Common menu bar links

Breadcrumb Trail

ARCHIVED - Patented Medicine Prices Review Board Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

SECTION II - ANALYSIS OF THE PROGRAM ACTIVITY BY STRATEGIC OUTCOME

Analysis by Program Activity

Strategic Outcome:

Prices charged by manufacturers of patented medicines sold in Canada are not excessive.

Program Activity Name:

Patented Medicine Prices Review

The PMPRB has one program - Patented Medicine Prices Review. This program has two priorities:

-

compliance and enforcement

-

report on pharmaceutical trends

The objectives of the program are to protect consumer interests and contribute to Canadian health care.

Financial Resources ($ millions):

| 2006-2007 | ||

| Planned Spending | Authorities | Actual Spending |

| $6,512.0 | $11,690.0 | $7,365.3 |

Human Resources:

| 2006-2007 | ||

| Planned | Actual | Difference |

| 48 | 43 | 5 |

Priority 1: Compliance and Enforcement

Financial Resources ($ thousands):

| 2006-2007 | ||

| Planned Spending | Authorities | Actual Spending |

| $3,107.0 | $8,225.1 | $5,551.9 |

Human Resources:

| 2006-2007 | ||

| Planned | Actual | Difference |

| 25 | 30 | (5) |

Price Reviews

The PMPRB reviews pricing information filed pursuant to the Patented Medicines Regulations, 1994 (Regulations) under the Patent Act (Act) for all new and existing patented medicines sold in Canada, both prescription and non-prescription, to ensure that the prices charged by patentees are not excessive - i.e., that they comply with the Excessive Price Guidelines (Guidelines) established by the Board.4

These Guidelines are based on the price determination factors in section 85 of the Act and were developed by the Board in consultation with stakeholders, including the provincial and territorial Ministers of Health, consumer groups and the pharmaceutical industry.

The price reviewed by the PMPRB is that charged by a patentee at the "factory gate". This encompasses the prices charged in Canada by patentees for both prescription and non-prescription patented drugs, for human and veterinary use, to each class of customer5 in each province and territory.

In summary, the Guidelines provide that:

-

New medicines are classified as either breakthrough/substantial improvement, or moderate, little or no therapeutic advantage over comparable medicines, or are new DINs of an existing or comparable dosage form of an existing medicine (sometimes referred to as line extensions);

-

Prices for new breakthrough patented drug products and those that bring a substantial improvement are generally limited to the median of the prices charged for the same drug in the comparator countries listed in the Regulations (France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States);

-

Prices for new patented drug products that offer moderate, little or no therapeutic advantage over comparable medicines are limited to the highest price of comparable existing drugs used to treat the same disease or symptoms;

-

Prices for new patented drug products that are line extensions of an existing medicine must bear a reasonable relationship to other strengths of the same or comparable dosage forms already on the Canadian market;

-

After introduction, price increases are limited to changes in the Consumer Price Index (CPI); and

-

The price of a patented drug product in Canada can never exceed the highest price for the same drug in the foreign countries listed in the Regulations.

The expected result of the price review program is that all patentees' prices for new and existing patented medicines sold in Canada are reviewed in a timely and transparent manner, and in accordance with the Board's Excessive Price Guidelines.

The program activity supports the Government's priority of healthy Canadians by ensuring that Canadians have access to patented pharmaceutical products at prices that are not excessive.

The indicators that show that the PMPRB is achieving its expected results, and in turn contributing to its strategic outcome, are as follows:

-

The vast majority of prices of patented medicines sold in Canada are within the Guidelines;

-

The vast majority of price increases for existing patented medicines are not higher than changes in the CPI;

-

Enforcement measures are taken to correct prices that exceed the Guidelines; and

-

Canadian prices of patented drugs are, on average, below the median of international prices in the foreign countries listed in the Regulations.

Price Review of New Patented Drugs for Human Use in 2006

Ninety-nine new patented drugs products6 (DINs) were introduced for human use in 2006. Of these, 29 medicines were new active substances, representing 43 DINs. By March 31, 2007, the Board had reviewed 79 of the 99 introduced. Of those, 68 were considered to be within the Guidelines while 11 appeared to exceed the Guidelines and were subject to ongoing investigations. At March 31, 2007, of the original 99 new drug products, 20 DINs remained under review.

Price Review of Existing Patented Drugs for Human Use

A total of 1,082 existing patented drug products (or DINs) were sold during 2006.7 Of these

-

973 DINs (89.9%) were within the Guidelines

-

6 DINs were subject to investigations due to introductory pricing

- 2 were opened in 2004

- 4 were opened in 2005

-

59 DINs were subject to investigations due to price increase

- 2 were opened in 2003

- 16 were opened in 2005

- 41 were opened in 2006

-

27 DINs were, or are currently, the subject of hearings under section 83 of the Act (For additional information see Quasi-judicial Activities - Hearings, on page 24)

- 3 pertaining to Nicoderm (1999)

- 1 pertaining to Dovobet (2004)

- 6 pertaining to Adderall XR (2006)

- 3 pertaining to Risperdal Consta (2006)8

- 1 pertaining to Airomir (2006)9

- 1 pertaining to Copaxone (2006)

- 4 pertaining to Concerta (2006)

- 5 pertaining to Strattera (2007)

- 1 pertaining to Quadracel (2007)

- 1 pertaining to Pentacel (2007)

- 1 pertaining to Penlac (2007)

-

17 DINs were still under review.

A summary of the review, compliance and investigation status of the new and existing patented drug products for human use in 2006 is provided in Table 1 below.

Table 1

| Patented Drug Products (DINs) for Human Use Sold in 2006 - Status of Price Review as of March 31, 2007 | |||

| New Drugs Introduced in 2006 | Existing Drugs | Total | |

| Total | 99 | 1,082 | 1,181 |

| Within Guidelines | 68 | 973 | 1,041 |

| Under Review | 20 | 17 | 37 |

| Under Investigation | 11 | 65 | 76 |

| Notice of Hearing | - | 27 | 27 |

Update of the Review of Existing Patented Medicine Prices reported in the 2005-2006 Departmental Performance Report

Last year's Performance Report reported that, of the 969 existing patented drug products for human use sold in 2005, the prices of 22 were still under review. The results of those reviews concluded that: six DINs were within the Guidelines; ten DINs were priced at levels that appeared to exceed the Guidelines resulting in initiation of investigations; and six are still under review and included in the total figure of existing drugs under review reported in Table 1.

