ARCHIVED - Agriculture and Agri-Food Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2010-11

Departmental Performance Report

Agriculture and Agri-Food Canada

The original version was signed by

The Honourable Gerry Ritz

Minister of Agriculture and Agri-Food and Minister for the Canadian Wheat Board

Table of Contents

Section I: Organizational Overview

- Raison d'être

- Responsibilities

- Strategic Outcomes (SO) and Program Activity Architecture (PAA)

- Organizational Priorities

- Risk Analysis

- Summary of Performance

- Expenditure Profile

- Canada's Economic Action Plan (EAP)

- Estimates by Vote

Section II: Analysis of Program Activities by Strategic Outcome

- Strategic Outcome 1 - An environmentally sustainable agriculture, agri-food and agri-based products sector

- Strategic Outcome 2 - A competitive agriculture, agri-food and agri-based products sector that proactively manages risk

- Strategic Outcome 3 - An innovative agriculture, agri-food and agri-based products sector

- Canada's Economic Action Plan

- Program Activity 4.1: Internal Services

Section III: Supplementary Information

Section IV: Other Items of Interest

Minister's Message

The Canadian agriculture industry plays a major role in our economy, generating more than 2 million jobs and over eight per cent of our Gross Domestic Product.

This economic powerhouse has helped drive Canada's economic recovery over the past year, positioning our farmers and food processors to capture new opportunities in global markets.

Our Government's strategy for this great sector is clear: the marketplace is the most sustainable way to deliver bigger profits back to the farm gate and throughout the value chain. That's why we continue to pursue an aggressive international trade agenda that has delivered real results for our industry, making sure that our farmers and processors can market their top-quality products for the top dollar they deserve.

In 2010, our agriculture, agri-food, and seafood product exports grew to more than $39 billion, the second highest level in history, putting us in the top five global agri-food exporters. The Market Access Secretariat, which we created, was a big part of that success, and we're strengthening it to help our exporters secure and grow their sales.

Side by side with industry, we have embarked on trade missions to more than 20 different markets around the world, growing our sales with key customers, including Mexico, China, Hong Kong, Russia and South Korea. While defending Canada's system of supply management and ensuring our trading partners play by science-based rules, we are aggressively pursuing bilateral and multilateral trade arrangements with major markets including the European Union and India.

Innovation is as old as agriculture and continues to drive our industry's competitiveness. Working with industry we're making strategic investments in result-based science and innovation that are leveraging investments from industry. We will make strategic decisions to make sure we get the best bang for our research buck, in support of Canadian farmers and the entire sector.

Challenges will always be part of agriculture. Last year, our business risk management programs helped farmers weather financial pressures from markets, flooding and drought, with over $2 billion in support provided by federal, provincial and territorial governments. Canada's Economic Action Plan and our five-year, federal-provincial-territorial agriculture policy framework, Growing Forward, are delivering flexible, proactive programs that are helping farmers tackle real issues in the agricultural sector, strengthen the environment and food safety from gate to plate, and deliver innovative, tangible results that will pay dividends in the future.

Long-term, the outlook for Canada's agriculture sector is bright. Farming has become increasingly complex and competitive on the world stage. We're seeing a growing demand for healthy, high-quality food and we know Canadian farmers can deliver. Our natural advantages of land, water, clean environment, skilled workforce, and strong policies and regulations, position us well for future growth and prosperity.

We are now sitting down with industry and provincial-territorial governments to shape a new agricultural framework for the future that will help us move to a more modern, innovative, competitive, and sustainable sector that will define our success over the next decade.

I know I can rely on the continuing collaborative efforts of my entire Portfolio team to support me in tackling the agricultural sector's challenges, while helping the sector to capitalize on its tremendous potential for growth and future profitability.

The Honourable Gerry Ritz, P.C., M.P.,

Minister of Agriculture and Agri-Food and

Minister for the Canadian Wheat Board

Section I: Organizational Overview

Raison d’être

The Department of Agriculture and Agri-Food Canada (AAFC) was created in 1868 – one year after Confederation – because of the importance of agriculture to the economic, social and cultural development of Canada. Today, the Department helps ensure the agriculture, agri-food and agri-based products industries can compete in domestic and international markets, deriving economic returns to the sector and the Canadian economy as a whole. Through its work, the Department strives to help the sector maximize its long-term profitability and competitiveness, while respecting the environment and the safety and security of Canada’s food supply.

Responsibilities

AAFC provides information, research and technology, and policies and programs to help Canada's agriculture, agri-food and agri-based products sector increase its environmental sustainability, compete in markets at home and abroad, manage risk, and embrace innovation. The activities of the Department extend from the farmer to the consumer, from the farm to global markets, through all phases of producing, processing and marketing of agriculture and agri-food products. In this regard, and in recognition that agriculture is a shared jurisdiction, AAFC works closely with provincial and territorial governments.

AAFC's mandate is based upon the Department of Agriculture and Agri-Food Act. The Minister is also responsible for the administration of several other Acts, such as the Canadian Agricultural Loans Act. The Department is responsible for ensuring collaboration among the organizations within the Agriculture and Agri-Food Portfolio; this means coherent policy and program development and effective cooperation in meeting challenges on cross-portfolio issues. The other portfolio organizations consist of: the Canadian Dairy Commission; the Canadian Food Inspection Agency; the Canadian Grain Commission; Farm Credit Canada; Canada Agricultural Review Tribunal; and the Farm Products Council of Canada. AAFC also includes the Canadian Pari-Mutuel Agency, a special operating agency that regulates and supervises pari-mutuel betting on horse racing at racetracks across Canada.

AAFC provides the overall leadership and coordination on federal rural policies and programs through Canada's Rural Partnership, and supports co-operatives to promote economic growth and social development of Canadian society. Through the Rural and Co-operatives Development program activity, AAFC coordinates the Government's policies towards the goal of economic and social development and renewal of rural Canada. This program activity also facilitates the development of co-operatives which help Canadians and communities capture economic opportunities.

The Department also supports the Minister in his role as Minister for the Canadian Wheat Board.

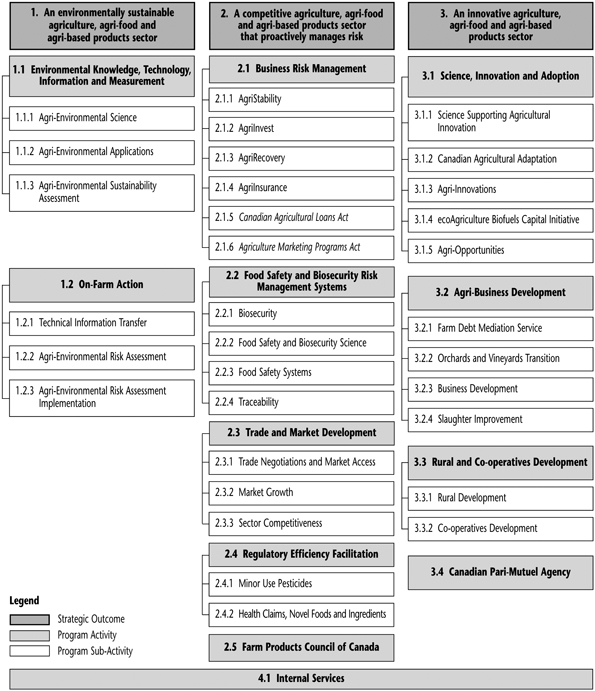

Strategic Outcomes (SO) and Program Activity Architecture (PAA)

-

SO 1 An environmentally sustainable agriculture, agri-food and agri-based products sector

AAFC supports an economically and environmentally sustainable agriculture, agri-food and agri-based products sector that ensures proper management of available natural resources and adaptability to changing environmental conditions. Addressing key environmental challenges in Canada including agriculture's impact on water quality and water use, adaptation to the impact of climate change, mitigation of agriculture's greenhouse gas emissions and the exploration of new economic opportunities contribute to a cleaner environment and healthier living conditions for the Canadian public, while enabling the sector to become more profitable.

