the Governor in Council of Board members to fill the positions of Chairperson and Vice-Chairperson;

- completing a review of the Government of Canada information management policies, training staff in information management, and selecting two new software systems to assist with the management of corporate records; and

- the finalization and approval of a Performance Measurement Strategy Framework both of the PMPRB’s program activities, including a Program Evaluation Framework for the Pharmaceutical Trends Analysis Program.

Section III : Supplementary Information

Financial Highlights

| % Change | 2010–11 | 2009–10 | |

|---|---|---|---|

| Total Assets | (284.7%) | $884.3 | $3,402.0 |

| Total Liabilities | (95.9%) | $2,359.9 | $4,622.3 |

| Equity of Canada | 17.3% | ($1,475.5) | ($1,220.2) |

| (284.7%) | $884.3 | $3,402.0 |

| % Change | 2010–11 | 2009–10 | |

|---|---|---|---|

| Total Expenses | 6.4% | $10,900.8 | $10,205.8 |

| Total Revenues | (4.0%) | $23,272.6 | $24,204.6 |

| Net Cost of Operations | (12.4%) | ($12,371.8) | ($13,908.8) |

The Patented Medicine Prices Review Board (PMPRB) entered the 2010-2011 year with stable funding commensurate with its projected workload pressures.

Primary attention was given to critical activities such as the conduct of more complex and numerous price reviews, investigations and hearings and the implementation and monitoring, on an ongoing basis of the application and impact of the major changes made to the Guidelines.

Effort was dedicated to the re-development of the mission-critical database. The new database is now being rigorously tested and employees have been trained.

The financial highlights presented within this Department Performance Report are intended to serve as a general overview of the PMPRB’s financial position and operations.

Financial Statements

The Board’s financial statements can be found on the Board’s Web site at http://www.pmprb-cepmb.gc.ca/english/View.asp?x=118.

List of Supplementary Information Tables

All electronic supplementary information tables listed in the 2010-11 Departmental Performance Report can be found on the Treasury Board of Canada Secretariat’s website at: http://www.tbs-sct.gc.ca/dpr-rmr/2010-2011/index-eng.asp.

- Sources of Respendable and Non-Respendable Revenue

- Green Procurement

- Upcoming Evaluations Over the Next Three Fiscal Years

Section IV : Other Items of Interest

Organizational Contact Information

The Patented Medicine Prices Review Board

Box L40

Standard Life Centre

333 Laurier Avenue West

Suite 1400

Ottawa, Ontario K1P 1C1

Telephone: (613) 952-7360

Toll-free no.: 1-877-861-2350

Facsimilie: (613) 952-7626

TTY: (613) 957-4373

Email: pmprb@pmprb-cepmb.gc.ca

Website: www.pmprb-cepmb.gc.ca

Additional Information (if applicable)

PMPRB Annual Report 2010 (http://www.pmprb-cepmb.gc.ca/english/view.asp?x=91)

Quarterly NEWSletter (http://www.pmprb-cepmb.gc.ca/english/View.asp?x=287&mp=68)

Patentee’s Guide to Reporting (http://www.pmprb-cepmb.gc.ca/english/view.asp?x=146)

Compendium of Guidelines, Policies and Procedures, June 2009 (implementation January 1, 2010) http://www.pmprb-cepmb.gc.ca/english/View.asp?x=1206&mp=808

(http://www.pmprb-cepmb.gc.ca/english/view.asp?x=1034)

Compendium of Policies, Guidelines and Procedures, March 2008 (http://www.pmprb-cepmb.gc.ca/english/view.asp?x=1034)

Patent Act (http://laws.justice.gc.ca/en/P-4/index.html)

Patented Medicines Regulations (http://laws.justice.gc.ca/en/P-4/SOR-94-688/index.html)

1Type is defined as follows: Previously committed to—committed to in the first or second fiscal year before the subject year of the report; Ongoing—committed to at least three fiscal years before the subject year of the report; and New—newly committed to in the reporting year of the DPR.

