ARCHIVED - Canada Revenue Agency - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2010-11

Departmental Performance Report

Canada Revenue Agency

The original version was signed by

The Honourable Gail Shea, P.C., MP

Minister of National Revenue

Table of Contents

Message from the Commissioner and Chief Executive Officer

- Our raison d’être

- Responsibilities

- Strategic outcome(s) and program activity architecture (PAA)

- Organizational priorities

- Risk analysis

Section II: Analysis of program activities by strategic outcome

- Taxpayer and business assistance (PA1)

- Assessment of returns and payment processing (PA2)

- Accounts receivable and returns compliance (PA3)

- Reporting compliance (PA4)

- Appeals (PA5)

- Benefit programs (PA6)

- Internal services (PA7)

- Canada’s Economic Action Plan Initiatives

Section III: Supplementary Information

Section IV: Other Items of Interest

Message from the Minister

Most Canadians give little thought to tax collection, other than at tax time each spring, yet every day the work of the Canada Revenue Agency (CRA) has a direct impact on our lives and livelihoods. Governments across Canada depend on the CRA to collect revenue needed to pay for a vast range of social and economic programs and benefits that sustain our high standard of living and quality of life.

Through its unparalleled service to Canadians, the CRA helps us understand and meet our tax responsibilities. Along with firm enforcement measures that discourage non-compliance, such as those aimed at individuals and businesses participating in the underground economy or attempting to avoid taxes through aggressive tax planning, the CRA works to ensure that everyone pays their fair share. Protecting Canada’s revenue base is particularly important in these economically challenging times, when governments must exercise fiscal restraint while continuing to meet the needs and expectations of Canadians.

The Government of Canada is committed to helping hard-working Canadians save money wherever they can. We have introduced important new tax relief measures under the next phase of our Economic Action Plan. These measures, aimed at individuals, families and businesses, include the Children's Arts Tax Credit, the Working Income Tax Benefit, the Canada Employment Credit, the First Time Home Buyers Tax Credit, and the Volunteer Firefighter Tax Credit. Thanks to these and ongoing tax relief programs, the average family of four now receives $3,000 in extra tax savings. In fact, the federal tax burden is at an all-time low in Canada, the lowest level in more than a half a century. I encourage people to visit the CRA Web site to learn more about these tax savings so they can take full advantage of them.

The CRA Departmental Performance Report 2010‑2011 highlights the many ways the organization is constantly improving, evolving and expanding its core business to secure the ongoing economic and social well-being of Canadians. Since being named Minister of National Revenue, I have had the pleasure to witness this progress for myself. The CRA consistently demonstrates that it is a world-class tax and benefit administrator that provides value to its government clients, and a fair and accessible revenue collector in whom Canadian taxpayers can confidently put their trust.

As Minister of National Revenue, I am pleased to present the Departmental Performance Report 2010‑2011 for tabling.

Message from the Commissioner and Chief Executive Officer

The Canada Revenue Agency (CRA) makes a major contribution to Canada’s economy and the social well-being of Canadians. We administer taxes for federal, provincial, territorial, and First Nations governments, and also help to advance governments’ social goals through our administration of benefit programs that increase the standard of living of many Canadians. Our reputation as a world-class tax and benefits administration is well-earned and we are proud of our accomplishments over the past year.

During 2010-2011, the CRA continued to focus on ensuring the integrity of Canada’s tax and benefits systems through initiatives designed to promote compliance with tax legislation, to strengthen services for individuals and business to make compliance easier, and to put in place ways that make non-compliance more difficult. Our work to expand outreach to selected groups of Canadians through electronic means is an important step toward improved voluntary compliance while increased opportunities for taxpayers to interact with the CRA through electronic means is a way that we are strengthening our services. To ensure that individuals were aware of, and could apply or register for, their entitlements to benefits and credits, we ensured that taxpayers had access to information they needed.

To make non-compliance more difficult, we undertook actions to counter aggressive tax planning schemes and underground economic activity. Among our most notable achievements this past year was our timely and efficient implementation of the Harmonized Sales Tax (HST) for the provinces of Ontario and British Columbia. The CRA will continue to administer the HST in BC until the transition back to GST in that province. Another noteworthy undertaking during 2010-2011 was our participation in an international tax benchmarking exercise, which saw selected CRA results compared with nine other Western tax administrations. This study revealed that the CRA has in place many of the leading practices in tax administration, and is often in the top ranking for cost effectiveness. I was particularly pleased to see that the CRA’s debt collection function achieved top results. We will carefully review opportunities revealed to further enhance our effectiveness.

As we move forward, we are cognizant of the evolving economic environment; in particular, the government’s priority to restore budgetary balance, in part by asking all federal government departments and agencies to contain costs. We have set in motion a plan to respond quickly and responsibly to this directive in order to maintain our core business while making prudent investments to sustain our operations over the longer term.

I would like to extend my sincere thanks for the dedication, knowledge, and professionalism of the staff of the CRA, qualities that will enable us to continue to deliver quality results that matter to Canadians.

Section I: Agency overview

Our raison d’être

Canada’s tax system is based on voluntary compliance and self-assessment. A well-functioning tax system is critical to the ability of federal, provincial, territorial, and First Nation governments to deliver programs and services that are important to Canadians and Canadian businesses.

The Canada Revenue Agency (CRA) has the mandate to administer tax, benefit, and other programs on behalf of the Government of Canada and provincial, territorial, and First Nations governments.

Parliament created the CRA so we could meet the mandate by:

- providing better service to Canadians;

- offering more efficient and more effective delivery of government programs; and

- fostering closer relationships with provinces and other levels of government for which the CRA delivers programs, and providing better accountability.

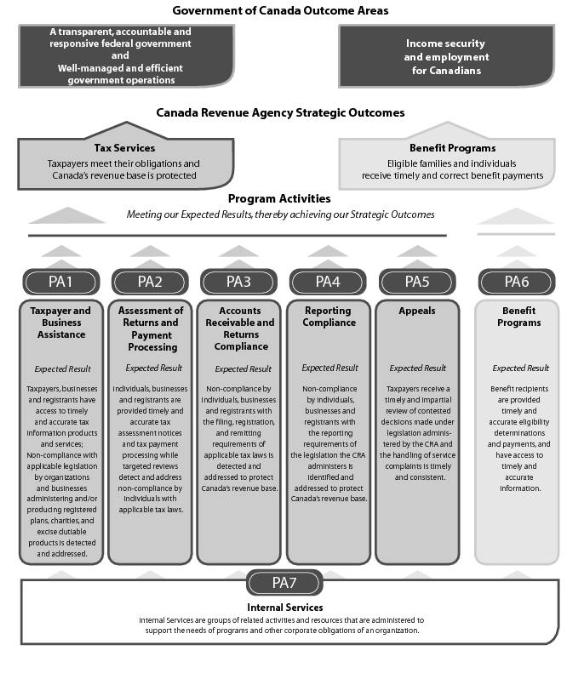

The CRA’s mandate reflects the broad role that the CRA plays in the lives of Canadians. The CRA contributes to three of the Government of Canada’s outcome areas:

- A transparent, accountable and responsive federal government;

- Well-managed and efficient government operations; and

- Income security and employment for Canadians.

Responsibilities

The CRA exercises its mandate within a framework of complex laws enacted by Parliament, as well as by provincial and territorial legislatures.