-

SO 2 A competitive agriculture, agri-food and agri-based products sector that proactively manages risk

Canada's capacity to produce, process and distribute safe, healthy, high-quality and viable agriculture, agri-food and agri-based products is dependent on its ability to proactively manage and minimize risks and to expand domestic and global markets for the sector by meeting and exceeding consumer demands and expectations. Proactive risk management to ensure food safety, market development and responsiveness, and improved regulatory environment contribute directly to the economic stability and prosperity of Canadian farmers and provide greater security for the Canadian public regarding the sector.

-

SO 3 An innovative agriculture, agri-food and agri-based products sector

Sector innovation includes the development and commercialization of value-added agricultural-based products, knowledge-based production systems, processes and technologies, and equipping the sector with improved business and management skills and strategies to capture opportunities and to manage change. Such innovation is vital for ongoing growth and improvement in the productivity, profitability, competitiveness and sustainability of Canada's agriculture, agri-food and agri-based products sector and its rural communities.

The graphic below displays AAFC's Program Activities and Program Sub-Activities that comprise its PAA. It reflects how the Department allocates and manages its resources and makes progress toward its Strategic Outcomes.

AAFC's 2010-11 Program Activity Architecture

Organizational Priorities

AAFC's priorities described in the 2010-11 Report on Plans and Priorities reflected the ongoing importance of competitiveness, innovation, environmental sustainability, and proactive risk management to ensure the sector's long-term profitability. There is a need for continuous investment in scientific research, the development and adoption of leading-edge products and technologies, and business skills, risk management and market intelligence to enable producers and enterprises to achieve a sustainable competitive advantage.

Domestic and international market demands for agricultural and agri-food products continue to evolve, and the Canadian sector must adapt and become more competitive and innovative to meet the challenges of a globalized market. In support of this, AAFC provides information to help the sector identify and respond to emerging trends ahead of Canada's competitors, as well as the tools necessary to encourage adaptation that enables the sector to achieve lower costs and penetrate higher-value markets. In addition, given the sector's heavy reliance on export markets, AAFC works to ensure continued access to existing markets and to gain access to new ones through market access and trade negotiations and disputes programs. Finally, the Department continues to address market demands for assurances that Canada's environmental resources are protected.

With the current agricultural policy framework, Growing Forward, set to expire on March 31, 2013, a new framework is required to position the sector for success over the long term. AAFC is working with provinces and territories to develop the next agricultural policy framework, to help achieve a profitable, sustainable, competitive and innovative agriculture, agri-food and agri-products industry.

AAFC began engagement with industry stakeholders to discuss challenges and opportunities facing the sector. The Department continues to work with provinces and territories to develop policy directions for the next framework based on what has been heard.

AAFC, together with provincial and territorial governments, undertook a strategic review of Business Risk Management (BRM) programs to assess current programs. The findings of the BRM Strategic Review were presented to stakeholders as part of the first phase of the next agricultural policy framework industry engagement in 2010-11. The results of the Strategic Review will inform the policy development process for the next policy framework.

The Government also continued to make significant investments in scientific research, which is a key component to ensuring continued innovation in the agricultural sector. In addition, as the sector and Canada's economy move into recovery from the economic downturn, AAFC continued to implement the important initiatives launched under Canada's Economic Action Plan (EAP), including the Agricultural Flexibility Fund, the Slaughter Improvement Program, and the Canadian Agricultural Loans Act.

The ongoing focus on management excellence was important to deliver results for the sector, of note, through improved service to clients, and reflected in human resources and investment plans driven by government priorities.

Additional information on departmental priorities is provided below.

Priority Status Legend

Percentage of the expected level of performance that was achieved during the fiscal year for the priority identified in the corresponding RPP

Exceeded: More than 100%

Met All: 100%

Mostly Met: 80 to 99%

Somewhat Met: 60 to 79%

Not Met: Less than 60%

| Priority | Type | Strategic Outcome: |

|---|---|---|

| Secure and enhance market access for Canadian agricultural and agri-food products | Ongoing | SO2 - A competitive sector that proactively manages risk |

| Status: Met All | ||

| Globally, breakthroughs were made for exporters in the following sectors: animal genetics (bovine, porcine and poultry); beef; canary seed; canola; feed and flax; fish and seafood products (including lobster); horticulture (including potatoes); organic commodities; peas; plant biotechnology; pork and swine; poultry meal and porcine blood meal; rendered animal by-products; and wheat, among others. | ||

| Priority | Type | Strategic Outcomes: |

|---|---|---|

| Support science and innovation, keys to the sector's competitiveness | Ongoing | SO1 - An environmentally sustainable sector SO2 - A competitive sector that proactively manages risk SO3 - An innovative sector |

| Status: Met All | ||

|

AAFC scientists and their partners worked to make significant contributions to research and innovation in Canada. The Department developed improved agricultural practices that address environmental challenges, new food production, processing and distribution techniques that mitigate food safety risks, new crops enhancing Canada's biodiversity, and improved livestock production and management. Growing Forward innovation programs, such as the Canadian Agri-Clusters and Developing Innovative Agri-Products initiatives, accelerated the pace of innovation by providing support all along the innovation continuum — from discovery through marketplace. Through the Agricultural BioProducts Innovation Program, AAFC supported conversion of feedstocks into agricultural bioproducts, developed technologies for agricultural biomass conversion, and found ways to diversify products. As a result, Canada's R&D capacity increased and the country was positioned as a significant player in the bioproducts and bioprocessing sector. The Department helped increase farmer participation in the biofuels industry and contributed to the government's biofuels content target in transportation fuels via the ecoAgriculture Biofuels Capital Initiative. AAFC accelerated the commercialisation of new innovative value-added agricultural, agri-food and agri-based products, services and processes through the delivery of the Agri-Opportunities Program. AAFC continued to enhance its management tools for science and innovation, ensuring that its strategic action plan and its human resource, communications and investment plans are fully developed. |

||

| Priority | Type | Strategic Outcome: |

|---|---|---|

| Ensure current suite of Business Risk Management programs is achieving its objective through the Business Risk Management Strategic Review with Provinces and Territories | Previously committed to | SO2 - A competitive sector that proactively manages risk |

| Status: Met All | ||

|

Federal, provincial, and territorial officials undertook a Strategic Review of BRM programs, which showed that BRM programs played an important role in stabilizing producers' income when market income dropped. The results of the BRM Strategic Review are helping inform the policy development process. They were presented during the first phase of the next agricultural policy framework industry engagement. |

||

| Priority | Type | Strategic Outcomes: |

|---|---|---|

| Improve the sector's environmental performance in support of Canada's environmental agenda | Ongoing | SO1 - An environmentally sustainable sector SO2 - A competitive sector that proactively manages risk SO3 - An innovative sector |

| Status: Met All | ||

|

AAFC continued to develop and support an evolving set of expertise and tools required to help the sector adapt to climate change and water issues. The Agricultural Greenhouse Gases Program, Canada’s contribution to the Global Research Alliance, was developed and launched. AAFC continued to explore new approaches to address complex agri-environmental challenges and continued to deliver initiatives that enabled sound environmental decision-making. AAFC continued to work with partners to improve conservation of air, water, soils, and biodiversity through sector stewardship practices, and to improve ecosystems by increasing and sharing scientific knowledge. AAFC continued to increase collaboration among stakeholders to help the sector be more resilient and sustainable in the face of complex agri-environmental challenges. |

||

| Priority | Type | Strategic Outcomes: |

|---|---|---|

| Management Excellence | Ongoing | SO1 - An environmentally sustainable sector SO2 - A competitive sector that proactively manages risk SO3 - An innovative sector |

