Common menu bar links

Breadcrumb Trail

ARCHIVED - Department of Justice Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

SECTION III - SUPPLEMENTARY INFORMATION

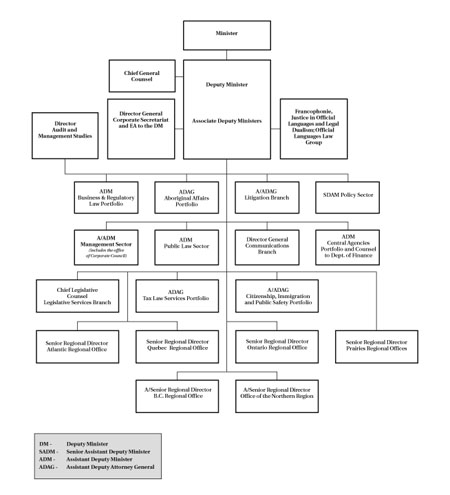

Organizational Information

Table 1: Comparison of Planned to Actual Spending

| ($ millions) |

2004-05

|

2005-06

|

2006-2007

|

|||

|

Actual

|

Actual

|

Main Estimates

|

Planned Spending

|

Total Authorities

|

Actual

|

|

Developing policies and laws |

24.2

|

29.3

|

30.7

|

31.1

|

42.2

|

37.5

|

| Delivering and implementing programs |

391.1

|

369.9

|

296.6

|

382.2

|

373.0

|

363.0

|

| Managing and coordinating the strategic policies/priorities function |

9.6

|

10.8

|

-

|

-

|

-

|

-

|

| Providing legal advisory, litigation and legislative services to government |

415.1

|

436.3

|

507.7

|

508.6

|

515.7

|

461.0

|

| Providing prosecution services |

103.0

|

113.3

|

80.7

|

83.8

|

97.7

|

112.7

|

| Total |

943.0

|

959.6

|

915.7

|

1,005.7

|

1,028.6

|

974.2

|

| Total1 Less: Non-Respendable Revenue2 Plus: Cost of Servive Received without Charge |

943.0

(195.8) 71.6 |

(959.6)

(175.5) 72.8 |

915.7

N/A N/A |

(1,005.7 )

(237.5) 75.3 |

N/A

N/A N/A |

(974.2)

(176.6) 75.7 |

|

TOTAL Departmental Spending2

|

818.8

|

856.9

|

N/A

|

843.5

|

N/A

|

873.3

|

| Full Time Equivalents |

4,989

|

4,710

|

N/A

|

4,783

|

N/A

|

4,812

|

Note 1: Actual spending differs from amount reported in Financial Statements as Net cost of operations (879.8 million). Reconciliation of these two amounts is provided in Note 4 of Financial Statements (Table 15).

Note 2: Non-Respendable Revenue includes Cost Recovery.

Table 2: Resources by Program Activity

| ($ millions) |

Budgetary |

Plus: Non Budgetary |

Total |

||||||

|

Program Activity |

Operating |

Capital |

Grants |

Contributions and Other Transfer Payments |

Total: Gross Budgetary Expenditures |

Less: Respendable Revenue |

Total: Net Budgetary Expenditures |

Loans, Investment and Advances |

- |

A.1 Developing policies and laws |

|||||||||

|

Main Estimates |

30.7

|

-

|

-

|

-

|

30.5

|

-

|

30.7

|

-

|

30.7

|

|

Planned

|

31.1

|

-

|

-

|

-

|

31.1

|

-

|

31.1

|

-

|

31.1

|

|

Total Authorities

|

42.2

|

-

|

-

|

-

|

42.2

|

-

|

42.2

|

-

|

42.2

|

|

Actual Spending

|

37.5

|

-

|

-

|

-

|

37.5

|

-

|

37.5

|

-

|

37.5

|

A.2 Developing and implementing programs |

|||||||||

|

Main Estimates |

9.7

|

-

|

2.4

|

326.8

|

338.6

|

-

|

338.6

|

-

|

338.6

|

|

Planned |

9.7

|

-

|

2.4

|

365.8

|

380.0

|

-

|

380.0

|

-

|

380.0

|

|

Total Authorities |

9.0

|

-

|

1.7

|

364.0

|

377.1

|

-

|

377.1

|

-

|

377.1

|

|

Actual Spending |

8.0

|

-

|

1.6

|

356.4

|

369.9

|

-

|

369.9

|

-

|

369.9

|

B.1 Providing legal advisory, litigation and legislative services to government |

|||||||||

|

Main Estimates |

507.7

|

-

|

-

|

-

|

13.6

|

-

|

13.6

|

-

|

13.6

|

|

Planned |

508.6

|

-

|

-

|

-

|

13.6

|

-

|

13.6

|

-

|

13.6

|

|

Total Authorities |

515.7

|

-

|

-

|

-

|

14.1

|

-

|

14.1

|

-

|

14.1

|

|

Actual Spending |

461.0

|

-

|

-

|

-

|

10.8

|

-

|

10.8

|

-

|

10.8

|

B.2 Providing prosecution services |

|||||||||

|

Main Estimates |

80.7

|

-

|

-

|

-

|

452.8

|

-

|

452.8

|

-

|

452.8

|

|

Planned |

83.8

|

-

|

-

|

-

|

454.8

|

-

|

454.8

|

-

|

454.8

|

|

Total Authorities |

97.7

|

-

|

-

|

-

|

449.4

|

-

|

449.4

|

-

|

449.4

|

|

Actual Spending |

112.7

|

-

|

-

|

-

|

415.0

|

-

|

415.0

|

-

|

415.0

|

TOTAL |

|||||||||

|

Main Estimates |

628.8 |

- |

2.3 |

284.6 |

915.7 |

- |

915.7 |

- |

915.7 |

|

Planned |

633.2

|

-

|

2.3

|

370.2

|

1,005.7

|

-

|

1,005.7

|

-

|

1,005.7

|

|

Total Authorities |

664.6

|

-

|

2.7

|

361.3

|

1,028.6

|

-

|

1,028.6

|

-

|

1,028.6

|

|

Actual Spending |

619.2

|

-

|

1.9

|

353.1

|

974.2

|

-

|

974.2

|

-

|

974.2

|

Table 3: Voted and Statutory Items

|

$ millions |

|

2006-2007 |

|||

|

Vote or Statutory Item |

Truncated Vote or Statutory Working |

Main Estimates |

Planned Spending |

Total Authorities |

Total Actuals |

|

Vote 1 |

Operating Expenditures |

549.0 |

553.3 |

591.8 |

546.4 |

|

Vote 5 |

Grants and Contributions |

286.9 |

372.5 |

364.0 |

355.0 |

|

(S) |

Minister of Justice – Salary and motor car allowance |

0.1 |

0.1 |

0.1 |

0.1 |

|

(S) |

Contribution to employee benefit plans |

79.8 |

79.8 |

72.7 |

72.7 |

|

Total |

915.8 |

1,005.7 |

1,028.6 |

974.2 |

|

Table 4: Services Received Without Charge

| ($ millions) |

2006-2007

Actual Spending |

| Accommodation provided by Public Works and Government Services Canada (PWGSC) |

42.9

|

| Contributions covering employers' share of employees' insurance premiums and expenditures paid by TBS (excluding revolving funds) |

