ARCHIVED - Office of the Superintendent of Financial Institutions Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2006-2007

Departmental Performance Report

Office of the Superintendent of Financial Institutions Canada

The Honourable James M. Flaherty, P.C., M.P.

Minister of Finance

TABLE OF CONTENTS

- I.1 Message from the Superintendent

- I.2 Management Representation Statement

- I.3 Summary Information

- I.3.1 OSFI’s Reason for Existence

- I.3.2 Total Financial and Human Resources

- I.3.3 Summary of Performance

- I.4 OSFI’s Overall Performance

- I.4.1 Description of Overall Performance

- I.4.2 Supporting the Government of Canada’s Outcomes

- I.4.3 Operating Environment

- I.4.4 Context

II. Analysis of Performance by Strategic Outcome

- II.1 Strategic Outcomes

- II.2 Program Activities

- II.3 Monitoring Mechanisms and Performance

- II.4 Detailed Analysis of Performance

III. Supplementary Information

- III.1 Organizational Information

- III.2 Financial and Other Tables

- Table 1: Comparison of Planned to Actual Spending

- Table 2: Use of Resources by Program Activity

- Table 3: Voted and Statutory Items

- Table 4: Services Received Without Charge

- Table 5: Respendable and Non-Respendable Revenues

- Table 6: Resource Requirements by Sector Level

- Table 7A: User Fee Act

- Table 7B: Policty on Service Standards for External Fees

- Table 8: Progress against OSFI's Regulatory Plan

- Table 9: Financial Statements

- Table 10: Internal Audits or Evaluations

- Table 11: Travel Policies

- IV.1 Internal Services

- IV.2 Program Support Priorities

- IV.3 Government Priorities and Other Initiatives

- IV.4 Other References

I. Overview

I.1 Message from the Superintendent

I am pleased to present the Departmental Performance Report (DPR) for the Office of the Superintendent of Financial Institutions (OSFI) for the period ending March 31, 2007.

This report focuses on the benefits of OSFI's contribution to Canadians and to Canada’s financial and economic strength. It concentrates primarily on our two strategic outcomes: to regulate and supervise financial institutions so as to contribute to public confidence, and to contribute to the public confidence in Canada's public retirement income system. Both outcomes matter for sound economic performance — a key government priority. This benefits all aspects of Canadian society.

The financial services industry is dynamic – rapidly changing both here and around the world. Canadian financial

institutions are facing increased risks and competition while managing highly complex transactions. OSFI’s role is to be vigilant, and to take action if institutions appear to be engaging in unsafe or unsound activity, or failing to fully understand the potential consequences of the risks they are taking. By focusing on the risk management strategies, risk appetite and

profile, capital levels and stress testing of institutions, OSFI can help prevent or mitigate catastrophic loss. As of March 31, 2007, 95% of all rated institutions have been assigned a low or moderate Composite Risk Rating, which represents the fourth straight year that this statistic has improved.

The financial services industry is dynamic – rapidly changing both here and around the world. Canadian financial

institutions are facing increased risks and competition while managing highly complex transactions. OSFI’s role is to be vigilant, and to take action if institutions appear to be engaging in unsafe or unsound activity, or failing to fully understand the potential consequences of the risks they are taking. By focusing on the risk management strategies, risk appetite and

profile, capital levels and stress testing of institutions, OSFI can help prevent or mitigate catastrophic loss. As of March 31, 2007, 95% of all rated institutions have been assigned a low or moderate Composite Risk Rating, which represents the fourth straight year that this statistic has improved.

One of our priorities is the implementation of the Basel II Capital Accord. The International Convergence of Capital Measurement and Capital Standards: a Revised Framework, or “Basel II”, provides a new set of standards for establishing minimum capital requirements for banks. It applies to all internationally active banks operating in the jurisdictions of members of the Basel Committee (G10 countries). In 2006-2007, we continued to work closely with Canadian banks and our international counterparts on a roadmap to help them integrate the Accord into their business processes. More than a compliance exercise, we believe the Accord will help institutions to enhance their risk management practices.

A key role for OSFI is to monitor and assess the impact of changes in the economic environment on the risk profile of financial institutions. We must have the resources in place to identify and deal with an economic downturn or unexpected events/potential problems, such as a pandemic, that could disrupt business. In 2006-2007, we developed plans to test OSFI’s business continuity plan against various scenarios and to assess institutions’ stress-testing capabilities. This planning is essential to meeting our ongoing responsibilities for accurate risk assessment and timely, effective intervention.

Although the financial health of federally regulated private pension plans had improved significantly by the end of 2006, the dramatic turnaround demonstrates the volatility in this area. Pension

plan sponsors and administrators should seize the opportunity provided by stronger solvency results to enhance their risk management strategies. They must continue to be vigilant and knowledgeable about techniques to manage the potential risks volatility can pose. OSFI continued to make strategic investments in our pension systems, controls and monitoring resources.

Although the financial health of federally regulated private pension plans had improved significantly by the end of 2006, the dramatic turnaround demonstrates the volatility in this area. Pension

plan sponsors and administrators should seize the opportunity provided by stronger solvency results to enhance their risk management strategies. They must continue to be vigilant and knowledgeable about techniques to manage the potential risks volatility can pose. OSFI continued to make strategic investments in our pension systems, controls and monitoring resources.

Canada has a public pension system that is expected to be sustainable and affordable well into the future in the face of changing demographic conditions. Ongoing review of the system, including actuarial studies performed by the Office of the Chief Actuary (OCA) on various public pension programs, will help to ensure that this remains the case. During 2006-2007, the OCA released its 22nd Actuarial Report on the Canada Pension Plan (CPP), required after Bill C-36 was introduced in the House of Commons as a result of the CPP triennial financial review completed by the federal and provincial Ministers of Finance in June 2006. The OCA also provided statutory actuarial reports, subsequently tabled in Parliament during the year, on the pension plan for the Public Service, the RCMP and the Canadian Forces, including the Public Service Death Benefit Account and the Regular Force Death Benefit Account.

OSFI conducts periodic anonymous surveys of knowledgeable observers on our operations, consults broadly with industry and other regulators, and welcomes opportunities to appear before Parliament to raise awareness about the important work we do. For example, in 2006-2007, on our behalf an independent firm conducted a confidential consultation with insurance companies and related service providers to explore their perceptions of the current insurance marketplace, OSFI in general, and the work of our actuarial division in particular. The results, which are posted on our Web site, indicate that OSFI is viewed as being effective in discharging its mandate, and that staff involved in actuarial matters are knowledgeable in core areas. Areas for improvement were also identified and are being addressed through management’s response to the survey findings.

In the fall of 2007, Canada’s financial sector will be reviewed by the International Monetary Fund (IMF) under its Financial Sector Assessment Program (FSAP). During 2006-2007, OSFI worked with Canadian banks, as well as the Department of Finance and the Bank of Canada, to prepare for the review. Canada was already reviewed by the Financial Action Task Force (FATF), for which OSFI provided input for an international evaluation of our anti-money laundering and anti-terrorist financing regime. Results of the FATF review are expected to be released in early 2008.

Financial institutions are not the only place where rapid change is taking place. The regulatory environment is evolving as well, with emerging practices such as principles-based versus rules-based

regulation. Already moving in this direction, OSFI continued to evolve the regulatory framework for federally regulated financial institutions by contributing to the review and update of financial institutions legislation (Bill C-37), releasing a number of new guidelines, and collaborating with a number of foreign country supervisory authorities.

Financial institutions are not the only place where rapid change is taking place. The regulatory environment is evolving as well, with emerging practices such as principles-based versus rules-based

regulation. Already moving in this direction, OSFI continued to evolve the regulatory framework for federally regulated financial institutions by contributing to the review and update of financial institutions legislation (Bill C-37), releasing a number of new guidelines, and collaborating with a number of foreign country supervisory authorities.

To support its program priorities, OSFI invests resources in high-quality internal governance and related reporting. We completed a Treasury Board assessment of our Management Accountability Framework during 2006-2007, and achieved “notable” results for several indicators. OSFI was also commended for its efforts in developing the internal audit function under the new Treasury Board Policy on Internal Audit. We increased capacity in our internal audit function as well as the number of internal audits performed in the fiscal year. We also appointed an independent member as Vice-Chairperson to further enhance the Audit Committee’s independence.

OSFI continues to strive to manage its costs, the majority of which are recovered from industry. Because OSFI places significant reliance on boards of directors, senior managers and external auditors of financial institutions, OSFI’s costs are generally lower than regulatory bodies that do not use such systems. However, the need to hire and keep highly skilled staff to deal with the rapidly changing and complex environment, and to make investments in technology to allow us to monitor and assess risk in the financial institutions and pension plans we regulate, continues to place cost pressures on OSFI.

OSFI will continue to play a pivotal role in the Canadian financial services industry, charting a course that builds on our strengths and balances our approach. We will also continue to assess and measure our performance in order to retain and enhance our reputation as a world leader in financial regulation and supervision.

I.2 Management Representation Statement

Click on image to enlarge

I.3 Summary Information

I.3.1 OSFI’s Reason for Existence

OSFI's legislated mandate, established in 1996, is to:

- Supervise federally regulated financial institutions and private pension plans to determine whether they are in sound financial condition and meeting minimum plan funding requirements respectively, and are complying with their governing law and supervisory requirements;

- Promptly advise institutions and plans in the event there are material deficiencies and take, or require management, boards or plan administrators to take, necessary corrective measures expeditiously;

- Advance and administer a regulatory framework that promotes the adoption of policies and procedures designed to control and manage risk; and

- Monitor and evaluate system-wide or sectoral issues that may impact institutions negatively.

In meeting this mandate, OSFI contributes to public confidence in the financial system.

OSFI’s legislation also acknowledges the need to allow institutions to compete effectively and take reasonable risks. It recognizes that management, boards of directors and plan administrators are ultimately responsible for setting strategy and managing the financial institutions and pension plans and that there can be failures.

The Office of the Chief Actuary (OCA), which is an independent unit within OSFI, provides actuarial services to the Government of Canada.

Strategic Outcomes

Primary to OSFI’s mission and central to its contribution to Canada’s financial system are two strategic outcomes:

- To regulate and supervise to contribute to public confidence in Canada’s financial system and safeguard from undue loss. OSFI safeguards depositors, policyholders and private pension plan members by enhancing the safety and soundness of federally regulated financial institutions and private pension plans.