| Status: Met All | ||

|

Sound management practices, processes and systems, particularly in areas such as human resources and service delivery, continued to be key to AAFC's ability to deliver programs and services and achieve its strategic outcomes. Details of the Department's performance in these areas are provided in the discussion of Internal Services in Section II. Highlights include: Actions to further implement AAFC's Service Excellence agenda included the delivery of a suite of initiatives aimed at helping AAFC to better understand its clients, to better communicate its offerings, and to improve its services to clients through modernized business approaches and system enhancements. For example, AAFC has established service standards for 75% of its programs. People management strategies identified in the Department's 2009-12 Integrated Human Resources Plan were implemented in support of objectives that advanced Government priorities. As examples, the Department exceeded its student recruitment target for 2010-11, reviewed staffing policies with a view to eliminating duplication and redundant information, and developed a draft new AAFC Values and Ethics Code to be implemented with the new Values and Ethics Code for the Public Sector. The Plan also established the foundation for fostering a work environment that values professional excellence, diversity, linguistic duality, continuous learning, and mutual respect. With regard to the 2009-10 Management Accountability Framework (MAF) assessment, TBS's observations on AAFC's management capacity were very positive, consistent with the Department's strong performance from the previous year. The Department received five "Strong" ratings and seven "Acceptable" ratings, and progress was made with respect to management priorities identified in the previous MAF assessment. No area of management was rated below "Acceptable". The Department was recognized for maintaining high standards in its level of management performance, while also handling a busy policy and program agenda, specifically the implementation of Growing Forward programs and Budget 2009 (Canada's Economic Action Plan) initiatives. |

||

AAFC's three-year Integrated Human Resources Plan continued to be an important element of the Department's integrated planning approach. Its ongoing relevance will be assured through an update in 2011-12, reflecting the changing environment, business priorities and risks. The key human resources issues facing the Department are similar, but some have grown to be more pressing. These key issues include:

- projected gaps, as well as shortages of skills and knowledge, in key areas due to retirement rates;

- ongoing management of human resources to maintain long-term capacity to deliver strategic outcomes through a period of sustained fiscal restraint; and

- a workplace where the contributions of all employees and the use of both official languages are encouraged and supported.

Strategies to achieve the Department's goals in these areas include:

- a staffing and recruitment strategy outlining initiatives that support the Department in meeting its current and future staffing needs, attract high-quality candidates, and continuously improve the effectiveness of the staffing system;

- enhanced opportunities for career and skill development and continuous learning;

- revising the departmental Employment Equity and Inclusiveness strategy to respond to the findings of the Employment Systems Review; and

- continuing the national official languages awareness campaign emphasizing employee rights and obligations under the Official Languages Act.

AAFC finalized the first departmental five-year Investment Plan (2010-15) in accordance with Treasury Board's Policy on Investment Planning — Assets and Acquired Services to guide effective investment of resources that clearly support program outcomes and government priorities. The Plan was approved by Treasury Board June 17, 2010. In year one of the Plan, all EAP-funded projects were completed and many other projects were advanced. The Department also positioned itself for year two of the Plan.

Risk Analysis

In 2010, Canada saw its Gross Domestic Product rebound by a healthy 3.1% in real terms, after having declined by 2.5% in 2009. Stronger domestic demand, government spending and business investment in 2010 helped buoy this economic growth as inflationary pressures remained moderate.

For the agriculture and agri-food sector, 2010 saw a small increase in real Gross Domestic Product in spite of lower production. Crop production was down due to adverse weather on the Prairies that hampered planting and harvesting. In the second half of the year, crop and livestock prices advanced significantly in world markets. Higher crude oil prices tended to push up input prices and transportation costs for primary producers, food processors and consumers. However the Canadian dollar appreciated by 10% in 2010 relative to the U.S. dollar, off-setting some of the commodity price increases and the effect of higher crude oil prices. Farm incomes were up positively as a result. The food processing sector, which maintained its steady growth during the recession of 2009, continued to advance at a steady rate in 2010.

The stronger dollar also provided an opportunity for farmers and processors to boost productivity with the help of lower-priced imported machinery and equipment.

Other challenges resulted from changes in regulations and policies in other countries regarding safety and quality issues. For instance, the Canadian livestock industry bore the brunt of the impact of mandatory country of origin labelling in the U.S., its major market. Prices were higher in the European Union, but regulations (e.g., on hormone use) and tariff rate quotas were effective barriers to some Canadian exports.

In terms of AAFC's operating environment, as the employee population ages and retirements continue to peak, maintaining workforce capacity to deliver results to Canadians is important. Renewal of the workforce is being tackled through the targeted recruitment of new employees and the creation of programs to ensure transfer of knowledge about the agriculture sector and to develop management competencies. In a climate of sustained fiscal restraint across the public service, AAFC is committed to ongoing refinement of its integrated business planning process to align human and other resources to deliver on business priorities.

To help accomplish its mandate, AAFC continues to enhance and integrate its risk and opportunity management practices to nourish a risk-smart culture. Risk and opportunity management continues to be a key factor that supports and informs departmental priority setting, business and resource planning, and decision-making.

AAFC's Corporate Risk Profile, which is updated annually, summarizes the possible exposure to risks by identifying key potential events or circumstances and documents management action under way. In 2010-11, AAFC effectively mitigated identified corporate risks, avoiding adverse effects on the achievement of results. The following chart provides a brief description of the risks identified in AAFC's 2010-11 Corporate Risk Profile, and summarizes the status of mitigation strategies.

| Risk | Status of Risk and Mitigation Strategies |

|---|---|

| Catastrophic Crisis A large-scale event could present a severe risk to the sector and/or Canadians at large. |

AAFC has a long history of responding to emergencies with appropriate policies and programs. The Department leveraged the AgriRecovery Framework of the BRM suite to facilitate the implementation of 13 initiatives in response to natural disaster events across the country. The Department also continued to engage government and sector partners to enhance emergency preparedness. Significant progress was made in preparing the Department to respond quickly to internal emergencies, such as power outages or a pandemic. As a result of recent threats, such as H1N1, business continuity plans and tested emergency response plans have been refined. Work began to develop plans to address animal diseases; subsequent analysis may help adapt these plans to address plant health concerns. |

| Information Management Compromised information, information management or information systems could impact the Department's ability to make effective policy and program decisions, and subsequently affect reporting. |

Mitigation activities progressed effectively. AAFC continued to advance recordkeeping guidance and developed a year-round communications strategy on Information Management/Record Management awareness and education. A privacy management framework was developed to help meet Privacy Act requirements. To improve information and data management, AAFC continued to work towards solutions, such as internet portals, enhanced search tools, reviewed data warehousing, and business intelligence design. Electronic document management was expanded in the National Capital Region and network preparations for further deployment of the electronic document and records management software to AAFC regional offices are complete. |

|

Program Risk |

Mitigation activities such as recipient auditing, consistent performance reporting and service standard monitoring have reduced program design and management risks while enhancing service to clients. Business Risk Management (BRM) program administrators continued to work cooperatively to identify and address risks towards the consistent and increasing quality of BRM program delivery. Initiatives were implemented that helped improve client service and accuracy. AAFC developed technology to provide a one-window access to both federally and provincially delivered programs. A service excellence communication plan was also developed to drive culture change and meet AAFC's priority of achieving service excellence. A contribution agreement template for non-BRM programs, as well as grants and contributions program and risk management training, helped ensure efficient program control. Recipient reporting and auditing were enhanced through centralized financial and performance reporting of provincial and territorial agreements and the Department's Recipient/Project Risk Management Framework. |

|

Infrastructure |

AAFC is a large custodian of buildings (2,360), land (940,000 hectares), and equipment ($213 million). It has 19 major research centres, 37 research stations and 33 dams. Infrastructure management occurs through the integrated Investment Plan (IP) and IP governance to support ongoing operations of the Department and address government priorities. Implementation of the IP progressed successfully. Effective project management practices were in place with defined roles and responsibilities, and progress continues to be closely monitored. |

