ARCHIVED - Office of the Chief Electoral Officer

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2007-08

Departmental Performance Report

Office of the Chief Electoral Officer

The original version was signed by

The Honourable Jay Hill, PC, MP

Leader of the Government in the House of Commons and Minister for Democratic Reform

The Honourable Marc Mayrand

Chief Electoral Officer of Canada

Section I – Overview

Chief Electoral Officer's Message

The 2007–2008 fiscal year was both interesting and challenging for Elections Canada, and in some respects unprecedented. During this period, we worked to enact the provisions of bills C-31 and C-18, which require electors to prove their identity and address when voting. The new requirements represent significant changes for electors and the way the electoral process is administered. We conducted seven by-elections under the new voter identification regime introduced by these bills.

We also engaged in a significant, cross-country training initiative to inform political entities about the new Electronic Financial Return software and how to use it, as well as about the political financing rules that came into effect on January 1, 2007, with the passing of the Federal Accountability Act. This work was accomplished in the context of a minority government, with no fewer than eight confidence votes during the fiscal year. The resulting uncertainty meant that we needed to maintain the highest level of readiness, both in the field and in Ottawa, to conduct a federal general election at any time.

The past fiscal year brought considerable attention to Elections Canada, particularly with regard to its regulatory role in the areas of political financing, acceptable pieces of identification for voting and compliance. This heightened scrutiny tested the resilience and vigilance of the agency. We had to exert significant effort, mostly to demonstrate that we were delivering our statutory mandate in an independent, fair, transparent and effective manner, in compliance with the provisions of the Canada Elections Act.

To ensure we could continue meeting these challenges and new ones that are sure to come our way, we set out in 2007 to develop a five-year strategic plan that would identify our long-term strategic priorities and the key enabling functions required to achieve them. The Strategic Plan 2008–2013 was completed in September 2007. It will guide us as we strive to continuously improve the way we fulfill our mandate.

During this period, we prepared a submission to the Treasury Board of Canada, seeking to increase our annual funding so that we will be able to expand our base of indeterminate employees. More such employees are required to increase our capacity to continue implementing significant electoral and legislative reforms, improving our information technology infrastructure, and carrying out initiatives resulting from the Federal Accountability Act.

This reporting period presented significant challenges. We will continue to work closely with electors, parliamentarians, political parties and other stakeholders to fulfill our strategic priorities, serve the electoral needs of Canadians and maintain their trust in the federal electoral framework.

____________________________

Marc Mayrand

Chief Electoral Officer of Canada

Management Representation Statement

I submit, for tabling in Parliament, the 2007–2008 Departmental Performance Report (DPR) for the Office of the Chief Electoral Officer.

This document has been prepared based on the reporting principles contained in the Guide to the Preparation of Part III of the 2007–2008 Estimates; Reports on Plans and Priorities and Departmental Performance Reports:

- It adheres to the specific reporting requirements outlined in the Treasury Board Secretariat guide.

- It is based on the agency's strategic outcome and Program Activity Architecture, approved by the Treasury Board.

- It presents consistent, comprehensive, balanced and reliable information.

- It provides a basis of accountability for the results achieved with the resources and authorities entrusted to the agency.

- It reports finances based on approved numbers from the Estimates and the Public Accounts of Canada.

____________________________

Marc Mayrand

Chief Electoral Officer of Canada

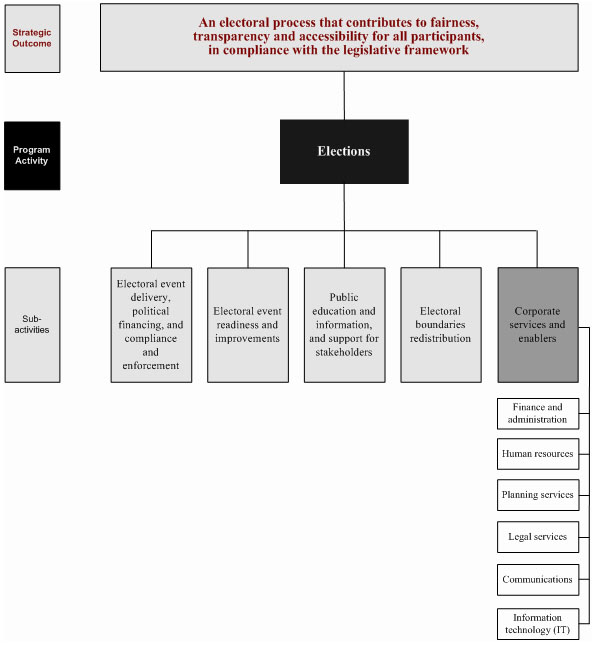

Strategic Outcome and Program Activity Architecture

Elections Canada has a single strategic outcome supported by the following Program Activity Architecture:

Summary Information

Raison d'être

The Chief Electoral Officer is an independent, non-partisan Officer or Agent of Parliament. More information on Officers of Parliament can be obtained at:

The Office of the Chief Electoral Officer is commonly known as Elections Canada. The mandate of this agency is to:

- be prepared at all times to conduct a federal general election, by-election or referendum

- administer the political financing provisions of the Canada Elections Act

- monitor compliance and enforce electoral legislation

- conduct voter education and information programs

- provide support to the independent commissions in charge of adjusting the boundaries of federal electoral districts following each decennial census

- carry out studies on alternative voting methods and, with the approval of Parliament, test electronic voting processes for future use during electoral events

Elections Canada's responsibilities include ensuring that all voters have access to the electoral process, providing information and education programs to citizens about the electoral system, maintaining the National Register of Electors, enforcing electoral legislation, and maintaining readiness to conduct electoral events.

Its mission is to ensure that Canadians can exercise their democratic rights to vote and be a candidate. Its vision is to provide an accessible electoral framework that Canadians trust and use.

The Office of the Chief Electoral Officer is funded by an annual

appropriation that provides for the salaries of permanent full-time staff, and

by the statutory authorities contained in the Canada Elections Act, the

Referendum Act and the Electoral Boundaries Readjustment Act. The

statutory authorities provide for all other expenditures, including the costs of

electoral events, reimbursements of election expenses to eligible candidates and

parties, quarterly allowances for eligible political parties, redistribution of

electoral boundaries and expenses incurred by the Commissioner of Canada

Elections or on behalf of the Commissioner in connection with the enforcement of

the legislation. There are two further statutory items: the salary of the Chief

Electoral Officer and contributions to employee benefit plans.

The statutory authority ensures that Elections Canada has the capacity to be ready at all times to conduct an electoral event. It also serves to recognize Elections Canada's independence from the government and from the influence of political parties. It is a critical component in maintaining the integrity of the democratic process in Canada.

Financial Resources ($ thousands)

| 2007–2008 | ||

| Planned Spending | Total Authorities | Actual Spending |

| $104,422 | $122,185 | $120,740 |

Human Resources (full-time equivalents (FTEs))

| 2007–2008 | ||

| Planned | Actual | Difference |

| 387 | 423 | 36 |

Agency Priorities

|

Name |

Type |

Performance Status |

| 1. Electoral event delivery, political financing, and compliance and enforcement |

Ongoing |

Successfully met |

| 2. Electoral event readiness and improvements |

Ongoing |

Successfully met |

| 3. Public education and information, and support for stakeholders |

Ongoing |

Successfully met |

| 4. Electoral boundaries redistribution |

Ongoing |

Redistribution was last completed in 2003–2004. It will begin again once we receive the 2011 census return. However, we will begin planning activities for this priority starting in 2008–2009. |

Elections Canada also worked on a number of programs and services related to internal operations and administration, identified in the 2007–2008 Report on Plans and Priorities under the heading of "Other Programs and Services."