- To contribute to public confidence in Canada's public retirement income system. This is achieved through the activities of the Office of the Chief Actuary, which provides accurate, timely advice on the state of various public pension plans and on the financial implications of options being considered by policy makers.

I.3.2 Total Financial and Human Resources

The table below identifies OSFI’s financial and human resources, planned and actual, for the 2006-2007 fiscal year.

OSFI’s actual number of average full-time equivalents (FTEs) for the year was 456 or three less than planned and 22 more than the previous year.

The increase of 22 FTEs from the previous year was largely in the Regulation and Supervision of Federally Regulated Financial Institutions program. OSFI focused aggressively during the latter half of 2006-2007 on filling vacancies, particularly in the Toronto office. OSFI also increased its resources in the Regulation and Supervision of Federally Regulated Private Pension Plans program due to this sector’s challenges.

2006-2007 Financial Resources ($ millions)

|

Planned |

Authorities |

Actual |

|

$85.0 |

$85.0 |

$84.6 |

2006-2007 Human Resources (Average Full-Time Equivalents)

|

Planned |

Actual |

Difference |

|

459 |

456 |

3 |

Note: Refer to Section III.1 for additional details.

I.3.3 Summary of Performance

In OSFI’s Report on Plans and Priorities, eight program priorities and two program support priorities were identified for 2006-2007. The following tables summarize performance against these priorities.

Program Priorities

|

Priority |

Type |

Expected Results |

Performance Status |

Planned Spending |

Actual Spending |

|

|

Strategic Outcome: Regulate and Supervise to Contribute to Public Confidence in Canada’s Financial System and Safeguard from Undue Loss |

||||||

|

Program Activity: Regulation and supervision of federally regulated financial institutions |

||||||

|

Priority 1: Accurate risk assessments of financial institutions and timely, effective intervention and feedback. |

On-going |

|

Successfully met |

$50.1M |

$51.3M |

|

|

Priority 8: Ensure that OSFI is in a position to review and approve applications that are submitted for approval under the Basel II capital framework. |

NEW |

|

Successfully met

In progress

|

Costs for this priority are included in the costs for Priority 1 above |

Costs for this priority are included in the costs for Priority 1 above |

|

|

Priority 2: A balanced, relevant regulatory framework of guidance and rules that meets or exceeds international minimums. |

On-going |

|

Successfully met |

$15.2M |

$14.2M |

|

|

Priority 7: Participate in and monitor international work on conceptual changes to accounting standards. |

NEW |

|

Successfully met |

Costs for this priority are included in the costs for Priority 2 above |

Costs for this priority are included in the costs for Priority 2 above |

|

|

Priority 3: A prudentially effective, balanced and responsive approvals process. |

On-going |

|

Successfully met |

$7.9M |

$6.9M |

|

|

Program Activity: Regulation and supervision of federally regulated private pension plans |

||||||

|

Priority 4: Accurate risk assessments of pension plans, timely and effective intervention and feedback, a balanced relevant regulatory framework, and a prudentially effective and responsive approvals process. |

On-going |

|

Successfully met |

$5.2M |

$5.7M |

|

|

Program Activity: International Assistance |

||||||

|

Priority 5: Contribute to awareness and improvement of supervisory and regulatory practices for selected foreign regulators through the operation of an International Assistance Program. |

On-going |

|

Successfully met |

$1.9M |

$2.0M |

|

|

Strategic Outcome: To contribute to public confidence in Canada's public retirement income system. |

||||||

|

Program Activity: Office of the Chief Actuary |

||||||

|

Priority 6: Contribute to financially sound federal government public pension and other programs through the provision of expert actuarial valuation and advice. |

On-going |

|

Successfully met |

$4.7M |

$4.5M |

|

NOTE: Detailed analysis of performance against these Priorities is provided in Section II.3

Program Support Priorities

|

Priority |

Type |

Expected Results |

Performance Status |

Planned Spending |

Actual Spending |

|

Priority 9: High-quality internal governance and related reporting. |

On-going |

|

Successfully met |

Costs for these priorities are included in the costs for Priorities |

Costs for these priorities |

|

Priority 10: Resources and infrastructure necessary to support supervisory and regulatory activities. |

On-going |

|

Successfully met |

NOTE : Detailed analysis of performance against these Priorities is provided in Section IV.2

I.4 OSFI’s Overall Performance

I.4.1 Description of Overall Performance

In terms of performance, the year 2006-2007 was overall a good one, during which OSFI was successful in meeting the expectations flowing from all of its priorities. This success can be in part ascribed to the rigorous internal monitoring of our performance which in turn is evidenced by the results of surveys of stakeholders. These results confirm our commitment to performance monitoring and continuous improvement.

As a regulator of financial institutions, OSFI constantly endeavors to promote sound practices by organizations to identify and manage risk. As of March 31 2007, 95% of all rated institutions have been assigned a low or moderate Composite Risk Rating.

OSFI has developed a clear framework and rules to help Canadian banks develop systems that meet the Basel II Capital adequacy norms. A major focus of this year has been review and approval of Basel II capital framework implementation. OSFI was extensively involved in the rollout of the regulatory norms and processes for approving applications for banks. OSFI also conducted three ‘college of supervisors’ events to exchange information on cross-border implementation approaches with supervisors of major foreign subsidiaries of Canadian banks in order to reduce regulatory overlap and facilitate effective communication between banks and other regulators.

OSFI continued to evolve the regulatory framework for financial institutions it supervises. In this process, OSFI strives to make guidelines and rules for financial institutions that are in agreement with international norms. Some of the key achievements for this year include work with the Department of Finance to review and update the financial institutions legislation (Bill C-37), release of several new guidelines, and development of information-sharing agreements with a number of foreign country supervisory authorities.In the international arena, OSFI has been working with foreign regulators and sharing its expertise in improvement of supervisory and regulatory practices in many countries. Specifically, OSFI’s work included providing help to implement on-site examination programs, providing consultative, legislative and regulatory drafting expertise, and providing training and in-house programs. One of the major achievements this year has been the significant inroads made into the African nations, a region highly important for the Canadian International Development Agency (CIDA).

Finally, OSFI continued to provide its expert actuarial valuation and advice to the Federal Government for sound financial management of the Public Sector Pension and Insurance Programs through the Office of the Chief Actuary (OCA). The OCA was instrumental in providing the Government with expert advice in the form of high quality reports including on the Canada Pension Plan, Public Sector Pension and Insurance Plans, and the Canada Student Loans Program.

Consultations with StakeholdersTo monitor the status of its strategic outcomes, OSFI conducts periodic, anonymous, independent consultations with stakeholders. This provides OSFI with an indication of its performance in certain areas, such as the appropriateness of its supervisory or rule-making practices and the usefulness of its feedback to institutions. Such stakeholder consultations are a key mechanism for monitoring organizational performance (see section II.2).

In 2006-2007, for example, OSFI commissioned The Strategic Counsel, an independent research firm, to conduct confidential consultations with insurance companies to explore perceptions of the current insurance marketplace, of OSFI in general, and of the work of OSFI’s actuarial division in particular.1 As the primary regulator of federally registered life, and property and casualty, insurance companies, OSFI interacts with representatives of these companies, and professionals who act on their behalf, in order to fulfil its mandate. Information from the consultation enabled OSFI to know if we are providing the necessary guidance and direction to our stakeholders.

In terms of our Program Activity Architecture, this consultation measured OSFI performance in relation to both Risk Assessment and Intervention, and Rule Making.

The findings revealed that OSFI is viewed as being effective in discharging its mandate, in identifying problems and being proactive in dealing with issues, and staff involved in actuarial matters are perceived as knowledgeable in core areas. Areas for improvement were identified, such as providing greater feedback on required filings; broadening communication about OSFI’s international efforts; and increasing the level of expertise and the complement of staff dealing with actuarial matters.

OSFI is developing an action plan to address areas for improvement and will keep the industry informed of its progress. The complete Report on Actuarial Consultations is available on OSFI’s Web site, under About OSFI / Reports / Consultations and Surveys.

1 OSFI provided The Strategic Counsel, an independent research firm, with a list of executives and professionals representing a cross-section of the life and property and casualty insurance companies regulated by OSFI. The research firm conducted 64 one-on-one confidential interviews. The research firm independently selected the samples from the list, and OSFI does not know who was interviewed. Unless otherwise noted, the findings reported emerged consistently across stakeholder groups.

I.4.2 Supporting the Government of Canada’s Outcomes

OSFI’s strategic outcomes, supported by our plans and priorities, are intrinsically aligned with broader government outcomes, specifically strong economic growth, income security and employment for Canadians, and a safe and secure world, as identified in the TBS report Canada’s Performance 2007. The following table summarizes the linkages between OSFI’s strategic outcomes and priorities and the Government of Canada’s Outcomes. The specific linkages are described in more detail after the table.

|

OSFI’S Strategic Outcomes |

OSFI’s |

OSFI’s contributions to Government of Canada’s Outcomes |

|

Public Confidence in the Financial System and Safeguarding from Undue Loss |

1) Accurate risk assessments of financial institutions and timely, effective intervention and feedback. 8 ) Ensure that OSFI is in a position to review and approve applications that are submitted for approval under the Basel II capital framework. |

|

|

2) A balanced, relevant regulatory framework of guidance and rules that meets or exceeds international minimums. 7) Participate in and monitor international work on conceptual changes to accounting standards. |

|

|

|

3) A prudentially effective, balanced and responsive approvals process. |

|

|

|

4) Accurate risk assessments of pension plans, timely and effective intervention and feedback, a balanced, relevant regulatory framework, and a prudentially effective and responsive approvals process. |

|

|

|

5) Contribute to awareness and improvements of supervisory and regulatory practices for selected foreign regulators through the operation of an International Assistance Program. |

|

|

|

Public Confidence in Canada’s Public Retirement Income System |

6) Contribute to financially sound federal government public pension plans and other programs through provision of expert actuarial valuation and advice. |

|

Strong Economic Growth

A properly functioning financial system, in which consumers and others (inside and outside Canada) who deal with financial institutions have a high degree of confidence, makes a material contribution to Canada’s economic performance. The achievement of OSFI’s strategic outcomes, which are shared by other institutional partners within government and the private sector, provides an essential foundation for a productive and competitive economy.