No other public organization touches the lives of more Canadians on a daily basis. Each year, we collect billions of dollars in tax revenue and deliver income-based benefits, credits, and other services that help families and children, low- and moderate-income households, and persons with disabilities. These programs contribute directly to the economic and social well-being of Canadians.

The following two strategic outcomes summarize our contribution to Canadian society.

- Taxpayers meet their obligations and Canada’s revenue base is protected; and

- Eligible families and individuals receive timely and correct benefit payments.

In July 2010, the CRA implemented the harmonized sales tax (HST) in Ontario and British Columbia Footnote 1.

The CRA also verifies taxpayer income levels in support of a wide variety of federal, provincial, and territorial programs, ranging from student loans to health care initiatives. In addition, we provide other services, such as the Refund Set-Off Program, through which we aid other federal agencies and departments, as well as provincial and territorial governments, in the collection of debts that might otherwise become uncollectible.

Strategic outcome(s) and program activity architecture (PAA)

Organizational priorities

The CRA is responsible for administering, assessing, and collecting billions of dollars in taxes annually. We deliver tax services and benefit programs that support the economic and social well-being of Canadians, including families and children, low- and moderate income households, and persons with disabilities.

The CRA’s mandate sets out two strategic outcomes that summarize its contribution to Canadian society. The achievement of these outcomes demonstrates that we are fulfilling our mandate from Parliament.

We are continually evolving our strategic direction and refining our vision to meet challenges within our changing environment. We have increased our emphasis on mitigating risk factors which may impact our capacity to deliver services to Canadians.

We have introduced five overarching strategic elements to guide our work over the planning period. Our tax and benefit operational and management focus will be on building trust to promote compliance, strengthening service to make compliance easier, making non-compliance more difficult, making it easier to receive the right social benefits, and maintaining business sustainability.

The tables below links our priorities to the achievement of our strategic outcomes.

|

Type

Table note 1 |

||

|---|---|---|

|

We continually seek to build on the trust and confidence of our stakeholders in the CRA. Our objective is to make sure that Canadians have access to the information they need to voluntarily comply with Canada’s tax laws as well as impartial and timely review of contested decisions. We work to build and

maintain the trust and confidence of Canadians and our stakeholders through a range of activities and by treating their personal information confidentially. Our tax system works best when individuals and businesses believe that the CRA can be trusted to be fair, efficient, and impartial.

|

||

|

Type Table note 1

|

||

|---|---|---|

|

Type

Table note 1 |

||

|---|---|---|

|

Although instances of non-compliance are not frequent, they have a significant fiscal impact and erode the integrity of the tax and benefit system. We must continue to apply innovative strategies to remove the remaining opportunities for non-compliance.

Non-compliance is the failure, for whatever reason, to register as required under the law, file returns on time, report complete and accurate information to determine tax liability, and pay all amounts when due. It takes many forms, from errors and omissions to deliberate tax evasion. We are constantly assessing non-compliance risks and taking steps to focus

our resources on areas of highest risk in order to make non-compliance more difficult. Ensuring compliance with Canada’s tax and benefit legislation is essential to protecting Canada’s tax revenue.

|

||

|

||

|

Type

Table note 1 |

||

|---|---|---|

|

The CRA supports the efforts of federal, provincial, and territorial governments by administering benefits to families, low- and moderate-income households, and persons with disabilities. Our objective in administering benefits is to make sure that Canadians have access to the benefits and credits to which they

are entitled, and that related payments are timely and correct.

|

||

|

Type Table note 1

|

||

|---|---|---|

|

We must ensure that we have in place the modern and innovative management practices and sound infrastructure necessary to maintain the sustainability of the high-quality tax, benefit, and related services we deliver on behalf of governments across Canada.

We invest resources each year to make sure that we can comply with the accountability requirements of financial and administrative legislation, regulations, and government policies and directives, and to sustain and advance our core information technology (IT) functions, which are critical to the delivery of

all our programs. In addition, we use effective human resources practices that keep us competitive in the labour market.

|

||

|

||

- Table note 1

- Type is defined as follows: Previously committed to—committed to in the first or second fiscal year before the subject year of the report; Ongoing—committed to at least three fiscal years before the subject year of the report; and New—newly committed to in the reporting year of the DPR.

Risk analysis

The Enterprise Risk Management program is designed to effectively manage risks through a systematic and comprehensive approach that is methodically integrated into CRA’s decision-making, planning, and reporting processes.

An update to Our Corporate Risk Inventory 2009 was completed in 2010. The 2010 edition of the Inventory was developed by conducting interviews that provided a broad perspective on shifts in the internal and external environments that drove changes to the risks presented in the 2009 Inventory. The conclusion drawn from these interviews was that no significant changes to the enterprise risks have been identified that warrant additional action. Consequently, we are continuing to implement strategies for already identified risks requiring mitigation.

During 2010-2011, we consulted with national and international organizations from the public and private sectors as well as communities of expertise on leading practices. Based on our research findings, we adopted an improved enterprise risk management cycle. This multi-year approach will eliminate cycle overlap and process fatigue, provide a more horizontal outlook, and reduce inefficiencies while increasing the availability of more timely and relevant risk information.

Through an updated methodology and approach, we began the development of our Corporate Risk Profile 2011. We are using environmental scans, risk interviews and risk analysis to support risk responses and action plans. We have increased the level of risk management training throughout the organization, while improving the efficiency and content of our training programs. Additional work continues to develop a more agile and robust enterprise risk management regime.

Summary of performance

2010-2011 Financial resources (thousands of dollars)

|

Taxpayer and business assistance (PA1) Table note 2

|

||||||

|

Assessment of returns and payment processing (PA2) Table note 3

|

||||||

|

Benefit programs (PA6) Table note 4

|

||||||

|

Internal services (PA7) Table note 5

|

||||||

|

|

||||||

|

|

||||||

- Table note 2

- Includes the Softwood Lumber statutory disbursements ($205.5 million in 2009-2010 and $220.7 million in 2010-2011). Return to Table note 2 source text

- Table note 3

- Includes payments to the Ministère du Revenu du Québec for the administration of the Goods and Services Tax in that province ($148.4 million in 2009-2010 and $142.2 million in 2010-2011). Return to Table note 3 source text

- Table note 4

- Includes a) Relief for Heating Expenses (program announced in 2000) ($500.0 thousand in 2009-2010 and $4.0 thousand in 2010-2011); b) Energy Costs Assistance Measures expenses (program announced in the Fall of 2005) ($21.2 thousand in 2009-2010 and $4.7 thousand in 2010-2011); and c) Statutory Children’s Special Allowance payments ($215.3 million in 2009-2010 and $222.4 million in 2010-2011). Return to Table note 4 source text

- Table note 5

- For planning purposes, the budget for real property accommodations is shown in Internal Services, however, at year-end the actuals are attributed to all other program activities. Return to Footnote 5 source text

Expenditure profile

Canada’s Economic Action Plan

In 2010-2011, the CRA was provided with $9.6 million in action plan funding to administer the Home Renovation Tax Credit and First-Time Home Buyers Tax Credit. Additional monies were also provided for late filing and incorrect format penalties and for the simplification of GST/HST for the direct selling industry. These supplementary funds enabled the CRA to augment its capacity to deal satisfactorily with the increased information requirements presented by these initiatives.

