ARCHIVED - National Research Council Canada - Report

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2009-10

Departmental Performance Report

National Research Council Canada

The original version was signed by

The Honourable Tony Clement

Minister of Industry

Table of Contents

- 1.1 Raison d'être and Responsibilities

- 1.2 Program Activity Architecture (PAA) 2009-2010

- 1.3 Performance Summary

- 1.4 Risk Analysis

- 1.5 Expenditure Profile

- 1.6 Canada's Economic Action Plan

- 1.7 Voted and Statutory Items

Section II: Analysis of Program Activities

- 2.0 Strategic Outcome

- 2.1 Program Activity: Research and Development (R&D)

- 2.2 Program Activity: Technology and Industry Support (TIS)

- 2.3 Program Activity: Internal Services

Section III: Supplementary Information

Minister's Message

Last year, Canada was the last country to fall into the global recession. Today, our economy is beginning to emerge in the strongest position of any advanced country in the world. Investment and key stimulus measures as part of Year 1 of Canada's Economic Action Plan provided continued results and helped set Canada apart from its G-8 counterparts in terms of economic strength.

In 2009-2010, Industry Canada worked quickly with its Portfolio Partners to deliver timely and targeted stimulus initiatives. Composed of Industry Canada and 10 other agencies, Crown corporations and quasi-judicial bodies, the Portfolio helps the department to build a more productive and competitive economy.

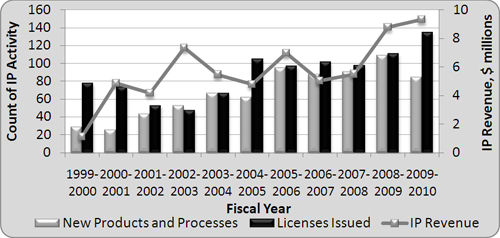

Industry Canada works closely with the National Research Council of Canada (NRC) to position Canada as a leader in the global knowledge economy. Last year, the Government of Canada invested $200 million over two years in the NRC Industrial Research Assistance Program to temporarily expand its initiatives for small and medium-sized businesses. NRC was successful in commercializing its technologies and issued 135 license agreements in 2009-2010, a 22 percent increase since 2008-2009, to support the economic growth in industry sectors including information technology, manufacturing and bioproducts.

Moving forward, Industry Canada will continue to ensure that the jobs and industries of the future are created right here in Canada. We will follow through on delivering existing stimulus plans and continue to support government priorities. This means ensuring that we have the right conditions and regulatory frameworks in place to encourage investment in Canada, increasing support for R&D to improve Canada's long-term competitiveness and developing a digital economy.

I will work with the Industry Portfolio Partners, the private sector and other governments to enhance Canada's productivity and create the foundation for strong, sustainable and balanced growth.

It is my pleasure to present this year's Departmental Performance Report for the National Research Council of Canada.

Tony Clement

Minister of Industry

President's Message

I submit for tabling in Parliament, the 2009-2010 Departmental Performance Report for the National Research Council of Canada.

In 2009-2010, NRC was able to find the balance between pursuing goals related to the Federal Science and Technology (S&T) Strategy Mobilizing Science and Technology to Canada's Advantage and efficiency measures arising from the Strategic Review exercise.

The report demonstrates the spirit of NRC employees pursuing excellence as they enhance Canadian innovation working across institutes, across disciplines and with collaborators across Canada and around the world. NRC's eleven technology cluster initiatives are an example of a partnership approach that supports the federal S&T Strategy, through accelerating the commercialization of new technologies, products, processes and services, and by building S&T capacity in key sectors and regions. Since 2003, the technology cluster initiatives have demonstrated contribution to improved Canadian productivity with significant growth in private sector firm participation, in private sector investment in research and development (R&D), and in the number of R&D employees working within the technology clusters. Targeted NRC R&D in key industry sectors links to federal priorities in S&T and to NRC's Industrial Research Assistance Program (NRC-IRAP) to support the growth of innovative Canadian firms, provide jobs and develop technologies that enhance the lives of Canadians. NRC-IRAP has been a key stimulus mechanism in Canada's Economic Action Plan, receiving a boost of $100 million in the past year alone that has allowed it to fund projects in over a thousand additional firms, which supported over five thousand additional jobs for Canadians. In 2009-2010, NRC R&D touched the lives of Canadians in many ways, including by supporting Canada's Olympic Winter Games with transportation based on innovative clean energy technologies and by helping Canadian athletes with detailed analysis to enhance their aerodynamics and bring home a record number of Olympic medals.

I was appointed to lead the National Research Council in April 2010. As NRC approaches the end of its five year strategy, I will be undertaking a strategic renewal exercise to further strengthen the organization's position as a key science, technology and innovation agency that is aligned with national priorities and a key supporter of Canadian productivity and competitiveness.

Mr. John McDougall, President

Section I – Overview

1.1 Raison d'être and Responsibilities

NRC is one of the nation's leading resources to help Canadians generate value through S&T in the face of a changing innovation landscape, with a focus on enhancing socio-economic benefits for Canadians. With a presence in every province, NRC provides a strong national foundation along with international linkages to help Canada remain competitive in the transitioning global economy. NRC's expertise and unique capabilities both generate and move ideas to the marketplace by undertaking R&D in areas critical to Canada's future, fostering industrial and community innovation and growth through technology and industry support, and providing, maintaining and advancing national infrastructure and information for the scientific and industrial community to help push innovation forward and keep Canada at the cutting-edge. NRC's approach is directly aligned with the Government of Canada's 2007 S&T Strategy, Mobilizing Science and Technology to Canada's Advantage, and is underpinned by four key principles: excellence in research; focus on priorities for the short and long term; strong partnerships; and enhanced accountability.

NRC Mandate

Under the National Research Council Act, NRC's authorities include:

- Undertaking, assisting or promoting scientific and industrial research in different fields of importance to Canada;

- Providing vital scientific and technological services to the research and industrial communities;

- Investigating standards and methods of measurement;

- Working on the standardization and certification of scientific and technical apparatus and instruments and materials used or usable by Canadian industry;

- Operating and administering any astronomical observatories established or maintained by the Government of Canada;

- Administering NRC's research and development activities, including grants and contributions used to support a number of international activities;

- Establishing, operating and maintaining a national science library; and

- Publishing and selling or otherwise distributing such scientific and technical information as the Council deems necessary.

NRC Operating Environment

The federal S&T Strategy, Mobilizing Science and Technology to Canada's Advantage, was launched in May 2007 laying out a plan to build three key advantages for Canada: an Entrepreneurial Advantage, a Knowledge Advantage, and a People Advantage. NRC has unique attributes that support the three Advantages in the federal S&T Strategy and shape its operating environment, including:

Entrepreneurial Advantage

- The ability to help companies move from discoveries in the laboratory to the development, prototyping and commercialization for the global marketplace.

- The ability to put together national programs for delivery in regions across the country.

- A national S&T infrastructure positioned to improve Canada's innovation capacity in existing and emerging fields of research by building networks for researchers and businesses, training highly qualified personnel, creating new technology-based companies and jobs, and transferring knowledge and technology to Canadian companies.

- The capacity to adopt an integrated approach that brings research, technologies and industrial links together in delivering its mandate to provide access to international S&T infrastructures.

