Common menu bar links

Breadcrumb Trail

ARCHIVED - Privy Council Office

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section III: Supplementary Information—Financial Highlights

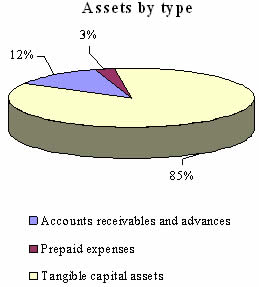

| Condensed Statement of Financial Position At End of Year (March 31, 2009) |

% Change | 2009 | 2008 |

|---|---|---|---|

| Assets | |||

| Total Assets | -9% | 10,874 | 11,879 |

| Total | -9% | 10,874 | 11,879 |

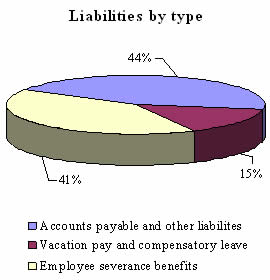

| Liabilities | |||

| Total Liabilities | 22% | 44,866 | 36,764 |

| Equity | |||

| Total Equity | 37% | (33,992) | (24,885) |

| Total | -9% | 10,874 | 11,879 |

| Condensed Statement of Financial Position At End of Year (March 31, 2009) |

% Change | 2009 | 2008 |

|---|---|---|---|

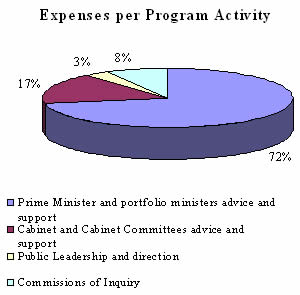

| Expenses | |||

| Total Expenses | 14% | 172,548 | 150,816 |

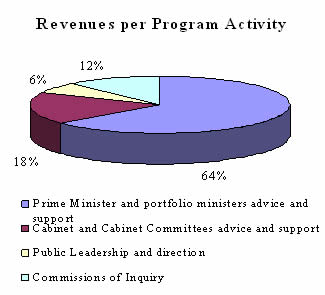

| Revenues | |||

| Total Revenues | -70% | (17) | (56) |

| Net Cost of Operations | 14% | 172,531 | 150,760 |

The increase of $21,771 thousand in the net cost of operations for fiscal year 2008-09 over the previous fiscal year is mainly due to the undertaking of new initiatives that have resulted in increases in basic salary, vacation pay, severance pay and employee benefit expenses. Ratification of collective bargaining also contributed to the increase in salary expenses.

Financial Highlights Chart

Financial Statements

PCO’s financial statement can be found in the Reports and Publications section at

http://www.pco-bcp.gc.ca.

List of Supplementary Information Tables

All electronic supplementary information tables in the 2008-09 Departmental Performance Report can be found on the Treasury Board of Canada Secretariat’s website at www.tbc-sct.gc.ca/dpr-rmr/st-ts-eng.asp.

Table 1: Sources of Respendable and Non-Respendable Revenue

Table 2: User Fees/External Fees

Table 3: Response to Parliamentary Committees and External Audits

Table 4: Internal Audits and Evaluations

Contacts for Further Information:

Privy Council Office

General Inquiries

Room 1000

85 Sparks Street

Ottawa

Canada

K1A 0A3

Telephone : (613) 957-5153

TTY : (613) 957-5741

Fax : (613) 957-5043

e-mail: info@pco-bcp.gc.ca

- The G7 is a group of seven highly industrialized countries: Canada, France, Germany, Italy, Japan, the United Kingdom and the United States.

- www.nrcan-rncan.gc.ca/stat/energ-eng.php#sec2

- Commissions of Inquiry funds are excluded because they are accounted for as special purpose allotments.

- Please refer to the spending trends graph for more details on departmental spending trends. Please refer to the Performance Summary above or to Annex II (provided electronically) for more details on the total Main Estimates and the total Actual Spending.

- In previous years, the Leader of Government in the House of Commons was considered as a Minister without Portfolio in accordance with the Salaries Act. Under an amendment (Bill C-30) to the Salaries Act, the Leader of the Government in the House of Commons is now considered a full-fledged Minister and thus his expenses (salary and motor car allowance) are therefore no longer “voted” but “statutory” items. The Supplementary Estimates A and Actual Spending for the 2008-09 year reflect this amendment, which will be permanently reflected in the 2009-10 Main Estimates for PCO.

- In 2008-09, the salary and motor car allowance for the Minister of State and Chief Government Whip are considered as statutory items.