Figure 1 Spending Trends

For the period 2006-2007 to 2010-2011, total spending amounts include all Parliamentary appropriations and revenue sources: Main Estimates, Supplementary Estimates, funding associated with the increased personnel costs of collective agreements, maternity allowances and severance payments, as well as funding to implement Federal Budget initiatives and the Agency’s carryforward adjustments from the prior year. It also includes spending of revenues received through the conduct of CRA’s operations pursuant to Section 60 of the Canada Revenue Agency Act, Children’s Special Allowance payments, payments to private collection agencies pursuant to Section 17.1 of the Financial Administration Act and disbursements to the provinces under the Softwood Lumber Products Export Charge Act, 2006.

Since 2006-2007 the Canada Revenue Agency’s reference levels have changed primarily as a result of: collective agreements/contract awards; policy and operational initiatives arising from various Federal Budgets and Economic Statements; transfers from the Department of Public Works and Government Services Canada for accommodations and real property services; the Softwood Lumber Agreement; and the commencement of responsibilities related to the administration of corporate tax in Ontario and the harmonization of sales tax in Ontario and British Columbia. Over the same period, there have also been a number of decreases as a result of various government-wide budget reduction exercises.

Expenditures pursuant to the Agency’s Statutory Authorities have fluctuated over the course of the 2006-2007 to 2010-2011 period as a result of: adjustments to the Children’s Special Allowance payments for eligible children in the care of specialized institutions; adjustments to the rates for the contributions to employee benefit plans; increases to the spending of revenues received through the conduct of operations pursuant to Section 60 of the Canada Revenue Agency Act; the introduction from 2007-2008 to 2009-2010 of payments to private collection agencies pursuant to Section 17.1 of the Financial Administration Act; and finally, the introduction in 2006, and annual adjustments to, disbursements to the provinces under the Softwood Lumber Products Export Charge Act, 2006.

In 2010-2011, of the $4,596.7 million total authority, CRA’s actual spending totalled $4,418.5 million resulting in $178.2 million remaining unexpended at year-end. After deducting unused resources to be returned to the Treasury Board related to advertising campaigns, the remaining $178.0 million is available for use by the Agency in 2011-2012. This amount represents 3.9% of the total authority.

Authorities approved After Main Estimates

The following table details the additional authorities approved for the Agency after the tabling in Parliament of Main Estimates and reconciles with the Total Authorities shown here.

- Table note 6

- Numbers may not add due to rounding. Return to Table note 6 source text

Estimates by vote

For information on our organizational votes and/or statutory expenditures, please see the 2010-11 Public Accounts of Canada (Volume II) publication. An electronic version of the Public Accounts is available at

http://www.tpsgc-pwgsc.gc.ca/recgen/txt/72-eng.html.

Section II: Analysis of program activities by strategic outcome

Taxpayer and business assistance (PA1)

Strategic outcome

Taxpayers meet their obligations and Canada’s revenue base is protected.

Program activity description

Assisting taxpayers and businesses in meeting their obligations under the self‑assessment system through the provision of accurate and timely responses to their enquiries; information products through various media such as, Website, pamphlets and brochures; targeted outreach activities and services; income and commodity tax rulings and interpretations; Canada Pension Plan and Employment Insurance Act eligibility determinations; services relating to the registration of pension and other deferred income plans; and services relating to the registration of charities.

Performance summary and analysis of program activity

Building trust to promote compliance

Strengthen outreach

Our outreach programs and communications activities promote compliance by providing information and tools to reach our diverse audiences through a variety of formats and venues. During 2010-2011, our continued use of technology allowed us to connect with wider audiences efficiently and cost effectively, including those who live in remote locations. For example, we provided 6 distinct outreach groups with 48 video conferencing sessions. We delivered outreach sessions to a total of 28 distinct target groups such as small and medium enterprises, individual taxpayers, youth, newcomers to Canada, seniors, volunteers, people with disabilities, and Aboriginal communities.

In 2010-2011, work continued on furthering our outreach strategy. We developed an inventory of existing outreach products, gap analysis and recommendations. Based on these recommendations, work will continue to strengthen outreach. We also developed integrated outreach plans for taxpayer segments and responsible citizenship messaging.

A prime focus during 2010-2011 was the advent of the harmonized tax regimes in Ontario and British Columbia, which required targeted communications strategies and products to create awareness. A proactive multi-media approach was used to educate businesses. Interactive on-line seminars (webinars) were conducted. In addition, a series of short videos were produced and made available on the CRA Web site which provided information on various HST topics. Our communication and outreach activities are most often used to inform and assist individuals and businesses with ongoing programs and issues.

Optimize service delivery channels

Individuals and businesses often require information and services specific to their situations. Providing information alone is not sufficient to support the needs of Canadians. We strive to ensure that taxpayers can rely on our agent-assisted services including specialized 1-800 telephone numbers, technological interactive services such as Smartlinks, and in-person appointments to meet their information needs. Comprehensive automated telephone response systems provide service 24 hours a day, seven days a week. During regular business hours, we route calls among call centres as demand increases or decreases. This makes the most effective use of our resources, reduces costs, and provides extended hours of service for Canadians.

In 2010-2011, we met our caller accessibility targets of 90% for general and business enquires, despite a more than 7% increase in call demand on the business lines. This increase was largely due to enquiries related to the implementation of the Harmonized Sales Tax in Ontario and British Columbia as well as changes in mandatory electronic filing for GST/HST registrants. We also exceeded the 90% caller accessibility target for answering tier 1 charities enquiries.

We also work hard to ensure that the information we provide to taxpayers through our enquiries services is accurate. We make sure that agents have access to up-to-date training and online reference materials, including a newly developed service excellence training product, and use quality assurance techniques that provide ongoing, prompt feedback to our individual and business enquiries agents. This helps our agents to provide technically accurate responses to taxpayers’ questions.

We provide an array of user-friendly electronic services that help individuals and businesses to pay their taxes. Over the past year we made improvements to My Account based on our analysis of client needs. While electronic services can generate efficiencies for the CRA, they may also create a need to provide support and assistance to those who wish to take advantage of them. For instance, calls to the e-Services Helpdesk increased almost 15% over the previous year. Many of the calls were enquiries about the introduction of mandatory electronic filing for GST/HST registrants that came into effect on July 1, 2010. The introduction of the Credential Management System, which replaced the Government of Canada epass process for CRA services also contributed to the increase.

Enhance the Charities program

In 2010-2011, we continued to provide timely telephone and written responses to the charitable sector through our registration application processes, our call centers, and our written enquiries process. We offered 75 Charities Information Sessions to registered charities across Canada, with 96% of participants indicating they were satisfied or very satisfied with the sessions. We also delivered 17 webinars (a limited interactive environment in which dialogue can occur between participants and CRA representatives) to 2,164 individuals. When surveyed, 91% of participants indicated that they were satisfied or very satisfied.

We also enhanced the functionality of the Charities and Giving Web site by updating search tips, download instructions, links to definitions, and providing the latest available web and e-mail addresses of registered charities. There were over 1,700,000 visits to the Charities and Giving Web site, an increase of 14% over 2009-2010.

Making non-compliance more difficult

Implement an enhanced tobacco stamping regime

In 2010, Parliament passed legislative changes to implement a new tobacco stamping regime in Canada. The CRA responded immediately by developing the necessary framework of policies and procedures to manage the new tobacco stamping program. To ensure successful implementation, the CRA consulted regularly with stakeholders, including industry members. A detailed communication strategy was also developed that included industry outreach.

All implementation deadlines were met. We consider the successful execution of this initiative to be a very significant achievement.