|

People Work Environment |

To mitigate workforce risks, AAFC put in place its 2009-12 Integrated Human Resources Plan and supporting multi-year strategies for staffing and recruitment, employment equity and inclusiveness, and official languages. This included a focus on maintaining science capacity in the Department. To reduce the web of rules, AAFC reviewed all staffing policies, with a view to eliminating duplication and redundant information. Access to Human Resources services was streamlined through a single online window called Human Resources Direct Access. AAFC embarked on collaborative projects with other federal government organizations aimed at sharing administrative systems. These efforts will continue into the next several years. |

|

System/Technology Sufficiency |

Mitigation activities progressed satisfactorily. AAFC started the development of a foundational Information Management/Information Technology (IM/IT) architecture with the main emphasis on security architecture. It also advanced its portfolio project management practices as per Treasury Board Secretariat standards, which included a foundational costing model for shared application support services. AAFC reviewed its IT policy instruments and developed new ones where gaps existed. IM/IT disaster recovery options related to business continuity and critical business services for 0-48 hours recovery were approved, and work began on developing the implementation plan. |

Summary of Performance

2010-11 Financial Resources ($ millions - net)

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| There is an overall reduction between Planned Spending and Total Authorities primarily as a result of a reduction in the requirement for Business Risk Management program funding mainly due to stronger commodity prices. Variances between Total Authorities and Actual Spending result from the annual demand for multi-year program funding as well as timing of new program implementation. The majority of the unspent funding is expected to be carried forward for use in future years. | ||

| 3,331.3 | 2,918.3 | 2,674.8 |

2010-11 Human Resources (Full-Time Equivalents - FTEs)

| Planned | Actual1 | Difference2 |

|---|---|---|

|

1 Full-Time Equivalents - reflect only those FTEs funded through the Department's appropriated resources. In addition to the actual FTEs of 6,266 there were 25 FTEs employed by AAFC for research funded through collaborative agreements with industry partners and 9 FTEs funded from other government departments. Also, an additional 528 FTEs were employed as students. 2 Actual FTEs are higher than Planned primarily due to additional resources required for the development of the next agricultural policy framework and the creation of the Market Access Secretariat. Planned FTEs did not reflect these factors due to timing of the preparation of the Report on Plans and Priorities. The actual number of FTEs has decreased by 14 when compared to the 2009-10 Actual FTEs of 6,280. |

||

| 6,086 | 6,266 | 180 |

| Performance Indicators | Targets | 2010-11 Performance |

|---|---|---|

| * The indices listed measure agri-environmental progress in each of the four key areas of soil, water, air, and biodiversity. The scale for these indices is: 0-20 = Unacceptable; 21-40 = Poor; 41-60 = Average; 61-80 = Good; and 81-100 = Desired. A target of 81-100, with a stable or improving trend, represents the desired value for the sector's performance. Results are based on 2006 data published in 2010 in Environmental Sustainability of Canadian Agriculture: Agri-Environmental Indicator Series, Report #3. | ||

| Soil Quality Agri-Environmental Index* |

81 by Mar 31, 2030 | The Soil Quality index was within the Good range and showed an improving trend. This is attributed to increased adoption of conservation and no-till practices, increased forage and permanent cover crops, and reduced use of summer fallow. |

| Water Quality Agri-Environmental Index* |

81 by Mar 31, 2030 | The Water Quality index was within the Good range but showed a deteriorating trend. This is due to an overall increase in supplemental nutrients as there was an increase in farmland under cultivation. |

| Air Quality Agri-Environmental Index* |

81 by Mar 31, 2030 | The Air Quality index was within the Good range and showed an improving trend. This is attributed to increased adoption of conservation and no-till practices, increased forage and permanent cover crops, and reduced use of summer fallow. |

| Biodiversity Quality Agri-Environmental Index* |

81 by Mar 31, 2030 | The Biodiversity index was within the Average range on the Agri-Environmental Index, showing a stable trend. |

| Program Activity | 2009-10 Actual Spending ($ millions - net)1 |

2010-11 ($ millions - net) | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates2 |

Planned Spending3 |

Total Authorities4 |

Actual Spending5 |

|||

| Environmental Knowledge, Technology, Information and Measurement | 92.9 | 58.5 | 59.6 | 92.9 | 89.8 | A Clean and Healthy Environment |

| On-Farm Action | 85.0 | 152.2 | 152.5 | 152.1 | 89.7 | |

| Total | 178.0 | 210.7 | 212.1 | 245.0 | 179.6 | |

| Performance Indicators | Targets | 2010-11 Performance |

|---|---|---|

| Increase in agriculture and agri-food (includes seafood processing) Gross Domestic Product (GDP), in constant dollars (1997 dollars) | 10% by Mar 31, 2013 | Progress toward the strategic outcome can be considered satisfactory. Between 2009 and 2010, GDP for agriculture and agri-food processing has increased 1.5% to $44.9 billion due to higher prices for agriculture crops and a higher value of food industry shipments. |

| Program Activity | 2009-10 Actual Spending ($ millions - net)1 |

2010-11 ($ millions - net) | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates2 |

Planned Spending3 |

Total Authorities4 |

Actual Spending5 |

|||

| Business Risk Management | 1,508.2 | 1,678.9 | 1,996.2 | 1,477.6 | 1,452.5 | Strong Economic Growth |

| Food Safety and Biosecurity Risk Management Systems | 98.1 | 150.3 | 154.8 | 144.8 | 95.2 | |

| Trade and Market Development | 100.5 | 116.3 | 116.3 | 123.0 | 93.4 | |

| Regulatory Efficiency Facilitation | 12.5 | 35.9 | 35.9 | 25.8 | 12.1 | |

| Farm Products Council of Canada | 3.0 | 2.8 | 2.8 | 3.1 | 2.8 | |

| Total | 1,722.2 | 1,984.1 | 2,306.0 | 1,774.4 | 1,656.1 | |

| Performance Indicators | Targets | 2010-11 Performance |

|---|---|---|

| Percentage increase in the development of food and other agriculture-derived products and services as measured by 1) revenues from bio-products and 2) percentage increase in private industry's Research and Development (R&D) expenditures in the agri-food sector as measured by the food processing and bio-products sectors (Percentage reflects a real increase, after adjustments for inflation) | 10% by Mar 31, 2014 | In making progress towards the four-year target, AAFC is meeting or exceeding its goals for programs and initiatives within the Program Activities that support this Strategic Outcome. Please see the Performance Analysis in Section II of this report for a description of progress at these lower levels. |

| Increase in agriculture Net Value-Added (Value-Added is a Statistics Canada measure of Canadian value-added GDP) | 7% by Mar 31, 2014 | In making progress toward the four-year target, AAFC is meeting or exceeding its goals for programs and initiatives within the Program Activities that support this Strategic Outcome. Please see the Performance Analysis in Section II of this report for a description of progress at these lower levels. |

| Program Activity | 2009-10 Actual Spending ($ millions - net)1 |

2010-11 ($ millions - net) | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates2 |

Planned Spending3 |

Total Authorities4 |

Actual Spending5 |

|||

| Science, Innovation and Adoption | 275.7 | 404.4 | 408.8 | 368.0 | 360.3 | An Innovative and Knowledge-Based Economy |

| Agri-Business Development | 48.6 | 64.1 | 72.9 | 148.9 | 104.3 | |

| Rural and Co-operatives Development | 22.0 | 25.1 | 25.1 | 24.9 | 21.1 | |

| Canadian Pari-Mutuel Agency | 0.7 | 0.4 | 0.4 | 4.6 | 1.0 | A Fair and Secure Marketplace |

| Total | 347.0 | 494.0 | 507.2 | 546.4 | 486.7 | |

| Program Activity | 2009-10 Actual Spending ($ millions - net)1 |

2010-11 ($ millions - net) | |||

|---|---|---|---|---|---|

| Main Estimates2 |

Planned Spending3 |

Total Authorities4 |

Actual Spending5 |

||

| Internal Services | 357.9 | 301.4 | 306.0 | 352.5 | 352.5 |

| 2009-10 Actual Spending ($ millions - net)1 |

2010-11 ($ millions - net) | ||||

|---|---|---|---|---|---|

| Main Estimates2 |

Planned Spending3 |

Total Authorities4 |

Actual Spending5 |

||

| Total Departmental Spending | 2,605.2 | 2,990.1 | 3,331.3 | 2,918.3 | 2,674.8 |

For an explanation of the variances for the total Department spending, please refer to the Expenditure Profile subsection of this report.

