Common menu bar links

Breadcrumb Trail

ARCHIVED - Immigration and Refugee Board of Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section 3: Supplementary Information

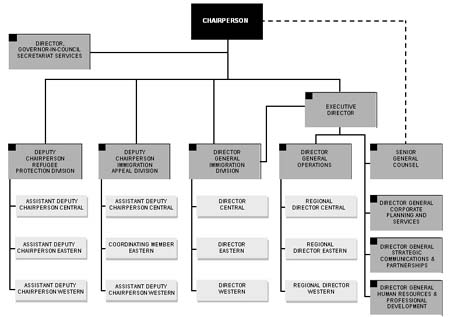

Organizational Information

Chairperson

The Chairperson is the IRB's Chief Executive Officer, senior decision-maker and spokesperson. Providing overall leadership and direction to the Board's three decision-making divisions, the Chairperson is responsible for creating and promoting a vision of the IRB that unifies all IRB personnel around the common purpose of providing resolutions, including well-reasoned decisions on immigration and refugee matters, as early as possible in the process, while maintaining fairness and quality.

In addition to the broad responsibility of the management of GIC appointees, the Chairperson has a range of statutory powers at his disposal to provide assistance to decision-makers in order to enhance the quality, consistency and efficiency of decision-making. The Chairperson is accountable to Parliament and reports to it through the Minister of CIC.

Executive Director

The Executive Director is the IRB's Chief Operating Officer and reports to the IRB Chairperson. The Executive Director is responsible for IRB operations and the administration of the Board's three decision-making divisions.

The Executive Director is responsible for the complement of public service employees, including those who provide direct support to the decision-making activities at the IRB. This position is currently vacant pending decisions on IRB governance.

Senior Management

Two Deputy Chairpersons (appointed by the Governor in Council) and one Director General (appointed under the Public Service Employment Act) oversee decision-making in the three divisions. Four Directors General and a Senior General Counsel (all appointed under the Public Service Employment Act) are responsible for the operations, legal services and corporate management and services functions of the IRB.

Organization Chart

Figure 3.1: IRB Organizational Chart

(Click on image to enlarge)

Overview of Financial Performance

The IRB's total authorities of $119.3 million increased by $2.5 million from its planned spending of $116.8 million. This increase was attributable mainly to:

- An additional amount of $4.4 million in funding carried forward from 2005-2006;

- An additional amount of $1.0 million in compensation for collective agreements; and

- A reduction of $2.9 million associated with the employee benefit plans.

The net overall increase of $2.5 million was allocated primarily to cover requirements relating to the Immigration Appeal program activity.

Actual spending for 2006-2007 was $110.4 million, $8.9 million less than the total authorities. Unused resources were attributable mainly to:

- A surplus of $6.9 million in the special purpose allotment for the translation of decisions primarily as a result of a lower volume of finalizations; and

- A surplus of approximately $2.0 million as a result of delays in staffing (specifically, fewer decision-maker appointments than initially planned).

Comparison of Planned to Actual Spending (incl. FTEs)*

This table offers a comparison of the Main Estimates, Planned Spending, Total Authorities, Actual Spending for 2006-2007 and historical figures for Actual Spending.

Table 3.1: Comparison of Planned to Actual Spending (incl. FTEs)

| ($ millions) | 2004-2005 | 2005-2006 | 2006-2007 | |||

| Actual | Actual | Main Estimates |

Planned Spending |

Total Authorities |

Actual | |

| Refugee Protection | 104.4 | 90.6 | 86.8 | 86.4 | 86.3 | 81.4 |

| Admissibility Hearings and Detention Reviews | 10.9 | 10.4 | 15.3 | 15.2 | 15.5 | 12.2 |

| Immigration Appeal | 10.6 | 11.7 | 15.2 | 15.2 | 17.5 | 16.8 |

| Total | 125.9 | 112.7 | 117.4 | 116.8 | 119.3 | 110.4 |

| Less: Non respendable revenue | ||||||

| Plus: Cost of services received without charge | 19.3 | 20.3 | 19.5 | 19.5 | ||

| Total Departmental Spending | 145.2 | 133.0 | 136.3 | 129.9 | ||

| Full-time Equivalents (FTEs) | 1,170 | 1,035 | 1,050 | 942 | ||

*Because of rounding, figures may not add to totals shown.

