ARCHIVED - National Research Council Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2006-2007

Departmental Performance Report

National Research Council Canada

The Honourable Jim Prentice

Minister of Industry

Table of Contents

Acronyms and AbbreviationsSection I — Agency Overview

- Minister's Message

- Management Representation Statement

- National Research Council's (NRC's) Business (Summary Information)

- NRC's Overall Performance for 2006-2007

- Priority 1 - Research and Development for Canada: Economy, the Environment, Health and Safety

- Priority 2 - Technology and Industry Support: Serving as a Catalyst for Industrial Innovation and Growth

- Priority 3 - Enhancing Development of Sustainable Technology Clusters for Wealth Creation and Social Capital

- Priority 4 - Program Management for a Sustainable Organization

Acronyms and Abbreviations

|

ACURA |

Association of Canadian Universities for Research in Astronomy |

|

AIP |

Atlantic Investment Partnership |

|

ALMA |

Atacama Large Millimeter Array |

|

CBRN |

Chemical, Biological, Radiation and Nuclear |

|

cGMP |

Current Good Manufacturing Practices |

|

CFHT |

Canada-France-Hawaii Telescope |

|

CIHR |

Canadian Institutes of Health Research |

|

CRTI |

CBRN Research and Technology Initiative |

|

CTI |

Competitive Technology Intelligence |

|

DRDC |

Defence Research and Development Canada |

|

FCHP |

Fuel Cell and Hydrogen Program |

|

FTE |

Full-Time Equivalent |

|

GHI |

Genomics and Health Initiative |

|

HRM |

Human Resources Management |

|

INA |

Innovation and Network Advisor |

|

IP |

Intellectual Property |

|

IPF |

Industry Partnership Facility |

|

ITA |

Industrial Technology Advisor |

|

JCMT |

James Clerk Maxwell Telescope |

|

LRP |

Long Range Plan for Astronomy and Astrophysics |

|

LTRC |

Language Technologies Research Center |

|

MSE |

Medium-Sized Enterprise |

|

NIC |

NRC Information Centre (NRC-CISTI) |

|

NINT |

National Institute for Nanotechnology |

|

NMI |

National Metrology Institute |

|

NRC |

National Research Council Canada |

|

NRC-AMTC |

Aerospace Manufacturing Technology Centre |

|

NRC-ATC |

Aluminium Technology Centre |

|

NRC-BRI |

Biotechnology Research Institute |

|

NRC-CB |

Commercialization Branch |

|

NRC-CHC |

Canadian Hydraulics Centre |

|

NRC-CISTI |

Canada Institute for Scientific and Technical Information |

|

NRC-CPFC |

Canadian Photonics Fabrication Centre |

|

NRC-CSIR |

Centre for Sustainable Infrastructure Research |

|

NRC-CSTT |

Centre for Surface Transportation Technology |

|

NRC-GTL |

Gas Turbine Laboratory |

|

NRC-HIA |

Herzberg Institute of Astrophysics |

|

NRC-IAR |

Institute for Aerospace Research |

|

NRC-IBD |

Institute for Biodiagnostics |

|

NRC-IBS |

Institute for Biological Sciences |

|

NRC-ICPET |

Institute for Chemical Process and Environmental Technology |

|

NRC-IFCI |

Institute for Fuel Cell Innovation |

|

NRC-IIT |

Institute for Information Technology |

|

NRC-IMB |

Institute for Marine Biosciences |

|

NRC-IMI |

Industrial Materials Institute |

|

NRC-IMS |

Institute for Microstructural Sciences |

|

NRC-IMTI |

Integrated Manufacturing Technologies Institute |

|

NRC-INMS |

Institute for National Measurement Standards |

|

NRC-INH |

Institute for Nutrisciences and Health |

|

NRC-IOT |

Institute for Ocean Technology |

|

NRC-IRAP |

Industrial Research Assistance Program |

|

NRC-IRC |

Institute for Research in Construction |

|

NRC-PBI |

Plant Biotechnology Institute |

|

NRC-SIMS |

Steacie Institute for Molecular Sciences |

|

NSERC |

Natural Sciences and Engineering Research Council of Canada |

|

OAG |

Office of the Auditor General of Canada |

|

OECD |

Organisation for Economic Co-operation and Development |

|

OTEC |

Ocean Technology Enterprise Centre |

|

R&D |

Research and Development |

|

RMAF |

Results-based Management and Accountability Framework |

|

S&T |

Science and Technology |

|

SMEs |

Small- and Medium-sized Enterprises |

|

SOFC |

Solid Oxide Fuel Cells |

|

STM |

Scientific, Technical and Medical |

|

TBS |

Treasury Board of Canada Secretariat |

|

TIS |

Technology and Industry Support |

|

TRIUMF |

Tri-University Meson Facility |

Section I: Agency Overview

Minister's Message

|

I am pleased to present the National Research Council's Departmental Performance Report for 2006 – 07.

My goal as Minister of Industry, and one of the top priorities of Canada's New Government, is to ensure we maintain a strong economic environment — one that allows Canadians to prosper in the global economy. We are seeing great changes in the international marketplace. New trade agreements, rapidly advancing technologies and the emergence of developing countries are all contributing to today's business environment. Canada needs to keep pace.

Part of my mandate is to help make Canadians more productive and competitive. We want our industries to continue to thrive and all Canadians to continue to enjoy one of the highest standards of living in the world.

For this to happen, the government is committed to maintaining a fair, efficient and competitive marketplace — one that encourages investment, sets the stage for greater productivity, and facilitates innovation. We are relying on market forces to a greater extent, regulating only when it is absolutely necessary. Our policies have helped turn research into new products and business processes. In addition, we are making efforts to increase awareness of sustainability practices among Canadian industry, emphasizing the social, environmental and economic benefits they bring.

The Department and the Industry Portfolio have made progress on a wide range of issues this past year, most notably in the areas of telecommunications, science and practical research, manufacturing, small business, consumer protection, patents and copyrights, tourism and economic development.

The Industry Portfolio is composed of Industry Canada and 10 other agencies, Crown corporations and quasi-judicial bodies. These organizations collectively advance Canada's industrial, scientific and economic development, and help ensure that we remain competitive in the global marketplace.

We have accomplished much this year. Using Advantage Canada — the government's long-term economic plan — as our roadmap, we have made great strides toward many of our most important goals. We will continue to focus on these goals to support the conditions for a strong economy — an environment that Canadians expect and deserve.

Jim Prentice

Minister of Industry

Management Representation Statement

|

I submit, for tabling in Parliament, the 2006 – 2007 Departmental Performance Report for the National Research Council Canada.

Dr. Pierre Coulombe |

National Research Council's (NRC's) Business (Summary Information)

Raison d'être

NRC is the Government of Canada's leading resource for Science and Technology (S&T) development. NRC's primary business is:

- improving the social and economic well-being of Canadians;

- providing technology and industry support for industrial innovation and growth; and

- supplying excellence and leadership in research and development (R&D).

NRC Benefits to Canadians

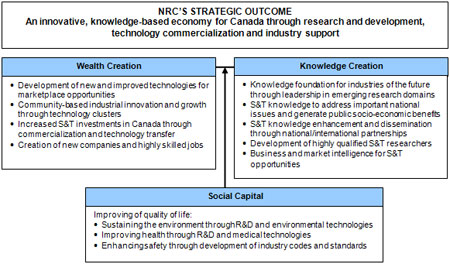

NRC delivers on its strategic outcome by creating wealth, knowledge and social capital for Canadians.

