ARCHIVED - Canadian Forces Grievance Board

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2006-2007

Departmental Performance Report

Canadian Forces Grievance Board

The Honourable Peter G. MacKay

Minister of National Defence

Table of Contents

- Chairperson’s Message

- Management Representation Statement

- Summary Information

- Overall Board’s Performance

SECTION II – ANALYSIS OF PROGRAM ACTIVITIES BY STRATEGIC OUTCOME

SECTION III – SUPPLEMENTARY INFORMATION

- Organizational Information

- Table 1: Comparison of Planned to Actual Spending (including FTEs)

- Table 2: Resources by Program Activity

- Table 3: Voted and Statutory Items

- Table 4: Services Received Without Charge

- Table 5: Financial Statements of the Canadian Forces Grievance Board

- Table 6: Travel Policies

SECTION IV – OTHER ITEMS OF INTEREST

SECTION I – OVERVIEW

Chairperson’s Message

I am pleased to submit the Canadian Force’s Grievance Board’s (CFGB) sixth Departmental Performance Report, for the period ending March 31, 2007.

Last year, in collaboration with the Director General, Canadian Forces Grievance Authority (DGCFGA), we undertook a review of the grievance system as a whole and in particular, at the Final Authority level. The main purpose behind this exercise was to improve the process’ overall efficiency and reduce duplicate efforts.

Following extensive consultation with key Canadian Forces (CF) stakeholders, in November 2006, the CFGB and the DGCFGA embarked on a Pilot Project that would address concerns regarding shared processes between the two organizations and to assess the CFGB’s capacity to manage discretionary files (under current legislation, the Board receives approximately 40% of the grievances arriving at the Final Authority level). For this reporting period, initial results have been very positive and a final report will be submitted to the Vice-Chief of the Defence Staff in June 2007. The Board firmly believes that all grievances should be referred to us so that all CF members benefit from an independent review.

Throughout 2006, the CFGB kept up its focus on operational efficiency. The reviews of grievance files, both received and completed in 2006-2007, were done so in less than six months on average. At the end of this reporting period, we had fewer unresolved grievance files in our inventory than in previous years; a total of 78 grievances remained active.

Process changes aside, the CFGB also pursued its external communications strategy, using key outreach activities in order to enhance the knowledge among its primary stakeholders about the value and impact of the organization’s work.

Seven years after its inception, the CFGB is becoming more well-known among CF members and it will continue to progress towards ensuring that the military regard this organization as playing an essential, impartial and fair role in the CF grievance system.

Management Representation Statement

I submit for tabling in Parliament, the 2006-07 Departmental Performance Report for the Canadian Forces Grievance Board.

This document has been prepared based on the reporting principles contained in the Guide for the Preparation of Part III of the 2006-2007 Estimates: Reports on Plans and Priorities and Departmental Performance Reports:

- It adheres to the specific reporting requirements outlined in the Treasury Board Secretariat guidance;

- It is based on the department’s approved Strategic Outcome(s) and Program Activity Architecture that were approved by the Treasury Board;

- It presents consistent, comprehensive, balanced and reliable information;

- It provides a basis of accountability for the results achieved with the resources and authorities entrusted to it; and

- It reports finances based on approved numbers from the Estimates and the Public Accounts of Canada.

________________________________________________

| Name: | Diane Leurin |

| Title: | Chairperson |

Summary Information

The Grievance Context –

The concept of military personnel having the right to grieve and receive redress is not new. Canada’s introduction, in the year 2000, of an extra-military component to the Canadian Forces grievance system represented a major innovation in the handling of military grievances. That innovation was the creation of the Canadian Forces Grievance Board.

As stipulated in the National Defence Act (NDA) and Chapter 7.12 of the Queen’s Regulations and Orders for the Canadian Forces (QR&O), the Board’s mandate is to review all military grievances referred to it by the Chief of the Defence Staff (CDS). Following its review, the Board submits its findings and recommendations (F&Rs) to the CDS, simultaneously forwarding a copy to the grievor. It is the CDS, however, who is the final adjudicator on the grievance.

| Mission To review grievances, in order to render fair and impartial findings and recommendations in a timely and informal manner to the Chief of the Defence Staff and the grievor. |

The Board, which has quasi-judicial powers, can summon witnesses and compel them to give oral or written evidence. The Board can also order the production of documents or things. Although hearings would normally be held in private, the Chair can deem that a public hearing would benefit the participants and serve the public’s interest.

Chapter 7.12 of the QR&O sets out the types of grievances that can be referred to the Board. Specifically:

- The Chief of the Defence Staff shall refer to the Grievance Board any grievance relating to the following matters:

- Administrative action resulting in the forfeiture of, or deductions from, pay and allowances, reversion to a lower rank or release from the Canadian Forces;

- Application or interpretation of Canadian Forces policies relating to expression of personal opinions, political activities and candidature for office, civil employment, conflict of interest and post-employment compliance measures, harassment or racist conduct;

- Pay, allowances and other financial benefits; and

- Entitlement to medical care or dental treatment.

- The Chief of the Defence Staff shall refer every grievance concerning a decision or an act of the Chief of the Defence Staff in respect of a particular officer or non-commissioned member to the Grievance Board for its findings and recommendations.

Section 29.12 of the NDA stipulates that the CDS may also refer any other grievance to the Board.

Financial Resources ($000’s)

| 2006-07 | ||

|---|---|---|

| Planned Spending | Total Authorities | Actual Spending |

| $6,407.0 | $6,412.8 | $5,852.0 |

Human Resources *

| 2006-07 | ||

|---|---|---|

| Planned | Actual | Difference |

| 46 | 40 | 6 |

* Includes Board Members appointed by Governor in Council.

Departmental Priorities

| Status on Performance | 2006-07 | |||

| Planned Spending | Actual Spending | |||

|

Strategic Outcome: The recommendations of the Canadian Forces Grievance Board are implemented in the Canadian Forces and lead to improvements in the conditions of work. |

||||

| Alignment to Government of Canada Outcomes: Government Affairs | ||||

|

Priority No. 1 (Ongoing) Operational productivity |

Program Activity: Expected Results:

Ensure sound internal management practices in accordance with the Management Accountability Framework (MAF) and reflected in the Board's Performance Measurement Strategy:

|

Performance Status

Successfully met Successfully met

Successfully met Successfully met |

$3,685,000 | $3,175,412 |

| Status on Performance | 2006-07 | |||

| Planned Spending |

Actual Spending |

|||

|

Priority No. 2 (Ongoing) External Communications |

Program Activity: Stakeholders recognize the value-added of the Board's findings and recommendations.

|

Performance Status

Successfully met Successfully met Successfully met |

$410,000 | $280,526 |

Context and Operating Environment

As an administrative tribunal, the Board is independent of the Department of National Defence (DND), although DND has overall responsibility for the grievance process in which it operates. The Board reports directly to Parliament through the Minister of National Defence, who tables the Board’s annual and ministerial reports.

The CF Grievance System: a two-level process

Level I: Review by the Initial Authority (within the Canadian Forces)

A common misconception about the Canadian Forces grievance procedure is that a grievor can submit a grievance directly to the Board. In fact, the process begins not with the Board, but with the grievor’s Commanding Officer (CO).

Step 1: The grievor submits the grievance to his or her CO.

Step 2: If the CO cannot act as the Initial Authority (IA), the grievance will be submitted to someone who can, such as the next superior officer invested with the responsibility for dealing with the issue. If the grievor is satisfied with the IA’s decision, the grievance process ends there.

Level II: Review by the CDS

Grievors who are dissatisfied with the IA’s decision may ask to have their grievance be reviewed at the Final Authority (FA) level, that is, by the CDS, whose decision is the final stage in the grievance process.

|

Grievors initiate this second level of review as follows:

Step 1: They submit their request for a second level of review.

Step 2: If the grievance falls within the Board’s mandate, the Director General Canadian Forces Grievance Authority (DGCFGA) forwards the grievor’s file, on behalf of the CDS, to the Board.

The Board’s Procedure

- When the Board’s registrar receives the grievor’s file from the DGCFGA, the Board sends a letter of acknowledgement to the grievor, and in accordance with the rules of procedural fairness, also discloses to the grievor the information the file contains.

-

The Board invites the grievor to submit any additional information related to the case.

-

Should the Board acquire new information, it will be disclosed to the grievor.

A grievance officer conducts an in-depth analysis, which also involves a legal review from Legal Services. Thereafter, the Board Member assigned by the Chair, develops the final findings and recommendations. These are subsequently forwarded to the CDS and to the grievor.

|

“This process is outstanding, notwithstanding the result, I achieved my aim—an unbiased outside the chain of command analysis of my situation, and a verdict rooted in analysis of current Canadian law, morals and norms.”

— Source: Comments from CFGB Survey to grievors |

Overall Board’s Performance

Priority # 1 Operational productivity

Commitments

To achieve its objectives to improve operational productivity, the Board undertook several initiatives in 2006-07 fiscal year. They included commitments to:

-

Address efficiency and effectiveness in the service delivery to our clients:

- Achieve a steady state of operations with a target to complete a grievance review and issue its findings and recommendations within six months from the day that it is received at the Board;

- Ensure consistent high quality of analysis.