32.7

|

| Worker's compensation coverage provided by Social Development Canada |

0.1

|

| Total 2006-2007 Services received without charge |

85.3

|

Table 5: Sources of Respendable and Non-Respendable Revenue

| Non-Respendable Revenue ($ millions) |

Actual 2004-05

|

Actual 2005-06

|

2005-2006

|

|||

|

Main Estimates

|

Planned Revenue

|

Total Authorities

|

Actual

|

|||

| A.1 Developing policies and laws | ||||||

|

Family Order and Agreements Enforcement Assistance Program |

6.4

|

6.4

|

-

|

5.1

|

5.1

|

6.6

|

|

Central Registry of Divorce Proceedings |

0.7

|

0.7

|

-

|

0.7

|

0.7

|

0.8

|

|

A.2 Developing and Implementing programs

|

||||||

|

Miscellaneous Revenues1 |

21.7

|

7.5

|

-

|

-

|

-

|

3.8

|

|

B.1 Providing legal advisory and litigation services to government

|

||||||

|

Legal Services - Crown Corp. |

1.6

|

1.3

|

-

|

0.4

|

0.4

|

1.0

|

|

Client-Departments Cost Recoveries2 |

144.0

|

153.6

|

-

|

219.8

|

219.8

|

154.5

|

|

Miscellaneous Revenues1 |

20.4

|

2.5

|

-

|

1.2

|

1.2

|

3.2

|

| B.2 Providing prosecution services | ||||||

|

Legal Services - Crown Corp. |

-

|

0.2

|

||||

|

Client-Departments Cost Recoveries 2 |

-

|

6.0

|

6.0

|

5.2

|

||

|

Central Registry of Divorce Proceedings |

1.0

|

2.9

|

1.2

|

1.2

|

1.0

|

|

|

Miscellaneous Revenues1 |

0.2

|

0.3

|

0.1

|

0.1

|

0.8

|

|

| Total Non-Respendable Revenues3 |

195.8

|

175.5

|

-

|

237.5

|

237.5

|

176.6

|

Note 1: Miscellaneous revenues have been applied to proper program activities in 2005 and 2006.

Note 2: Cost recoveries were reported in 2005 and 2006 under one program activity, and are now reported under

proper program activities in 2007.

Note 3: Non-Respendable Revenues include refunds and reversal of previous years expenditures. Under accrual

accounting (see Departmental Financial Statements - Table 15), these refunds and reversals are excluded

from revenues and reported with expenses.

Table 6: Resource Requirements by Branch/Sector

| Department of Justice ($ millions) |

A.1 Developing policies and laws

|

A.2 Developing and implementing programs

|

B.1 Providing legal advisory litigation and legislative services to government

|

B.2 Providing prosecution services

|

Total

|

| Policy and Law Section | |||||

|

Main Estimates |

24.8

|

296.6

|

2.2

|

-

|

323.6

|

|

Planned Spending |

25.0

|

382.2

|

3.1

|

-

|

410.3

|

|

Total Authorities |

36.1

|

373.0

|

3.1

|

-

|

412.2

|

|

Actual Spending |

31.4

|

363.0

|

3.1

|

-

|

397.5

|

| Federal Prosecution Service | |||||

| Main Estimates |

-

|

-

|

5.1

|

80.7

|

85.5

|

| Planned Spending |

-

|

-

|

5.1

|

83.8

|

88.9

|

| Total Authorities |

-

|

-

|

5.1

|

97.7

|

102.8

|

| Actual Spending |

-

|

-

|

5.1

|

112.7

|

117.8

|

| Legislative Services | |||||

| Main Estimates |

-

|

-

|

35.3

|

35.3

|

|

| Planned Spending |

-

|

-

|

35.3

|

35.3

|

|

| Total Authorities |

-

|

-

|

35.3

|

35.3

|

|

| Actual Spending |

-

|

-

|

32.2

|

32.2

|

|

| Civil Litigation and Public Law | |||||

| Main Estimates |

3.1

|

-

|

12.6

|

-

|

15.7

|

| Planned Spending |

3.1

|

-

|

12.6

|

-

|

15.7

|

| Total Authorities |

3.1

|

-

|

34.3

|

-

|

37.4

|

| Actual Spending |

3.1

|

-

|

33.6

|

-

|

36.7

|

| Tax Law Portfolio | |||||

| Main Estimates |

-

|

-

|

73.4

|

-

|

73.4

|

| Planned Spending |

-

|

-

|

73.4

|

-

|

73.4

|

| Total Authorities |

-

|

-

|

78.4

|

-

|

78.4

|

| Actual Spending |

-

|

-

|

68.8

|

-

|

68.8

|

| Citizenship and Immigration Portfolio | |||||

| Main Estimates |

-

|

-

|

67.3

|

-

|

67.3

|

| Planned Spending |

-

|

-

|

67.3

|

-

|

67.3

|

| Total Authorities |

-

|

-

|

67.3

|

-

|

67.3

|

| Actual Spending |

-

|

-

|

65.5

|

-

|

65.5

|

| Aboriginal Affairs Portfolio | |||||

| Main Estimates |

2.8

|

-

|

127.3

|

-

|

130.1

|

| Planned Spending |

3.0

|

-

|

127.2

|

-

|

130.2

|

| Total Authorities |

3.0

|

-

|

118.9

|

-

|

121.9

|

| Actual Spending |

3.0

|

-

|

102.0

|

-

|

105.0

|

| Business and Regulatory Law Portfolio | |||||

| Main Estimates |

-

|

-

|

166.8

|

-

|

166.8

|

| Planned Spending |

-

|

-

|

166.9

|

-

|

166.9

|

| Total Authorities |

-

|

-

|

155.6

|

-

|

155.6

|

| Actual Spending |

-

|

-

|

136.9

|

-

|

136.9

|

| Central Agencies Portfolio | |||||

| Main Estimates |

-

|

-

|

17.7

|

-

|

17.7

|

| Planned Spending |

-

|

-

|

17.7

|

-

|

17.7

|

| Total Authorities |

-

|

-

|

17.7

|

-

|

17.7

|

| Actual Spending |

-

|

-

|

13.8

|

-

|

13.8

|

| Total Department | |||||

| Main Estimates |

30.7

|

296.6

|

507.7

|

80.7

|

915.7

|

| Planned Spending |

31.3

|

382.2

|

508.6

|

83.8

|

1,005.7

|

| Total Authorities |

42.2

|

373.0

|

515.7

|

97.7

|

1,028.6

|

| Actual Spending |

37.5

|

363.0

|

461.0

|

112.7

|

974.2

|

Table 7-A: User Fees Act

|

2006-2007

|

Planning Years

|

||||||||||

|

A. User Fee

|

Fee Type

|

Fee-setting

Authority |

Date Last

Modified |

Forecast Revenue

($000) |

Actual Revenue

($000) |

Full Cost

($000) |

Performance

Standard |

Performance Results

|

Fiscal Year

|

Forecast Revenue

($000) |

Estimated Full Cost

($000) |

| The family Order and Agreements Enforcement Assistance (FOAEA) The Central Divorce Proceedings |

Regulatory

|

FOAEA Act

|

1999

|

6,000

|

6,559

|

6,559

|

Yes

|

Results are

available in table 7-B |

2007-08

2008-09 2009-10 |

6,000

6,000 6,000 |

6,000

6,000 6,000 |

| CRDP Certificate fee |

Regulatory

|

Central Registry of Divorce Regulations

|

1986

|

750

|

818

|

818

|

Yes

|

Results are

available in table 7-B |

2007-08

2008-09 2009-10 |

800

800 800 |

800

800 800 |

| Fees charged for the processing of access requests filed under the Access to Information Act (ATIA) (please see note 1) |

Other

product and services |

Access to Information Act

|

1992

|

2.7

|

3.3

|

1,566

|

Yes

|

Results are available in table 7-B |

2007-08

2008-09 2009-10 |

4.0 4.5 5.0 |

2,000 2,300 2,550 |

Note 1: Full cost reflects the cost of the Access to Information and Privacy (ATIP) Office in Justice. The role of the ATIP Office is to respond to all formal requests that are made to the Department of Justice, in accordance with the Access to Information Act. As other central agencies, the DOJ ATIP Office has an expanded role; in addition to processing requests, the Office responds to consultations from other government institutions regarding solicitor-client information for the Government as a whole. Although the User Fees Act may provide some of the performance indicators, fee waiver must be considered in light of the ATIP legislation. Performance should also be assessed because of the increasing number of requests received, as well as the requests closed during the respective years.

