ARCHIVED - Canadian Human Rights Commission

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2007-08

Departmental Performance Report

Canadian Human Rights Commission

The original version was signed by

The Honourable Rob Nicholson, P.C., M.P.

Minister of Justice and Attorney General of Canada

Table of Contents |

|

| SECTION I | Overview |

|

|

| SECTION II | Analysis of Program Activities by Strategic Outcome |

|

|

|

| SECTION III | Supplementary Information |

|

|

| SECTION IV | Other Items of Interest |

SECTION I – OVERVIEW

Chief Commissioner’s Message

The 2007–2008 fiscal year marked a turning point for the Canadian Human Rights Commission as we began to shift our focus towards human rights education and awareness, based on outreach, strengthened relationships and new partnerships. Our commitment is to be a proactive and influential human rights catalyst, both nationally and internationally. The Commission’s organizational culture of respect, sound leadership, and values-based workforce greatly contributed to our ability to achieve our objectives.

Through a strategic use of resources, Commission research and policy development has informed and influenced public debate. Our litigation efforts before the Canadian Human Rights Tribunal, Federal Court and Supreme Court contributed to the development of jurisprudence on human rights in Canada. The Commission also provided leadership in extending full human rights protection to First Nations people living under the Indian Act by successfully advocating for the repeal of Section 67 of the Canadian Human Rights Act.

Discrimination prevention—building knowledge and raising capacity with federally regulated employers—was a key focus this year. Stakeholders have welcomed the launch of a streamlined employment equity audit process as a practical and effective way to guide organizations to improve their compliance with the Employment Equity Act.

We have also implemented very effective early resolution mechanisms for human rights complaints, with promising early results. During the reporting period, the Commission handled 1,343 complaints and met its service standard for timely process. In the final quarter of the reporting period, 43% of cases that went to early resolution were resolved even before they became formal complaints.

The Commission is a recognized authority on human rights in Canada and internationally. Our ongoing research and knowledge development provide the basis for effective laws, policies, guidelines and dispute resolution practices. We identify and advance knowledge in ever-evolving areas such as Aboriginal rights, hate on the Internet, environmental sensitivities, mental health, and human rights report cards.

Internationally, the Commission has reinforced Canada’s reputation as a human rights leader by chairing the International Coordinating Committee of National Institutions for the Promotion and Protection of Human Rights (ICC). We led the ICC to full status at the United Nations Human Rights Council and launched a governance review to support the new role. In this hemisphere, the Commission engaged with the Organization of American States to obtain recognition for the role of National Rights Institutions in advancing good government and the rule of law.

As the Commission celebrates these successes, we remain very much aware of the additional challenges we face as a small organization that provides service and leadership in an area so fundamental to who we are as a country. Our mandate is not static—it grows with the expectations of society, Parliament and the courts. Yet because the Commission is so small, vacancies and resource lacunae have an acute impact on our work. The Commission remains inspired to manage these challenges and seize more opportunities to foster an enduring human rights culture in Canadian society.

Jennifer Lynch, Q.C.

Chief Commissioner

Management Representation Statement

I submit for tabling in Parliament, the 2007–2008 Departmental Performance Report for the Canadian Human Rights Commission.

This document has been prepared based on the reporting principles contained in the Guide for the Preparation of Part III of the 2007–2008 Estimates: Reports on Plans and Priorities and Departmental Performance Reports:

- It adheres to the specific reporting requirements outlined in the Treasury Board Secretariat guidance;

- It is based on the department’s approved Strategic Outcome and Program Activity Architecture that were approved by the Treasury Board;

- It presents consistent, comprehensive, balanced and reliable information;

- It provides a basis of accountability for the results achieved with the resources and authorities entrusted to it; and

- It reports finances based on approved numbers from the Estimates and the Public Accounts of Canada.

Richard Burton

Secretary General

Summary Information

|

Raison d’Ítre The Commission’s founding legislation inspires a vision for Canada in which “all individuals should have an opportunity equal with other individuals to make for themselves the lives that they are able and wish to have” free from discrimination. The Commission works with employers, service providers, individuals, unions, governmental and non-governmental organizations, and provincial and territorial human rights bodies to foster understanding and commitment to achieving a society where human rights are respected in everyday practices. The Commission is working within a new service delivery model that provides discrimination prevention initiatives; modern dispute resolution approaches for addressing inquiries and complaints; as well as regulatory, policy, and knowledge development. Enhancing employment equity in federally regulated employment sectors for women, Aboriginal peoples, persons with disabilities, and members of visible minorities is also a key function. Internationally, the Commission’s strong leadership role includes chairing the International Coordinating Committee of National Institutions for the Promotion and Protection of Human Rights, within the United Nations. |

Financial Resources ($ thousands)

|

Planned Spending

|

Total Authorities

|

Actual Spending

|

|

$23,272

|

$22,587

|

$21,993

|

Human Resources in Full-time Equivalents (FTEs)

|

Planned

|

Actual

|

Difference

|

|

200

|

176

|

24

|

| Departmental Priorities | ||||

| 2007-2008 | ||||

| Status on Performance | Planned Spending |

Actual Spending |

||

| Strategic Outcome: Equality, respect for human rights and protection from discrimination by fostering understanding of, and compliance with, the Canadian Human Rights Act and the Employment Equity Act by federally regulated employers and service providers, as well as the public whom they serve. | ||||

| Alignment to Government of Canada Outcomes: The Commission’s strategic outcome aligns to the Government of Canada’s strategic outcome of creating “a diverse society that promotes linguistic duality and social inclusion.” | ||||

| Priority (type) | Program Activity – Expected Result | Performance Status | Planned Spending | Actual Spending |

| Deliver a human rights knowledge development program | Understanding of, and compliance with, the Acts through: research; strategic initiatives; stakeholder awareness through knowledge sharing and outreach; and the National Aboriginal Initiative. | Successfully met | $5,035 | $6,190 |

| Enhance, expand and integrate prevention initiatives and employment equity activities of the Discrimination Prevention Program. | A commitment from federally regulated departments and organizations to enhance human rights and equality principles and practices through knowledge sharing, best practices and removal of barriers. | Successfully met | $6,466 | $5,347 |

| Provide an effective dispute resolution process. | A timely, effective and efficient dispute resolution process. | Successfully met | $11,771 | $10,456 |