Improve the detection and deterrence of non-compliance in our Charities program

Registered charities in Canada are tax-exempt and can issue charitable donation receipts to donors. To maintain these privileges, registered charities must operate within the parameters of the Income Tax Act. In cases of serious non-compliance, contraventions can result in the revocation of the registered charitable status of the organizations involved. The overall level of compliance by registered charities with the requirements of the Income Tax Act is determined based on an analysis of the results of random audits conducted annually. For the past three years, audit results show that the overall level of compliance has been stable and confirm that the vast majority of registered charities are complying with legal requirements. While some charities required education on mostly minor compliance issues, very few serious issues of non-compliance were noted. For the third consecutive year, less than 4% of random audits resulted in a revocation action against a charity. In 2009 (last year of complete data), 99% of registered charities filed an annual information return. 61% of registered charities filed within the required six months of fiscal year end, with the remaining 38% having been filed late. Based on returns filed to date, we anticipate a similar filing rate for 2010.

Continue implementing a risk-based approach to registered plans

In 2010-2011, we delivered outreach sessions on registered plans in Toronto, Montreal and Vancouver. We also published several bulletins and a guide to assist our clients in the administration of deferred income plans.

We continued our work on our registered plans compliance strategy. Once implemented, this strategy will enhance the risk-based approach to registered plans by providing accurate data for risk assessment. The strategy itself is currently in development. In the meantime, we continued to use a risk-based approach in registering pension plans, resulting in the inventory dropping below 10,000, representing an improvement on recent years.

Enhance the Tax-Free Savings Account program

The response to the TFSA has been overwhelmingly positive. At the end of 2009, there were approximately 4.8 million TFSA holders. That number rose to 6.7 million by the end of 2010. Given the program’s popularity, we anticipate continued and considerable growth in the number of holders in future years. To accommodate the increase, and to ensure timely updating of TFSA records, we are exploring ways to streamline our processing routines.

As part of the administration of the program, the CRA reviews information received from financial institutions and TFSA issuers to identify individuals who may have over-contributed. The results of these reviews showed that a small minority of Canadians, around 1.5% of all TFSA holders, did not fully understand the rules. We responded to this by:

- conducting public opinion research;

- improving the information on the CRA Web site; and,

- conducting Outreach with the financial industry.

In the second year of the program we saw a slight decrease, to 1.4%, in the proportion of TFSA holders who made excess TFSA contributions.

We continue to work to increase awareness of TFSA guidelines among Canadians and financial institutions. We will do so by continuing to update TFSA web pages, issue relevant Tax Tips, write community newspaper articles, and deliver webinars to financial institutions.

Lessons learned

What worked well: We improved the quality of our services to taxpayers by making them more timely, accessible, and easier to use. We maintained our high caller accessibility levels on all of our enquiries lines. Following the passage of legislation in the Parliament, we successfully implemented an enhanced tobacco stamping regime to aid in the detection of counterfeit products. We enhanced the functionality of the Charities and Giving Web site.

What could be improved: We must further pursue opportunities to enhance our service offerings to meet the evolving information needs to taxpayers, make sure that individuals and businesses are better able to navigate and understand an often-complex tax system, and be responsive and adaptive to emerging business practices and economic developments.

Performance report card

|

87% Table note 7

|

46.5% Table note 8

|

||||||

|

Percentage of general callers who reach our telephone service Table note 9

|

|||||||

|

Percentage of business callers who reach our telephone service Table note 9

|

|||||||

- Table note 7

- This became a service standard in 2006-2007. Prior year results reflect performance against an internal target. Return to Table note 7 source text

- Table note 8

- For more information on this result, please visit: http://www.cra-arc.gc.ca/gncy/nnnl/menu-eng.html Return to Table note 8 source text

- Table note 9

- The caller accessibility targets for general and business callers were raised from 80% in 2008-2009. Return to Table note 9 source text

Assessment of returns and payment processing (PA2)

Strategic outcome

Taxpayers meet their obligations and Canada’s revenue base is protected.

Program activity description

Processing and validating taxpayer returns for both individuals and businesses through initial assessment, validation, accounting, and adjustments; registering businesses for the Business Number, establishing, and maintaining accounts; and receiving payments.

Performance summary and analysis of program activity

Strengthening service to make compliance easier

Enhance our electronic services

We added features to My Business Account this past year to encourage businesses to perform certain transactions. One of the key new features has made it easier to transfer payments within a program account and between program accounts of the same nine digit business number, to make adjustments to GST/HST returns, and to make online requests for certain financial transactions. We also added an instalment payment calculator to our Web site in 2010‑2011 to make it easier for businesses to calculate their instalments for corporation and GST/HST accounts. Enhancements have been made to our Payroll Deductions Online Calculator, as well, to calculate payroll deductions more easily. The improvements include enhancements to screen displays, organization of tools, and information access. For GST/HST NETFILE, features were added so that registrants can now also file their Public Service Bodies’ Rebate at the same time as they electronically file their GST/HST Return.

A new option added to our Web site in 2010-2011 helps employers ensure that enough Canada Pension Plan contributions and Employment Insurance premiums have been withheld for full year employees. The growing number of log-ins to this Web page provides evidence that businesses see the benefits of using this online service.

We witnessed a 2.5% increase in self-service transactions by individual and business taxpayers, benefit recipients and/or their representatives from a year ago. This places us firmly on track to attain our objective of a 5% increase by 2012. The public appetite for online services has been increasing with electronic filing rates for individuals and businesses continuing to trend upwards. Our Quick Access online option continues to be a popular choice for taxpayers, as it provides information on their taxes and benefits, such as tax return status, RRSP deduction limit, TFSA contribution room, and the status of benefit payments. We have added even more services for TFSA administrators, their agents, or representatives, by including TFSA payment and a related search facility. We also increased the capacity for taxpayers requiring assistance to connect directly with enquiries agents from the My Business Account profile through the addition of Smartlinks.

In 2010-2011, we introduced important new measures to increase security. As one example, we implemented our own credential management service. These measures have lowered the overall cost, allowing the CRA to offer a broader suite of secure electronic services.

Promote the take-up of electronic filing and electronic payments

The timely and accurate processing of returns is another way to encourage voluntary compliance. We met our external service standards this past year for processing T1 individual returns in both paper and electronic formats, confirming that we provided timely service to Canadians. In addition, we met our internal processing target by processing 100% of the individual returns that were filed on time by mid-June 2010.

Despite the recent introduction of HST in Ontario and British Columbia, which significantly impacted the complexity of the GST/HST return and review process, we were able to process 90.3% of GST/HST returns within 30 days. Although we did not meet our 95% target, we are working to introduce additional efficiencies that will accelerate our processing times.

Our My Payment service lets individuals and businesses make payments electronically through a secure link with participating Canadian financial institutions that offer the Interac® Online payment service. We promoted the use of My Payment during 2010-2011 through outreach and promotional activities including news releases and other CRA announcements, mail-outs and conferences.

Our T1 Quality Evaluation Program reviews initial assessments of individual tax and benefit returns. It is our primary tool to determine the accuracy of individual returns assessed. Our results for 2010-2011 show that processing errors with an impact on a taxpayer’s refund or balance due was 1.17%. This compares with 0.96% the previous year. From 2000 through 2010, the amounts per error averaged $252.06.

Effectively manage business partnerships

We expanded the use of the Business Number (BN) this past year as a common client identifier for businesses to securely and efficiently interact with various levels of government. In December, 2010, the CRA and the Province of Saskatchewan signed a letter of intent to adopt the BN for their Corporate Registry in April, 2012. The wider use of the BN will reduce the administrative burden for both businesses and the CRA.