Program Activities by Strategic Outcome

The following chart summarizes Elections Canada's four key programs and corporate services or program enablers that complement our single strategic outcome.

|

Expected Results |

Performance Status |

2007–2008 |

Contributes to |

||

|

Planned Spending |

Actual Spending |

||||

| Strategic Outcome: an electoral process that contributes to fairness, transparency and accessibility for all participants, in compliance with the legislative framework. | |||||

| Key Program 1: Electoral event delivery, political financing, and compliance and enforcement |

|

Successfully met (see details) |

34,251 |

42,249 |

Priority 1 |

| Key Program 2: Electoral event readiness and improvements | Readiness to deliver electoral events whenever they may be called | Successfully met (see details) |

59,344 |

71,515 |

Priority 2 |

| Key Program 3: Public education and information, and support for stakeholders | Timely and high-quality electoral public education and information programs | Successfully met (see details) |

10,827 |

6,976 |

Priority 3 |

| Key Program 4: Electoral boundaries redistribution | Efficient and non-partisan administration of the Electoral Boundaries Readjustment Act | This cyclical activity was last completed in 2003–2004. Planning for this priority resumes in 2008–2009. |

0 |

0 |

Priority 4 |

| Corporate services and enablers | Provision of support and enabling activities for the four mandated priority functions | Successfully met (see details) | Included in the above | Included in the above | All four mandated priorities |

Agency Performance

Elections Canada's Report on Plans and Priorities (RPP) for 2007–2008 guided the agency's activities during this reporting period. The plans and priorities were directed by our strategic outcome, and were also influenced by Parliament's legislative initiatives, as well as the requirement to conduct two sets of by-elections.

1. Performance Highlights

In the past fiscal year, Elections Canada was successful in fulfilling all of its mandated priorities and in addressing the actions set out in the 2007–2008 RPP.

The highlights include:

Electoral Event Delivery, Political Financing, and Compliance and Enforcement

Within this mandated priority, Elections Canada achieved the following major deliverables:

- On September 17, 2007, the agency administered by-elections in the

electoral districts of Outremont, Roberval–Lac-Saint-Jean and

Saint-Hyacinthe–Bagot. On March 31, 2008, the Chief Electoral Officer

submitted to the Speaker of the House of Commons his report on the

administration of these by-elections, in accordance with subsection 534(2)

of the

Canada Elections Act.

Implemented successfully in these by-elections were the provisions of Bill C-31 (which came into force in July 2007), requiring electors to prove their identity and address.

The report for the by-elections is posted on the Elections Canada Web site at: - Elections Canada successfully administered four by-elections on

March 17, 2008, in the electoral districts of Desnethé–Missinippi–Churchill

River, Toronto Centre, Vancouver Quadra, and Willowdale. Implemented in

these by-elections were the provisions of both bills C-31 and C-18. (Bill

C-18 came into force in December 2007. It allows an elector to establish his

or her residence by presenting a piece of identification that is consistent

with information related to the elector or voucher that appears on the list

of electors.)

The Chief Electoral Officer's report on this event is an action item for the agency for 2008–2009. - All political entities were informed of the new political financing rules in the Federal Accountability Act, which came into force on January 1, 2007.

- The agency completed a review of 93 percent of the 39th general election returns. Reimbursements of election expenses were issued to eligible candidates, as were payments of audit subsidies to auditors.

- The Office of the Commissioner of Canada Elections assessed, investigated and resolved complaints about contraventions of the Canada Elections Act related to the 38th and 39th general elections and two sets of by-elections (in seven electoral districts) in 2007–2008.

- Prosecutions related to the 38th general election were completed. One prosecution relating to the 39th general election was ongoing and was being conducted by the Director of Public Prosecutions, who is now responsible for the prosecution of offences under the Canada Elections Act.

Electoral Event Readiness and Improvements

Within this mandated priority, Elections Canada achieved the following deliverables:

- The provisions of bills C-31 and C-18 establishing a new voter

identification regime were assessed and implemented over the course of the

seven by-elections held in 2007–2008.

Some of the changes to improve the accuracy of the National Register of Electors were also implemented, including the addition of an explicit confirmation of Canadian citizenship to the 2007 income tax form. This will allow new electors, especially youth, to be added directly to the Register. The changes will begin to yield results in fall 2008.

The statutory report on the September 2007 by-elections (posted on the Elections Canada Web site) contains details of the implementation of the provisions of Bill C-31. - A more advanced, automated Quality Measurement System (QMS) was implemented to assist in managing the National Register of Electors. The system allows the agency to prepare quality estimates more efficiently. Using QMS information, Elections Canada can accurately inform stakeholders about the quality of data in the Register.

- New geographic tools and maps were created to facilitate the grouping and location of advance polling districts and polling sites, and to help in determining an elector's electoral district and polling division. These changes ultimately make voting more accessible for Canadians and improve the administration of polling station activities for election officials.

- Approximately 10,100 polling divisions, 800 mobile polls and 2,070 advance polling districts were revised on the basis of recommendations received from returning officers. The aim was to reduce waiting times resulting from high voter turnout.

- Returning officers were appointed and trained in accordance with the provisions of the Federal Accountability Act. During the reporting period, 24 returning officers resigned. Another six positions had fallen vacant before the start of the fiscal year. To fill all the vacancies, 30 returning officers were appointed. Of these, 27 were trained at Elections Canada in Ottawa.

- An amendment was proposed to the Tariff of Fees for election workers. It suggested rates intended to reflect the increasing degree of responsibility and complexity required for specific management positions, and to provide adequate remuneration for all other positions. The proposed rates will allow for the continued hiring and retention of a sufficient number of qualified persons for elections, while reducing the costs associated with hiring and training, and facilitating the implementation of process innovations and improvements.

Public Education and Information, and Support for Stakeholders

Within this mandated priority, Elections Canada achieved the following deliverables:

- The Community Relations Officer Program was expanded to include any electoral district with a post-secondary institution. This gave the program greater scope, presence and visibility. The result was improved transmission and availability of electoral information for young electors.

- The Chief Electoral Officer appeared before Parliament several times between April 1, 2007, and March 31, 2008, to give technical advice and answer questions about several legislative initiatives. Transcripts for all appearances are posted on the Elections Canada Web site at www.elections.ca. Click on Media > Statements and Speeches.

Corporate Services and Enablers

Within this priority, Elections Canada achieved the following deliverables:

- A new strategic plan was developed to establish our priorities for the next five years and to respond to opportunities and challenges of the environment in which we operate. This was accompanied by internal governance changes, which included the adoption of a new business planning cycle and process. To better support the Chief Electoral Officer and empower managers, three new committees were created: the Regulatory and Compliance Committee, the Electoral Readiness Committee, and the Information Management and Technology Committee.

- As a result of a broadened mandate and the need to stabilize operations, the agency made a submission to the Treasury Board of Canada, seeking to increase our annual funding so that we will be able expand our base of indeterminate employees. More such employees are required to increase our capacity to address changes introduced to the political financing regime in 2004 and other recent changes resulting from the 2006 Federal Accountability Act, to support the renewal of our information technology (IT) environment, and to enable the agency to deal with other urgent and mission-critical pressures.

- Amendments to the delegations of authorities within Elections Canada were proposed to ensure appropriate operational management and financial controls of the agency's decision-making process. The amendments ensure that controls contribute to effective program delivery and ensure sound accountability in the exercise of authority.

- A risk-based internal audit plan for 2008–2009 through 2010–2011 was developed to ensure appropriate coverage of the activities of Elections Canada.