Resources by Program Activity

The following table outlines how resources were utilized by program activity for the 2006-2007 fiscal year.

Table 3.2: Resources by Program Activity

| 2006-2007 | ||||

| ($ millions) | Budgetary | |||

| Program Activity | Operating | Total: Gross Budgetary Expenditures | Total: Net Budgetary Expenditures | Total |

| Refugee Protection | ||||

| Main Estimates | 86.8 | 86.8 | 86.8 | 86.8 |

| Planned Spending | 86.4 | 86.4 | 86.4 | 86.4 |

| Total Authorities | 86.3 | 86.3 | 86.3 | 86.3 |

| Actual Spending | 81.4 | 81.4 | 81.4 | 81.4 |

| Admissibility Hearings and Detention Reviews | ||||

| Main Estimates | 15.3 | 15.3 | 15.3 | 15.3 |

| Planned Spending | 15.2 | 15.2 | 15.2 | 15.2 |

| Total Authorities | 15.5 | 15.5 | 15.5 | 15.5 |

| Actual Spending | 12.2 | 12.2 | 12.2 | 12.2 |

| Immigration Appeal | ||||

| Main Estimates | 15.2 | 15.2 | 15.2 | 15.2 |

| Planned Spending | 15.2 | 15.2 | 15.2 | 15.2 |

| Total Authorities | 17.5 | 17.5 | 17.5 | 17.5 |

| Actual Spending | 16.8 | 16.8 | 16.8 | 16.8 |

Voted and Statutory Items

The table below shows how Parliament votes resources to the IRB, and largely replicates the summary table listed in the Main Estimates. Resources are presented to Parliament in this format. Parliament approves the voted funding and the statutory information is provided for information purposes.

Table 3.3: Voted and Statutory Items

| 2006-2007 | |||||

| Voted or Statutory Items ($ millions) |

Truncated Vote of Statutory Wording | Main Estimates | Planned Spending | Total Authorities | Actual |

| 10 | Operating expenditures | 103.3 | 102.7 | 108.1 | 99.2 |

| (S) | Contributions to employee benefit plans | 14.1 | 14.1 | 11.2 | 11.2 |

| Total | 117.4 | 116.8 | 119.3 | 110.4 | |

Services Received Without Charge

The following table provides information on services received without charge for the IRB.

Table 3.4: Services Received Without Charge

| ($ millions) | 2006-2007 |

| Accommodation provided by Public Works and Government Services Canada | 14.0 |

| Contributions covering employers' share of employees' insurance premiums and expenditures paid by TBS (excluding revolving funds). Employer's contribution to employees' insured benefits plans and associated expenditures paid by TBS | 5.5 |

| Salary and associated expenditures of legal services provided by the Department of Justice Canada | 0.0 |

| Total 2006-2007 Services received without charge | 19.5 |

Resource Requirements by Branch or Sector

The table below shows the distribution of funding to the IRB at the organizational level.