Figure 1-1: NRC Benefits to Canadians

NRC's Business and Management Priorities for 2006-2007 – Status on Performance

Table 1-1: NRC Resources for 2006-2007

| Financial Resources ($ millions) | ||

|

Planned |

Total Authorities |

Actual Spending |

|

714.1 |

844.7 |

742.1 |

|

Human Resources (Full-Time Equivalents – FTEs) |

||

|

Planned |

Actual |

Difference |

|

4,033 |

4,191 |

158 |

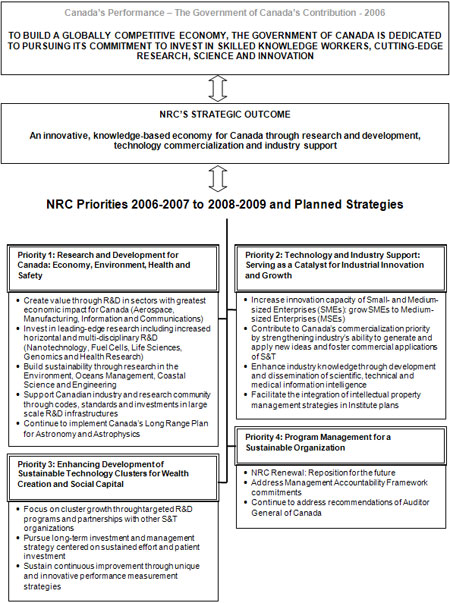

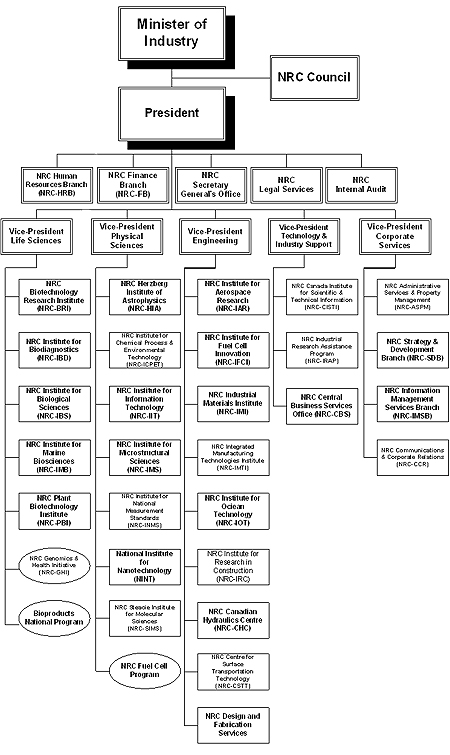

Figure 1-2 highlights the plans and priorities identified in the 2006-2007 to 2008-2009 period (as identified in NRC's 2006-2007 Report on Plans and Priorities (RPP)).

Figure 1-2: Strategic Framework for NRC Plans and Priorities

Table 1-2: NRC Business and Management Priorities for 2006-2007

|

NRC's Strategic Outcome: |

Performance Status* |

2006-2007 |

||

|

Priorities and Type |

Program Activity/ Expected results |

Planned spending |

Actual spending |

|

|

Priority no. 1 Type: ongoing |

Program Activity: Research and Development |

successfully met |

390.66 |

380.8 |

|

Expected results:

|

||||

|

Priority no. 2 Type: ongoing |

Program Activity: Technology and Industry Support |

successfully met |

179.22 |

182.2 |

|

Expected Results:

|

||||

|

Priority no. 3 Type: previously committed |

Program Activity: Research and Development and Technology and Industry Support |

successfully met |

75.89 |

75.2 |

|

Expected Results:

|

||||

|

Priority no. 4 Type: ongoing |

Program Activity: |

successfully met |

68.28 |

103.9 |

|

Expected Results:

|

||||

* It should be noted that the Expected Results identified in the 2005-2006 RPP apply to a three-year period and therefore not all listed results have been successfully met in the 2005-2006 fiscal year; however, overall the priority is considered "successfully met".

** Program Activities' contributions to this priority are significantly supported by NRC's Corporate Branches which provide policy, program advice and executive support for the coordination and direction of NRC's operations and its Council. The Corporate Branches also specialize in finance, information management, human resources, administrative services and property management, and

corporate services.

NRC's Operating Environment

NRC has:

- A national S&T infrastructure positioned to: improve Canada's innovation capacity in existing and emerging fields of research; build networks for researchers and businesses; train highly qualified personnel; create new technology-based companies and jobs; and transfer knowledge and technology to Canadian companies.

- A core strength of over 4,000 talented and dedicated people, 19 research institutes, 15 industrial partnership facilities, the Industrial Research Assistance Program (NRC-IRAP), the Canada Institute for Scientific and Technical Information (NRC-CISTI) and two technology centres.

- The ability to help companies move discoveries in the laboratory towards the development, prototyping and commercialization of these ideas and technologies for the global marketplace.

- The skills to manage research towards short- and long-term specific goals.

- The capability to bring together multi-disciplinary research teams to tackle issues of national importance.

- The ability to put together national programs for delivery in regions across the country.

National S&T Infrastructure

NRC delivers a national S&T program with laboratories, centres and facilities in communities across Canada (http://www.nrc-cnrc.gc.ca/contactIBP_e.html).

Ownership, Management and Maintenance of Capital Assets

Responsible for its own highly technical and complex operations, NRC manages 175 buildings totalling approximately 517,406 square metres of space.

Funding

NRC is funded through government appropriations. In the course of providing technical services to companies and other organizations, it recovers its costs for the purpose of reinvesting in the operation and maintenance of equipment and facilities.

Context

Internal Factors

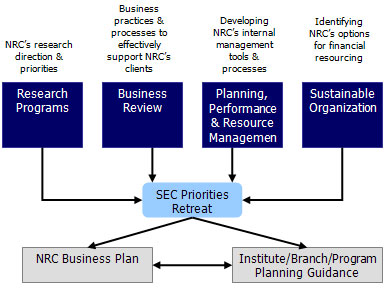

NRC New Strategic Direction: Building a Roadmap for Future Sustainability

The 2006-2007 fiscal year began with the official release of NRC's new strategy, Science at Work for Canada: A Strategy for the National Research Council, 2006-2011. Shortly thereafter, the organization put in place four major implementation initiatives composed of cross-functional teams with the requisite subject-matter expertise:

- Research Programs

- Business Review

- Planning, Performance & Resource Management (PPRM)

- Sustainable Organization

As illustrated below, these implementation teams made recommendations that were presented to the Senior Executive Committee (SEC) in fall 2006 as part of NRC's annual priority setting exercise. Decisions reached by SEC served as key inputs into the development of NRC's inaugural corporate business plan, a draft of which was developed by the end of fiscal year 2006-2007. A final version of the NRC corporate business plan is expected to be in place by early 2007-2008.

Figure 1-3: NRC's Strategy Implementation Process

The following summarizes the implementation teams' key recommendations that were approved by SEC:

Research Programs

NRC will focus its R&D efforts in nine key industrial sectors: Aerospace, Agriculture, Automotive, Chemicals, Construction, Electronic Instruments, Information and Communications Technologies, Manufacturing & Materials and Bio-Pharma. These sectors were identified through significant quantitative and qualitative analysis, as well as through consultation with internal and

external stakeholders that took place throughout 2006-2007. Each NRC research vice-president (VP) was assigned accountability for one or more sectors. Beginning in 2007-2008, Directors General (DGs) will be appointed to lead the development of plans and objectives for each sector.

In addition, NRC will work closely with other government departments, industry and universities to address national priorities in health & wellness, sustainable energy and the environment. As a first major initiative, NRC is committed, in cooperation with Agriculture and Agri-food Canada, to putting in place a national program in bioproducts which will address those latter two national priorities. An accountable VP, a lead DG and a working group have been assigned to the development of the National Bioproducts Program and a target date of Q1 2008-2009 has been established for full launch of the National Bioproducts Program.

NRC has also identified an opportunity to establish a second national program in Fuel Cells & Hydrogen, building on an existing cross-NRC program. A target of 2009-2010 has been set as the formal launch date for the program, although planning work will begin in earnest in 2007-2008.

Business Review

NRC's strategy calls for increased outreach and collaboration with clients and key innovation system players. The Business Review implementation initiative was put in place to identify existing NRC business processes and practices (as they relate to clients, collaborators and other third parties) and recommend changes to strengthen NRC's client orientation.

As a result of this initiative, NRC is committed to placing greater emphasis on leveraging client relationships across all institutes, branches and programs with the aim of maximizing the value NRC can deliver to clients. To this end, an IT-based client relationship management system was identified as a priority and NRC has put in place the financial and non-financial resources required to implement such a system.

NRC will also provide training for staff who interact with clients, strengthening its commercialization capabilities and redesigning some internal business processes, such as the process for reviewing/approving contractual agreements. In collaboration with other parts of the organization, the Vice-President Technology and Industry Support put forward a business case at the end of 2006-2007 identifying the resources required to address these recommendations.

Planning, Performance & Resource Management (PPRM)

The PPRM initiative focused on establishing and enhancing management practices at NRC. The implementation achievements in 2006-2007 included:

(a) Establishing a new organizational-wide business planning process. This process was developed and piloted throughout 2006-2007 and integrates strategic and operational planning, performance measurement, risk management and resource management (financial, human, physical assets). All NRC institutes/branches/programs will be charged with developing three-year rolling

business plans.