Table 7-B: Policy on Service Standards for External Fees

|

A. External Fee

|

Service Standard

|

Performance Result

|

Stakeholder Consultation

|

| Fees charged for the processing of access requests filed under the Access to Information Act |

1. Response provided within 30 days following receipt of request; the response |

In fiscal year 2005-2006 the requests received were 286 compared to the past fiscal at 356, an increase of 24%. For the same period, 301 requestswere closed compared to 432, an increase of 44%. | The service standard is established by the Access to Information Act and the Access to Information Regulations. Consultations with stakeholders were undertaken for amendments made in 1986 and 1992. |

| Family Orders and Agreements Enforcement Assistance (Interceptions) |

1. Processing of tracing applications under Part I of the Actwill be completed and a response provided to provincial/territorial enforcement programs within 10 business days. 2. Garnishment applications under Part II of the Act 3. Licence-denial applications under Part III of the Act 4. Public enquiries are to be responded to within 48 hours. |

A total of 23,087 applications received

Standard met

|

Informal feedback and general day-to-day interactions with clients and stakeholders, including provincial and territorial maintenance and enforcement programs, courts, creditors and other federal government partners, indicate a high level of satisfaction with the services provided under both the Family Orders and Agreement Enforcement Assistance and Central Registry of Divorce Proceedings programs. A client satisfaction survey was launched in January 2005 to provide a more formal assessment of client satisfaction with service standards, levels and accessibility. Findings indicate strong levels of satisfaction |

| Central Registry of Divorce Proceedings |

1. Clearance Certificates are to be issued within 3 weeks of receipt of the application. 2. Divorce information is to be provided to Statistics Canada annually, according to schedule. 3. All telephone enquiries are to be responded to within 24 hours and all written enquiries are to be responded to within 5 business days. 4. Quarterly invoices and compensation reports are to be issued within 30 days. |

Standard met at 90%

|

A client satisfaction survey was launched in January 2005 to provide a more formal assessment of client satisfaction with service standards, levels and accessibility. Findings indicate strong levels of satisfaction |

Supplementary information on the following TPPs can be found at http://www.tbs-sct.gc.ca/est-pre/estime.asp.

Table 8: Details on Transfer Payment Programs (TPPs)

Supplementary information on transfer payment programs can be found at http://www.tbs-sct.gc.ca/rma/eppi-ibdrp/hrdb-rhbd/profil_e.asp.

| 1) Name of Transfer Payment Program: Aboriginal Justice Strategy (Voted) | ||||||

| 2) Start Date: April 2002 | 3) End Date: March 2007 | |||||

|

4) Description: Aboriginal people continue to be over-represented in the criminal justice system, both as victims and accused, and under-represented in the judiciary, legal profession and police. When Aboriginal people come into contact with the justice system as victims or accused, their needs - related to culture, economic positions and social circumstances - must be taken into

account to make the system fairer, relevant and more effective for them. One of the federal government's key responses to addressing these issues has been the Aboriginal Justice Strategy (AJS), which co-funds diversion, sentencing, and family and civil mediation projects in Aboriginal communities with provinces and territories.

The AJS is managed by the Department of Justice Canada's (DOJ) Aboriginal Justice Directorate (AJD). In collaboration with provincial and territorial counterparts, the AJD pursues the goals of the AJS through policy development and support, community-based justice program funding, training and development funding, self-government negotiations and capacity-building support, and

outreach and partnership (formerly the Aboriginal Justice Learning Network: AJLN). The AJS supports activities on- and off- reserve and in urban settings to all members of their communities. |

||||||

| 5) Strategic outcomes: A fair, relevant and accessible justice system that reflects Canadian values. | ||||||

|

6) Results Achieved: According to the AJS formative evaluation of June 2005, the success of the AJS has taken several forms including more awareness of victims' issues and greater mainstream justice system awareness and recognition. In 2005-2006, the AJS made the largest funding commitment to community-based programs in its history. In total 111 programs were operational, an increase of 2% from 2004-05. This has allowed communities to participate meaningfully in the administration of justice. A study of five community programs that was conducted as part of the 2000 AJS evaluation found evidence that the five programs were more effective in reducing recidivism than comparative mainstream programs, and thus crime among Aboriginal offenders in their communities. The impact of the AJS on victimization, crime and incarceration rates will be examined in the summative evaluation (06/07). |

||||||

| - |

7) Actual Spending 2003-04

|

8) Actual Spending 2004-05

|

9) Planned Spending 2005-06

|

10) Total Authorities 2005-06

|

11) Actual Spending 2005-06

|

12) Variance(s) Between 9 and 11

|

| 13) Program Activity (PA) A2 Developing and Implementing Programs |

-

|

-

|

-

|

-

|

-

|

-

|

| 14) Total Grants |

NIL

|

$100,000

|

$75,000

|

$75,000

|

$55,000

|

$20,000

|

| 14) Total Contributions |

$6,873,209

|

$7,041,464

|

$7,325,000

|

$7,325,000

|

$7,345,000

|

$(20,000)

|

| 14) Total Other Types of TPs |

NIL

|

NIL

|

NIL

|

NIL

|

NIL

|

NIL

|

| 15) Total PA |

$6,873,209

|

$7,141,464

|

$7,400,000

|

$7,400,000

|

$7,400,000

|

$0

|

| 16) Comment(s) on Variance(s) | ||||||

|

17) Significant Audit and Evaluation Findings and URL (s) to Last Audit and / or Evaluation: Summary of Key Findings of the AJS Formative Evaluation June 2005 Key findings include:

The report makes 9 recommendations. These focus on:

More details can be found at: http://canada.justice.gc.ca/en/ps/eval/reports/05/abomid/index.html |

||||||

|

17) Significant Audit and Evaluation Findings and URL (s) to Last Audit and / or Evaluation: Summary of Key Findings of the AJS Formative Evaluation June 2005 Key findings include:

The report makes 9 recommendations. These focus on:

More details can be found at: http://canada.justice.gc.ca/en/ps/eval/reports/05/abomid/index.html |

||||||

| 1) Name of Transfer Payment Program: Aboriginal Justice Strategy (Voted) | |||||||

| 2) Start Date: April 2002 | 3) End Date: March 31, 2007 | ||||||

|

4) Description: Aboriginal people continue to be over-represented in the criminal justice system, both as victims and accused, and under-represented in the judiciary, legal profession and police. When Aboriginal people come into contact with the justice system as victims or accused, their needs – related to culture, economic positions and social circumstances –

must be taken into account to make the system more relevant and effective for them.

|

|||||||

| 5) Strategic Outcome(s): A fair, relevant and accessible justice system that reflects Canadian values. | |||||||

|

6) Results Achieved: In 2006-2007, the AJS supported 108 community-based justice programs serving just under 400 Aboriginal communities across Canada, along with 18 training and development and 4 self-government capacity-building initiatives. As part of the Department’s commitments to Treasury Board, a summative evaluation of the AJS 2002-2007 mandate was conducted in 2006-2007 and finalized in April 2007. This evaluation helped shape the development and implementation of a renewal plan for the AJS, which was due to expire on March 31 2007. |

|||||||

| - |

7) Actual Spending

2004–2005 |

8) Actual Spending

2005–2006 |

9) Planned Spending

2006–2007 |

10) Total Authorities

2006–2007 |

11) Actual Spending

2006–2007 |

12) Variance(s) Between

9) and 11) |

|

|

13) Program Activity A2 Developing and implementing programs; A2.1 Providing funding for Aboriginal justice programs. |