- An independent Audit Committee was established to provide guidance to the Chief Electoral Officer on governance, risk management, control, audit and reporting practices.

- Final testing of new hardware and software for local offices was completed. The new technology was successfully deployed in field offices for the March 2008 by-elections. The upgrade allowed the agency to continue supporting the electoral process with existing field systems. It also positioned the agency to support the new systems to be delivered under the Information Technology Renewal initiative.

These actions were consistent with our established plans and priorities. By accomplishing them, the agency was able to continue fulfilling its strategic outcome during the reporting period.

2. Agency Context and Operating Environment

The following operating factors influenced the performance of the agency during this reporting period.

New Legislation

Elections Canada must continually monitor and respond to legislative initiatives and judicial decisions. Of particular significance were the changes implemented in 2007–2008 resulting from the passage of the Federal Accountability Act (S.C. 2006, c. 9); these included modifications to political financing rules (rules governing gifts), as well as the application of the Access to Information Act to Elections Canada. In addition, legislative changes introduced by Bill C-31, An Act to amend the Canada Elections Act and the Public Service Employment Act (S.C. 2007, c. 21), concerning new voter identification procedures, were implemented in the by-elections held on September 17, 2007, and March 17, 2008. Further changes resulting from the passage of Bill C-18, An Act to amend the Canada Elections Act (verification of residence) (S.C. 2007, c. 37) were implemented during the March 17, 2008, by-elections.

A detailed description of new legislative initiatives and judicial decisions is provided in Section IV, "Other Items of Interest."

Strategic Plan 2008–2013

In fall 2007, Elections Canada completed the development of a strategic plan to guide its activities through 2013. The plan established three strategic objectives (trust, accessibility and engagement) and identified four key enablers (human resources, information technology, governance and communications). All are essential for the agency to deliver our mandate and achieve our strategic outcome.

Among high priorities for 2008–2009 are the first steps in implementing the Strategic Plan and the long‑term action plan for each enabler.

Risks and Challenges

- The length of Elections Canada's business cycle continues to vary in the ongoing situation of minority governments. The uncertainty makes planning and delivery challenging. We must continually monitor parliamentary and political events and trends so that we can take into account circumstances that might affect our electoral readiness and preparations for electoral events. Maintaining a constant state of readiness also imposes a strain on the organization. The pressure has increased with the succession of minority governments, the heavier volume of work resulting from closely spaced general elections, recent far-reaching electoral reform and further proposed significant changes to the electoral process.

- The regulatory regime for electoral events has become highly complex, imposing demands that are daunting. The result is that many individuals hesitate to become financial or official agents. In fact, many entities find the regulatory burden excessive. Nonetheless, the regulatory framework and the transparency it provides are crucial in supporting public trust in political entities. The regulatory framework for political financing is expected to continue to evolve significantly and rapidly, presenting new responsibilities and challenges for Elections Canada. The agency does not set regulations. However, through administrative decisions such as the adoption of interpretations and positions, it sets precedents on regulatory matters that affect political entities. In performing this role, Elections Canada must first ensure that the administrative requirements are tailored and smart, and that they facilitate compliance, provide for an efficient process, and do not create undue difficulties for political entities in carrying out their core activities. At the same time, the agency must continue to ensure a level of integrity in the system, warranting ongoing public confidence.

- As a result of successive electoral reforms, Elections Canada's role in regulating some aspects of the electoral process has grown considerably, particularly in connection with acceptable pieces of identification for electors and political financing. This has necessarily increased the regulatory presence of the agency requiring us to divert resources from other activities. Therefore, we may need to realign priorities.

- Significant investments are needed now to renew our information technology (IT) infrastructure; we had no choice but to stretch its lifespan to meet our ongoing readiness goals in the context of minority governments. The existing IT environment has reached the limits of its capability and cannot be augmented further to meet new and ongoing requirements. The situation affects every aspect of the IT environment. To address this risk, an IT renewal initiative has begun and will, over a period of years, replace our current infrastructure with one better suited to our needs.

Section II – Analysis of Program Activities by Strategic Outcome

Introduction

Elections Canada operates under a Program Activity Architecture (PAA) that contains one main strategic outcome:

The PAA contains one program activity – elections.

Program Activity: Elections

| Financial Resources ($ thousands) | ||

|

Planned Spending |

Authorities |

Actual Spending |

|

$104,422 |

$122,185 |

$120,740 |

| Human Resources (FTEs) | ||

|

Planned |

Actual |

Difference |

|

387 |

423 |

36 |

Elections Canada is committed to providing four key programs that are beneficial to Canadians:

- delivering federal elections, by-elections and referendums that maintain the integrity of the electoral process, and administering the political financing provisions of the Canada Elections Act

- achieving and maintaining a state of readiness to deliver electoral events whenever they may be called, and improving the delivery of electoral events

- providing timely and high-quality public education and information programs, as well as assurance that support on electoral matters is available to the public, parliamentarians, political entities and other stakeholders

- administering the Electoral Boundaries Readjustment Act, under which readjustment of federal electoral boundaries is carried out by independent commissions after each decennial (10‑year) census to reflect changes and movements in Canada’s population

We also identified major initiatives to improve our internal services and operations. These initiatives will increase our efficiency and ultimately our ability to deliver our strategic outcome to Canadians more effectively. The initiatives planned for 2007–2008 were described in the 2007–2008 Report on Plans and Priorities under “Key Program 5: Other Programs and Services.”

Key Program 1: Electoral Event Delivery, Political Financing, and Compliance and Enforcement

Expected Results:

- delivery of high-quality elections, by-elections and referendums at all times

- fair, efficient and transparent administration of the political financing provisions

- effective compliance and enforcement programs, in accordance with legal requirements

Planned Spending

| Financial Resources ($ thousands) | ||

|

Planned Spending |

Authorities |

Actual Spending |

|

$34,251 |

$42,438 |

$42,249 |

Sub-programs

This key program is delivered via three sub-programs:

- Electoral Event Delivery – When required by Parliament, delivers federal elections, by-elections and referendums that maintain the integrity of the electoral process.

- Political Financing – Administers the provisions of the Canada Elections Act related to political financing.

- Compliance and Enforcement – Addresses complaints about contraventions of the Canada Elections Act.

Performance Highlights

|

Expected Results |

Results Achieved |

Additional Information/ Lessons Learned/Areas for Improvement |

|

| Electoral Event Delivery | |||

|

Successful administration and delivery of the following by-elections:

|

Areas for improvement in event delivery include:

|

|

|

|

||

| Political Financing | |||

|

|

|

|

|

|

||

|

Results as of March 31, 2008:

|

|

|

|

|

||

| Compliance and Enforcement | |||

|

|

Additional information:

|

|

*A caution letter is used as an informal enforcement measure.

Key Program 2: Electoral Event Readiness and Improvements

Expected Result:

- readiness to deliver electoral events whenever they may be called

Planned Spending

| Financial Resources ($ thousands) | ||

|

Planned Spending |

Authorities |

Actual Spending |

|

$59,344 |

$72,553 |

$71,515 |

Sub-program

This key program is delivered via one sub-program:

- Electoral Event Readiness and Improvements – Electoral processes, systems, databases and materials are up to date; staff and election officers are well trained and ready for any electoral event.