The PMPRB also reported in the 2005-2006 Departmental Performance Report that 37 DINs were under investigation. Of those, 11 investigations have been concluded; in eight cases the prices were ultimately found to be within the Guidelines. In three cases, VCUs were approved: Eloxatin (2 DINs), Hextend (1 DIN). (See Voluntary Compliance Undertakings on page 22.)

Patented Drugs for Veterinary Use

The Board has adopted a policy for the review of patented veterinary medicines that differs somewhat from that for human drugs. Board staff only reviews the introductory prices of new patented veterinary medicines according to the current Guidelines and determines whether or not the price is excessive. In subsequent years, veterinary drug prices are subject to formal review only when a complaint with significant evidence has been received. Thus, patentees are required to maintain price information but only file this with the PMPRB upon request following a complaint. No complaints were received in 2006. Last year we reported that all new drugs for veterinary use had been reviewed and found to be within the Guidelines.

One drug product, Paylean 20, sold by Elanco Animal Health Canada, a division of Eli Lilly and Company, was sold prior to being reported to the PMPRB in 2006. In 2006, in total, six new DINs were reported to the PMPRB and are under review. The summary reports of the price reviews of drug products for veterinary use are made available on the PMPRB's Web site under Regulatory; Patented Medicines; Reports on New Patented Drugs for Veterinary Use.

Enforcement Measures

Voluntary Compliance Undertakings

A Voluntary Compliance Undertaking (VCU) is a written undertaking by a patentee to adjust its price to conform to the Board's Guidelines and to pay back any excess revenue which was obtained as a result of the medicine being sold at an excessive price.

Under the Compliance and Enforcement Policy, patentees are given an opportunity to submit a VCU when Board Staff concludes, following an investigation, that the price at which the patentee has sold the patented medicine in Canada appears to have exceeded the Guidelines.

Approval of a VCU by the Chairperson is an alternative compliance mechanism to the commencement of formal proceedings through the issuance of a Notice of Hearing. Under the PMPRB's Compliance and Enforcement Policy, a VCU can also be submitted following the issuance of a Notice of Hearing. A VCU submitted at this point must be approved by the Board Panel struck for the purpose of the Hearing.

In 2006-2007, and up to the date of this report, VCUs were approved for five patented medicines:10

NuvaRing, Organon Canada Ltd.

NuvaRingTM is a new medicine for contraception. It is a flexible, soft, transparent, slow release vaginal ring.

On June 20, 2006, the Vice-Chairperson of the Board accepted a VCU for NuvaRingTM, submitted by Organon Canada Ltd. (Organon). Organon reduced the average transaction price of NuvaRingTM to a level at or below the 2006 maximum non-excessive (MNE) price of $13.6791. To offset excess revenues, as calculated by Board Staff, during the period January 17 to June 30, 2005, Organon made a payment to the Government of Canada in the amount of $115,584.93. The remaining excess revenues, for the period July 1, 2005, to June 30, 2006, were offset by the reduction of the price of another patented drug, RemeronRD 15mg, 30mg and 45mg. The price of NuvaRingTM remains under the PMPRB's jurisdiction until the patent expires in 2018.

Eloxatin, sanofi-aventis Canada Inc.

Eloxatin is used to treat patients with metastatic carcinoma of the colon or rectum whose disease has recurred or progressed during or within six months of completion of first-line therapy with the combination of bolus 5-FU/LV and irinotecan.

On July 14, 2006, the Chairperson of the Board accepted a VCU for Eloxatin. sanofi-aventis Canada Inc. (sanofi-aventis) agreed that the MNE prices for Eloxatin 50 mg and 100 mg were $430.9208 and $922.6750 at introduction and that they were $490.5901 and $1,030.0175 in 2006. In lieu of a price reduction for the 50 mg vial and in order to avoid a distortion in the pricing relationship between the 50 mg and 100 mg vials, sanofi-aventis agreed to maintain the price of Eloxatin 100 mg vial at $1,000.00 until such time as the MNE price for the 50 mg vial reached $500.00. In order to offset excess revenues received from the sale of Eloxatin, sanofi-aventis made payments totaling $1,767,078.84 to hospitals, cancer clinics and cancer boards that had previously purchased Eloxatin at excessive prices. The individual payments reflected the distribution of purchases of Eloxatin across Canada up to the end of March 31, 2006. The price of Eloxatin is under the PMPRB's jurisdiction at least until the end of the January to June 2019 reporting period.

Hextend, Hospira Healthcare Corporation

Hextend is indicated for the treatment of hypovolemia when plasma volume expansion is required.

The Chairperson approved a VCU for Hextend on July 14, 2006. Hospira Healthcare Corporation (Hospira) agreed that the 2004 and 2005 MNE prices of Hextend were $0.0858 per mL. It will ensure that the average transaction price of Hextend in all future periods does not exceed the MNE price - where the price in the U.S. in local currency terms remains unchanged or increases, the MNE shall be the lower of the CPI-adjusted price and $0.0858 per mL; and where the price in the U.S. in local currency terms decreases, the MNE shall be calculated using the new U.S. price in conducting the International Price Comparison (IPC) test as set out in the Guidelines. Hospira further agreed to ensure that the average transaction price for 2006 did not exceed the 2006 MNE price. Hospira offset excess revenues accrued between March 15 and December 31, 2004, by making a payment to the government of Canada in the amount of $8,823.60. The price of Hextend remains under the PMPRB's jurisdiction until the patent expires in 2014.

Airomir, 3M Canada Company

Airomir is used for the treatment of asthma, chronic bronchitis, and other breathing disorders.