OSFI supervises more than 450 financial institutions. This requires that we balance the need to maintain effective supervision with the need to focus risk assessment and intervention toward higher risk areas. We must allow institutions to compete and grow their businesses, yet scrutinize their ability to manage the inherent risk of increasingly complex financial products through better controls.

OSFI’s activities and programs to enhance the safety and soundness of financial institutions are key to a regulatory framework underpinning the financial system, which in turn is essential to remain competitive in the global economy.

Income Security for Canadians

OSFI supervises more than 1,300 federally-regulated private pension plans in Canada. Our actions and decisions affect plan members as well as the sponsors and administrators of the plans. We work to promote responsible pension plan governance and actuarial practices.

OSFI’s approach to private pension plan supervision is a balanced one that recognizes that plan administrators need to take reasonable risks in their investment and funding strategies and that plans or their sponsors can sometimes experience difficulties that lead to loss of benefits. While OSFI is mandated to protect pension plan members, our approach means we are careful to avoid actions that could place defined benefit plans at a disadvantage. Despite considerable financial pressures on pension plans, there were very few cases of plans terminating with a reduction of benefits, and these affected a very small number of Canadians.

Canada has set in place a public pensions system that is expected to be sustainable and affordable well into the future in the face of changing demographic conditions. Ongoing review of the system, including actuarial studies performed by the Office of the Chief Actuary on various public pension programs, will help to ensure this remains the case.

The federal government, through the Canada Pension Plan in conjunction with the provinces and territories, and through public sector pension arrangements and other social programs, has made commitments to Canadians and is responsible for ensuring the sustainability of these commitments. Some are long term, and it is important that decision-makers, Parliamentarians and the public understand these commitments and the inherent risks they present. In the case of the Canada Pension Plan, these commitments have been made in conjunction with the provinces and territories, who are co-stewards of the CPP.

The Office of the Chief Actuary has a vital and independent role to play in this process. The OCA provides appropriate checks and balances on the future costs of the different pension plans and social programs that fall under our responsibilities. The OCA produces and tables before Parliament actuarial reports on the Canada Pension Plan (CPP), Old Age Security (OAS) program and public sector employee pension and insurance plans.

A Safe and Secure World

OSFI supports the government’s priority for a safe and secure world by contributing to the fight against terrorism financing and money laundering. OSFI’s focus relates to the guidance and supervisory review of the operation of financial institution programs to comply with anti-money laundering / anti-terrorism financing requirements.

Canadian financial institutions, many of which are increasingly expanding their physical presence and exploring business opportunities outside of Canada, are involved in the global financial system. Canada and other G-8 governments have recognized that upgrading the supervisory capacity of emerging market regulatory bodies can help to enhance the stability of the global financial system. Canada has chosen to play an important role in this regard, both directly and indirectly, through OSFI’s technical- assistance program, which is designed to help emerging market economies improve their financial institution supervisory systems.

I.4.3 Operating Environment

OSFI’s Accountability Framework

OSFI was created in 1987 through the enactment of the Office of the Superintendent of Financial Institutions Act (OSFI Act), and subsequently received a legislated mandate that clarified its objectives in the regulation and supervision of federal financial institutions and private pension plans.

The OSFI Act provides that the Minister of Finance is responsible for OSFI. It also provides that the Superintendent is solely responsible for exercising the authorities provided by the financial legislation, and is required to report to the Minister of Finance from time to time on the administration of the financial institutions’ legislation. The Superintendent periodically appears before various House of Commons and Senate Committees.

The Office of the Chief Actuary (OCA) was created within the organization as an independent unit to effectively provide actuarial and other services to the Government of Canada and provincial governments who are Canada Pension Plan (CPP) stakeholders. The OCA has a vital and independent role to play in this process. The Reporting and Accountability Framework for the Office of the Chief Actuary within OSFI establishes the Chief Actuary as the person solely responsible for the content and the actuarial opinions in reports prepared by the OCA. The Chief Actuary periodically appears before various House of Commons and Senate Committees. More information is available on OSFI’s Web site under the Office of the Chief Actuary.

OSFI's accountability framework is made up of a variety of elements. OSFI participates in established international reviews jointly led by the World Bank / International Monetary Fund to determine whether OSFI is meeting internationally established principles for prudential regulators. OSFI regularly conducts anonymous surveys of its knowledgeable observers to assess its performance and effectiveness as a regulator. This includes OSFI’s contribution to public confidence and how OSFI compares to other regulators. Survey results are disclosed on OSFI's Web site under About OSFI / Reports / Consultations and Surveys.

OSFI consults extensively on its regulatory rules before they are finalized with financial institutions, other government agencies and subject matter experts. OSFI has its financial statements reviewed and approved by an audit committee which includes a majority of independent members, and audited annually by the Auditor General. OSFI reports to Parliament through the publication of a Report on Plans and Priorities (RPP), a Departmental Performance Report (DPR), and an Annual Report. OSFI also produces and distributes to its stakeholders an annual Plan and Priorities. The Superintendent reports to the Minister of Finance on OSFI operations.

Finally, as described in this document, OSFI has implemented a range of measures that allow OSFI to assess its performance.

In the fall of 2005, OSFI created the position of Director, Strategic Planning and Performance Measurement, in recognition that to be effective we must continue to enhance this area. The Director is responsible for strategic planning processes and key planning documents; for enhancing key management practices; and for coordinating corporate-level performance measures.

In 2005-2006, as part of OSFI’s ongoing commitment to improved identification of risks and assessment of the quality of risk mitigants during the planning process, the Enterprise Risk Management (ERM) process was rolled out across OSFI. This process allows for greater understanding and ownership of risks at the working levels, and provides a consistent approach to risk management across the organization. The Director of Strategic Planning and Performance Measurement coordinates the ERM process and ensures that the ERM results are incorporated into corporate planning.

In the spring of 2006, OSFI appointed independent members to its Audit Committee, who serve along with the Superintendent. Consistent with the Comptroller General of Canada’s approach to internal audit oversight, OSFI named one representative from the public sector. The independent members represent a majority of the committee, further enhancing the oversight of OSFI’s operations. The mandate of the Audit Committee is to provide independent, objective advice, guidance, and assurance to help OSFI efficiently and effectively achieve its business objectives and mandate. In order to give this support to the Superintendent, the Audit Committee will exercise active oversight of core areas of OSFI's accountability, risk and control processes. The committee is expected to meet at least four times a year, and members may serve a term of up to four years, with a maximum of two terms. Biographies of the audit committee members are available on OSFI’s Web site under Audit Committee.

OSFI’s internal Audit and Consulting Services Group conducts regular internal audits as per its audit plan and posts the results of these audits on its Web site under About OSFI / Reports / Internal Audit Reports. Management’s response to identified issues is contained in each report. More information is available in this report in Section III, Table 10.

Regulated Entities

The Office of the Superintendent of Financial Institutions (OSFI) is the primary regulator of financial institutions and private pension plans operating in Canada under federal jurisdiction.

OSFI supervises and regulates all federally incorporated or registered deposit-taking institutions (e.g., banks), life insurance companies, property and casualty insurance companies, and federally regulated private pension plans. These 1,785 organizations managed a total of $3,375 billion of assets (as at March 31, 2007).

Federally Regulated Financial Institutions and Private Pension Plans and Related Assets

|

|

Deposit- Taking Institutions |

Life Insurance Companies |

Property and Casualty Companies |

Federally Regulated Private Pension Plans |

Total |

|

Number of organizations |

148 |

114 |

191 |

1,332 |

1,785 |

|

Assets |

$2,679 billion |

$463 billion |

$103 billion |

$130 billion |

$3,375 billion |

OSFI also undertakes supervision of provincially incorporated financial institutions on a cost recovery basis under contract arrangements with some provinces. Additional detail may be found on OSFI’s Web site under Who We Regulate.

Cost Recovery

OSFI recovers its costs from several revenue sources. OSFI is funded mainly through asset-based, premium-based or membership-based assessments on the financial institutions and private pension plans that OSFI regulates and supervises, and a user-pay program for selected services.

The amount charged to individual institutions for OSFI’s main activities of risk assessment and intervention (supervision), approvals and rule making is determined in several ways, according to various formulas set out in regulations. In general, the system is designed to allocate costs based on the approximate amount of time spent supervising and regulating each industry. Costs are then assessed to individual institutions within an industry based on the applicable formula, with a minimum assessment for smaller institutions.