Performance Highlights

|

Expected Results |

Results Achieved |

Additional Information/ Lessons Learned/Areas for Improvement |

| Electoral Event Readiness and Improvements | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Key Program 3: Public Education, Information and Support for Stakeholders

Expected Results:

- timely and high-quality electoral public education and information programs

- electoral processes that are better known to the public, particularly persons and groups most likely to experience difficulties in exercising their democratic rights

Planned Spending

| Financial Resources ($ thousands) | ||

|

Planned Spending |

Authorities |

Actual Spending |

|

$10,827 |

$7,194 |

$6,976 |

Sub-programs

This key program is delivered via four sub-programs:

- Voter Education and Outreach – Voter Education informs and educates electors about upcoming federal elections, by-elections and referendums, as required. Outreach informs and educates specific groups of electors with targeted communications designed to fulfill one of our strategic objectives. Under our engagement strategic objective, we want to increase young Canadians’ understanding of the importance of voting and becoming candidates in elections.

- Corporate Research plans and conducts research on Canada’s electoral process, and assists the agency in evaluating its key initiatives, including the use of post-election studies.

- Support for Stakeholders provides both parliamentarians and political parties with advice and support, including expertise and technical advice regarding electoral legislation initiatives.

- International Research and Co-operation researches and monitors international best practices and innovations in election administration, provides training, and coordinates information exchanges with similar agencies in other countries.

Performance Highlights

|

Expected Results |

Results Achieved |

Additional Information/ Lessons Learned/Areas for Improvement |

| Voter Education and Outreach | ||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

| Corporate Research | ||

|

|

|

|

|

|

|

|

|

| Support for Stakeholders | ||

|

|

|

| International Research and Co-operation | ||

|

|

|

|

|

|

|

|

|

|

|

|

Key Program 4: Electoral Boundaries Redistribution

Expected Result:

- efficient and non-partisan administration of the Electoral Boundaries Readjustment Act

Planned Spending

| Financial Resources ($ thousands) | ||

|

Planned Spending |

Authorities |

Actual Spending |

|

$0 |

$0 |

$0 |

Sub-program

This program activity is delivered via one sub-program:

- Electoral Boundaries Redistribution – After each decennial (10-year) census, representation in the House of Commons is readjusted to reflect changes and movements in Canada’s population. Readjustment of federal electoral boundaries is carried out by independent commissions in each province, with the support of Elections Canada.

Performance Highlights

This priority was last completed in May 2004 with the coming into force of the Representation Order of 2003. Planning will begin in 2008–2009 to receive the 2011 census return, after which redistribution will formally begin again.

Corporate Services and Enablers

Expected Results:

- improved support for the agency’s mandated and strategic priorities

- strengthened business planning, reporting and accountability through results-based management

| Financial Resources ($ thousands) | ||

|

Planned Spending |

Authorities |

Actual Spending |

|

Included in other sub-programs |

||

Performance Highlights

|

Expected Results |

Results Achieved |

Additional Information/ Lessons Learned/Areas for Improvement |

| Human Resources Modernization | ||

|

|

|

|

|

|

|

|

|

| Performance Management Framework | ||

|

|

|

|

|

|

|

|

|

| Resource Management and Delegation of Authority | ||

|

|

|

|

|

|

| Internal Audit | ||

|

|

|

|

|

|

| Information Technology Renewal | ||

|

|

|

|

|

|

Section III – Supplementary Information

Financial Tables

In 2007–2008, the following financial tables were applicable to Elections Canada’s operations.

Table 1: Comparison of Planned to Actual Spending (including FTEs)

|

($ thousands) |

2005–2006 Actual |

2006–2007 Actual |

2007–2008 |

|||

|

Main Estimates |

Planned Spending |

Total Authorities |

Actual |

|||

| 1. Electoral event delivery, political financing, and compliance and enforcement |

256,401 |

40,239 |

34,251 |

34,251 |

42,438 |

42,249 |

| 2. Electoral event readiness and improvements |

50,899 |

68,435 |

59,344 |

59,344 |

72,553 |

71,515 |

| 3. Public education and information, and support for stakeholders |

7,084 |

6,542 |

10,827 |

10,827 |

7,194 |

6,976 |

| 4. Electoral boundaries redistribution |

3 |

– |

– |

– |

– |

– |

| Total |

314,387 |

115,216 |

104,422 |

104,422 |

122,185 |

120,740 |

| Less: Non-respendable revenue |

– |

– |

– |

– |

– |

– |

| Plus: Cost of services received without charge |

5,472 |

5,832 |

– |

6,369 |

– |

6,163 |

| Total Agency Spending |

319,859 |

121,048 |

104,422 |

110,791 |

122,185 |

126,903 |

| Full-time Equivalents |

452 |

396 |

387 |

387 |

453 |

423

|

Table 2: Voted and Statutory Items

|

Vote Number or Statutory |

Truncated Vote or Statutory Wording |

2007–2008 ($ thousands) |

|||

|

Main Estimates |

Planned Spending |

Total Authorities |

Actual |

||

| 15 | Program expenditures |

21,766 |

21,766 |

22,071 |

20,627 |

| S | Expenses of elections |

78,398 |

78,398 |

95,168 |

95,167 |

| S | Salary of the Chief Electoral Officer |

231 |

231 |

253 |

253 |

| S | Contributions to employee benefit plans |

4,027 |

4,027 |

4,693 |

4,693 |

| Total |

104,422 |

104,422 |

122,185 |

120,740 |

|

Table 3: Details on Transfer Payment Programs (TPPs)

| 1) Name of Transfer Payment Program: Reimbursements to candidates, parties and auditors, and allowances to eligible political parties (new political financing provisions of the Canada Elections Act) | |||||||

| 2) Start Date: Ongoing | 3) End Date: Ongoing | ||||||

|

4) Description: Elections Canada’s role is to administer the Canada Elections Act, which has three main objectives: fairness, transparency and participation. To promote fairness and participation, the Act provides for reimbursement of election expenses to candidates and parties, and a subsidy for certain auditors’ fees. A candidate who is elected or receives at least 10% of the valid votes cast at an election is entitled to a reimbursement of 60% of the election expenses limit. A registered party is eligible for reimbursement of election expenses if the party obtains 2% or more of the total valid votes cast nationally, or 5% of the valid votes cast in electoral districts where the party has endorsed candidates. The Act provides for a subsidy, equal to the lesser of $1,500 or 3% of the candidate’s election expenses with a minimum of $250, to be paid out of public funds directly to the candidate’s auditor. A registered association that has, in a fiscal period, accepted contributions or incurred expenses of $5,000 or more in total (less transfers to other political entities), must obtain an audit report that provides an audit opinion as to whether the Registered Association Financial Transactions Return presents fairly the information contained in the financial records on which it is based. When an audit of the Registered Association Financial Transactions Return is required, the Act provides for a subsidy of a maximum of $1,500 for the audit of the expenses. This amount is paid out of public funds directly to the electoral district association’s auditor after the Chief Electoral Officer has received the return, the auditor’s report and other documents required to accompany the return. For eligible political parties, the Act also provides for the payment of a quarterly allowance according to the following formula: a registered political party that obtained at least 2% of the total valid votes cast in a general election, or 5% of the valid votes cast in the ridings where it presented candidates, has the right to a quarterly allowance that is calculated as the product of $0.4375 multiplied by the number of valid votes cast in the most recent general election preceding that quarter and the inflation adjustment factor that is in effect for that quarter. |

|||||||

| 5) Strategic Outcomes: To maintain and strengthen the recognition among Canadians, whether they are electors or other participants in the electoral process, that we administer the Canada Elections Act in a fair, consistent, effective and transparent manner. | |||||||

| 6) Results Achieved: Elections Canada issued election expense reimbursements to eligible candidates, audit subsidies to candidate and registered electoral district association auditors, and quarterly allowances to eligible registered parties in accordance with the Act. | |||||||