-

|

-

|

-

|

-

|

-

|

-

|

|

| 14) Total Grants |

$ 100,000

|

$ 55,000

|

$ 50,000

|

$ 50,00

|

$ 4,000

|

$ 46,000

|

|

| 14) Total Contributions |

$7,041,464

|

$7,345,000

|

$7,250,000

|

$7,250,000

|

$7,287,586

|

$-37,586

|

|

| 14) Total Other Types of TPs |

$0

|

$0

|

$0

|

$0

|

$0

|

$0

|

|

| 15) Total |

$6,873,209

|

$7,400,000

|

|

$7,300,000

|

$7,291,586

|

$8,414

|

|

| 16) Comment(s) on Variance(s): Excess funds were transferred to the contribution side of the Program to offset higher funding needs. | |||||||

|

17) Significant Audit and Evaluation Findings and URL (s) to Last Audit and / or Evaluation: A summative evaluation of the 2002-2007 AJS mandate was conducted in 2006-07 and finalized in April 2007. The complete 2007 AJS summative evaluation report will soon be posted on the Department of Justice Program Evaluation web site at: http://www.justice.gc.ca/en/ps/eval/index.html. The evaluation included a series of case studies and a study on the impact of the AJS on recidivism rates that shows that participants in an AJS program are approximately half as likely to re-offend as are individuals who do not participate in such a program. Other positive impacts noted in the evaluation report are that AJS programs address victims’ concerns, enable victims to participate in justice processes, contribute to stable communities and contribute to a marked reduction in youth alienation. The evaluation found that the AJS represents a cost-effective and relevant model for dealing with Aboriginal offenders, which

|

|||||||

| 1) Name of Transfer Payment Program: Child-Centred Family Justice Fund (Voted) | ||||||

| 2) Start Date: April 1, 2003 | 3) End Date: March 31, 2008 | |||||

| 4) Description: The Child-centred Family Justice Fund (CCFJF) is one of the three pillars of the Child-centred Family Justice Strategy. While the federal government does not provide direct services to separated and divorced parents, since the provinces and territories are responsible for the administration of justice, the Department of Justice is committed to assisting and promoting the development, expansion and maintenance of such services through the CCFJF. These services include child support, support enforcement and services that address parenting arrangement issues (e.g. parenting agreements and orders, contact orders, custody orders and access rights). | ||||||

| 5) Strategic Outcomes: A fair, relevant and accessible justice system that reflects Canadian values. | ||||||

|

6) Results Achieved :

|

||||||

| - |

7) Actual Spending 2004-05

|

8) Actual Spending 2005-06

|

9) Planned Spending 2006-07

|

10) Total Authorities 2006-07

|

11) Actual Spending 2006-07

|

12) Variance(s) Between 9 and 11

|

|

13) Program Activity (PA) |

-

|

-

|

-

|

-

|

-

|

-

|

| 14) Total Grants |

$10,000

|

$23,430

|

$50,000

|

$50,000

|

$29,950

|

$20,050

|

| 14) Total Contributions |

$15,774,968

|

$16,042,102

|

$11,950,027

|

$15,950,027

|

$16,170,761

|

$-4,220,734

|

| 14) Total Other Types of TPs |

$0

|

$0

|

$0

|

$0

|

$0

|

$0

|

| 15) Total |

$15,784,968

|

$16,065,532

|

$12,000,027

|

$16,000,027

|

$16,200,711

|

$-4,200,684

|

| 16) Comment(s) on Variance(s): Supplementary funding of $4M was approved by Treasury Board and $220,684 was transferred to the PLEI/Professional Training component from internal sources to support projects that address the needs of official languages minority communities. | ||||||

|

17) Significant Audit and Evaluation Findings and URL (s) to Last Audit and / or Evaluation: |

||||||

| 1) Name of Transfer Payment Program : Contraventions Act Fund - Voted | ||||||

| 2) Start Date: April 1, 2002 | 3) End Date: ongoing | |||||

|

The mechanics of the Contraventions Act includes the identification of federal offences that are to be considered “contraventions” and the establishment of a scheme to process these contraventions. In 2001, the Federal Court was asked to clarify the extent to which judicial and extra-judicial language rights requirements were applicable in the context of the Contraventions Act. The Court concluded that while the federal government is authorized to use the prosecution scheme of a province or territory to process federal contraventions, it must comply with all language rights requirements that would be applicable in the context of a federal prosecution scheme. More specifically, the Court stated that any level of government that processes federal contraventions is, in fact, acting on behalf of the Government of Canada. Following the Federal Court decision, the Department of Justice initiated the process of modifying existing Contraventions Act agreements to include new provisions addressing language rights requirements identified in the ruling. To support this process, the Department of Justice received funding to establish the Contraventions Act Fund, which is the object of this formative evaluation. |

||||||

|

5) Strategic Outcomes:

|

||||||

|

6) Results Achieved:

|

||||||

| - |

7) Actual Spending 2004-05

|

8) Actual Spending 2005-06

|

9) Planned Spending 2006-07

|

10) Total Authorities 2006-07

|

11) Actual Spending 2006-07

|

12) Variance(s) Between 9 and 11

|

| 14) Total Grants |

$0

|

$0

|

$0

|

$0

|

$0

|

$0

|

| 14) Total Contributions |

$3,106,445

|

$1,688,870

|

$7,916,155

|

$4,216,155

|

$2,613,100

|

$5,303,055 5

|

| 14) Total Other Types of TPs |

$0

|

$0

|

$0

|

$0

|

$0

|

$0

|

| 15) Total |

$3,106,445

|

$1,688,870

|

$7,916,155

|

$4,216,155

|

$2,613,100

|

$5,303,055

|

|

16) Comment(s) on Variance(s):

|

||||||

|

17) Significant Audit and Evaluation Findings and URL (s) to Last Audit and/or Evaluation: |

||||||

| 1) Name of Transfer Payment Program : Legal Aid (Voted) | ||||||

| 2) Start Date: August 17, 1971 | 3) End Date: Ongoing | |||||

|

4) Description: Contribution funding to the provinces for the delivery of criminal, youth criminal and immigration and refugee legal aid (Funding for criminal and civil legal aid in the territories is provided through the Access to Justice Agreements). The objective of the federal Legal Aid Program is to ensure that economically disadvantaged persons have access to justice

through criminal legal aid. |

||||||

| 5) Strategic Outcomes: A fair, relevant and accessible justice system that reflects Canadian values. | ||||||

| 6) Results Achieved: Under the Legal Aid Renewal Strategy, contribution funding agreements were signed with the ten provinces for the delivery of legal aid in criminal, youth criminal and immigration and refugee legal aid. As these agreements were set to expire by March 31, 2006, funding was extended for one year (FY 2006-07) at 2005-06 funding levels. | ||||||

| - |

7) Actual Spending 2004-05

|

8) Actual Spending 2005-06

|

9) Planned Spending 20065-07

|

10) Total Authorities 2006-07

|

11) Actual Spending 2006-07

|

12) Variance(s) Between 9 and 11

|

| 13) Program Activity (PA) A.2 Developing and Implementing Programs |

||||||

| 14) Total Grants |

$0

|

$0

|

$0

|

$0

|

$0

|

$0

|

| 14) Total Contributions |

$124,713,507

|

$119,775,396

|

$79,827,507

|

$119,827,507

|

$119,827,507

|

$-40,000,000

|

| 14) Total Other Types of TPs |

$0

|

$0

|

$0

|

$0

|

$0

|

$0

|

| 15) Total |

$124,713,507

|

$119,775,396

|

$79,827,507

|

$119,827,507

|

$119,827,507

|

$-40,000,000

|

| 16) Comment(s) on Variance(s): The 2003-2006 legal aid agreements expired at the end of fiscal year 2005-2006, and funding had not yet been approved for fiscal year 2006-2007 and beyond. As a result, the planned spending amount for fiscal year 2006-2007 only reflected legal aid “base” funding. Subsequently, legal aid funding was extended for one year (fiscal year 2006-2007) at fiscal year 2005-2006 funding levels and included: Base funding ($79,827,507), Interim funding ($9.5M) initiated in 2001-2002; and Investment Fund ($19M) and Immigration and Refugee Legal Aid funding ($11.5M) initiated in Fiscal years 2003-2006. | ||||||

| 17) Significant Audit and Evaluation Findings and URL (s) to Last Audit and / or Evaluation: A Formative Evaluation of the Legal Aid Program was completed in December 2006 and is available at http://canada.justice.gc.ca/en/ps/eval/2006.html. It noted: the unpredictable nature of funding associated with the short duration of agreements; the absence of adequate funding to support core legal aid services; the need for improved performance reporting; and the ongoing pursuit by the provinces of a fair and equitable funding distribution formula. | ||||||

| 1) Name of Transfer Payment Program: Intensive Rehabilitative Custody and Supervision Program (voted) | ||||||

| 2) Start Date: April 1st, 2002 | 3) End Date: March 31st, 2006 | |||||

| 4) Description: In conjunction with, and in support of, the Youth Justice Renewal Initiative, these transfer payments assist the provinces and territories in providing the specialized therapeutic programs required for the administration of the new sentencing option known as the Intensive Rehabilitative Custody and Supervision Order (see ss. 42(2)(r) and 42(7) of the Youth