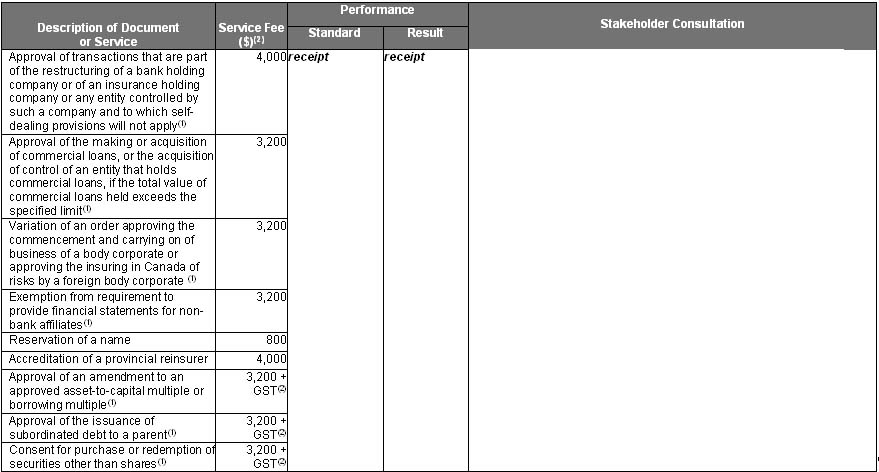

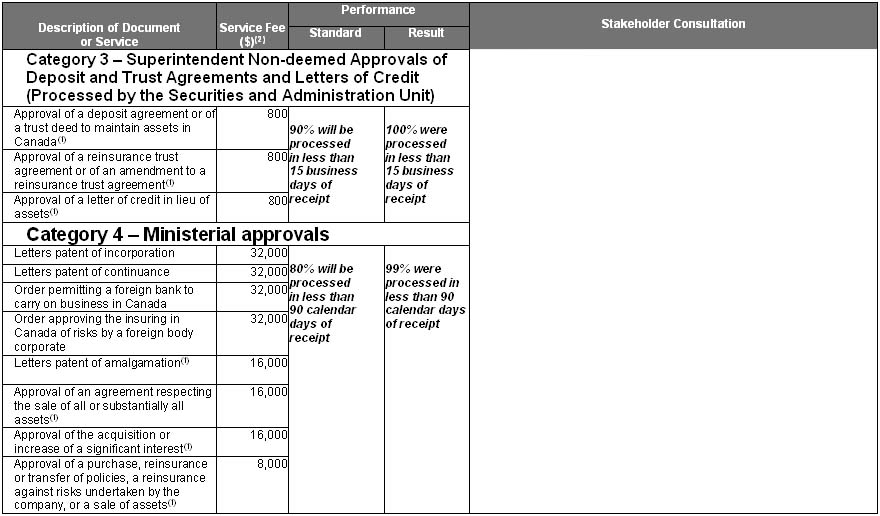

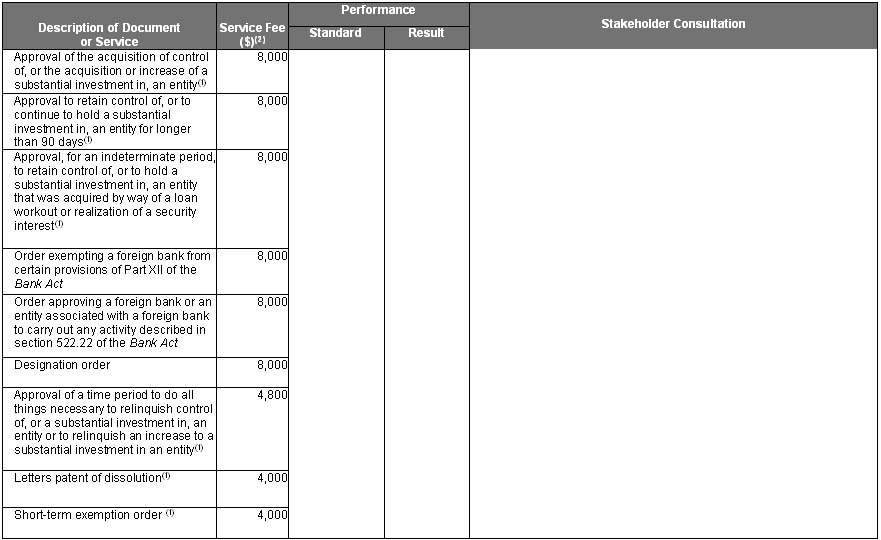

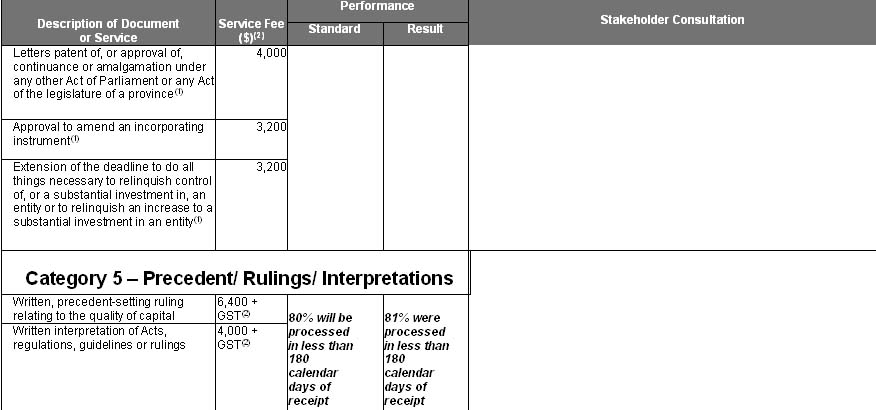

Specific user fees cover costs for certain approvals. The coming into force on April 28, 2006 of the Regulations Amending the Charges for Services Provided by the Office of the Superintendent of Financial Institutions Regulations 2002 reduced the number and types of legislative approvals that attract a fee. Ongoing costs to process approvals for which user fees no longer apply are recovered through base assessments.

Problem (staged) institutions are assessed a surcharge on their base assessment, approximating the extra supervision resources required. As a result, well-managed, lower-risk institutions bear a smaller share of OSFI’s costs.

OSFI also receives revenues for cost-recovered services. These include revenues from the Canadian International Development Agency (CIDA) for international assistance; revenues from provinces for which OSFI does supervision of their financial institutions on contract; and revenues from other federal agencies for which OSFI provides administrative support. Effective 2002-2003, cost-recovered services revenue also included amounts charged separately to major banks for the implementation of the internal ratings-based approach of the New Capital Adequacy Framework or “Basel II”; these cost-recovery Memoranda of Understanding will expire in October of 2007, after which time any ongoing Basel II costs will be recovered through base assessments.

Overall, OSFI fully recovered all its expenses for the fiscal year 2006-2007.

Effective 2002-2003, OSFI began collecting late and erroneous filing penalties from financial institutions that submit late and/or erroneous financial and corporate returns. On August 31, 2005 the Administrative Monetary Penalties (OSFI) Regulations came into force. These Regulations implement an administrative monetary penalties regime pursuant to which the Superintendent can impose penalties in respect of specific violations, as designated in the schedule to the Regulations. These Regulations incorporate the late and erroneous filing penalty regime and replace the Filing Penalties (OSFI) Regulations. These penalties are billed quarterly, collected and remitted to the Consolidated Revenue Fund. By regulation, OSFI cannot use these funds to reduce the amount that it assesses the industry in respect of its operating costs.

The Office of the Chief Actuary is funded by fees charged for actuarial services relating to the Canada Pension Plan, the Old Age Security program, the Canada Student Loans Program and various public sector pension and benefit plans, and by a parliamentary appropriation.

Informing Canadians

OSFI remains committed to informing Canadians about our activities and plans, and to contributing to a dialogue on key issues facing the financial sector and pension plans. The Superintendent and other OSFI subject experts delivered nearly 40 presentations, both nationally and internationally, to such audiences as the World Bank, the Institute of International Bankers, the Global Association of Risk Professionals, the Empire Club, the Canadian Institute of Actuaries, and various House of Commons and Senate Committee hearings. Most of these presentations are available on OSFI’s Web site.

As part of our commitment to transparency, OSFI made public various reports and findings, including its Plan and Priorities 2007-2010; Report on Actuarial Consultation; several reports from the Office of the Chief Actuary; and various internal audit reports. The full text of these findings and reports can be found on OSFI’s Web site under About OSFI/ Reports.

In an initiative to increase efficiency and reduce duplication, effective November 2005, OSFI outsourced the handling of public telephone enquiries to the Canada Deposit Insurance Corporation Call Centre. Callers to OSFI’s toll-free line now benefit from extended hours of operation and greater efficiency, as more officers are available to answer telephone calls and the call centre has up-to-date tracking technology. OSFI furnishes the information that is provided via the call centre to the public.

|

Sharing OSFI’s Expertise Throughout 2006-2007, OSFI shared its expertise with interested Canadians, including members of the general public, media, industry, regulators, and legislators:

|

I.4.4 Context

Key Partners

OSFI works with a number of key partners in advancing its strategic outcomes. Together, these organizations constitute Canada’s network of financial regulation and supervision and provide a system of deposit insurance. On a federal level, partnering organizations include the Department of Finance (www.fin.gc.ca), the Bank of Canada (www.bank-banque-canada.ca), the Canada Deposit Insurance Corporation (www.cdic.ca), the Financial Consumer Agency of Canada (www.fcac-acfc.gc.ca), and the Financial Transactions and Reports Analysis Centre of Canada (www.fintrac.gc.ca).

OSFI collaborates with provincial and territorial supervisory and regulatory agencies, as necessary, and with private-sector organizations and associations, particularly in rule making.

OSFI plays a key role in international organizations such as the Basel Committee on Banking Supervision, the Joint Forum, the Financial Stability Forum, the International Association of Insurance Supervisors, the Integrated Financial Supervisors, the Association of Supervisors of Banks of the Americas, the International Actuarial Association, and Le Groupe des superviseurs bancaires francophones.

OSFI engages several partners at various stages of its processes. As the following table shows, within the regulatory framework, other federal government organizations play prominent roles.

|

Regulatory Framework Roles |

|

|

Government Organization |

Role |

|

Department of Finance |

|

|

Canada Deposit Insurance Corporation |

|

|

Bank of Canada |

|

Maintaining good relationships with these organizations is critical to OSFI’s success. OSFI constantly strives to enhance its involvement with these organizations to ensure it is maximizing the effective use of resources.

Economic and Financial Environment

Canadian financial institutions are highly international. Their health is affected by economic and financial conditions in Canada and abroad. Despite a slowdown in the United States, global economic growth remained resilient in 2006 and was particularly strong in Asia. In Canada, there was robust growth in the first six months of the year but the economy slowed in the second half. That was largely attributable to reduced demand for Canadian exports from weakened automotive and housing sectors in the U.S. Offsetting this drag on real Gross Domestic Product (GDP) was growth in non-residential construction and personal expenditures. Moderate economic growth is projected for 2007.

The global corporate default rate remained near all-time lows, and credit trends were broadly favourable. However, the global default rate is expected to edge up in 2007. In Canada, there are signs the credit cycle has peaked and is in the early stages of a slowing trajectory.

Supported by positive economic and financial market conditions in Canada and abroad, Canadian financial institutions continued to perform very well in 2006-2007, enjoying record profits in many cases. As well, they remained well capitalized, and credit quality was good. The six largest Canadian banks posted very strong profits in 2006. Average return on equity was 23.2%, compared with 15.9 % in 2005.

Source: Standard and Poor’s

Domestic retail business lines continued to be the primary driver of earnings growth. In particular, there was rising demand for mortgage and business loans and for credit card products.

Driven by favourable economic conditions in Canada and continued strong demand for financial products in 2006, the smaller deposit-taking institutions showed broad-based year-over-year growth in assets and net income. Capital ratios remained generally strong, and there was a decrease in the number of staged institutions.