Table 3.5: Resource Requirements by Branch or Sector

| 2006-2007 | ($ millions) | |||

| Organization | Refugee Protection | Admissibility Hearings and Detention Reviews | Immigration Appeal | Total |

| Chairperson, Executive Director and Secretariat (including GIC salaries) | ||||

| Planned Spending | 24.6 | 0.2 | 4.6 | 29.4 |

| Actual Spending | 16.4 | 0.2 | 4.8 | 21.4 |

| Refugee Protection Division | ||||

| Planned Spending | 1.2 | 1.2 | ||

| Actual Spending | 1.0 | 1.0 | ||

| Immigration Appeal Division | ||||

| Planned Spending | 0.9 | 0.9 | ||

| Actual Spending | 0.9 | 0.9 | ||

| Immigration Division | ||||

| Planned Spending | 4.0 | 4.0 | ||

| Actual Spending | 5.6 | 5.6 | ||

| Strategic Communications and Partnerships (including special purpose account for translation of decisions) | ||||

| Planned Spending | 6.0 | 5.4 | 2.8 | 14.2 |

| Actual Spending | 3.9 | 0.7 | 3.3 | 7.9 |

| Human Resources and Professional Development | ||||

| Planned Spending | 3.3 | 0.4 | 0.4 | 4.1 |

| Actual Spending | 3.5 | 0.5 | 0.5 | 4.5 |

| Legal Services | ||||

| Planned Spending | 4.3 | 0.2 | 0.2 | 4.7 |

| Actual Spending | 4.2 | 0.2 | 0.2 | 4.6 |

| Corporate Planning and Services | ||||

| Planned Spending | 6.9 | 1.2 | 1.2 | 9.3 |

| Actual Spending | 12.4 | 1.6 | 1.5 | 15.5 |

| Operations (including regions and ICMS) | ||||

| Planned Spending | 40.1 | 3.8 | 5.1 | 49.0 |

| Actual Spending | 40.0 | 3.4 | 5.6 | 49.0 |

Details on Project Spending (ICMS)*

This table identifies IRB projects, information technology and major crown projects underway or completed during the reporting period.

The scope of this multi-year project is to improve case management by streamlining and automating business processes within the IRB and to implement an integrated case management system that will support IRB operations. When fully implemented, ICMS will provide IRB employees with access to all information required to manage or work with IRB cases and provide the IRB with the capacity to automate its case processing improvements. It will also:

- Improve processing time;

- Promote a consistency in decisions that will enhance predictability for claimants and counsel;

- Increase security and integrity of the data; and

- Improve the current IT infrastructure.

Table 3.6: Details on Project Spending (ICMS)

| Current Estimated Total Cost ($ millions) | Cumulative Spending to March 31, 2007 ($ millions) |

| 40.0 | 39.6 |

| Plans | Results |

| Stage 1 | |

| Release 1: Replace the current Claim Type Management System and automate screening and streamlining activities | More robust system that improves the IRB's case management - Implemented June 2004 |

| Release 2: Automate research processes | Increases the effectiveness of the research processes by automating the research requests - Implemented April 2005 |

| Release 3: Create Electronic Personal Information Form (e-PIF) | Enhances client services by allowing counsel to send PIFs electronically - Implemented May 2005 |

| Release 4: Automate RPD processes | Delivers the program through the automation of RPD functions and improves decision-making by providing timely, integrated, comprehensive and accurate information on cases - Implemented April 2007 |

| Stage 2 | |

| Automate IAD processes | Building on Stage 1, development of the various ICMS elements required to provide case processing and scheduling for the IAD (under review pending business rationalization of IAD processes) |

| Stage 3 | |

| Automate ID processes | Building on Stage 2, development of the various ICMS elements required to provide case processing and scheduling for the ID (under review pending business rationalization of ID processes) |

*Although ICMS does not meet the TBS definition of a major project for reporting purposes, it represents a significant investment for the IRB.

Financial Statements of Departmental Corporations and Agencies (including Agents of Parliament) and Revolving Funds Financial Statements

The following financial statements are prepared in accordance with accrual accounting principles. The unaudited supplementary information presented in the financial tables in the IRB Departmental Performance Report is prepared on a modified cash basis of accounting in order to be consistent with appropriation-based reporting. Note 3 of the financial statements reconciles these two accounting methods.

Statement of Management Responsibility

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2007, and all information contained in these statements rests with the management of the IRB. These financial statements have been prepared by management in accordance with TBS accounting policies, which are consistent with Canadian generally accepted accounting principles for the public sector.