-

Ensure sound internal management practices in accordance with the Management Accountability Framework (MAF) and reflected in the Board's Performance Measurement Strategy:

- Rigorous planning of human and financial resources' needs.

- Ensure an efficient grievance review process that is cost effective.

Main Achievements

A More Effective, Efficient Grievance System — Laying the Groundwork

Following an intense examination of the grievance process at the Final Authority level, the Board participated in highly productive ongoing discussions with the DGCFGA and senior staff from National Defence Head Quarters (NDHQ). The review and discussions enabled the participants to collaboratively identify problem areas and agree on potential approaches to address them. As a result, the Board and the DGCFGA together devised and implemented a Pilot Project to test the proposed changes. These process changes are designed to significantly reduce the time required to analyze grievances and present the CDS with recommendations.

Efficiency Behind Case Reviews Continues to Improve

Meanwhile, the Board continued to streamline its own internal processes. In 2006-07, it reduced its remaining inventory of grievance files carried over from previous years.

Figure 1

| CFGB WORKLOAD OVERVIEW | 2000-01 | 2001-02 | 2002-03 | 2003-04 | 2004-05 | 2005-06 | 2006-07 |

| Cases in process at beginning of the period | 0 | 178 | 219 | 261 | 264 | 166 | 150 |

| Cases received for the period | 197 | 147 | 179 | 160 | 75 | 103 | 69 |

| Cases returned to DCFGA for the period | 0 | 0 | -6 | -2 | -4 | 0 | 0 |

| Cases completed for the period | 19 | 106 | 131 | 158 | 169 | 119 | 141 |

| Cases remaining in the process at the end of the period | 178 | 219 | 261 | 264 | 166 | 150 | 78 |

A Timely Review

In 2005, the Board increased its efficiency by 28% in terms of production time; the average turn-around time for completing its steady-state cases (those received from 2004 on) was 138 business days. In comparison, for the 66% of the 2006 completed cases to date, 69% averaged a turn-around time of 96 business days.

Presently, the average turnaround time is six months (120 business days) from the time the case is received at the Board, until it is sent to the CDS for a final decision. Not all cases, however, are equal in terms of the time it takes to complete a review. Several factors outside the Board’s control can affect a review’s time, including timeliness with which a grievance is referred to the Board, its complexity, delays in obtaining relevant information, and in some instances, the number of Board Members available to review grievances.

Figure 2 – Timeline to complete cases according to the year referred to the Board shows the percentage of cases completed (according to the year received) that were within timeframes of more than one year, six months to a year, and less than six months.

| Year Cases Referred to CFGB |

Less than

6 months

|

6 months

to 1 year

|

More than

1 year

|

| 2000 | 7.3% | 9.5% | 83.2% |

| 2001 | 9.5% | 24.8% | 65.7% |

| 2002 | 6.9% | 13.8% | 79.3% |

| 2003 | 6.2% | 11.6% | 82.2% |

| 2004 | 6.1% | 28.6% | 65.3% |

| 2005 | 12.5% | 28.1% | 59.4% |

| 2006 | 69.0% | 28.6% | 2.4% |

| 2007 |

100.0% |

0.0% |

0.0% |

Data as of March 31, 2007

Rigorous planning of human and financial resources' needs

In compliance with the new Public Service Modernization Act (PSMA), the Board developed an Integrated Human Resources and Business Plan, to ensure that its human and financial resources needs are in place. The Board continues to align its HR practices with the requirements of the Public Service Modernization Act (PSMA), which included training for the managers and staff as well as developing internal policies and procedures.

Lessons Learned

2006-07 proved to be a busy and productive year for the Board; it made solid progress in reducing the inventory of grievance files. More than six years after its inception, the Board has proven its value-added and it will carry on towards ensuring that the Canadian Forces continue to regard this organization as playing an essential role in the CF grievance system.

The Board is ever mindful that careful planning of its resources goes a long way towards ensuring that the quality of its work is not compromised. This includes the continuity and renewal of its specialized workforce in keeping with changes flowing from the Public Service Modernization Act. The Board will also continue to cultivate its management practices using the Government’s own blueprint for sound management, the Management Accountability Framework.

Priority # 2 External Communications

Commitments

- Stakeholders recognize the value-added of the Board's findings and recommendations.

- Enhance knowledge sharing and increase support from stakeholders.

- Participate at senior levels forums in support of a more efficient and responsive military grievance process.

- Disseminate information of the impact and value of the Board's work.

Main Achievements

Presentations and Tours

The Board has always recognized that it must deliberately reach out to its primary stakeholders—the members of the CF— to familiarize them with the work it is doing. This outreach strengthens the members’ understanding of the role the Board plays in improving the quality of Canadian military life. In addition to pursuing all opportunities to interact and communicate with senior military leaders through established communications channels, Board Members and senior management visit CF bases (CFB) and facilities, attend conferences and make presentations on key issues.

The following is a summary of the Board’s 2006-2007 visits and presentations:

- In June, the Vice-Chair spoke at two bases in Newfoundland: CFB Gander and CFB Goose Bay.

- In October, the Chair made a presentation in Cornwall, Ontario at a conference hosted by the Director General Military Careers.

- Also in October, Denis Brazeau, part-time Board Member, visited CFB Esquimalt, B.C., and the Chair and Vice-Chair made a joint presentation at a Town Hall meeting while visiting CFB Comox, B.C.

- In December, the Vice-Chair made a presentation to the CF School of Administration and Logistics at CFB Borden, Ontario

- In February 2007, the Operations sector visited and made a presentation to the Naval Reserve (NAVRES) in Quebec City.

New Communications Initiatives

The Board’s newest communications endeavour, developed this year, is an electronic newsletter—the eBulletin—Launched in early 2007, it is designed for a subscriber list of key audiences. Experience has shown that CF members want to know more about the grievance system, the specific grievances the Board receives, and their outcomes. Each issue highlights the most current and interesting cases that have been referred to the Board and for which a CDS decision was received. In addition to these summaries, the newsletter also include updates on key grievance statistics and Board activities.

Anyone who would like to receive the newsletter can subscribe through the Board’s Website: www.cfgb-cgfc.gc.ca

Lessons Learned

Visits to CF bases across Canada are particularly valuable because they ensure that the Board has the opportunity to meet the members of the CF directly. During these visits, Town Hall meetings have proven to be an effective approach for exchanging views and experiences. The meetings are usually well attended, with lively dialogue between the Board’s Members and the audience.

Another important aspect of the Board’s outreach is to maximize the effectiveness of its communications vehicles, including: updating its website with regular postings of case summaries and other related information, brochure mail-outs to key audiences, and contributing articles about the Board to military newsletters. In 2006, articles about the Board were featured in four such newsletters: The Totem Times, Voxair, The Aurora and The Sword and Scale.

SECTION II – ANALYSIS OF PROGRAM ACTIVITIES BY STRATEGIC OUTCOME

Analysis by Program Activity

Strategic Outcome: The recommendations of the Canadian Forces Grievance Board are implemented in the Canadian Forces and lead to improvements in the conditions of work.

Program Activity: Review of Canadian Forces grievances referred by the Chief of the Defence Staff.

Financial Resources:

(in $000,s)

| Planned Spending | Authorities | Actual Spending |

|---|---|---|

| $3,344.0 | $3,314.5 | $2,967.1 |

Human Resources:

| Planned | Actual | Difference |

|---|---|---|

| 28 | 25 | 3 |

Note: The contribution of Corporate Services to this Program Activity is an actual spending of $2,884.9 and 15 FTE.

The Board conducts objective and transparent reviews of grievances with due respect to fairness and equity for each member of the CF, regardless of rank or position. It ensures that the rights of military personnel are considered fairly throughout the process and is committed that its Board Members act in the best interest of the parties concerned. The findings and recommendations it issues are not only based in law but form precedents which ensure coherence in the interpretation and the application of policies and regulations within the Canadian Forces.

As an institution vested with quasi-judicial powers, the Board must ensure that its recommendations conform to law and in accordance with its enabling statute and the relevant legislation. In particular, the Board members must be conversant with decisions taken by the Canadian courts in the various areas related to the Canadian Forces and that may affect the Board’s work or the grievances it has to review. The Board must respect the decisions taken by higher courts regarding grievances by CF members, including the Federal Court, Trial Division. The Board members shall be responsible for knowing, among others regulations: the Queen's Regulations and Orders for the Canadian Forces (QR&O), the Canadian Forces Administrative Orders (CFAOs) and the Treasury Board policies which apply to the grievance in question and which help to support the analysis, and assist in the development of the Board’s findings and recommendations.

Expected Results

The Board’s Results Chain or Logic Model demonstrates how each of the items contributes to the fulfillment of the Board’s mission and the achievement of its strategic outcome.

