Common menu bar links

Breadcrumb Trail

ARCHIVED - Office of the Superintendent of Financial Institutions Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

III. Supplementary Information

III.1 Organizational Information

Organizational Structure

OSFI comprises three sectors (see organization chart below), each headed by an Assistant Superintendent. Each sector works interdependently to achieve OSFI’s strategic outcomes. In addition, there is an independent Internal Audit and Consulting function that reports directly to the Superintendent. In 2006, a Director of Strategic Planning and Performance Measurement position was created, reporting directly to the Superintendent.

The Office of the Chief Actuary (OCA) was created within the organization as a separate unit to provide effective actuarial and other services to the Government of Canada and provincial governments that are Canada Pension Plan (CPP) stakeholders.

OSFI Organization Chart, as at March 31, 2007

A more detailed organization chart may be found on OSFI’s Web site under About OSFI.

Workforce

As at March 31, 2007, OSFI employed 462 people in offices located in Ottawa, Montreal, Toronto and Vancouver.

OSFI’s work requires the effort and attention of multidisciplinary teams. It requires a combination of broad perspective and in-depth expertise. OSFI builds excellence into its culture, and encourages continuous learning through teamwork, professional development and training opportunities, and the provision and support of advanced technologies.

OSFI’s unique work environment benefits from a full spectrum of professional experience and expertise, drawing on the talents of recent graduates, as well as seasoned industry and regulatory experts.

OSFI ended the 2006-2007 year with a head count of 462. The increase of 26 or 6.0% from the prior year is in part due to additional resources in the Corporate Services Sector in support of major technology initiatives; where appropriate, projects are staffed with term positions that coincide with the project's duration. (As at March 31, 2006 and 2007, there were one and seven project term positions on strength, respectively). The Corporate Services Sector includes employees in the Superintendent’s Office, the Project Management Group, Audit and Consulting Services and the Secretariat of the Audit Committee. During 2006-2007, OSFI enhanced its governance and accountability framework in part through increased capacity in its Internal Audit function.

The change in the Supervision Sector reflects the staffing of approved positions that were vacant as at March 31, 2006. The change in the Regulation Sector mainly reflects the addition of resources in the areas of private pension plans, anti-money laundering and anti-terrorism financing activities, and of accounting policy to support OSFI’s Accounting Standards priority. The decrease in the Office of the Chief Actuary Sector is due to vacancies as at March 31, 2007.

Chart of Year End Headcount (2006 vs. 2007)

|

Sector |

As at |

% of total |

As at |

% of total |

|

Corporate Services |

118 |

27% |

132 |

29% |

|

Supervision |

169 |

39% |

177 |

38% |

|

Regulation |

121 |

28% |

127 |

27% |

|

OCA |

28 |

6% |

26 |

6% |

|

TOTAL |

436 |

100% |

462 |

100% |

III.2 Financial and Other Tables

This section presents a number of financial tables that detail OSFI’s Expenditures, Revenues and Statutory Payments for 2006-2007. Tables 1 to 6 are provided in accordance with Treasury Board requirements. Tables 7A, 7B, 8, 10 and 11 provide additional information on User Fees, Service Standards, Regulatory Plan, Internal Audits and Travel Policies, according to Treasury Board requirements. (NOTE: In accordance with TBS guidelines, tables 7B, 8, and 11 do not form part of this document but links are provided. A link is also provided to the Financial Statements, termed Table 9.)

Background

OSFI recovers its costs from several revenue sources. Costs for risk assessment and intervention (supervision), approvals and rule making are charged to the financial institutions and private pension plans that OSFI regulates and supervises.

The amount charged to individual institutions for OSFI’s main activities of supervision, approvals and rule making is determined in several ways. In general, the system is designed to allocate costs based on the approximate amount of time spent supervising and regulating institutions. As a result, well-managed, lower-risk institutions bear a smaller share of OSFI’s costs.