Knowledge Advantage

- Leading-edge knowledge generation capability through publications in refereed journals, conference proceedings, and technical reports.

- The capability to bring together multi-disciplinary research teams to tackle issues of national importance.

- The skills to manage research projects towards specific outcomes as well as long-term goals.

People Advantage

- A core strength of over 4,500 talented and dedicated people who are engaged in over 1100 research collaborations valued at over $800 M.

NRC Accountability Framework

NRC is a departmental corporation of the Government of Canada, reporting to Parliament through the Minister of Industry. NRC works in partnership with the members of the Industry Portfolio to leverage complementary resources and exploit synergies in areas such as increasing the innovation capacity of firms through S&T, facilitating the growth of small- and medium-sized enterprises (SMEs) and fostering the economic growth of Canadian communities. NRC's Council provides strategic direction and advice to the President and reviews organizational performance. The President is the leader, responsible for fulfilling corporate strategies and delivering results. Each of six Vice-Presidents (Life Sciences, Physical Sciences, Engineering, Technology and Industry Support, Human Resources and Corporate Management) has responsibility for a portfolio of research institutes, programs, centres or corporate branches. In addition, the Secretary General is responsible for NRC governance and accountability, ethics, conflict of interest, communications and corporate relations, corporate policy, and strategy and performance management.

| Strategic Outcome | Program Activity | Sub-Activity |

|---|---|---|

| An innovative, knowledge-based economy for Canada through research and development, technology commercialization and industry support | Research and Development (R&D) |

|

| Technology and Industry Support (TIS) |

|

|

| Internal Services |

|

The Research and Development (R&D) Program Activity is undertaken for strategic fields of science and engineering leading to the application of innovative technologies through commercialization and technology transfer in key economic and national S&T priority areas. These priority areas are: environmental science and technologies; natural resources and energy; health and related life science technologies; and information and communications technologies. Through these priority areas, NRC contributes to wealth generation for Canadians, in alignment with the Government of Canada's S&T strategy, and to one of the Government of Canada's outcomes: an innovative and knowledge-based economy. It also provides national science infrastructure for the benefit of industry, universities and government collaborators, such as facilities in astronomy and astrophysics and metrology.

The Technology and Industry Support (TIS) Program Activity includes the provision of technology assistance, financial support and commercialization assistance to SMEs; dissemination of scientific, technical and medical information to industry, government and universities; and business-focused support to NRC executives and managers.

1.3 Performance Summary

| Planned Spending | Total Authorities | Actual Spending |

|---|---|---|

| 705.2 | 990.1 | 931.0 |

| Planned | Actual | Difference |

|---|---|---|

| 4,504 | 4,508 | 4 |

The Planned Spending amount of $705.2 M represents the best known amount at the time the Main Estimates were prepared. The Total Authorities includes Planned Spending, amounts from Budget 2009, amounts from Supplementary Estimates, and other statutory authorities. The difference between the Planned Spending and the Total Authorities is $284.9 M ($140.0 M for Canada's Economic Action Plan, $71.9 M for personnel costs ($38.3 M for retroactive payments under collective bargaining; $11.4 M for severance pay, pay-in-lieu of notice and maternity leave; and $22.2 M for employee benefit plans), $69.4 M in other statutory authorities, $3.6 M in other). The $59.1 M difference between the Total Authorities and the Actual Spending is unspent funding from statutory revenues of $46 M, frozen allotments of $9 M and a lapse of $4 M in transfer payments. Human resource utilization is expressed in units of Full Time Equivalent (FTE). The variance between planned and actual FTE values is discussed in Section 2.3.4.

Note: Except where noted otherwise, all financial results are reported on a cash accounting basis for historical comparability.

| Performance Indicators | Targets | 2009-2010 Performance |

|---|---|---|

| Percentage change in private sector client capacity for innovation through growth of client firms. Growth in client capacity for innovation is measured using the annual R&D expenditures of client firms and the number of technical staff devoted to R&D in client firms. | Establish baseline by FY 2009-2010 with a 10% increase in client innovation capacity in subsequent years | NRC developed a statistical and econometric framework for measuring the economic impacts of its research and activities on its clients in comparison with non-clients. The analysis focuses on growth in client innovation capacity and NRC's influence on that growth. NRC worked with Statistics Canada to build the performance comparison models from 6 SME databases. Modeling and data analysis of over 10,000 client and matched non-client firms was completed and the results are under review with Statistics Canada. Preliminary results are positive and statistically-significant. Final results are anticipated during 2010-2011. |

| Program Activity | 2008-2009 Actual Spending ($ millions) |

2009-2010 ($ millions) | Alignment to Government of Canada Outcomes | |||

|---|---|---|---|---|---|---|

| Main Estimates | Planned Spending | Total Authorities | Actual Spending | |||

| Research and Development | 455.6 | 439.8 | 439.8 | 556.3 | 497.9 | An Innovative and Knowledge-based Economy |

| Technology and Industry Support | 189.9 | 184.8 | 184.8 | 328.0 | 309.8 | |

| Internal Services | 112.4 | 80.6 | 80.6 | 105.8 | 123.3 | |

| Total | 757.9 | 705.2 | 705.2 | 990.1 | 931.0 | |

| Note: Due to rounding, figures may not add to totals shown. The difference between planned and actual spending for Internal Services is due to the existing budget allocation methodology, which results in an artificially low budget or planned spending allocation for Internal Services. This discrepancy in financial reporting for Internal Services will be remedied with implementation of the new 2010-2011 Program Activity Architecture. | ||||||

Contribution of Priorities to Strategic Outcome

| Operational Priorities | Type | Linkages to Strategic Outcome 1 |

|---|---|---|

| Priority 1 – Support Canada's S&T Strategy | New | NRC contributed to its strategic outcome of an innovative, knowledge-based economy for Canada through research and development, technology commercialization and industry support by aligning with Canada's S&T Strategy. |

|

Performance status – Met All1

NRC also contributed to Canada's People Advantage by providing employment opportunities for over 600 research associates and recent post-secondary graduates to develop and enrich their skills. |

||

| Priority 2 – Support and conduct R&D in key industry sectors | Ongoing | NRC examined the economic importance, R&D intensity, and potential NRC impact of Canada's Industry Sectors and arrived at key industry sectors. The identified key sectors depend on innovation for their growth and competitiveness, and accordingly, benefit the most from the resources and knowledge which NRC can provide. |

|

Performance status – Met All1 |

||

| Priority 3 – Provide integrated industry support that engages key players | Ongoing | The Canadian innovation system comprises all the organizations that support and conduct research, and transform new knowledge into new products and services for sale into both domestic and international markets. NRC strengthened the Canadian innovation system by supporting regional and national research and development organizations, assisting individual firms improve their own innovation capacity through specialized advisory services and providing relevant and challenging work experience for recent university graduates to develop the next generation of highly qualified research and development personnel. |

|

Performance status – Met All1 |

||

| Management Priorities | Type | Linkages to Strategic Outcome 1 |

|---|---|---|

| Priority 4 – Ensure effective program management for a sustainable organization | Ongoing | NRC must be a sustainable and agile national research and innovation organization for Canada in order to achieve its outcome. |

|

Performance status – Met All1 |

||

1.4 Risk Analysis

Canada's federal S&T Strategy speaks to a need to enhance Canadian productivity and competitiveness through innovation. However, global competition is growing with major R&D investments by countries such as the United States and China.