In early 2007, the Board approved a VCU agreed to by 3M Canada Company (3M Canada) and Board Staff, for the payment in full of revenues, in the amount of $485,498.58, alleged by Board Staff to have been excessive, received from January 1, 2004 to December 29, 2006. By order of the Board Hearing Panel, the proceeding that was commenced by the issuance of a Notice of Hearing was concluded. On February 20, 2006, the Board had issued a Notice of Hearing pertaining to the allegations of Board Staff that Airomir had been, and was being, sold by 3M Canada at prices exceeding the Excessive Price Guidelines. The Board held a pre-hearing conference on May 19, 2006, and scheduled the hearing to commence on October 19. At the request of 3M Canada, the hearing was postponed. The Board was subsequently informed that 3M Canada had sold its marketing rights for Airomir to Graceway Canada (Graceway) on December 29, 2006. On May 9, 2007, the Board received a submission for the approval of a VCU to resolve all issues raised by the Notice of Hearing.

For purposes of the application of the Board's Excessive Price Guidelines, Graceway is the Canadian patentee of Airomir as of December 29, 2006. Under the Patented Medicines Regulations, 1994, Graceway is required to file pricing and sales information with the PMPRB twice a year, at regular intervals, as well as file its R&D expenditures annually.

Risperdal Consta, Janssen-Ortho Inc.

Risperdal Consta is used for the management of the manifestations of schizophrenia and related psychotic disorders.

In June 2007, the Board approved a VCU agreed to by Janssen-Ortho Inc. (Janssen-Ortho) and Board Staff. Janssen-Ortho agreed to the MNE prices for Risperdal Consta for 2004, 2005, 2006 and 2007 and to offset cumulative excess revenues by making a payment to Her Majesty in right of Canada in the amount of $4,386,172.99. On January 30, 2006, the Board had issued a Notice of Hearing in the matter of Janssen-Ortho and the medicine Risperdal Consta. The Hearing was held in 2006 and 2007. On July 4, 2007, the Board Hearing Panel accepted the VCU of Janssen-Ortho which concluded the proceeding.

Quasi-judicial Activities - Hearings

Under section 83 of the Act, the Board can hold a public hearing to determine whether a patented medicine is being or has been sold at an excessive price and, if it finds that the price is or was excessive, it may issue an Order to reduce the patentee's price and to offset the excess revenues.

From January 2006 to March 31, 2007 the Board has issued eight Notices of Hearing, which brought the total number of hearings to ten.11 This represented a significant increase in the number of Notices of Hearing compared to previous years. Indeed, by way of comparison this number is equal to the total of the Notices of Hearing issued by the Board going back to its inception in 1987 through to 2005. Of those previous eight, one hearing was completed, five were resolved through Voluntary Compliance Undertakings, and two others - Dovobet and Nicoderm - are ongoing as part of the ten hearings referred to above.

The reasons for an increase in hearings may involve such factors as the shift in the drug pipeline away from blockbuster new chemicals to more incremental innovations, and the influence of global pricing goals. It may also relate in part to recent price increases after a period of considerable price stability. The purpose of these hearings is to determine whether, under sections 83 and 85 of the Act, patentees are selling or have sold medicines in any market in Canada at prices that, in the Board's opinion, are, or were, excessive, and if so, what order if any, should be made.

Adderall XR, Shire BioChem Inc.

Adderall XR is a medicine indicated for the treatment of Attention Deficit Hyperactivity Disorder.

On January 18, 2006, the Board issued a Notice of Hearing in the matter of Shire Biochem Inc. (Shire) and the price of the medicine Adderall XR.On December 15, 2006, the Board issued a decision on the issue of pre-patent. Shire had made a motion to the Board for an order that the Board amend its Notice of Hearing to limit the Board's inquiry to the period following the date of issuance of patent 2,348,090, namely April 13, 2004. The Board dismissed Shire's motion. Shire filed an application for judicial review in this matter with the Federal Court of Canada. The matter has not yet been heard.

Closing arguments on the merits were heard on June 18, 2007. The decision of the Board Hearing Panel is pending.

Airomir, 3M Canada Company

Airomir is used for the treatment of asthma, chronic bronchitis, and other breathing disorders.

On February 20, 2006, the Board issued a Notice of Hearing in the matter of 3M Canada Company (3M Canada) and the price of the medicine Airomir.

On May 14, 2007, the Board Hearing Panel approved a VCU12 which resolved all issues raised by the Notice of Hearing.

Concerta, Janssen-Ortho Inc.

Concerta is indicated for the treatment of Attention Deficit Hyperactivity Disorder.

On July 24, 2006, the Board issued a Notice of Hearing in the matter of Janssen-Ortho Inc. (Janssen-Ortho) and the price of the medicine Concerta.

Closing arguments were heard on August 29, 2007. The decision of the Board Hearing Panel is pending.

Copaxone, Teva Neuroscience G.P.-S.E.N.C.

Copaxone 20 mg/1.0 mL syringe is a new formulation of an existing compound (glatiramer acetate) indicated for use in ambulatory patients with Relapsing-Remitting Multiple Sclerosis to reduce the frequency of relapses.

On May 8, 2006, the Board issued a Notice of Hearing in the matter of Teva Neuroscience G.P.-S.E.N.C. (Teva) and the price of the medicine Copaxone.

Closing arguments were heard on August 13, 2007. The decision of the Board Hearing Panel is pending.

Dovobet, LEO Pharma Inc.

Dovobet is a dermatological drug administered for bringing psoriasis under control.

On November 29, 2004, the Board issued a Notice of Hearing in the matter of LEO Pharma Inc. (LEO Pharma) and the price of the medicine Dovobet. The hearing concluded in December 2005. On April 19, 2006, the Hearing Panel issued its decision.

On April 19, 2006, LEO Pharma made an application to the Federal Court of Canada for a judicial review of the Board's decision. A hearing was held on February 12, 2007 and the reasons and judgement of the Court were issued on March 21, 2007. The final order of the Board Hearing Panel is pending.

Nicoderm, Hoechst Marion Roussel Canada Inc.

Nicoderm is a transdermal nicotine patch, indicated as an aid for smoking cessation for the partial relief of nicotine withdrawal symptoms.