The Canadian life insurance industry had a very solid year in 2006. Average return on equity was 14.4%, up from 12.9% the year before. For the three largest competitors, industry consolidation over the past five years has presented opportunities to gain economies of scale.

The property and casualty insurance industry continued to perform above industry norms and reported another very profitable year in 2006. Average return on equity was 20.9%, up from 18.0% the previous year.

Strong investment returns over the 2006-2007 period helped to improve the financial health of federally regulated private pension plans. Stable long-term interest rates and the temporary Solvency Funding Relief Regulations introduced by the Government of Canada in November 2006 further contributed to easing funding pressures for defined benefit plans over the period. However, pension plans continued to face a challenging financial and economic environment over the period as interest rates remained at or near historically low levels, with the result that pension liabilities remain high. A number of pension plans continue to face large funding demands resulting from the difficult conditions of the last few years and, for some plan sponsors, the ability to meet these demands remains a concern. While the average solvency ratio calculated by OSFI for defined benefit plans improved to 1.06 in December 2006 from 0.90 from December 2005, vigilance is still required. For instance, year-end 2006 data also showed that approximately 51% of all defined benefit plans supervised by OSFI were under-funded, meaning their estimated liabilities exceeded assets, with 36% of these under-funded plans having liabilities that exceeded their assets by more than 10%. Going forward, OSFI will continue to monitor plans' solvency positions and financial condition of plan sponsors with persistently low solvency ratios, and intervene where appropriate to protect the rights and interests of plan members.

Competitive Environment

The financial services industry is dynamic – rapidly changing both in Canada and around the world. Canadian financial institutions are facing increased risks and competition while managing highly complex transactions. These developments in the competitive landscape continue to pose significant challenges for financial service providers as they attempt to maintain their long-run profitability and/or viability. OSFI's challenge is to understand and keep pace with these changes, provide guidance and direction, and help chart a course for the future while continuing to fulfill the obligations of its mandate.

Increased globalization has contributed to a progressively more complex and competitive international environment for Canadian financial institutions that are deriving an increasing proportion of their revenues from international operations. Further, many new foreign financial institutions are coming to Canada. These trends enhance competition within Canada but also expose domestic financial institutions to the risks and opportunities associated with foreign marketplaces. Consequently, OSFI faces additional pressure to increase its assessment of risks arising from offshore operations and to monitor Canadian institutions’ ability to manage those risks. OSFI remains aware of influences affecting foreign parents of Canadian financial institutions that could materially and adversely affect Canadian operations.

Global competitive factors added to the importance of increased cooperation among global regulators. OSFI continued to put emphasis on participation in international forums, on efforts to ensure that our supervisory framework remains appropriate, and on maintaining or enhancing relationships with other regulators. During 2006-2007, OSFI worked with Canadian banks, the Department of Finance, and the Bank of Canada to prepare for a review of Canada’s financial sector by the International Monetary Fund under its Financial Sector Assessment Program.

New domestic and international complexities and competition have led to new and different risks. Technological developments, in particular, permit the unbundling of many financial risks which can then be sold or passed on to other financial institutions or intermediaries. Technological developments have also given rise to alternative delivery channels which are increasingly important in the daily operations of all financial institutions.

Increased complexity and competition requires institutions to adopt enhanced analytical techniques, risk-transfer mechanisms and new control processes to keep pace with inherent risks. Many financial institutions have taken important steps to manage the changing nature of their risk profiles. Management, corporate governance and oversight of risks in Canadian financial institutions are markedly improved compared to five or ten years ago. However, OSFI remains concerned that the development of control processes may not be keeping pace with the inherent risk, particularly with respect to new financial institutions and those experiencing rapid growth. Such financial institutions are subject to more supervisory scrutiny. Based on onsite reviews and monitoring, OSFI makes recommendations for addressing these concerns and follow ups are conducted as appropriate.

Financial crime and the financing of terrorism are receiving greater attention by regulators than was the case a few years ago. OSFI increased the number of resources focused on assessing financial institutions' ability to detect and deter money laundering and terrorist financing. These reviews indicated a need for further improvements in institutions' practices. While many institutions are applying considerable resources to this area, some need to do more, and this has been brought to their attention.

Policy Environment

OSFI continued to play a role in the development and implementation of domestic and international policy initiatives.

As the administrator of the federal financial institutions legislation, OSFI was actively engaged in 2006 in the Department of Finance’s five-year review of the financial sector legislation. OSFI played a key role in the development of Bill C-37, An Act to amend the law governing financial institutions and to provide for related and consequential matters. The Bill addressed a number of areas of importance to OSFI, including the reduction of regulatory burden through the amendment or elimination of a number of regulatory approvals, and further clarification and simplification of the rules surrounding the foreign bank entry regime. Bill C-37 received Royal Assent on March 29, 2007.

OSFI continued to develop or modify rules to keep the regulatory framework current and appropriate for the evolving financial environment, as well as provide a level playing field for Canadian financial institutions. For example, during the year, OSFI worked closely with the Canadian Institute of Chartered Accountants to finalize OSFI’s Guideline D-10 on implementation of the Fair Value Option, which also necessitated a number of consequential amendments to several other OSFI accounting guidelines. The implementation of this guidance will help to ensure that Canada is consistent with the intent of international rules in this area, namely that there should be an ability to assess whether fair values are reliable and consistent, and whether those values are based on sound internal management practices.

OSFI also completed the bulk of revisions to its capital guidance in respect of banks and trust and loan companies. The updated guidelines will ensure Canada maintains a capital regime that meets international standards, while recognizing the realities of the Canadian environment. During the year, banks and trust and loan companies worked closely with OSFI on implementation issues. The new guidance will formally take effect as of the beginning of the 2008 fiscal year.

As noted in previous performance reports, defined-benefit pension plans in Canada, as in many jurisdictions around the world, continue to face challenges from a range of sources. In addition to the impact of current financial conditions on plan solvency and funding, there are a number of issues that private pension plan stakeholders have identified as potential threats to the long term viability of defined-benefit pension plans. In order to address the key issue of funding, OSFI assisted the Department of Finance in the development of the Solvency Funding Relief Regulations, which came into force in November 2006. The regulations include measures to provide temporary solvency-funding relief for defined benefit plans, which are designed to facilitate adequate funding while protecting the security of plan members’ benefits.

Efficiency and Effectiveness

In today’s environment, there is a need for organizations such as OSFI to continually refine their business processes, enhance their technological capabilities, and improve the knowledge and skills of their human resources. Stakeholders rely on OSFI to meet its mandate in the most efficient and cost effective manner possible. OSFI has worked to achieve these goals through investments in information technology and improvements in business processes. This will continue as a priority.

OSFI has a multi-year Information Management/Information Technology (IM/IT) strategy that is dependent on implementing business intelligence technology and data warehouse tools to support centrally managed information stores. These stores will allow information to be efficiently captured, stored and shared, and managed as a strategic asset. The technology is being standardized across the organization enabling the pursuit of an integrated approach to information management and delivery.

The bulk of changes currently under way are being executed in IM/IT in support of this strategy. Data continues to be consolidated while reporting interfaces and analytical capabilities continue to be standardized as well as enhanced in accordance with changing business requirements. This is enabling OSFI to respond ever more readily to changes in the financial sector by providing easier access to existing data, allowing for more comprehensive cross sector reporting and improving system flexibility. For example, OSFI built and tested a new data warehouse designed to accept and manage Basel and detailed credit data in order to improve the efficiency of handling regulatory data. OSFI also implemented a data management process to maximize the usefulness of financial data collected from the industry while minimizing potential duplication of data collected.

New data architecture and standards have been developed to ensure that data accuracy, quality and security levels remain high in this new data warehousing environment. During 2006-2007, a number of new internal business applications began using this technology including the application required to manage the new Basel Framework.

OSFI completed the current phase of the Electronic Document Management System (EDMS) project to reorganize the balance of its electronic records to improve information sharing. EDMS is enabling OSFI employees to share information more easily and ensuring that electronic corporate records continue to be managed effectively in accordance with government policy.

In addition, OSFI has embarked on a review of those legacy systems currently supporting the execution of pension plan reviews. This review will result in the development of an implementation road map for the replacement of these systems in accordance with OSFI’s approved strategic IM/IT plan.

It is essential for OSFI to continue to attract and retain the skilled human resources it needs to fully meet its mandate. Failing to do so would affect OSFI’s ability to effectively supervise financial institutions and private pension plans. The skills OSFI needs are highly marketable in today’s environment and necessitate that OSFI continue to remain competitive in the workplace.

OSFI introduced several human resources (HR) policies, processes, training and communication plans in 2006-2007 to ensure compliance with the new Public Service Modernization Act, which is designed to modernize HR management in the federal government. These changes provided OSFI the opportunity to enhance its labour relations environment; to respond to employee issues surrounding transparency and access within the staffing process; and to clarify management’s role and accountabilities with respect to HR matters.

During 2006-2007, OSFI continued its succession planning in all high risk areas and the integration of its human resources planning process into the business planning process; staffing and training/development plans were developed at the divisional level as part of the annual planning process.

During this past year, OSFI updated its emergency preparedness tools, facilities and processes to ensure effective recovery and continuity of critical services. OSFI also planned for alternate resources to sustain critical services in the event of pandemic-related staff shortages and introduced preventative measures to minimize potential impact on staff.

Risks, Challenges and Opportunities

Complexity in the Financial Industry

Increased complexity in the financial industry, coupled with the competitive nature of global markets, present risk to the financial markets. The growing participation of Canadian financial institutions in foreign markets challenges OSFI’s ability to implement an effective consolidated supervisory framework. Increased risk is evident in several areas, including reputation

risk associated with the use of complex products in both the banking and insurance industries. OSFI has focused on risks arising from Canadian institutions’ offshore operations and their ability to manage those risks, and continued to develop and maintain effective working relationships with foreign regulators to optimize supervisory efforts.

Accounting and Capital

OSFI needs to be better positioned to understand and address the potential risk associated with implementing evolving accounting standards and their impact on capital regimes. These changes will have important implications for OSFI and regulated financial institutions. OSFI strives to ensure that high priority Canadian

issues are considered by Canadian and international committees and dealt with appropriately. OSFI has participated in the Accounting Task Force (ATF) of the Basel Committee on Banking Supervision and other international committees to develop a common conceptual framework, and is monitoring institutions’ ability to manage challenges of adopting international accounting

standards.