Overall Departmental Performance

Operating Environment

The Commission’s activities are accomplished by its commissioners and its employees, with the support of professional contracts when specific expertise is required. The Commission does not fund external organizations, assign grants or contributions, nor does it operate any other transfer programs.

The Commission has recently created a service delivery model that distributes resources among the different stages of human rights management. This model consists of Knowledge Development, Discrimination Prevention, and Dispute Resolution.

Organizational Context

The Commission resolves disputes, develops knowledge about human rights issues, and works to prevent discrimination. Increased funding would enable the Commission to make greater progress in the following areas.

Enhancing International Focus

The Chief Commissioner’s mandate includes a focus on international activities. These activities were unfunded. Resources have been reallocated to meet ongoing and new international commitments.

National Human Rights Institutions (NHRIs) are a critical component of national human rights protection, as their actions contribute to good governance, the rule of law, and the promotion and protection of human rights. The Canadian Human Rights Commission is recognized by the International Coordinating Committee of National Institutions for the Promotion and Protection of Human Rights (ICC) as an “A” Status member, and, as such, must meet the standards and responsibilities dictated by the Paris Principles to maintain its accreditation. The Paris Principles are a set of rules adopted by the United Nations (UN) General Assembly that provide guidance to UN member states on the mandate, composition, and functioning of independent national human rights institutions. The ICC is the principal representative of NHRIs at the global level, including the UN, where gaps in the human rights protection of member states are brought to the attention of the international community.

In addition, in March 2007 the Commission was elected by acclamation to serve a three-year term as the Chair of the ICC. Created in 1991, the ICC works to strengthen NHRIs in conformity with the Paris Principles.

As the Chair, the Commission governs the business and administrative matters of the ICC to ensure its viability, leads an internationally recognized accreditation process, and engages in an active advocacy role on behalf of ICC members before the UN, national governments, non-governmental organizations, and other human rights stakeholders. Achievements this year include launching governance restructuring, and formalizing standing for the ICC and its member NHRIs within the UN Human Rights Council.

With its increasing international profile, the Commission has also formalized its participation within the Organization of American States, and before the Commonwealth Forum of National Human Rights Institutions.

Recommending legislative change

The Canadian Human Rights Act provides the Commission with the authority to influence legislative change through, for example, Special Reports to Parliament. In addition, pursuant to the Act, the Commission has the authority to issue guidelines that could help prevent discrimination in areas where the jurisprudence and the legislation are unclear. However, insufficient

current resources place the Commission in a ‘reactive’ rather than ‘proactive’ position for most such activities. Additional resources would enable the Commission to engage proactively, which is required in the present climate where important rights are increasingly conflicting (e.g., the current debates regarding regulating hate on the Internet, freedom of

expression and freedom of religion).

Providing authoritative expertise on human rights in Canada

The Canadian Human Rights Act provides the Commission with the authority to influence societal understanding and behaviours by conducting information programs and research, by fostering common policies and practices across Canada’s human rights commission system, and by using persuasion, publicity or any other means that it considers appropriate to discourage and reduce discriminatory practices (s. 27).

New human rights issues emerge; existing issues grow more complex. For example, the accepted definition of disability now clearly includes mental illness and environmental sensitivity. Organizations struggling with their responsibilities to accommodate workers and customers with these and other disabilities turn to the Commission for guidance. Our research and knowledge development provide the basis for identifying discriminatory practices and addressing them; for finding solutions; and for formulating policies, guidelines, prevention tools, and practices. The goal is nothing less than the integration of human rights into daily practice.

Increased funding would secure the Commission’s ability to fulfill its statutory responsibility to serve as a thought leader and catalyst for advances in human rights.

Ensuring federally regulated employers comply with the Acts

The Commission is mandated by the Employment Equity Act to ensure, through compliance audits, that federally regulated employers comply with the Act. The Commission has met its goal of streamlining and increasing the number of audits during the year. To date, we have initiated audits for 41% of federally regulated employers, representing 75% of the workforce under our mandate. Our goal of attaining 100% is at risk, however, because the number of employers under our mandate has increased by about 20% in the past four years, with no increase in resources. In addition, the audit process now includes a progress assessment phase focusing on the achievement of goals by employers previously found in compliance.

The Commission fosters comprehensive compliance among employers with the Canadian Human Rights Act. This includes providing targeted services, such as training to employers with whom a Memorandum of Understanding (MOU) has been signed. MOUs are in place with 14 employers representing almost 25% of employees under our mandate but only approximately 1% of federally regulated employers. This model is very effective yet resource intensive. The expansion of the program would require additional resources. To partially address the resource shortfall, the Commission is developing a maturity model.