NRC is looking at how to grow its relevance to Canada in light of the evolving Canadian and global environment, and how best to manage the resultant risks in order to achieve its objectives. In 2009-2010, NRC put particular focus on addressing the following key risks and related issues, as identified within the analysis and findings of its annual Corporate Risk Profile (CRP):

- funding and financial pressures (direct and indirect) resulting from factors including the economic downturn, Strategic Review, rising operational costs and several sunsetting program funds;

- continued suitability of NRC's direction for implementation of its Strategy given the changes that have taken place in the environment, as well as the factors raised above; and

- limited awareness and knowledge of NRC's role and contributions among critical stakeholders.

Work was undertaken on a number of fronts to manage the key risks identified above, such as:

- Financial strategies: NRC had gone through an internal strategic re-alignment, prior to the externally driven strategic review to help focus allocation of resources. These resources continue to be increasingly eroded by inflation and the growing costs of an increasingly senior and experienced workforce. To address funding and financial pressures, a number of measures were put in place. Short-term measures included tightened restrictions on travel and hospitality, efficiency reviews and a moratorium on external hiring. Longer-term measures include increased research focus, increased revenue generation and investigating alternative business models. The SAP Business Intelligence Tool, now implemented and in use, will facilitate financial information management and reporting with linkages to non-financial performance. A financial dashboard is accessible as a monthly report, and NRC continues to undertake quarterly reviews of its financial situation. A financial control framework is in place, as well as audited annual financial statements, commentary, and analyses.

- Strategy re-assessment: A mid-term assessment of NRC's 2006-2011 Strategy was carried out to better understand the degree of implementation success to date, lessons learned, and how best to move forward. The assessment identified a number of required adjustments. Recommendations included establishing an appropriate governance model to optimize NRC's impact, defining and clearly communicating updated criteria for decision-making on priorities for the future, and ensuring a process is in place for strategic investment decisions with a good balance between short and long term research. Furthermore, implementation of new Treasury Board policies on project management and investment planning are expected to affect many of the issues around investment decisions.

- Stakeholder relationships: A strategy to build stakeholder relationships has also been developed by NRC's Communications and Corporate Relations Branch to address the issue of awareness and knowledge of NRC's role and contributions. To date, senior executive and senior management have been engaged to: 1) more strategically target and engage the right stakeholders; and 2) ensure the right key messages are in place for communications. Good progress was made over the summer of 2009-2010 with more than 30 ceremonies associated with NRC-IRAP successes and a dozen other announcements related to NRC. Internal communications was enhanced through a revamped Web site, with other initiatives including a Speaker's Bureau Pilot Project, in place for 2010. The objectives of the latter, in particular, are to: build NRC's public profile and to better manage and expand our key relationships; promote and coordinate speaking opportunities for NRC science-speakers; and serve as a key tool in positioning NRC by showcasing our scientific achievements, building awareness, and creating excitement about Canadian science and technology.

The annual CRP also identified Human Resource (HR) challenges associated with capacity and workforce renewal (attraction and retention, succession planning) as areas of high risk in addition to the priority ones identified above. This is of particular note given the nature of NRC's activities being heavily reliant on the highly specialized skills and knowledge of scientific and technical personnel. HR strategies have been developed to review its executive talent, increase the rigour around workforce planning (development, training), and put in place an improved HR performance management system.

Opportunities – NRC will be undertaking a strategic renewal exercise to address the risk challenges identified and further strengthen the organization's position as a key science, technology and innovation agency that is aligned with national priorities and a key supporter of Canadian industrial productivity and competitiveness. NRC is well positioned to contribute to issues of national importance. It has a presence across the country, with multi-disciplinary scientific and technical expertise, experienced in addressing complex issues. NRC can also more visibly demonstrate its effectiveness in bridging the national innovation gap by moving new science, technology and knowledge from universities and federal labs to commercialized products and services, by working closely to support private sector industry.

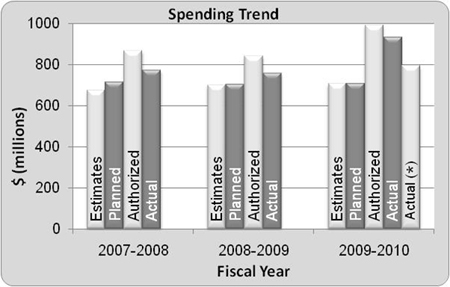

1.5 Expenditure Profile

Actual spending for fiscal year 2009-2010 was $931.0 M, which was an increase of $173.3 M over fiscal year 2008-2009. The largest component of this increase was related to the $140.0 M received from Budget 2009 for Canada's Economic Action Plan. When the Economic Action Plan amount is removed, the average spending over the period from fiscal 2007-2008 to 2009-2010 is $773.3 M. This amounts to an average annual increase of less than 0.9% per year over this three year period.

(*) excluding Canada's Economic Action Plan

[D]

1.6 Canada's Economic Action Plan

Budget 2009, Canada's Economic Action Plan, was designed to provide $4.9 B in new S&T investments, one of the most substantial S&T investments in Canadian history. Through these investments, the government strengthens the economy, builds the future of Canadian S&T, and advances our nation's position amongst global innovation leaders. The initiatives funded below contribute to Canada's long-term competitiveness and improved quality of life for Canadians. All were delivered using existent NRC salary resources.

Temporary Expansion of the NRC Industrial Research Assistance Program:

Under this initiative, NRC will have received by 2010-2011 a total of $200 M over two years to enable it to temporarily expand its existing initiatives under NRC-IRAP for SMEs. This included $170 M to double the Program's contribution to firms, and $30 M to help companies hire new post-secondary graduates under its Youth Employment Program.

| 2009-2010 Planned | 2009-2010 Actual | 2010-2011 Planned |

|---|---|---|

| 100.0 | 97.6 | 100.0 |

| NRC-IRAP Expected Result through Canada's Economic Action Plan: SMEs in Canada have merit-based access to effective and efficient innovation support resulting in increased wealth. | ||

| Performance Indicators | Targets | Performance Summary |

|---|---|---|

| Number of firms assisted | 720 firms by March 2010 | 1,355 firms |

| Number of graduates placed | 333 graduates by March 2010 | 488 graduates |

Budget 2009 also provided NRC-IRAP with an additional $27.5 M from the Federal Economic Development Agency for Southern Ontario (FedDev Ontario). These funds were provided to NRC through an agreement with Industry Canada to support economic and community development of SMEs in Southern Ontario. For further details refer to Section 2.2.1.

| 2009-2010 Planned | 2009-2010 Actual | 2010-2011 Planned |

|---|---|---|

| 27.5 | 27.3 | 42.8 |

| Note: The values shown reflect grants and contributions to SMEs. The 2010-2011 planned value includes $26.6 M from the Community Adjustment Fund (CAF) that has been added to NRC's reference levels under FedDev Ontario. | ||

Modernizing Federal Laboratories (MFL):

Under this initiative, NRC will have received a total of $19.07 M of infrastructure stimulus over two years, which was used to address deferred maintenance issues and to generally modernize facilities across Canada that support research in areas of national importance such as health and wellness, sustainable energy, manufacturing,

and metrology. Additional details are available in Section 2.3.1.