Logic Model – Immediate outcomes: These are the short-term results of the Board’s activities and its output.

| Planned immediate outcomes | Performance Indicators |

|---|---|

| Useful and understandable findings and recommendations that assist the CDS in rendering decisions on grievances. |

|

| The grievor and the CF have had the benefit of a grievance review by an independent quasi-judicial tribunal leading to the resolution of grievances. |

Overview of CDS Decisions

CDS Decisions Received in 2006-07

During 2006-07, the Board received CDS decisions on 78 grievances, of which he fully or partially endorsed 89% following the Board’s findings and recommendations.

| CFGB’s Findings and Recommendations (F&Rs) | CDS Decisions Received in 2006-07 | |||

| CDS endorses CFGB’s F&Rs | CDS partially endorses CFGB’s F&Rs | CDS does not endorse CFGB’s F&Rs | Total | |

| To uphold the grievance | 9 | 4 | 4 | 17 |

| To partially uphold the grievance | 5 | 5 | 4 | 14 |

| To deny the grievance | 43 | 3 | 46 | |

| Grievance withdrawn | 1 | 1 | ||

| Total | 58 | 12 | 8 | 78 |

Informal Resolutions and Withdrawals in 2006-07

Ten additional cases reviewed by the Board were resolved by the CF through informal resolution, and five additional ones were withdrawn by the grievor subsequent to the issuance of the Board’s findings and recommendations, but prior to the CDS decision.

| CFGB’s Findings and Recommendations (F&Rs) |

Informal Resolutions and Withdrawals in 2006-07 (Subsequent to CFGB’s issuing Findings and Recommendations) | ||

| Informal Resolutions by the CF | Cases withdrawn at the CDS Level | Total | |

| To uphold the grievance | 2 | 3 | 5 |

| To partially uphold the grievance | 1 | 1 | 2 |

| To deny the grievance | 7 | 1 | 8 |

| Total | 10 | 5 | 15 |

These informal resolutions came about after the Board had submitted its findings and recommendations to the CDS for a final decision, which in turn may have influenced the move to an informal resolution.

In the other grievance cases, the grievors chose to withdraw their grievances at the CDS level because:

- They declared themselves satisfied with the explanations found in the Board’s findings and recommendations, despite the recommendation to deny the grievance;

- Administrative measures were taken, either before or following receipt of the Board’s findings and recommendations, that allowed for the grievance to be resolved to the satisfaction of the grievor.

A First Hearing

In December 2006, the Board received the CDS’s decision with respect to its findings and recommendations, following its first hearing on a grievance.

The grievance in question related to an investigation and report prepared following a harassment complaint against the grievor. At the hearing, the Board heard testimony from both the grievor and the harassment complaint investigator. The Board concluded that the investigation report contained serious deficiencies in the analysis of the collected evidence and the weight given to certain evidence. Consequently, the Board deemed it unwise to rely on this investigation to justify the imposition of administrative measures. For these reasons, along with the passing of time since the events, the Board concluded that it would be futile to order a new investigation into the harassment allegations.

The Board recommended that the CDS cancel any measures taken as a result of the investigation and remove any references to it from the grievor’s personnel files. Finally, besides recommending that the grievor receive an apology, the Board recommended that the CF consider the implementation of a quality control process before acceptance of harassment or other similar investigations that have the potential to cause prejudice to a CF member.

The CDS accepted the Board’s findings. He partially agreed with the Board’s recommendations, determining, however, that the addition of a further step to control the quality of harassment investigations is not necessary, and that, in any case, it would not eliminate potential errors. He noted that any CF member who believes that he or she has been wronged can make use of the existing grievance process to request a review of an investigation.

The CDS added that it was regrettable the responsible officer in charge had accepted the findings of the investigation report, which found that there was harassment, despite the obvious irregularities. Finally, the CDS concluded that the grievor did not provide any evidence supporting his claim for financial compensation on the basis that his career had suffered as a result of the complaint (this was not an issue before the Board). The CDS also noted that the grievor had been promoted since the allegations had been made against him.

Logic Model – Intermediate Outcomes: These are the longer term results, that flow from the Board’s activities, outputs and immediate outcomes, and which will demonstrate progress towards achieving its ultimate result.

| Planned intermediate outcomes | Performance Indicators |

| Precedents created by the Board, which may facilitate change. | CDS decisions to address systemic issues raised by the Board that merit further study for possible policy or regulatory change. |

| Better understanding and application of regulations, policies and guidelines governing the conditions of work within the CF. | Reduction of grievances of the same nature. |

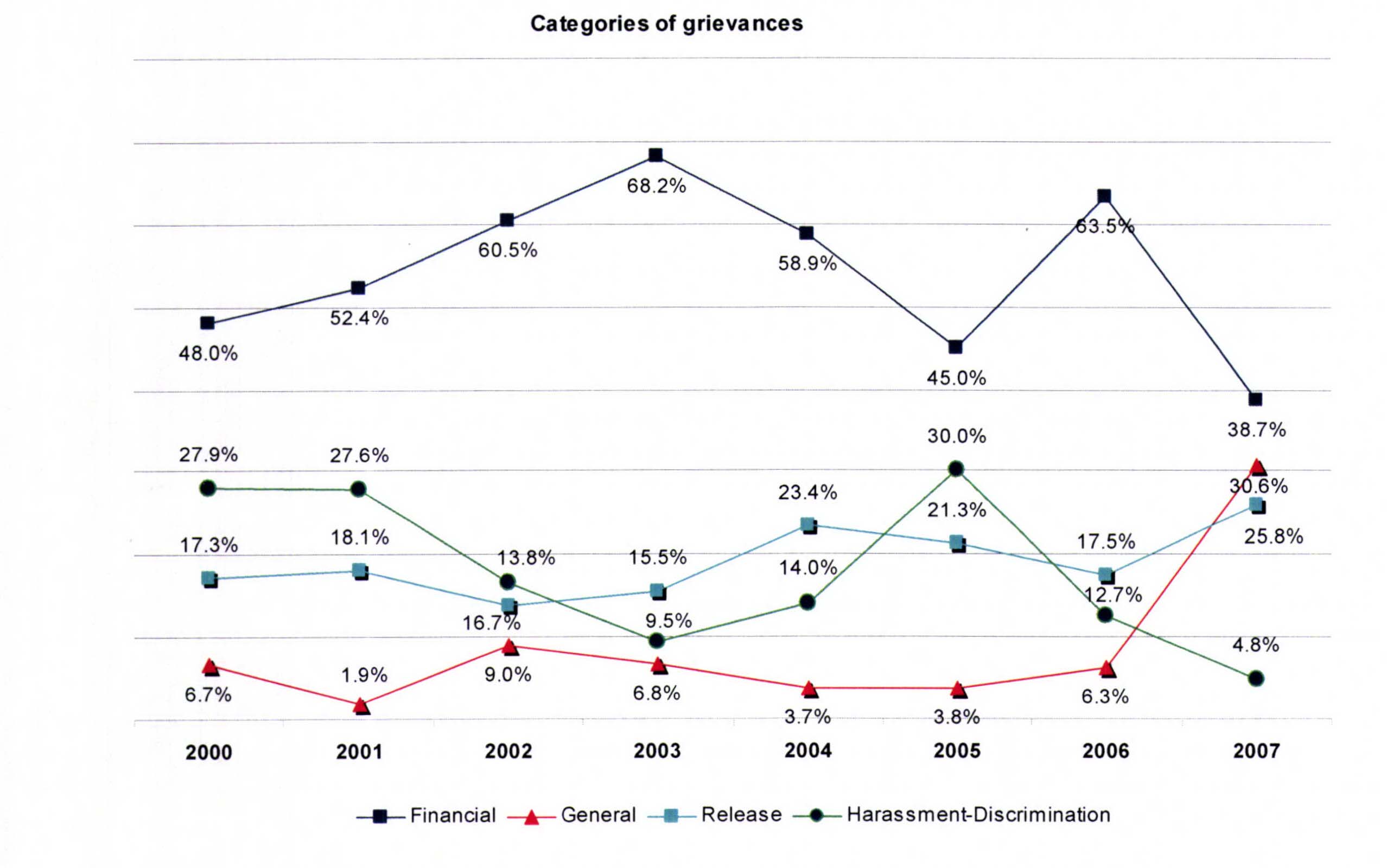

Distribution of Category of Cases by Year Referred

Over the first six years, the percentage of grievances received according to four categories (financial, general, harassment/ discrimination and release) remained relatively consistent. Financial grievances dominated the workload, followed by harassment/discrimination and release cases. In 2007, as part of a pilot project, DGCFGA began to refer discretionary files1 to test the Board’s capacity and capability to review files not ordinarily referred. These files were classified under the general category, thereby causing the increase under that category.

Figure 3

An Issue of Claims Authority

An issue that has been identified previously but remains a recurring problem within the current grievance system is that the CDS (the Final Authority), does not have claims adjudication authority. The authority to settle claims against the Crown or to give ex gratia payments to members of the CF has been delegated to the Director Claims and Civil Litigation (DCCL) from the Legal Advisor to the Department of National Defence and the Canadian Forces. Accordingly, in cases where the Board has recommended that grievors receive financial compensation as one of the remedies to the resolution of their grievances, the CDS has been limited to referring the cases to the DCCL for his review and determination of the merit of such compensation. While the Board and the CDS have often shared the view that some grievors had a valid claim or that the circumstances of their cases deserved to be considered for an ex gratia payment, the DCCL may not necessarily agree.