In July 2010, the CRA implemented the harmonized sales tax (HST) in Ontario and British Columbia Footnote 2. Harmonization involved a significant number of system enhancements and changes to CRA programs and activities.

A multi-media campaign to educate businesses and create public awareness was rolled out. It included interactive online seminars, short video presentations, in-person information sessions, and the distribution of over 1.1 million HST information sheets. Videos providing information on topics such as HST transitional rules, electronic filing, housing rebates, and forms for both businesses and consumers were posted on the CRA Web site and YouTube. Filing information was provided in several formats including inserts sent with GST/HST returns and webcasts on filing electronically using GST/HST NETFILE and how to identify the changes to GST/HST Rebates.

Making non-compliance more difficult

Optimize program efficiency and the accurate assessment of tax owed

The CRA strives to be fair in all aspects of its activities as this is crucial to sustaining taxpayers’ trust. When we find errors on tax returns, we correct them, if possible. While some errors result in additional tax owing, others mean taxpayers pay more tax than required. As part of our processing review, we compare an individual’s return to third-party information to identify areas where the taxpayer may have under-claimed credits. We adjust these returns to allow amounts the taxpayer is entitled to and, if applicable, issue a refund. In 2010-2011, we identified and corrected over 341,000 individual returns, resulting in an average beneficial adjustment of $284 per return.

Enhance our ability to detect and address non-compliance

Individuals

In 2010-2011, we estimated that 17.6% of claims or deductions made by individuals on key tax credits and deductions not subject to third-party reporting were non-compliant, meaning they were disallowed following a review. The increase may be attributed, among other factors, to the change in deductions and credits that were reviewed in each program year.

One of our pre-assessment review programs is the Confidence Validity Program. Through this program, various deductions and credits on returns are reviewed and corrected before a notice of assessment is issued. During 2010‑2011, we identified an average of $472 of additional tax assessed per review, for a total of almost $162 million in additional taxes assessed. This represents a decrease of 5% over the previous year.

Our Processing Review Program selects files for review after the assessment notice (and any refunds) have been issued. The program promotes compliance and help to maintain confidence in the fairness of our programs through increased education, effective risk-scoring systems, and a balanced approach to our file selection process. In 2010‑2011, this program identified and assessed almost $232 million in additional taxes, an increase of 15% over the previous year.

Our T1 Matching Program compares information on an individual’s tax return with information provided by third‑party sources, such as employers or financial institutions. In 2010-2011, this program identified and addressed additional tax assessments of almost $600 million.

The objective of the three programs is not simply to assess dollar values but also to educate taxpayers by identifying common areas of misunderstanding. We also gauge the effectiveness of our targeted reviews, through looking at the value of additional tax dollars assessed by targeted reviews compared with random reviews. Over the 2007-2008 to 2010-2011 period, for the Processing Review Program, our targeted reviews were approximately three times as effective as random reviews. Because the volume of each deduction and credit examined change according to our annual review strategies, in addition to new claims being added or dropped, the average dollars recovered, and the ratio of targeted to random, vary each year.

In 2009-2010, we launched our Corporate Assessing Review Program (CARP). The main objective of the program is to validate the accuracy of our assessments by ensuring that corporations file accurate and complete information on their T2 Tax Returns and that reported amounts are consistent with applicable tax legislation. In 2010-2011, CARP reviewed more than 48,000 corporation returns generating assessments totalling more than $45 million dollars in additional federal and provincial tax. During this past year, we embarked on a number of reviews to ensure that tax reserves, pool balances, and tax credits were accurately represented based on businesses’ past and present reporting. Through this work, we detected and reduced overstated pool balances by $43 million. These are amounts that would have been available to corporations to reduce future tax payable.

Lessons learned

What worked well: We expanded our electronic service options to make it easier for taxpayers to interact with us. We introduced new online security measures to protect taxpayer information, allowing us to offer a broader suite of secure services. We processed individual and business tax and information returns and payments accurately and on time. We carried out pre-assessment and post-assessment activities to detect and address instances of non-compliance.

What could be improved: Our programs are directly impacted by evolving government priorities, budget announcements and economic updates. We must make sure that we are well positioned to maintain effective delivery of our programs under all circumstances. We must also work to sustain this capacity in the longer-term.

Performance Report Card

|

Service Standards Table note 10

|

|||||||

|

Processing T1 individual income tax returns (electronic): within an average of 2 weeks Table note 11

|

|||||||

|

97.3% Table note 12

|

not available Table note 13

|

||||||

- Table note 10

- See www.cra.gc.ca/annualreport for breakdown of indicators, targets, and overall results against external service standards. Return to Table note 10 source text

- Table note 11

- Represents the average number of weeks. Return to Table note 11 source text

- Table note 12

- The service standard was changed from 21 to 30 days to align with a legislative change. Return to Table note 12 source text

- Table note 13

- Substantiated results are not available for 2009-2010. Revised data capture method began in June 2010. Return to Table note 13 source text

For supplementary information on this program activity, please visit:

www.cra.gc.ca/annualreport

Accounts receivable and returns compliance (PA3)

Strategic outcome

Taxpayers meet their obligations and Canada’s revenue base is protected.

Program activity description

Identifying and addressing non-compliance with the registration, filing, and remittance requirements of the Acts administered by the Canada Revenue Agency and managing the level of debt. These are achieved through the collection of accounts receivable and the development, implementation, and maintenance of national systems, policies, and guidelines. This framework facilitates and enforces compliance with the requirements for the filing, reporting, withholding, and payment of individual and corporate tax returns, employer source deductions, Goods and Services Tax/Harmonized Sales Tax, and other levies, as well as delinquent non-tax account receivables administered on behalf of other government departments and agencies.

Performance summary and analysis of program activity

Making non-compliance more difficult

Enhance strategies to manage payment non-compliance

Once an assessment is completed through self-assessment, or re-assessed through our subsequent verification actions, taxpayers must remit any amounts due. We use various means to collect the amounts that are owed to the Government of Canada in order to protect Canada’s revenue base.

Almost all reported taxes are paid on time by individuals and businesses. In cases where monies owed are not paid when they become due, we pursue taxpayers using a range of collection and enforcement actions. To do so, we use a risk-based approach to identify the right compliance response for debtors, ranging from helping individuals further understand their obligations, to undertaking swifter and firmer responses with those whose history demonstrates a need for such action. The CRA manages the federal government’s largest debt collection service, collecting debt arising from taxes, related interest, and penalties owed to the Government of Canada. A recent international benchmarking study showed the CRA has the second lowest cost to collect a dollar of debt among the ten participating tax jurisdictions for the period studied.

In 2010-2011, almost $388 billion in taxes and duties were processed by the Agency. Of this amount, more than 97% was received within the current fiscal year. This situation has been stable over the past four years and is indicative of our receivables being well managed. The international benchmarking study referenced earlier noted that the CRA ranked first among the ten participating tax jurisdictions, for the period studied, in the collection of debt as a percentage of its revenue.

In 2010-2011, our collections area continued to identify efficiencies and strategies related to current workloads as well as new business. As one example, our Debt Management Call Centre started handling another revenue line, deductions from employee salaries remitted by employers. This allows collectors at our Tax Services Offices to focus on more complex cases for these types of accounts. In preparation for the amalgamation of our national and regional pools into one national inventory, we centralized certain accounts, creating Centres of Expertise for these particular workloads. This past year, collections work related to the Harmonized Sales Tax (HST) on behalf of British Columbia and Ontario was initiated. This work has led us to examine our current practices for collecting GST and has resulted in an enhanced focus on improved workload management practices and increased the use of risk management, since it is anticipated that the introduction of HST will have an impact on the level of tax debt in this revenue line.