| 2009-2010 Planned | 2009-2010 Actual | 2010-2011 Planned |

|---|---|---|

| 8.710 | 8.710 | 10.360 |

| Performance Indicators | Targets | Performance Summary |

|---|---|---|

| Program completion by 2010-2011 | Approximately 80 projects by March 2011 | On track with 54 projects completed by March 2010 |

| Number of jobs created | Approximately 145,000 hours of labour by March 2011 | On track with 67,000 hours of labour completed by March 2010 |

Accelerated Federal Contaminated Site Action Plan (FCSAP):

Under this initiative, NRC will have received by 2010-2011 $4.84 M of infrastructure stimulus over two years to remediate contaminated areas in an effort to clean up the environment and improve safety. Works associated with this initiative commenced in 2009 and will continue into 2010-2011.

| 2009-2010 Planned | 2009-2010 Actual | 2010-2011 Planned |

|---|---|---|

| 2.380 | 2.380 | 2.455 |

| Performance Indicators | Targets | Performance Summary |

|---|---|---|

| Program completion for 2010-2011 | Approximately 13 projects (assessment, remediation, risk management) by March 2011 | All projects are on track. See Section 2.3.1 for details. |

| Number of jobs created | Approximately 15,000 hours of labour | This data will be compiled at the completion of the Initiative in March 2011. |

1.7 Voted and Statutory Items

| Vote Number or Statutory Item (S) |

Truncated Vote or Statutory Wording |

2007-2008

Actual Spending |

2008-2009

Actual Spending |

2009-2010

Main Estimates |

2009-2010

Actual Spending |

|---|---|---|---|---|---|

| 55 | Operating expenditures | 422.9 | 429.6 | 397.6 | 430.5 |

| 60 | Capital expenditures | 45.1 | 42.4 | 42.4 | 51.2 |

| 65 | Grants and contributions | 148.1 | 141.8 | 140.6 | 271.0 |

| (S) | Spending of revenues pursuant to the National Research Council Act | 96.7 | 87.2 | 79.0 | 110.2 |

| (S) | Contributions to employee benefit plans | 57.6 | 56.5 | 45.7 | 67.9 |

| (S) | Spending of proceeds from Disposal of Crown Assets | 0.7 | 0.1 | 0.2 | |

| (S) | Collection Agency Fees | 0.0 | 0.0 | 0.0 | |

| (S) | Loss on foreign exchange | 0.3 | |||

| Total | 771.1 | 757.9 | 705.2 | 931.0 | |

| Note: Due to rounding, figures may not add to totals shown. Values shown as zero are non-zero values which, due to rounding, display as "0.0". | |||||

The difference between Main Estimates and Actual Spending in 2009-2010 is discussed in Section 1.3. The increase to employee benefit plan spending in 2009-2010 is due primarily to collective bargaining.

Section II – Analysis of Program Activities

2.0 Strategic Outcome

Significant structural changes in the economy often follow major economic crises. These changes are generally good opportunities to foster innovation. In the context of the recent world economic upheaval, Canadian businesses and research centres need support to create these opportunities in the short term. By virtue of its competencies, infrastructure, national and international networks and partnerships, NRC is the Government's key R&D instrument to address national issues of importance and to bridge academia and industry to support knowledge creation and its commercialization for positive economic impact. Given the recent economic stresses on small- and medium-sized businesses, NRC played an even more important role in helping sustain Canadian innovative activity to support economic recovery.

Through an extensive econometric study carried out with Statistics Canada, NRC met its performance target of establishing a baseline for quantifying its impact on growth of private sector client capacity for innovation. In addition, preliminary results of the study revealed a positive, statistically-significant growth (in terms of R&D expenditures, employment of R&D personnel, and sales revenue) of NRC client firms relative to matched non-client firms selected by Statistics Canada. The analysis was based on a study of over 10,000 clients during the 10 years leading to 2009. These results are undergoing a rigorous validation process with Statistics Canada.

NRC's Technology Clusters

When several innovative companies come together and concentrate in a region, known as clusters, they attract others with technological and business expertise, and an interest in sharing the risks and benefits of collaborative research. A cluster benefits strongly from the presence of a local science and technology anchor – a prominent research organization or university – that can

work with local companies to transfer technology and spin off new enterprises. This is the role that NRC has played in Canada's Technology Clusters. Technology Cluster Initiatives (TCIs) are an example of a partnership approach that supports the federal S&T Strategy, directed at accelerating the commercialization of new technologies, products, processes and services, and furthering S&T capacity in key sectors and regions. Building on 10 years of experience in the field, the investment in technology clusters has led to the establishment of centres across

the country with core attributes focused on increasing Canadian productivity and competitiveness. Working with Statistics Canada in 2009-2010, NRC quantified the early-stage outcomes in its developing and growing technology cluster. These include the following results that have been validated and approved by Statistics Canada for

release.

- Growth in the number of private sector firms participating in clusters – In 2009, there were 2,356 private sector firms, not including ancillary firms, identified as participating within NRC's portfolio of technology cluster initiatives. Total sales by cluster firms grew from $23 B in 2003 to $43 B in 2009.

- Growth in private sector investment in R&D – The cluster firms invested $3.2 B in R&D in 2009, which is up from $1.0 B in 2003. This represents between 18% to 21% of the total industrial R&D investment in Canada in 2009. This has grown from 7% of the total R&D investment in 20032.

- Total number of R&D employees of private sector firms participating in the technology area of focus of the clusters – The total number of R&D employees of private sector firms participating in the technology area of focus of the cluster is estimated at 23,500 in 2009 as compared to 10,500 in 2003.

In addition, a 2009 evaluation of the TCIs found that $342 M in NRC funds attracted an additional $330 M from other sources from inception through 2007-2008.

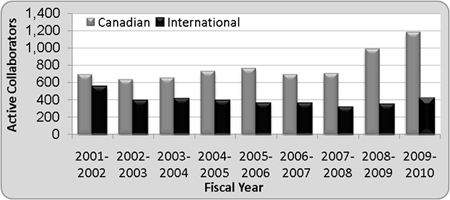

NRC: A Valued Research Partner

The value and relevance of NRC's research and supporting activities is evidenced by partner investments in collaborative projects. In 2009-2010, NRC had a total of 1245 active collaborative research agreements with 1184 Canadian and 414 international partners from industries,

universities, and governments. NRC's portfolio of active collaborations increased in value from $415 M in 2001-2002 to a high of $831 M in 2009-2010 including $207 M leveraged from foreign sources. There has been an upward trend in the number of Canadian collaborators during this period.