In December 2006, the Board met with the DCCL specifically to discuss the position of his office with respect to the resolution of claims contained in grievance files. The DCCL has informed the Board that in almost all grievances referred to his office, it was felt that administrative payments or other administrative remedies could be made instead of seeking claims adjudication. As such, almost every grievance referred to the DCCL to date by the CDS has been rejected on the premise that the grievance process could sufficiently provide a remedy with respect to wrongdoing, and only a very small percentage of grievances were considered potential claims against the Crown (i.e. damages resulting from tort or negligence). While the Board acknowledges that the CF grievance system provides a broad range of remedies, such as retroactive promotion, the Board is of the view that administrative remedies are not always sufficient. An administrative payment can be made only when there is an entitlement (i.e. under the Compensation and Benefits Instructions). However, for those cases where grievors suffer a wrongdoing for which an entitlement or a change of status cannot be ordered, administrative remedies are of little assistance. For example, the Board has reviewed many harassment grievances where either the complainant or the respondent has suffered serious emotional and career-related damages. In those cases, possible remedies are very limited and while the CF may not be liable for what has happened, in several cases, the Board and the CDS have agreed that there is a moral obligation to compensate these grievors.

Having to wait for the DCCL’s review and determination with respect to possible claim settlements or ex gratia payments delays the ultimate outcome of the grievance process. Considering that the CDS is the final authority, the Board strongly believes that he should be given the authority to settle claims and to award ex gratia payments when he determines that the circumstances warrant such payments. This authority was identified as an important tool to a prompt resolution of grievances by Chief Justice Lamer in his National Defence Act Review and Recommendations dated September 2003 (the “Lamer Report”). Justice Lamer had recommended that such authority be obtained; however, it has yet to be implemented.

Case Summaries

The following are summaries of some Board’s Findings and Recommendations for which the CDS rendered a decision in 2006-2007. They offer a glimpse of the kinds of grievances referred to the Board. Summaries of other cases where the CDS rendered a decision in 2006-2007 can be found on the Board’s Website at www.cfgb-cgfc.gc.ca .

|

Treasury Board Travel Directives – Meal Allowance Board Findings and Recommendations The grievor alleged that a faulty interpretation of the regulations deprived him from receiving the full meal allowance to which he was entitled during Operation BOXTOP 2/01, and that confusing and conflicting information concerning the appropriate meal allowance disadvantaged him financially. As remedy, he requested reimbursement of the difference between the daily rate he received and the Treasury Board (TB) rate for “overseas” travel when residing in government quarters (i.e. 80% of the applicable TB meal allowance). He also requested payment of 6% interest on the amount owing to him, computed from the date of submission of his grievance. The IA ruled that the grievor was entitled only to reimbursement for his actual meal charges in a military establishment. The IA concluded that the only military establishment in Thule was the Dundas Hall dining facility. The IA therefore denied the grievance because the grievor had already been reimbursed for the cost of his meals at that facility. The Board found that the grievor was entitled to the actual amounts he was charged for meals in a military establishment, not 80% of the daily meal allowance prescribed by TB for “overseas” travel. The Board found insufficient evidence to conclude that misinformation negatively affected the grievor in this instance. The Board also found that, in addition to the main dining facility (Dundas Hall), both the Top of the World (TOW) Club and the TOW Dining Hall were considered to be military establishments. As such, the Board found that the grievor was entitled to claim reimbursement for actual meal charges, based on receipts or an itemized list certified by the grievor and not to exceed the daily meal allowance specified by TB. The Board recommended that the CDS partially uphold the grievance, by amending the grievor’s travel claim in this respect. CDS DecisionThe CDS agrees with the Board’s recommendation to partially uphold the grievance. The CDS notes that there was some ambiguity as to which part of the TB Travel Directive applies to the grievor’s situation. For example, Part IV of the TB Travel Directive (Meals, Incidentals, and Other Expenses) provides in part that public employees travelling in Canada and the continental US, who are visiting or residing in government or institutional accommodation, shall be reimbursed actual meal charges up to the appropriate limits based on receipts. However, Part VI of the TB Travel Directive (Overseas Travel), provides in part that public employees travelling outside of Canada and the continental US, who are visiting or residing in government or institutional accommodation in a location for which an authorized meal allowance has been established, shall be reimbursed 80% of that allowance. In reviewing the grievance, it was found that QR&O 209.30 clearly states that the TB Travel Directive pertaining to travel in the United States applies to personnel who travel outside of Canada. The CDS also finds, in the absence of any further limitations, that CFAO 209-4 expressly limits the amount of meal reimbursement to actual expenses. The CDS is, therefore, satisfied that the grievor should be reimbursed in an amount not to exceed the rate found in Part IV of the TB Travel Directive for actual meal expenditures incurred at an authorized eating establishment. Although the CDS agrees with the Board’s finding that the grievor should be reimbursed his actual meal expenditures at either establishment, he finds that the TOW Club is not a military dining establishment but rather a non-public licensed restaurant operating on a military base. In reviewing the BOXTOP 2/01 Administrative Order, the CDS finds that it expressly authorized personnel to purchase any meal at the Dundas dining facility on a 24-hour basis and that evening meals would be available at the TOW Club. The CDS is satisfied that both facilities were authorized eating establishments for the duration of Op BOXTOP 2/01 and that the grievor was entitled to be reimbursed for his actual meal expenditures incurred at either of these establishments in an amount not to exceed the applicable TB rate for travel in the US. The grievor will be paid the difference between what he received on his original Op BOXTOP 2/01 travel claim and the amount he actually spent for meals while he was deployed on Op BOXTOP 2/01. Should actual receipts be unavailable to support his claim, the grievor is to provide an itemized list and a supporting statutory declaration of his actual expenditures endorsed by his Op BOXTOP 2/01 aircraft captain (if available) and his present commanding officer. The review of this grievance by the Board revealed that there were no specific meal arrangements in place at the time of the exercise, thus leading to confusion regarding the application of TB policy. Given the high cost associated with grievance resolution at the CDS level, and the possibility that other members who participated in the same or similar operations might submit grievances pertaining to this issue, the Director General CF Grievance Authority suggested that those claims could be settled in the same fashion. Furthermore, he recommended that the Administrative and/or Operational Instructions/Orders regarding future BOXTOP exercises and/or other out-of country exercises clearly indicate the applicable TB rates for the reimbursements of Meals and Incidentals during Temporary Duty. |

|

Definition of Dependants – Reimbursement of Purchase Costs for Principal Residence Board Findings and Recommendations The grievor was living in married quarters (MQ) with his spouse and two special needs children when his mother and step-father both became too ill to continue living on their own. As a result, the grievor’s mother and step-father moved into the grievor’s MQ. The grievor applied to have his parents listed as his dependants at that time. After his parents lived with him and his family for some months, he purchased a house where he stayed with his parents while his wife stayed with their children in the MQ. The grievor received reimbursement of the purchase costs for the house from the CF. He affirmed that he spent 50% of his time in the house with his parents. When the grievor was posted, he was told he was not entitled to benefits associated with the sale of the house because it was not his principal residence. The grievor was also told he should not have received reimbursement for purchase costs and the funds he received for the purchase of the house would be recovered. The grievor filed a grievance. The grievor was supported in his grievance by the chain of command, which agreed that, while outside the norm, the grievor’s parents were his dependants and the house he bought was his principal residence. The IA for the grievance, the Director General Compensation and Benefits (DGCB), found that, for the purposes of relocation, a member cannot have two principal residences and the MQ was his principal residence. The IA noted that the grievor’s furniture and effects had last been moved to the MQ at public expense, and that is where his “primary dependants” continued to live. The IA also found that the grievor’s parents were not his dependants. As a result, the IA confirmed the recovery of the purchase reimbursement costs and the denial of the sale costs. The Board found that the regulations relied upon by the IA were misunderstood. In fact, the purchased house did meet the requirements for a principal residence and the grievor’s parents also met the criteria for dependants. The Board recommended that the grievance be upheld. CDS Decision The CDS agrees with the Board’s findings and recommendation to uphold the grievance. The CDS determined that the grievor’s principal residence at the time of his relocation was the home he bought and lived in with his parents and that he was entitled to reimbursement of the fees associated with both the purchase and sale of that residence. The CDS also determined that the grievor’s parents were his dependants while they were living with him at his residence. However, they are not entitled to any relocation expenses to Kingston because they did not take up residence with the grievor at the time of his relocation but rather occupied their own residence. |

|

Wrongful Release – Lack of Medical Limitations Board Findings and Recommendations The grievor was released from the Canadian Forces on the basis that he suffered from medical limitations that placed him in violation of the universality of service principle (USP). The grievor’s chain of command supported his grievance and strongly recommended that the grievor be retained. No IA decision was issued, and after granting one extension, the grievor requested that the matter be forwarded to the CDS. The Board found that the grievor’s employment limitations did not place him in violation of the USP. The Board recommended that the CDS arrange for the grievor to be offered the opportunity to re-enrol and that his pay, pension and benefits be adjusted accordingly. The Board also recommended that the matter be referred to the DCCL for consideration of payment of potential damages arising from the release, if any financial entitlement could be dealt with via internal adjustments. As an alternative, the Board recommended that the CDS cancel the release and adjust the grievor’s pay, pension and benefits accordingly. CDS Decision The CDS agrees with the Board’s findings and recommendation to uphold the grievance. The CDS is satisfied that the grievor has been incorrectly released as a result of medical employments limitations that were not evidentiary- based. The grievor should have been allowed to continue his service to his intermediate engagement point. However, the CDS is of the opinion that he did not have the authority to grant the redress seeking compensation for the remainder of the grievor’s intermediate engagement. Accordingly, an adjustment of his pension lies within the purview of the DCCL. Therefore, the CDS has referred the grievance to DCCL for consideration, and a copy of the decision has also been sent to the Assistant Deputy Minister (Human Resources) (ADM (HR-Mil)) for his review. |