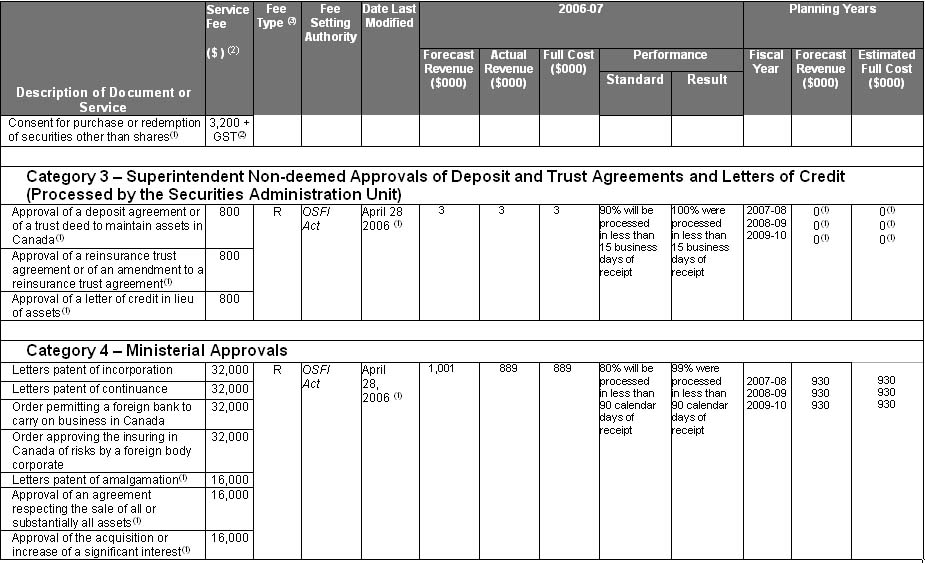

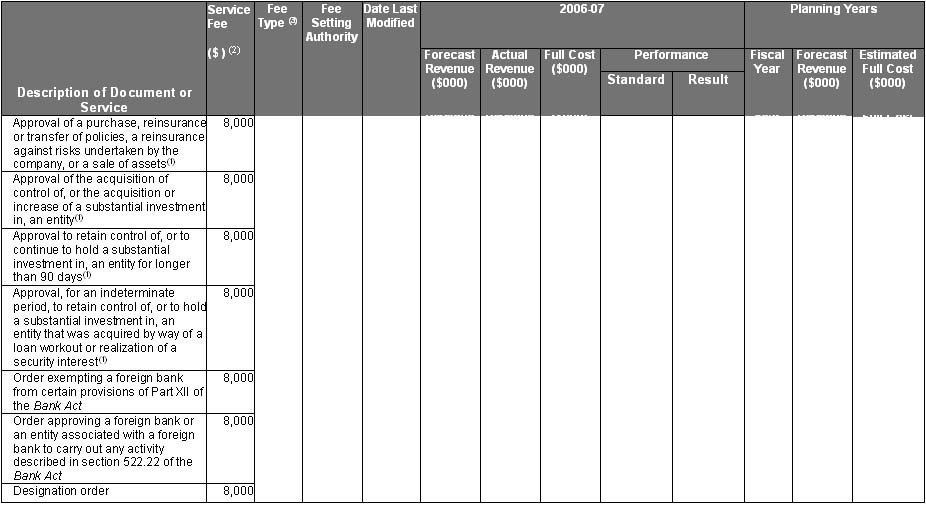

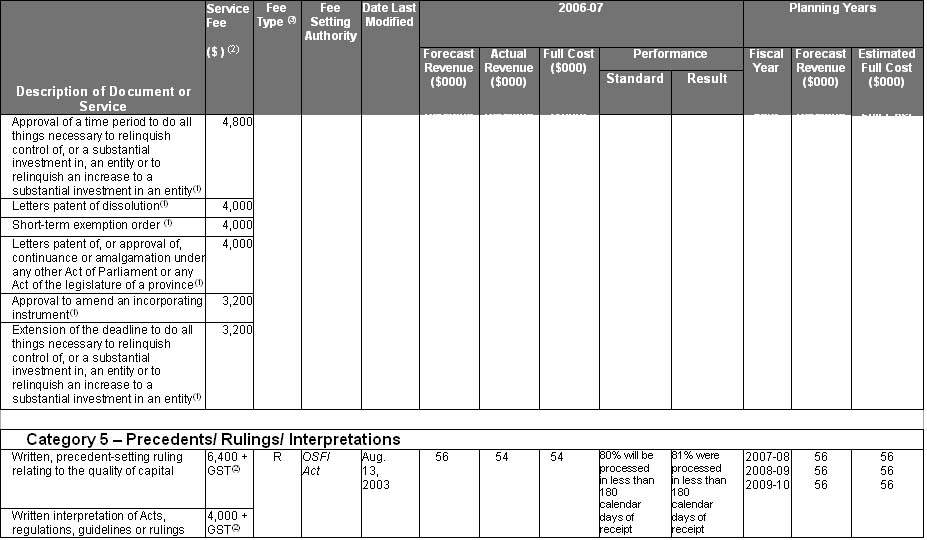

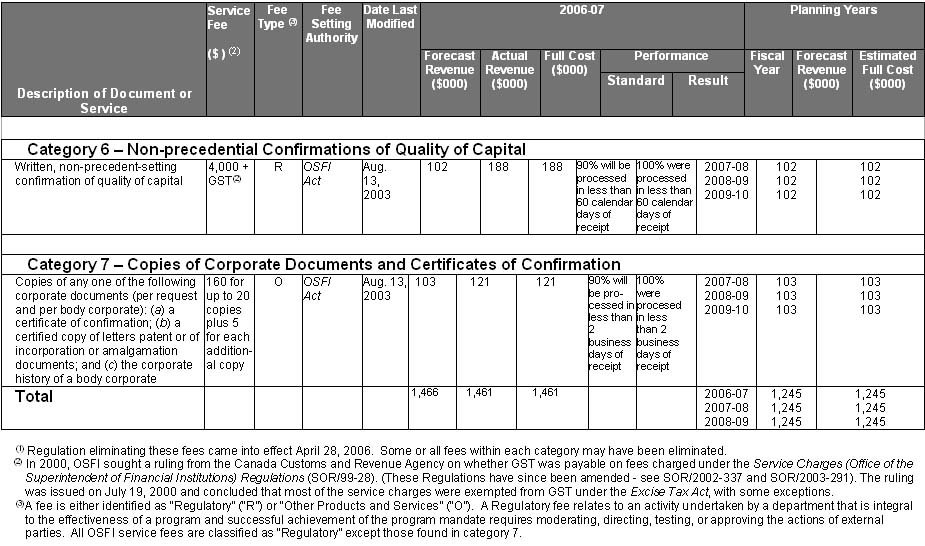

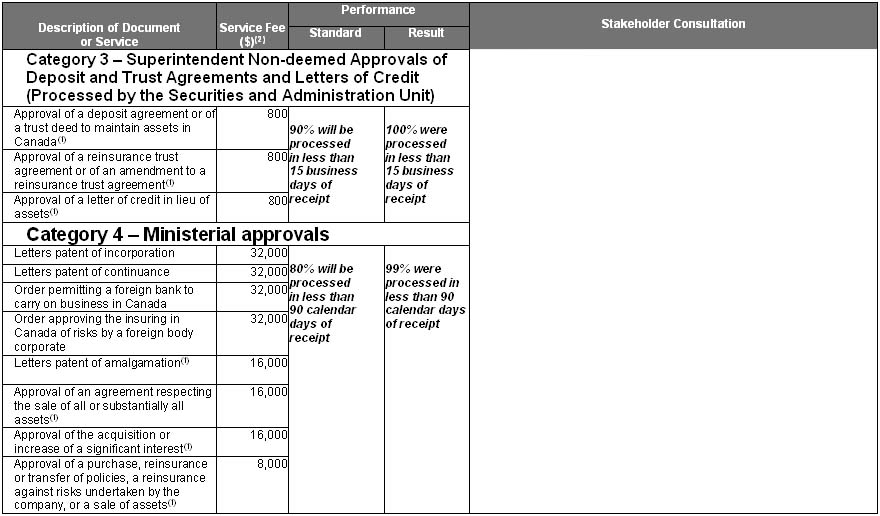

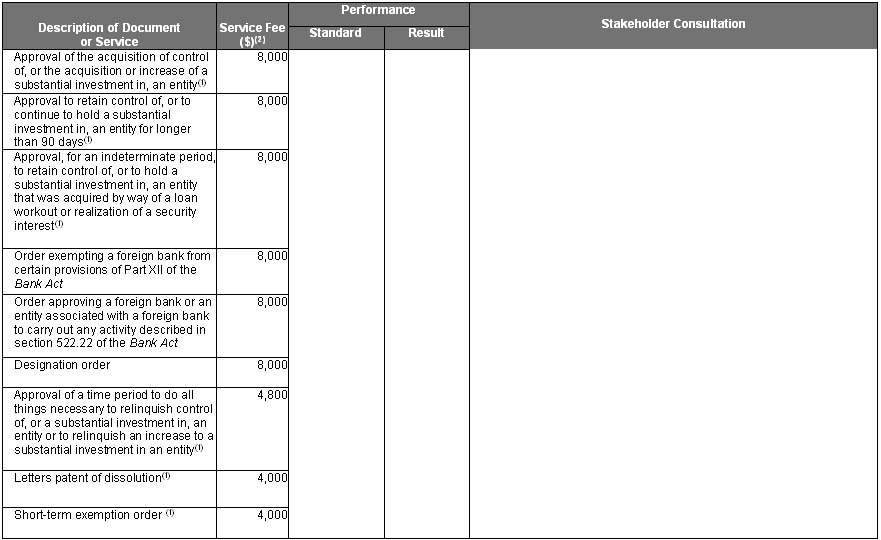

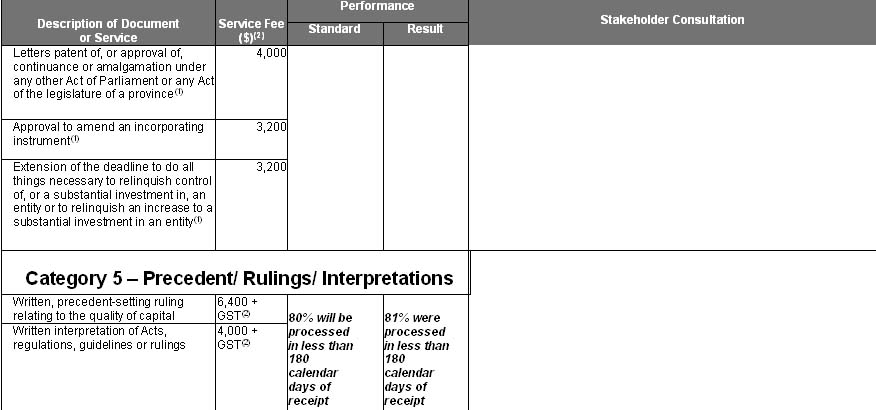

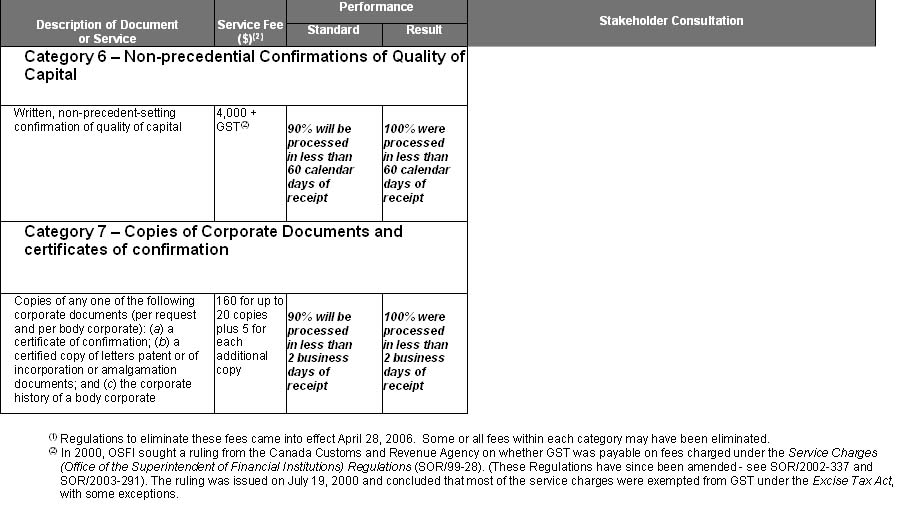

Specific user fees cover costs for certain approvals. Problem (staged) institutions are assessed a surcharge approximating the extra supervision resources required. As of April 28, 2006, new regulations came into effect that reduced the number of applicable service charges from 51 to 14. The only charges retained are those that apply to new applicants that are not subject to a base assessment and those charged for rulings, interpretations, capital quality confirmations and copies of corporate documents, which are often resource intensive.

OSFI also receives revenues for cost-recovered services. These include revenues from the Canadian International Development Agency (CIDA) for international assistance, revenues from provinces for which OSFI does supervision on contract, and revenues from other federal agencies for whom OSFI provides administrative support. Effective 2002-2003, cost-recovered services revenue also includes amounts charged separately to major banks for the implementation of the internal ratings-based approach of the New Basel Capital Accord; these cost-recovery Memoranda of Understanding will expire in October of 2007, after which time any ongoing Basel II costs will be recovered through base assessments.

The remainder of costs of risk assessment and intervention, approvals and rule making are recovered through base assessments against institutions and private pension plans fees according to various formulae.

Effective 2002-2003, OSFI began collecting late and erroneous filing penalties from financial institutions that submit late and/or erroneous financial and corporate returns. On August 31, 2005 the Administrative Monetary Penalties (OSFI) Regulations came into force. These Regulations implement an administrative monetary penalties regime pursuant to which the Superintendent can impose penalties in respect of specific violations, as designated in the schedule to the Regulations. These Regulations incorporate the late and erroneous filing penalty regime and replace the Filing Penalties (OSFI) Regulations. These penalties are billed quarterly, collected and remitted to the Consolidated Revenue Fund. By regulation, OSFI cannot use these funds, which are recorded as non-respendable revenue, to reduce the amount that it assesses the industry in respect of its operating costs.

The Office of the Chief Actuary is funded by fees charged for actuarial services and in part by an annual parliamentary appropriation for services to the Government of Canada related to public pensions.

Overall, OSFI fully recovered all its expenses for the fiscal year 2006-2007 based on the recording of its revenues and expenses on a full accrual accounting basis according to Canadian Generally Accepted Accounting Principles (GAAP) for the private sector. The following tables give details on OSFI’s spending compared to plan as detailed in the 2006-2007 Report on Plans and Priorities.