On April 20, 1999, the Board issued a Notice of Hearing in the matter of Hoechst Marion Roussel Canada Inc. (HMRC) and the price of the medicine Nicoderm. On May 25, 1999, HMRC filed a motion requesting that the Board rescind the Notice of Hearing. The Board Hearing Panel issued decisions on the motion in two parts on August 3, 1999 and August 8, 2000.

On September 3, 1999, HMRC sought a judicial review of the first and later, the second Board decision. The Federal Court issued its decision on November 17, 2005. The resolution of the hearing is pending.

Penlac Nail Lacquer, sanofi-aventis Canada Inc.

Penlac is a new formulation of an existing compound (ciclopirox), indicated as part of a comprehensive nail management program in immunocompetent patients with mild to moderate onychomycosis (due to Trichophyton rubrum) of fingernails and toenails without lunula involvement.

On March 26, 2007, the Board issued a Notice of Hearing in the matter of sanofi-aventis Canada Inc. (sanofi-aventis) and the price of the medicine Penlac. A pre-hearing conference was held on June 6, 2007; the hearing is pending.

Quadracel and Pentacel, sanofi pasteur Limited

Quadracel and Pentacel, sanofi pasteur Limited Quadracel is indicated for the primary immunization of infants, at or above the age of 2 months, and as a booster in children up to their 7th birthday against diphtheria, tetanus, whooping cough (pertussis) and poliomyelitis.

Pentacel is indicated for the routine immunization of all children between 2 and 59 months of age against diphtheria, tetanus, whooping cough (pertussis), poliomyelitis and haemophilus influenzae type b disease. It is sold in Canada in the form of a reconstituted product for injection combining one single dose vial of Act HIB (Lyophilized powder for injection) and one single (0.5 mL) dose ampoule of Quadracel (suspension for injection).

On March 27, 2007, the Board issued a Notice of Hearing in the matter of sanofi-pasteur Limited (sanofi pasteur) and the prices of the medicines Quadracel and Pentacel.

A pre-hearing conference is scheduled to be held on October 31, 2007 and hearing dates have been set for November 28-30, 2007.

Risperdal Consta, Janssen-Ortho Inc.

Risperdal Consta is a new formulation of an existing compound (risperidone) indicated for the management of the manifestations of schizophrenia and related psychotic disorders.

On January 30, 2006, the Board issued a Notice of Hearing in the matter of Janssen-Ortho Inc. (Janssen-Ortho) and the price of the medicine Risperdal Consta. The Hearing was held in 2006 and 2007. On July 4, 2007, the Board Hearing Panel accepted the VCU of Janssen-Ortho which concluded the proceeding.

Strattera, Eli Lilly Canada Inc.

Strattera is indicated for the treatment of Attention Deficit Hyperactivity Disorder in children 6 years of age and over, adolescents and adults.

On December 15, 2006, the Board issued a Notice of Hearing in the matter of Eli Lilly Canada Inc. (Eli Lilly) and the price of the medicine Strattera. On February 22, 2007, the Board Hearing Panel held a hearing on a Motion for Adjournment brought by Eli Lilly; a verbal decision to dismiss the motion was issued. The hearing in the matter is pending.

Consultations

Amendments to the Patented Medicines Regulations, 1994

On December 31, 2005, proposed regulatory amendments were published in the Canada Gazette, Part I. Following publication, numerous submissions were received from stakeholders and were carefully examined by the Board.

As part of the subsequent consideration of revisions to the proposed amendments, Board Staff met with Rx&D in the spring of 2006 and with Rx&D, the Canadian Generic Pharmaceutical Association and BIOTECanada in February and March 2007. Work on the regulatory amendments is ongoing.

Review of the Board's Excessive Price Guidelines

In 2005, the Board had released a Discussion Paper on Price Increases and the submissions of stakeholders identified introductory prices as being of greater concern. The release of the Discussion Guide on the Board's Excessive Price Guidelines (Guide) in May 2006 marked the first step in the Board's review of its Guidelines, with a focus on introductory price issues. The Guide asked stakeholders to consider three issues: the categorization of new drugs; introductory price tests; and the wording of the Act regarding excessive prices in "any market." The Board received 45 written submissions in response, reflecting the wide-ranging views of the individuals and groups affected by or interested in the Guidelines: patentees; patient and health care provider representatives; private and public insurance plans; members of the PMPRB's Human Drug Advisory Panel; academics; and consultants.

In November 2006, the Board met with close to 140 members of these stakeholder groups at sessions held in Edmonton, Montreal, Toronto, Halifax, and Ottawa. Participants deliberated on the topics of "categories" and "any market", as well as two new subjects: whether and when an introductory price should be "re-benched" (re-evaluated); and potential principles that could guide how the price factors in the Act are operationalized in the price review process. (The Guide and Summary Reports on each stakeholder meeting are available on the PMPRB's Web site: www.pmprb-cepmb.gc.ca, under Consultations, Consultations on the Board's Excessive Price Guidelines, Reference Material.)

The fundamental purpose of the Guidelines is to provide transparency and predictability in the price review process for all stakeholders. The Board recognizes that the pharmaceutical environment has evolved since the last major revision to the Guidelines in 1994, and that it is essential to ensure that the Guidelines remain relevant and appropriate in the current context. At the same time, it must be recognized that the Guidelines have been very effective in promoting voluntary compliance with non-excessive pricing. Currently, there are more than 1,100 patented drug products under the Board's jurisdiction. While a number of Notices of Hearing were issued and several investigations into apparent excessive prices were ongoing in 2006, the overall rate of compliance with the Guidelines for all patented drugs being sold in Canada is extremely high - at over 90%.

The Board is continuing its analysis in 2007. It has noted that the current Guidelines do not encompass all of the factors in the Act that the Board must consider in determining whether prices of patented medicines are excessive. For example, there is no guidance on the review of the second part of paragraph 85(1) (c), "the prices at which ...other medicines in the same therapeutic class have been sold in countries other than Canada."