Criminal Justice Act). |

||||||

| 5) Strategic Outcomes: A fair, relevant and accessible justice system that reflects Canadian values | ||||||

| 6) Results Achieved: The Program is available in every jurisdiction. As of March 31st, there had been 18 individuals sentenced to an IRCS order across the country, and 16 cases remained active. | ||||||

| - |

7) Actual Spending 2003-04

|

8) Actual Spending 2004-05

|

9) Planned Spending 2005-06

|

10) Total Authorities 2005-06

|

11) Actual Spending 2005-06

|

12) Variance(s) Between 9 and 11

|

| 13) Program Activity (PA) Developing and Implementing Programs (A.2) |

-

|

-

|

-

|

-

|

-

|

-

|

| 14) Total Grants |

NIL

|

NIL

|

NIL

|

NIL

|

NIL

|

NIL

|

| 14) Total Contributions |

$1,520,000

|

$1,944,150

|

$11,325,250

|

$2,899,100

|

$2,885,475

|

$8,439,775

|

| 14) Total Other Types of TPs |

NIL

|

NIL

|

NIL

|

NIL

|

NIL

|

NIL

|

| 15) Total PA |

$1,520,000

|

$1,944,150

|

$11,325,250

|

$2,899,100

|

$2,885,475

|

$8,439,775

|

| 16) Comment(s) on Variance(s): The number of IRCS orders imposed by the courts has been much lower than initially anticipated. | ||||||

| 17) Significant Audit and Evaluation Findings and URL (s) to Last Audit and / or Evaluation: the upcoming report on the Summative Evaluation of the Youth Justice Renewal Initiative, scheduled for completion this fall will include relevant information on the Program. However, the low number of sentences of that type to date is likely to preclude any firm conclusion. | ||||||

| 1) Name of Transfer Payment Program: Youth Justice Services Funding Program (voted) | ||||||

| 2) Start Date: April 1984 | 3) End Date: On-going | |||||

| 4) Description: The overall objective of this Program is to support the policy directions of the Youth Justice Initiative. The specific objectives of the individual agreements are to support and promote an appropriate range of programs and services that: encourage accountability measures for unlawful behaviour that are proportionate and timely; encourage the effective rehabilitation and reintegration of young persons into their communities; target the formal court process to the most serious offences; and target detention and custody to the most serious offences. | ||||||

| 5) Strategic Outcomes: A fair, relevant and accessible justice system that reflects Canadian values. | ||||||

|

6) Results Achieved: New five-year agreements were negotiated with the provinces and territories during 2006-07. These agreements are intended to sustain, over the period of 2006-07 to 2010-2011, an adequate range of programs and services that encourage accountability measures, effective rehabilitation and reintegration of offenders and target the use of the formal court

system, detention and custody to serious offences. |

||||||

| - |

7) Actual Spending 2004-05

|

8) Actual Spending 2005-06

|

9) Planned Spending 2006-07

|

10) Total Authorities 2006-07

|

11) Actual Spending 2006-07

|

12) Variance(s) Between 9 and 11

|

| 13) Program Activity (PA) A.2 - Developing and Implementing Programs |

||||||

| 14) Total Grants |

$0

|

$0

|

$0

|

$0

|

$0

|

$0

|

| 14) Total Contributions |

$188,652,100

|

$185,302,415

|

$144,750,000

|

$177,302,415

|

$177,302,415

|

$32,552,415

|

| 14) Total Other Types of TPs |

NIL

|

NIL

|

NIL

|

NIL

|

NIL

|

NIL

|

| 15) Total |

$188,652,100

|

$ 185,302,415

|

$144,750,000

|

$177,302,415

|

$177,302,415

|

($40,552,415)

|

| 16) Comment(s) on Variance(s): Additional funding was obtained through Supplementary Estimates.. | ||||||

| 17) Significant Audit and Evaluation Findings and URL (s) to Last Audit and / or Evaluation: A Summative Evaluation of the Youth Justice Renewal Initiative, including this Program, was completed in 2006-2007 and will be available soon at http://www.justice.gc.ca/en/ps/eval/index.html. The evaluation concluded that the success of the initiative can be attributed to the multi-pronged approach of the Youth Justice Initiative, which consisted of legislation, financial incentives to the provinces, training, the funding of programs and services, and building partnerships with a variety of groups. The next evaluation of the program is expected to be completed in 2009-2010. | ||||||

| 1) Name of Transfer Payment Program: Youth Justice Fund - Voted | ||||||

| 2) Start Date: April 1, 1999 | 3) End Date: On-going | |||||

| 4) Description: The overall objective of funding under the Youth Justice Fund is to encourage a fairer and more effective youth justice system. Funding is available for non-governmental organizations, youth justice stakeholders, Aboriginal organizations and provinces/territories to strengthen the youth justice system. Priorities are set annually based on identified gaps and emerging federal youth justice policies and priorities. | ||||||

| 5) Strategic Outcomes: A fair, relevant and accessible justice system that reflects Canadian values. | ||||||

|

6) Results Achieved: Project funding is provided to help support alternative approaches to youth justice services. A wide range of activities were supported that have encouraged effective rehabilitation and reintegration of youth. The majority of projects funded (65 percent) helped support the delivery of new or specialized programs for youth in conflict with the

law. The remaining projects included training, program development work, and creating awareness across youth justice stakeholders. |

||||||

|

7) Actual Spending 2004-05

|

8) Actual Spending 2005-06

|

9) Planned Spending 2006-07

|

10) Total Authorities 2006-07

|

11) Actual Spending 2006-07

|

12) Variance(s) Between 9 and 11

|

|

|

13) Program Activity |

||||||

| A2.2 - Providing funding for criminal justice programs for adults, youth and children | ||||||

| 14) Total Grants |

$1,801,582

|

$814,388

|

$565,000

|

$1,315,000*

|

$790,325

|

($225,325)

|

| 14) Total Contributions |

$7,034,631

|

$3,602,614

|

$2,715,000

|

$4,665,000*

|

$2,880,238

|

($165,238)

|

| 14) Total Other Types of TPs |

$0

|

$0

|

$0

|

$0

|

$0

|

$0

|

| 15) Total |

$8,836,213

|

$4,417,002

|

$3,280,000

|

$5,980,000

|

$3,670,563

|

($390,563)

|

| 16) Comment(s) on Variance(s): * An additional $2.5M was received under the Fund through Supplementary Estimates for youth involved in Guns, Gangs and Drugs. A portion of these funds were unspent as resources were only approved in the Fall of 2006. In addition, $200,000 was returned to the Fund due to a re-allocation of an earlier funding cut to another Justice program. | ||||||

| 17) Significant Audit and Evaluation Findings and URL (s) to Last Audit and / or Evaluation: A Summative Evaluation of the Youth Justice Renewal Initiative, including this Program, was completed in 2006-2007 and will be available soon at http://www.justice.gc.ca/en/ps/eval/index.html. The evaluation concluded that the success of the initiative can be attributed to the multi-pronged approach of the Youth Justice Initiative, which consisted of legislation, financial incentives to the provinces, training, the funding of programs and services, and building partnerships with a variety of groups. The next evaluation of the program is expected to be completed in 2009-2010. | ||||||

| 1) Name of Transfer Payment Program: Youth Justice Intensive Rehabilitative Custody and Supervision Program - Voted | ||||||

| 2) Start Date: April 1, 2002 | 3) End Date: On-going | |||||

| 4) Description: The overall objective of this Program is to financially assist the provinces and territories in providing the services required for the implementation of the Intensive Rehabilitative Custody and Supervision (IRCS) sentence (paragraph 42(2)(r) and subsection 42(7) of the Youth Criminal Justice Act). This sentence is intended to reduce violence in those convicted of the most serious violent offences. | ||||||