Further details on OSFI’s finances are detailed in its Audited Financial Statements, which are published in OSFI’s Annual Report. OSFI’s annual reports can be accessed on OSFI’s web site under About OSFI/ Reports/ Annual Reports.

NOTE: OSFI operates on an accrual basis and the following tables are reported on a modified cash basis, hence there are differences between the audited financial statements and the following tables. Typically the differences result from treatment of capital expenditures and accounts receivable.

Table 1: Comparison of Planned to Actual Spending

OSFI has four program activities: (1) Regulation and Supervision of Federally Regulated Financial Institutions; (2) Regulation and Supervision of Federally Regulated Private Pension Plans; (3) International Assistance; and (4) Office of the Chief Actuary. The table below provides a comparison of OSFI’s 2006-2007 planned versus actual spending by program activity, and a comparison to actual spending in the two previous fiscal years.

The amounts shown reflect net spending: total expenditures less total revenue. As OSFI must fully recover its expenditures or costs for all programs other than the Office of the Chief Actuary, the planned spending is zero on a modified cash basis. OSFI fully recovered its costs on an accrual basis as shown in its audited financial statements; however differences between the accounting methodologies give rise to fluctuations from year to year in spending levels. The table below illustrates such fluctuations in actual spending.

On the modified cash basis of accounting, OSFI had a greater outflow of funds than inflows during 2006-2007. The net budgetary expenditures for the year were $5,304 thousand, which was $4,536 thousand over the plan as a result of three main factors which affected all four program activities: accounts receivable ($5,500 thousand) and higher capital expenditures ($1,551 thousand), offset by lower than planned human resources costs due to vacancies.

|

($ thousands) |

|

|

2006–2007 |

|||

|

Main |

Planned |

Total |

Actual |

|||

|

(1) Regulation and Supervision of Federally Regulated Financial Institutions |

7,811 |

(6,757) |

- |

- |

- |

4,150 |

|

(2) Regulation and Supervision of Federally Regulated Private Pension Plans |

1,773 |

1,584 |

- |

- |

- |

447 |

|

(3) International Assistance |

609 |

380 |

- |

- |

- |

273 |

|

(4) Office of the Chief Actuary |

1,310 |

32 |

768 |

768 |

768 |

434 |

|

Total |

11,504 |

(4,761) |

768 |

768 |

768 |

5,304 |

|

Less: Non-Respendable revenues |

365 |

805 |

- |

- |

- |

227 |

|

Plus: Cost of services received without charge * |

204 |

438 |

- |

- |

- |

658 |

|

Net Cost of Program |

11,343 |

(5,128) |

768 |

768 |

768 |

5,735 |

|

Average Full-Time Equivalents |

453 |

434 |

459 |

|

|

456 |

* See Table 4: Services Received Without Charge

Table 2: Use of Resources by Program Activity

The table below shows a comparison of OSFI’s 2006-2007 planned versus actual spending by program activity. As revenue is recorded based on the amounts of money received from bills paid, rather than the amount that was actually billed, OSFI’s actual spending is higher than planned mainly due to the amounts owing for uncollected receivables.