- A new Minister of State was appointed to PCO on October 30, 2008. The salary and motor car allowance of the new Minister of State (Democratic Reform) are considered statutory items for 2008-09.

- PCO’s key role is to provide advice and support to the Prime Minister, ministers within his portfolio and Cabinet. PCO is challenged to find meaningful and useful measures for this work; quantitative measures have been implemented with full understanding of their limitations. One of the key limitations is that quantitative measures cannot alone demonstrate the complexity of the analysis and research necessary to achieve the goals and the scope or range of the different activities. PCO has further developed its Performance Measurement Framework with the goal of providing increasingly accurate and relevant indicators for success against priorities.

- “Value-added” means complete, accurate, relevant and timely.

- PCO provided analysis on the federal/provincial/territorial mechanisms involved in the Growing Forward framework and monitored and provided advice on the progress of the bi-lateral agreements on behalf of the Prime Minister, the Minister of Intergovernmental Affairs, President of the Queen’s Privy Council for Canada, and Minister for La Francophonie and the Minister responsible for Official Languages.

- The Shiprider Program brought Canadian RCMP officers and U.S. Coast Guard officers together on jointly crewed vessels in shared waterways in an effort to tackle cross-border crime.

- An Order-in-Council is a legal instrument made by the Governor-in-Council pursuant to a statutory authority or, less frequently, the royal prerogative. All Orders-in-Council are made on the recommendation of the responsible Minister of the Crown and take legal effect only when signed by the Governor General. Orders-in-Council include appointments, regulations, statutory instruments and other orders, e.g. orders for international agreements, coming-into-force date for legislation, official Government responses and granting of citizenship.

- The mandate of the Procurement Ombudsman is to review procurement practices across government on an ongoing basis to ensure fairness and transparency; make recommendations for improvements to the relevant department; review complaints from potential suppliers after contract award with respect to procurements of goods and services that are covered by the Agreement on Internal Trade (AIT) but which are below the monetary thresholds of that agreement ($25,000 for goods and $100,000 for services); review complaints with respect to the administration of contracts; and ensure the provision of an alternative dispute resolution process for contract disputes.

- The Extractive Sector Corporate Social Responsibility Counsellor 's mandate is to assist companies and stakeholders in the resolution of disputes related to the corporate conduct of Canadian extractive companies (mining, oil and gas) abroad.

- Where necessary, PCO undertakes preliminary site visitations in order to assess and provide plans for operation within a variety of environments, so that the Prime Minister can function with a full level of support.

- This responsibility is in addition to and separate from the Treasury Board’s traditional responsibility under the Financial Administration Act, for which it receives support from the Treasury Board Secretariat.

- The volume of submissions under the Canada Evidence Act can vary significantly from one year to the next. For example, in 2007-2008, one single submission contained 52,977 pages. Such volume variances are due to fluctuation in the occurrence and magnitude of litigation cases. The fluctuation depends on unpredictable factors such as the number of court actions and the nature of the claims, as well as directions and deadlines imposed by the courts.

- Please refer to Section IV for more information on s. 69 of the Access to Information Act and s. 70 of the Privacy Act.

- Please refer to Section IV for more information on s. 39 of the Canada Evidence Act.

- Report of the Prime Minister’s Advisory Committee on the Public Service at http://www.psagency-agencefp.gc.ca/ren/cpmc/menu-eng.asp

- Clerk’s Annual Report at http://www.pco-bcp.gc.ca/index.asp?lang=eng&Page=information&Sub=publication&Doc=ar-ra/15-2008/table-eng.htm

- The report was also published as an annex to the Clerk's Sixteenth Report to the Prime Minister (www.pco-bcp.gc.ca/index.asp?lang=eng&page=information&sub=publications&doc=ar-ra/16-2009/table-eng.htm)

- In the 2007-08 Public Service Renewal Action Plan, integrated business and human resources planning was a core priority. The panel’s report is available at www.pco-bcp.gc.ca. In its report, the panel makes four recommendations for advancing integrated planning across the Public Service.

- As recommended in March 2008 by the Prime Minister’s Advisory Committee on the Public Service.

- These included the Canada Public Service Agency, Canada School of the Public Service, Public Service Commission, Public Service Labour Relations Board, Public Service Staffing Tribunal, and Human Resources function in the Labour Relations and Compensations Operations, Pensions and Benefits and Expenditure Management Sectors of Treasury Board of Canada.