Some information in the financial statements is based on management's best estimates and judgment and gives due consideration to materiality. To fulfil its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of the IRB's financial transactions. Financial information submitted to the Public Accounts of Canada and included in the IRB Departmental Performance Report is consistent with these financial statements.

Management maintains a system of financial management and internal controls designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are in accordance with the Financial Administration Act and prescribed regulations, are within Parliamentary authorities, and are properly recorded to maintain accountability of Government funds. Management also seeks to ensure the objectivity and integrity of data in its financial statements by careful selection, training and development of qualified staff, by organizational arrangements that provide appropriate divisions of responsibility, and by communication programs aimed at ensuring that regulations, policies, standards and managerial authorities are understood throughout the IRB.

The Chairperson's Management Board (CMB) is the senior management body responsible for setting organizational priorities and objectives and providing overall direction to the IRB. The CMB oversees major initiatives that cut across the organization to ensure a comprehensive and integrated approach.

Management is supported and assisted by an Audit and Evaluation Committee (AEC), a sub committee of the CMB. The primary role of the AEC is to provide functional guidance over internal audit and evaluation.

The Senior Financial Officer is a full member of both the CMB and the AEC.

The financial statements of the IRB have not been audited.

| Brian Goodman Chairperson |

Jean B�langer Senior Financial Officer |

Ottawa, Canada

August 2nd, 2007

Statement of Operations (Unaudited) For the Year Ended March 31

(in thousands of dollars)

| 2007 | 2006 | ||||

| Refugee Protection | Immigration Appeal | Admissibility Hearings & Detention Reviews | Total | Total | |

| Operating Expenses | |||||

| Salaries and employee benefits | 63,265 | 12,528 | 10,042 | 85,835 | 88,734 |

| Rentals | 11,017 | 1,881 | 2,138 | 15,036 | 15,462 |

| Professional and special services | 10,359 | 3,899 | 1,697 | 15,955 | 11,747 |

| Amortization | 4,595 | 37 | 41 | 4,673 | 2,333 |

| Transpor- tation and telecom munications |

3,272 | 764 | 522 | 4,558 | 4,396 |

| Acquisition of equipment (less than $10K) | 1,428 | 212 | 208 | 1,848 | 2,791 |

| Repair and mainte- nance |

992 | 135 | 132 | 1,259 | 1,635 |

| Utilities, materials and supplies | 578 | 74 | 70 | 722 | 762 |

| Information | 194 | 16 | 17 | 227 | 246 |

| Other | 37 | (2) | (3) | 32 | 95 |

| Total Operating Expenses | 95,737 | 19,544 | 14,864 | 130,145 | 128,201 |

| Total Revenues | 7 | 1 | 1 | 9 | 4 |

| Net Cost of Operations | 95,730 | 19,543 | 14,863 | 130,136 | 128,197 |

The accompanying notes form an integral part of these financial statements.

Statement of Financial Position (Unaudited) at March 31

(in thousands of dollars)

| 2007 | 2006 | ||

| ASSETS | |||

| Financial assets | |||

| Accounts receivables and advances (Note 4) | 3,576 | 2,717 | |

| Non-financial assets | |||

| Prepaid expenses | 129 | 23 | |

| Tangible capital assets (Note 5) | 23,307 | 22,798 | |

| Total non-financial assets | 23,435 | 22,821 | |

| TOTAL | 27,011 | 25,538 | |

| LIABILITIES | |||

| Accounts payable and accrued liabilities | 9,723 | 8,299 | |

| Vacation pay and compensatory leave | 3,445 | 3,778 | |

| Employee severance benefits (Note 6) | 15,239 | 14,086 | |

| Total liabilities | 28,407 | 26,163 | |

| EQUITY OF CANADA | (1,396) | (625) | |

| TOTAL | 27,011 | 25,538 | |

| Contingent liabilities (Note 7) | |||

The accompanying notes form an integral part of these financial statements.