Basel II

As do other regulators, OSFI faces significant challenges in implementing the Basel II capital framework. In its supervision, OSFI must balance the need for quality implementation, which achieves the benefit of the framework, with adequate flexibility to recognize the challenges faced by institutions. OSFI must

also ensure that its approach is comparable to that in other major jurisdictions. Canadian banks and OSFI are well advanced in efforts to implement the Basel II Capital Accord, but this requires continued focus and ongoing work. OSFI continues to work closely with Canadian banks, and our international counterparts, on a roadmap to help integrate the Accord into their business

process and enhance their risk management process. The new capital framework and events in the market also require banks and OSFI to focus more on the measurement and management of operational risk and its relation to capital.

Financial Crime

Financial crime and the financing of terrorism are receiving greater attention by regulators than was the case a few years ago. Additional requirements are likely to be put in place for Canada to remain compliant with international norms. OSFI continues to assess institutions’ ability to detect and deter terrorist financing

and money laundering and its reviews also indicate a need for further improvement in institutions’ practices. Doing a highly credible job that is substantially compliant with international norms is important for the reputation of both Canadian financial institutions and OSFI.

Private Pension Plans

The current economic and financial environment creates challenges for OSFI in meeting its mandate to regulate and supervise private pension plans. OSFI’s resources have been called on to contribute to changes in pension rules, while dealing with a backlog of pension approvals. OSFI has published guidance on funding

relief and on plan registrations to clarify expectations and improve transparency, and has intervened successfully in many cases, both through the courts using our intervention powers, and cooperatively, to avoid significant losses to plan members. Internally, OSFI has increased resources and refined internal processes to intervene promptly, to clarify rules and expectations

and to improve efficiency of approvals. OSFI will continue to make timeliness of the approval function a priority, through the addition of further resources and the consideration of enhancements to systems that support these activities. OSFI will also continue to dedicate resources to pension rule review and development.

People Risks

OSFI faces a continual challenge to hire and retain staff with the relevant skills, knowledge and experience. To function as an effective regulator in a rapidly changing and complex environment, OSFI requires staff with the ability to perform in-depth analyses and apply judgment, within short timeframes, on complex issues where the

solution is not always clear-cut. The extent and pace of change both internally and externally have put stress on staff and on OSFI’s ability to implement change. Continual progress needs to be made in upgrading internal processes and managing change. Leadership development was a key focus during the year. The mandatory leadership development program, consisting of

leadership skills and business process training, continued throughout the year. Management staff are required to complete this modularized program over a two or three-year period, depending on management level and when they begin the program. At year’s end, approximately 70% of the targeted audience had completed the available course offerings, which is on target with

the planned schedule.

Information Technology Systems Risks

To fulfill its mandate, OSFI must continue to make significant systems investments to support communications and information requirements and increase efficiency, flexibility and effectiveness of its core supervisory and regulatory processes. The challenge is to get the full benefit from these investments and

to identify and implement further systems development needs in selected areas. OSFI has a multi-year IM/IT strategy that is dependent on implementing technology to support centrally managed information stores. These stores will allow information to be efficiently captured, stored and shared, and managed as a strategic asset. This is enabling OSFI to respond ever more readily to

changes in the financial sector by providing easier access to existing data, allowing for more comprehensive cross sector reporting and improving system flexibility.

II. Analysis of Performance by Strategic Outcome

II.1 Strategic Outcomes

Primary to OSFI’s mission and central to its contribution to Canada’s financial system are two strategic outcomes:

- To regulate and supervise to contribute to public confidence in Canada’s financial system and safeguard from undue loss. OSFI safeguards depositors, policyholders and private pension plan members by enhancing the safety and soundness of federally regulated financial institutions and private pension plans.

- To contribute to public confidence in Canada's public retirement income system. This is achieved through the activities of the Office of the Chief Actuary, which provides accurate, timely advice on the state of various public pension plans and on the financial implications of options being considered by policy makers.

In 2004-2005, OSFI implemented the Program Activity Architecture (PAA), as recommended by the Treasury Board Secretariat, as part of the federal government’s commitment to strengthen oversight and accountability. OSFI began reporting under the PAA framework effective with the 2004-2005 DPR.

II.2 Program Activities

Three program activities support OSFI’s first strategic outcome to regulate and supervise financial institutions and private pension plans so as to contribute to public confidence.

-

Regulation and supervision of federally regulated financial institutions (FRFIs)

This program activity is central to the achievement of OSFI’s mandate to protect the rights and interests of depositors and policyholders and advance a regulatory framework that contributes to public confidence in the Canadian financial system. The three sub-activities of this program are:- Risk assessment and intervention includes activities to monitor and supervise financial institutions, monitor the financial and economic environment to identify emerging issues and intervene in a timely way to protect depositors and policyholders, while recognizing that all failures cannot be prevented.

- Rule making encompasses the issuance of guidance and regulations, input into federal legislation affecting financial institutions, contributions to accounting, auditing and actuarial standards, and involvement in a number of international rule-making activities.

- Approvals of certain types of actions or transactions undertaken by regulated financial institutions. This covers two distinct types of approvals: those required under the legislation applying to financial institutions and approvals for supervisory purposes.

There is a strong interrelationship among the three parts of this supervisory and regulatory program. The supervisory function relies on an appropriate framework of rules and guidance. In some situations, regulatory approval is required because a proposed transaction may significantly affect an institution’s risk profile. Approving such a change involves both a supervisory and regulatory assessment. Supervisory experiences often identify areas where new or amended rules are needed.

As identified in OSFI’s mandate, OSFI must also recognize the need for financial institutions to compete effectively. The sustainability and success of regulated institutions is important for the long-term safety and soundness of the financial system. As a result, OSFI needs to strike an appropriate balance between promoting prudence and allowing financial institutions to take reasonable risks in order to compete and prosper. - Regulation and supervision of federally regulated private pension plans

This program incorporates risk assessment, intervention, rule making and approvals related to federally regulated private pension plans under the Pension Benefits Standards Act, 1985. - International Assistance

OSFI supports initiatives of the Government of Canada to assist emerging market economies to strengthen their regulatory and supervisory systems. This program incorporates activities related to providing help to selected countries that are building their supervisory and regulatory capacity. This program is largely funded by the Canadian International Development Agency and is carried out by OSFI directly and through its participation in the Toronto International Leadership Centre for Financial Sector Supervision. This involvement strengthens the financial-system regulatory and supervisory regimes in those jurisdictions.A fourth program activity, the Office of the Chief Actuary (OCA), supports OSFI’s second strategic outcome : to contribute to public confidence in Canada’s public retirement income system.

-

Office of the Chief Actuary (OCA)

The OCA provides a range of actuarial services, under legislation, to the Canada Pension Plan (CPP) and some federal government departments, including the provision of expert and timely advice in the form of reports tabled in Parliament. The basic elements of this program include:- Canada Pension Plan and Old Age Security: The OCA estimates long-term expenditures, revenues and current liabilities of the CPP and long-term future expenditures for Old Age Security programs. The OCA also prepares statutory triennial actuarial reports on the financial status of these programs.

- Other Public Sector Pension Plans: The OCA prepares statutory triennial actuarial reports on the financial status of federal public sector employee pension and insurance plans covering the federal Public Service, the Canadian Armed Forces, the Royal Canadian Mounted Police, the federally appointed judges and Members of Parliament.

The following diagram shows how OSFI’s main activities are linked to the outputs generated in support of programs and their link to strategic outcomes.

1 Canada Pension Plan, Old Age Security, Canada Student Loans Program, and various public sector pension and insurance plans.

2 These activities are provided with Program Support (by Corporate Services and other organization-wide activities). These Program Support costs and FTEs are allocated to the activities based on share of direct human resources costs.

While the program activity “Regulation and Supervision of Federally Regulated Private Pension Plans” consists primarily of risk assessment and early intervention, it also includes components directed at ensuring a balanced regulatory framework and providing a prudentially sound and responsive approvals process, which are not shown on the diagram.

II.3 Monitoring Mechanisms and Performance

To monitor and assess the impact of its priorities on its strategic outcomes, OSFI uses a combination of performance measurement data and information. For each priority, the reporting is based on the types of monitoring mechanisms used.

To monitor the status of the strategic outcomes themselves, OSFI uses various types of performance measures, including independent assessments (public surveys) and peer reviews. Beginning in 1998, OSFI has engaged in a process of periodic, anonymous, independent consultations with industry stakeholders. This provides OSFI with an indication of its performance in program areas, including whether we are providing the guidance and direction necessary to stakeholders. Such consultations are a key mechanism for monitoring organizational performance. As noted in Section I.4.1, in 2006-2007, a consultation was done with insurance stakeholders.

OSFI’s mandate explicitly provides that closures and terminations can occur and are not by themselves an indication of OSFI’s performance. So in considering those that do occur, OSFI assesses how it performed relative to its early intervention mandate in identifying the situation and intervening appropriately.

It should be recognized that OSFI’s performance does not constitute the only influence on its strategic outcomes. Indeed, OSFI’s legislation recognizes that there are many other factors and stakeholders whose actions or inactions have a large impact on the strategic outcomes. However, OSFI continues to monitor this type of information to ensure it has a clear understanding of the status of its key strategic outcomes and to gain additional insights into the ways by which OSFI itself can continue to contribute to those outcomes.

OSFI also monitors a variety of indicators that contribute to its effectiveness such as the appropriateness of its supervisory or rule making practices and the usefulness of its feedback to institutions.

In 2004-2005, OSFI developed a new performance measurement framework and a suite of measures corresponding to its Program Activity Architecture (PAA), which were implemented in 2005-2006. As part of this work, OSFI analyzed performance standards established by relevant prudential supervisors in foreign jurisdictions to develop comparable standards. Performance measures that are included for the first time in this DPR, i.e., they were not reported on in the 2005-2006 DPR, are identified as “NEW”.

II.4 Detailed Analysis of Performance

The diagram below illustrates the link between OSFI’s priorities and its Program Activity Architecture.

In addition to the above Program Priorities, OSFI had two Program Support Priorities which are discussed in Section IV.2.