(b) Establishing a new performance management framework to support NRC's strategy. In 2006-2007, development of a performance management framework based on the Balanced Scorecard began. A draft, with proposed measures, was completed by the end of the fiscal year. Further consultation is expected to take place in 2007-2008 before the framework is finalized and fully

implemented across NRC.

(c) Establishing a new Program Activity Architecture (PAA) for NRC. In Q4 2006-2007, SEC approved a new PAA for NRC which will be used for all business planning activities going forward. The PAA will be reviewed by Treasury Board Secretariat (TBS) in 2007-2008. A business case is expected to be put forward in Q1 2007-2008 detailing the implementation requirements.

Sustainable Organization

The Sustainable Organization implementation initiative was aimed at identifing options for securing NRC's long-term financial sustainability. The project team made a number of initial recommendations that were presented to SEC and finalized by the end of the fiscal year. Specifically, NRC will:

- Focus the organization's R&D priorities in defined areas: key sectors, national priorities, regional/community innovation (including technology clusters) and areas of national mandate.

- Identify internal operational efficiencies.

- Work increasingly with collaborators.

- Identify areas requiring future investments and funding.

External Factors

Economic Context – Canadian economic performance continued to be solid in 2006 with a real GDP growth rate of 2.7%, a slight deceleration from the 2.9% of the preceding year. 1

In 2006, employment creation in Canada remained solid, it increased by 1.9% with 314.6 thousand net new jobs created, more than in each of the two preceding years. The bulk of the increase consisted of full time jobs (2.3%) with part-time jobs accounting for just 0.4%. The unemployment rate in Canada reached historic lows, reaching an average of 6.3% in 2006, down from 6.8% in 2005. The unemployment rate closed the year at 6.1% in December 2006.2

The Canadian dollar appreciated against the U.S. dollar a further 6.8% in 2006 while the appreciation rates against the euro and the pound were 6.0% and 5.6%, respectively. This appreciation reflected partly a rise in the commodity prices. Despite currency appreciation, Canadian exports of goods increased slightly in 2006 (1.2%).3

Personal expenditure on consumer goods and services advanced 4.1% in 2006, its best performance since 1997. The strength of personal spending comes as no surprise as both labour income and corporate profits increased by approximately 6%.4

Venture capital investment across Canada in the first quarter of 2007 showed very strong growth on both a year-over-year and quarter-over-quarter basis, totalling $598 million. This represents a 62% increase over the $370 million invested during Q1 2006, and is also 16% above the $517 million invested in the previous quarter (Q4 2006). The growth in venture capital investment was strongest in Ontario, where $302 million was invested, more than double the $149 million invested in Q1 2006. 5

Biopharmaceutical and other life science investments increased in Q1 2007 with 25 companies receiving $206 million in new venture capital (up 44% from the $143 million in Q1 2006). Venture investment in environmental "clean" technologies also showed strong growth during the quarter, with $35 million invested in nine companies, compared to $15 million invested in seven transactions during Q1 2006.6

NRC's Link to the Government of Canada Outcome Areas – NRC has a long history of making valuable scientific discoveries that contribute to the well-being of Canadians, Canadian industry and others worldwide. NRC's efforts support two main Government of Canada Outcome Areas as outlined below:

- An Innovative and Knowledge-based Economy: A better life for all Canadians is the highest priority for the federal government7 which strives to create a higher standard of living and a greater quality of life for its citizens. Productive efforts in science and technology, education and commercialization are the cornerstones to achieving this objective. NRC supports Canada's innovative and knowledge-based economy through its focus on excellence and leadership in R&D; technology cluster growth; added value for Canada through knowledge transfer; and the development of outstanding people through education and training.

- A Safe and Secure World Through International Cooperation: Canada seeks to play a major role in alleviating economic, health, environmental and security challenges facing the world. Through its research in human health and medical devices; sustainable technologies; and the environment, as well as its focus on international research collaborations and assistance, NRC contributes to the development of a prosperous economy that benefits Canadians and the world.

1 Canada's State of Trade: Trade and Investment Update 2007. 7 June 2007, http://www.dfait-maeci.gc.ca/eet/pdf/07-1989-DFAIT-en.pdf

2 Ibid.

3 Ibid.

4 Ibid.

5 Canada's Venture Capital Industry in Q1 2007, Thomson Financial. 2007, http://www.canadavc.com/files/Q12007OverviewFrench.pdf.

6 Ibid.

7 Budget Speech (May 2006), The Honourable Jim Flaherty, Minister of Finance, http://www.fin.gc.ca/budget06/pdf/speeche.pdf

Section II – Analysis of Program Activities

This section provides an overview of NRC's Program Activities (based on NRC's Program Activity Architecture established in 2004) and how they contributed in 2006-2007 to the organization's priorities and strategic outcome - an innovative, knowledge-based economy for Canada through research and development, technology commercialization and industry support.

Overview of Program Activities

NRC Program Activities are structured along two business lines (Research and Development, and Technology and Industry Support). These provide a balance between conducting R&D and delivering technical and innovation support services to industry and the public.

Table 2-1: Program Activity Profiles

NRC Programs

In 2006-2007, in addition to its specific Research and Development and Technology Industry Support activities, NRC focused its efforts on programs that also support important Canadian priorities. Many of these are multi-disciplinary, cross-organizational initiatives that encompass a number of NRC entities (e.g., research institutes, laboratories, centres, facilities, programs and services). These collaborative programs address the Government's priorities on optimizing its S&T investments and expanding its value and reach. Examples of NRC's programming efforts in these areas can be found in the following "program spotlights" sections:

- The Genomics and Health Initiative (NRC-GHI)

- The Industrial Research Assistance Program (NRC-IRAP)

- The Canada Institute for Scientific and Technical Information (NRC-CISTI)

NRC's Overall Performance for 2006-2007

Priority 1: Research and Development for Canada: Economy, the Environment, Health and Safety

Performance Indicators (as identified in the 2006-2007 RPP) |

|

The performance indicators that do not change year-over-year are not reported on annually.

In 2006-2007, the Research and Development portfolio contributed to areas that are recognized as priorities for Canada through its core strengths: national research institutes and innovation activities dedicated to technology fields important to Canada; value creation through knowledge and technology transfer; the pursuit of leading-edge and integrated research in emerging cross-disciplinary fields; and the creation of economic and social benefits for Canadians. Continued support of Canadian industry and the research community through codes and standards, access to national facilities and stewardship of Canada's "big science" facilities remained a foundation to global marketplace access and international R&D alliances. The portfolio continued to develop new technologies leading to commercialization opportunities for Canadian industry.

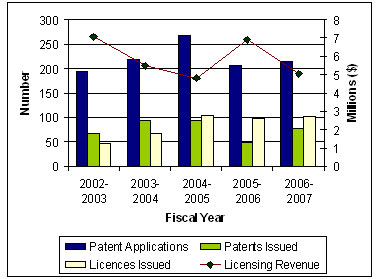

A new patent is a key step in the continuum from discovery to innovation. The strategic management of intellectual property (IP) makes a contribution to the innovative capacity of firms. In 2006-2007, NRC applied for 215 new patents and secured 78 patents from applications made in previous years. Forty-five percent of these were issued in the U.S. – an Organization for Economic Cooperation and Development (OECD) recognized measure of competitiveness. Based on a 2003 benchmarking study of best practices in IP management, NRC is changing its approach by screening disclosures early; conducting market research and patent analysis assessments; and regularly reviewing its IP portfolio to generate, identify and develop more "high potential commercial value" IP.

By negotiating a licence agreement to use NRC technology, the industrial partner endorses the merit of NRC research and these agreements show a direct flow of innovation into business application. NRC entered into 102 new licence agreements in 2006-2007 and IP licensing revenue was $5.0 million (see Figure 2-1).

Figure 2-1: NRC IP Portfolio (2002-2007)

Source: NRC Performance Information Database, 2006

Just over $2.3 million of IP revenue in 2006-2007 was attributed directly to the Meningitis-C vaccine developed by the NRC Institute for Biological Sciences (NRC-IBS) and $1.1 million of revenue from hardware and software development can be attributed to the NRC Institute for Information Technology (NRC-IIT).