Neither is there direction on subsection 85(2) - "Where, after taking into consideration the factors referred to in subsection (1), the Board is unable to determine whether the medicine is being or has been sold in any market in Canada at an excessive price, the Board may take into consideration the following factors: (a) the costs of making and marketing the medicine; and (b) such other factors as may be specified in any regulations made for the purposes of this subsection or as are, in the opinion of the Board, relevant in the circumstances." The current Guidelines are silent on guidance as to when a determination of whether prices are excessive based on subsection 85(1) may not be possible, and on how the costs of making and marketing the medicine should be assessed, if the Board considers it appropriate to do so.

The need to address these gaps has been added to the Board's overall workplan on the review of the current Guidelines. To further advance this work, and as announced in its April 2007 NEWSletter, the Board is holding bilateral consultations with groups representing sectors of the pharmaceutical industry, federal/provincial/territorial governments and consumers beginning in the summer of 2007.

Priority 2: Report on pharmaceutical trends

Financial Resources ($ thousands):

| 2006-2006 | ||

| Planned Spending | Authorities | Actual Spending |

| $3,405.0 | $3,464.9 | $1,813.4 |

Human Resources:

| 2006-2006 | ||

| Planned | Actual | Difference |

| 23 | 13 | 10 |

Price Trends

The PMPRB's second priority is to report on pharmaceutical price trends relating to all medicines, and on R&D spending by pharmaceutical patentees. This priority contributes to informed decisions and policy-making among stakeholders.

Section 100 of the Act requires the Board to annually submit to the Minister of Health a report on its activities during the preceding year. The report must include a summary of pricing trends in the pharmaceutical industry, and patentees' expenditures on research and development as a proportion of total revenues from sales of medicines in Canada. The Minister is required to table the report before Parliament.

The PMPRB maintains and uses the Patented Medicine Price Index (PMPI) to monitor and report on trends in prices of patented drugs. The PMPI is a price index measuring the average year-over-year change in the ex-factory prices of patented drugs sold in Canada. The PMPI does not measure changes in the utilization of patented drugs: a quantity index, the PMQI, is calculated for this purpose. The PMPI does not measure the cost-impact of changes in prescribing patterns or the introduction of new medicines. By design, the PMPI isolates the component of sales growth attributable to changes in the prices of patented drugs.

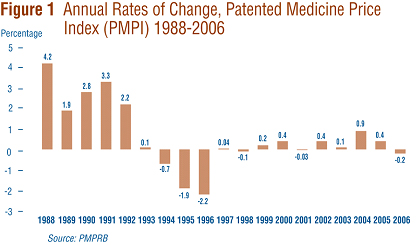

Figure 1 provides year-over-year changes in the PMPI for the years 1988 through 2006. As measured by the PMPI, prices of patented drugs declined on average by 0.2% from 2005 to 2006. This small decline in the PMPI in 2006 follows two years of slight increases.

Comparison of PMPI and CPI

Section 85 of the Act provides that, among other factors, the PMPRB shall consider changes in the Consumer Price Index (CPI) in determining whether the price of a patented drug is excessive.

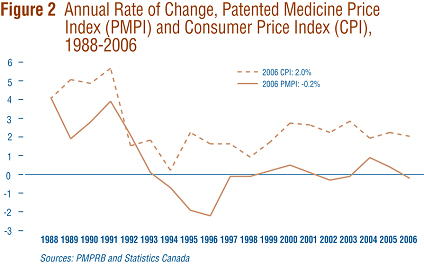

Figure 2 plots year-over-year rates of change in the PMPI against corresponding changes in the CPI. Inflation, as measured by the CPI, has exceeded the average increase in patented drug prices in every year since 1988 except 1992 when the forecast rate of CPI inflation (used by patentees to set price increases) significantly exceeded the ultimate actual rate of inflation. This pattern continued in 2006, with the CPI rising by 2.0% while the PMPI declined by 0.2%. That the PMPI has not kept pace with the CPI is not surprising. The Board's Guidelines allow the price of a patented drug to rise by no more than the CPI over any three-year period. (The Guidelines also impose a cap on year-over-year price increases equal to one-and-one-half times the current year rate of CPI inflation. Theoretically, the cap could result in the PMPI exceeding CPI inflation, but this has never occurred.)

This effectively establishes CPI-inflation as an upper bound on the rate at which the PMPI may rise over any period of three years. Increases in the PMPI normally do not reach this upper bound because many patentees do not raise their prices by the full amount permitted under the Guidelines.

Price Change by Therapeutic Class

Table 2 provides average rates of price change among patented drugs at the level of major therapeutic classes drawn from the World Health Organization's Anatomical Therapeutic Chemical (ATC) Classification System. Results in this table were obtained by applying the PMPI methodology to data segregated by the first level ATC class. The table also lists each therapeutic class' share of total sales of patented drugs, as well as the average percentage price change among the drugs in each class. The last column multiplies the rate of price change in each class by its share of overall sales: this yields an approximation of the contribution of each class to the overall PMPI change.

By this measure, antineoplastics and immunomodulating agents were the largest contributors to overall price change in 2006 with a price decline of 0.3%.

Table 2

| Change in the Patented Medicine Price Index (PMPI) by Major Therapeutic Class, 2006 | |||

| Therapeutic Class | Share of Sales (%) | Change: 2004-2005(%) | Contribution to Overall Change(%)32 |

| A: Alimentary Tract and Metabolism | 13.0 | -0.5 | -0.1 |

| B: Blood and Blood Forming Organs | 6.7 | -1.1 | -0.1 |

| C: Cardiovascular System | 25.6 | 0.2 | 0.0 |

| D: Dermatologicals | 0.8 | 1.3 | 0.0 |

| G: Genito-urinary System and Sex Hormones | 3.2 | 1.1 | 0.0 |

| H: Systemic Hormonal Preparations | 0.9 | -2.1 | 0.0 |

| J: General Antiinfectives for Systemic use; and P: Antiparasitic Products13 | 9.7 | 0.2 | 0.0 |