|

Recruitment Allowance – Negligent Misrepresentation Board Findings and Recommendations The grievor argued that he was entitled to a $10,000 recruitment allowance (RA) and a promotion to the rank of acting corporal with a retroactive salary increase, in light of the information he received at the Recruiting Centre. The grievor maintained that his decision to sign a contract with the Forces instead of continuing his career as a civilian was largely based on obtaining the RA and a promotion. On the basis of the conclusions of the Canadian Forces School of Communications and Electronics (CFSCE), the acting commander of the Canadian Forces Recruiting Group (CFRG), who was the IA in this case, dismissed the grievance. The IA indicated that an analysis of his education and previous experience showed that he was neither qualified for the RA, nor a promotion to the rank of acting corporal. The Board found that the grievor did not meet the prerequisites for the RA and was not entitled to it under the regulations. The Board also found that the grievor was not entitled to a promotion to the rank of acting corporal. However, the Board did find that the CFRC’s representations were inaccurate and that the job offer that appeared on the “Jobboom” Internet site for a position as a computer specialist was misleading, since the required qualifications did not pertain to informatics but to electronics. Nonetheless, the Board found that based on an analysis of the five conditions determined by the Supreme Court in the Cognos Decision, the grievor was the victim of negligent misrepresentation on the part of CF personnel and suffered damages by relying on inaccurate information. The Board recommended that the CDS allow the grievance in part and refer the matter to the DCCL so that the grievor could obtain financial compensation in the amount of the RA, (i.e. $10,000), as well as financial compensation for the loss of earnings incurred until obtaining his rank of corporal. CDS Decision The CDS supports the Board’s conclusions and its recommendation that the grievance be partially upheld through referral of the case to the DCCL. The CDS specifies that this does not mean that he supports the grievor’s retroactive promotion to the rank of Cpl (i), as the grievor requested, but that consideration should be given to compensation for the financial hardship that resulted from his decision to enrol on the basis of inaccurate statements. The diploma he needed had to correspond in large part with the technical training of the Military Occupation Code—now called MOS ID—military occupational structure identification, that is, “electronics,” and not “computer technology,” as the information given the grievor and the offer of employment would have had him believe. |

|

Reimbursement of Reservist Relocation Expenses Board Findings and Recommendations The grievor was a reservist originally posted in Saskatchewan who voluntarily accepted an attached posting in Ontario. Subsequently, the grievor received numerous posting messages, which indicated that he was being posted to other positions within the same unit in Ontario. After three years in this province, the grievor was again posted to Saskatchewan. However, as the grievor had been posted from Saskatchewan to Ontario, the CF treated the move to Saskatchewan as a return to his former place of residence (FPOR) and not as a posting. The grievor contended that he was unfairly denied relocation expenses because his move to Saskatchewan had been improperly treated as a return posting. He argued that the applicable regulations for his move were found in the Compensation and Benefit Instruction (CBI) 209.971- CF Integrated Relocation Program (IRP) and not in the applied Travel and Relocation Policy (TR/POL) 009/95. As such, the grievor argued that he was entitled to relocation expenses for his move from Ontario to Saskatchewan and to a commuting allowance. The grievor also requested that he be issued an apology. As IA, the DGCB took the position that the grievor knew he was being attached posted to Ontario but that he would be returned to his employment unit in Saskatchewan, under TR/POL 009/95. The IA further argued that the grievor was not eligible for commuting assistance because he chose to live outside the normal commuting distance for his workplace. The IA added that the grievor moved his family for purely personal reasons not service needs, which disqualified him from any assistance. The IA, however, did find that the grievor was entitled to be reimbursed for a house hunting trip and directed the grievor to submit a claim. The Board found that the grievor was no longer filling a position in Saskatchewan and, therefore, no longer fit the definition of an “attached posting”. Therefore, the grievor was not being returned to his FPOR but was being posted into a position. The Board found that, in 2003, the grievor’s place of residence was in Ontario, not Saskatchewan, and that the grievor was moved under the incorrect policy instead of in accordance with CF Integrated Relocation Program (CFIRP). The Board found that the grievor was not entitled to commuting assistance and that the IA had adequately addressed the issue of the requested apology in his decision. The Board recommended to the CDS that the grievance be partially upheld. CDS Decision The CDS agrees with the Board’s recommendation and partially upholds the grievance in that the grievor be reimbursed his expenses for his relocation from Ontario to Saskatchewan, not because it was a "posting" but because the grievor met the criteria contained in CFIRP 2003 Addendum 10 (Primary Reserve Force Relocation - Full-Time Class B and C Employment) for a move from a place of ordinary residence (POR) to an Employment Unit (EU). In addition, the CDS finds that the grievor should have been on duty travel status for his House Hunting Trip (HHT) and decided that the grievor’s leave account would be credited with five days annual leave. The CDS finds that, although reservists had been authorized reimbursement of their relocation expenses under both TR Pol 009/95 and CFIRP when moved from one EU to another, this type of move is not reflected in published CFIRP policy. Accordingly, the CDS requests that the Assistant Deputy Minister (Human Resource - Military) review CFIRP policy regarding reimbursement of Reserve relocation expenses for moves to subsequent EUs. |

Attached Posting – Temporary DutyBoard Findings and Recommendations The grievor, a member of the Supplementary Holding Reserve, was attached posted to a cadet summer training center (CSTC) in 2003. As a result of the attached posting, the grievor did not receive incidental benefits. However, members of the Primary Reserves sent to the same cadet summer camp were placed on Temporary Duty (TD) and did receive such benefits. The grievor felt this practice was unfair, and lodged a grievance. The IA stated that since the grievor was attached posted, he was not on travel status, and therefore, not entitled to incidental benefits. The IA also noted that the grievor was not ordered to attend the cadet summer camp, and that he was aware of the benefits to which he was entitled when he accepted the position. The IA denied the grievance. The Board considered precedent cases, and although the Board found that there was no discrimination against the grievor, the practice of affording differential treatment to sub-components of the Reserve Force was inequitable. Furthermore, the Board found that the primary reason for the differential treatment was based solely upon CF budgetary concerns. The Board recommended that the CDS uphold the grievance. CDS Decision The CDS partially agrees with the Board’s finding but disagrees with the Board’s recommendation to grant the grievance. The CDS agrees that the grievor was attached posted and not on Temporary Duty (TD). The CDS disagrees with the Board’s finding that the decision to place the grievor on an attached posting was an improper application of regulations. Therefore, the CDS is satisfied that the grievor was not entitled to incidental expenses, beyond the two prescribed travel days for which he was reimbursed. However, like the Board, the CDS is concerned that certain policies have resulted in personnel who belong to different sub-components of the Reserve Force being treated differently. The CDS insists that this different treatment is not illegal, unethical or discriminatory, but he acknowledges that the current policy framework, which causes variations in treatment of personnel employed at CSTCs, is a major cause of dissatisfaction and needs to be addressed. As such, the Vice-Chief of the Defence Staff is conducting a review to address the question of differences in employment of Reservists at CSTCs. A working group began deliberations on 20 October 2005 with the direction to examine the applicable policies regarding the use of attached postings and TD. |

|

Medical – CF Spectrum of Care Board Findings and Recommendations The grievor’s infant son was diagnosed with a form of eye cancer necessitating the removal of an eye. The attending civilian cancer specialist recommended that the grievor undergo genetic testing to determine whether she carried a genetic mutation that would place any future children at 50% risk of retinoblastoma. The specialist also stated that for the test to be carried out on the grievor, they would have to first test the removed eye to determine the specific genetic mutation. The tests were carried out off-base; the grievor acknowledged that she did not seek the required prior approval from CF medical authorities at the time because of the tension and stress she was under due to her son’s operation. When the grievor was subsequently refused her request for reimbursement for the costs of the tests, she contended that genetic testing done on her son was an integral part of the genetic testing required for her, and was therefore a covered service under the CF Spectrum of Care. The Board found that these diagnostic services are covered under the CF Spectrum of Care, that the genetic testing was specifically prescribed for the grievor, and there is no impediment to the retroactive approval for the reimbursement of the genetic testing expenses. The Board further found that the genetic testing performed meets the criteria for Principle no. 1 (under the Spectrum of Care) and that the funding for this specific genetic testing in Quebec and Alberta, as well as in three other provinces on a case-by-case basis, meets the criteria of Principle no. 5. The Board also found that the expense claimed was part of a medical testing process for the grievor and, ergo, should be reimbursed. The Board recommended that the CDS uphold the grievance. CDS Decision The CDS agrees with the Board’s findings and recommendation to uphold the grievance. The CDS is satisfied that under the circumstances, the testing conducted on the sample from her son’s eye was an integral step in the tests mandated for her. The CDS further agrees that the tests were to determine whether the grievor also carried the genetic mutation related to retinoblastoma as it was connected to the purpose of maintaining her health and mental well-being, preventing disease, and/or diagnosing an illness or disease consistent with the CF Spectrum of Care. The fact that the initial results eliminated the need for further testing on the grievor does not alter this and speaks to a prudent diagnostic approach. Both the grievor and her doctor have acknowledged that they did not obtain the appropriate approval in advance for the testing expenses. The CDS, however, believes that this was an honest mistake and should not bar the grievor’s reimbursement for the costs of off-base treatment along with the limited associated interest costs. |