|

Program |

2006-2007 ($ thousands) |

|||||

|

Operating |

Capital |

Grants and |

Total: Gross Budgetary Expenditures |

Less: |

Total: Net Budgetary |

|

|

(1) Regulation and Supervision of Federally Regulated Financial Institutions |

|

|

|

|

|

|

|

Main Estimates |

69,481 |

3,696 |

- |

73,177 |

73,177 |

- |

|

Planned Spending |

69,481 |

3,696 |

- |

73,177 |

73,177 |

- |

|

Total Authorities |

69,481 |

3,696 |

- |

73,177 |

73,177 |

- |

|

Actual Spending |

66,773 |

5,588 |

- |

72,361 |

68,211 |

4,150 |

|

(2) Regulation and Supervision of Federally Regulated Private Pension Plans |

|

|

|

|

|

|

|

Main Estimates |

4,938 |

246 |

- |

5,184 |

5,184 |

- |

|

Planned Spending |

4,938 |

246 |

- |

5,184 |

5,184 |

- |

|

Total Authorities |

4,938 |

246 |

- |

5,184 |

5,184 |

- |

|

Actual Spending |

5,728 |

- |

- |

5,728 |

5,281 |

447 |

|

(3) International Assistance |

|

|

|

|

|

|

|

Main Estimates |

1,895 |

63 |

- |

1,958 |

1,958 |

- |

|

Planned Spending |

1,895 |

63 |

- |

1,958 |

1,958 |

- |

|

Total Authorities |

1,895 |

63 |

- |

1,958 |

1,958 |

- |

|

Actual Spending |

1,976 |

- |

- |

1,976 |

1,703 |

273 |

|

(4) Office of the Chief Actuary |

|

|

|

|

|

|

|

Main Estimates |

4,682 |

32 |

- |

4,714 |

3,946 |

768 |

|

Planned Spending |

4,682 |

32 |

- |

4,714 |

3,946 |

768 |

|

Total Authorities |

4,695 |

32 |

- |

4,727 |

3,946 |

781 |

|

Actual Spending |

4,498 |

0 |

- |

4,498 |

4,064 |

434 |

|

TOTAL |

|

|

|

|

|

|

|

Main Estimates |

80,996 |

4,037 |

- |

85,033 |

84,265 |

768 |

|

Planned Spending |

80,996 |

4,037 |

- |

85,033 |

84,265 |

768 |

|

Total Authorities |

81,009 |

4,037 |

- |

85,046 |

84,265 |

781 |

|

Actual Spending |

78,975 |

5,588 |

- |

84,563 |

79,259 |

5,304 |

Table 3: Voted and Statutory Items

This table summarizes Parliament’s voted appropriations, or funds, to OSFI. OSFI receives an annual parliamentary appropriation pursuant to section 16 of the OSFI Act to support its mandate relating to the Office of the Chief Actuary.

In this fiscal year, OSFI was granted $781 thousand (2006: $755 thousand). This parliamentary appropriation is to defray the expenses associated with the provision of actuarial services to various public sector employee pension and insurance plans, including the Canadian Armed Forces, the Royal Canadian Mounted Police, the federally appointed judges and Members of Parliament.

Please note that the appropriations are calculated using a modified cash basis of accounting rather than full accrual accounting. This difference will give rise to variances between OSFI’s use of funds and appropriated funds.

|

Vote or |

Truncated Vote |

2006–2007 |

|||

|

Main |

Planned |

Total |

Total Actual |

||

|

35 |

Operating expenditures |

768 |

768 |

781 |

433 |

|

|

Total |

768 |

768 |

781 |

433 |

Table 4: Services Received Without Charge

|

($ thousands) |

2006–2007 |

|

Financial audit performed by the Office of the Auditor General |

99 |

|

Salary and associated expenditures of legal services from the Department of Justice Canada |

559 |

|

Total Services Received Without Charge |

658 |

Table 5: Sources of Respendable and Non-Respendable Revenues

This table identifies revenues by program activity received from sources both internal and external to the government. For 2006-2007, OSFI’s total revenues were $79.3 million, including non-respendable revenue of $227 thousand for the collection of Late and Erroneous Filing Penalties 1. The respendable revenues are largely comprised of asset- or premium - based industry assessments, surcharge assessments to staged institutions, and user fees for specific services related to Regulatory Approvals. The majority of cost-recovered services in Regulation and Supervision of Federally Regulated Financial Institutions relates to implementing the internal ratings-based approach of the New Basel Capital Accord.

1 On April 1, 2002, OSFI began collecting late and erroneous filing penalties from financial institutions that submit late and/or erroneous financial and non-financial returns. On August 31, 2005, the Administrative Monetary Penalties (OSFI) Regulations came into force. These Regulations implement an administrative monetary penalties regime pursuant to which the Superintendent can impose penalties in respect of specific violations, as designated in the schedule to the Regulations. These Regulations incorporate the late and erroneous filing penalty regime and replace the Filing Penalties (OSFI) Regulations, which came into force on April 1, 2002. These penalties are billed quarterly, collected and remitted to the Consolidated Revenue Fund. By regulation, OSFI cannot use these funds, which are recorded as non-respendable revenue, to reduce the amount that it assesses the industry in respect of its operating costs.

Respendable Revenues

The decrease in respendable revenues in 2006-2007 from the previous year is largely due to the collection of outstanding accounts receivable pertaining to 2004-2005 during 2005-2006.

|

($ thousands) |

Actual |

Actual |

2006-2007 |

|||

|

Main |

Planned |

Total |

Actual |

|||

|

(1) Regulation and Supervision of Federally Regulated Financial Institutions |

|

|

|

|

|

|

|

Base Assessments |

54,616 |

67,726 |

64,733 |

64,733 |

64,733 |

60,375 |

|

User Fees and Charges |

6,677 |

6,268 |

5,019 |

5,019 |

5,019 |

3,588 |

|

Cost-Recovered Services |

3,574 |

3,515 |

3,425 |

3,425 |

3,425 |

4,248 |

|

(2) Regulation and Supervision of Federally Regulated Private Pension Plans |

|

|

|

|

|

|

|

Pension Plan Fees |

3,411 |

3,809 |

5,184 |

5,184 |

5,184 |

5,281 |

|

(3) International Assistance |

|

|

|

|

|

|

|

Base Assessments |

- |

- |

483 |

483 |

483 |

93 |

|

Cost-Recovered Services |

1,172 |

1,378 |

1,475 |

1,475 |

1,475 |

1,610 |

|

(4) Office of the Chief Actuary |

|

|

|

|

|

|

|

User Fees and Charges |

63 |

96 |

35 |

35 |

35 |

145 |

|

Cost-Recovered Services |

2,524 |

3,993 |

3,911 |

3,911 |

3,911 |

3,919 |

|

Total Respendable Revenues |

72,037 |

86,784 |

84,265 |

84,265 |

84,265 |

79,259 |

Non-Respendable Revenues

|

($ thousands) |

Actual |

Actual |

2006-2007 |

|||

|

Main |

Planned |

Total |

Actual |

|||

|

Regulation and Supervision of Federally Regulated Financial Institutions |

||||||

|

Filing Penalties |

365 |

805 |

425 |

425 |

425 |

227 |

|

Total Non-Respendable Revenues |

365 |

805 |

425 |

425 |

425 |

227 |

The non-respendable revenues are all related to late and erroneous filing penalties as described in Section III.2.

Table 6: Resource Requirements by Sector Level

Table 6 identifies the distribution of resources by sector, by program activity.