Some examples of NRC technology licensed to industry in 2006-2007 include:

- In December 2006, Canadian-based Nstein Technologies Inc. announced the signing of a 10-year technology licence agreement, and a three-year collaborative research agreement related to the use of NRC's "Factor" text mining technology. Developed at NRC-IIT, "Factor" is a leading-edge search tool that will give Nstein a competitive advantage in the text analytics market. This technology and research partnership, valued at over $7.5 million, is one of the largest commercialization deals signed by NRC-IIT.

- The NRC Institute for National Measurement Standards (NRC-INMS), a world leader in the field of radiation therapy dosimetry, continues to benefit from the licensing of its Monte Carlo Code for Electron Beam Calculations to MDS Nordion. The Canadian company sold its oncology software portfolio to an international firm, Nucletron® B.V. in 2003 with a five-year licence extension to December 2012.

- The NRC Institute for Microstructural Sciences (NRC-IMS) has been active in the development of OLEDs (organic light-emitting devices) in collaboration with Canadian and international partners. One such partnership with National Tsing Hua University in Taiwan led to the synthesis of a new organic compound by NTHU that was fabricated into commercially promising devices by NRC-IMS resulting in a patent application in Canada, the U.S. and Taiwan.

When NRC develops a technology with particularly strong market potential and there is no Canadian receptor capacity identified, entirely new companies may be created to commercialize the technology. These new companies create innovative products and services for the global marketplace and new jobs for Canadians. In 2006-2007, NRC launched one new company bringing the total of new companies created since 1995 to 68 accounting for approximately 604 full-time jobs and an estimated $437 million in cumulative investment, a 6% decrease from last year8. In 2006, investment from all sources into NRC new companies was $63 million.

Company created in 2006-2007:

- Kent Imaging Inc. – based on NRC patented technology, Kent Imaging has developed a camera system that will enable emergency doctors and surgeons to survey injured or reconstructed tissue to determine its state of health. Taking "viability" pictures of tissue using the camera system can supply information to doctors on the amount of blood and oxygen reaching it and thus indicating its potential for survival. These are crucial pieces of information that will help with critical decision-making during initial injury assessment, surgery, or post-operative recovery.

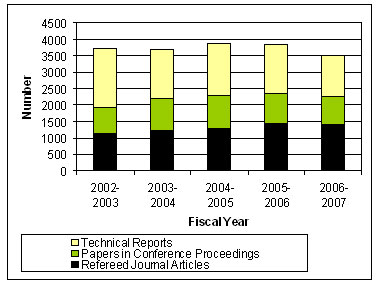

Scientific papers in leading peer-reviewed publications and conference proceedings are internationally acknowledged measures of research quality and relevance. They are also a key tool for the dissemination of knowledge and the eventual creation of value for Canada in the long-term. NRC has consistently produced over a thousand peer-reviewed publications each year over the last five years. In 2006-2007, researchers published 1,403 articles in refereed journals. NRC researchers also presented 870 papers at S&T conferences and produced 1,239 technical reports for clients (see Figure 2-2).

Figure 2-2: NRC Publications (2002-2007)

Source: NRC Performance Information Database, 2006

NRC's research excellence is also evident in the involvement of its researchers in multi-researcher networks and centres of excellence as well as the number of externally funded, peer-reviewed research grant proposals. In 2006-2007, NRC researchers participated in 110 research networks, held 217 positions on editorial boards of scientific journals and were appointed to 499 adjunct professorships in Canadian universities. One hundred and seventy four grants provided NRC researchers and their partners with $36 million, over the lifetime of the projects. Examples of external awards received by NRC researchers in the last year can be found in Section IV – Awards and Achievements.

National leadership in R&D and innovation is demonstrated by the participation of NRC researchers on 593 national committees and by the 206 conferences and workshops organized by the institutes.

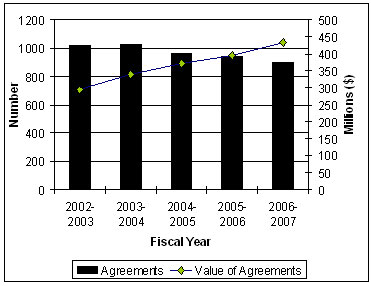

In 2006-2007, NRC signed 361 new formal collaborative research agreements with Canadian partners worth a total of $149 million. The total value over the lifetime of these agreements grew to $434 million (see Figure 2-3). The number and value of collaborative agreements signed during a year are indicators that foretell increased research activity. NRC's Canadian partners invest 1.48 dollars for every dollar NRC invests.

Figure 2-3: Canadian Collaborations (2002-2007)

Source: NRC Performance Information Database, 2006

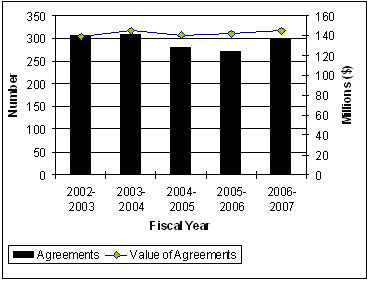

Participation in international projects and consortia exposes Canadian students, researchers and companies to the best-in-the-world capabilities. In 2006-2007, NRC signed 99 new formal collaborative research agreements with international partners worth $41 million. The total number of active international collaborative agreements is similar to last year's number (see Figure 2-4), with a total value over the lifetime of the agreements of close to $145 million. NRC's international partners invest 5.3 dollars for every dollar NRC invests.

Figure 2-4: International Collaborations (2002-2007)

Source: NRC Performance Information Database, 2006

8 Adventus Research Inc., Economic Impact of National Research Council Canada Spin-Off Companies 2007 Survey, February 25, 2007.

Strategy: Creating value through R&D in sectors with the greatest economic impact for Canada |

Facilitate technology advantage for next generation aerospace industry – Fiscal year 2006-2007 was the second year the NRC-Aerospace Manufacturing Technology Centre (NRC-AMTC) occupied its new building in Montreal. Over the past year, it has embarked on a $9 million technology demonstration project with funding support from Canada Economic Development for Quebec Regions. This project is focused on the manufacture of aircraft major structural components from composite materials. The strategic objective of the project is to facilitate the development in Canada of a tier 2 major subcomponent integrator within the aerospace supply chain.

In 2006-2007, the NRC Gas Turbine Laboratory (NRC-GTL), working with Industry Canada's Aerospace and Defence Branch established a national network for the development of a technology roadmap and technology demonstrator capability in aerospace diagnostics, prognostics and health management. The network, consisting of the major Canadian Original Equipment Manufacturers (Bell Helicopter, Pratt & Whitney and Bombardier), with government, university and small- and medium-sized enterprises (SMEs) from the aerospace community, identified priority technology needs in 14 projects and developed the funding solutions to proceed with two new projects this past year. The network links all of the innovation system components in this domain, for the first time. Approximately 80 participants worked together to advance the process for teaming. A national steering committee directs the activities through regular meetings and a website. The establishment of the network and successful implementation of team – led innovation across the community is of benefit to the Canadian aerospace community and will form a working model for the development of a Technology Roadmap in Combustion – focused Computational Fluid Dynamics.

The NRC Institute for Aerospace Research (NRC-IAR) and GE Aviation, in partnership with Aéroports de Montréal, built a new facility to conduct icing certification tests on large engines. Construction of the facility, located at the end of Montreal's Mirabel International Airport runway, was completed in February 2007. This new NRC facility, along with existing facilities in Ottawa, could result in Canada becoming the icing certification centre of excellence for the world.

Position Canadian industry as a key player in advanced manufacturing – In 2006-2007, the NRC Industrial Materials Institute (NRC-IMI) continued to focus on the processing and forming industries. Much progress was made in biomaterials, metal foaming technologies, aluminium forming, environmental membranes, natural fibre composites and biodegradable polymers. Sectors served included automotive, medical devices, aerospace, and general manufacturing in metals and plastics. NRC-IMI, for example, achieved the development of an integrated mathematical model for the hydroforming of structural aluminium automobile components. They also developed innovative aluminium rear suspension components for automobiles to be manufactured in 2010-12. The design was optimized for the use of robotic welding equipment in their assembly.