Managing tax debt poses a significant challenge since levels of indebtedness are strongly influenced by our external environment. According to the OECD’s 2010 Comparative Information Series report, tax debt is a growing problem for the majority of OECD countries. We have implemented strategies to address this issue, including our Payment Compliance Action Plan, which addresses the underlying cause of payment non-compliance at the behavioural level. Nonetheless, we anticipate that the level of tax debt will continue to grow over the short to medium term.

At the end of the 2010-2011 fiscal year, our total tax debt inventory rose to about $27.4 billion, an increase of $2.4 billion over the prior period. This debt includes accounts for which a pending resolution has been reached (for example, the taxpayer has agreed to pay the debt over a specified time) but the debt has not yet been paid in full.

Early determination of our ability to collect debt facilitates both timely and efficient debt collection, since the longer the debt exists, the harder and more expensive it is likely to be to collect. For this reason, during 2010-2011, we continued to rely on our Debt Management Call Centre (DMCC), which addresses high volume routine, low-risk, tax debt at minimal cost within a specified period of time. The DMCC allows our Tax Services Office (TSO) agents to focus on addressing more complex, higher-risk accounts that involve the use of escalating collection measures, including legal and enforcement actions, to deal with non-compliant taxpayers.

Our automated strategies, including our Debt Management Call Centres and our Tax Services Offices addressed a total of $34.1 billion of tax during 2010-2011. When compared to results from the previous year, this total represents an increase of 15.2%. Included in this result are amounts totalling $2 billion that were deemed to be uncollectible and have consequently been written-off. A recent international benchmarking study discussed the prevailing practices of other tax jurisdictions. The study noted that the CRA maintained, for the period studied, the lowest percentage of write-off to total tax revenue among the ten participants. In addition, it is important to note that this is an essential administrative function that is key to maintaining a healthy accounts receivable portfolio. The process is governed by both the Financial and Administration Act and the Bankruptcy and Insolvency Act, whereby accounts must meet prescribed criteria before being subject to write-off.

Timely resolution of debt facilitates our collection efforts. To assess our performance in addressing tax debt on a timely basis, we expect to resolve at least 60% of the TSO intake of new debt in the year of intake. In 2010-2011, we achieved 64.4%, exceeding our target.

The $17.7 billion tax debt we resolved in our TSOs represents 93.1% of the dollar value of the intake of new debt in the past year. This exceeded our target of 90%, indicating that we are successfully managing the higher risk inventory addressed by our TSOs.

The proportion of the age segments of our debt inventory has remained relatively stable over the last five years. This trend confirms that we are managing all segments of the tax debt portfolio in a consistent manner. The international benchmarking study referred to earlier also ranked the CRA second out of the ten participating tax jurisdictions with respect to debt aged less than one year for the period studied.

At the end of 2010-2011, debt over five years old represented 16.9% of the inventory. In absolute terms, the dollar value of inventory greater than five years old at the end of 2010-2011 was $3.4 billion, which represents an increase of approximately $500 million from the previous year, but remains within our targeted threshold of $3.5 billion.

strengthening service to make compliance easier

Enhancements have been made to our Payroll Deductions Online Calculator, as well, to calculate payroll deductions more easily. The improvements include enhancements to screen displays, organization of tools, and information access.

Reporting non-compliance

Our employer withholding and GST/HST examination activities enforce employers’ and taxpayers’ obligations to withhold, report, and remit source deductions, taxable benefits, and GST/HST. To increase and encourage compliance, we use a balanced approach to identify and address non‑compliance through the use of education, assisted compliance activities, and, where warranted, more rigorous actions, such as prosecutions. In 2010‑2011, 2.2 million non‑compliant cases were addressed. Although this represents a shortfall from our initial target of 2.6 million, it is explained by a realignment in workload which resulted in 500,000 cases being transferred to another area within the CRA. We also completed 556,227 reviews and exams and 15,056 GST/HST examinations which generated a total value of identified non-compliance of $1.6 billion.

Maintain and enhance non-filer/non-registrant programs, including underground economy identification projects

The goal of the filing and registering compliance area is to ensure that taxpayers file a return and/or register for the GST/HST if they are required to do so. Our compliance actions range from a simple request to file to more punitive measures such as penalties and prosecution. We make efficient use of available resources by focusing on early intervention. Accounts are identified and strategies are applied to non-compliant behaviour according to recognized risk factors.

Accounts that do not respond to early intervention measures are considered high-risk. We identify these accounts through various means including third-party data and risk models. These accounts require human intervention and are referred for escalating enforcement action. The CRA also undertakes underground economy projects aimed at identifying and addressing filing and registration non-compliance in cases where there are no records on the CRA databases as well as where new or additional information is obtained.

This past year, an evaluation of the Non-Filer/Non-Registrant program was completed. This evaluation will contribute to the renewal of the national program delivery model. The overall intent is to create program improvements that will, over time, contribute to increased short and longer term compliance with filing and registration requirements, thereby furthering the CRA’s goal of making non-compliance more difficult.

Our activities extend to GST/HST registration requirements of businesses. Over the past year, 8,464 businesses were identified as required to register for GST/HST. Our estimates of the rate of registration compliance have remained consistently above our target over the past several years. By comparing our data with information from Statistics Canada, we estimate that 93% of businesses were registered to collect GST/HST during 2010-2011. This met our 90% target.

In 2010-2011, our work to identify non-filers, including underground economy, generated 722,487 returns from individuals and corporate taxpayers that had not met their filing requirements. To gauge the compliance of individual taxpayers with their obligation to file a timely return, we compare our data for individual filers 18 years of age and older with Statistics Canada’s Census of Population data for this segment. For 2010-2011, 92.6% of this population filed their tax return on time, exceeding our 90% target. These estimates have consistently remained above the 92.5% level for every year since the 2001-2002 reporting year, providing a reliable trend for this high degree of voluntary filing compliance that we observe.

Our compliance rate estimates apply to those corporations which are taxable and have filed a T2 Corporation Income Tax Return showing that tax is payable. The incidence of timely filing among such corporations in 2010-2011 was 85.1%, a result which is comparable with past years.

Another important measure of our success in addressing identified filing non-compliance is the increase in the observable long-term filing rate by both individuals and corporations. Our research on filing behaviour shows that, of the taxpayers who did not file their return on time, a majority file these returns within five years after the year the return was due. For example, 93% of individuals and 86.4% of corporations filed their returns on time for the 2005 tax year and, over the subsequent five years 97.4% of individuals and over 99% of corporations had filed their 2005 returns. In addition to the long-term filing rates witnessed, our actions identified $2.8 billion in non-compliance in 2010-2011.

Lessons Learned

What worked well: We identified efficiencies related to current collection workloads and implemented appropriate solutions. One good example is having our Debt Management Call Centre handle an additional revenue line, deductions from employee salaries remitted by employers, which permits our TSO collectors to focus on more complex cases resulting for these types of accounts. We met our targets for timeliness on resolving tax debt and government programs’ (non-tax) debt and our Tax debt and government programs’ (non-tax) debt were within targeted levels.