The following sections focus on the specific priorities outlined in the 2007–2008 Report on Plans and Priorities (RPP) for the period under review:

PRIORITY 1 |

Deliver a human rights knowledge development program |

The Knowledge Centre increased understanding of, and engagement in, human rights by conducting and disseminating research in new areas. For example, the new Research Division completed Phases I and II of its groundbreaking National Human Rights Report Card, and advanced its research into the viability of legislative amendments to include ‘social condition’ (i.e., poverty) in the Canadian Human Rights Act. Our research in environmental sensitivities was published online (http://www.chrc-ccdp.ca/research_program_recherche/default-en.asp), leading to the completion by the Policy Directorate of a new policy on environmental sensitivities (http://www.chrc-ccdp.ca/legislation_policies/policy_environ_politique-en.asp). Policies on drug and alcohol testing and on accommodating mental health issues are at the consultation stage. The lack of resources has forced the delay of consultations on a national disability act, and the follow-up consultations on No Answer I and II (a review of Government of Canada telephonic communication with people who are deaf, deafened, hard of hearing, or have a speech impediment). A work plan evaluation is under way to ensure that policy plan objectives reflect available resources.

The Knowledge Centre created and leads the Commission’s National Aboriginal Initiative (NAI) and its outreach to key First Nations organizations (http://www.chrc-ccdp.ca/publications/ar_2007_ra/page2-en.asp#21). The Commission clearly and strongly advocated for the repeal of s. 67 of the Canadian Human Rights Act (which denied Aboriginal peoples full access to the same rights) through parliamentary committee appearances, dozens of stakeholder meetings, and by publishing the special report, Still a Matter of Rights (http://www.chrc-ccdp.ca/proactive_initiatives/smr_tqd/toc_tdm-en.asp). To support the NAI, the research division commissioned and released Alternative Dispute Resolution in Aboriginal Contexts: A Critical Review, a report that provides guiding principles for the development of alternate dispute resolution in Aboriginal contexts.

PRIORITY 2 |

Enhance, expand and integrate prevention initiatives and employment equity activities of the Discrimination Prevention Program |

During the reporting period, a key focus for the Commission was to consolidate and strengthen discrimination prevention initiatives. Beyond working directly with employers to prevent discrimination, the Commission also engages civil society—non-governmental organizations, unions and other stakeholders—to hear their concerns and benefit from their perspectives.

In 2007–2008 new tools were developed, including a Community of Practice website and a Train-the-Trainer initiative. The materials are now shared with our MOU signatories and other stakeholders among federally regulated employers: (http://www.chrc-ccdp.ca/publications/ar_2007_ra/page4-en.asp#31)

The employment equity audit process was improved to shorten the time required to complete an audit, by streamlining the audit steps and approval processes (http://www.chrc-ccdp.ca/publications/ar_2007_ra/page4-en.asp#32).

PRIORITY 3 |

Provide an effective dispute resolution process |

The Commission focused on improving process efficiency during the reporting period. Professional development initiatives helped employees screen complaints more efficiently. This year, we made strides in streamlining our internal process to refer complaints to other redress mechanisms and other bodies, such as the Public Service Labour Relations Board and the Public Service Staffing Tribunal. Communications with the parties to disputes were also improved. The Commission offered early resolution and preventive mediation services to help parties resolve disputes before filing complaints (http://www.chrc-ccdp.ca/publications/ar_2007_ra/page6-en.asp). The results achieved from early resolution services are promising: approximately 43% of the cases sent to early resolution in the last quarter were resolved.

Performance improvements for dealing with complaints more effectively were a key focus for the Commission. An assessment tool was developed to expedite the processing of complaints by identifying relevant facts and narrowing issues, and, where possible, facilitating settlements. However, it could not be used to full capacity because of acute staff shortages. This new tool was used in 9% of cases (http://www.chrc-ccdp.ca/publications/ar_2007_ra/toc_tdm-en.asp). During the reporting period, the Commission also continued to focus on litigating cases that affect human rights (http://www.chrc-ccdp.ca/publications/ar_2007_ra/page7-en.asp and http://www.chrt-tcdp.gc.ca/index_e.asp). In 2007–2008 progress was made on the creation of a regulatory framework to identify the need for regulations, guidelines, position papers and/or policies that could provide guidance on the Canadian Human Rights Act and relevant case law.

SECTION II – ANALYSIS OF PROGRAM ACTIVITIES BY STRATEGIC OUTCOME

Analysis by Program Activity

STRATEGIC OUTCOMEEquality, respect for human rights and protection from discrimination by fostering understanding of, and compliance with, the Canadian Human Rights Act and the Employment Equity Act by federally regulated employers and service providers as well as the public whom they serve.

Social change takes time and must be pursued relentlessly. The Commission has tried to make strides in these areas by reallocating scarce resources to programs, initiatives, and emerging issues, but these stop-gap efforts fall short of fully exploring and fulfilling the objectives of the Canadian Human Rights Act, the Employment Equity Act, and, more precisely, the mandate of the Commission.

PROGRAM ACTIVITY NAME

A. Knowledge Development – Develop knowledge products, including policies, and research initiatives, to foster understanding of and compliance with the Canadian Human Rights Act and the Employment Equity Act for use by the Commission, key stakeholders, and the Canadian public.

Financial Resources ($ thousands)

|

Planned Spending

|

Authorities

|

Actual Spending

|

|

$5,035

|

$6,314

|

$6,190

|

Human Resources (FTE)

|

Planned

|

Actual

|

Difference

|

|

37

|

39

|

2

|

Program Activity Description

The Knowledge Development Program coordinates research, policy development, strategic initiatives, the delivery of the National Aboriginal Initiative, and international relations. The Commission’s domestic work is informed by and contributes to international human rights developments. The Commission also monitors human rights trends and assesses the impact of government and international initiatives on the status of human rights in Canada. The objective is to create and transfer human rights knowledge in order to positively influences Canadian society.