| L: Antineoplastics and Immunomodulating Agents | 12.8 | -2.4 | -0.3 |

| M: Musculo-skeletal System | 3.9 | 0.5 | 0.0 |

| N: Nervous System | 15.1 | 0.3 | 0.1 |

| R: Respiratory System | 6.7 | 1.0 | 0.1 |

| S: Sensory Organs | 1.2 | 0.4 | 0.0 |

| V: Various | 0.6 | -3.6 | 0.0 |

| Total | 100.0* | -0.2 | |

| Source: PMPRB * Values in this column may not add to 100.0 due to rounding. |

|||

Price Change by Class of Customer

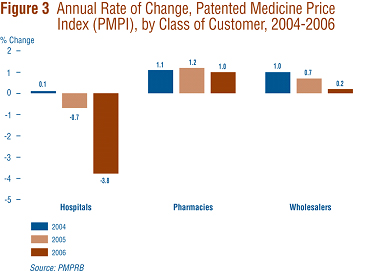

Figure 3 presents average rates of price change by class of customer.14 These results were obtained by applying the PMPI methodology to data on sales of patented drugs made specifically to hospitals, to pharmacies and to wholesalers. 15

Rates of 2005-to-2006 price change ranged from 1.0% for direct sales to pharmacies to -3.8% for sales to hospitals. Not surprisingly, the rate of price change for sales to wholesalers (which accounts for about three quarters of all sales) is closest to the overall change in the PMPI. Note that in all customer classes, rates of price change were substantially less than CPI-inflation.

It is clear from Figure 3 that the slight decline in the overall PMPI was the result of falling prices paid by hospitals: a PMPI covering just sales to pharmacies and wholesalers would have risen by approximately 0.4% between 2005 and 2006.

Price Change by Province/Territory

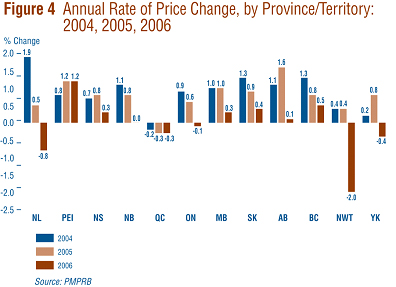

Figure 4 presents average rates of price change by province and territory. These results were obtained by applying the PMPI methodology to data segregated according to the province or territory in which the sale took place. Rates of price change for 2005-to-2006 range from 1.2% in Prince Edward Island to -2.0% in the Northwest Territories. Average price increases in six of the thirteen provincial/territorial jurisdictions were offset by the modest declines in Ontario and Quebec, resulting in the average national price decrease of 0.2%.

Price Change in Canada and Comparator Countries

In accordance with the Act and the Regulations, patentees must report publicly available ex-factory prices of patented drugs in seven foreign countries. These countries are: France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States. The PMPRB uses this information to: conduct the international price comparison tests specified in the Guidelines; and compare the Canadian prices of patented drugs to those in other countries.

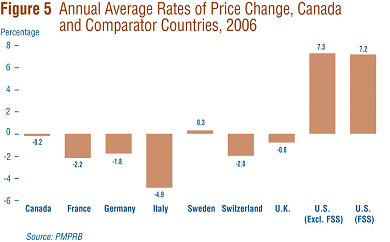

Figure 5 gives annual 2005-to-2006 rates of price change for Canada and each of the seven comparator countries. These results were obtained by applying the PMPI methodology (with weights based on Canadian sales patterns) to international price data submitted to the PMPRB. Note that two results are presented for the U.S.: the first of these is restricted to U.S. prices reported by patentees, the second incorporates prices from the U.S. Federal Supply Schedule (FSS) in addition to reported prices. (FSS prices are those negotiated between companies and the U.S. Department of Veteran Affairs.)

Five of the seven comparator countries registered overall price declines in 2006, the exceptions being the U.S. and Sweden. Of these five, Italy saw the largest average decline (-4.9%). In contrast, U.S. prices rose by more than 7% on average.

Bilateral Comparison of Foreign Prices to Canadian Prices

Table 3 provides detailed statistics comparing the foreign prices of patented drugs to their Canadian prices. The table provides four average price ratios. These are differentiated according to (1) the averaging formula applied and (2) the method by which foreign prices were converted to Canadian dollar equivalents. The table also shows the number of drugs (DINs) and the volume of sales encompassed by each reported statistic.

The PMPRB has traditionally reported average Foreign-to-Canadian price ratios constructed as a sales-weighted geometric mean of individual ratios. Such results are included in Table 3 (under the label "Geometric Mean"). The table also provides results obtained using a sales-weighted arithmetic average (under the label "Arithmetic Mean"). These statistics provide an answer to questions of the type: "How much more/less would Canadians have paid for the patented drugs they purchased in 2006 if they had paid Country X prices rather than Canadian prices?"

Table 3

| Table 3 Average Foreign-to-Canadian Price Ratios, Bilateral Comparisons, 2006 | ||||||||

| (i) At Market Rates |

Can | Fra | Ita | Ger | Swe | Swi | U.K. | U.S. |

| Geometric Mean | 1.00 | 0.87 | 0.77 | 0.99 | 0.92 | 1.06 | 1.00 | 1.68 |

| Arithmetic Mean | 1.00 | 0.92 | 0.81 | 1.09 | 1.00 | 1.14 | 1.05 | 1.80 |

| Number of DINs | 1,176 | 769 | 746 | 849 | 817 | 813 | 843 | 1,014 |

| Net Revenues ($M) | 11,989.2 | 10,004.8 | 9,855.0 | 10,226.2 | 10,122.5 | 10,427.3 | 10,640.6 | 10,898.1 |

| (ii) At PPPs |

Can | Fra | Ita | Ger | Swe | Swi | U.K. | U.S. |

| Geometric Mean | 1.00 | 0.78 | 0.73 | 0.91 | 0.75 | 0.79 | 0.89 | 1.68 |

| Arithmetic Mean | 1.00 | 0.83 | 0.77 | 1.00 | 0.81 | 0.85 | 0.94 | 1.79 |

| Number of DINs | 1,176 | 769 | 746 | 849 | 817 | 813 | 843 | 1,014 |

| Net Revenues ($M) | 11,989.2 | 10,004.8 | 9,855.0 | 10,226.2 | 10,122.5 | 10,427.3 | 10,640.6 | 10,898.1 |

For example, Table 3 (i) states that the 2006 average French-to-Canadian price ratio obtained using the arithmetic mean is 0.92. This means that Canadians would have paid 8% less for the patented drugs they purchased in 2006 had they been able to buy these products at French prices.