|

Election of Prior Service Board Findings and Recommendations Upon transfer from the Reserve Force to the Regular Force in 1986, the grievor was provided with a form entitled “Acknowledgement of Notification of Rights to Elect to Pay for Prior Service under the Canadian Forces Superannuation Act” (CFSA). The grievor signed the form but failed to indicate his prior service. Subsequently in 2001, the grievor elected his prior service (1985–1986) for CFSA purposes but at a much greater rate than had he made the election within one year of transfer to the Regular Force. The grievor submitted that in fact what he was signing had not been explained to him, and that he had signed the form under duress without knowledge of its importance or implications. As redress, the grievor requested that the cost of his election for prior pensionable service be calculated on a non-belated basis. The DGCB, the IA in the matter, denied redress. The IA explained that, in accordance with the CFSA and, as indicated on the acknowledgement form, elections for prior service must be made within one year of enrolment or transfer to the Regular Force. While failure to do so does not void the member’s right to elect at any time while a member of the Regular Force, it does result in a higher cost to the member. The IA concluded that the late election was administered properly and that there were no grounds to revoke it. The Board found that the failure of the grievor to elect his past service within one year of his transfer to the Regular Force was his responsibility. An examination of the form in question indicated that the title of the document was clear as to its purpose and that the content was in plain language. The Board recommended to the CDS that the grievance be denied. CDS Decision The CDS agrees with the Board’s findings and recommendation to deny the grievance. The CDS agrees that the grievor’s failure to elect to pay for previous full-time paid service within one year of his transfer to the Regular force was his responsibility. The CDS is satisfied that the document signed by the grievor clearly stated his obligation and that he was properly advised that failure to elect to pay for previous service within one year of his transfer to the Regular Force might be less favourable, resulting in a higher cost to buy back prior service at a later date. The grievor has been treated fairly and in accordance with the relevant law and policy. |

|

Definition of “Working” – Daycare Assistance Board Findings and Recommendations The grievor was posted to the United States and applied for daycare assistance. In his request, the grievor cited Military Foreign Service Instructions (MFSI) Section 11 that provides daycare assistance when the member’s spouse is working full-time. The grievor indicated that his spouse was working full-time as a student, and he stated that the Canada Revenue Agency included studying in its definition of the term “working” for income tax purposes. The IA denied the grievance because the grievor’s eligibility for daycare assistance rested to a significant degree upon the interpretation of the word “working,” and that the grievor’s definition was too broad. According to the IA, the term “working,” as per MFSI Section 11, applies solely to the act of earning employment income and cannot be construed to mean full or part-time enrolment in an education program, as specified in the Income Tax Act or otherwise. In its review of the terminology at issue, the Board found that “working” must be ascribed its ordinary meaning and cannot be expanded to include situations where a spouse is enrolled in an education program. The Board recommended that the CDS deny the grievance. CDS Decision The CDS agrees with the Board’s findings and recommendation to deny the grievance. The CDS finds that the intent of the allowances and benefits under the MFSI is to recognize and to facilitate a member’s service outside Canada and to ensure that, as much as possible, members are neither better nor worse off than their counterparts serving in Canada. Upon review of the MFSI and the Foreign Service Directives (FSD), the CDS finds that both policies have the same eligibility criteria, which restrict the benefit to single parents or those whose spouse or commonlaw partner is working while the member is posted outside of Canada. Notwithstanding the finding that the grievor was not entitled to daycare assistance, the CDS notes that the Director General Compensation and Benefits has agreed with the Board’s suggestion that the scenario portrayed by this grievance be presented to the National Joint Council (NJC) for consideration when it commences its cyclical review of the federal government’s FSDs in the fall of 2006. The CDS is to forwarding a copy of his decision to the Chief Military Personnel so that the NJC may consider daycare assistance to CF members serving outside of Canada whose spouses are attending school full-time. |