This knowledge development process is essential to understanding human rights issues and principles, and to ensuring that the development of legislation, policies, programs, and interventions are grounded in evidence and best practices. It is also essential to effectively communicate that understanding to employers, service providers, and the Canadian public. Engaging specific groups, addressing their needs, and involving them in consultations enables concerned parties to develop a sense of ownership in the Commission’s activities. The intended result is for the participants, and the public as a whole, to integrate human rights in their daily lives and business practices.

Repealing Section 67

For the past 30 years, the Commission has urged Parliament to grant Aboriginal peoples full access to the Canadian Human Rights Act (CHRA) by a repeal of section 67. The Commission has made significant efforts to reach out to First Nations organizations and to understand the human rights issues they face. The Commission’s National Aboriginal Initiative engaged over 1,000 individuals—members of numerous First Nations communities, Aboriginal stakeholders, and parliamentarians—in discussions about human rights access and the potential implications of repeal. The report, Alternative Dispute Resolution in Aboriginal Contexts: A Critical Review, identifies Aboriginal dispute resolution mechanisms; these practices will inform our own future practices for resolving issues that arise within Aboriginal communities. In its first two months, the report was accessed online approximately 600 times.

Disability

Of the 11 statutory grounds upon which a discrimination complaint can be brought to the Commission, disability is by far the most commonly alleged, accounting for 36% of signed complaints. To understand Canadians’ concerns, key relationships were fostered and consultations on policy and legislation continued. When disability forces an employee to take a leave of absence from work, reintegrating into the workplace can be difficult and frustrating. In response to this issue, the Commission distributed A Guide for Managing the Return to Work. The guide has received over 10,000 website visits, has been cited in numerous publications, and has been requested in hard copy over 2,000 times. The guide was distributed to members of the Commission’s Employer Advisory Council and all employers participating in the Commission’s training sessions on the duty to accommodate. As a result, managers, employees, and other experts involved in return-to-work programs were informed of the guide through various Commission events. In addition, the Commission’s report, International Best Practices in Universal Design: A Global Review, continues to serve as a useful tool for service providers and employers, with over 7,500 website visits and over 400 requests for hard copies.

The Duty to Accommodate Environmental Sensitivities

Our changing environment also has an impact on our well-being. The health impact of environmental agents (such as new chemicals, smog, and wireless technology) has become a growing concern, and some Canadians have even experienced paralyzing symptoms. Two Commission reports provide information and guidelines for accommodation to prevent discrimination and reduce health and safety concerns in the workplace. Together they have been viewed online over 9,000 times, referenced in over 16 publications, requested from every corner of the world, and reported on both nationally and internationally. The author has presented the material at approximately 20 different fora. Presentations on environmental sensitivities were also provided to the Commission’s Employer Advisory Council. An associated policy was developed to provide guidance to employers.

The Commission has recognized a growth trend in the public’s need for information related to human rights. Over the last three years, visits to the Commission website have more than doubled and requests for publications have also increased at a considerable rate. The Commission received 26,000 requests for information on publications over the last year including 300 online subscription requests. As well, approximately 150 researchers from universities, non-governmental organizations, and other government departments joined our research network.

Within the Commission, a monthly review of performance indicators provides management with detailed statistics on complaint processing, employment equity audits, and prevention initiatives. The Commission has begun to identify additional indicators that track the impact Commission work is having on Canadians.

One of the challenges will be to better integrate communications and outreach with the work of the program areas responsible for product development and knowledge transfer. The development of a comprehensive outreach initiative will serve to build relationships, inform, engage, and inspire people in the vision of the Canadian Human Rights Act.

The value of listening to, learning from, and involving stakeholders in aspects of the Commission’s work cannot be understated. With appropriate resources devoted to targeted outreach initiatives, the Commission would further succeed at informing and influencing the public dialogue on key human rights issues.

PROGRAM ACTIVITY NAME

B. Discrimination Prevention – Engaging key stakeholders with the goal of preventing discrimination in federally regulated workplaces and service centres, and raising awareness, understanding, and acceptance of human rights.

Financial Resources ($ thousands)

|

Planned Spending

|

Authorities

|

Actual Spending

|

|

$6,466

|

$6,990

|

$5,347

|

Human Resources (FTEs)

|

Planned

|

Actual

|

Difference

|

|

60

|

42

|

18

|

PROGRAM ACTIVITY DESCRIPTION

The Commission works with federally regulated organizations to identify areas where improvements are required to create workplaces and service delivery centers that embrace a human rights culture. The Commission provides information and assistance to employers and service providers so they can better understand their obligations under the Canadian Human Rights Act and Employment Equity Act and their responsibilities to apply human rights principles. The Commission works collaboratively with central agencies in furthering human rights across the federal system.

The Commission conducts workplace audits to ensure compliance with employment equity obligations under the Employment Equity Act. In addition to ensuring compliance, these audits allow the Commission to identify hiring and promotion practices that best help to ensure equality in the workplace for designated groups, and to identify positive practices and measures instituted by employers to correct barriers to employment in several areas, including accommodation, development and training, promotion, recruitment, retention, selection and hiring, and termination. In 2007–2008, the Commission audited 42 employers.

In the past, the Commission reported on increases in representation of under-represented designated groups in organizations that had been audited. The Commission now reports on its statutory performance indicator, namely the attainment by the organization of short-term goals contained in its employment equity plan.