| 5) Strategic Outcomes: A fair, relevant and accessible justice system that reflects Canadian values. | ||||||

|

6) Results Achieved: Programs are in place to deal with individuals receiving an Intensive Rehabilitative Custody and Supervision sentence. During 2006-2007, new agreements where negotiated with the provinces and territories to extend IRCS program funding to March 31, 2008. This will provide time for the negotiation of new long-term agreements. |

||||||

|

7) Actual Spending 2004-05

|

8) Actual Spending 2005-06

|

9) Planned Spending 2006-07

|

10) Total Authorities 2006-07

|

11) Actual Spending 2006-07

|

12) Variance(s) Between 9 and 11

|

|

|

13) Program Activity |

||||||

| A2.2 - Providing funding for criminal justice programs for adults, youth and children | ||||||

| 14) Total Grants |

$0

|

$0

|

$0

|

$0

|

$0

|

$0

|

| 14) Total Contributions |

$1,944,150

|

$2,885,475

|

$6,903,500

|

$3,903,500*

|

$3,424,450

|

$3,479,050

|

| 14) Total Other Types of TPs |

$0

|

$0

|

$0

|

$0

|

$0

|

$0

|

| 15) Total |

$1,944,150

|

$2,885,475

|

$6,903,500

|

$3,903,500

|

$3,424,450

|

$3,479,050

|

| 16) Comment(s) on Variance(s): The number of IRCS sentences has been much lower than was anticipated when the program was developed and, as a result, annual spending has been significantly below planned levels. Treasury Board has approved the use of $3M to offset other departmental requirements. | ||||||

| 17) Significant Audit and Evaluation Findings and URL (s) to Last Audit and / or Evaluation: A Summative Evaluation of the Youth Justice Renewal Initiative was completed in 2006-2007 and will be available soon at http://www.justice.gc.ca/en/ps/eval/index.html. The evaluation concluded that the success of the initiative can be attributed to the multi-pronged approach of the Youth Justice Initiative, which consisted of legislation, financial incentives to the provinces, training, the funding of programs and services, and building partnerships with a variety of groups. The next evaluation of the program is expected to be completed in 2009-2010. | ||||||

Table 9: Financial Statements

Since 2005-2006, all federal government departments as defined in section 2 of the Financial Administration Act and departments with revolving funds are to include financial statements in their DPR.

Financial Statements For Year Ended March 31, 2007

Management Responsibility for Financial Statements

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2006 and all information contained in these statements rests with departmental management. These financial statements have been prepared by management in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management's best estimates and judgment and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of the department's financial transactions. Financial information submitted to the Public Accounts of Canada and included in the department's Departmental Performance Report is consistent with these financial statements.

Management maintains a system of financial management and internal control designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are in accordance with the Financial Administration Act, are executed in accordance with prescribed regulations, within Parliamentary authorities, and are properly recorded to maintain accountability of Government funds. Management also seeks to ensure the objectivity and integrity of data in its financial statements by careful selection, training and development of qualified staff, by organizational arrangements that provide appropriate divisions of responsibility, and by communication programs aimed at ensuring that regulations, policies, standards and managerial authorities are understood throughout the department.

The financial statements of the department have not been audited.

| John H. Sims Deputy Minister of Justice and Deputy Attorney General of Canada Ottawa, Canada |

Virginia McRae A/Assistant Deputy Minister, Corporate Services Senior Financial Officer |

| Date: August 3, 2007 | |

Statement of Financial Position (unaudited)

As at March 31

(in dollars)

Assets |

||

|

2007

|

2006

Restated (Note 17) |

|

| Financial Assets | ||

|

Receivables (Note 7) |

27,811,772

|

21,791,359

|

|

Advances (Note8) |

51,985

|

34,125

|

|

Total financial assets |

27,863,757

|

21,825,484

|

| Non-financial assets | ||

|

Prepaid expenses |

135,834

|

158,492

|

|

Tangible capital assets (Note 9) |

36,683,852

|

34,971,948

|

|

Total non-financial assets |

36,819,686

|

10,264,165

|

|

Total |

64,683,443

|

56,797,432

|

Liabilities and Equity of Canada |

||

| Liabilities | ||

|

Accounts payable and accrued liabilities (Note 10) |

59,352,085

|

62,969,296

|

|

Transfer payments payable |

612,001,885

|

437,609,360

|

|

Vacation pay and compensatory leave |

17,268,384

|

16,657,597

|

|

Employee severance benefits (Note 11) |

83,850,340

|

78,277,118

|

|

Family Law account (Note 13) |

3,930,643

|

1,562,044

|

|

Total liabilities |

776,403,337

|

597,075,415

|

| Equity of Canada |

(711,719,894)

|

(540,277,983)

|

| Total |

64,683,443

|

56,797,432

|

Contingent liabilities (Note 12)

Contractual obligations (Note 14)

The accompanying notes form an integral part of these financial statements.

Expenses (Note 5) |

||

|

Providing legal advisory and litigation services to government |

526,014,088

|

494,111,816

|

|

Developing and implementing programs |

360,646,912

|

369,896,574

|

|

Providing prosecution services |

121,275,989

|

129,271,195

|

|

Developing policies and laws |

41,867,608

|

44,249,771

|

| Total expenses |

1,049,804,597

|

1,037,529,336

|

Revenues (Note 6) |

||

|

Providing legal advisory and litigation services to government |

155,830,964

|

151,409,648

|

|

Developing policies and laws |

7,105,336

|

7,157,656

|

|

Providing prosecution services |

7,087,850

|

7,572,930

|

| Total revenues |

170,024,150

|

166,140,234

|

| Net cost of operations |

879,780,447

|

871,389,122

|

The accompanying notes form an integral part of these financial statements

Statement of Equity of Canada (unaudited)

For the year ended March 31

(in dolars)

|

2007

|

|

| Equity of Canada, beginning of year |

(540,277,983)

|

|

Net cost of operations |

(879,780,447)

|

|

Current year appropriations used (Note 4) |

974,223,007

|

|

Revenue not available for spending |

(170,077,588)

|

|

Change in net position in the Consolidated Revenue Fund (Note 3) |

(171,464,895)

|

|

Services provided without charge by other government departments (Note 16) |

75,658,012

|

| Equity of Canada, end of year |

(711,719,894)

|

The accompanying notes form an integral part of these financial statements

Statement of Cash Flow (unaudited)

For the year ended March 31

(in dollars)

Operating activities |

||

|

2007

|

2006

Restated (Note 17) |

|

| Net cost of operations |

879,780,447

|

871,389,122

|

| Non-cash items | ||

|

Amortization of tangible capital assets (Note 9) |

(11,115,407)

|

(9,149,985)

|

|

Gain on disposal of capital assets

|

9,218

|

|

|

Services provided without charge by other government departments (Note 16) |

(75,658,012)

|

(73,823,178)

|

| Variations in Statement of Financial Position | ||

|

Increase (decrease) in accounts receivable and advances |

6,038,273

|

(14,813,293)

|

|

Increase (decrease) in prepaid expenses |

(22,658)

|

34,378

|

|

Increase in liabilities |

(179,327,922)

|

113,277,698

|

| Cash used by operating activities |

619,703,939

|

660,359,346

|

Capital investment activities |

||

|

Acquisitions of tangible capital assets (Note 9) |

13,000,181

|

12,950,526

|

|

Proceeds from disposal of tangible capital assets

|

(23,596)

|

0

|

| Cash used by capital investment activities |

12,976,585

|

12,950,526

|

Financing activities |

||

|

Net cash provided by Government of Canada |

632,680,524

|

(673,309,872)

|

The accompanying notes form an integral part of these financial statements

Notes to the Financial Statements (unaudited)

1. Authority and objectives

The Department of Justice was created by an Act of Parliament in 1868 to be responsible for the legal affairs of the Government of Canada and to provide legal services to individual departments and agencies. The department's work reflects the duties of its Minister's dual role as Attorney General of Canada and as Minister of Justice.