Statement of Equity of Canada (Unaudited) at March 31

(in thousands of dollars)

| 2007 | 2006 | |

| Equity of Canada, beginning of year | 625 | 9,367 |

| Net cost of operations | (130,136) | (128,197) |

| Current year appropriations used (Note 3) | 110,438 | 112,733 |

| Adjustments of previous years accounts payables and miscellaneous revenues not available for spending | (55) | (397) |

| Change in net position in the Consolidated Revenue Fund (Note 3) | (542) | 4,261 |

| Services received without charge from other government departments (Note 8) | 19,524 | 20,342 |

| Equity of Canada, end of year | (1,396) | (625) |

The accompanying notes form an integral part of these financial statements.

Statement of Cash Flow (Unaudited) For the Year Ended March 31

(in thousands of dollars)

| 2007 | 2006 | |

| Operating activities | ||

| Net cost of operations | 130,136 | 128,197 |

| Non-cash items: | ||

| Amortization of capital assets | (4,673) | (2,333) |

| Bad debts write-off | - | (4) |

| Previous year correction | - | (444) |

| Services received without charge | (19,524) | (20,342) |

| Variations in Statement of Financial Position: | ||

| Increase in accounts receivable and advances | 859 | 243 |

| Increase in prepaid expenses | 105 | 23 |

| Decrease (increase) in liabilities | (2,244) | 4,077 |

| Cash used by operating activities | 104,659 | 109,417 |

| Capital investment activities | ||

| Acquisitions of tangible capital assets (Note 5) | 5,182 | 7,180 |

| Cash used by capital investment activities | 5,182 | 7,180 |

| Financing activities | ||

| Net cash provided by Government of Canada | (109,841) | (116,597) |

The accompanying notes form an integral part of these financial statements.

Notes to the Financial Statements (Unaudited)

1. Authority and Objectives

Created by an Act of the Canadian Parliament in 1989, the IRB is the largest Canadian administrative tribunal performing quasi-judicial functions. Its mandate is contained in Part 4 of the Immigration and Refugee Protection Act.

As an independent tribunal, the IRB's mandate is to:

- Determine claims for refugee protection made in Canada;

- Adjudicate admissibility hearings and review reasons for detention; and

- Decide appeals from sponsorship refusals, certain removal orders and residency obligation decisions, and decide appeals by the Minister of CIC from decisions made in admissibility hearings.

As an organization with three administrative divisions, the IRB provides a responsive and efficient means of delivering administrative justice for individuals and ensures that all people who come before it are treated fairly. In fulfilling its mandate, the IRB contributes directly to maintaining public confidence in the integrity of Canada's immigration and refugee determination system.

2. Summary of Significant Accounting Policies

The financial statements have been prepared in accordance with TBS accounting policies, which are consistent with Canadian generally accepted accounting principles for the public sector.

Significant accounting policies are as follows:

(a) Parliamentary Appropriations - The IRB is financed by the Government of Canada through Parliamentary appropriations. Appropriations provided to the IRB do not parallel financial reporting according to generally accepted accounting principles since appropriations are primarily based on cash flow requirements. Consequently, items recognized in the statement of operations and the statement of financial position are not necessarily the same as those provided through appropriations from Parliament. Note 3 provides a high-level reconciliation between the two reporting bases.

(b) Net Cash Provided by Government - The IRB operates within the Consolidated Revenue Fund (CRF), which is administered by the Receiver General for Canada. All cash received by the IRB is deposited to the CRF and all cash disbursements made by the IRB are paid from the CRF. Net cash provided by Government is the difference between all cash receipts and all cash disbursements including transactions between departments of the federal government.

(c) Change in net position in the Consolidated Revenue Fund is the difference between the net cash provided by Government and appropriations used in a year, excluding the amount of non-respendable revenue recorded by the IRB. It results from timing differences between when a transaction affects appropriations and when it is processed through the CRF.