2April 2010 – International Therapeutic Class Comparison Test;

October 2010 – Direction of the Board on the Application of the Policy on Use of Patented and Non-Patented Drug Products in the Price Tests; under, The Guidelines - Update

October 2010 – Clarification of the Offset of Excess Revenues; under, The Guidelines – Update, and

January 2011 – Existing Patented Drug Products Subsequently Sold by Another Patentee.

3 Outreach sessions were held in Montreal and Toronto in March 2011; a total of 72 patentees/consultants attended.

4 More detailed information on the Guidelines concerning the DIP Methodology and “Any Market”Price Reviews can be found in Schedule 10 and 12 of the Compendium of Policies, Guidelines and Procedures respectively.

5 The PMPRB hosted a Webinar in April 2011 to present the recommendations of the DIP Methodology Working Group to interested stakeholders.

6 With the adoption of the 1987 amendments to the Act, Canada’s Research Based Pharmaceutical Companies (Rx&D) made a public commitment to increase their annual R&D expenditure to 10% if sales revenue by 1996 - as published in the Regulatory Impact Assessment Statement (RIAS) of the Patented Medicines Regulations, 1988, published in the Canada Gazette, Part II, Vol. 122, No. 20 – SOR/DORS/88-474

7 The NPDUIS Steering Committee is comprised of representatives of participating public drug plans (all jurisdictions except Quebec) and Health Canada.

8 Non-industry stakeholders include: consumer groups, patient advocacy groups, disease groups/associations, health care groups/associations, health care professionals and associations, provincial/territorial ministers of health, public drug plans, private payers, and academics.

9 The final report of the working group was presented to the Board at its quarterly meeting on March 4, 2011 and is available on the PMPRB Web site: www.pmprb-cepmb.gc.ca, under Consultations, DIP Methodology Technical Working Group.

10 More detailed information on the Guidelines concerning the DIP Methodology can be found in Schedule 10 of the Compendium of Policies, Guidelines and Procedures. The Compendium is available on the PMPRB Web site: www.pmprb-cepmb.gc.ca, under Legislation, Regulations and Guidelines

11 For more information on the Hearings and the Board Decisions refer to the Voluntary Compliance Undertakings and Hearings section of the PMPRB’s 2010 Annual Report which is available on the PMPRB’s Web site: www.pmprb-cepmb.gc.ca

12 The Supreme Court of Canada Decision – Celgene Corporation v. Attorney General of Canada http://www.scc-csc.gc.ca/case-dossier/cms- sgd/sum-som-eng.aspx?cas=33579

13 This is based on a sales-weighted arithmetic average of individual median-international-to-Canadian price ratios.

14 The variance between Planned Spending and Total Authorities is due to the fact that all EBP expenses were included in the Total Authorities for Internal Services.

15 The Total Authorities for Internal Services include the EBP expensed for the Compliance and enforcement of non-excessive prices for patented drug products of $606.9K and the Pharmaceutical trends reporting programs of $316.9K and the carry-forward amount of $393.4 K.

16 The variance between Planned Spending and Total Authorities is due to the fact that all EBP expenses were included in the Total Authorities for Internal Services.

17 For more in depth information on the Criteria for Commencing an Investigation prior to January 1, 2010, refer to the Compendium of Guideline, Policies and Procedures “up to 2009”, Schedule 5

18 For additional information on the Policy for When a Price May be Considered Excessive, refer to the Compendium of Guideline, Policies and Procedures, - June 2009, Part B – Policies, Para. B.5

19 The variance between Planned Spending and Total Authorities is due to the fact that all EBP expenses were included in the Total Authorities for Internal Services.

20 The Total Authorities for Internal Services include the EBP expensed for the Compliance and enforcement of non-excessive prices for patented drug products of $606.9K and the Pharmaceutical trends reporting programs of $316.9K and the carry-forward amount of $393.4 K.