|

2006-2007 ($ thousands) |

|||||

|

Organization |

Regulation and Supervision of Federally Regulated Financial Institutions |

Regulation and Supervision of Federally Regulated Private Pension Plans |

International Assistance |

Office of the Chief Actuary |

Total |

|

Supervision Sector |

|

|

|

|

|

|

Main Estimates |

50,271 |

|

|

|

50,271 |

|

Planned Spending |

50,271 |

|

|

|

50,271 |

|

Total Authorities |

50,271 |

|

|

|

50,271 |

|

Actual Spending |

50,616 |

|

|

|

50,616 |

|

Regulation Sector |

|

|

|

|

|

|

Main Estimates |

22,906 |

5,184 |

1,958 |

|

30,048 |

|

Planned Spending |

22,906 |

5,184 |

1,958 |

|

30,048 |

|

Total Authorities |

22,906 |

5,184 |

1,958 |

|

30,048 |

|

Actual Spending |

21,745 |

5,728 |

1,976 |

|

29,449 |

|

Office Chief Actuary Sector |

|

|

|

|

|

|

Main Estimates |

|

|

|

4,714 |

4,714 |

|

Planned Spending |

|

|

|

4,714 |

4,714 |

|

Total Authorities |

|

|

|

4,727 |

4,727 |

|

Actual Spending |

|

|

|

4,498 |

4,498 |

|

TOTAL |

|

|

|

|

|

|

Main Estimates |

73,177 |

5,184 |

1,958 |

4,714 |

85,033 |

|

Planned Spending |

73,177 |

5,184 |

1,958 |

4,714 |

85,033 |

|

Total Authorities |

73,177 |

5,184 |

1,958 |

4,727 |

85,046 |

|

Actual Spending |

72,361 |

5,728 |

1,976 |

4,498 |

84,563 |

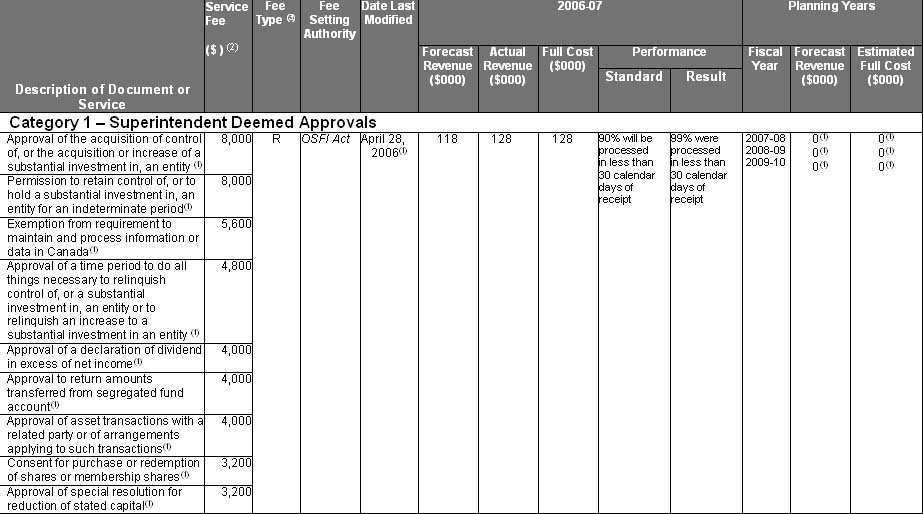

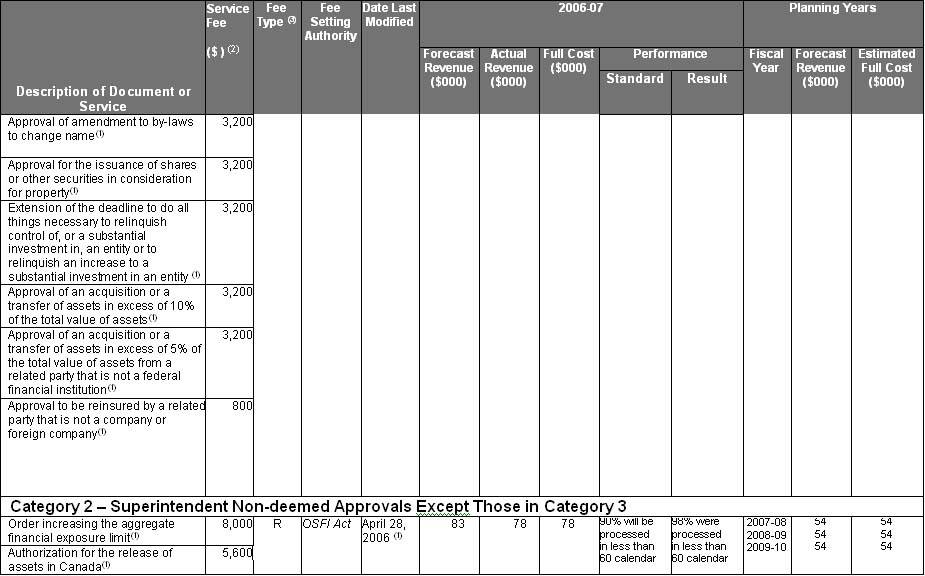

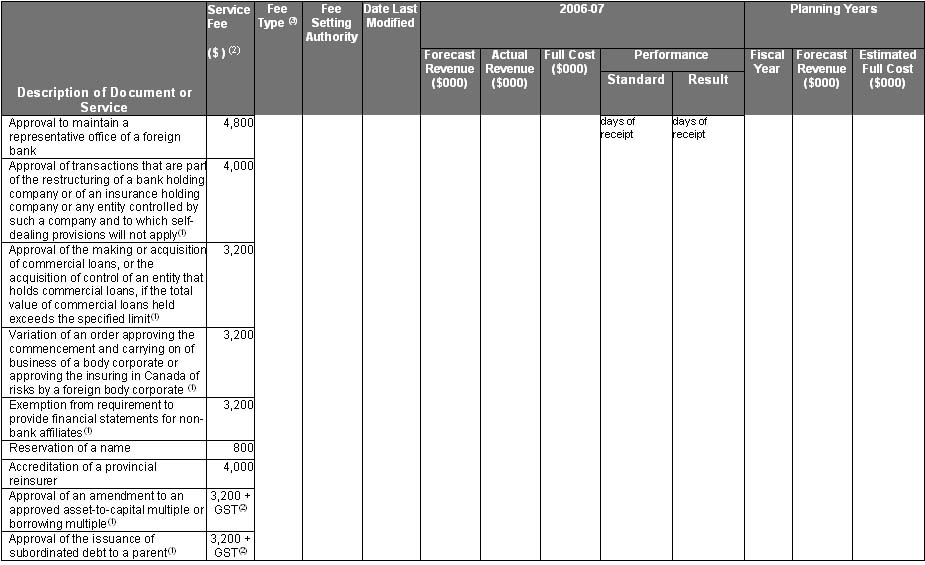

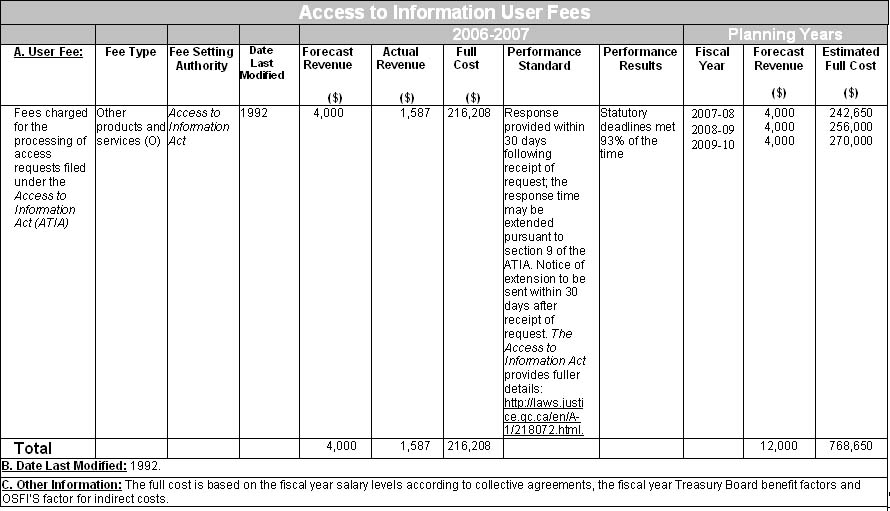

Table 7A: User Fees Act

User Fees

OSFI currently funds its annual operating costs primarily through base assessments on financial institutions (based on the size of the institution) and private pension plans and, to a lesser extent, through user fees and surcharges paid by financial institutions and other users of OSFI’s services. Any change in user fee revenue will not impact OSFI’s total revenues, just the proportion derived from base assessments versus user fees.