(d) Revenues - Revenues are accounted for in the period in which the underlying transaction or event occurred that gave rise to the revenues. The IRB does not charge for its services and its only revenues stem from gains on disposals of crown assets and Access to Information and Privacy fees.

(e) Expenses - Expenses are recorded on an accrual basis:

- Vacation pay and compensatory leave are expensed as the benefits accrue to the employees under their respective terms of employment; and

- Services received without charge by other government departments for accommodation, the employer's contribution to the health and dental insurance plans and legal services are recorded as operating expenses at their estimated cost.

(f) Employee future benefits

- Pension benefits: Eligible employees participate in the Public Service Pension Plan, a multi-employer administered by the Government of Canada. The IRB contributions to the Plan are charged to expenses in the year they are incurred and represent the total obligation of the Board to the Plan. Current legislation does not require the IRB to make contributions for any actuarial deficiencies of the Plan.

- Severance benefits: Employees are entitled to severance benefits under labour contracts or conditions of employment. These benefits are accrued as employees render the services necessary to earn them. The obligation relating to the benefits earned by employees is calculated using information derived from the results of the actuarially determined liability for employee severance benefits for the Government as a whole.

(g) Accounts receivables are stated at amounts expected to be ultimately realized. A provision can be made for external parties receivables where recovery is considered uncertain.

(h) Contingent liabilities - Contingent liabilities are potential liabilities, which may become actual liabilities when one or more future events occur or fail to occur. To the extent that the future event is likely to occur or fail to occur, and a reasonable estimate of the loss can be made, an estimated liability is accrued and an expense recorded. If the likelihood is not determinable or an amount cannot be reasonably estimated, the contingency is disclosed in the notes to the financial statements.

(i) Tangible capital assets - All tangible capital assets having an initial cost of $10,000 or more are recorded at their acquisition cost. Amortization of tangible capital assets is done on a straight-line basis over the estimated useful life of the assets as follows:

| Asset class | Amortization Period |

| Informatics hardware | 4 years |

| Informatics software | 5 years |

(j) Measurement uncertainty - The preparation of these financial statements in accordance with TBS accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses reported in the financial statements. At the time of preparation of these statements, management believes the estimates and assumptions to be reasonable. The most significant items where estimates are used are the liability for employee severance benefits and the useful life of tangible capital assets. Actual results could significantly differ from those estimated. Management's estimates are reviewed periodically and, as adjustments become necessary, they are recorded in the financial statements in the year they become known.

3. Parliamentary Appropriations

The IRB receives its funding through annual Parliamentary appropriations. Items recognized in the statement of operations and the statement of financial position in one year may be funded through Parliamentary appropriations in prior, current or future years. Accordingly, the IRB has different net results of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled in the following tables:

(a) Reconciliation of net cost of operations to current year appropriations used:

| (in thousands of dollars) | 2007 | 2006 |

| Net cost of operations | 130,136 | 128,197 |

| Adjustments for items affecting net cost of operations but not affecting appropriations: | ||

| Add (Less): | ||

| Services received without charge (Note 8) | (19,524) | (20,342) |

| Amortization of tangible capital assets | (4,673) | (2,333) |

| Previous year correction | - | (444) |

| Adjustments to previous years accounts payable | 3 | 337 |

| Vacation pay and compensatory leave | 333 | 270 |

| Contingent liability reversal | - | 150 |

| Refunds of previous year's expenditures | 49 | 56 |

| Justice Canada's expenditures | (29) | (45) |

| Prepaid expenses previously charged to appropriations | - | (5) |

| Bad debts write-off | - | (4) |

| Employee severance benefits | (1,153) | (313) |

| Revenue | 9 | 4 |

| 105,151 | 105,528 | |

| Adjustments for items affecting net cost of operations but not affecting appropriations: | ||