| ($ thousands) |

7) Actual spending 2005–2006 |

8) Actual spending 2006–2007 |

9) Planned spending 2007–2008 |

10) Total authorities 2007–2008 |

11) Actual spending 2007–2008 |

12) Variance(s) between columns 9 and 11 |

|

| 13) General elections and by-elections |

|

|

|

|

|

|

|

| – Candidates |

24,628 |

(684) |

|

158 |

158 |

(158) |

|

| – Political parties |

27,998 |

(816) |

|

4 |

4 |

(4) |

|

| – Candidates’ auditors |

1,124 |

(246) |

|

51 |

51 |

(51) |

|

| 14) Quarterly allowances |

|

|

|

|

|

|

|

| – Allowance to eligible political parties |

24,536 |

27,452 |

28,141 |

28,016 |

28,016 |

125 |

|

| 15) Electoral district associations’ auditors | |||||||

| – Electoral district associations’ auditors |

932 |

879 |

902 |

804 |

804 |

98 |

|

| 16) Total TPP |

79,218 |

26,585 |

29,043 |

29,033 |

29,033 |

10 |

|

Table 4: Response to Parliamentary Committees and External Audits

| Response to Parliamentary Committees |

|

No recommendations were received for the current reporting period.

|

| Response to the Auditor General, including to the Commissioner of the Environment and Sustainable Development |

|

No recommendations were received for the current reporting period.

|

|

External Audits* *Refers to other external audits conducted by the Public Service Commission of Canada or the Office of the Commissioner of Official Languages. |

|

The agency has nothing to report for the current reporting period.

|

Table 5: Internal Audits and Evaluations

| Name of Internal Audit | Audit Type | Status | Completion Date | Electronic Link to Report |

| Follow-up audit to the Auditor General of Canada’s November 2005 Report to Parliament, Chapter 6, “Elections Canada – Administering the Federal Electoral Process” | Follow-up audit | In progress | September 2008 | N/A |

Financial Statements

OFFICE OF THE CHIEF ELECTORAL OFFICER

For the year ended March 31, 2008

Management Responsibility for Financial Statements

Responsibility for the integrity and objectivity of the accompanying Financial Statements for the year ended March 31, 2008 and all information contained in these statements rests with the management of the Office of the Chief Electoral Officer (OCEO).

These Financial Statements have been prepared by management in accordance with Treasury Board accounting policies, which are consistent with Canadian generally accepted accounting principles for the public sector and year-end instructions issued by the Office of the Comptroller General. Some of the information in the Financial Statements is based on management’s best estimates and judgements and gives due consideration to materiality. These statements should be read within the context of the significant accounting policies set out in the Notes.

Management maintains a system of financial management and internal controls designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded, resources are managed economically and efficiently in the attainment of corporate objectives, and that transactions are in accordance with the Financial Administration Act and regulations, the Canada Elections Act, the Referendum Act, the Electoral Boundaries Readjustment Act and the Constitution Acts.

Management is supported and assisted by a program of internal audit services. OCEO also has an independent audit committee. The responsibilities of the committee are to provide the Chief Electoral Officer with independent advice and assurance on the effectiveness of Elections Canada governance, risk management, control, audit and reporting practices.

The Auditor General of Canada, the independent auditor for the Government of Canada, has audited the transactions and the Financial Statements and issued the attached auditor’s report.

| Marc Mayrand Chief Electoral Officer of Canada |

Janice Vézina Associate Deputy Chief Electoral Officer, Political Financing and Chief Financial Officer |

Ottawa, Canada

July 11, 2008

OFFICE OF THE CHIEF ELECTORAL OFFICER

Statement of Financial Position

At March 31

|

2008 |

2007 |

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

Financial assets

|

|

|

|

Accountable advances

|

$3 |

$6 |

|

Due from the Consolidated Revenue Fund

|

19,370 |

23,592 |

|

Receivables

|

|

|

|

- from external parties

|

512 |

897 |

|

- from government departments and agencies

|

1,028 |

767 |

|

Total financial assets

|

20,913 |

25,262 |

|

|

|

|

|

Non-financial assets

|

|

|

|

Prepaid expenses

|

590 |

907 |

|

Consumable supplies

|

7,549 |

8,733 |

|

Tangible capital assets (Note 4)

|

16,353 |

16,062 |

|

Total non-financial assets

|

24,492 |

25,702 |

|

|

|

|

| Total |

$45,405 |

$50,964 |

| LIABILITIES | ||

|

Accounts payable and accrued liabilities

|

|

|

|

- to external parties

|

$16,775 |

$20,024 |

|

- to government departments and agencies

|

1,907 |

2,059 |

|

Accrued employee salaries and benefits

|

1,674 |

2,206 |

|

Lease obligation for tangible capital assets (Note 5)

|

318 |

249 |

|

Provision for vacation leave

|

1,411 |

1,294 |

|

Deposits from political candidates

|

44 |

71 |

|

Employee severance benefits (Note 6)

|

4,429 |

3,655 |

|

Provision for contingent liabilities

|

- |

56 |

|

Total liabilities

|

26,558 |

29,614 |

|

|

|

|

| EQUITY OF CANADA |

18,847 |

21,350 |

|

|

|

|

| Total |

$45,405 |

$50,964 |

Contractual Obligations (Note 7) and Contingencies (Note 8)

The accompanying notes form an integral part of these Financial Statements.

Approved by:

| Marc Mayrand Chief Electoral Officer of Canada |

Janice Vézina Associate Deputy Chief Electoral Officer, Political Financing and Chief Financial Officer |

OFFICE OF THE CHIEF ELECTORAL OFFICER

Statement of Operations

For the Year Ended March 31

|

2008 |

2007 |

|

|

|

|

|

| Expenses (Note 9) |

|

|

|

|

|

|

|

Salaries and benefits

|

$40,583 |

$37,253 |

|

Political parties quarterly allowance

|

28,016 |

27,452 |

|

Professional services

|

24,725 |

23,079 |

|

Travel and communication

|

9,211 |

6,013 |

|

Rental of equipment and accommodation

|

8,720 |

7,202 |

|

Advertising, publishing and printing

|

7,448 |

6,225 |

|

Amortization of tangible capital assets

|

4,268 |

4,532 |

|

Repair and maintenance of equipment

|

1,833 |

2,072 |

|

Small equipment

|

1,645 |

1,661 |

|

Reimbursement (adjustments) of candidates’ and parties’ expenses

|

1,018 |

(868) |

|

Utilities, materials and supplies

|

803 |

1,106 |

|

Write-off of tangible capital assets

|

707 |

- |

|

Interest and other charges

|

61 |

6 |

| Total Expenses |

129,038 |

115,733 |

|

|

|

|

| Non-tax revenue |

(70) |

(69) |

|

|

|

|

| Net Cost of Operations |

$128,968 |

$115,664 |

The accompanying notes form an integral part of these Financial Statements.

OFFICE OF THE CHIEF ELECTORAL OFFICER

Statement of Equity of Canada

For the Year Ended March 31

|

2008 |

2007 |

|

|

|

|

|

| Equity of Canada, beginning of year |

$21,350 |

$16,088 |

|

|

|

|

| Net cost of operations |

(128,968) |

(115,664) |

|

|

|

|

| Change in Due from the Consolidated Revenue Fund |

(4,222) |

(42,435) |

|

|

|

|

| Net cash provided by Government |

124,524 |

157,529 |

|

|

|

|

| Services provided without charge (Note 10) |

6,163 |

5,832 |

|

|

|

|

| Equity of Canada, end of year |

$18,847 |

$21,350 |

The accompanying notes form an integral part of these Financial Statements.