Source: NRC Business Intelligence System

[D]

| 2009-2010 Financial Resources ($ millions) | 2009-2010 Human Resources (FTEs) | ||||

|---|---|---|---|---|---|

| Planned Spending | Total Authorities | Actual Spending | Planned | Actual | Difference |

| 439.8 | 556.3 | 497.9 | 2,873 | 3,140 | 267 |

| The difference between planned spending and actual spending is due mainly to an increase of $22.4 M spending of revenue; increase of $13.5 M pertaining to revenue salaries, operating budget exchanges, and salary increases arising from collective bargaining; increase of $23.4 M in operations; decrease of $0.5 M in capital spending; and decrease of $2.7 M in transfer payments. The variance between planned and actual FTE values is discussed in Section 2.3.4. | |||||

| Expected Results | Performance Indicators | Targets | Performance Status | Performance Summary |

|---|---|---|---|---|

| Excellence and leadership in research that benefits Canadians | Publications in refereed journals / proceedings and technical reports | 3,500 publications by March 2010 | Exceeded4 | NRC researchers produced a total of 8174 articles: 1344 in refereed journals, 799 in conference proceedings, and 6031 technical reports. |

| Technology licences issued | 85 licences in high impact and emerging industry sectors by March 2011 | Exceeded4 | Issued licenses increased by 22% to 135. In addition, NRC introduced 85 unique product and process innovations to industry. |

2.1.1 Benefits to Canadians

Although the socio-economic benefits from scientific research can often take years to be visible, investment today is critical for future innovation and sustained global competitiveness. NRC contributes to the research continuum in Canada, from basic research to commercialization. These activities have long-term impacts on many segments of the economy. The following are examples of achievements and milestones in longer-term efforts demonstrating NRC's benefit to Canadians. NRC scientists and engineers have contributed to major advances in:

- non-invasive medical devices and techniques for early diagnosis, improved treatment and prognosis of such neurodegenerative diseases as Alzheimer's and Parkinson's;

- innovative molecular-level strategies, vaccine technologies and immunotherapies to help prevent and treat infectious diseases;

- marine-based bioactive compounds to treat neurological and obesity-related disorders, control infection and increase immunity;

- developing new crop platforms for the production of biofuels and industrial bioproducts;

- developing synthetic biological approaches to produce high-quality pharmaceuticals, natural products, and industrial bioproducts;

- developing protein-based targeting agents as prospective therapeutics for treatment of cancer;

- lithium-ion batteries and solid oxide fuel cells for portable power sources;

- developing solar cells on lightweight flexible substrates that can be incorporated into fabrics, window coverings, built into architectural structures or integrated into portable electronic devices;

- better construction materials, such as ultra high-performance concrete, and designs that protect critical public infrastructure against extreme shocks;

- flight safety, conducting icing experiments to modify winter flight operation regulations; and

- improving maritime safety in the performance and survivability of a lifeboat in ice and winter conditions.

2.1.2 Performance Analysis

One of the first tangible outputs of an investment in R&D is a publication in a scientific or engineering journal. Publication activity is a good predictor of the immediate outcome from NRC research and can be used to benchmark NRC's performance against the rest of the world. In 2009-2010, NRC's publications in refereed journals and in refereed conference proceedings declined in number by 5.0% and 20.3%, respectively, from 2008-2009. This can be explained by a greater focus on applied research and by restricted funding for travel to conferences. The reported number of technical reports has increased significantly since 2007-2008. This is due to an improved system for counting calibration reports and certificates of chemical analysis.

NRC's research output is high and cited more than the world average – A 20095 bibliometric analysis of NRC's research output between the years 1997 and 2008 revealed that the contribution of NRC research (publications with NRC authors) remains high at 2.6% relative to the overall Canadian publications productivity. Citations are a measure of the potential use and impact of a researcher's work by fellow researchers. The report stated qualitatively that NRC's research output is cited more than the world average and that NRC's papers are published in journals that are cited more frequently than the world average. This is consistent with an earlier report6 stating that NRC remained approximately 40% ahead of the world average and ahead of the Canadian and federal government averages for the previous 26 years.

Impact of NRC Licensing – Licensing statistics are impact or outcome indicators pertaining to NRC's successes in attracting industries to bring NRC innovations to market. They are indicative of

industry confidence in the commercial value of NRC innovations.

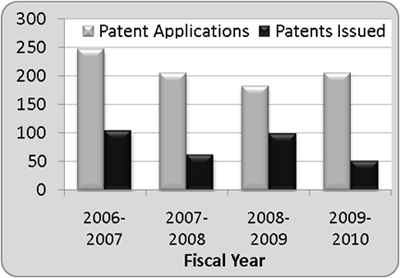

During 2009-2010, NRC increased the flow of technologies into high-impact and emerging sectors of the economy by introducing 85 unique product and process innovations to industry. NRC filed 206 patents, and 51 patents were issued. Issued licenses increased by 22% to 135.

NRC licensing activity has generally increased during the decade as NRC increased its focus on applied, market-driven research. The number of issued licenses almost doubled from 78 in 1999-2000 to a high of 135 in 2009-2010. Intellectual Property (IP) revenue increased from $1.1 M in 1999-2000 to a high of $9.3 M in 2009-2010. The number of products and processes transferred to industry7 almost tripled from 29 in 1999-2000 to 85 in 2009-2010. The rise in license revenue in 2002-2003 is attributed mainly to NRC's Meningitis-C Vaccine, which had recently been approved for use in Canada. The top licenses, in terms of IP revenue received in 2009-2010, are diversified across the industries and national priority areas of health, bioproducts, information technology, transportation, manufacturing, aerospace, and

construction, with a specific strength in immunology.

NRC's increased focus on solutions-oriented research is also reflected in improved license efficiency. For every patent awarded to NRC in 2009-2010, NRC issued 2.6 licenses contributing to Canadian companies' growth.

This is more than double the efficiency of 1.1 licenses per patent realised in 1999-2000.

Exploring NRC's R&D Contributions – In 2009-2010, guided by the federal S&T Strategy, NRC focused strategically in areas that are of national interest from a social and economic perspective and contributed to:

- The global competitiveness of Canadian industry in key sectors and to the economic viability of communities (sector specific and applied research and technology development that contributes now and in the future to a growing and sustainable economy).

- Canada's S&T priority areas critical to Canada's future (longer term innovative research that brings about scientific discoveries for the public good). These include environmental science and technologies; natural resources and energy; health and related life sciences and technologies; and information and communications technologies.

- Strengthening Canada's Innovation System and S&T infrastructure (development of critical technology platforms, knowledge dissemination, major S&T infrastructure, codes and standards, etc.).

These areas can be explored in much greater detail on NRC's Web site.

2.1.3 Lessons Learned

Lacking a central process for compiling and managing business-related performance data, NRC gathers such information from the diverse management systems of its individual institutes. Recognizing the inefficiencies and potential for errors of such diffused processes, NRC launched its business intelligence (BI) information system that is expandable to collecting performance data centrally on a transaction basis. This includes data for licensing, collaborative agreements, and client feedback. The BI system is still a work in progress with various modules still to be developed to capture real-time data. When fully integrated, this will lead to more effective management of organizational R&D performance with increased efficiency and reliability.