1 Actual Spending figures represent the actual expenditures incurred during the 2009-10 fiscal year, as reported in the 2009-10 Public Accounts.

2 Main Estimates figures are as reported in the 2010-11 Main Estimates.

3 Planned Spending figures are as reported in the 2010-11 Report on Plans and Priorities (RPP). Planned Spending reflects funds already brought into the Department's reference levels as well as amounts to be authorized through the Estimates process as presented in the Annual Reference Level Update. It also includes adjustments totalling $341.1 million for funding approved in the government fiscal plan, but not yet brought into the Department's reference levels at the time of the Main Estimates.

4 Total Authorities reflect 2010-11 Main Estimates plus a net total reduction of $71.8 million comprised of Supplementary Estimates and allotment transfers received during the 2010-11 fiscal year, as well as adjustments to statutory amounts to equal Actual Spending, and internal adjustments and transfers, as reported in the 2010-11 Public Accounts.

5 Actual Spending figures represent the actual expenditures incurred during the 2010-11 fiscal year, as reported in the 2010-11 Public Accounts. In certain cases, where authorized amounts are unspent, they can be reprofiled for use in future years.

The figures in the above table have been rounded. Due to rounding, figures may not add up to the totals shown.

Expenditure Profile

AAFC departmental spending varies from year to year in response to the circumstances in the agriculture, agri-food and agri-based products sector in any given period. Programming within AAFC is in direct response to industry and economic factors which necessitate support to this vital part of the economy. Much of AAFC's programming is statutory (i.e. for programs approved by Parliament through enabling legislation) and the associated payments fluctuate according to the demands and requirements of the sector.

Canada's Economic Action Plan (EAP)

AAFC's spending plans were augmented through initiatives under EAP, recognizing that agriculture and agri-food as a vital sector of the Canadian economy. Key investments were made to help Canadian farmers maximize market opportunities and derive benefits as soon as possible, on the understanding that they have an important role in helping Canada recover from the global recession. In implementing these investments, AAFC ensured that they are complementary and integrated with Growing Forward programs.

Progress was achieved on the EAP initiatives in support of Canada's farm and agricultural businesses as the Government continues to make funding available to the sector. The Agricultural Flexibility Fund supported new initiatives, both federally and in partnership with provinces, territories and industry, to improve the sector’s competitiveness. Under the Slaughter Improvement Program, 20 projects worth $56 million were approved to help make red meat packing and processing facilities more competitive and accessible to farmers across Canada. The Canadian Agricultural Loans Act helped farmers gain easier access to credit. Transfer of Delivery of the AgriStability Program to the provinces of Saskatchewan and British Columbia was implemented with no significant client service impacts to program applicants. The Modernizing Federal Laboratories Program enabled facilities to be updated at eight AAFC laboratories. Also, the Accelerating Federal Contaminated Sites Action Plan resulted in accelerated assessment and remediation activities at several sites, thereby reducing risks to human health and the environment as well as the Department's liability risks. Detailed information regarding these EAP initiatives can be found in Section II.

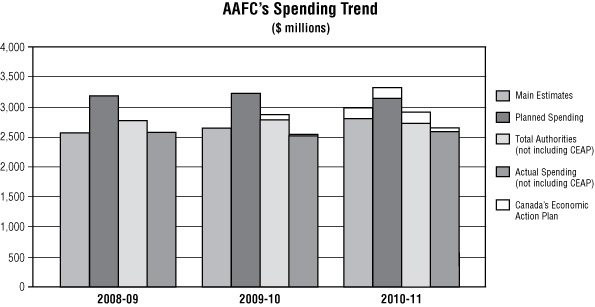

Departmental Spending Trend

The figure below illustrates AAFC's spending trend in Main Estimates, Planned Spending, Total Authorities, and Actual Spending from 2008-09 to 2010-11.

Notes:

1 Main Estimates figures are as reported in the Main Estimates for each respective year.

2 Planned Spending figures are as reported in the respective Report on Plans and Priorities. Planned Spending reflects funds already brought into the Department's reference levels as well as funding approved in the government fiscal plan, but yet to be brought into the Department's reference levels, at the time of the respective Report on Plans and Priorities. Planned Spending did not reflect Budget 2008, 2009 or 2010 information. These adjustments were subsequently made and reflected in Total Authorities.

3 Total Authorities reflect Main Estimates plus adjustments comprised of Supplementary Estimates and allotment transfers, adjustments to statutory amounts to equal Actual Spending, and internal adjustments and transfers, as reported in Public Accounts.

4 Actual Spending represents the actual expenditures incurred during each respective fiscal year, as reported in Public Accounts. In certain cases where authorized amounts are unspent, they can be reprofiled for use in future years.

Over the past three fiscal periods from 2008-09 to 2010-11, the Actual, Planned and Authorized Spending ranged from a low of $2.6 billion in 2009-10 to a high of $3.3 billion in 2010-11. Although the actual spending trend depicted above is generally consistent across the years, the programs and initiatives vary from year to year in response to changes affecting the agriculture, agri-food and agri-based products sector.

2009-10 included funding provided to the pork industry to support an orderly transition of the sector in view of new market challenges, while 2010-11 reflects support under the Prairie Excess Moisture Initiative, which provided emergency assistance to producers affected by flooding conditions from the spring and summer of 2010. Both 2009-10 and 2010-11 included investments under Canada's Economic Action Plan to assist in the recovery from the global economic recession.

The requirement for Business Risk Management program funding over the recent years has been lower than in the past as a result of stronger commodity prices.

Actual Spending in 2010-11 is lower than authorities as the result of several factors including the timing of the start-up of some programs. However, the majority of the unspent funding is expected to be carried forward for use in future years.

Estimates by Vote

For information on organizational Votes and/or statutory expenditures, please see the 2010-11 Public Accounts of Canada (Volume II) publication.

Section II: Analysis of Program Activities by Strategic Outcome

Performance Status Legend

Percentage of the expected level of performance (as evidenced by the indicator and target or planned activities and outputs) that was achieved during the fiscal year for the expected result identified in the corresponding RPP

Exceeded: More than 100%

Met All: 100%

Mostly Met: 80 to 99%

Somewhat Met: 60 to 79%

Not Met: Less than 60%

Strategic Outcome 1 - An environmentally sustainable agriculture, agri-food and agri-based products sector

AAFC supports an economically and environmentally sustainable agriculture, agri-food and agri-based products sector that ensures proper management of available natural resources and adaptability to changing environmental conditions. Addressing key environmental challenges in Canada including agriculture's impact on water quality and water use, adaptation to the impact of climate change, mitigation of agriculture's greenhouse gas emissions and the exploration of new economic opportunities contribute to a cleaner environment and healthier living conditions for the Canadian public, while enabling the sector to become more profitable.

Did you know?