Table 1: Employment Equity Plan Goals

| Private Sector Employers | ||||||||||||||||

| Monitoring years | Women | Aboriginal Peoples | Person with Disabilities | Visible Minorities | Total | |||||||||||

| Not | % | Not | % | Not | % | Not | % | Not | % | |||||||

| Met | Met | Met | Met | Met | Met | Met | Met | Met | Met | Met | Met | Met | Met | Total | Met | |

| 1999-2001 | 3 | 4 | 43% | 3 | 2 | 60% | 2 | 5 | 29% | 2 | 3 | 40% | 10 | 14 | 24 | 42% |

| 2000-2002 | 31 | 39 | 44% | 16 | 24 | 40% | 26 | 44 | 37% | 32 | 42 | 43% | 105 | 149 | 254 | 41% |

| 2001-2003 | 42 | 52 | 45% | 25 | 28 | 47% | 25 | 84 | 23% | 30 | 64 | 32% | 122 | 228 | 350 | 35% |

| 2002-2004 | 23 | 42 | 35% | 18 | 22 | 45% | 21 | 60 | 26% | 31 | 41 | 43% | 93 | 165 | 258 | 36% |

| 2003-2005 | 38 | 59 | 39% | 29 | 18 | 62% | 49 | 79 | 38% | 46 | 61 | 43% | 162 | 217 | 379 | 43% |

| 2004-2006 | 28 | 33 | 46% | 15 | 24 | 38% | 18 | 76 | 19% | 26 | 54 | 33% | 87 | 187 | 274 | 32% |

| Total 1999-2006 |

165 | 229 | 42% | 106 | 118 | 47% | 141 | 348 | 29% | 167 | 265 | 39% | 579 | 960 | 1539 | 38% |

| Public Sector Employers | ||||||||||||||||

| Monitoring years | Women | Aboriginal Peoples | Person with Disabilities | Visible Minorities | Total | |||||||||||

| Not | % | Not | % | Not | % | Not | % | Not | % | |||||||

| Met | Met | Met | Met | Met | Met | Met | Met | Met | Met | Met | Met | Met | Met | Total | Met | |

| 2000-2002 | 4 | 1 | 80% | 2 | 2 | 50% | 1 | 1 | 50% | 3 | 3 | 50% | 10 | 7 | 17 | 59% |

| 2001-2003 | 12 | 6 | 67% | 5 | 5 | 50% | 5 | 5 | 50% | 10 | 21 | 32% | 32 | 37 | 69 | 46% |

| 2002-2004 | 11 | 7 | 61% | 5 | 7 | 42% | 19 | 6 | 76% | 17 | 14 | 55% | 52 | 34 | 86 | 60% |

| 2003-2005 | 16 | 6 | 73% | 7 | 4 | 64% | 13 | 6 | 68% | 11 | 15 | 42% | 47 | 31 | 78 | 60% |

| 2004-2006 | 9 | 7 | 56% | 2 | 6 | 25% | 5 | 10 | 33% | 9 | 13 | 41% | 25 | 36 | 61 | 41% |

| 2005-2007 | 0 | 0 | 0% | 0 | 1 | 0% | 0 | 0 | 0% | 1 | 1 | 50% | 1 | 2 | 3 | 33% |

| Total 2000-2007 |

52 | 27 | 66% | 21 | 25 | 46% | 43 | 28 | 61% | 51 | 67 | 43% | 167 | 147 | 314 | 53% |

Employers have three years to attain these short-term goals. In the private sector, employers attained 38% of 1,539 goals that they had set in their employment equity plans between 1999 and 2006. This included 47% of the goals for Aboriginal peoples, 42% for women, 39% for visible minorities and 29% for persons with disabilities. Between 2004 and 2006, 32% of goals for all four designated groups were attained. A total of 46% of goals set for women were met, but just 19% of those for persons with disabilities. Of the goals set for Aboriginal peoples and visible minorities, 38% and 33% were met, respectively.

Attainment of short-term goals tended to be slightly higher in the public sector than in the private sector. Overall, 53% of the 314 goals established by these employers were attained between 2000 and 2007. This included 66% of goals for women and 61% for persons with disabilities. Employers were less successful in meeting their goals for other groups: 46% of goals for Aboriginal peoples and 43% of those for visible minorities were achieved. Since audits of most employers in the public sector were completed prior to 2005, just one employer was required to set goals between 2005 and 2007. This employer had set one goal for Aboriginal peoples and two for visible minorities. No goals were needed for women and persons with disabilities. Just one goal for visible minorities was met and the goal for Aboriginal peoples was not achieved. This led to a 33% decrease in overall goals met between 2005 and 2007.

During the reporting period, the Commission worked closely with key federally regulated departments and organizations by sharing knowledge (including the removal of barriers to persons with disabilities) and best practices aimed at preventing discrimination in the workplace or service delivery centre. (http://www.chrc-ccdp.ca/publications/ar_2007_ra/page4-en.asp#31)

Preliminary data from organizations that have had an MOU in effect for one or two years show an encouraging reduction in the number of complaints filed with the Commission. The Commission is working with MOU signatories to prepare a trend analysis of their human rights dispute data.

The Commission is designing a maturity model that can be used to assess an organization’s level of maturity in achieving a human rights culture in the workplace—a major step in promoting and gauging progress towards its expected results. Employers are also being provided with tools and training that increase their capacity to prevent discrimination and promote a shift towards a human rights culture. In turn, they have demonstrated a real commitment to improving their working environments.

We look forward to having data available for longer time periods to measure the new division’s long-term contribution.

PROGRAM ACTIVITY NAME

C. Dispute Resolution – Resolution of individual human rights complaints filed against federally regulated employers and service providers to foster understanding of, and compliance with, the Canadian Human Rights Act..