At the NRC-AMTC some projects were able to deliver significant results quickly for General Motors and Bombardier. A collaborative project with General Motors Canada (GMC) on High Speed Grinding of Steel and Nodular Cast Iron has achieved higher material removal rates than has ever been obtained before. This has significant impact on the productivity and reduction of the manufacturing costs of crankshafts and camshafts at GMC. In collaboration with Bombardier Aerospace (BA), NRC-AMTC has developed the first in the world high accuracy positioning system for fuselage panel riveting using collaborative robots. Novel methods of calibration and the use of metrology-in-the loop for the positioning control improved the accuracy of positioning the part on a panel. The impact of the implementation of this system will be a 50 to 75 % reduction of production costs of fuselage components according to a Bombardier forecast and, as a secondary benefit, the reduction of occupational diseases due to obviating the need to have a human operator close to a noise-filled workspace environment. According to the client, this breakthrough will result in ensuring that the production of fuselage panels for most BA aircraft will remain in Montreal rather than being shipped outside Canada.

In collaboration with industrial, university and government partners, the NRC Integrated Manufacturing Technologies Institute (NRC-IMTI) held six meetings with current and potential members in three of their Special Interest Groups: Precision Freeform Fabrication Technologies (PFFTech), Precision Micro Fabrication Technologies (PMFTech) and Reconfigurable and Flexible Manufacturing Technologies (RFMTech).

The NRC Institute for Chemical Process and Environmental Technology (NRC-ICPET) continued to focus on two major research thrusts: energy-oriented processes and solution-driven materials within a sustainable framework. The Institute worked with Environment Canada, Industry Canada, Natural Resources Canada and Five Winds International on the refinement of SAFT V2, a tool that can help researchers in companies determine the overall sustainability of proposed research approaches and industrial processes. As part of the evaluation, the tool was applied to several bioproducts projects currently underway at NRC. NRC-ICPET continued to build on its fuel cell research capabilities, creating new materials that outperform current commercial membranes in cost and performance. In the oil sands area, NRC-ICPET developed and renewed industrial collaborations with the Canadian Oil Sands Network for Research and Development (CONRAD) and Syncrude. These industrial collaborations complement a significant investment from other government departments in NRC-ICPET's research program which brings a fundamental chemical science approach to oil sands processing and significantly reduces the energy and process requirements associated with synthetic crude oil production.

The NRC Institute for Fuel Cell Innovation's (NRC-IFCI) R&D program in 2006-2007 aimed at advancing fundamental fuel cell science and technology applications and accelerating the adaptation and commercialization of these technologies. To contribute to these objectives, the Institute assembled a multi-disciplinary team of research scientists, engineers, and technical staff, with recognized expertise in fuel cell and hydrogen technologies. NRC-IFCI had several critical achievements in 2006-2007 in advanced materials and manufacturing which will reduce the cost of Proton Exchange Membrane Fuel Cells (PEMFC) and Solid Oxide Fuel Cells (SOFC) materials and enable the Canadian Fuel Cell and Hydrogen industry to mass produce fuel cell materials:

- Using the internally developed Reactive Spray Deposition Technology, NRC-IFCI developed high-performance membrane electrode assemblies (MEA) with low loading nano-platinum catalyst layers. Through the development of an advanced catalyst coating membrane (CCM) technique and the use of an internally developed vacuum table, NRC-IFCI achieved a significant performance improvement, better than many commercial baseline MEAs. These achievements position NRC-IFCI as a leader in the development of high performance MEAs.

- Cost-effective processes for SOFC fabrication were developed, which are scaleable for high-volume manufacturing. The production of nanopowders for SOFC using axial injection plasma spray, the fabrication of thin film SOFC materials, and the deposition of thin SOFC electrolytes with high gas tightness enable the production of SOFCs at lower cost and temperatures, vastly improving overall performance and commercial viability.

- Technical concepts for a 2-layer structure air cathode, with a hydrophobic diffusion layer (GDL) and a catalyst impregnated mesh layer, as opposed to the commercially available 4-layer air cathode were developed. The new cathode with high performance and high stability has resulted in several patents, which have become the core technology for one of NRC-IFCI's local cluster partners. This technology has enabled the industrial client to develop their first fuel cell product in a cost effective manner.

Reduce industry risks and costs of working on next generation information and communications technology – In 2006-2007, NRC-IMS and NRC-IIT continued to be involved in developing next-generation capabilities in information and communications technology. NRC-IIT's areas of research priority are Knowledge from Data, People-Oriented Systems and eBusiness and include research in data mining, cybersecurity and machine translation.

The Language Technologies Research Centre (LTRC) located on the main campus of the Université du Québec en Outaouais (UQO) unites researchers from the partnering organizations (Translation Bureau of Canada, UQO, Industry Canada and NRC-IIT) as well as the language industry association AILIA, UQO's technology transfer office (BLUM) and NRC-IRAP. The group has now achieved a full complement of researchers together with graduate students and post-doctoral fellows. Three technologies in the group's portfolio which present commercialization potential include: TransCheck (a translation error-detection software), Barçah (terminometry support software) and Portage (statistical machine translation). In December 2006, NRC-IIT signed its first industrial cooperation agreement for the use of some components of Portage technology to enhance existing translation support products.

In 2006-2007, NRC-IIT's research contract for the use of PORTAGE in the multimillion dollar GALE (Global Autonomous Language Exploitation) research program was renewed for a second year. GALE, sponsored by the U.S. Government's Defense Advanced Research Projects Agency (DARPA), has the goal of making foreign language (Arabic and Chinese) speech and text accessible to English monolingual people, particularly in military settings. NRC-IIT is the only Canadian R&D participant in GALE, the largest project in the world in natural language processing. Participation will build future returns; in working with the best in the world, NRC-IIT is involved in developing technologies that will eventually be espoused by Canadian industry and allow Canada to be competitive in this emerging area. The PORTAGE technology was also instrumental in fostering a new research project called SMART, which targets the development of new techniques in machine translation in collaboration with a consortium of European laboratories.

NRC-IMS is anticipating the importance to the Information and Communication Technologies (ICT) sector of working at the nano and quantum scales. NRC-IMS's work with self-assembled quantum dots lays the foundation for future sources of single and entangled photons with application to secure information transfer using fibre-based communication channels. In another effort, NRC-IMS led a three-nation team to optically detect a fraction of the electron's charge, a research breakthrough published in the prestigious journal Nature Physics.

An NRC-IMS team demonstrated the first functional electronic circuit composed of three single electron spins localized in a field-effect transistor, and as a result was invited to become a partner in QuantumWorks, a new Innovation Platform based at the University of Waterloo, funded by the Natural Sciences and Engineering Research Council of Canada (NSERC), that links Canadian researchers with industrial and government agency partners to lead Canada into the nano and quantum technological revolution.

In 2006, researchers from three NRC institutes demonstrated the first silicon photonic wire evanescent field (PWEF) sensor element. Given that optical PWEF sensor elements can occupy an onchip space less than a few tens of micrometers across, this technology lends itself to integration in multiplexed sensor arrays – an essential requirement for a practical molecular sensing technology. It is also compatible with standard silicon fabrication processes and therefore has the potential to provide a manufacturable solution, filling a need for label-free sensor arrays in genomics and proteomics based diagnostics and research, as well as for drug screening in the pharmaceutical industry.

Strategy: Invest in leading-edge research including increased horizontal and multi-disciplinary R&D |

Supporting Canada's leadership in fuel cells – The Fuel Cell and Hydrogen Program mobilizes fuel cell expertise and research strength from a network of NRC research institutes across Canada, including the Institute for Fuel Cell Innovation (NRC-IFCI) in Vancouver, which is the flagship for this program. A total of $6.2 million over five years (from 2003-2004 to 2007-2008) was allocated to NRC for its Fuel Cell and Hydrogen Program - a key horizontal initiative. In 2006-2007, seven projects in PEMFC and SOFC were funded with $1.1 million at five NRC institutes. With matching institute contributions, total value of the program was $4.5 million. In 2006-2007, 35 scientific papers were published in refereed journals and two patent applications filed. NRC's research accomplishments from this cross-NRC program have been recognized in the academic community, and NRC is an important partner in research network proposals submitted to Natural Sciences and Engineering Research Council of Canada (NSERC) for SOFCs, Hydrogen and PEMFC research. Fundamental research and strong competencies developed in the program have now resulted in establishing an international reputation for NRC-IFCI in hydrogen and fuel cell research resulting in five signed collaborative projects with Canada's top fuel cell companies as well as Nissan of Japan. Continuing work with Ballard Power Systems, Hyteon Inc., Tekion Inc. and Northwest Mettech is bringing this technology closer to the marketplace. These "spin-off" projects directly resulted from the research done within the program. Program funding will be up for renewal in 2008-2009.