AAFC is partnering with farmers, industry and universities to make agricultural tile drainage systems more environmentally sustainable. Part of this work includes examining the use of large in-ground filters called bioreactors to treat drain tile water. Bioreactors use a biological process in which naturally existing bacteria are supplied with readily available carbon feedstock such as woodchips and corn cobs. Once fed, the bacteria thrive and eat up excess nutrients such as nitrogen.

Program Activity 1.1: Environmental Knowledge, Technology, Information and Measurement

Program Activity Description

AAFC is focussed on supporting the sector through initiatives that enable it to use a more systematic management approach to making decisions with respect to environmental risks and help identify suitable corrective actions. The Department is conducting basic and applied research to improve scientific understanding of agriculture's interactions with the environment on the key environmental challenges facing Canada and its regions; developing sustainable agricultural practices and validating environmental and economic performance at the farm level; and developing, enhancing and using agri-environmental indicators, greenhouse gas accounting systems and economic indicators to assess the sector's environmental and economic sustainability. This program provides the platform for innovation and discovery of technologies and strategies which are used as the basis for application by the sector to improve its agri-environmental performance.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| Difference in financial resources is largely due to a realignment among Program Activities. | ||

| 59.6 | 92.9 | 89.8 |

| Planned | Actual | Difference |

|---|---|---|

| 692 | 682 | (10) |

| Expected Results |

Performance Indicators* |

Targets* | Performance Status |

|---|---|---|---|

| *The Performance Indicator and Target reported in the 2010-11 RPP were subsequently modified to the above performance measures as reported in the 2009-10 DPR. For further information, see Lessons Learned below. | |||

| Agriculture and agri-food sector makes decisions that incorporate sound environmental practices | Percentage of farms in Canada which have a formal Environmental Farm Plan (EFP) |

34% (The 2006 Farm Environmental Management Survey (FEMS) results indicate that 27% of all farms had an EFP. Next FEMS survey is planned for 2012.) |

While the target is established for 2013, progress to date indicates that it will be achieved |

Performance Summary and Analysis of Program Activity

AAFC supported sector decision-making through science-based policies and programs that improve the understanding of challenges and opportunities. AAFC's expertise ranges from basic science to applied research and technical transfer, as well as measurement and reporting for priority setting. On-farm environmental risk plans were key means by which the sector incorporated environmental considerations into decision-making. Further, the Sustainable Agriculture Environmental Systems initiative is improving the scientific understanding of agriculture's interaction with the environment while accelerating the creation of beneficial management practices. Farmers benefit through new and improved agricultural practices that address environmental challenges such as climate variability and water management, and issues related to livestock and crop production.

Agricultural decision makers require good quality information to address complex economic and environmental issues. In response, AAFC developed a set of science-based agri-environmental indicators that integrate information on soils, climate and topography with statistics on land use and crop and livestock management. These indicators help integrate environmental considerations into decision-making processes on overall environmental risks and conditions in agriculture and how these change over time.

Agri-environmental risks and opportunities are best addressed through collaborative efforts of governments, producers and stakeholders. In 2010-11, AAFC placed special emphasis on working with its partners to adopt innovation from other countries for sustainable agriculture.

Lessons Learned

Producers are responding to environmental concerns and progress is being made towards addressing the critical issues of water quality and climate change. However, further expansion and intensification of cropping and livestock production, due to an increasing demand for food and fibre or changing business conditions, could increase environmental pressure points arising from production practices unless appropriate actions are taken.

Awareness of on-farm environmental issues and how to manage them is the first step to improving environmental performance. The EFP process has become a key source of information and education for producers in Canada. It includes learning about agri-environmental issues, applying this knowledge on individual farms to identify potential environmental risks and developing an action plan to mitigate those risks. AAFC is working to better understand and report on the practices being implemented on Canadian farms for management of nutrients, pesticides, and land and water resources. To that end, AAFC has established new baseline values to better measure the decisions being made by the sector that integrate or include environmental considerations, including the number of farms in Canada which have a formal EFP.

Program Activity 1.2: On-Farm Action

Program Activity Description

AAFC supports farmers through direct on-farm programming that identifies environmental risks and opportunities and promotes the continuous growth of the stewardship ethic within the agriculture and agri-food sector. The Department supports farmers through: agri-environmental risk assessment and planning; providing expertise, information and incentives to increase the adoption of sustainable agriculture practices at the farm level; investigating and developing new approaches that encourage and support the adoption of sustainable agriculture practices; and increasing the recognition of the value of sustainable agriculture practices. This program supports environmental stewardship and helps reduce the sector's overall impact on the environment. It contributes to a cleaner environment and healthier living conditions for Canadian people, and a more profitable agriculture sector.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

|

Difference in financial resources is largely due to lower expenditures than authorized in the 2010-11 fiscal year as a result of timing in implementation of Growing Forward programs, the complexity of proposals and timing of implementation for multi-year projects under the AgriFlexibility program, and realignment among Program Activities. A large part of this unspent funding is expected to be carried forward. |

||

| 152.5 | 152.1 | 89.7 |

| Planned | Actual | Difference |

|---|---|---|

| The increase in FTEs is primarily a result of realignment of resources among Program Activities. | ||

| 384 | 411 | 27 |

| Expected Results |

Performance Indicators* |

Targets* | Performance Status |

|---|---|---|---|

| *The Performance Indicator and Target reported in the 2010-11 RPP were subsequently modified to the above performance measures as reported in the 2009-10 DPR. For further information, see Lessons Learned below. | |||

|

Improved agri-environmental risk assessment and planning by agricultural producers |

Percentage of farms in Canada taking action on their Environmental Farm Plan (EFP) |

92% by Mar 31, 2013 (The 2006 Farm Environmental Management Survey (FEMS) results indicate that 90% of all farms had implemented at least 1 best management practice (BMP). Next FEMS survey is planned for 2012) |

While the target is established for 2013, progress to date indicates that it will be achieved |

Performance Summary and Analysis of Program Activity

AAFC provides knowledge and tools for producers, land resource specialists and policy makers to support effective land management practices, agri-environment risk assessment and planning. The Department conducts basic and applied research, provides funding, and coordinates domestic and international approaches.

For example, AAFC is a founding member of the Global Research Alliance on Agriculture Greenhouse Gas Emissions (GRA). The GRA was launched in 2009 to increase international cooperation, collaboration and investment in public and private research activities to help the sector reduce greenhouse gas emissions while enhancing productivity and resilience to climate change. The expected results from these initiatives will be transferable to producers and throughout the GRA community. AAFC has developed the $27 million Agricultural Greenhouse Gases Program as Canada's initial contribution to GRA objectives.

AAFC continues to assist the sector to realize environmental benefits and reduce environmental risks by developing economically sustainable beneficial management practices (BMPs) and technologies. This work is complemented by ongoing scientific research to develop BMPs, technology transfer initiatives to help accelerate the adoption of environmentally sound management practices, and measuring and reporting the impact of agriculture on the environment.

Lessons Learned

The 2006 Farm Environmental Management Survey indicated strong adoption of nutrient management practices, such as soil nutrient testing. The 2006 survey also showed that improvements could be made to solid and liquid manure storage practices, the level of access grazing livestock have to surface water and the timing of pesticide applications.

BMP adoption levels, however, should be interpreted with caution. Farm management practices and their potential environmental impacts vary regionally since agricultural production, soil and landscape characteristics, weather and other factors differ across the country. Work is under way by AAFC to better understand these regional differences through an objective BMP Adoption Index that reflects the practices being implemented on farms by province and commodity. This work has led to the development of a new indicator and target to better reflect all programming in this area.

Strategic Outcome 2 - A competitive agriculture, agri-food and agri-based products sector that proactively manages risk

Canada's capacity to produce, process and distribute safe, healthy, high-quality and viable agriculture, agri-food and agri-based products is dependent on its ability to proactively manage and minimize risks and to expand domestic and global markets for the sector by meeting and exceeding consumer demands and expectations. Proactive risk management to ensure food safety, market development and responsiveness, and improved regulatory environment contribute directly to the economic stability and prosperity of Canadian farmers and provide greater security for the Canadian public regarding the sector.