The department conducts its 2 priorities along 6 program activities:

(a) A fair, relevant and accessible justice system that reflects Canadian values

Developing policies and laws

The planning and development of government justice policies dealing with matters within the mandate of the Minister of Justice.

Developing and implementing programs

The design, development and implementation of cost-shared programs and grants and contributions.

(b) A federal government that is supported by effective and responsive legal services

Providing legal advisory and litigation services to government

The provision of legal advisory services to departments and agencies and the supervision, coordination and/or conduct of civil litigation on their behalf.

Providing prosecution services

The conduct of criminal prosecutions, including money laundering and drug prosecutions, and regulatory prosecutions such as those related to income tax, the competition law provisions on telemarketing, customs and immigration. Responding to international requests and trans-national crime and working to combat organized crime and terrorism.

2. Summary of significant accounting policies

The financial statements have been prepared in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector.

The significant accounting policies are as follows:

(a) Parliamentary appropriations

The department is financed by the Government of Canada through Parliamentary appropriations. Appropriations provided to the department do not parallel financial reporting according to generally accepted accounting principles since appropriations are primarily based on cash flow requirements. Consequently, items recognized in the Statement of Operations and the Statement of Financial Position are

not necessarily the same as those provided through appropriations from Parliament. (Note 4) provides a high-level reconciliation between the bases of reporting.

(b) Net cash provided by Government

The department operates within the Consolidated Revenue Fund (CRF), which is administered by the Receiver General for Canada. All cash received by the department is deposited to the CRF and all cash disbursements made by the department are paid from the CRF. The net cash provided by Government is the difference between all cash receipts and all cash disbursements including transactions between

departments of the federal government.

(c) Change in net position in the Consolidated Revenue Fund

The change in net position in the Consolidated Revenue Fund is the difference between the net cash provided by Government and appropriations used in a year, excluding the amount of non-respendable revenue recorded by the department. It results from timing differences between when a transaction affects appropriations and when it is processed through the CRF.

(d) Revenues

- Revenues derived from the provision of legal services are recognized in the year of billing. Billings are for salaries or hours of service rendered and disbursements;

- Service and administration fees revenues under the Family Law programs are recognized based upon the services provided in the year, such as upon validation of the garnishment application or upon issuance of the divorce clearance certificate;

- Fines, forfeitures and court costs are recognized upon receipt of payment by the department.

(e) Expenses

- Grants are recognized in the year in which the conditions for payment are met. In the case of grants which do not form part of an existing program, the expense is recognized when the Government announces a decision to make a non-recurring transfer, provided the enabling legislation or authorization for payment receives parliamentary approval prior to the completion of the financial statements.

- Contributions are recognized in the year in which the recipient has met the eligibility criteria or fulfilled the terms of a contractual transfer agreement;

- Vacation pay and compensatory leave are expensed as the benefits accrue to employees under their respective terms of employment;

- Expenses related to the provision of legal services are limited to those costs borne and settled directly by the department. These legal services may or may not be recovered as revenue from the client department. The cost of legal services which are paid directly by client departments to outsoide suppliers such as Crown agents, are not included in the expenses of the department;

- Services provided without charge by other government departments for accommodation, the employer's contribution to the health and dental insurance plans, and worker's compensation costs are recorded as operating expenses at their estimated cost.

(f) Employee future benefits

i. Pension benefits:

Eligible employees participate in the Public Service Pension Plan, a multiemployer plan administered by the Government of Canada. The department's contributions to the Plan are charged to expenses in the year incurred and represent the total departmental obligation to the Plan. Current legislation does not require the department to make contributions for any actuarial deficiencies of the

Plan.

ii. Severance benefits:

Employees are entitled to severance benefits under labour contracts or conditions of employment. These benefits are accrued as employees render the services necessary to earn them. The obligation relating to the benefits earned by employees is calculated using information derived from the results of the actuarially determined liability for employee severance benefits for the Government as a

whole.

g) Receivables

Receivables are stated at amounts expected to be ultimately realized; a provision is made for receivables where recovery is considered uncertain.

(h) Contingent liabilities

Contingent liabilities are potential liabilities which may become actual liabilities when one or more future events occur or fail to occur. To the extent that the future event is likely to occur or fail to occur, and a reasonable estimate of the loss can be made, an estimated liability is accrued and an expense recorded. If the likelihood is not determinable or an amount cannot be reasonably

estimated, the contingency is disclosed in the notes to the financial statements.

(i) Tangible capital assets

All tangible capital assets are recorded at their acquisition cost and amortized over their estimated useful life on a straight-line basis as follows:

| Asset class | Acquisition cost equal or greater than | Amortization period | |||||||||||||||||||

| Office and other equipment | $10,000 | 5 to 8 years | |||||||||||||||||||

| Telecommunications equipment | $10,000 | 4 to 5 years | |||||||||||||||||||

| Informatics hardware | $1,000 | 3 to 5 years | |||||||||||||||||||

| Informatics software | $10,000 | 3 to 5 years | |||||||||||||||||||

| Furniture and furnishings | $1,000 | 10 years | |||||||||||||||||||

| Motor vehicles | $10,000 | 5 years | |||||||||||||||||||

| Leasehold improvements | $10,000 | Lesser of useful life or term of the lease | |||||||||||||||||||

| Work in progress | In accordance with asset class | Once in service, in accordance with asset class |

|||||||||||||||||||

(j) Measurement uncertainty

The preparation of these financial statements in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses reported in the financial statements. At the time of preparation of

these statements, management believes the estimates and assumptions to be reasonable. The most significant items where estimates are used are contingent liabilities, the liability for employee severance benefits and the useful life of tangible capital assets. Actual results could significantly differ from those estimated. Management's estimates are reviewed periodically and, as adjustments become

necessary, they are recorded in the financial statements in the year they become known.

3. Changes in accounting policy

In 2006-07, the department made changes to its accounting policy for tangible capital assets to better reflect the significant investment by the department in these assets. The first change is the reduction of the threshold value for capitalization of certain tangible assets, namely informatics hardware and furniture and furnishings, from $10,000 to $1,000. The second change is the revision in approach from capitalizing assets on a component basis to a whole asset or project basis. The final change is the capitalization of salary and related employee benefit costs for informatics software that is developed in house.

These changes have been accounted for retroactively with the following impact on the comparative results for 2005-06:

| 2006 As previously stated |

Effect of the changes |

2006 Restated |

||||||||||||||

| (in dollars) | ||||||||||||||||

| Statement of Equity of Canada | ||||||||||||||||

| Equity of Canada, beginning of the year | (436,894,775) | 20,872,864 | (416,021,911) | |||||||||||||

| Net cost of operations | (874,396,294) | 3,007,172 | (871,389,122) | |||||||||||||

| Note 9 Tangible capital asstes | ||||||||||||||||

| Net book value | ||||||||||||||||

| Office and other equipment | 456,876 | 20,568 | 477,444 | |||||||||||||

| Telecommunications equipment | 313,697 | 344,848 | 658,545 | |||||||||||||

| Informatics hardware | 656,471 | 7,563,537 | 8,220,008 | |||||||||||||

| Informatics software | 1,619,504 | 5,567,563 | 7,187,067 | |||||||||||||

| Furniture and furnishings | 249,087 | 8,843,193 | 9,092,280 | |||||||||||||

| Motor vehicles | 86,197 | 0 | 86,197 | |||||||||||||

| Leasehold improvements | 6,094,150 | 730,193 | 6,824,343 | |||||||||||||

| Work in progress - software development | 1,457,438 | 391,363 | 1,848,801 | |||||||||||||

| Work in progress - leasehold improvements | 0 | 418,771 | 418,771 | |||||||||||||

| 10,933,420 | 23,880,036 | 34,813,456 | ||||||||||||||

| Amortization expense for the year ended March 31, 2006 is $9,149,985 (previously stated as $3,002,463). |