NRC's Industry Partnership Facilities (IPFs) are unique workplaces in over 15 NRC facilities across Canada where firms are co-located and incubated to develop their technology and business opportunities in a supportive and cooperative environment. With over 10 years of operating experience at these facilities, NRC understands the extended timeline for typical start-up technology companies to reach the launch point. It is also apparent that for many of the current cohort of university graduates, the immediate reward of an interesting job is more attractive than the risky future reward of running one's own company. NRC has learned to seek "old entrepreneurs" to complement "young" ones. An established company that already has market traction and knowledge can have greater chance of success in selling a new technology product than an unknown start-up. This knowledge is being applied on a trial basis in the operation of an IPF.

| 2009-2010 Financial Resources ($ millions) | 2009-2010 Human Resources (FTEs) | ||||

|---|---|---|---|---|---|

| Planned Spending | Total Authorities | Actual Spending | Planned | Actual | Difference |

| 184.8 | 328.0 | 309.8 | 800 | 703 | 97 |

| The difference between planned spending and actual spending is due to the $125 M increase in grants and contributions from Canada's Economic Action Plan. This Plan provided limited operations funding. The variance between planned and actual FTE values is discussed in Section 2.3.4. | |||||

| Expected Results | Performance Indicators | Targets | Performance Status | Performance Summary |

|---|---|---|---|---|

| Enhanced innovation capacity of Canadian firms | Percentage of technology and industry support clients satisfied with NRC innovation support | 80% by March 2011 | Exceeded4 |

The following performance data on service standards and client feedback indicate a high degree of client satisfaction.

|

2.2.1 Canada's Economic Action Plan

Under Canada's Economic Action Plan (see Section 1.6 for details), NRC received a total of $200 M over two years to enable it to temporarily expand its existing initiatives under NRC-IRAP for SMEs. This included $170 M to double the Program's contribution to firms, and $30 M to help companies hire new post-secondary graduates under its Youth Employment Program. For 2009-2010, this amounted to $90 M in contributions to firms and $10 M for youth

projects.

Budget 2009 also provided NRC-IRAP with an additional $27.5 M from the new Federal Economic Development Agency for Southern Ontario Development Plan (FedDev Ontario). These funds were provided to NRC through

agreements with Industry Canada to support economic and community development of SMEs in Southern Ontario. With these resources, NRC-IRAP funded 387 innovation projects that supported 1,402 jobs.

Canada's Economic Action Plan Risk Management

For NRC, the capacity of the field delivery staff to ensure effective and efficient movement of the stimulus funding, which doubled NRC-IRAP's national budget and quadrupled NRC-IRAP Ontario's budget, was a major risk to achieving expected results. NRC-IRAP was able to deliver by readjusting resources to expand staff capacity,

implementing program delivery improvements, and reducing the amount of advisory services provided. The extra funding also allowed NRC-IRAP to more effectively meet the demand for larger innovation projects.

2.2.2 Benefits to Canadians

NRC supported Canadian wealth generation through the funding of specifically identified industry projects. NRC's Industrial Research Assistance Program (NRC-IRAP) strengthened the Canadian innovation system by supporting regional and national research and development organizations, assisting individual firms with improving their own innovation capacity through specialized advisory services and providing relevant and challenging work experience for recent university graduates contributing to develop

the next generation of highly qualified research and development personnel. The social well-being of Canadians was also enhanced through NRC's support of its clients' products, many of which fell within the federal government's key strategic areas of health, environment, energy, and information and communications technologies.

NRC's Canada Institute for Scientific and Technical Information (NRC-CISTI) provided Canada's research community with tools and services for accelerated discovery, innovation and

commercialization. The national science library program ensured the availability of the world's scientific information to Canadian researchers. As Canada's leading science publisher, the NRC Research Press provided a platform for disseminating the best in research articles in key areas of interest to Canadians.

2.2.3 Performance Analysis

NRC's Industrial Research Assistance Program (NRC-IRAP) switched the emphasis of its offerings to meet the immediate and emerging needs of the SMEs today and to help them prepare for the future. In stable economic times, SMEs need linkages to sources of assistance, technical and business advisory services and financial support. In turbulent times, these needs are even greater.

Providing comprehensive commercialization support, including technology transfer, intellectual property management, licensing, and entrepreneurship – As part of NRC's continuous efforts to effectively move technology from the lab to the marketplace, NRC established technology transfer-oriented services related to Intellectual Property (IP), the negotiation of complex business agreements, and the development of tools and services to serve external clients. With the deployment of these services in 2009-2010, NRC:

- filed 206 patent applications. The decision to file was made after a rigorous disclosure review process, which assessed new technologies for patentability and marketability. NRC concentrated on patents with defined market potential; and

- was granted 51 patents.

Building innovation capacity of SMEs – NRC ensured that more new firms benefited from the Program's financial and non-financial support, thereby increasing SME access to needed services and building effective regional/community innovation system relationships and services that benefit all SMEs. With the help of Canada's Economic Action Plan, NRC expanded its outreach by providing funds and advice to over 1,700 new clients. This was a four-fold increase over the number of new funded clients in the previous year.

Helping industry manage risks as new products are developed and marketed and as new processes and practices are integrated into their operations – In addition to the risk sharing that the NRC undertakes with SMEs through its financial support to Canadian firms' technology projects, NRC helped industry reduce or manage the risk in developing new products and processes. This included arming firms with comprehensive market intelligence before they embark on the adoption, adaptation or development of new technologies or process, and helping SMEs become "investment ready".

From 2006 to 2009, Eastside Industrial grew from 20 to 32 employees and from $2.5 M to $5 M in revenue. In 2009, the firm opened a new $3 M composites manufacturing facility in Winnipeg. A small amount of financial support combined with highly valued advice has had a major impact on a willing client and an extended impact on the local economy.

Providing S&T information and intelligence services – NRC provided access to global S&T information to all Canadians. Increased information access for researchers in six Federal Science eLibrary partner

departments was achieved, along with significant cost savings, through the successful negotiations of the Federal Science eLibrary consortium with Springer, a major scientific publisher. Information analysis and market intelligence to support commercialization decisions were provided to Canadian

industry. Interviews with selected SMEs who benefited from these services indicated that they valued the analyses provided to help identify new markets and make investment and product development decisions with confidence. A service delivery partnership was formed with Health Canada for introducing shared services that leverage the

expertise of each organization and that reduces costs. Two initiatives to ensure the visibility and accessibility of Canadian research results came to fruition: The NRC Publications Archive (NPArC) and PubMed

Central Canada both implemented publicly available Web-based search services. NPArC now contains over 50,000 publication records, including 5,000 full-text publications by NRC researchers.

More information on the Technology and Industry Support Program Activity can be found on NRC's Web site.

2.2.4 Lessons Learned

To deliver on the temporary additional funds received through Canada's Economic Action Plan, staff capacity was enhanced through the implementation of Standard Operating Procedures as well as implementation of an exhaustive Field Manual to streamline program delivery across the country. This major initiative, combined with risk management activities, resulted in a decreased administrative burden on clients for small projects, reduced time for new field staff to become effective, and increased efficient management of the program. The capacity to deliver non-funded advisory services, however, was unavoidably diminished. Nonetheless, advisory services, such as business, technical and market assistance, continued to be provided to funded clients to help ensure the success of their projects.

| 2009-2010 Financial Resources ($ millions) | 2009-2010 Human Resources (FTEs) | ||||

|---|---|---|---|---|---|

| Planned Spending | Total Authorities | Actual Spending | Planned | Actual | Difference |

| 80.6 | 105.8 | 123.3 | 831 | 665 | 166 |

| The variance between planned and actual FTE values is discussed in Section 2.3.4. | |||||

2.3.1 Canada's Economic Action Plan

NRC received funding for two initiatives under Canada's Economic Action Plan that were managed through the Internal Services Program Activity. See Section 1.6 for further details.