The assessment of costs to individual institutions for OSFI’s main activities of supervision, approvals and rule making is determined in several ways. In general, the system is designed to allocate costs to institutions based on the approximate amount of time spent supervising and regulating the institutions. The time spent supervising and regulating is measured both in terms of size and also an evaluation of the level of risk within each institution. As a result, well-managed, lower-risk institutions bore a smaller proportionate share of OSFI’s costs in 2006-2007.

The user pay system for approvals came into effect on January 1, 1999 and has undergone a number of revisions since that time. As the user fees imposed by OSFI on certain approvals are included in regulations, any amendments to these regulations require consultation before final approval is given by the Governor-in-Council. OSFI has sent draft copies of all proposed or amended regulations, along with supporting explanatory letters, to the various industry associations that represent the federal financial institutions. Following comments received from these associations, amendments may be made to the proposed regulations. In addition, proposed or amended regulations are published in the Canada Gazette to solicit further comments and also published in final form upon approval by the Governor-in-Council.

At the time of implementation of the user fees and periodically since, OSFI reviewed the user fees charged by regulatory bodies in other countries for similar types of approvals (particularly the Office of the Comptroller of the Currency in the United States and the Financial Services Authority in the United Kingdom) to ensure the fees charged in Canada are reasonable compared to other countries. In addition, OSFI has reviewed fees charged by other federal government departments such as Industry Canada, Canada Deposit Insurance Corporation and Canada Revenue Agency to ensure fees and/or rates are reasonable.

Of note, is that regulations became effective April 28, 2006 that eliminated all user fees except those that are paid by non-Federally Regulated Financial Institutions (non-FRFIs), such as new applicants and foreign banks planning to carry on certain activities in Canada, and those that are charged for rulings, accreditations, interpretations, capital quality confirmations, and copies of corporate documents, which can be time consuming to process and are sometimes outside OSFI’s core businesses. These regulations reduced the number of service charges from 51 to 14. The regulations eliminated the majority of user fees, recognizing that the fees currently do not significantly redistribute OSFI’s costs amongst FRFIs and that the fees do not recover a meaningful percentage of OSFI’s annual costs. In other words, prior to the April 2006 changes, user fees recovered less than four per cent of OSFI’s total regulatory and supervisory costs charged to institutions, and eliminating the majority of service charges has little impact on the total amounts individual FRFIs pay. Charges to non-FRFIs (e.g., new applicants and foreign banks) and for rulings, accreditations, interpretations, capital quality confirmations, and copies of corporate documents are being retained on the basis that charging for these services (which are not part of OSFI’s normal course of regulation and supervision and are often resource intensive to process) represents a more equitable approach to recovering OSFI’s costs associated with those services than would charging these services directly to FRFIs through base assessments. The performance standards associated with the service charges that have been eliminated will be maintained.

The current consolidated table of service charges can be found on OSFI’s Web site at:

www.osfi-bsif.gc.ca/app/DocRepository/1/eng/guides/fees/UserPayTable_13082004_e.pdf

User Fee Act

On March 31, 2004, Bill C-212 An Act respecting user fees (“the Act”) received Royal Assent and came into force on the same day. The Act requires that before a regulating authority fixes, increases, expands the application of, or increases the duration of, a user fee promulgated subsequent to March 31, 2004, it must consult with stakeholders; establish performance standards comparable to those established by other countries with which a comparison is relevant; establish an independent advisory panel to report recommendations for resolving complaints on the proposed user fees; and table, through their responsible Minister, a user fee proposal in each House of Parliament. Further, the Act requires that where user fees are promulgated subsequent to March 31, 2004, there be a proportional fee reduction (to a maximum of 50% of the fee) where performance standards established under the Act are not met by a percentage greater than 10%.

The Act also requires the tabling of an annual report before each House of Parliament by December 31 each year, reporting:

- all user fees in effect, and

- the performance standards established under the Act and actual performance levels that have been reached in respect of the performance standards for user fees promulgated subsequent to March 31, 2004.

Table 7A is a standard reporting form developed to meet the reporting requirements of the Act. As noted above, OSFI first introduced user fees for specific regulatory approvals and certain services prior to the promulgation of the Act. As such, the performance standards developed were not tabled in the Houses of Parliament as would have been required if the user fees had been promulgated subsequent to March 31, 2004.

However, in developing the performance standards, OSFI met the requirements of the Act by analyzing performance standards established by other relevant prudential supervisors in foreign jurisdictions (particularly the Office of the Comptroller of the Currency in the United States and the Financial Services Authority in the United Kingdom) and developed comparable performance standards in consultation with key paying and non-paying stakeholders. Performance against the standards for all categories has been monitored in fiscal 2006-2007.

A detailed description of OSFI’s performance standards is available on OSFI’s Web site at:

www.osfi-bsif.gc.ca/app/DocRepository/1/eng/guides/fees/standards_e.pdf

Table 7-A

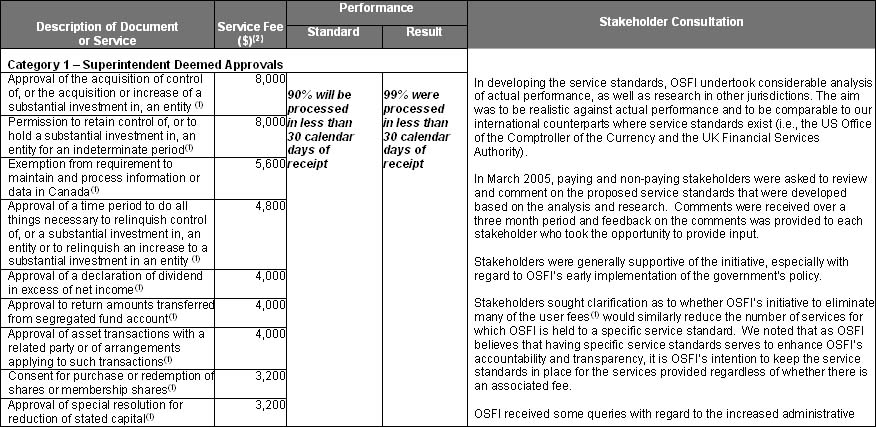

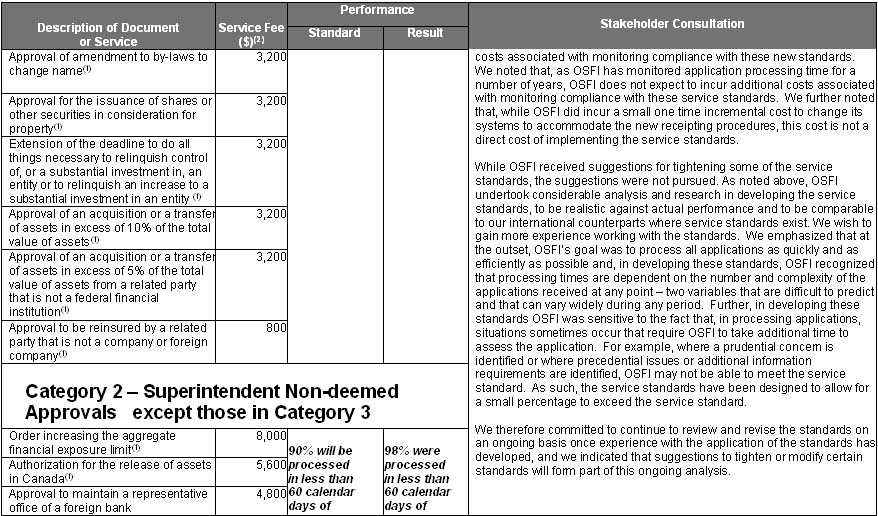

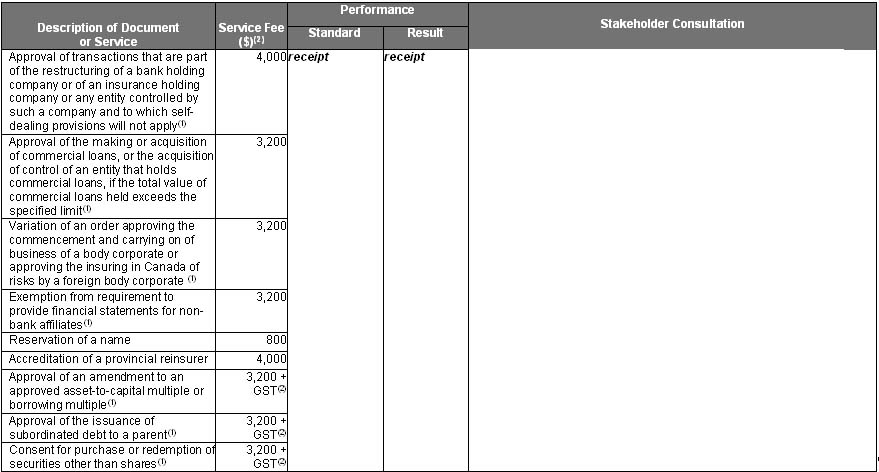

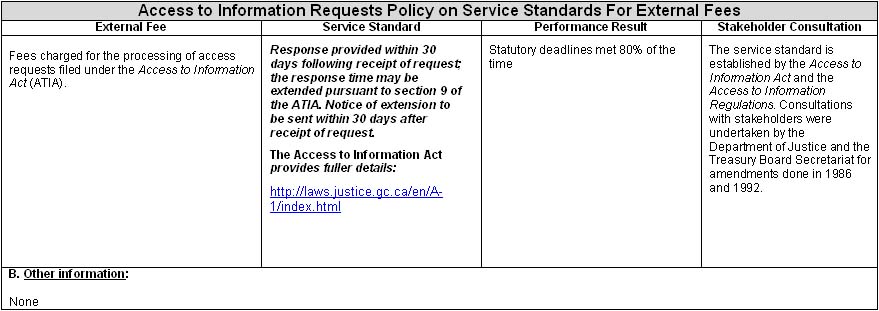

Table 7B: Policy on Service Standards for External Fees

In order to enhance its accountability and transparency, OSFI has developed performance measures. As part of this process, service standards have been developed for services provided by OSFI for which a fee is or has been charged. OSFI’s initiative is part of the Government of Canada’s commitment toward enhancing the fundamental principles of parliamentary oversight, strengthened accountability, and stakeholder consultations in the development and management of user charges.

These service standards comply with the Government of Canada’s November 29, 2004 “Policy on Service Standards for External Fees” (the Policy). (Note: The term “service standards” is used in the Policy and the term “performance standards” is used in the User Fee Act; these terms are interchangeable for OSFI’s purposes.) This Policy required federal departments and agencies to develop service standards for external fees that are measurable and relevant for paying stakeholders, and required that the standards and a summary of stakeholder feedback from the consultation be published in the annual Departmental Performance Report (DPR) no later than the 2005-2006 DPR.These service standards apply only to services or fees that incur user fees or used to incur fees prior to amendments to these regulations, as per the Charges for Services Provided by the Office of the Superintendent of Financial Institutions Regulations 2002. These requirements do not apply where OSFI and the paying stakeholder have negotiated a contract or formal agreement stipulating the service standard (or some equivalent provision), nor do they apply to OSFI’s annual assessments.

Table 7-B

Table 7-B is a standard reporting form developed to meet the reporting requirements of the Policy. As the requirements of the User Fee Act and the Policy are very similar, much of the information contained in this table is also found in table 7-A.

Table 8: Progress against OSFI’s Regulatory Plan

OSFI develops proposals for new regulations or changes to existing regulations consistent with its mandate. The Minister of Finance, based on advice from OSFI, can recommend new regulations or regulatory changes to the Governor in Council, who ultimately approves new regulations and or regulatory changes.

The table provides a summary of the performance of OSFI's Regulatory Initiatives as outlined in the 2006-2007 RPP as well as additional items that were not anticipated at the time the RPP was written (indicated by NEW).

|

Legislative Acts and/or Regulations |

Expected Results |

Performance Measurement Criteria |

Achieved Results |

|

Order Amending the Schedule to the Insurance Companies Act (Classes of Insurance) |

The Schedule to the Insurance Companies Act is being revised to harmonize the federal, provincial and territorial classes of insurance. |

Harmonizing the classes will reduce the number of classes from over 50 to 17 and will reduce administrative burden and cost to insurers. |

The revised Schedule came into force on June 23, 2006. |

|

Regulations Amending the Charges for Services Provided by the Office of the Superintendent of Financial Institutions Regulations 2002 |

The amendments will eliminate all service charges except (i) charges paid by non- federally regulated financial institutions, (e.g., new entrants); and (ii) charges paid for rulings, accreditations, interpretations, capital quality confirmations, and copies of corporate documents. |

The regulations will reduce the number of service charges from 52 to 14 and will reduce costs associated with administering the service charges. |

The regulations came into force on April 28, 2006. |

|

Regulations Amending the Investment Limits Regulations |

The regulations are being reviewed to determine (i) whether the investment limit for property and casualty companies adequately considers excess assets; and (ii) whether certain investments made by life companies and deposit-taking institutions for hedging purposes should be exempt from the equity investments limits. |

Federally regulated financial institutions experience increased flexibility under the investment limits regime. |

Commenced preliminary internal analysis and consultations with stakeholders. Developing regulatory proposal for legal examination by the Department of Justice. |

|

Regulations Amending the Reinsurance (Canadian Companies) Regulations and the Reinsurance (Foreign Companies) Regulations |

The key amendments under consideration will clarify that the regulations apply to life insurance companies that write accident and sickness insurance and that all of the premium income (not only the accident and sickness premium income) should be included in the denominator for purposes of determining the reinsurance limit. |

Industry appropriately interprets and applies reinsurance regulations. |

Further consideration of this proposal is required in light of certain legislative amendments included in Bill C-37. |

|

Solvency Funding Relief Regulations |

The regulations will provide federal pension plans with temporary relief from solvency funding pressures, allowing them to choose among a number of options for amortizing their solvency funding deficits over five years or ten years, subject to certain conditions. While still requiring that solvency deficits be funded, the measures give pension plan sponsors more flexibility to balance the financial requirements of their pension plans with the need to invest in their business operations. |

Federal pension plan sponsors experience greater funding flexibility without compromising protections and interests of plan members and beneficiaries. |

The regulations were published in the Canada Gazette Part II on November 15, 2006. |

|

Pension Benefits Standards Act, 1985 and Regulations Amending the Pension Benefits Standards Regulations, 1985

|

These amendments would, among other things: (i) permit letters of credit with certain characteristics to be recognized as pension assets in solvency valuations; (ii) void amendments to a pension plan if the solvency ratio of the plan falls below the prescribed level; (iii) require employers to pay into the plan, upon termination of the plan, the amount necessary to fund the full benefits promised to plan members; and (iv) provide funding flexibility to pension plans whose sponsor is restructuring under the CCAA, BIA, or WURA. |

Performance measurement criteria to be developed. |

These amendments are being considered in the context of the Department of Finance review of the legislative and regulatory framework for defined benefit pension plans. The government continues to monitor defined benefit pension plans and analyze the submissions from an earlier consultation. |

|

NEW Regulations Amending the Property and Casualty Companies Borrowing Regulations |

To recognize the unique nature of the mortgage insurance industry, the amendment is expected to increase, from 2% to 10%, the prescribed percentage of debt and stated capital to total assets. |