Through research results and competencies developed as the key institute within this program, NRC-IFCI has played a pivotal role in supporting the growth of the Canadian hydrogen and fuel cell industry. During the five years since the establishment of the institute the British Columbia hydrogen and fuel cell cluster has grown from just a few companies to a dynamic emerging cluster. Today, British Columbia is widely considered to be the centre of one of the world's most advanced clusters of companies and organizations focused on fuel cell and hydrogen technologies. NRC-IFCI has worked on 19 collaborative industry projects, was invited to participate in the "EU Framework Program 6" group involving 18 European organizations, and was chosen as one of three organizations worldwide for Japan's New Energy and Industrial Technology Development Organization (NEDO) international fuel cell program.

Increase synergies in bioproducts – As part of its new strategy, NRC will be implementing a series of national programs to address Canadian priorities in health and wellness, environment, and sustainable energy. These programs will be "outcome-focused", involving multi-disciplines from across NRC and other research and commercial organizations (including other government departments and industry players). In April 2007, it was announced that the Vice-President Life Sciences will be responsible for the implementation of the first national program in bioproducts. During 2006-2007, work accomplished in establishing this new program included aligning stakeholders (including Agriculture and Agri-Food Canada who is co-leading the implementation of this program), identifying expertise and capacity at NRC which will be relevant to program objectives and scoping out a potential focus. Developing bioproducts will increase the value of Canadian virgin resources and find higher value applications for low-value streams such as agricultural and forestry wastes, municipal solid waste, residual organics and other under-utilized organic resources, as well as have an impact on two Canadian priorities: environment and sustainable engery.

Support health for Canadians: Vaccines, immunology and neurodegenerative diseases – Building on the success of its Meningitis C vaccine for people of all ages, NRC-IBS continued to address important public health concerns through the application of neuro- and glycosciences to reduce the impact of age-related and infectious diseases by, among other things, developing an effective vaccine against Alzheimer's disease and conducting research on brain repair solutions through a new neuroglycobiology program. In 2006-2007, new immunology and neuroglycobiology laboratory facilities were put in place and staffing was added to grow these new activities. NRC-IBS continued to collaborate with Dow AgroSciences to reduce the load of food-borne pathogens in animals thereby contributing to the safety of the world's meat supply.

Support National Security – NRC is the lead on one Chemical Biological Radiological Nuclear (CBRN) Research Technology Initiative project and participates in three others. In partnership with the NRC Steacie Institute for Molecular Sciences (NRC-SIMS), Laval University, Health Canada and Defence Research and Development Canada Suffield, NRC-IMI designs and fabricates plastic-based substrates and devices for micro-magnetic manipulation for detection purposes. The NRC-SIMS portion of the project involves the design of nano-material architectures for the detection and capture of pathogens. The technology has a wide range of applications contributing to the speed and efficiency of diagnostics for both therapeutic and security purposes.

Safety is a major concern and governments devote a lot of effort to this area. NRC-IMI makes use of horizontal programs to develop materials technologies for safety applications, in particular the chemical or biochemical detection of pathogens, in collaboration with the Canadian Government (National Defence, Genome Canada, GHI-3, and other NRC institutes), research centres and universities, and other major players in this area.

NRC-IMI takes part in many projects in collaboration with Canada's National Defence, including:

- Development of smart detectors for diagnosing and predicting the condition of aerospace structures over time. Networks of ultrasonic piezoelectric detectors were incorporated into aerospace structures manufactured with various materials. The use of these detectors has shown that faults in the structure can be detected at a great distance, on flat as well as curved surfaces.

- Anti-corrosive coatings for increasing the useful life of aircraft structures.

- Development of an aluminium anode coating, obtained either by thermal deposition or low-temperature deposition, offering protection against corrosion under stress and against corrosion fatigue for aluminium alloys, while preserving their initial mechanical properties.

- Development of a microfluidic manipulation system in collaboration with several research groups at Laval University that can concentrate and filter DNA targets for the detection of bacteriological agents (anthrax).

- Demonstration of the capture and detection by magnetic confinement of DNA targets at a concentration of less than 1000 copies/ml.

- Development of a manufacturing process for nanometric polymer fibres with certain properties such as electrical conductivity, thermochromism, etc.

In 2006-2007, the NRC Centre for Surface Transportation Technology (NRC-CSTT) played a key role in assisting the Canadian Armed Forces with the Leopard 2 Tank System Integration. The Armed Forces decided to make greater use of tracked vehicles, such as the Leopard 2 Tank to improve troop protection, vehicle mobility and defence capability while removing the risks associated with the use of local roadways. The new Leopard tanks however lacked many of the Canadian communications, situational awareness and command and control systems. Under very tight timelines to accommodate the desire to ship completed and operational tanks to Afghanistan, NRC-CSTT played an integral part of the team to utilize its unique approach to design and integration using a virtual design environment. In addition, NRC-CSTT assisted in the evaluation and option analysis of using varied tank crew cooling systems to combat the expected hot temperatures of operating a 66-ton metal tank in desert locations. The contribution of NRC-CSTT staff to this work served to significantly reduce the number of soldier lives lost to hazards of moving on the roadways in and around Kandahar, Afghanistan. It represents a contribution by NRC to saving Canadian lives and raising Canada's ability to function effectively in this threatening theatre.

Participate in international collaborations in a non-traditional role – In the fall of 2006 NRC, in collaboration with the Centre de recherche et de restauration des musées de France (C2RMF), announced the completion of the most important scientific study ever done of Leonardo da Vinci's Mona Lisa. The two-year collaboration involved the use of a number of cutting-edge technologies to examine the painting's physical properties. Among these was a three-dimensional (3D) colour laser scanner designed and built by NRC which was taken to Paris to scan the painting. The scanner is capable of scanning 3D images at a depth resolution of 10 micro-meters, or about 1/10 the diameter of a human hair. The 3D model was used to document and precisely measure the shape of the wooden panel on which the Mona Lisa is painted, to examine features of the composition and the craquelure of the paint and to study the painting's state of conservation. The technology has an extensive range of museum and heritage applications and has been widely recognised.

Integrate nanotechnology research and innovation – To build its competencies and leverage its resources and knowledge, NRC is developing a horizontal nanotechnology initiative (NRCNano) that will increase the integration of expertise across the NRC as well as facilitate collaborations with external partners, including other government departments, universities and industry. The program will work in concert with a nascent nanotechnology network growing around the National Institute for Nanotechnology (NINT) in which specialized nano centres across Canada are linking together to share information and enable collaborative ventures.

One illustrative example of the way in which NRC institutes already work collaboratively in nanotechnology is the research being performed by three NRC institutes in the area of single walled carbon nanotubes (SWNT). NRC-SIMS has world-leading capabilities in making and functionalizing high purity SWNT; NRC-IMI brings its knowledge and operational experience in blending and setting process parameters for unique blends of polymers and additives; and NRC-IAR contributes its materials testing capabilities and in-depth understanding of the future needs of the Canadian aerospace industry.