SECTION III – SUPPLEMENTARY INFORMATION

Organizational Information

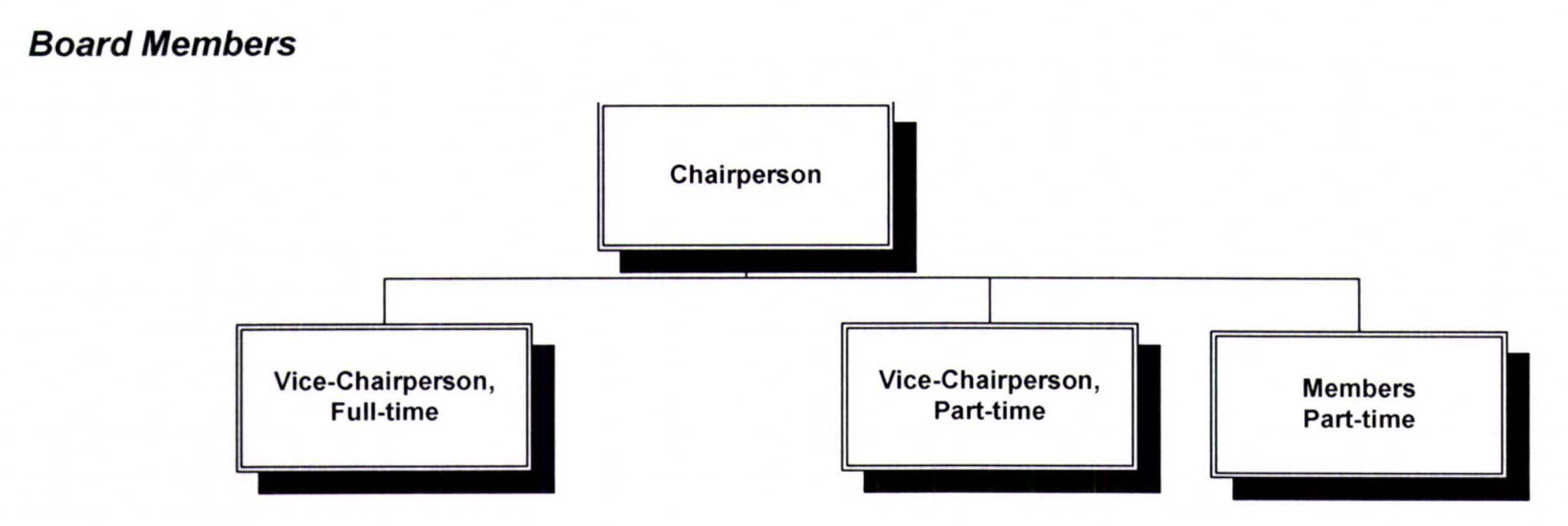

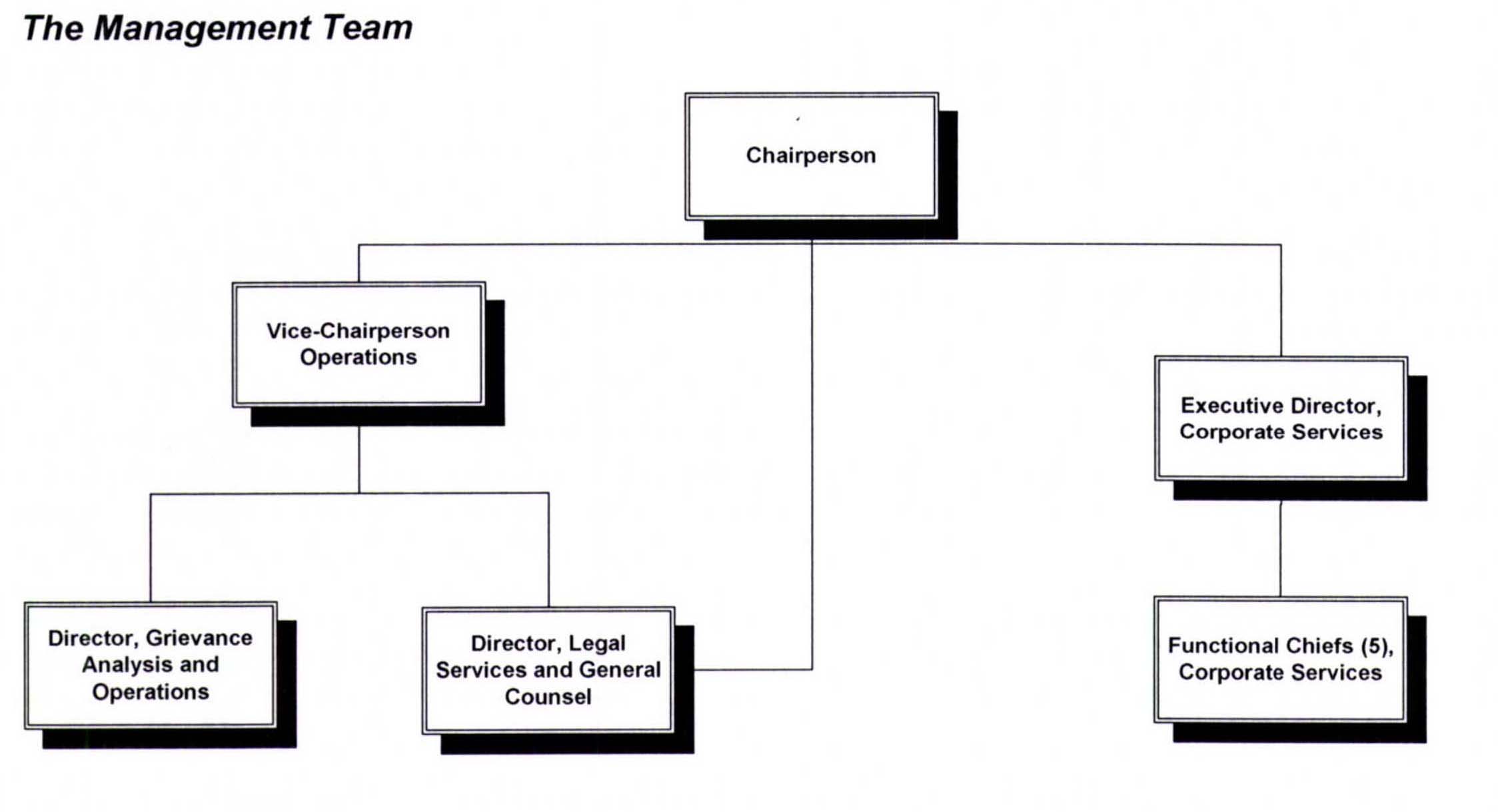

- The Chairperson is ultimately accountable to Parliament for the work carried out by the Members of the Board.

- The Chairperson, the Vice-Chairperson and other Board Members are primarily supported in their work by the Director, Grievance Analysis and Operations.

- Grievance officers review individual grievances and seek legal input and advice when conducting their research.

- In addition to providing legal advice to grievance officers and Members of the Board, legal counsel led by the Director, Legal Services and General Counsel, also provide legal opinions to the Chairperson and the Vice-Chairperson on a wide range of issues.

- The Executive Director is responsible for providing corporate services to support the operations, including strategic business planning and performance reporting, in addition to communications, finance, administration, information technology and human resources services.

Table 1: Comparison of Planned to Actual Spending (including FTEs)

| (in $000,s) |

2004-05 Actual |

2005-06 Actual |

2006-07 | |||

| Main Estimates | Planned Spending | Total Authorities | Actual | |||

| Review of Canadian Forces grievances referred by the Chief of Defence Staff | 6,784.1 | 3,370.1 | 3,344.0 | 3,344.0 | 3,314.5 | 2,967.1 |

| Corporate Services | N/A | 2,818.4 | 3,063.0 | 3,063.0 | 3,098.3 | 2,884.9 |

| Total | 6,784.1 | 6,188.5 | 6,407.0 | 6,407.0 | 6,412.8 | 5,852.0 |

| Plus: Cost of services received without charge | 276.0 | 276.8 | 240.0 | 240.0 | 240.0 | 255.9 |

| Total Departmental Spending | 7,060.1 | 6465.3 | 6,647.0 | 6,647.0 | 6,652.8 | 6,107.9 |

| Full-time Equivalents* | 47.0 | 43.0 | 46.0 | 46.0 | 46.0 | 40.0 |

* Includes Members appointed by the Governor in Council.

Table 2: Resources by Program Activity

|

(in $000,s)

2006-07

|

||

| Program Activity |

Budgetary | Total |

| Operating | ||

| Review of Canadian Forces Grievances referred by the Chief of Defence Staff |

||

| Main Estimates | 3,344.0 | 3,344.0 |

| Planned Spending | 3,344.0 | 3,344.0 |

| Total Authorities | 3,314.5 | 3,314.5 |

| Actual Spending | 2,967.1 | 2,967.1 |

| Corporate Services | ||

| Main Estimates | 3,063.0 | 3,063.0 |

| Planned Spending | 3,063.0 | 3,063.0 |

| Total Authorities | 3,098.3 | 3,098.3 |

| Actual Spending | 2,884.9 | 2,884.9 |

Table 3: Voted and Statutory Items

|

(in $000,s) Vote or Statutory Item |

Canadian Forces Grievance Board | 2006-07 | |||

| Main Estimates | Planned Spending | Total Authorities | Total Actuals | ||

| 15 | Operating expenditures | 5,798.0 | 5,798.0 | 5,849.0 | 5,288.2 |

| (S) | Contributions to employee benefit plans |

609.0 | 609.0 | 563.8 | 563.8 |

| Total | 6,407.0 | 6,407.0 | 6,412.8 | 5,852.0 | |

Table 4: Services Received Without Charge

| (in $000,s) | 2006-07 |

| Contributions covering employers’ share of employees’ insurance premiums and expenditures paid by Treasury Board of Canada Secretariat (excluding revolving funds). Employer’s contribution to employees’ insured benefits plans and associated expenditures paid by TBS | 255.9 |

| Total 2006-07 Services received without charge | 255.9 |

Table 5: Financial Statements of the Canadian Forces Grievance Board

Financial statements are prepared in accordance with accrual accounting principles. The unaudited supplementary information presented in the financial tables in the DPR is prepared on a modified cash basis of accounting in order to be consistent with the appropriations-based reporting. Note 3 on page 37 of the Financial statements reconcile these two accounting methods.

| Canadian Forces Grievance Board | |||||||

| Statement of Operations (unaudited) | |||||||

| for the year ended March 31 | |||||||

| (in dollars) | 2007 | 2006 | |||||

| OPERATING EXPENSES | |||||||

| Personnel | 4,063,355 | 4,544,018 | |||||

| Other professional services | 673,143 | 739,139 | |||||

| Rental | 589,517 | 581,467 | |||||

| Machinery and Equipment | 153,437 | 110,740 | |||||

| Informatics services | 149,254 | 77,398 | |||||

| Accounting & Legal services | 141,934 | 150,498 | |||||

| Telecommunication services | 84,801 | 91,117 | |||||

| Training and Educational services | 79,951 | 68,887 | |||||

| Travel and Relocation | 73,075 | 124,901 | |||||

| Repairs | 40,927 | 16,862 | |||||

| Materials and Supplies | 35,251 | 59,434 | |||||

| Communication Services | 21,738 | 42,103 | |||||

| Amortization of tangible capital assets | 18,440 | 15,943 | |||||

| Publishing and Printing | 7,249 | 3,222 | |||||

| Postage and Freight | 6,741 | 11,129 | |||||

| Protection Services | 5,903 | 4,006 | |||||

| Interest | 71 | 3,361 | |||||

| Total Expenses | 6,144,787 | 6,644,225 | |||||

| REVENUES | |||||||

| Revenues | 15 | 90 | |||||

| 15 | 90 | ||||||

| Total Revenues | |||||||

| Net costs of Operations | 6,144,772 | 6,644,135 | |||||

The accompanying notes form an integral part of these financial statements.

| Canadian Forces Grievance Board | |||||

| Statement of Financial Position (unaudited) | |||||

| at March 31 | |||||

| (in dollars) | 2007 | 2006 | |||

| ASSETS | |||||

| Financial assets | |||||

| Accounts Receivable and Advances | 50,753 | 6,422 | |||

| Total financial assets | 50,753 | 6,422 | |||

| Non-financial assets | |||||

| Tangible Capital assets (Note 4) | 31,423 | 31,887 | |||

| Total non-financial assets | 31,423 | 31,887 | |||

| TOTAL | 82,176 | 38,309 | |||

| LIABILITIES | |||||

| Accrued salaries and wages | 209,822 | 181,278 | |||

| Accounts payable - External parties | 212,970 | 243,075 | |||

| Accounts payable - Other government departments | 61,652 | 297,449 | |||

| Vacation pay and compensatory leave | 166,089 | 166,089 | |||

| Employee severance benefits (Note 5) | 691,041 | 646,788 | |||

| Equity of Canada | (1,259,398) | (1,496,370) | |||

| TOTAL | 82,176 | 38,309 | |||

The accompanying notes form an integral part of these financial statements

| Canadian Forces Grievance Board | ||||

| Statement of Equity of Canada (unaudited) | ||||

| at March 31 | ||||

| (in dollars) | 2007 | 2006 | ||

| Equity of Canada, beginning of year | ||||

| Net cost of operations | (1,496,370) | (1,205,246) | ||

| Current year appropriations used (Note 3) | (6,144,772) | (6,644,135) | ||

| Change in net position in the Consolidated Revenue Fund (Note 3) | 5,852,064 | 6,188,481 | ||

| Other professional services | 273,750 | (112,180) | ||

| Services provided without charge by other government departments (Note 8) |

(15) | (90) | ||

| 255,945 | 276,800 | |||

| Equity of Canada | (1,259,398) | (1,496,370) | ||

The accompanying notes form an integral part of these financial statements

| Canadian Forces Grievance Board | ||||||||

| Statement of Cash Flow(unaudited) | ||||||||

| For the Year ended March 31 | ||||||||

| (in dollars) | 2007 | 2006 | ||||||

| Operating Activities | ||||||||

| Net Costs of Operations | 6,144,772 | 6,644,135 | ||||||

| Non-Cash items | ||||||||

| Other professional services | ||||||||

| Amortization of tangible capital assets | (18,440) | (15,943) | ||||||

| Services provided without charge by other government departments | (255,945) | (276,800) | ||||||