Financial Resources ($ thousands)

|

Planned Spending

|

Authorities

|

Actual Spending

|

|

$11,771

|

$9,283

|

$10,456

|

Human Resources (FTEs)

|

Planned

|

Actual

|

Difference

|

|

103

|

95

|

8

|

PROGRAM ACTIVITY DESCRIPTION

Under the Canadian Human Rights Act, the Commission deals with allegations of discrimination by federally regulated employers and service providers based on the 11 grounds enumerated in the Act. Allegations of discrimination are screened to ensure they are within the Commission’s jurisdiction, and inquirers may be referred to other redress mechanisms, such as a grievance process. The parties are then encouraged and supported to try to settle the matter, either before a complaint is filed or immediately afterward. If the matter cannot be resolved, the complaint is investigated and submitted to the Commissioners for one of the following possible decisions: dismiss, refer to conciliation, or refer to the Canadian Human Rights Tribunal for further inquiry. Alternative dispute resolution, including mediation and conciliation, is available at all stages of the process. The Dispute Resolution Program is also supported by legal analysis and advisory services throughout the complaint process.

With our new early resolution initiative, opportunities for dialogue and mediation are offered before a formal complaint is filed.

Before a formal complaint is filed

In recent years, the Commission introduced two new initiatives with a view to resolving disputes more quickly, informally, and less resource-intensively. Preventive mediation (mediation before a complaint is filed) was introduced at the end of fiscal 2006-2007, and early resolution (facilitation and negotiation by telephone) was introduced in 2007-2008. The results of these two initiatives for the period under review are as follows: 87 cases were dealt with through preventive mediation, and 52% were settled; 396 cases were dealt with through early resolution and, according to initial data covering the final quarter of the year, 43% were resolved.

Preliminary conclusions are that both early resolution and preventive mediation are succeeding in bringing together parties to talk about and resolve their differences. This is a positive move towards creating a culture of human rights and encouraging compliance with the Act through non-litigious mechanisms.

After a complaint is filed

In 2007–2008, the Commission had a caseload of 1,343 formal complaints, approximately half of which were carried over from the previous year, while the other half were new or reactivated.

Of the total caseload, 50% of the complaints were closed. Taking into account the carryover of cases, a balanced caseload of complaints was achieved.

Approximately 30% of closed complaints did not require further action by the Commission due to the following statutory limitations: another redress mechanism was available, the time limitation was exceeded as set out in the Act, or the complaint was outside the Commission’s jurisdiction or considered trivial, frivolous, or vexatious. The majority (61%) of cases “not dealt with” were referred to other available redress mechanisms, a decrease of 1% from 2006–2007.

After the formal filing, 48% of complaints in voluntary mediation were settled and 26% of those undertaking conciliation were settled.

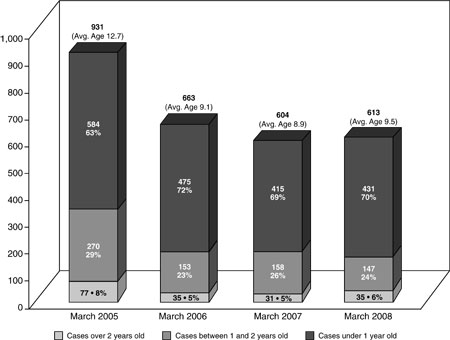

As shown below, 70% of the 613 active cases were less than one year old and 6% were over two years old on March 31, 2008. The Commission continues to carefully monitor trends.

Total Caseload of ACCEPTED complaints by Age Category

(Average Age in Months)

During the reporting period, the Dispute Resolution Program made progress towards its expected result. The Commission has begun monitoring satisfaction with alternative dispute mechanisms. Litigation successes during 2007–2008 constituted important steps in obtaining results, since these successes changed and/or clarified the laws on human rights—progress that benefits all Canadians.

SECTION III – SUPPLEMENTARY INFORMATION

Table 1: Commission Link to the Government of Canada Outcomes

Strategic Outcome: Equality, respect for human rights and protection from discrimination by fostering understanding of, and compliance with, the Canadian Human Rights Act and the Employment Equity Act by federally regulated employers and service providers, as well as the public whom they serve.

| Program Activity | Actual Spending 2007-2008 | Alignment to Government of Canada Outcome Area | ||

| Budgetary | Non-budgetary | Total | ||

| Knowledge Development |

$6,190 | non-applicable | $6,190 | A diverse society that promotes linguistic duality and social inclusion |

| Discrimination Prevention |

$5,347 | non-applicable | $5,347 | A diverse society that promotes linguistic duality and social inclusion |

| Dispute Resolution |

$10,456 | non-applicable | $10,456 | A diverse society that promotes linguistic duality and social inclusion |

The human rights Knowledge Development Program contributes to a diverse society that promotes linguistic duality and social inclusion by creating and disseminating knowledge regarding human rights through knowledge products and activities, such as research studies, policies, guidelines, regulations, information tools, published opinions, and/or involvement in groundbreaking human rights cases.

The Discrimination Prevention Program contributes to a diverse society that promotes linguistic duality and social inclusion by engaging federally regulated organizations in discrimination prevention initiatives related to human rights and employment equity, such as action plans, policies, consultations, and training.

The Dispute Resolution Program contributes to a diverse society that promotes linguistic duality and social inclusion by providing dispute resolution options to parties who are unable to resolve their disputes using other recourse mechanisms.