Program Spotlights - NRC Genomics and Health Initiatives (NRC-GHI): Address key social and economic challenges through integrated Genomics and Health Research

|

Description: NRC conducts over half of all biotechnology research performed by the federal government and is a major contributor to important advances in genomics, proteomics and health-related research through the NRC Genomics and Health Initiative (NRC-GHI). NRC-GHI was established in 1999 to strengthen NRC's capabilities in genome and health sciences, integrate research capabilities across NRC, and contribute to national genomics and health research efforts in collaboration with other federal agencies, industries and universities. NRC-GHI currently comprises six large-scale and diverse biotechnology research programs, supported by three technology platforms (DNA Microarray, DNA Sequencing and Proteomics). NRC-GHI is NRC's flagship horizontal life sciences initiative and currently involves ten NRC institutes and more than 400 personnel. Plans: In 2006-2007, NRC-GHI will be entering the second year of its third phase of research activity. The initiative will continue to focus its efforts on six research programs oriented towards diagnosing, treating and preventing human and animal disease, developing technologies for pathogen detection and advancing new technologies for cardiac care and the production of commercially valuable agricultural crops. NRC completed an evaluation of NRC-GHI in 2005-2006. The results of this study will feed into a broader evaluation of the interdepartmental Genomics R&D Initiative in 2005-2006 and 2006-2007. NRC is leading this evaluation on behalf of the six participating departments. Recognized Program Management and Governance Process: NRC is committed to effective research program management practices and has integrated lessons learned from the first two phases of NRC-GHI to refine the competitive program selection process for the third phase. An external Expert Panel with industry representation has reviewed all program proposals for quality and relevance. NRC uses selection criteria that favour integration of research capabilities across institutes, collaboration with external partners in other government departments, academia and industry, as well as commercial potential. NRC has also instituted formal program management for all NRC-GHI programs, tracking progress against explicit milestones and deliverables; progress is evaluated quarterly as well as annually. A new comprehensive governance model for NRC-GHI was assembled for the third phase to ensure that various accountabilities and responsibilities are clarified and understood. Approved by NRC Senior Executive Committee, the NRC-GHI governance structure is being promoted as a model for horizontal programs within NRC. |

||

|

2006-2007 Financial Resources |

||

|

Planned |

Total Authorities* |

Actual** |

|

$11.00 million |

$11.57 million |

$10.94 million |

|

*$6 million of annual funding is subject to renewal. Current approval covers the period of April 2006 to March 2008. Planned Results (from 2006-2007 RPP):

2006-2007 Performance: On behalf of the six participating departments, NRC led an evaluation of the interdepartmental Genomics R&D Initiative in 2006-2007 and revised the Results-based Management and Accountability Framework (RMAF) for the Initiative. The process to renew NRC-GHI into a fourth phase (GHI-4) was launched in 2006-2007. NRC research teams were encouraged to demonstrate their ability to integrate research and technology disciplines in order to drive commercially relevant advances in cutting-edge areas of genome and health-sciences, while ensuring alignment with the new NRC strategy. Decisions on which Letters of Intent would be moving forward for full proposal development were made and new investments are being considered in areas that focus on cerebrovasular and infectious diseases. Scientific Output:

Examples of impacts from selected NRC-GHI programs include:

Economic Benefits

In addition, NRC-GHI programs have profited from several collaborations and service contracts with external partners:

Citizenship Engagement

Participating NRC Research Institutes (2006-2007): NRC-BRI, NRC-IIT, NRC-IBD, NRC-IMB, NRC-IBS, NRC-PBI, NRC-SIMS, NRC-IMI, NINT, NRC-IMS. Website: http://ghi-igs.nrc-cnrc.gc.ca/ |

||

Strategy: Build sustainability in the Environment, Oceans Management, Coastal Science and Engineering |

Continue to support Canada's commitment to reduce greenhouse gas emissions and improve the environment9 – NRC works with other government departments in the delivery of interdepartmental programs on clean energy and climate change. Its main contributions are in two areas: hydrogen and fuel cell R&D and in the new national program on bioproducts. In partnership with an industry collaborator NRC-IFCI developed technology for generating hydrogen on demand. The device generates 99.99% pure hydrogen and can easily be started and stopped by "throwing a switch". Its purity makes it ideal as a fuel for proton exchange membrane fuel cells and for providing gases to laboratories and industrial processes. Safety is a key concern regarding hydrogen use especially when it must be stored in large quantities or transported using public transportation infrastructure. As this newly developed device generates hydrogen on demand and does not need storage capacity it addresses these safety issues very effectively. Owing to its devices key features and scalability, NRC anticipates the technology will be used in a number of applications ranging from portable electronics, back-up power systems and possibly automobiles. This technology is currently being commercialized and will bring us one step closer to reaping the environmental benefits of hydrogen as a fuel.

NRC-IBS scientists designed an enzymatic process to effectively degrade pectin from hemp fibres, for which a patent application has been filed. Through a licensing agreement, a Vancouver company, Naturally Advanced Technologies, plans to commercialize the process and produce soft, white hemp clothing that can compete with cotton. Unlike cotton, hemp can be grown without pesticides and herbicides and rain provides enough irrigation. It absorbs carbon dioxide five times more efficiently than the same acreage of forest, so it can also help fight the greenhouse effect. NRC-IBS developments in hemp fibre processing will contribute to a sustainable value-added Canadian agricultural industry permitting Canadian farmers to compete in the lucrative world market for fabrics. Cotton cannot be grown in Canada, which has limited the potential for a Canadian presence in this market.

The NRC Biotechnology Research Institute (NRC-BRI) was co-responsible for a major environment technology demonstration project in 2006, consisting of testing groundwater (bio) remediation technologies, including nanotechnologies. Total budget for the project was $1.56 million. The technology is being transferred to a Canadian company.

In Montreal, a former industrial and municipal waste dumping site, Technoparc, represented a hazard to aquatic life in the St-Lawrence River because of the toxic leachate and oils seeping in the river, was converted into a high tech park. NRC-BRI, through a technology platform set-up in collaboration the province of Quebec, City of Montreal, Environment Canada, Economic Development Canada, and environmental industries has been involved in the testing of technologies, evaluation of industrial technology performance and assessment, management of the whole project, making links with stakeholders (private and public) and in communications with the public. NRC- BRI is further developing this project which should lead to a large scale technology demonstration project, estimated at $4.5 million for 2007-2008. When completed, this site could be redeveloped by the "Société du Havre de Montréal".

The NRC Institute for Research in Construction (NRC-IRC) developed an Integrated Indoor Air Quality Model software program that provides an integrated view to indoor environment pollution issues including pollutants (vapours and particles), sources (indoor and outdoor), and fate/transport mechanisms that affect levels of indoor pollutants. This software supports the construction (and related) industries in reducing emissions from materials, reducing ventilation loads, and improving material selection.

The NRC Canadian Centre for Housing Technology (NRC-CCHT) performed a number of projects largely aimed at assessing innovative construction products and systems and reducing energy consumption and associated green house gas (GHG) production. During 2006-2007, the Centre was the focus of a number of joint research and strategic projects. The following are highlights:

- In-situ Performance of Two-stage Gas Furnace. Following the mid versus high efficiency furnace project, the evaluation of a two-stage gas furnace continued for several weeks in different conditions.

- RAD Zone Control System for Houses. An innovative controller for individual room control on a forced air system was assessed over two seasons.

- Thermostat Setback and Set-forward. A detailed study and report were completed, documenting the effects of thermostat set-back in winter and set-forward in summer.

- StART – Hydrogen Electrolyzer. A prototype of a hydrogen generator based on the electrolysis of water was deployed at NRC-CCHT in a proof-of-concept experiment, which saw the generation of hydrogen on site in the Test House. This hydrogen was then blended with the domestic natural gas stream and subsequently burned to recover the energy as heat.

- Window Glazing Technologies – Comparison of High and Low solar Heat Gain Low-e Technologies. A window experiment involving whole-house performance comparisons of low-e coatings with differing solar heat gain ran successfully for four weeks of winter testing and four weeks of summer testing. The analysis and modeling is now complete.

Build sustainability through oceans science – The reliable performance of technology in the marine environment is of commercial value to all ocean industries. The evaluation of that performance is an important tool in assuring the safety of people, the security of assets and the protection of the ocean environment. These concerns have led to increasing demand for cost-effective systems to harvest ocean renewable energy. In 2006-2007, researchers at the NRC Institute for Ocean Technology (NRC-IOT) began testing novel technologies at model scale, utilizing the Institute's Offshore Engineering Basin. The results will be used to launch field trials of full-scale systems, giving Canadian developers an international advantage in this emerging sector.

Canada's energy industry also benefited from performance evaluation of flexible risers for offshore oil and gas operations. These risers are often subject to vortex induced vibrations. NRC-IOT carried out physical tests to measure riser response behaviour in currents. That information was used to develop a numerical model for dynamic flexible riser vibrations. This capability to model and assess deep-water technologies is benefiting the east coast offshore industry and is being delivered in turn to the international market by Canadian SMEs.

The Ocean Sciences Technology Partnership (OSTP) in 2006-2007 succeeded, through extensive consultation sessions across Canada, in capturing the links between ocean science researchers and technology innovators from government, industry, academia, coastal communities and regional organizations. These relationships strengthened national linkages between regional networks, information sharing and awareness building, leveraging of funds, building technology commercialization demonstrations, partnerships and joint ventures. As had been envisaged, OSTP represented a national voice for the ocean technology community in 2006-2007. In addition to preparation of their "Smart Oceans Strategy", OSTP developed an Internet-based directory that provides information on Canada's suppliers of ocean related research and technology solutions.