Did you know?

Japanese and Mexican consumers have very positive perceptions of Canada and our food and beverage products. In fact, recent polling of consumers in these countries revealed that they think of Canadian food products as safe, clean, fresh, and high quality. However, Canadian products that do make their way to the grocery shelves in these countries are rarely identified as being from Canada. Through AAFC's Canada Brand program, efforts are under way to change this. Canadian companies who export to these countries are encouraged to become Canada Brand members so they can use the brand identifiers, including the stylized maple leaf, recognized by Mexican and Japanese consumers as a symbol of Canada, on their product packaging.

Program Activity 2.1: Business Risk Management

Program Activity Description

AAFC, in partnership with the provinces and territories, has a comprehensive suite of BRM programs to better equip producers with the tools and capacity to manage business risks. These programs consist of coverage for small income declines through AgriInvest, margin-based support for larger income losses through AgriStability, rapid assistance to producers through the disaster relief framework AgriRecovery, and protection against production losses due to uncontrollable natural hazards through AgriInsurance.

In addition, the Department provides assistance to producers through several financial guarantee programs. For instance, the Advance Payments Program facilitates the marketing of producers' crops when market conditions and prices may be more favourable.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| The reduced requirement for Business Risk Management program funding is primarily due to stronger commodity prices. | ||

| 1,996.2 | 1,477.6 | 1,452.5 |

| Planned | Actual | Difference |

|---|---|---|

| The decrease in FTEs is primarily a result of the transfer of delivery of the AgriStability program from the federal government to British Columbia and Saskatchewan, which is an initiative under Canada's Economic Action Plan discussed in Section II. | ||

| 549 | 486 | (63) |

| Expected Results |

Performance Indicators |

Targets | Performance Status |

|---|---|---|---|

| Producers' income losses are reduced | Current year producers' net market income (NMI) plus BRM payments compared to the previous five-year average NMI plus BRM payments for the sector | 85% of the previous five-year average NMI plus BRM payments by Mar 31, 2011 | Exceeded |

Performance Summary and Analysis of Program Activity

BRM programs under Growing Forward are comprised of AgriInvest, AgriStability, AgriInsurance, and the AgriRecovery framework. All programs in the suite work together to provide comprehensive farm income protection against the impacts of income or production losses and to help industry become more proactive in managing risks, while being more responsive, predictable and bankable.

BRM programs and other BRM-related payments totalling $1.45 billion helped stabilize net income (net market income plus BRM program payments) at a level higher than the five-year historical levels at 121%, exceeding the 85% target. This result is based on 2008 tax information, the most current information available. Program payments in 2008 represented a decrease of $766 million from the previous year. At the same time, the value of net market income increased by 44%, from $3.79 billion in 2007 to $5.47 billion in 2008.

A survey of Canadian producers in March 2010 showed a majority (78%) of those who have used two or more BRM programs agreed that they helped minimize financial risks. This survey collected information directly from producers on their risk management approaches and their views on the effectiveness of BRM programs.

Under AgriStability, payments are made when a producer suffers a significant loss. For producers receiving program payments, their current year margins improved from about 24% of their historical average margin to 63% in the 2008 program year, slightly below the target of 65%. Participation in the program has declined largely due to improved farm incomes, particularly in the grains and oilseeds sector. However, the program continues to play a significant role in the management of risk on Canadian farms with the percentage of market revenues covered by the program being 68% (Target: 75%). According to the 2009 BRM survey, about 60% of producers indicated that the program helped them recover their income loss.

Under AgriInvest, producer contributions to a savings account are matched by federal and provincial and territorial governments to help manage smaller income declines or investments in the farm operation. Participation in AgriInvest reached over 70% of all Canadian producers in the 2008 program year, which was similar to the first year of the program (Target: 65%). Participation has declined with the implementation of deposit requirements, but remains significant. About 60% of participants who suffered an income decline and triggered AgriStability payments in 2008 also made withdrawals from their AgriInvest accounts (Target: 60%), suggesting that the majority of producers are using the program to manage income declines. The 2009 BRM survey indicated that 90% of those who withdrew money from the accounts used it to address income declines, and 54% of producers viewed the program as an effective risk management tool. As program understanding and account balances increase, it is expected that the percentage of producers viewing the program as an effective management tool will increase.

AgriInsurance provides insurance protection to producers against the impacts of declines in production. In the 2009-10 crop year, about 87% of the value of all crops grown in Canada was insurable (Target: 85%). The value of crops grown in Canada that was actually insured represented about 63% of the total value of all agricultural products eligible for insurance (Target: 60%). Work is continuing to develop further livestock production insurance where there is an industry interest. Only limited livestock plans have been implemented to date, but officials are working to ensure consistency across the country and that both private and public sector plans can play a role in supporting the industry's insurance needs. The 2009 BRM survey revealed that the producers who received insurance payments over the past five years indicated it met their expectations in terms of amount (65% of respondents), the payments helped them recover from production loss (87%), and payments arrived in a timely manner (81%).

AgriRecovery helps federal, provincial and territorial governments respond to disasters. Since the implementation of the AgriRecovery under Growing Forward, federal, provincial and territorial governments have committed nearly $785 million under 26 initiatives to help producers affected by natural disasters in various regions across Canada. In 2010-11 alone, governments put in place 12 initiatives including the Prairie Excess Moisture Initiative with a commitment of nearly $601 million in disaster relief assistance. Discussions with provinces indicate that almost all of the producers who received AgriRecovery assistance indicate it has helped in the recovery of their operations, surpassing the target of 75%. In most cases, the producers were still in business one year after the disaster payments.

The Department also supported the consolidation of the Canadian hog sector. The two-year Hog Farm Transition Program helped the sector to transition to new market realities by providing a total of $71.9 million to 446 successful bidders who agreed to empty their barns and cease production for three years.

Lessons Learned

Together with provinces and territories, the Department continued to monitor performance through the BRM Performance Measurement Framework to ensure the programs are meeting their objectives. The information on the performance of the programs has been shared with industry stakeholders and will continue to inform the program development process for the next agricultural policy framework. In general, the programs are playing a significant role in stabilizing producer income concerns. However, producers’ concern about timeliness and predictability remains, as indicated by the 2009 BRM Service Delivery Client Satisfaction Survey and further reinforced by the 2010 Service Excellence Focus Group Study. These concerns will be considered in the discussions leading up to program design under the next agricultural policy framework.

An evaluation of AAFC's response to the bovine spongiform encephalopathy (BSE) crisis was completed in 2010-11. The evaluation found that the Department achieved its key objectives of sustaining the industry through the crisis, avoiding a mass slaughter of cattle herd, and maintaining producer and consumer confidence in the industry. In terms of the lessons learned, the evaluation identified several considerations relevant for the design of future disaster-related initiatives, including the importance of maintaining knowledge of current market structures in the design of future disaster related initiatives.