Table 2: Comparison of Planned to Actual Spending (including Full-time Equivalents)

(thousands of dollars)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

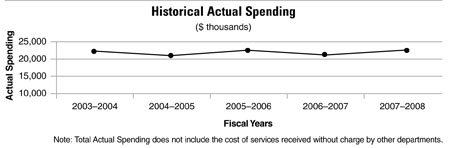

During the last five years, the actual spending fluctuations of the Commission were mainly due to temporary funding received for the following reasons:

-

to participate in the hearings of three major pay equity complaints before the Canadian Human Rights Tribunal (this funding sunsetted in March 2006);

-

to provide resources for the reduction of the complaints backlog, including those related to pay equity (this funding sunsetted in March 2006);

-

to fund the development of a new Complaints Management System and Employment Equity Audit Tracking System (this funding sunsetted in March 2008);

-

to support the Commission's Legal Services Division with regards to program integrity pressures (permanent funding); and

-

to fund salary increases resulting from collective bargaining agreements and executive salary increases (permanent funding).

Table 3: Voted and Statutory Items ($ thousands)

|

||||||||||||||||||||||||||||||||||

The 2006-2007 Total Authorities represent an increase of approximately of $1. 1 million or 5% over the 2006-2007 Total Main Estimates of $ 21 million. This difference represents funding received through the Supplementary Estimates for 2005-2006 operating budget carry forward and for the salary increases resulting from the collective bargaining agreements.

Table 4: Details on Project Spending ($ thousands)

|

|||||||||||||||||||||||||||||||||

Table 5: Financial Statements

Statement of Management Responsibility

Responsibility for the integrity and objectivity of the accompanying financial statements of the Canadian Human Rights Commission for the year ended March 31, 2008, and all information contained in these statements rests with Commission's management. These financial statements have been prepared by management in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management's best estimates and judgment and gives due consideration to materiality. To fulfil its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of the Commission's financial transactions. Financial information submitted to the Public Accounts of Canada and included in the Commission's Departmental Performance Report is consistent with these financial statements.

Management maintains a system of financial management and internal control designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are in accordance with the Financial Administration Act, are executed in accordance with prescribed regulations, within Parliamentary authorities, and are properly recorded to maintain accountability of Government funds. Management also seeks to ensure the objectivity and integrity of data in its financial statements by careful selection, training and development of qualified staff, by organizational arrangements that provide appropriate divisions of responsibility, and by communication programs aimed at ensuring that regulations, policies, standards and managerial authorities are understood throughout the Commission.

The financial statements of the Commission have not been audited.

| _______________________________________ Jennifer Lynch, Q.C. Chief Commissioner Ottawa, Ontario |

_______________________________________ Heather Throop Director General, Corporate Management Ottawa, Ontario |

|

_______________________________________

July 24, 2008 |

Statement of Operations (unaudited)

For the year ended March 31

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements.

Statement of Financial Position (unaudited)

As at March 31

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements.

Statement of Equity (unaudited)

For the year ended March 31

|

|||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements.

Statement of Cash Flow (unaudited)

For the year ended March 31

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements.

Notes to the Financial Statements (unaudited)

1. Authority and Objective

The Canadian Human Rights Commission (Commission) was established in 1977 under Schedule II of the Financial Administration Act in accordance with the Canadian Human Rights Act.

The mandate of the Commission is to discourage and reduce discriminatory practices by dealing with complaints of discrimination on the prohibited grounds in the Canadian Human Rights Act; conducting audits of federal departments and agencies and federally regulated private companies to ensure compliance with the Employment Equity Act; conducting research and information programs; and working closely with other levels of government, employers, service providers, and community organizations to promote human rights principles.

2. Summary of Significant Accounting Policies

The financial statements have been prepared in accordance with Treasury Board accounting policies, which are consistent with Canadian generally accepted accounting principles for the public sector.

Significant accounting policies are as follows:

(a) Parliamentary appropriations

The Commission is financed by the Government of Canada through Parliamentary appropriations. Appropriations provided to the Commission do not parallel financial reporting according to generally accepted accounting principles since appropriations are primarily based on cash flow requirements. Consequently, items recognized in the Statement of Operations and the Statement of Financial Position are not necessarily the same as those provided through appropriations from Parliament. Note 3 provides a high-level reconciliation between the bases of reporting.

(b) Net cash provided by government

The Commission operates within the Consolidated Revenue Fund (CRF), which is administered by the Receiver General for Canada. All cash received by the Commission is deposited to the CRF and all cash disbursements made by the Commission are paid from the CRF. The net cash provided by government is the difference between all cash receipts and all cash disbursements, including transactions between departments of the federal government.

(c) Change in net position in the Consolidated Revenue Fund

Change in net position in the Consolidated Revenue Fund is the difference between the net cash provided by the Government and appropriations used in a year, excluding the amount of non respendable revenue recorded by the Commission. It results from timing differences between when a transaction affects appropriations and when it is processed through the CRF.

(d) Revenues

Revenues are accounted for in the period in which the underlying transaction or event occurred that gave rise to the revenues.

(e) Operating Expenses

Expenses are recorded on the accrual basis:

- Vacation pay and compensatory leave are expensed as the benefits accrue to employees under their respective terms of employment.

- Services received without charge by other government departments for accommodation, employer's contribution to the health and dental insurance plans, worker's compensation coverage and legal services are recorded as operating expenses at their estimated cost.

(f) Employee future benefits

Eligible employees participate in the Public Service Pension Plan, a multi-employer plan administered by the Government of Canada. The Commission's contributions to the Plan are charged to expenses in the year incurred and represent the total Commission obligation to the Plan. Current legislation does not require the Commission to make contributions for any actuarial deficiencies of the Plan.

Severance benefits

Employees are entitled to severance benefits under collective agreements or conditions of employment. These benefits are accrued as employees render the services necessary to earn them. The obligation relating to the benefits earned by employees is calculated using information derived from the results of the actuarially determined liability for employee severance benefits for the Government as a whole.