NRC-IRAP staff played a role in the evolution of OSTP, serving as an advisor to the Board and helping guide the development of the deliverables through participation in Board meetings and interactions with the OSTP project manager and individual board members. Additional information is available from the website: http://www.ostp-psto.ca

9As a Schedule II (Financial Administration Act) departmental corporation, NRC is not subject to the 1995 amendments to the Auditor General Act requiring the preparation of a Sustainable Development Strategy. However, NRC has an Environmental Management Policy to ensure that its operations contribute to sustainable development. NRC fosters the integration of sustainable development strategies and practices across Canada and in the innovation processes of Canadian SMEs.

Strategy: Support Canadian industry and research community through codes, standards and investments in R&D infrastructures |

Harmonize international measurement standards – NRC-INMS is Canada's national metrology institute (NMI), determining physical standards and methods of measurement that impact directly on the ability of Canadian firms to trade internationally by reducing non-tariff trade barriers. NRC-INMS's work helps assure global market access to Canadian industry. NRC-INMS has now completed the implementation of a quality management system (QMS) for all its calibration and measurement services, meeting the requirements of ISO/IEC 17025, the international quality standard for calibration and testing laboratories. A QMS is a mandatory requirement for full participation in the activities related to the Mutual Recognition Arrangement (MRA) facilitated by the Comité international des poids et mesures (CIPM).

An ongoing challenge for NRC-INMS has been addressing measurement barriers to innovation arising from rapidly developing technologies such as nanotechnology and biotechnology, while maintaining essential calibration and measurement capability in more traditional areas. NRC-INMS has significantly expanded its response to the need for measurement standards for nanotechnology, a priority established in its Strategic Plan 2002-2007. NRC-INMS is playing a leadership role at the national and international level in activities promoting the harmonized development of regulatory and measurement standards that will underpin nanotechnology innovation. The Institute's new measurement and calibration capabilities will support nanoscience activities in other NRC institutes, as well as commercialization opportunities resulting from this work. In biotechnology, NRC-INMS collaborated with the Canadian Food Inspection Agency to produce a set of reference materials (RMs) for genetically modified (GM) canola that will be used to verify the accuracy of chemical analyses used to determine GM content. These RMs, the first of their kind world-wide, have attracted attention from other NMIs and, more importantly, from the major ag-biotech companies which will be able to use these reference materials to address marketing and labelling issues.

Objective-based model construction codes - clarity, flexibility and uniformity – NRC-IRC's new objective based codes, launched in 2005, facilitate the evaluation of alternative products and design solutions, making the Canadian construction codes more accommodating to innovation, renovations to existing buildings and international trade. To inform code users of the most significant of these changes in the 2005 Codes, NRC-IRC in coordination with the provinces and territories, delivered approximately 40 seminars over fiscal years 2005-2006 and 2006-2007 reaching 6,200 participants. A further 1000 stakeholders were engaged by additional presentations covering specific codes-related topics. In August 2006 the codes were made available on CD-ROM.

Leverage "Big Science" partnerships – TRIUMF (Tri-University Meson Facility) is one of the country's key investments in major science infrastructure. It provides world-class facilities for research in sub-atomic physics, nuclear physics, nuclear astrophysics, life sciences and condensed matter physics and encourages the transfer of technology developed at the laboratory to the marketplace. NRC provides funding for the facility on behalf of the Government of Canada via a contribution agreement and oversees the federal investment. TRIUMF has completed the second year of its 2005-2010 Plan, with five-year funding totalling $222 million. Canada Foundation for Innovation (CFI) funding was obtained by the Canadian university community for the ATLAS Data Hub, which will be located at TRIUMF. CFI funding was also obtained by the Canadian university community for the TRIUMF M20 beamline.

Strategy: Continue to implement Canada's Long Range Plan for Astronomy and Astrophysics |

The NRC Herzberg Institute of Astrophysics (NRC-HIA) plays a unique role in the implementation of Canada's Long Range Plan for Astronomy (LRP), a national strategy for astronomy research – Astronomy has evolved from a predominantly national enterprise into an international activity with regional or limited partnerships.

The top-priority LRP project, ALMA, is now well into facility construction and considerable effort has been focused on defining the Canadian role in the operational phase, which is scheduled to begin ramping up in fiscal year 2008 – 2009. NRC-HIA delivered on its commitment to produce receiver cartridges as part of the Canadian contribution to the project. Following rigorous acceptance testing, the first two Band 3 receiver cartridges were delivered by NRC-HIA to the ALMA integration centre in Virginia in 2006-2007. As a result of NRC's work, a contract has been awarded for the production of further cartridges to NanowaveTechnologies Inc. of Ontario.

The TMT project is in the design development phase. NRC-HIA makes an in-kind contribution based on the scientific and engineering expertise resident at the Institute. NRC‑HIA staff continued to hold key roles in the TMT project effort, including leading instrumentation development activities and defining the high-level requirements for construction. The TMT Structure Manager continues to work with Dynamic Structures Ltd., the industrial partner on the project.

NRC-HIA's SKA work has shifted with the release of the SKA reference design. The European Union has designated the SKA as a global project of interest to Europe, opening the door to non-European participation in the FP7 funding program. NRC-HIA is currently participating in a funding application endorsed by 27 international organizations.

In 2006-2007, NRC signed an agreement with the Commonwealth Scientific and Industrial Research Organisation (CSIRO) in Australia to seek funds to become a partner in the Mileura International Radio Array (MIRA), a demonstration project linked to the SKA. MIRA is a science-capable pathfinder telescope to be built in Western Australia over the next decade. NRC‑HIA is working with CSIRO's Australia Telescope National Facility on specifications, implementation and respective roles in the project.

The LRP also recognized the importance of computational resources and access to vast amounts of data. The NRC-HIA Canadian Astronomy Data Centre (CADC) allows researchers access to the data collected by telescopes. In 2006-2007, improvements resulted in raw Gemini datasets being made available to users within 15 minutes of acquisition. In 2006, more than 106 external refereed publications acknowledged use of the CADC, an indication that the use of archive data is becoming an integral part of astronomical research, both through the augmentation of original observations and through novel data-mining applications that are entirely dependent on the availability of such records. NRC-HIA is widely recognized for expertise in this domain.

Digital expertise at NRC-HIA is currently being used to build a $20 million supercomputer that will be the heart of the U.S. National Radio Astronomy Observatory's Very Large Array radio telescope in New Mexico. When complete in 2010, this will be the largest correlator in the world. The backbone components of the system are several large circuit boards which have challenged state-of-the-art printed-circuit board design and fabrication methods. The boards were designed and produced at NRC‑HIA.

Implementation of Phase II of the LRP

|

An evaluation of NRC-HIA's contributions to the LRP has been released. The evaluation, which involved over 50 interviews with peers and stakeholders in Canada and internationally, confirmed the relevance of NRC-HIA's contribution to the implementation of the LRP to university and industrial stakeholders and underlined the lack of duplication between NRC and university efforts. The Institute continues to focus its attention on all elements of the Long Range Plan (LRP) for Canadian Astronomy. LRP Phase I funding was received for the period 2002-2003 to 2006-2007, Phase II planning is currently under development. |

Priority 2: Technology and Industry Support: Serving as a Catalyst for Industrial Innovation and Growth

|

Performance Indicators (as identified in the 2006-2007 RPP) |

|

The performance indicators that do not change year-over-year are not reported on annually.

In support of the Government of Canada's commercialization priority, the NRC Technology and Industry Support portfolio (TIS) works closely with the NRC Research and Development portfolio to increase the commercialization of research through: technology licensing; provision of pre-commercialization assistance, mentoring and business intelligence to Canadian firms; access to vital national and international networks; knowledge dissemination and expertise; and helping companies create new products and/or new technologies. In addition, it collaborates with key partners to develop strategic initiatives to accelerate the successful competitiveness/commercialization of new technologies. TIS also helps to fuel the growth and innovative capacity of SMEs, and continues to streamline its approach to intellectual property management and the transfer of technology.

Strategy: Increase the innovation capacity of small- and medium-sized enterprises (SMEs): Growing SMEs to medium-sized enterprises (MSEs) |

Program Spotlights - Industrial Research Assistance Program (NRC-IRAP: Grow SMEs through innovation capacity support and expertise)

|