Program Activity 2.2: Food Safety and Biosecurity Risk Management Systems

Program Activity Description

AAFC supports producers and organizations in the development and implementation of food safety, biosecurity and traceability risk management systems to prevent and control risks to the animal and plant resource base thus strengthening the sector against widespread diseases and losses in domestic and foreign markets. The risk management systems are national, government-recognized on-farm and/or post-farm Hazard Analysis of Critical Control Points (HACCP) or HACCP-based food safety systems, National Biosecurity Systems, and a National Agriculture and Food Traceability System. These systems also support emergency management to limit the spread of animal and plant diseases, thereby reducing economic, environmental and social impacts of a crisis. A National Animal and Plant Biosecurity Strategy provides overall policy direction ensuring efforts are targeted at the highest possible biosecurity risks. Eligible recipients include national or regional non-profit organizations, producers and industry stakeholders.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| Difference in financial resources is largely due to lower expenditures than authorized in the 2010-11 fiscal year as a result of timing in implementation of Growing Forward programs, the complexity of proposals and timing of implementation for multi-year projects under the AgriFlexibility program and the Budget 2011 announcement to extend the existing Initiative for the Control of Diseases in the Hog Industry for an additional two years. A large part of this unspent funding is expected to be carried forward for use in future years. | ||

| 154.8 | 144.8 | 95.2 |

| Planned | Actual | Difference |

|---|---|---|

| 349 | 342 | (7) |

| Expected Results |

Performance Indicators* |

Targets* | Performance Status |

|---|---|---|---|

| *The Performance Indicator and Target reported in the 2010-11 RPP were subsequently modified to the above performance measures as reported in the 2009-10 DPR. For further information, see Lessons Learned below | |||

| Increased safety of the food systems | Percentage of producers participating in HACCP-based programs reporting adoption of food safety practices | 45% by Mar 31, 2013 | Progress measured to date indicates that the target should be met (The 2005 survey showed a level of participation of 28% for HACCP-based program; in 2008, the survey indicated a participation of 39%) |

Performance Summary and Analysis of Program Activity

Many Canadian farmers now are adopting HACCP-based food safety systems in a wide range of commodities. These include livestock (dairy, beef, pork, and veal) poultry (chicken, eggs, hatching eggs, and turkey) and horticulture (potatoes, fruit and nut, vegetable and melon, and greenhouse products).

During the reporting period, AAFC had agreements with 11 producer organizations and seven agri-business organizations to develop or enhance food safety systems and with 11 producer organizations to develop traceability systems.

AAFC, in collaboration with CFIA and its provincial and territorial partners, committed to phasing-in a comprehensive, mandatory, national traceability system for cattle, hogs, sheep, and poultry by 2011. Industry will take the lead, with government support. Identification of animals and premises will be the foundations of the traceability system to enable the movement of animals to be accurately recorded. Individual sector implementation plans for all livestock and poultry sectors will include the technical and legal processes required for these systems to operate.

Progress in 2010-11 included: amendments to the Health of Animals Act to include traceability regulations for hogs (with amendment processes begun for cattle, sheep and poultry); a working national traceability system for hogs; approval of national traceability standards; pilot of a Traceability National Information Portal to allow authorized parties to access traceability data from multiple sources; progress towards a national database service that combines elements of the existing Canadian Cattle Identification Agency and Agri-Traçabilité Québec databases; advances in traceability at co-mingling sites (feedlots, auction marts, fairs and exhibitions, etc.); and advances in premises identification and recording of animal movements in the priority sectors.

The Animal and Plant Health Research Program undertakes science to support national aims of food safety and biosecurity. Threats to national food security including the influence of emerging catastrophic diseases, such as clubroot disease of canola and the wheat stem rust pathotype Ug99, are identified as targets for this initiative and multi-team research has been launched. The factors responsible for genetic resistance to wheat stem rust Ug99 and the genes involved in resistance to clubroot were identified, and incorporation into new germplasm is in progress. Alternatives to antibiotic use in animal feeds, and science to mitigate food safety risks in food production, processing and distribution, are also included in the research. It has been demonstrated that the beneficial effect of antibiotics in animal feeds is mediated by the host immune system and opens the way to novel alternative strategies for production of antibiotic-free livestock.

Lessons Learned

To better reflect on-farm food safety in this Program Activity, the performance measurement has been changed. It focuses on producers participating in HACCP-based on-farm food safety systems rather than simply the percentage of producers indicating that they have adopted food safety practices. This reflects the fact that the majority of the national producer organizations are developing HACCP-based on-farm food safety systems.

Program Activity 2.3: Trade and Market Development

Program Activity Description

AAFC acts as Canada's agricultural trade advocate, working to break down trade barriers at home and abroad and expand opportunities for the agriculture, agri-food and agri-based products sector.

The Department assists the sector in identifying new domestic and global opportunities, markets and ways to enhance productivity, competitiveness and prosperity. AAFC also works to distinguish Canadian products under Canada Brand International and the Domestic Branding Strategy to expand and deepen the sector's strengths in the marketplace.

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| Difference in financial resources is largely due to a realignment among Program Activities as well as lower expenditures than authorized in the 2010-11 fiscal year as a result of the complexity of proposals and timing of implementation for multi-year projects under the AgriFlexibility program. | ||

| 116.3 | 123.0 | 93.4 |

| Planned | Actual | Difference |

|---|---|---|

| The increase in FTEs is primarily a result of the creation of the Market Access Secretariat and a realignment of resources among Program Activities. | ||

| 378 | 428 | 50 |

| Expected Results |

Performance Indicators* |

Targets* | Performance Status* |

|---|---|---|---|

| * When the Performance Indicator was first developed, a 1997 base year was used for deflating the growth in exports, which is reflected in the 2010-11 RPP. Since then, current year dollars have been adopted as a more meaningful basis for measuring and reporting performance. | |||

| A competitive sector that has the necessary attributes to strategically position itself to take advantage of new market opportunities, and/or to reposition itself to protect against changing market risks | Growth in total exports of agriculture and food | Reach a level of exports of $40 billion by Mar 31, 2013 | Met All (in terms of progress during the reporting period towards the 2013 target) |

Performance Summary and Analysis of Program Activity

In 2010, Canada exported $39.4 billion worth of agriculture, agri-food and seafood products to 194 countries, 42 of which purchased more than $100 million. This represented a 1.4% increase from 2009. The United States continued to be Canada's largest export destination; exports to the U.S. were valued at $20 billion, a slight decrease from 2009.

A key factor in the success of Canada's agriculture and agri-food industry in global markets is reliable and timely market intelligence. AAFC provided intelligence to a growing number of industry clients and provincial partners, including Canadian trade data on export commodities and markets that helped Canadian agricultural companies make business decisions.

In 2010-11, the Department continued to move forward with its multilateral and bilateral trade agenda. Negotiations with India, Ukraine and Morocco were successfully launched. The free trade agreement with Colombia was concluded, opening markets for key Canadian exports like beef and grains. Free trade agreements with Jordan and Panama are also expected to be implemented in 2011. Ongoing negotiations with the European Union continued to advance, as well as negotiations with Honduras and the Caribbean Community. Multilateral negotiations at the World Trade Organization (WTO) remained a work in progress.

The market access agenda for 2010 identified 10 priority markets to guide market access work. The priority markets included six established markets: United States, Mexico, Japan, South Korea, European Union, and Taiwan, and four emerging markets: Russia, India, China, and Indonesia. AAFC's 33 trade commissioners worked in 19 of our largest markets to advance and defend Canada's bilateral agri-food trade interests.

AAFC worked to promote science-based trade rules and to influence international standard-setting to provide a level playing field for Canadian exports. For example, Canada completed legal arguments to the WTO panels examining the U.S. Country of Origin Labeling (COOL) provisions and Korea's bovine spongiform encephalopathy bans on beef. A panel decision on U.S. COOL was expected in mid-2011. In parallel to the WTO panel process, Canada and Korea are also negotiating a science-based bilateral agreement aimed at securing commercially viable beef access.

The Canada brand continued to gain momentum at home and abroad. Research showed that this country's food processors can better compete against imports by more clearly identifying products grown, raised or processed in Canada. Putting a maple leaf on the front of a product label or package, and in close proximity to a Canadian content statement, increases sales of the product. Subsequent in-store pilot projects in three Canadian regions confirmed the results.

Internationally, results of public opinion research in Japan, South Korea and Mexico informed branding strategies to increase the visibility and desirability of Canadian products in those countries. Several marketing activities, including restaurant and retail chain promotions, helped increase consumer awareness of Canadian food.