For many years the PMPRB has reported average Foreign-to-Canadian price ratios with foreign prices converted to their Canadian dollar equivalents by means of market exchange rates (or, more exactly, the 36-month moving-averages of market rates the PMPRB normally uses in applying the Guidelines). Last year, the PMPRB began reporting Foreign-to-Canadian price ratios with currency-conversion at purchasing power parity (PPP). The PPP between any two countries measures their relative cost-of-living expressed in their own currencies. In practice, cost-of-living is determined by pricing out a standard set (or "basket") of goods and services at prices prevailing in each country. Because PPPs are designed to represent relative cost-of-living, they offer a simple way to account for differences in national price levels when comparing individual prices, incomes and other monetary values across countries. When applied in calculating average foreign-to-Canadian price ratios, they produce statistics allowing us to answer questions of the form: "How much more/less consumption of other goods and services would Canadians have sacrificed for the patented drugs they purchased in 2006 had they lived in Country X?"

Focusing on the results obtained with currency conversion at market exchange rates (and calculated as a geometric mean), in Table 3 (i), it appears that Canada is in the middle of the pack with regard to the prices of patented drugs. Prices in France and Italy are, on average, appreciably less than Canadian prices, while prices in Switzerland and the U.S. are higher. As in previous years, U.S. prices were substantially higher than prices in Canada or any other comparator country. However, using PPP and geometric means, Canadians would have sacrificed less consumption of other goods and services for the purchase of patented drugs had they lived in any of the comparator countries except the U.S.

Multilateral Price Comparisons

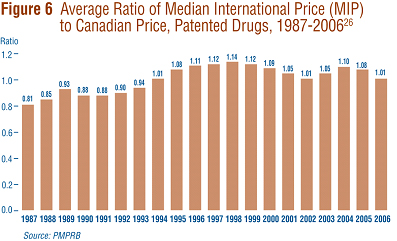

Focusing again on results at market exchange rates (and calculated as a geometric mean), the average Median International Price (MIP)-to-Canadian price ratio stood at 1.01 in 2006, representing a substantial decline from the value of 1.08 reported last year. Figure 6 puts this result in historical perspective. MIPs were on average 19% below Canadian prices in 1987. By 1998, MIPs were on average 14% higher than Canadian prices. The average MIP-to-Canadian price ratio has remained above parity throughout this decade. That is, prices in Canada have been below the MIP.

Utilization of Patented Drugs

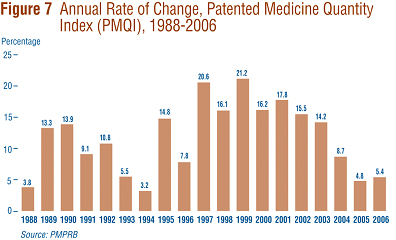

The price and sales data used to calculate the PMPI also allow the PMPRB to examine trends in the quantities of patented drugs sold in Canada. The PMPRB maintains the Patented Medicine Quantity Index (PMQI) for this purpose. Figure 7 displays average rates of utilization growth, as measured by the PMQI, from 1988 through 2006. These results confirm that growth in the utilization of patented drugs has been the primary source of rising sales, with rates of utilization growth roughly tracking rates of sales growth in recent years. This pattern continued in 2006, with utilization of patented drugs growing by 5.4%.

Canadian Sales in the Global Context

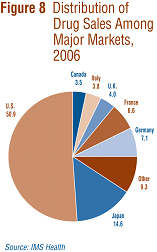

IMS Health regularly reports on patentees' sales to the retail sector across a wide range of countries. IMS reports that, in 2006, sales amounted to $440.3 billion among major markets.16 Figure 8 shows how this amount was distributed among these markets. Drug sales in Canada accounted for 3.5% of total major-market sales. The U.S. market is by far the largest, with drug sales exceeding the combined sales of all other major markets.

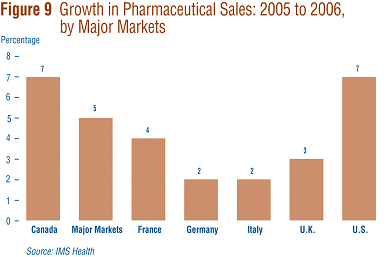

Figure 9 gives rates of 2005-to-2006 sales growth for individual major markets. Based on IMS data, Canadian sales growth matched that in the U.S. at 7% and exceeded growth observed in all other major markets.

Analysis of Research and Development Expenditures

With the adoption of the 1987 amendments to the Patent Act, Canada's Research-Based Pharmaceutical Companies (Rx&D) made a public commitment that brand name manufacturers would increase their annual research and development (R&D) expenditure to 10% of sales revenue by 1996.17 Under the Act, the PMPRB monitors and reports on R&D spending, but has no regulatory authority over the amount or type of research spending by patentees.

The Act requires each patentee to report its revenue from sales of drugs (including revenue from sales of non-patented drugs and from licensing agreements) and total R&D expenditure in Canada related to medicines. The Regulations require that R&D data submitted to the PMPRB be accompanied by a certificate affirming the submitted information is "true and correct". The Board does not audit submissions, but it does review submitted data for anomalies and inconsistencies, seeking corrections or clarifications from patentees where these are detected. To confirm that Board Staff has correctly interpreted submitted data, each patentee is given the opportunity to review and confirm the accuracy of its own R&D-to-sales ratio before publication in the Board's Annual Report. Companies without sales of patented medicines need not report on R&D expenditure. As new patents are granted and existing patents expire, the set of companies required to file R&D data may change from year to year.