What could be improved: We acknowledge the need to improve our performance measures to better assess our contribution to our business outcomes. To this end, we will continue to identify the best methods available to gauge the effectiveness of our activities in both identifying and addressing overall non-compliance.

Performance report card

|

Dollar value of TSO tax accounts receivable older than five years ($ billions) Table note 14

|

|||||||

|

$2.8 Table note 15

|

|||||||

|

Upward trend Table note 16

|

- Table note 14

- This is a revised indicator and target Return to Table note 14 source text

- Table note 15

- The target of $2.4 billion includes both T1/T2 and T3 non-filer and GST/HST non-registrant sources. The resulting fiscal value of non‑compliance was identified as $2.64 billion from the T1/T2 and T3 non-filer source, and $118 million from the GST/HST non-registrant source. Return to Table note 15 source text

- Table note 16

- Target does not include GST/HST delinquent filer program. Production and fiscal impact results were unavailable in 2009-2010 and 2010‑2011. Return to Table note 16 source text

For supplementary information on this program activity, please visit:

www.cra.gc.ca/annualreport

Reporting compliance (PA4)

Strategic outcome

Taxpayers meet their obligations and Canada’s revenue base is protected.

Program activity description

Verifying the complete and accurate disclosure by taxpayers of all required information to establish tax liabilities and protect the tax base through audit, enforcement, and incentive administrative activities. Activities for enhancing compliance include; increasing taxpayers’ understanding of their tax obligations through outreach activities, client service, and education; identifying and addressing non-compliance through risk assessment, audit and investigation; and establishing strategic partnerships with stakeholders to leverage compliance efforts.

Performance summary and analysis of program activity

Building trust to promote compliance

Enhance the administration of the Voluntary Disclosures Program

The Voluntary Disclosures Program (VDP) allows taxpayers to come forward and correct inaccurate or incomplete information or disclose information they have not previously reported to the CRA. Taxpayers using the program have to pay the taxes owing, plus interest, but may avoid penalties and prosecution relating to the amounts disclosed.

During 2010-2011, we promoted the program through speaking engagements and other outreach initiatives as well as increased references to VDP in our correspondence with taxpayers and in tax alerts. In addition, clarification of VDP policies was provided through presentations to various associations and responses to media enquiries.

The program saw growth in intake and an increase in the number of disclosures processed during the past year totalling $600 million in additional tax revenue. Voluntary disclosures led to the identification of $773 million in unreported income compared to $1.8 billion identified during 2009-2010. The latter was significantly larger than historical norms because it included two large disclosures with income totalling more than $900 million. Despite the growth in intake, the average number of days to process a file was 180 compared to 196 in 2009-2010 and our VDP inventory is the lowest it has been in years. This program is driven by taxpayers coming forward and therefore it is not possible to control either the number of taxpayers disclosing, or the associated unreported income.

Strengthening service to make compliance easier

Enhance the administration of the SR&ED program

The CRA oversees the integrity of various tax incentives that promote economic growth in Canada, such as the Scientific Research and Experimental Development (SR&ED) program. The SR&ED program is the largest single source of federal government support for industrial research and development. The CRA strives to deliver the tax incentives in a timely, consistent, and predictable manner, while ensuring businesses prepare their claims in compliance with tax laws, policies and procedures.

During 2010-2011, the SR&ED program provided about $3.5 billion in tax assistance to over 21,000 claimants. In addition, as a result of our risk assessment process, in 2010-2011, we identified and addressed $473 million of non‑compliance, an increase of 5.6% from the previous period.

Making non-compliance more difficult

Identify aggressive tax planning schemes more effectively

Aggressive tax planning (ATP) schemes are arrangements purposely undertaken to minimize tax liability. These transactions, often arranged by tax planners and promoters for individuals, trusts, and corporations, are intended to reduce, avoid, or evade Canadian taxes and they may not be consistent with the spirit and intent of the law.

These schemes sometimes involve international transactions or the use of tax havens. Left unchecked, aggressive tax planning presents a risk to the integrity and fairness of Canada’s tax system. Recognizing the problems inherent in relying on traditional audits alone, the CRA has a multi-faceted strategy to combat ATP.

The first component of the strategy is to strengthen legislation to reduce participation in ATP schemes. Over the reporting period, Finance Canada, with the support of the CRA, introduced proposed legislation that would require the mandatory reporting of tax avoidance transactions. This would provide an early warning system which would enable us to gather information on tax avoidance schemes at an early stage and address them before they become a larger problem.

A second component is to use tax information exchange agreements, negotiated by Finance Canada, to reduce the ability of taxpayers to hide income and assets in overseas banks. Of note, Canada signed a Protocol amending the Tax Convention with Switzerland in October 2010.

Thirdly, we work with international organizations such as the Seven Country Working Group, the Joint International Tax Shelter Information Centre and the Organization for Economic Co-Operation and Development (OECD) to share intelligence and best practices to combat ATP.

In 2010-2011 we secured information from our partner countries which identified Canadian taxpayers participating in a significant ATP scheme. There was a large amount of media interest in this information and the resulting CRA action. Taxpayers are realizing these types of schemes are highly risky. Our Voluntary Disclosures Program (VDP) continues to receive disclosures from taxpayers hoping to avoid penalties and prosecutions, by putting their tax affairs in order.

A final element of the multi-faceted strategy is to influence taxpayers by communicating our success in identifying ATP schemes, and outlining the consequences of tax avoidance and tax evasion. An example of the success we have had through communications is the reduction in the number of gifting tax shelter arrangements from 48,000 in 2006 to 10,000 in 2011. We achieved this by identifying arrangements that appeared problematic, following up with audits of 100% of these tax shelter claims, targeting tax shelter alerts to participants, and following this up with a letter campaign.

Identify non-compliance in the underground economy more effectively

The underground economy (UE) remains a priority for the CRA. Underground economic activity is any legal business activity that is unreported or under-reported for tax purposes. The UE undermines the competitiveness of Canadian businesses because it offers an unfair advantage to those who fail to comply with Canada’s tax laws. UE activity is concentrated in sectors where cash transactions are prevalent between businesses and consumers, books and records are weak or non-existent, taxes are not deducted at source, third party reporting is absent, business-to-consumer transactions are generally widespread and services are commonly offered at a discount, and where there is greater acceptance of tax evasion by either individuals or by businesses.

A recent study by Statistics Canada on the size of the underground economy relative to the Gross Domestic Product showed a reduction of half a percentage since 1992. We will continue our efforts to combat this area of non‑compliance.

Our UE strategy is to use a mix of outreach, education, communication, and compliance actions. This is supported by research and intelligence gathering and the systematic allocation of workloads to industry sectors with the highest risk. In 2010-2011, 78% of UE cases selected resulted in a tax assessment. These audits identified $595 million of unreported income with associated fiscal impact of $374 million. This amount represents an increase of 32% over the previous year.

In addition to our ongoing efforts in this area, a number of specific initiatives were conducted in the year to improve our intelligence and focus our efforts. For example, the Federal-Provincial-Territorial Underground Economy Working Group completed the Trade School Initiative. This initiative combined focus group research and a quasi-experimental study to develop a prevention-through-education strategy by aiming appropriate messaging at an early stage in a typical career path, ideally before bad behaviours become entrenched. Construction trade school students were selected as the initial target audience and the initiative will be ready for a full scale launch in 2011-2012. As part our strategy to address the UE, we share best practices with other tax administrations. The CRA has taken the lead for OECD countries to write a paper on the cash economy and we are supporting the Netherlands who are the lead on writing the paper, “Right from the Start.” This approach uses outreach and communications to target new businesses to ensure that “Right from the Start” compliance is encouraged.