Mono-line mortgage insurance companies experience increased flexibility to support business growth. |

Industry consultations have taken place. The regulatory proposal is under review by the Department of Finance as part of the pre-publication process. |

|

NEW Exclusion from the list of Subsidiaries Regulations |

The proposed regulations would permit federally regulated financial institutions to omit certain subsidiaries from the list of subsidiaries required for the purposes of annual statement disclosure. |

The regulations will reduce regulatory reporting burden and align federal reporting requirements more closely with provincial securities legislation. |

Draft regulations were submitted to the Department of Justice for legal examination. |

|

NEW Regulations Amending all Supervisory Information Regulations |

T he regulations are being revised to provide for greater consistency with provincial legislation by permitting auditors of financial institutions to disclose supervisory information to the Canadian Public Accountability Board for purposes related to the oversight of audits of the financial statements of the financial institution or any of its affiliates. |

Federal regulations will align more closely with provincial legislation. The Canadian Public Accountability Board will be able to review the audit files of financial institution auditors. |

Draft regulations were submitted to the Department of Justice for legal examination. |

Table 9: Financial Statements

OSFI’s Audited Financial Statements are published each year in OSFI’s Annual Report, which is tabled in Parliament in the fall.

The 2006-2007 Annual Report can be found on OSFI’s Web site under About OSFI / Reports / Annual Reports.

Table 10: Internal Audits or Evaluations

OSFI’s internal Audit and Consulting Services Group conducts regular internal audits as per its audit plan and posts the results of these audits on its Web site under About OSFI / Reports / Internal Audit Reports. Management’s response to any identified issues is contained in each report.

Four audit reports were published during 2006-2007. A brief summary of the findings is provided in the table below. The complete reports, along with management’s response are available on OSFI’s Web site under About OSFI/ Reports/ Internal Audit Reports.

|

Internal Audit : Capital Precedents Framework Review Date Published:2006-12-15 |

|

The objectives of this review were to:

The evaluation elements included operating environment, objective setting, risk management, process and control activities, information and communication, and monitoring and reporting. The review concluded that the current policies, practices and procedures for identifying and processing precedential capital proposals incorporate important elements of a comprehensive framework and that there are key elements that should be further incorporated into a formal framework including roles and responsibilities in the capital precedent work, factors taken into account in analyzing and assessing capital precedent proposals, standards for documenting and filing information supporting decisions regarding capital precedents and formal reporting to senior management on capital precedents function. |

|

In response to the review, the Capital Accounting and Research Division (CARD) took the following action:

For more details on the above audit report, including management’s response, please see the hyperlink below: www.osfi-bsif.gc.ca/app/DocRepository/1/eng/reports/osfi/cap_prec_e.pdf |

|

Internal Audit : Private Pension Plans Division – A Review of Planning Activities and Processes and 2006-07 Business and Priorities Plans Date Published:2006-12-15 |

|

The objectives of this review were to review and comment on:

The evaluation elements included: governance, objective setting, operating environment, information and inputs, risk management, planning process, and communications. The review concluded that the Division’s planning activities and processes incorporate many elements of a comprehensive planning framework in a satisfactory manner. The areas identified for improvement were strengthening the identification and assessment of capacity volumes and resource requirements, broadening the planning to a multi-year period, and summarizing the Division’s plans and priorities for communication. |

|

In response to the review, the Private Pension Plan Division (PPPD) took the following actions:

For more details on the above audit report, including management’s response please see the hyperlink below: www.osfi-bsif.gc.ca/app/DocRepository/1/eng/reports/osfi/pppd_plan_e.pdf |

|

Internal Audit: Financial Conglomerates Group (FCG) Review Date Published:2006-06-30 |

|

The objectives of this review were to:

The review concluded that for the two institutions reviewed, documentation could be improved, and an informed reader would be unable to follow the facts, analyses and judgments through to the conclusions and would, therefore, not be in a position to accept the assessments and rating made. Key observations and recommendations were made in the areas of identifying significant activities, assessing significant activities and oversight functions, using cross-system reviews, and development of supervisory strategies and plans. |

|

In response to the review, the Financial Conglomerates Division (FCG) took the following actions. The issues from the audit were categorized into the five workstreams listed below. For each workstream, action plans have been developed in conjunction with the Practices Department. Work has been ongoing since October 2006.

Workstreams 2, 3 and 4 have been completed as per the original schedule. Workstream 1 is in process (50% complete), and is expected to be completed by the end of August 2007 (also on schedule). Workstream 5 was scheduled as the last work effort because it related to assuring quality in all of the other efforts. It is assessed as 10% complete with an original completion date of November 30, 2007. Given that there is a Supervision-wide effort on Quality Assurance in process, and given that revised guidance is being developed, some portion of this effort might go beyond the original time lines, but a material portion of the work can be completed on time. For more details on the above audit report, including management’s response please see the hyperlink below: www.osfi-bsif.gc.ca/app/DocRepository/1/eng/reports/osfi/audit_fcg_e.pdf |

|

Internal Audit : Audit & Consulting Services – Review of OSFI’s Training and Development Framework(T&D) Date Published:2006-06-22 |

|

The objectives of this review were to assess the adequacy of OSFI’s current T&D framework and processes and to assess the degree to which the T&D framework and processes support an alignment between T&D programs and OSFI’s strategic and operational requirements. The evaluation elements included: the accountability framework, planning for T&D needs, and monitoring of outcomes. The review concluded that overall the T&D framework is satisfactory. More specifically, the accountability framework was considered strong and had no related recommendations, while the planning for T&D needs and the monitoring of outcomes were rates as satisfactory, with three related recommendations for improvement. |

|

In response to the audit, the Professional Development and Training Division took the following action:

For more details on the above audit report, including management’s response please see the hyperlink below: |

The Audit Committee approved the 2007-2008 Internal Audit Plan in Fiscal Year 2006-2007 Q4, and it is available on OSFI’s Web site under About OSFI/ Reports/ Internal Audit Reports

Table 11: Travel Policies

OSFI is a separate employer. In order to meet the requirements of its mandate, OSFI has elected to implement a travel policy specifically for OSFI. The OSFI policy is virtually identical to the Treasury Board Travel Directive, with the exception noted.

Comparison to the Treasury Board of Canada Special Travel Authorities as applied to OSFI’s executive group

OSFI takes a more restrictive approach than the TB Special Travel Authorities with respect to business class airfare for its Executive group of employees.

Comparison to the Treasury Board of Canada Travel Directive, Rates and Allowances as applied to all OSFI employees

|

OSFI Travel policy of the Office of the Superintendent of Financial Institutions |

|

Authority: Under section 13 of the OSFI Act, the Superintendent is authorized to exercise the powers and perform the functions of the Treasury Board that relate to human resources management within the meaning of the Financial Administration Act, including the determination of terms and conditions of employment and the responsibility for employer and employee relations. |

|

Coverage: The OSFI Travel Policy applies to all employees, including casual, term and indeterminate. |

|

Principal difference(s) in policy provisions: The TB Travel Directive allows for Business Class air travel for trips exceeding 9 hours. OSFI’s Travel Policy states that non-executives may be authorized to upgrade to Business/Executive Class air travel in accordance with the following principles:

|

|

Principal financial implications of the differences: For 2006-2007 the estimated net cost of this difference in policy is approximately $37 thousand, based on 31 trips at an average additional cost of $1.2 thousand per trip. |

OSFI effectively monitors its travel costs through communications with all employees, directed communications on policy interpretation and guidance, direct communications with managers on travel claim issues, monthly monitoring against budget, and semi-annual detailed analyses of travel expenses.