| Add (Less): | ||

| Acquisition of capital assets | 5,182 | 7,180 |

| Prepaid expenses | 105 | 28 |

| Temporary advances | - | (3) |

| Current year appropriations used | 110,438 | 112,733 |

(b) Appropriations provided and used

| (in thousands of dollars) | 2007 | 2006 |

| Vote 10 - Operating expenditures | 103,259 | 98,601 |

| Vote 10a - Supplementary | 3,829 | - |

| Vote 15 - Transfer from TBS | 1,049 | - |

| Governor General's special warrants | - | 6,498 |

| Statutory amounts | 11,189 | 12,520 |

| Less: | ||

| Lapsed appropriations: Operating | (8,888) | (4,886) |

| Current year appropriations used | 110,438 | 112,733 |

(c) Reconciliation of net cash provided by Government to current year appropriations used

| (in thousands of dollars) | 2007 | 2006 |

| Net cash provided by Government | 109,841 | 116,597 |

| Adjustments of previous years accounts payable and miscellaneous revenues not available for spending | 55 | 97 |

| 109,896 | 116,994 | |

| Change in net position in the Consolidated Revenue Fund | ||

| Variation in accounts receivable and advances | (859) | (243) |

| Variation in accounts payable and accrued liabilities | 1,423 | (3,969) |

| Other adjustments | (22) | (49) |

| 542 | (4,261) | |

| Current year appropriations used | 110,438 | 112,733 |

4. Accounts Receivable and Advances

The following table presents details of accounts receivable and advances:

| (in thousands of dollars) | 2007 | 2006 |

| Receivable from other Federal Government departments and agencies | 3,472 | 2,677 |

| Receivables from external parties | 100 | 36 |

| Standing advances | 4 | 4 |

| Total | 3,576 | 2,717 |

5. Tangible Capital Assets

Cost (in thousands of dollars)

| Capital asset class | Opening Balance | Acquisitions | Work in Progress Transfer | Closing balance |

| Informatics Hardware | 2,475 | 112 | - | 2,587 |

| Informatics Software | 12,300 | - | 5,125 | 17,425 |

| Software under development | 12,609 | 5,070 | (5,125) | 12,554 |

| Total | 27,384 | 5,182 | - | 32,566 |

Accumulated amortization (in thousands of dollars)

| Capital asset class | Opening Balance | Amortization | Closing balance |

| Informatics Hardware | 1,664 | 304 | 1,968 |

| Informatics Software | 2,922 | 4,369 | 7,291 |

| Software under development | - | - | - |

| Total | 4,586 | 4,673 | 9,259 |

| Capital asset class | 2007 Net book value | 2006 Net book value |

| Informatics Hardware | 619 | 811 |

| Informatics Software | 10,134 | 9,378 |

| Software under development | 12,554 | 12,609 |

| Total | 23,307 | 22,798 |

Amortization expense for the year ended March 31, 2007, is $4,673 (2006 - $2,333).

6. Employee Benefits

(a) Pension Benefits: IRB employees participate in the Public Service Pension Plan, which is sponsored and administered by the Government of Canada. Pension benefits accrue up to a maximum period of 35 years at a rate of 2 percent per year of pensionable service, times the average of the best five consecutive years of earnings. The benefits are integrated with Canada/Qu�bec Pension Plans benefits and they are indexed to inflation.

Both employees and the IRB contribute to the cost of the Plan. The 2006-07 expense amounts to $11,183,580 ($12,517,527 in 2005-06), which represents approximately 2.2 times (2.6 in 2005-06) the contributions by employees.

The IRB's responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the financial statements of the Government of Canada, as the Plan's sponsor.