We also initiate regional and local projects to identify and study emerging issues, conduct research and gather intelligence, gain industry knowledge by working with associations and other levels of government, and determine the complexity and the range of compliance risk treatments required to resolve the problems uncovered.

Use better risk assessment to detect and correct reporting non-compliance

Once a return is filed, we conduct various reviews and verification and risk assessment activities to identify areas where reporting by individuals, trusts, registered plans, and businesses is not consistent with taxpayers’ obligations to report complete and accurate information. Once identified we proceed to address the highest-risk accounts.

Businesses

In 2009-2010, our Core Audit Program selected self-employed individuals for examination. By examining small businesses that were subjected to its random sample audit, we estimated the percentage of all businesses in this segment that are likely non-compliant to a significant degree, defined as businesses underreporting $5,000 or more in federal taxes.

In 2010-2011, a non-compliance rate estimate was established for self-employed individual filers based on audits conducted during the 2009-2010 program year. The estimated rate of non-compliance was found to be 12.2%. This segment of the SME population has been reviewed twice previously: once in 2001-2002, when the non-compliance rate estimate for self-employed individuals was 8.6%, and again in 2006-2007, when the non-compliance rate estimate was 12.7%. We will focus our efforts on developing a strategy targeting this area of non-compliance.

In 2010-2011, we implemented the Research Audit Program (RAP) to replace the Core Audit Program. It conducts random audits that establish statistically valid levels of non-compliance for sectors of the Canadian economy. The RAP augments existing programs that gather risk intelligence at local, regional, and national levels and channels it into mechanisms used for workload selection. We will begin gathering results from the RAP assessments of the T1 Small and Medium Enterprises population in 2012.

Identifying non-compliant businesses involves a combination of risk assessments, reviews, and audits. Small business audits include owner-operated businesses, small corporations, and partnerships that have revenues of less than one million dollars. Medium-sized business audits typically include individuals with annual revenues over one million dollars and corporations with annual revenues between $1 million and $20 million for Income Tax.

One of the ways we evaluate our success in identifying non-compliance is by tracking how frequently a case selected for audit results in an adjustment. For the past year, the percentage of cases resulting in a change for SMEs was 80.3%, which was a slight decrease from 2009-2010. Research work conducted through our Core Audit Program indicates that our targeted audits are 3.8 times more likely to identify significant non-compliance than randomly selected audits. A recent international benchmarking study showed the CRA change rates for full SME audits fell within the mid-range of the rates identified by the other countries involved in the study.

We are also enhancing our approach to ensuring compliance within the large business population. We assess risk levels using sector intelligence, CRA-based expertise, and information from our tax treaty partners. We further combine these resources with information related to the nature of the business in question and their current and past behaviour, including aggressive tax planning (ATP), that indicates the potential risk of non-compliant behaviour. This further evolution of our approach should enable us to focus our resources on those large businesses most at‑risk of non-compliance. This will enhance change rates and encourage a level playing field for compliant businesses. For the past year, the percentage of cases resulting in a change for international and large business programs was 94%.

Through a combination of our employer actions and our SME and large business audits and reviews, we identified $8.3 billion of non-compliance for the 2010-2011 period. New this year is the introduction of a new performance measure aimed at measuring the effectiveness of our actions in obtaining fiscal impact per employee. This new measure highlights the value of our auditing function. For instance each audit Full Time Equivalent (FTE) is responsible in addressing an average of $2.9 million for the large business population and $400,000 for the small and medium enterprise and other populations. The inclusion of this measure permits the CRA to demonstrate the efficiency gains over time within the context of its available resources.

Use enhance risk assessment to identify non-compliance by employers and GST/HST registrants

The HST regime was extended to Ontario and British Columbia on July 1, 2010.Footnote 3 The HST now represents a significant source of tax revenue. In addition to significantly increased workload for the CRA, the combined federal and provincial rates entail increased compliance risks that the CRA is mitigating through a dedicated GST/HST organization and increased focus on risk intelligence and assessment.

During 2010-2011, review of business filings in our GST/HST pre-assessment program provided an early warning that a potentially significant number of large businesses would, perhaps inadvertently, not comply with HST reporting requirements for the recapture of input tax credits. This would normally result in audit action and the application of penalties. Our response was to take a proactive and constructive approach that involved acting on risk intelligence available from our systems to proactively communicate with businesses at risk of non-compliance to clarify their obligations and offer assistance where needed. Some 26,000 letters were sent to large registrants identified by our systems. Follow-up telephone calls were made to more than 15,000 businesses that were still at risk of non-compliance after the mail-out, and subsequent calls are still being placed to a subset of these businesses that still remain at risk.

We have determined that compliance action, including re-assessment and penalty application, is necessary and appropriate for a smaller number of businesses and are proceeding with these steps. The distribution of tax revenues collected by the CRA to participating provinces is dependent on registrants reporting full and accurate information about their taxable expenses. The approach followed in this instance protected the revenue base of our client governments through early identification of businesses at risk, proactive compliance communication based on intelligence, assistance and follow-up. In addition, the presence of the CRA within the community of large taxpayers may have prevented significant reporting non-compliance from arising, and averted important audit expenses and compliance costs for businesses.

Enforcement

While the CRA has a sustained audit presence across sectors, our Special Enforcement Program is focused on addressing the small minority of taxpayers who are engaged in more serious acts of non-compliance. Our Special Enforcement Program conducts audits and undertakes other civil enforcement actions against individuals and businesses known to be, or suspected of, deriving income from illegal activities. Suspected significant cases of fraudulent non-compliance are dealt with by our Criminal Investigations Program, which investigates and refers cases for prosecution to the Public Prosecution Service of Canada. These cases can result in penalties, court fines and up to five years of incarceration. We communicate the consequences of fraud committed against the Canadian public, in order to maximize the deterrent effect of these convictions. The CRA works with regional communications advisors to distribute news releases containing details of convictions on tax evasion to local, regional, and national media. In 2010-2011, the CRA distributed 235 news releases on convictions which were used to generate articles and broadcast news topics. In 2010-2011, a total of 204 taxpayers were convicted for tax evasion or fraud. The courts imposed $22.8 million in fines and 47 years of jail sentences. For the reporting period, 129 income tax and GST/HST investigations were referred to the Public Prosecution Service of Canada.

The nature of this taxpayer segment makes it difficult to measure the influence of our enforcement program on others who may be considering similar non-compliant behaviour. This is, in part, because the drivers of non-compliant behaviour among this population may go beyond strictly attempting to avoid taxes. Other criminal considerations may be at play.

The effectiveness of CRA enforcement programs and activities is essential to achieving its compliance objectives. In 2010, a multi-year evaluation of the CRA’s enforcement programs was completed. The findings from the report are being incorporated into action plans to support a more focused approach for the Criminal Investigations and the Special Enforcement programs, which will enhance file selection and further build upon partnerships with the Public Prosecutions Service of Canada and law enforcement agencies. The rate of conviction is very high due to case selection. Cases are selected for prosecution based on their expected outcome as there is a high cost to this type of compliance intervention. In this way, Canadians and Canadian businesses are reassured that the most egregious cases are pursued to the fullest extent. The results achieved during 2010-2011 support our assessment that we contributed to making non-compliance more difficult.

Lessons learned