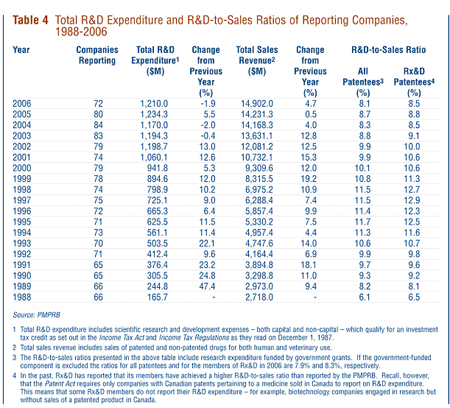

For 2006, a total of 72 companies selling drug products for human and veterinary use filed reports on their R&D expenditure. Of these, 28 companies were members of Rx&D.

Sales Revenue

For reporting purposes, sales revenue is defined as all revenue from Canadian sales of medicines and from licensing agreements.

As shown in Table 4, patentees reported total revenue of $14.9 billion from Canadian sales of drugs in 2006, an increase of 4.7% over 2005. Sales revenue reported by Rx&D members totaled $11.1 billion, accounting for 75% of the total. Less than 1% of reported sales revenue was generated by licensing agreements.

R&D Expenditure

As shown in Table 4, total 2006 R&D expenditure reported by patentees was $1.2 billion, a decrease of 1.9% from 2005. Rx&D members reported R&D expenditure of $949 million in 2006, accounting for 78.4% of all reported expenditure. This represents a decline of 8.7% relative to 2005 Rx&D expenditure.

By comparison, non-Rx&D members reported R&D expenditure of $261 million in 2006, an increase of 34.5% over the corresponding figure for 2005.

R&D-to-Sales Ratios

The ratio of R&D expenditure to sales revenue among all patentees was 8.1% in 2006, down from 8.7% in 2005. The ratio for members of Rx&D was 8.5%, down from 8.8% in the previous year. R&D-to-sales ratios have declined markedly in recent years, after reaching a peak in the late 1990s. This is the sixth consecutive year the overall ratio has fallen below 10% and the fourth year in which the Rx&D ratio has failed to achieve this target value.

The Global Context

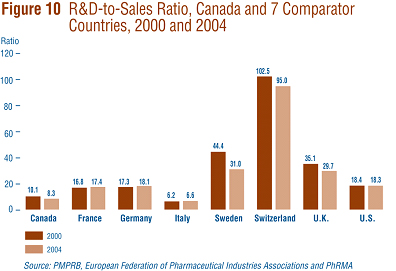

Figure 10 compares Canadian R&D-to-sales ratios to those in the seven comparator countries for the years 2000 and 2004. As noted in Figure 10, Canada's ratio stood at 10.1% in 2000. Only Italy (at 6.2%) had a lower ratio in that year. Switzerland had the highest ratio at 102.5%, followed by Sweden at 44.4%. France, Germany and the U.S. were in the 16-18% range, while the U.K. was more than double at 35.1%. A very similar pattern emerges in the ratios for 2004. Italy (6.6%) remained at the bottom of the range, with Canada second lowest at 8.3%. Ratios in all other comparator countries were again well above Canada's ratio, but showed declines in Switzerland, Sweden and the U.K.

Analytical Studies of Pharmaceutical Trends

National Prescription Drug Utilization Information System

The National Prescription Drug Utilization Information System (NPDUIS) provides critical analyses of price, utilization and cost trends so that Canada's health system has more comprehensive and accurate information on how prescription drugs are being used and on sources of cost increases. The Canadian Institute for Health Information (CIHI) and the PMPRB are partners in the NPDUIS. A steering committee, comprised of representatives of participating public drug plans and Health Canada, advises the PMPRB on the development of analytical studies. The NPDUIS initiative involves two major elements:

-

development and implementation of a prescription claims level database capable of incorporating drug program data from participating publicly-funded drug plans; and

-

production of analytical reports relying on information from this database.

CIHI is responsible for the first of these elements while, as requested by the Minister of Health under section 90 of the Patent Act, the PMPRB is principally responsible for the second.

The PMPRB has completed analyses of pharmaceutical trends from 1997-98 to 2004-05 based on aggregated DIN level prescription drug data, provided by eight public drug plans in Canada.

Two other projects have been recently completed to support informed decision-making:

-

Guidelines for Conducting Pharmaceutical Budget Impact Analyses for Submission to Public Drug Plans in Canada which provide guidance to industry on the methodology and reporting standards to be used when submitting BIAs to the Common Drug Review, administered by Canadian Agency for Drugs and Technologies in Health (CADTH), or to federal, provincial or territorial drug plans that participate in the Common Drug Review (CDR).

-

The New Drug Pipeline Monitor (NDPM) which summarizes information on new drugs that are in the later phases of research and could have a significant impact in terms of therapeutic value. Future editions of the NDPM will track the clinical development of drugs selected for this web-based publication, highlight potential new drugs in the pipeline, and provide market analyses to inform decision-makers of potential cost impacts of the new drugs.

Studies conducted under the NPDUIS are available on the PMPRB Web site, as is the list of ongoing projects.

Monitoring and Reporting of Non-Patented Prescription Drug Prices

In October 2005, the federal/provincial/territorial Ministers of Health announced the endorsement of the PMPRB to monitor and report on the prices of non-patented prescription drugs. In November 2005, the PMPRB received direction from the federal Minister of Health, to undertake this monitoring and reporting.

In 2006-2007, three reports were released:

-

Canadian and Foreign Price Trends, which examined domestic and international price and sales trends of non-patented prescription drugs, and was released in July 2006;

-

Trends in Canadian Sales and Market Structure (released in October 2006) which analyzed annual growth rates in sales, sources of growth, market shares, sales concentration, and international price comparisons by level of concentration; and

-

Markets for New Off-Patent Drugs (released in June 2007) which tracked market developments for non-patented drugs in the years immediately following patent expiry.

These reports are available on our Web site under Reporting; Non-Patented Prescription Drug Prices.

Future reports will examine the market for new off-patent drugs and trends in prices of non-patented single-source prescription drugs sold in Canada and abroad.