OFFICE OF THE CHIEF ELECTORAL OFFICER

Statement of Cash Flow

For the Year Ended March 31

|

2008 |

2007 |

|

|

|

|

|

| OPERATING ACTIVITIES |

|

|

|

|

|

|

|

Net cost of operations

|

$128,968 |

$115,664 |

|

|

|

|

|

Non-Cash items:

|

|

|

|

|

|

|

|

Amortization of tangible capital assets

|

(4,268) |

(4,532) |

|

|

|

|

|

Write-off of tangible capital assets

|

(707) |

- |

|

|

|

|

|

Services provided without charge

|

(6,163) |

(5,832) |

|

|

|

|

|

|

|

|

|

Variation in Statement of Financial Position:

|

|

|

|

|

|

|

|

(Decrease) in accounts receivable and accountable advances

|

(127) |

(260) |

|

|

|

|

|

(Decrease) increase in prepaid expenses

|

(316) |

429 |

|

|

|

|

|

(Decrease) increase in consumable supplies

|

(1,184) |

3,158 |

|

|

|

|

|

Decrease in liabilities

|

3,125 |

42,264 |

|

|

|

|

|

Cash used by operating activities

|

119,328 |

150,891 |

|

|

|

|

| CAPITAL INVESTMENT ACTIVITIES |

|

|

|

|

|

|

|

Acquisition of tangible capital assets (excluding capital leases)

|

5,126 |

6,589 |

|

|

|

|

|

Payment of capital lease obligations

|

70 |

49 |

|

|

|

|

|

Cash used by capital investment activities

|

5,196 |

6,638 |

|

|

|

|

| NET CASH PROVIDED BY GOVERNMENT OF CANADA |

$124,524 |

$157,529 |

The accompanying notes form an integral part of these Financial Statements.

OFFICE OF THE CHIEF ELECTORAL OFFICER

Notes to Financial Statements

For the year ended March 31, 2008

1. Authority and Objectives

The Office of the Chief Electoral Officer (the Office), commonly known as Elections Canada, is headed by the Chief Electoral Officer who is appointed by resolution of the House of Commons and reports directly to Parliament. The Chief Electoral Officer is completely independent of the federal government and political parties. The Office is named in Schedule I.1 of the Financial Administration Act.

The Office’s objectives are to enable the Canadian electorate to elect members to the House of Commons in accordance with the Canada Elections Act; to ensure compliance with and enforcement of all provisions of the Canada Elections Act; to calculate the number of members of the House of Commons to be assigned to each province pursuant to the Electoral Boundaries Readjustment Act and in accordance with the provisions of the Constitution Acts; and to provide the necessary technical, administrative and financial support to the ten electoral boundaries commissions, one for each province, in accordance with the Electoral Boundaries Readjustment Act.

The Office is funded by an annual appropriation (which provides for the salaries of permanent, full-time staff) and the statutory authority contained in the Canada Elections Act, the Referendum Act and the Electoral Boundaries Readjustment Act. The statutory authority provides for all other expenditures, including the costs of electoral events, maintenance of the National Register of Electors, quarterly allowances to eligible political parties, redistribution of electoral boundaries and continuing public education programs.

2. Summary of Significant Accounting Policies

- Basis of presentation – These Financial Statements have been prepared in accordance with Treasury Board accounting policies, which are consistent with Canadian generally accepted accounting principles for the public sector, and year-end instructions issued by the Office of the Comptroller General.

- Parliamentary appropriations – The Office operates under two funding authorities: an annual appropriation and the statutory authority. Appropriations provided to the Office do not parallel financial reporting according to Canadian generally accepted accounting principles for the public sector. They are based in a large part on cash flow

requirements. Consequently, items recognized in the Statement of Operations and the Statement of Financial Position are not necessarily the same as those provided through appropriations from Parliament.

Note 3 to these Financial Statements provides information regarding the source and disposition of these authorities and provides a high-level reconciliation between the two bases of reporting. - Due from the Consolidated Revenue Fund – The Office operates within the Consolidated Revenue Fund (CRF) which is administered by the Receiver General for Canada. All cash received by the Office is deposited to the CRF and all cash disbursements made by the Office are paid from the CRF. Due from the CRF represents the amount of cash

that the Office is entitled to draw from the Consolidated Revenue Fund without further appropriations in order to discharge its liabilities.

Net cash provided by Government is the difference between all cash receipts and all cash disbursements including transactions between departments of the federal government. - Receivables – Receivables are stated at amounts expected to be ultimately realized. A provision is made for receivables where recovery is considered uncertain.

- Consumable supplies – Consumable supplies consist mainly of forms and publications used to administer election events and documents distributed to political entities. These supplies are recorded at weighted average cost. The cost is charged to operations in the period in which the items are consumed. If they no longer have service potential, they are valued at the lower of cost or net realizable value.

-

Tangible capital assets – Tangible capital assets are recorded at historical cost less accumulated amortization. The Office records as tangible capital assets all expenses providing multi-year benefits and leasehold improvements having an initial cost of $5,000 or more. Similar items less than $5,000 are expensed in the Statement of

Operations under small equipment. Capital assets acquired for software under development are amortized once that software is put into production.

Amortization is calculated on a straight-line basis over the estimated useful lives of the tangible capital assets as follows:

Asset Class Useful Life

Office equipment 3 to 10 years

Informatics equipment 3 years

Software 3 to 5 years

Furniture and fixtures 10 years

Vehicles 5 years

Motorized equipment 10 years

Leasehold improvements and capital leases Term of lease

- Salaries and benefits, and vacation leave – Salaries and benefits, and vacation leave are expensed as the salary or benefits accrue to the employees under their respective terms of employment. The employee salaries and benefits liability is calculated based on the respective terms of employment using the employees’ salary levels at year end, and the number of days remaining unpaid at the end of the year. The liability for vacation leave is calculated at the salary levels in effect at the end of the year for all unused vacation leave benefits accruing to employees.

- Employee future benefits

1) Pension benefits – Eligible employees participate in the Public Service Pension Plan, a multiemployer plan administered by the Government of Canada. The Office’s contributions to the Plan are charged to expenses in the year incurred and represent the total of the Office’s obligation to the Plan. Current legislation does not require the Office to make contributions for any actuarial deficiencies of the Plan.

2) Severance benefits – Employees are entitled to severance benefits under labour contracts or conditions of employment. These benefits are accrued as employees render the services necessary to earn them. The obligation related to the benefits earned by employees is calculated using information derived from the results of the actuarially determined liability for employee severance benefits for the Government as a whole. - Contingent liabilities – Contingent liabilities are potential liabilities, which may become actual liabilities when one or more future events occur or fail to occur. To the extent that the future event is likely to occur or fail to occur, and a reasonable estimate of the loss can be made, an estimated liability is accrued and an expense recorded. If the likelihood is not determinable or an amount cannot be reasonably estimated, the contingency is disclosed in the notes to the Financial Statements.

- Services provided without charge – Services provided without charge by other government departments for accommodation, the employer’s contribution to the health and dental insurance plans, audit services and legal services are recorded as operating expenses, at their estimated cost, in the Statement of Operations. A corresponding amount is reported directly in the Statement of Equity of Canada.

- Political parties quarterly allowance – The Canada Elections Act allows for the payment from public funds of quarterly allowances to qualifying registered parties. The quarterly allowance is calculated based on the results of the most recent general election preceding the quarter. This allowance is expensed in each quarter of the calendar year as directed by the Act.

- Measurement uncertainty – The preparation of Financial Statements in accordance with Canadian generally accepted accounting principles for the public sector and year-end instructions issued by the Office of the Comptroller General requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at

the date of the Financial Statements and the reported amounts of income and cost of operations during the reporting year.