The following tables provide an assessment of OSFI’s performance for the year against its Program Priorities.

|

Strategic Outcome: Regulate and Supervise to Contribute to Public Confidence in |

|||||||||||||

|

Program Activity: Regulation and Supervision of Federally Regulated Financial Institutions |

|||||||||||||

|

Program Sub-Activity: Risk Assessment and Intervention |

|||||||||||||

|

Priority 1: Accurate risk assessments of financial institutions and timely, effective intervention and feedback. |

|||||||||||||

|

Description

|

|||||||||||||

|

Key Expected Results

|

|||||||||||||

| Key Performance Measures / Achieved Results | Ratings | ||||||||||||

|

|||||||||||||

|

Performance Discussion Steps taken during the year in support of this objective include:

Steps planned for the future to improve performance include:

|

|||||||||||||

|

Financial Resources ($ millions)

Human Resources (average Full-Time Equivalents, including Program Support)

3 Findings reported here are from the 2004 industry consultation process. An independent consultant, the Strategic Council, conducted a series of confidential one-on-one interviews with senior executives and professionals representing a cross-section of the institutions regulated by OSFI. OSFI provided a list of key contacts within regulated institutions, external actuaries and external auditors, and the consultant selected the final sample. OSFI does not know who was interviewed. A total of 63 interviews were conducted in November and December 2004. The findings reported here emerged consistently across stakeholder groups. The final report is available on OSFI’s Web site under About OSFI/ Reports/ Consultations and Surveys. 4 OSFI provided The Strategic Counsel, an independent research firm, with a list of executives and professionals representing a cross-section of the life and property and casualty insurance companies regulated by OSFI. The research firm conducted 64 one-on-one confidential interviews. The research firm independently selected the samples from the list, and OSFI does not know who was interviewed. Unless otherwise noted, the findings reported emerged consistently across stakeholder groups. |

|||||||||||||

PRIORITY 8

|

Strategic Outcome: Regulate and Supervise to Contribute to Public Confidence in |

|||||||

|

Program Activity: Regulation and Supervision of Federally Regulated Financial Institutions |

|||||||

|

Program Sub-Activity: Risk Assessment and Intervention |

|||||||

|

Priority 8: Ensure that OSFI is in a position to review and approve applications that are submitted for approval under the Basel II capital framework. |

|||||||

|

Description

|

|||||||

|

Key Expected Results

|

|||||||

| Key Performance Measures / Achieved Results | Rating | ||||||

|

|||||||

|

Performance Discussion Steps taken during the year in support of this objective include:

Steps planned for the future to improve performance include:

|

|||||||

|

Resources: Included in Priority 1 |

|||||||

PRIORITY 2

|

Strategic Outcome: Regulate and Supervise to Contribute to Public Confidence in |

|||||||||||||

|

Program Activity: Regulation and Supervision of Federally Regulated Financial Institutions |