| Variation in Statement of Financial Position | ||||||||

| Increase or (decrease) in accounts receivable and advances | (463) | (69,079) | ||||||

| Increase or (decrease) in accounts payables and accrued liabilities | 193,104 | 134,508 | ||||||

| Increase or (decrease) in receivables | 44,794 | (340,610) | ||||||

| Cash used by operating activities | 6,107,822 | 6,076,211 | ||||||

| Capital Investment Activities | ||||||||

| Acquisitions of capital tangible assets | 17,976 | |||||||

| Cash used by capital investments activities | 17,976 | |||||||

| Financing Activities | ||||||||

| Net cash provided by government | (6,125,798) | (6,076,211) | ||||||

The accompanying notes form an integral part of these financial statements

1. Authority and Objectives

The Canadian Forces Grievance Board (CFGB) is an independent, arms-length organization that was created through amendments to the National Defence Act (NDA) approved by Parliament on December 10, 1998. The amendments that were made to the NDA were aimed at modernizing and strengthening the military justice system, making the whole grievance review process simpler and shorter for members of the Canadian Forces. The CFGBThe Canadian Forces Grievance Board (CFGB) is an independent, arms-length organization that was created through amendments to the National Defence Act (NDA) approved by Parliament on December 10, 1998. The amendments that were made to the NDA were aimed at modernizing and strengthening the military justice system, making the whole grievance review process simpler and shorter for members of the Canadian Forces. The CFGB’’s mandate is to review grievances in order to render fair and impartial findings and recommendations in a timely and informal manner to the Chief of Defence Staff and the grievor.

2. Summary of Significant Accounting Policies

The financial statements have been prepared in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector.

Significant accounting policies are as follows:

- Parliamentary appropriations – the Canadian Forces Grievance Board is financed by the Government of Canada through parliamentary appropriations. Appropriations provided to the CFGB do not parallel financial reporting according to Canadian generally accepted accounting principles since appropriations are primarily based on cash flow requirements. Consequently, items recognized in the statement of operations and the statement of financial position, are not necessarily the same as those provided through appropriations from Parliament. Note 3 provides a high-level reconciliation between the bases of reporting.

- Net Cash Provided by Government - The department operates within the Consolidated Revenue Fund (CRF), which is administered by the Receiver General for Canada. All cash received by the department is deposited to the CRF and all cash disbursements made by the department are paid from the CRF. The net cash provided by government is the difference between all cash receipts and all cash disbursements including transactions between departments of the federal government.

- Change in net position in the Consolidated Revenue Fund is the difference between the net cash provided by Government and appropriations used in a year, excluding the amount of non respendable revenue recorded by the department. It results from timing differences between when a transaction affects appropriations and when it is processed through the CRF.

- Revenues:

- Revenues from regulatory fees are recognized in the accounts based on the services provided in the year.

- Funds received from external parties for specified purposes are recorded upon receipt as deferred revenues. These revenues are recognized in the period in which the related expenses are incurred.

- Other revenues are accounted for in the period in which the underlying transaction or event occurred that gave rise to the revenues.

- Revenues that have been received but not yet earned are recorded as deferred revenues.

- Expenses –– Expenses are recorded on the accrual basis:

- Vacation pay and compensatory leave are expensed as the benefits accrue to employees under their respective terms of employment;

- Services provided without charge by other government departments for the employer’s contribution to the health and dental insurance plans and legal services are recorded as operating expenses at their estimated cost.

- Employee future benefits

- Pension benefits: Eligible employees participate in the Public Service Pension Plan, a multiemployer plan administered by the Government of Canada. The department’s contributions to the Plan are charged to expenses in the year incurred and represent the total departmental obligation to the plan. Current legislation does not require the department to make contributions for any actuarial deficiencies of the Plan.

- Severance Benefits: Employees are entitled to severance benefits under labour contracts or conditions of employment. These benefits are accrued as employees render services necessary to earn them. The obligation relating to the benefits earned by employees is calculated using information derived from results of the actuarially determined liability for employee severance benefits for the Government as a whole.

- Accounts and loans receivables are stated at amounts expected to be ultimately realized; a provision is made for receivables where recovery is considered uncertain.

- Contingent liabilities – Contingent liabilities are potential liabilities which may become actual liabilities when one or more future events occur or fail to occur. To the extent that the future event is likely to occur or fail to occur, and a reasonable estimate of the loss can be made, an estimated liability is accrued and an expense recorded. If the likelihood is not determinable or an amount cannot be reasonably estimated, the contingency is disclosed in the notes to the financial statements.

-

Tangible capital assets – All tangible assets and leasehold improvements having an initial cost of $10,000 or more are recorded at their acquisition cost. The Board does not capitalize intangibles, works of art and historical treasures that have cultural, aesthetic or historical value, assets located on Indian Reserves and museum

collections.

Amortization of tangible capital assets is done on a straight-line basis over the estimated useful life of the capital asset as follows: Informatics hardware - 3 years.

- Measurement uncertainty - The preparation of these financial statements in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses reported in the financial statements. At the time of preparation of these statements, management believes the estimates and assumptions to be reasonable. The most significant items where estimates are used are contingent liabilities, the liability for employee severance benefits and the useful life of tangible capital assets. Actual results could significantly differ from those estimated. Management’s estimates are reviewed periodically and, as adjustments become necessary, they are recorded in the financial statements in the year they become known.

3. Parliamentary Appropriations

The Department receives most of its funding through annual Parliamentary appropriations. Items recognized in the statement of operations and the statement of financial position in one year may be funded through Parliamentary appropriations in prior, current or future years. Accordingly, the Department has different net results of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled in the following tables:

(a) Reconciliation of net cost of operations to current year appropriations used:

| (in dollars) | 2007 | 2006 | ||

| Net cost of Operations | 6,144,772 | 6,644,135 | ||

| Adjustments for items affecting net cost of operations but not affecting appropriations | ||||

| Add (Less): | ||||

| Services provided without charge | (255,945) | (276,800) | ||

| Employee severance benefits | (44,253) | (160,080) | ||

| Amortization of tangible capital assets | (18,440) | (15,943) | ||

| Vacation pay and compensatory leave | - | (15,936) | ||

| Other adjustments | (18,972) | (2,142) | ||

| Revenues | 15 | 90 | ||

| Refunds of Prior Years Expenditures | 26,911 | 15,157 | ||

| 5,834,088 | 6,188,481 | |||

| Adjustments for items not affecting net cost of operations but affecting appropriations | ||||

| Add (Less): | ||||

| Capital Acquisitions of tangible capital assets | 17,976 | - | ||

| Current year appropriations used | 5,852,064 | 6,188,481 | ||

(b) Appropriations provided and used

| (in dollars) | 2007 | 2006 | ||

| Vote 15 Operating expenditures | 5,849,000 | 5,963,000 | ||

| Statutory amounts | 563,841 | 626,036 | ||

| Less: | ||||

| Available for use in future years | - | - | ||

| Lapsed appropriations: Operating | (560,777) | (400,555) | ||

| Current year appropriation used | 5,852,064 | 6,188,481 |

(c) Reconciliation of net cash provided by Government to current year appropriations used

| (in dollars) | 2007 | 2006 | ||

| Net cash provided by Government | 6,125,798 | 6,076,211 | ||

| Revenue not available for spending | 15 | 90 | ||

| Change in net position in the Consolidated Revenue Fund | ||||

| Variation in advances | (129) | 69,079 | ||

| Variation in accounts receivable | (44,202) | 340,610 | ||

| Variation in accounts payable – others | (30,104)) | (191,755) | ||

| Variation in accounts payable – OGD | (235,797) | (36,141) | ||

| Variation in accrued salaries | 28,544 | (82,628) | ||

| Refund of prior year expenditures | 26,911 | 15,157 | ||

| Other adjustments | (18,972) | (2,142) | ||

| (273,734) | 112,180 | |||

| Current year appropriation used | 5,852,064 | 6,188,481 | ||

| (in dollars) | ||||||||

| COST | ACCUMULATED AMORTIZATION | |||||||

| Capital asset class | Opening balance | Acquisitions | Closing balance | Opening balance | Acquisitions | Closing balance |

2007

Net book value

|

2006

Net book value

|

| Machinery and equipment | 230,592 | 17,976 | 248,568 | 198,705 | 18,440 | 217,145 | 31,423 | 31,887 |

- Pension benefits: The Board’s employees participate in the Public Service Pension Plan, which is sponsored and administered by the Government of Canada. Pension benefits accrue up to a maximum period of 35 years at a rate of 2 percent per year pensionable service, times the average of the best five consecutive years of earnings. The benefits are integrated with

Canada/Québec Pension plans benefits and they are indexed by inflation.

Both the employees and the Board contribute to the cost of the Plan. The 2006-07 expense amounts to $415,551 (2005-06 $463,266), which represents approximately 2.2 times the contributions by employees.

The Board’s responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the financial statements of the Government of Canada, as the Plan’s sponsor.