At the time of preparation of these statements, management believes the estimates and assumptions to be reasonable. The most significant estimates used are contingent liabilities, the liability for employee severance benefits, the useful life of tangible capital assets and candidate and party reimbursement of eligible election expenses. Actual results could significantly differ from those estimated. Management’s estimates are reviewed periodically and, as adjustments become necessary, they are recorded in the Financial Statements in the year they become known.

3. Parliamentary Appropriations

The Office receives its funding through an annual Parliamentary appropriation and the statutory authority contained in the electoral legislation. Items recognized in the Statement of Operations and the Statement of Financial Position in one year may be funded through Parliamentary appropriations in prior, current or future years. Accordingly, the Office has different net results of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled in the following tables:

(a) Reconciliation of net cost of operations to current year appropriations used

|

2008 |

2007 |

|

|

|

|

|

| Net cost of operations |

$128,968 |

$115,664 |

|

|

|

|

|

Adjustments for items affecting net cost of operations but not affecting appropriations

|

|

|

|

Add (Less):

|

|

|

|

Amortization of tangible capital assets

|

(4,268) |

(4,532) |

|

Prepaid expenses

|

(1,111) |

(1,315) |

|

Consumable supplies

|

(1,184) |

3,158 |

|

Services provided without charge

|

(6,163) |

(5,832) |

|

Change in employee severance benefits obligation

|

(774) |

(303) |

|

Change in provision for vacation leave

|

(117) |

11 |

|

Write-off of tangible capital assets

|

(707) |

- |

|

Other

|

109 |

42 |

|

|

114,753 |

106,893 |

|

|

|

|

|

Adjustments for items not affecting net cost of operations but affecting appropriations

|

|

|

|

Add (Less):

|

|

|

|

Acquisition of tangible capital assets (excluding capital leases)

|

5,126 |

6,589 |

|

Payment of capital lease obligations

|

70 |

49 |

|

Prepaid expenses

|

795 |

1,744 |

|

Other

|

(4) |

(59) |

|

|

|

|

| Current year appropriations used |

$120,740 |

$115,216 |

(b) Reconciliation of Parliamentary appropriations provided to current year appropriations used

|

2008 |

2007 |

|

| Appropriations Provided: |

|

|

|

Program expenditures (Vote 25)

|

$22,072 |

$22,026 |

|

Statutory contributions to employee benefit plans

|

4,693 |

4,079 |

|

Other statutory expenditures

|

95,420 |

92,568 |

|

122,185 |

118,673 |

|

| Less: |

|

|

|

Lapsed appropriation – Program expenditures (Vote 25)

|

(1,445) |

(3,457) |

| Current year appropriations used |

$120,740 |

$115,216 |

(c) Reconciliation of net cash provided by Government to current year appropriations used

|

2008 |

2007 |

|

| Net cash provided by Government |

$124,524 |

$157,529 |

|

|

|

|

| Variation in accounts receivable and accountable advances |

127 |

260 |

| Variation in accounts payables and accrued liabilities |

(3,401) |

(40,542) |

| Variation in deposits from political candidates |

(27) |

(1,595) |

| Variation in accrued employee salaries and benefits |

(532) |

(395) |

| Other adjustments |

(21) |

(110) |

| Non-tax revenue |

70 |

69 |

| Current year appropriations used |

$120,740 |

$115,216 |

4. Tangible Capital Assets

|

Cost |

|

|

|||||

|

Opening balance |

Acquisitions |

Transfers |

Disposals and |

Closing balance |

2008 |

2007 |

|

| Office equipment (including capital leases) |

$1,078 |

$212 |

- |

$104 |

$1,186 |

$734 |

$ 677 |

|

|

|

|

|

|

|

|

|

| Informatics equipment |

7,725 |

521 |

- |

- |

8,246 |

747 |

734 |

|

|

|

|

|

|

|

|

|

| Software |

16,819 |

382 |

3,321 |

- |

20,522 |

8,382 |

7,837 |

|

|

|

|

|

|

|

|

|

| Software under development |

4,958 |

3,421 |

(3,321) |

685 |

4,373 |

4,373 |

4,958 |

|

|

|

|

|

|

|

|

|

| Furniture and fixtures |

1,403 |

240 |

- |

- |

1,643 |

743 |

654 |

|

|

|

|

|

|

|

|

|

| Vehicles and motorized equipment |

179 |

40 |

- |

35 |

184 |

111 |

93 |

|

|

|

|

|

|

|

|

|

| Leasehold improvements |

2,776 |

450 |

- |

723 |

2,503 |

1,263 |

1,109 |

| Total |

$34,938 |

$ 5,266 |

$0 |

$1,547 |

$38,657 |

$16,353 |

$16,062 |

|

Accumulated Amortization |

||||

|

|

Opening |

Amortization |

Disposals |

Closing balance |

| Office equipment (including capital leases) |

$401 |

$133 |

$82 |

$452 |

| Informatics equipment |

6,991 |

508 |

- |

7,499 |

| Software |

8,982 |

3,158 |

- |

12,140 |

| Furniture and fixtures |

749 |

151 |

- |

900 |

| Vehicles and motorized equipment |

86 |

22 |

35 |

73 |

| Leasehold improvements |

1,667 |

296 |

723 |

1,240 |

| Total |

$18,876 |

$4,268 |

$840 |

$22,304 |

5. Lease Obligation for Tangible Capital Assets

The Office has entered into agreements to rent office equipment under capital lease with a cost of $465,627 and accumulated amortization of $155,103 as at March 31, 2008 ($385,322 and $141,126 respectively as at March 31, 2007). The obligations for the upcoming years include the following:

| Maturing year |

2008 |

| 2009 |

$97 |

| 2010 |

97 |

| 2011 |

87 |

| 2012 |

48 |

| 2013 and thereafter |

14 |

| Total future minimum lease payments |

343 |

| Less: imputed interest (3.29% to 4.76%) |

(25) |

| Lease obligation for tangible capital assets |

$318 |

6. Employee Future Benefits

(a) Pension benefits

The Office’s employees contribute to the Public Service Pension Plan, which is sponsored and administered by the Government of Canada. Pension benefits accrue up to a maximum period of 35 years at a rate of 2 percent per year of pensionable service, times the average of the best five consecutive years of earnings. The benefits are integrated with Canada/Québec Pension plans benefits and they are indexed to inflation.

The Office’s and employees’ contributions to the Public Service Pension Plan for the year were as follows:

|

2008 |

2007 |

|

| Office’s contributions |

$3,424 |

$3,219 |

| Employees’ contributions |

$1,306 |

$1,202 |

The 2007-08 expense amount represents approximately 2.6 times the contributions by employees.

The Office’s responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the Financial Statements of the Government of Canada, as the Plan’s sponsor.

(b) Employee severance benefits

The Office provides severance benefits to its employees based on eligibility, years of service and final salary. These severance benefits are not pre-funded. Benefits will be paid from future appropriations. Information about the severance benefits, measured as at March 31 is as follows:

|

2008 |

2007 |

|

| Accrued benefit obligation, beginning of year |

$3,655 |

$3,352 |

| Expense for the year |

994 |

606 |

| Benefits paid during the year |

(220) |

(303) |

| Accrued benefit obligation, end of year |

$4,429 |

$3,655 |

7. Contractual Obligations

The nature of the Office’s activities can result in some large multi-year contracts and obligations whereby the Office will be obligated to make future payments when the services will be rendered or goods received. Significant contractual obligations that can be reasonably estimated are summarized as follows:

| 2009 |

$23,429 |

| 2010 |

19,575 |

| 2011 |

3,370 |

| 2012 |

1,684 |

| 2013 and thereafter |

95 |

| Total |

$48,153 |

8. Contingencies

Claims have been made against the Office in the normal course of operations. Legal proceedings for claims totalling approximately $1,019,317 ($80,000 in 2007) were still pending at March 31, 2008. Some of these potential liabilities may become actual liabilities when one or more future events occur or fail to occur. To the extent that the future event is likely to occur or fail to occur, and a reasonable estimate of the loss can be made, an estimated liability is accrued and an expense recorded in the Financial Statements.