|||||||||||||

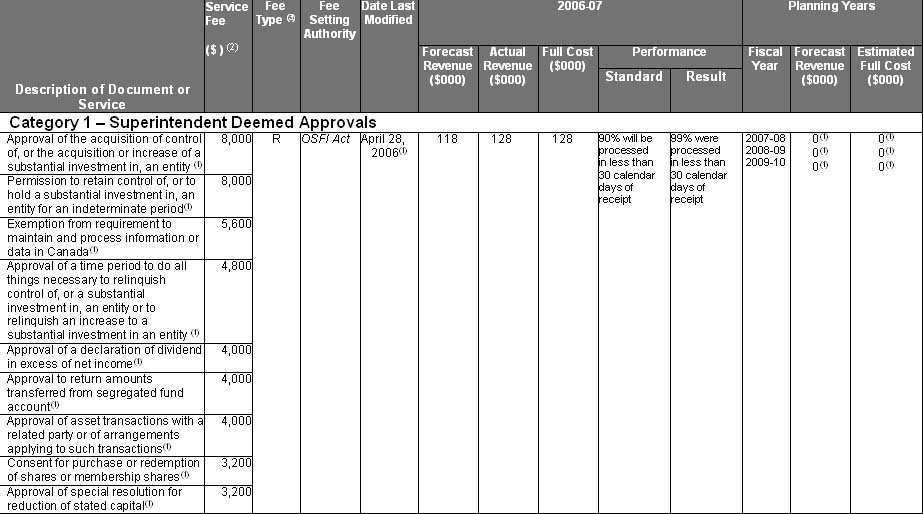

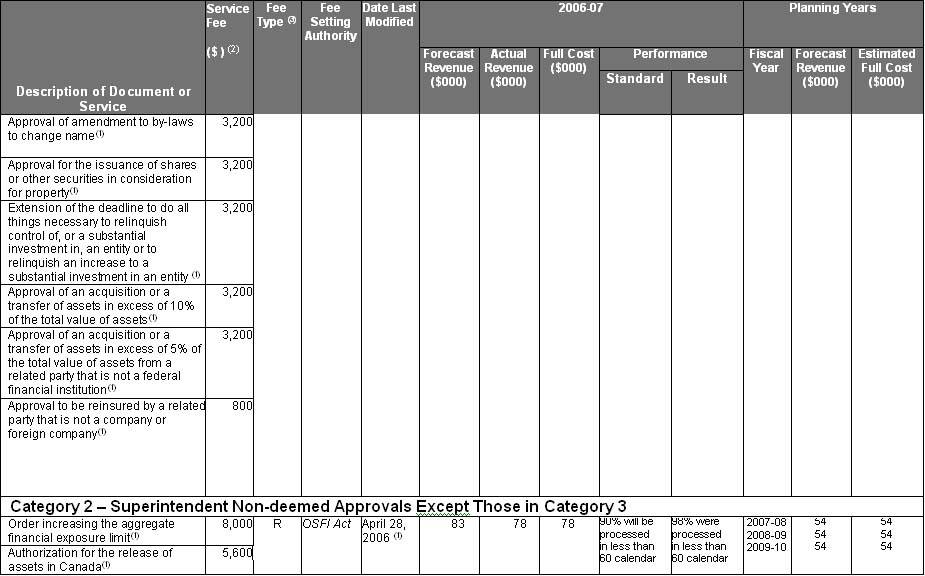

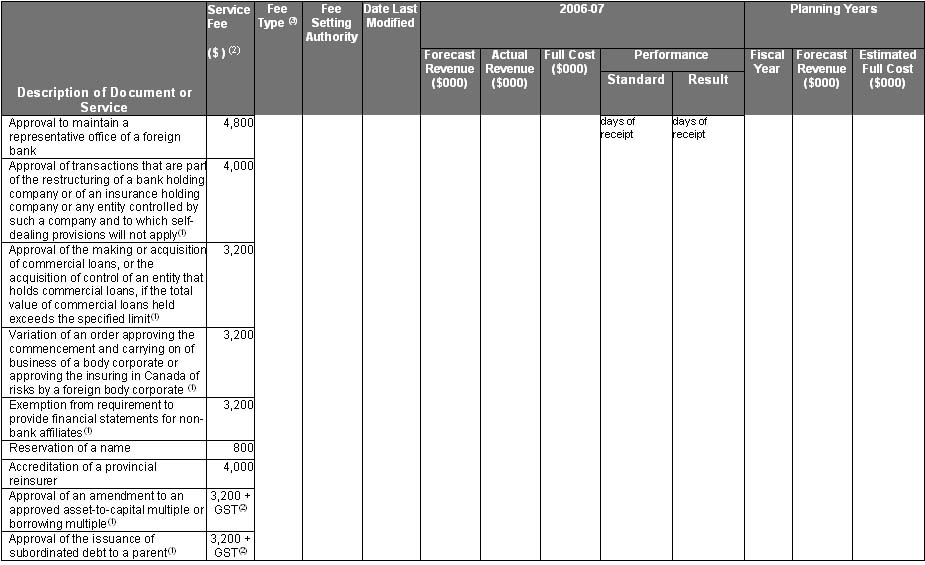

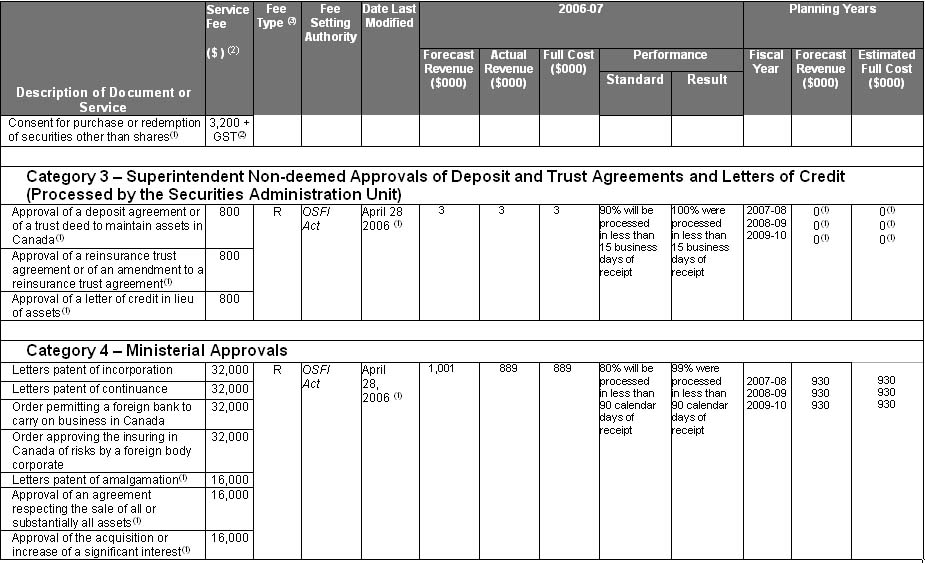

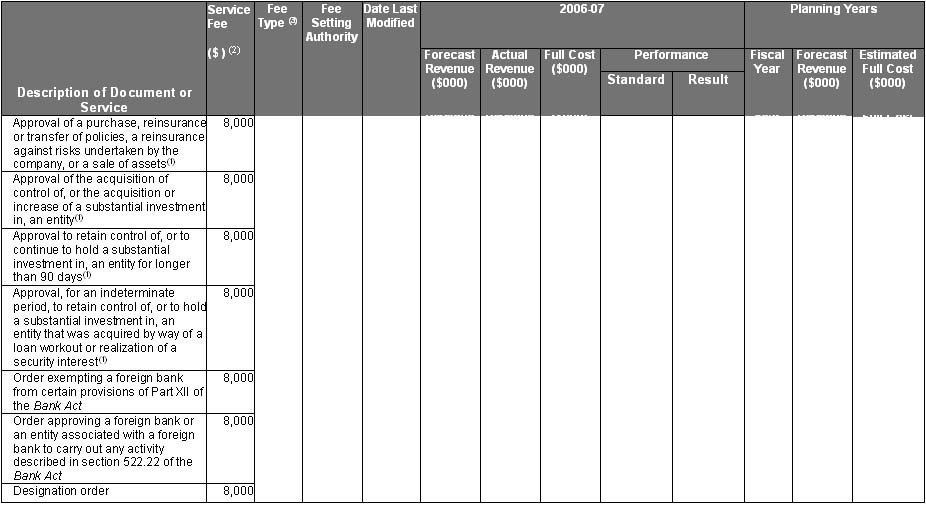

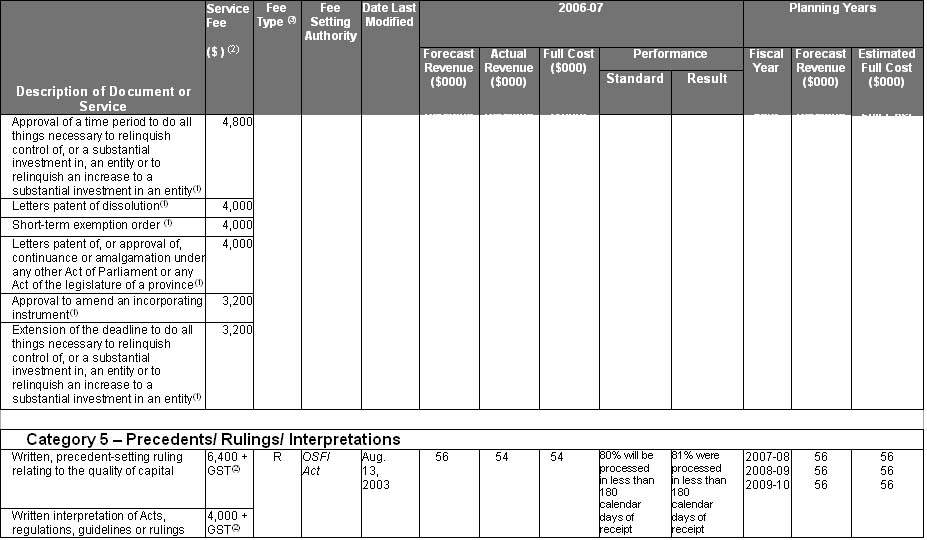

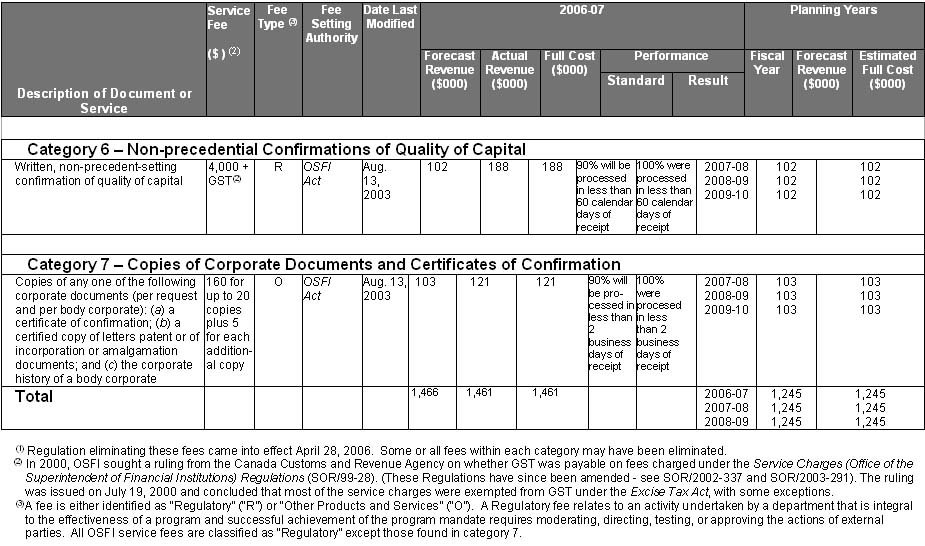

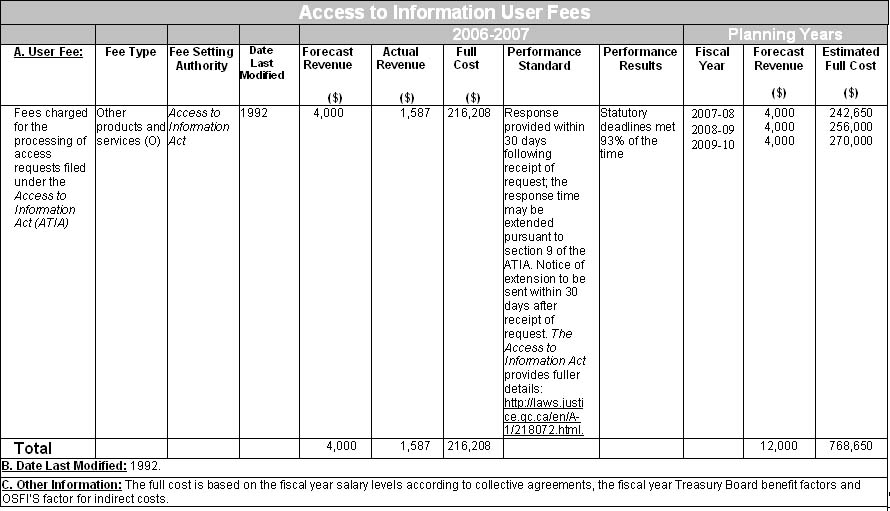

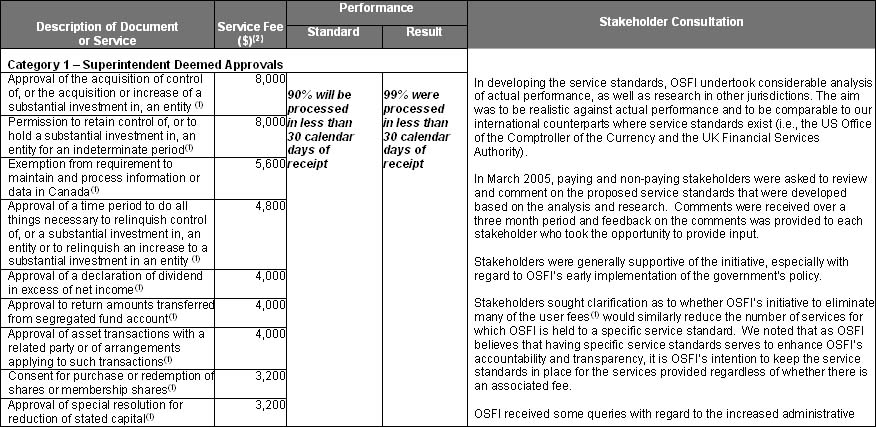

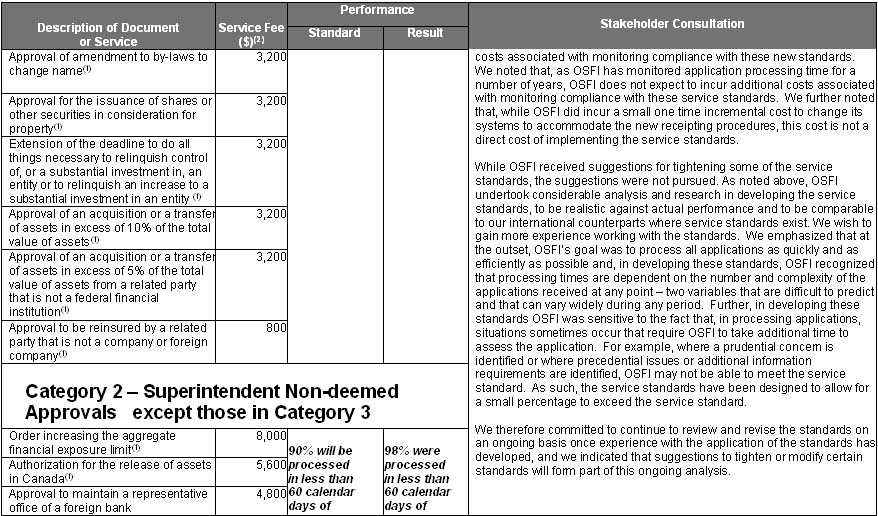

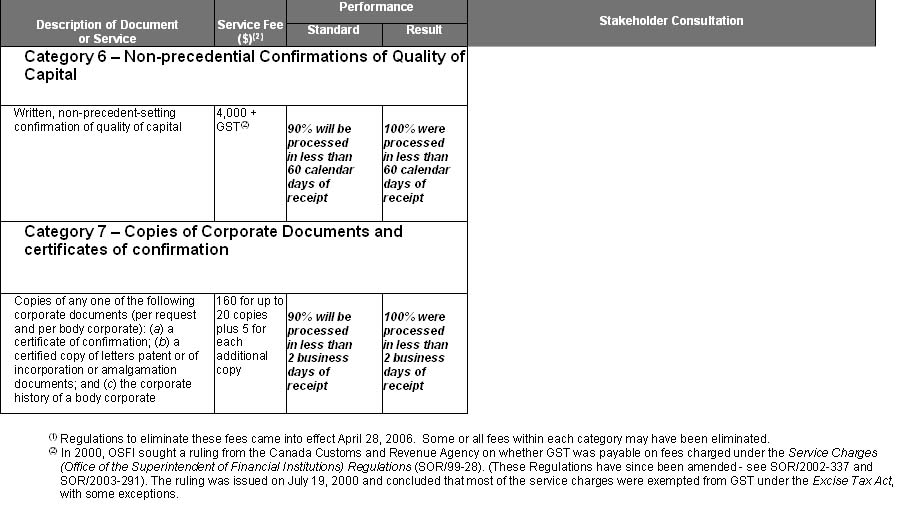

|