ARCHIVED - Canadian Artists and Producers Professional Relations Tribunal

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

2006-2007

Departmental Performance Report

Canadian Artists and Producers Professional Relations Tribunal

The Honourable Jean-Pierre Blackburn

Minister of Labour and Minister of the Economic Development Agency of Canada for the Regions of Quebec

Table of Contents

-

Section I – Overview

-

Section II – Analysis of Program Activities by Strategic Outcome

-

Section III – Supplementary Information

- Appendix – Financial Statements

Section I – Overview

Chairperson's Message

The Canadian Artists and Producers Professional Relations Tribunal administers a collective bargaining regime for professional self-employed artists and producers in federal jurisdiction. Under Part II of the Status of the Artist Act, the Tribunal defines sectors of artistic and cultural activity for collective bargaining, certifies artists' associations to represent artists working in those sectors, and resolves complaints of unfair labour practices and other matters brought forward by parties under the Act.

Parliament passed the Status of the Artist Act in 1992 as part of a commitment to recognize and reward the contribution of artists to the cultural, social, economic and political enrichment of the country. The Act reflects the recognition that constructive professional relations in the arts and culture sector are an important element of a vibrant Canadian culture and heritage.

Over the past twelve years, the Tribunal has defined 26 sectors of artistic activity and certified 24 artists' associations to represent them. Certified artists' associations have concluded over 60 scale agreements with producers, including government producers and specialty television services, since their certification. In over half of these, this is the first time that the parties have concluded a scale agreement.

While the Tribunal continues to make progress towards its strategic outcome of constructive professional relations between self-employed artists and producers in its jurisdiction, recent developments have challenged the Tribunal to shift the focus of its work. Broadcasting, one of the principal areas of the Tribunal's jurisdiction, is undergoing dramatic transformations – mergers, changes of ownership, new technologies, and the disruption of traditional business models – and these will have a significant impact on the work of the Tribunal. The complexity of the new digital media environment presents artists, artists' association and broadcasters with unprecedented challenges related to certification and negotiation. The Tribunal needs to understand these developments to ensure that labour law principles and the Tribunal's own precedents are applied appropriately.

Much of the work of the Tribunal until recently focused on certification. Most sectors are now defined, and artists' associations are certified to represent them. The Tribunal will likely be called upon to deal with changes in the definition of sectors, and possibly changes in representation, but otherwise its work will probably increasingly shift to complaints and determinations.

To realize its strategic outcome fully, the Tribunal needs to ensure that the Act is widely known and well understood, and that its services are understood and known by the client community to be readily available. Accordingly, for this year and the immediate future the Tribunal has refocused its efforts on fully informing and assisting artists, artists' associations, and producers of their rights and responsibilities under the Act and of the services that the Tribunal can make available to them.

The Tribunal remains committed to recommendations that came out of the Department of Canadian Heritage's 2002 review of the Act. These include amendments to permit arbitration in negotiations for first contracts, streamlining of the process for adding professional categories to be covered by the Act, and the creation of an association of government producers that would negotiate with artists' associations.

The Tribunal is also of the view that an amendment to the Act might facilitate the development of provincial status of the artist legislation. Such legislation would be an important complement to the work of the Tribunal, since so much cultural and artistic work takes place in provincial jurisdiction. At present, Quebec is the only province with a legislated collective bargaining regime for artists and producers. Several other provinces have recently considered similar enactments, but there are concerns about the cost of new provincial specialty tribunals to administer collective bargaining for the cultural sector. The Tribunal believes that, where a provincial statute and the Status of the Artist Act are substantially uniform, there would be advantages in an amendment to the Status of the Artist Act that would permit the Minister and the province to agree that the Tribunal would administer the provincial law on behalf of the province. This would allow the provinces to take advantage of the expertise and resources of the Tribunal, and contribute to consistent administration of similar legislation.

Management Representation Statement

I submit for tabling in Parliament, the 2006 –2007 Performance Report for the Canadian Artists and Producers Professional Relations Tribunal.