No contingent liabilities are recognized in the Office’s Financial Statements for the fiscal year ended March 31, 2008 ($56,000 in 2007).

9. Expenses by Event

In 2007-08, 7 by-elections were held while 2 by-elections were held in 2006-07. The resulting variance in the cost of operations is due to Election Readiness mode ($10.5 million) and by-elections ($2.8 million)

|

2008 |

2007 |

|||

| Expenses |

Electoral Event Delivery1 |

Other2 |

Electoral Event Delivery1 |

Other2 |

| Salaries and benefits |

$3,194 |

$37,389 |

$2,598 |

$34,655 |

| Political parties quarterly allowance |

- |

28,016 |

- |

27,452 |

| Professional services |

3,763 |

20,962 |

5,752 |

17,327 |

| Travel and communication |

497 |

8,714 |

629 |

5,384 |

| Rental of equipment and accommodation |

607 |

8,113 |

66 |

7,136 |

| Advertising, publishing and printing |

4,632 |

2,816 |

1,964 |

4,261 |

| Amortization of tangible capital assets |

- |

4,268 |

- |

4,532 |

| Repair and maintenance of equipment |

- |

1,833 |

3 |

2,069 |

| Small equipment |

- |

1,645 |

15 |

1,646 |

| Reimbursement (adjustment) of candidates’ and parties’ expenses |

214 |

804 |

(868) |

- |

| Utilities, materials and supplies |

32 |

771 |

21 |

1,085 |

| Write-off of tangible capital assets |

- |

707 |

- |

- |

| Interest and other charges |

- |

61 |

- |

6 |

| Total Expenses |

$12,939 |

$116,099 |

$10,180 |

$105,553 |

| 1 | Expenses incurred for general elections, by-elections and redistribution of electoral boundaries. |

| 2 | Salary of permanent staff, other statutory expenses incurred under the Canada Elections Act, including expenses related to election readiness activities, quarterly allowances to political parties and ongoing expenses. |

10. Related Party Transactions

The Office is related in terms of common ownership to all Government of Canada departments, agencies and Crown corporations.

The Office enters into transactions with these entities in the normal course of business and on normal trade terms. During the year, the Office expensed $21,898,381 from transactions in the normal course of business with other government departments and agencies. These expenses include services provided without charge from other government departments worth $6,163,296 as

presented in part (a).

(a) Services provided without charge:

During the year, the Office received services that were obtained without charge from other government departments and agencies. These services without charge have been recognized in the Office’s Statement of Operations as follows:

|

2008 |

2007 |

|

| Public Works and Government Services Canada - accommodation |

$4,565 |

$4,158 |

|

Treasury Board Secretariat - employer’s share of insurance premiums |

1,461 |

1,524 |

| Office of the Auditor General of Canada - audit services |

130 |

145 |

|

Human Resources and Social Development Canada - employer’s portion of Worker’s compensation payments |

7 |

5 |

| Total Services provided without charge |

$6,163 |

$5,832 |

Section IV – Other Items of Interest

New Legislation

In the past year, the Parliament of Canada adopted several significant legislative initiatives that amend the Canada Elections Act – particularly Bill C-31, An Act to amend the Canada Elections Act and the Public Service Employment Act, adopted in June 2007 (S.C. 2007, c. 21). Elections Canada implemented the new measures in the by-elections held in September 2007 and again in March 2008. It also responded to the following legislative and judicial activities:

Legislation enacted during 2007–2008

| New Enactments | Details and Impacts |

| An Act to amend the Canada Elections Act, S.C. 2007, c. 10 (formerly known as Bill C-16) | This legislation received royal assent in May 2007. It amends the Canada Elections Act to provide that, unless Parliament is dissolved earlier, a general election must be held on the third Monday in October in the fourth calendar year after polling day for the last general election. If Parliament is not dissolved earlier, the first fixed-date general election would be held on Monday, October 19, 2009. |

| An Act to amend the Canada Elections Act and the Public Service Employment Act, S.C. 2007, c. 21 (formerly known as Bill C-31) |

This legislation received royal assent in June 2007. It requires electors to prove their identity and address before voting. It also amends the Canada Elections Act to, among other things, make operational changes that will improve the accuracy of the National Register of Electors and enhance communications with the electorate. Changes requiring electors to prove their identity and address came into force in July 2007, in time for the three by-elections held on September 17, 2007, in Quebec. The new rules were also applied in the four by-elections held on March 17, 2008, in Toronto, northern Saskatchewan and Vancouver. For the most part, operational changes to the Register and the list of electors did not come into force until March 1, 2008. It is therefore not yet possible to measure their impact on the agency. |

| An Act to amend the Canada Elections Act (verification of residence), S.C. 2007, c. 37 (formerly known as Bill C-18) |

This legislation was introduced on November 2, 2007, and received royal assent on December 14, 2007. It amended the Canada Elections Act to solve two problems related to the new requirement (introduced by Bill C-31) that electors must prove their identity and residence prior to voting:

According to the amended Act, if the address on the identification provided by the elector does not prove his or her residence but is consistent with his or her address on the list of electors (often the elector’s mailing address), the elector’s residence is deemed to have been proven. If, however, an election official or a candidate’s representative has reasonable doubts about the residence of that elector, the elector may be requested to take an oath before his or her residence will be deemed to be proven. This change was not in place for the September 17, 2007, by-elections but would not have been required since there are civic addresses for all dwellings in the province of Quebec. The agency has not yet completed evaluation of the March 17, 2008, by-elections and the impact of this change. |

Legislation currently before Parliament

| Proposed Legislation | Details and Impacts |

| Bill C-6, An Act to amend the Canada Elections Act (visual identification of voters) | This bill would require that electors have their faces uncovered before voting, or registering to vote, in person, and would expand the authority of Elections Canada to appoint sufficient personnel to manage the conduct of the vote at the polls. The bill was referred to the House of Commons Standing Committee on Procedure and House Affairs on November 15, 2007. |

| Bill C-16, An Act to amend the Canada Elections Act (expanded voting opportunities) | This bill would increase the number of advance polling days from three to five. One of the new days would be the eighth day before polling day and would be governed by the rules currently applicable to advance polling days. The other new advance polling day would be the Sunday immediately before regular polling day. Voting on that day would take place at the same polling stations used for polling day. The bill was originally introduced in the first session of the 39th Parliament as Bill C-55 and was reintroduced in the second session in November 2007 as Bill C-16. The Standing Committee on Procedure and House Affairs has completed its study and submitted its report on the bill to the House, with a number of amendments. |

| Bill C-20, Senate Appointment Consultations Act | This bill provides for the consultation of electors in a province to determine their preferences for the appointment of senators to represent their province. The Chief Electoral Officer would be responsible for administering this legislation and the consultations for which it provides. The bill was originally introduced in the first session of the 39th Parliament as Bill C-43. It was reintroduced in the second session in November 2007 as Bill C-20, and was referred to a special legislative committee for study prior to second reading. The committee is still reviewing the bill. |