Modernizing Federal Laboratories (MFL) – Under this initiative NRC received a total of $19.07 M ($8.7 M in 2009-2010 and $10.36 M in 2010-2011) to address deferred maintenance issues and modernize NRC facilities across Canada that support research in areas of national importance such as health and wellness, sustainable energy, manufacturing, and metrology. By the end of March 2010, a total of 54 projects were completed, with a total value of $8.7 M. This represents approximately 67,000 hours of construction labour.

Accelerated Federal Contaminated Site Action Plan (FCSAP) – Under this initiative, NRC received $4.84 M of infrastructure stimulus to remediate contaminated areas in an effort to clean up the environment and improve safety. Works associated with this initiative commenced in 2009 and will continue into 2010-2011. The majority of this funding is allocated to soil remediation projects at sites in Montréal and Penticton. The balance of the funds will be used to conduct contaminated site assessments and risk management work at the site in Montréal, three sites in Ottawa, and at sites in Penticton, Victoria, St. John's and Chicoutimi. Phase I of this work has been completed. Phase II is currently on schedule without any manifestation of identified risks.

Canada's Economic Action Plan Risk Management

A comprehensive risk mitigation strategy was developed for this 2-year program in May 2009, and updated on a regular basis throughout the year. A major risk identified was the capacity to manage the additional workload. This risk was successfully mitigated with the effective use of in-house resources, supplemented by private sector resources from the consulting engineering community when

required. Risks associated with unclear project definition and associated cost estimates were also identified and managed with diligent tracking of prices, refinement of scope, and project substitution or addition where necessary, to effectively make use of the funding provided. All well-established processes and procedures for contracting were adhered to, simply at a higher volume than

normal.

2.3.2 Benefits to Canadians

Effective governance supports NRC's ability to deliver on its value proposition: "To provide integrated science and technology solutions in areas of critical importance to Canada". Examples of NRC's results in this regard can be found on NRC's Web site.

2.3.3 Performance Analysis

Integrated Structure and Governance Model – NRC clarified the role of the NRC Council. This included means to challenge management decisions in a manner that is integrated with the annual planning and reporting process, as well as the work of the NRC Senior Executive Committee.

Integrated Business and Client Services – NRC conducted a project to implement practices and software to facilitate performance management and sharing of information about clients and coordinate client interactions. A pilot Client Relationship Management (CRM) program was successfully tested, but work ceased as funding issues prevented its implementation across NRC. Resources were instead focused on designing an innovative online business training and orientation program to assist staff in sharing business knowledge and client management.

Integrated Ethics Framework – NRC developed an Integrated Ethics Framework that unites public service and business ethics policies and practices with those related to scientific research around NRC corporate values.

Human, Capital, IT & Financial Resources fully aligned with priorities – NRC continued to improve performance efficiency and effectiveness, and management performance. Efforts focused on reducing overhead costs and improving management practices, such as strengthening the ability to demonstrate achievement of results. For example, NRC responded to the government's Policy on Investment Planning – Assets and Acquired Services and the Policy on Management of Projects by establishing a project management office to manage the transition to the new policies. A readiness assessment on this transition was completed to position NRC for implementation of a new integrated investment planning process and associated governance structure in 2010-2011. This new approach ranks and approves investment projects on an NRC-wide basis and more clearly integrates investments with Government and NRC strategic priorities.

NRC implemented a new integrated HR planning and HR performance management process that resulted in more effective capturing and accessing of relevant resource performance information for better planning and decision-making, and alignment of staff efforts with organizational priorities.

To foster a workforce that is agile, highly engaged and contributes to NRC's sustainable competitive advantage, NRC:

- focused on building leadership capacity and on implementing a leadership development roadmap;

- developed a comprehensive succession planning framework to address succession challenges within key areas of vulnerability;

- began the implementation of a revised employee performance management system that supports NRC's Strategy 2011; and

- reviewed NRC's staffing policies and practices with a view to increasing NRC's ability to facilitate both the entry and mobility of its workforce.

Although planned, NRC did not:

- develop and implement a learning strategy to address priority learning needs in implementing NRC's organizational strategy. Knowing the effort required in creating a learning strategy and recognizing the need to prioritize limited learning resources, NRC instead focussed on building leadership management capacity.

- design and implement a recruitment initiative including a branding strategy to assist the organization in attracting new talent. NRC introduced a hiring moratorium to allow external recruitment to occur only on an exception basis. The branding strategy was also put on hold, allowing resources to be allocated to other priorities. NRC improved its recruitment Web site and commissioned an analysis of best practices for recruitment advertising.

More information on the Internal Services can be found on NRC's Web site.

2.3.4 Lessons Learned

The current methodology for planning Full Time Equivalent (FTE) utilization does not necessarily permit comparison with actual utilization. Future year FTE utilization is roughly estimated using a calculation based upon salary appropriation divided by an average salary. This methodology involves

several assumptions including constant average salary throughout the year. NRC has learned that these assumptions do not hold for 2009-2010. This renders planned FTE values incomparable to the actual values determined by actual usage. To correct the situation, NRC invested in developing its existing systems to include future year forecasting functionality and expects to have it available for the 2012-2013 reporting cycle.

NRC conducted an organization-wide review of its business planning processes. Through this review, NRC identified opportunities for continuous improvement in areas such as aligning the timing of planning-dependent activities (such as priority planning), clarifying objectives of

planning, and obtaining engagement at all levels. NRC addressed these issues by developing a streamlined three-year planning cycle. Full implementation was delayed by immediate executive needs pertaining to identified financial risks. One consequence of this is that performance targets and target dates were not reviewed and revised as is

normally done through the business planning process. NRC still recognizes that integrated planning is a work in progress – evolving, developing and improving with each cycle. As such, NRC will continue to work on continuous improvement and implementation in 2010-2011.

Outdated performance targets will be replaced with growth or trend targets in the interim.

NRC made significant progress in the design and development of various HR policies and programs that will have large impacts. NRC learned that almost without exception, these initiatives involve a change management aspect that needs to

be addressed. Implementation depends on focusing more in managing change and paying attention to the organization's capacity to undergo and absorb these changes.

Section III – Supplementary Information

3.1 Financial Highlights

The following general overview of NRC's financial position and operations are presented on an accrual basis for comparability with the complete financial statements published on NRC's Web site.

| Condensed Statement of Financial Position At End of Year (March 31, 2010) |

% Change | 2009-2010 | 2008-2009 |

|---|---|---|---|

| Assets | |||

| Total Assets | (0.5 %) | 816,923 | 821,313 |

| Total | (0.5 %) | 816,923 | 821,313 |

| Liabilities | |||

| Total Liabilities | 1.9 % | 336,152 | 329,943 |

| Equity | |||

| Total Equity | (2.2 %) | 480,771 | 491,370 |

| Total | (0.5 %) | 816,923 | 821,313 |

| Condensed Statement of Operations At End of Year (March 31, 2010) |

% Change | 2009-2010 | 2008-2009 |

|---|---|---|---|

| Expenses | |||

| Total Expenses | 14.8 % | 1,032,652 | 899,430 |

| Revenues | |||

| Total Revenues | 8.6 % | 169,627 | 156,246 |

| Net Cost of Operations | 16.1 % | 863,025 | 743,184 |

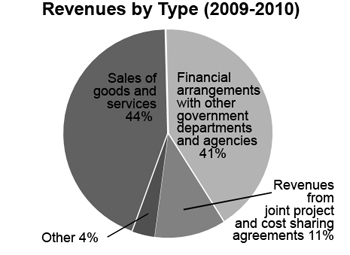

Revenue is important to NRC, not only as a means of financing operating and capital expenditures, but also as an indication of the value that NRC provides to its clients and collaborators. NRC earned total revenues of $169.6 M in 2009-2010, up from $156.2 M in 2008-2009. NRC's largest component of revenue results from the sale of goods and services at $74.7 M, primarily consisting of research services provided to industry and academic clients ($49.6 M), with the remaining balance provided by the sale of goods and information products ($11.7 M), NRC rights and privileges ($8.9 M) and lease and use of property ($4.5 M), all calculated on an accrual basis.