(g) Accounts receivable

Accounts receivable are stated at amounts expected to be ultimately realized. A provision is made for accounts receivable where recovery is considered uncertain.

(h) Tangible capital assets

Tangible capital assets and leasehold improvements having an initial cost greater than $5,000 are recorded at their acquisition cost and are amortized on a straight line basis over their estimated useful lives, as follows:

|

||||||||||||||

Amortization of the tangible capital asset commences the month following the asset is put into service.

(i) Measurement uncertainty

The preparation of these financial statements in accordance with Treasury Board accounting policies, which are consistent with Canadian generally accepted accounting principles for the public sector, requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses reported in the financial statements. At the time of preparation of these statements, management believes the estimates and assumptions to be reasonable. The liability for employee severance benefits and the useful life of tangible capital assets are the most significant items where estimates are used. Actual results could significantly differ from those estimated. Management's estimates are reviewed periodically and, as adjustments become necessary, they are recorded in the financial statements in the year they become known.

3. Parliamentary Appropriations

The Commission receives its funding through annual Parliamentary appropriations. Items recognized in the Statement of Operations and the Statement of Financial Position in one year may be funded through Parliamentary appropriations in prior, current or future years. Accordingly, the Commission has different net results of operations for the year on a government funding

basis than on an accrual accounting basis. The following tables present the reconciliation between the current year appropriations used, the net cost of operations and the net cash provided by the Government:

(a) Reconciliation of net cost of operations to current year appropriations used:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) Appropriations provided and used:

|

||||||||||||||||||||||||||||||||||||||||||

(c) Reconciliation of net cash provided by Government to current year appropriations used:

|

|||||||||||||||||||||||||||||||||||||||||||||

4. Operating Expenses

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

5. Revenues

|

|||||||||||||||||||||

6. Accounts Receivable

|

|||||||||||||||||||||

7. Tangible Capital Assets

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Amortization expense for the year ended March 31, 2007 is $103,791 ($96,855 in 2006).

8. Accounts Payable and Accrued Liabilities

|

||||||||||||||||||||||||||||||

9. Employee Future Benefits

a) Pension benefits

The Commission's employees participate in the Public Service Pension Plan, which is sponsored and administered by the Government of Canada. Pension benefits provide for pensions equal to 2% of the average of the five highest consecutive years' salary for each year of service to a maximum of 35 years. The benefits are integrated with Canada/Quebec Pension Plan benefits and they are indexed to inflation.

Both the employees and the Commission contribute to the cost of the Plan. In 2007-2008, the expenses amount to $2,072,031 ($2,095,144 in 2006-2007), which represents approximately 2.1 times (2.2 in 2006-2007) the contributions by employees.

The Commission's responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the financial statements of the Government of Canada, as the Plan's sponsor.

b) Severance benefits

The Commission provides severance benefits to its employees based on eligibility, years of service and final salary. The liability for severance benefits is not funded by Parliamentary appropriations, but the benefits paid during the year are funded. The severance benefits as of March 31 are as follows:

|

||||||||||||||||||||||||

10. Contractual Obligations

The nature of the Commission's activities can result in some large multi-year contracts and obligations whereby the Commission will be obligated to make future payments when the goods or services are rendered. Significant contractual obligations that can be reasonably estimated are summarized as follows:

|

||||||||||||||||

11. Related Party Transactions

The Commission is related as a result of common ownership to all Government of Canada departments, agencies, and Crown corporations. The Commission enters into transactions with these entities in the normal course of business and on normal trade terms.

During the year, the Commission receives services without charge from other departments, which are recorded at their estimated cost in the Statement of Operations as follows:

|

|||||||||||||||||||||||||||

The Government has structured some of its administrative activities for efficiency and cost-effectiveness purposes so that one department performs these on behalf of all without charge. The costs of the services, which include payroll and cheque issuance services provided by Public Works and Government Services Canada, are not included as an expense in the Commission's Statement of Operations.

12. Comparative Information

Comparative figures have been reclassified to conform to the current year's presentation.

SECTION IV – OTHER ITEMS OF INTEREST

Organizational Information

Mandate

The Commission has a mandate under the Canadian Human Rights Act (CHRA) to promote equality of opportunity and to protect individuals from discrimination in employment and in the provision of services. The CHRA identifies the prohibited grounds of discrimination as: race, national or ethnic origin, colour, religion, age, sex, sexual orientation, marital status, family status, disability, or conviction for an offence for which a pardon has been granted.

The Commission also has a mandate under the Employment Equity Act (EEA) to achieve equality in the workplace and to correct the conditions of disadvantage in employment experienced by women, Aboriginal people, persons with disabilities, and members of visible minorities.

Both the CHRA and the EEA apply to federal departments and agencies, Crown corporations and federally regulated private sector organizations (e.g., banks and interprovincial transportation companies).

Corporate Management

Internal services provide advice and integrated administrative services that enable the Commission to deliver its programs. These services encompass the following areas: assets management, communications, executive support, finance, human resources, information management/information technology, legal advisory, planning, security, and telecommunications. The costs associated with the provision of internal services have been apportioned to the Commission’s three program activities.

The Commission also provides various services to the Indian Specific Claims Commission, the Office of the Public Sector Integrity Commissioner, and the Public Service Labour Relations Board through a Memorandum of Understanding to support the principles of shared services.

During 2007–2008, the Commission developed an action plan that focuses on addressing management improvement priorities identified by the Treasury Board Secretariat in the Commission’s 2006 Management Accountability Framework (MAF) assessment. The Commission will monitor the status of the three-year action plan and provide information sessions to managers to ensure that they are well oriented to the MAF.