4. Parliamentary appropriations

The department receives most of its funding through annual Parliamentary appropriations. Items recognized in the Statement of Operations and the Statement of Financial Position in one year may be funded through Parliamentary appropriations in prior, current or future years. Accordingly, the department has different net results of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled in the following tables:

(a) Reconciliation of net cost of operations to current year appropriations used

| (in dollars) | 2007 | 2006 | ||||||||||||||

| Restated (Note 17) | ||||||||||||||||

| Net cost of operations | 879,780,447 | 871,389,122 | ||||||||||||||

| Adjustments for items affecting net cost of operations but not affecting appropriations | ||||||||||||||||

| Add (Less) | ||||||||||||||||

| Services provided without charge by other government departments (Note 16) | (75,658,012) | (73,823,178) | ||||||||||||||

| Receivable from Treasury Board Secretariat for employee benefits | 3,477,341 | 0 | ||||||||||||||

| Amortization of tangible capital assets | (11,115,407) | (9,149,985) | ||||||||||||||

| Revenue not available for spending | 170,077,588 | 166,140,234 | ||||||||||||||

| Employee severance benefits | (5,573,222) | (12,800,763) | ||||||||||||||

| Vacation pay and compensatory leave | (610,787) | 108,262 | ||||||||||||||

| Refunds and reversals of previous year expenses | 6,528,630 | 9,379,263 | ||||||||||||||

| Bad debt | (4,061,094) | (4,418,496) | ||||||||||||||

| Loss on disposal of assets | 0 | |||||||||||||||

| Other | (1,600,000) | (200,000) | ||||||||||||||

| Other | 0 | 0 | ||||||||||||||

| 81,465,037 | 75,235,337 | |||||||||||||||

| Adjustments for items not affecting net cost of operations but affecting appropriations | ||||||||||||||||

| Add (Less) | ||||||||||||||||

| Acquisitions of tangible capital assets | 13,000,181 | 12,950,526 | ||||||||||||||

| Change in prepaid expenses | (22,658) | 34,378 | ||||||||||||||

| 12,977,523 | 12,984,904 | |||||||||||||||

| Current year appropriations used | 974,223,007 | 959,609,363 | ||||||||||||||

(b) Appropriations provided and used

| 2007 | 2006 | |||||||||||||

|

|

||||||||||||||

| Restated (Note 17) | ||||||||||||||

| Vote 1 - Operating expenditures | 591,751,446 | |||||||||||||

| Vote 5 - Grants and contributions | 364,007,415 | 365,742,415 | ||||||||||||

| Statutory Amounts | 72,803,845 | 71,475,474 | ||||||||||||

| Less | ||||||||||||||

| Appropriations Available for future years | (837) | (7,379) | ||||||||||||

| Voted Authorities lapsed | (54,338,862) | (20,376,198) | ||||||||||||

| Current year appropriations used | 974,223,007 | 959,609,363 | ||||||||||||

| (c) Reconciliation of net cash provided by Government to current year appropriations used | ||||||||||||||

| 2007 | 2006 | |||||||||||||

| Restated (Note 17) | ||||||||||||||

| Net cash provided by Government | 632,680,524 | 673,309,872 | ||||||||||||

| Revenue not available for spending | 170,077,589 | 166,140,234 | ||||||||||||

| Change in net position in the Consolidated Revenue Fund | ||||||||||||||

| Change in GST refundable advance account | 178,171 | 248,203 | ||||||||||||

| Refund of previous year expenditures | 719,326 | 710,914 | ||||||||||||

| Adjustment to previous year accounts payable | 5,809,305 | 8,668,349 | ||||||||||||

| Family Law remission order | (3,703,325) | (4,055,043) | ||||||||||||

| 0 | 8,000 | |||||||||||||

| Loss on disposal of assets | 14,377 | 0 | ||||||||||||

| Doubtful receivables - G&C | 241,173 | 0 | ||||||||||||

| Payments for standing advances to employees | 5,745 | 13,100 | ||||||||||||

| Payments for accountable temporary advances | (23,605) | 0 | ||||||||||||

| 0 | 0 | |||||||||||||

| (3,320,185) | 14,163,178 | |||||||||||||

| 171,464,894 | 120,159,257 | |||||||||||||

| Current year appropriations used | 974,223,007 | 959,609,363 | ||||||||||||

| (c) Reconciliation of net cash provided by Government to current year appropriations used | ||||||||||||||

| 2007 | 2006 | |||||||||||||

| Restated (Note 17) | ||||||||||||||

| Net cash provided by Government | 632,680,524 | 673,309,872 | ||||||||||||

| Revenue not available for spending | 170,077,588 | 166,140,234 | ||||||||||||

| Change in net position in the Consolidated Revenue Fund | ||||||||||||||

| Variation in accounts receivable and advances | (6,038,273) | 14,432,481 | ||||||||||||

| Variation in accounts payable and accrued liabilities | 170,775,314 | 100,402,555 | ||||||||||||

| Adjustments and refunds of previous year accounts payable | 6,528,631 | 9,379,264 | ||||||||||||

| Other adjustments | 199,223 | (4,055,043) | ||||||||||||

| 171,464,895 | 120,159,257 | |||||||||||||

| Current year appropriations used | 974,223,007 | 959,609,363 | ||||||||||||

(c) Reconciliation of net cash provided by Government to current year appropriations used

5. Expenses

| (in dollars) | 2007 | 2006 | |||||||||||||||

| Restated (Note 17) | |||||||||||||||||

| Operating | |||||||||||||||||

| Salaries and employee benefits | 528,753,983 | 527,238,693 | |||||||||||||||

| Professional and special services | 65,121,464 | 60,717,166 | |||||||||||||||

| Accommodation | 43,911,327 | 42,201,714 | |||||||||||||||

| Travel and relocation | 15,995,105 | 15,962,623 | |||||||||||||||

| Amortization of tangible capital assets | 11,115,407 | 9,149,985 | |||||||||||||||

| Utilities, materials and supplies | 8,779,083 | 8,237,268 | |||||||||||||||

| Communications | 7,047,811 | 6,638,081 | |||||||||||||||

| Information | 5,123,369 | 7,278,749 | |||||||||||||||

| Bad debt expense | 4,061,094 | 4,418,496 | |||||||||||||||

| Claims and ex-gratia payments | 3,982,429 | 359,825 | |||||||||||||||

| Repairs and maintenance | 2,435,803 | 2,422,101 | |||||||||||||||

| Rentals | 1,202,760 | 1,506,527 | |||||||||||||||

| Other | 1,077,398 | 854,827 | |||||||||||||||

| Total operating expenses | 698,607,033 | 686,986,055 | |||||||||||||||

| Transfer payments | |||||||||||||||||

| Provinces and territories | 329,003,366 | 330,961,639 | |||||||||||||||

| Non-profit institutions and organizations | 15,965,498 | 13,543,147 | |||||||||||||||

| Persons | 6,053,428 | 5,922,283 | |||||||||||||||

| International organizations and foreign countries | 175,272 | 116,232 | |||||||||||||||

| Total transfer payments | 351,197,564 | 350,543,301 | |||||||||||||||

| Total expenses | 1,049,804,597 | 1,037,529,356 | |||||||||||||||

6. Revenues

| (in dollars) | 2007 | 2006 | ||||||||||||||||

| Services | ||||||||||||||||||

| Legal services | 161,660,834 | 155,492,858 | ||||||||||||||||

| Family Law fees | 6,807,063 | 7,378,009 | ||||||||||||||||

| 168,467,897 | 162,870,867 | |||||||||||||||||

| Other revenues | ||||||||||||||||||

| Fines and forfeitures | 967,907 | 2,870,421 | ||||||||||||||||

| Rent from residential housing provided to employees | 294,910 | 307,776 | ||||||||||||||||

| Court costs awarded | 0 | 79,252 | ||||||||||||||||

| Other | 293,436 | 11,918 | ||||||||||||||||

| 1,556,253 | 3,269,367 | |||||||||||||||||

7. Receivables

| (in dollars) |

2007

|

2006

|

| Federal government departments and agencies | ||

|

Accounts receivable |