This document has been prepared based on the reporting principles contained in the Guide for the Preparation of Part III of the 2006 –2007 Estimates: Reports on Plans and Priorities and Departmental Performance Reports:

- It adheres to the specific reporting requirements outlined in the Treasury Board Secretariat guidance;

- It is based on the department's approved Strategic Outcome and Program Activity Architecture that were approved by the Treasury Board;

- It presents consistent, comprehensive, balanced and reliable information;

- It provides a basis of accountability for the results achieved with the resources and authorities entrusted to it; and

- It reports finances based on approved numbers from the Estimates and the Public Accounts of Canada.

_______________________________________

Peter Annis

Chairperson and Chief Executive Officer

September 14, 2007

Summary Information

Reason for existence

The Canadian Artists and Producers Professional Relations Tribunal administers Part II of the Status of the Artist Act, which governs professional relations between self-employed artists and producers in federal jurisdiction. In doing so, the Tribunal contributes to constructive professional relations between these parties.

| 2006-2007 | ||

|---|---|---|

| Planned Spending | Total Authorities | Actual Spending |

| $1,900 | $1,900 | $1,340 |

| 2006-2007 | ||

|---|---|---|

| Planned | Actual | Difference |

| 10 | 10 | 0 |

| 2006-2007 ($ thousands) | ||||

|---|---|---|---|---|

| Status on Performance | Planned Spending | Actual Spending | ||

| Strategic Outcome: Constructive professional relations between self-employed artists and producers in CAPPRT's jurisdiction | ||||

| Priority No. 1 | Prompt and high quality processing of cases | Met | $1,600 | $1,140 |

| Priority No. 2 | Fully informed and assisted clients | Met | $300 | $200 |

In its Report on Plans and Priorities for 2006-2007, the Tribunal indicated that one of its priorities would be to work on amendments to the Status of the Artist Act, to bring about changes recommended in the 2002 evaluation of the Act. The Tribunal removed this initiative from its priorities because ultimately only the Department of Canadian Heritage can propose amendments to the legislation. However, the Tribunal continues to believe that the changes proposed in the 2002 evaluation of the Act would be beneficial, and remains ready to assist the Department should it begin work on amendments. This decision had no resource implications.

Overall Tribunal Performance

Mandate, Role and Responsibilities

The Canadian Artists and Producers Professional Relations Tribunal is a quasi-judicial, independent federal agency that administers Part II of the Status of the Artist Act, which governs professional relations between self-employed artists and federally regulated producers. The Tribunal reports to Parliament through the Minister of Labour. The Minister of Canadian Heritage also has responsibilities pursuant to Part II of the Act.

Under the Canadian constitution, labour relations between the vast majority of workers and employers fall under provincial jurisdiction. The federal government has jurisdiction over labour relations in a small number of sectors, including broadcasting, telecommunications, banking, interprovincial transportation, and federal government institutions. The Tribunal is one of four federal agencies that regulate labour relations. The other three are the Canada Industrial Relations Board, which deals with labour relations between private sector employers in federal jurisdiction and their employees, the Public Service Labour Relations Board, which deals with labour relations between federal government institutions and their employees, and the Public Service Staffing Tribunal, which deals with complaints from federal public service employees related to internal appointments and lay-offs.

The Tribunal's jurisdiction over producers is set out in the Status of the Artist Act, and covers broadcasting undertakings under the jurisdiction of the Canadian Radio-television and Telecommunications Commission, federal government departments, and the majority of federal agencies and Crown corporations (such as the National Film Board and the national museums).

The Tribunal's jurisdiction over self-employed artists also is set out in the Status of the Artist Act, and includes artists covered by the Copyright Act (such as writers, photographers, and music composers), performers (such as actors, musicians, and singers), directors, and other professionals who contribute to the creation of a production, such as those doing camera work, lighting and costume design.