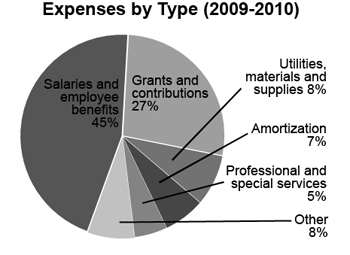

NRC incurred total expenses of $1,033.7 M in 2009-2010, up from $899.4 M in 2008-2009. NRC's major expense components are salaries and employee benefits ($468.3 M) and grants and contributions ($281.2 M), representing 72.6% of total expenses. The $133.3 M increase results from NRC's participation with the implementation of Canada's Economic Action Plan. In total, NRC received and spent an additional $142.5 M in grants and contributions as a result of Canada's Economic Action Plan in order to support scientific research and development activities performed by Canadian organizations during 2009-2010.

3.2 List of Supplementary Information Tables

The following tables are located on the Treasury Board Secretariat Web site:

- Sources of Respendable and Non-Respendable Revenue

- User Fees/External Fees

- Details on Transfer Payment Programs (TPPs)

- Horizontal Initiatives

- Green Procurement

- Response to Parliamentary Committees and External Audits

- Internal Audits and Evaluations

3.3 Other Items of Interest

3.3.1 NRC Council Members

NRC's Council provides strategic direction and advice to the President and monitors progress against strategic plans. The Minister of Industry may also consult the NRC Council for advice on matters that affect NRC and that are of importance to science and technology in Canada. The Council usually meets three times a year and has three standing committees: the Executive Committee, the Human Resources Committee and the Finance Committee. The Council is chaired by the President of NRC and the other members are appointed by the Government of Canada for three-year terms. Current members are as follows. An updated list is maintained on the NRC Web site along with biographies of the members.

John McDougall,

President (and Chair of Council), National Research Council Canada,

Ottawa, Ontario

Dennis Anderson,

Former President, Brandon University, and Management Consultant,

Gimli, Manitoba

Jacques Beauvais,

Vice Provost of Research, Université de Sherbrooke

Sherbrooke, Québec

Paul Clark,

Former Vice-President, Research and Technology, NOVA Chemicals Corporation,

Calgary, Alberta

Peter Frise,

Scientific Director and CEO, Auto 21, University of Windsor,

Windsor, Ontario

Alexandre Jodoin,

Materials and Structures Engineer, BMT Fleet Technology Limited,

Manotick, Ontario

Jay Josefo,

Lawyer,

Toronto, Ontario

Raymond Leduc,

Director and Senior Location Executive, IBM Bromont,

Bromont, Québec

Margaret Lefebvre,

Executive Director, Canadian Association of Income Funds,

Montréal, Québec

Kellie Leitch,

Associate Professor, Dept. of Surgery, University of Toronto, and Centre for Health Innovation & Leadership, Richard Ivey School of Business, University of Western Ontario,

Toronto, Ontario

Douglas MacArthur,

President, MacArthur Group, Inc.,

Charlottetown, Prince Edward Island

Eva Mah Borsato,

President, Intellectual Capital Corporation Inc.,

Edmonton, Alberta

Cecil Rorabeck,

Professor, Orthopaedic Surgery (Emeritus),

London, Ontario

Leo Steven,

Chairman, Health PEI,

Cardigan, Prince Edward Island

Iain Stewart,

Associate Vice-President, Research, Dalhousie University,

Halifax, Nova Scotia

Howard Tennant,

President Emeritus, University of Lethbridge,

Lethbridge, Alberta

Normand Tremblay,

Strategic Management Consultant, Normand Tremblay and Associates,

Montréal, Québec

Allan Warrack,

Professor of Business Emeritus, University of Alberta,

Edmonton, Alberta

David Wood,

Head of Finance and Corporate Development, Secretary and Treasurer, Celator Pharmaceuticals Inc.,

Vancouver, British Columbia

3.3.2 Online References

http://www.actionplan.gc.ca/eng/index.asp

http://www.nrc-cnrc.gc.ca/eng/reports/2009-2010/dpr-index.html

http://laws.justice.gc.ca/eng/N-15/index.html

http://www.tbs-sct.gc.ca/reports-rapports/cp-rc/2008-2009/cp-rctb-eng.asp

http://www.ic.gc.ca/eic/site/ic1.nsf/eng/h_00231.html

http://www.nrc-cnrc.gc.ca/eng/locations/index.html

http://www.nrc-cnrc.gc.ca/eng/business/colocating.html

http://www.nrc-cnrc.gc.ca/eng/evaluation/evaluation.html

http://www.labcanada.com/issues/story.aspx?aid=1000341991

http://www.nrc-cnrc.gc.ca/eng/news/irap/2009/07/07/avalon-microelectronics.html

http://www.nrc-cnrc.gc.ca/eng/ibp/irap.html

http://safstl-asbstf.scitech.gc.ca/eng/news/2010-04-29-fsel-licence-agreement.html

http://nparc.cisti-icist.nrc-cnrc.gc.ca/npsi/ctrl?lang=en

http://www.tbs-sct.gc.ca/dpr-rmr/2009-2010/index-eng.asp

http://www.nrc-cnrc.gc.ca/eng/about/council-members.html

1 Met All: "100 per cent of the expected level of performance (as evidenced by the indicator and target or planned activities and expected outputs) for the expected result or priority identified in the corresponding RPP was achieved during the fiscal year."

2 Based on data for total Canadian industrial R&D for 2003 and 2009 – see Table 1 in Statistics Canada Publication 88-202- x - Industrial Research and Development: Intentions, 2009. Constant dollar amounts for 2009 were calculated using the GDP deflator for that year.

3 A description of this program activity is available in Section 1.2.

4 Exceeded: "More than 100 per cent of the expected level of performance (as evidenced by the indicator and target or planned activities and outputs) for the expected result or priority identified in the corresponding RPP was achieved during the fiscal year."

5 "A Bibliometric and Technometric Analysis of the National Research Council Canada (1997-2008)" (Science-Metrix, 4 December 2009)

6 Bibliometric Analysis of the Scientific Production of the National Research Council of Canada, 1980-2007" (Observatoire des sciences et des technologies, July, 2008)

7 This data was not collected in 2007-2008. The value shown is estimated by linear regression.

8 A description of this program activity is available in Section 1.2.