(b) Severance Benefits: The IRB provides severance benefits to its employees based on eligibility, years of service and final salary. These severance benefits are not pre funded. Benefits will be paid from future appropriations. Information about the severance benefits, measured as at March 31, is as follows:

| (in thousands of dollars) | 2007 | 2006 |

| Accrued benefit obligation, beginning of the year | 14,086 | 13,773 |

| Cost for the year | 2,981 | 1,266 |

| Benefits paid during the year | (1,828) | (953) |

| Accrued benefit obligation, end of the year | 15,239 | 14,086 |

7. Contingent liabilities

(a) Claims and litigation: Claims have been made against the IRB in the normal course of operations. Legal proceedings for claims totalling approximately $5,616,000 ($5,886,000 in 2006) were still pending at March 31, 2007. Some of these potential liabilities may become actual liabilities when one or more future events occur or fail to occur. To the extent that the future event is likely to occur or fail to occur, and a reasonable estimate of the loss can be made, an estimated liability is accrued and an expense recorded in the financial statements. No liability set-up was required because no future events were likely to occur.

8. Related party transactions

The IRB is related in terms of common ownership to all Government of Canada departments and agencies and Crown corporations. The IRB enters into transactions with these entities in the normal course of business and on normal trade terms. Also, during the year, the IRB received services, which were obtained without charge from other Government departments as presented in part (a) below.

(a) Services received without charge: During the year, the IRB received without charge from other departments, accommodation, legal fees and the employer's contribution to the health and dental insurance plans. These services without charge have been recognized in the IRB Statement of Operations as follows:

| (in thousands of dollars) | 2007 | 2006 |

| Accomodation | 13,986 | 14,586 |

| Employer's contribution to the health and dental insurance plans | 5,533 | 5,753 |

| Legal services | 5 | 3 |

| Accrued benefit obligation, end of the year | 19,524 | 20,342 |

The Government has structured some of its administrative activities for efficiency and cost-effectiveness purposes so that one department performs these on behalf of all without charge. The costs of these services, which include payroll and cheque issuance services provided by Public Works and Government Services Canada, are not included as an expense in the Board's Statement of Operations.

(b) Payables and receivables outstanding at year-end with related parties:

| (in thousands of dollars) | 2007 | 2006 |

| Accounts receivable with other government departments and agencies | 3,472 | 2,676 |

| Accounts payable to other government departments and agencies | 1,308 | 517 |

Response to Parliamentary Committees, Audits and Evaluations

Table 3.7: Response to Parliamentary Committees, Audits and Evaluations

| RESPONSE TO PARLIAMENTARY COMMITTEES | |

| No recommendations were received | |

| RESPONSE TO THE AUDITOR GENERAL | |

| No recommendations were received | |

| EXTERNAL AUDITS | |

| No recommendations were received | |

| INTERNAL AUDITS OR EVALUATIONS | |

| Plans | Results |

| Cyclical Compliance Reviews | |

| Videoconferencing, Human Resources Strategy and Streamlining | Action plans to management response of the Videoconferencing and Streamlining Review and Evaluation were followed up. Both reviews called for the renewal of the respective policies to reflect the IRB's transition to tribunal integration. Management response to the Human Resources Strategy Review was completed and closed. |

| Logic Model and Performance Measurement Framework | |

| IAD Innovation | A logic model and a performance measurement framework were developed for this major initiative. Both instruments were further developed to respond to results of the implementation of this initiative. |

| Values and Ethics Framework | Development of the logic model and the associated performance measurement framework for this function have been deferred until the appropriate Values and Ethics Frameworks are developed in 2008-2009. |

| Internal Audit | |

| Contracting Practices | An audit of contracting practices and the management response was completed at the end of 2006-2007. The audit follow-up will be carried forward to 2007-2008. |

| Control Self-Assessment | |

| MAF Element: Stage One | A Core Management Controls self-assessment project was designed and planned in 2006-2007. Stage One included a comprehensive consultation with senior managers at the national and regional levels to assess the state of the IRB's control environment by using the TBS Core Management Controls Framework. |

These reports and the associated management responses and action plans can be found at:

http://www.irb-cisr.gc.ca/en/about/transparency/evaluations/index_e.htm.