The Tribunal has the following statutory responsibilities:

- To define the sectors of cultural activity suitable for collective bargaining between artists' associations and producers,

- To certify artists' associations to represent self-employed artists working in these sectors, and

- To deal with complaints of unfair labour practices and other matters brought forward by artists, artists' associations, and producers, and prescribe appropriate remedies.

Artists' associations certified under the Status of the Artist Act have the exclusive right to negotiate scale agreements with producers. A scale agreement specifies the minimum terms and conditions under which producers engage the services of, or commission a work from, a self-employed artist in a specified sector.

The Status of the Artist Act and the Tribunal's statutory responsibilities, professional category regulations, decisions, and reports to Parliament and central agencies can be found on the Tribunal's Web site at www.capprt-tcrpap.gc.ca.

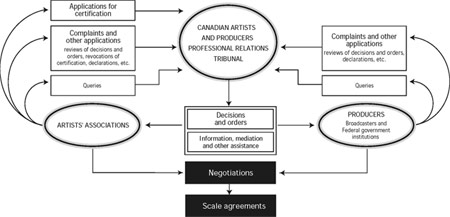

Figure 1 illustrates the Tribunal's responsibilities and the key processes under the Status of the Artist Act, Part II.

Figure 1. Tribunal Responsibilities and Key Processes

STATUS OF THE ARTIST ACT

Operating Environment and Context

The economics of artistic endeavour

Culture and the arts contribute significantly to Canada's economy. In 2002, the most recent year for which statistics are available, the arts and culture sector contributed $39 billion to the Canadian economy – almost 4 percent of gross domestic product. Beyond their economic contribution, Canadian artists enrich our lives and represent us at home and abroad.

Their earnings, however, do not reflect their contributions to the country. According to Statistics Canada, artists' average income rose 26 percent from 1991 to 2001. Yet that increase only brought their average income to $23,500, still well below the average for all workers in Canada ($31,800), despite the higher than average level of education of artists.

Besides having lower earnings, many artists are self-employed, and thus do not have the advantages enjoyed by employees, such as employment insurance, training benefits and pension funds. For example, according to the census, almost 70 percent of visual artists and close to 50 percent of writers and craftspersons work as independent entrepreneurs. An estimated 100,000 self-employed artists fall under the Tribunal's jurisdiction.1

The federal government has various institutions, programs and policies to recognize and support artists and producers. The Status of the Artist Act and the Tribunal are part of the federal support system for Canadian arts and culture.

Limitations of the Status of the Artist Act

The impact of the Act is limited, however, by its application to a small jurisdiction. Most work in the cultural sector, including the vast majority of film and television production, sound recording, art exhibitions, theatrical production and book publishing, falls under the jurisdiction of the provinces. To date, Quebec is the only province with legislation granting collective bargaining rights to self-employed artists. The need for provincial legislation was recognized by the Standing Committee on Canadian Heritage in its ninth report in 1999, and by the Department of Canadian Heritage in its 2002 evaluation2 of the provisions and operations of the Status of the Artist Act.

Saskatchewan adopted enabling legislation on the status of the artist in 2002, and the Saskatchewan government has attempted to introduce a legal collective bargaining framework for artistic work, but as yet the legislation has not passed. The province of Ontario recently passed legislation that dealt with status of the artist, but did not address collective bargaining.

The Tribunal supports the adoption of status of the artist legislation by more provinces. The Tribunal assisted the Saskatchewan legislature, at its request, in its deliberations on its status of the artist legislation, describing how the federal model works and the experience and lessons learned since the federal act was passed. The Tribunal will continue to provide information to policy makers and others interested in the benefits of such legislation.

The Act's effectiveness is also limited because few federal government institutions – one of the class of producers covered by the Act – have entered into scale agreements with artists' associations. Artists' associations are typically hard-pressed for time and resources, and they would rather negotiate with producers' associations than with individual producers. Similarly, many government producers would prefer to designate one department as their lead negotiator. One of the recommendations from the Department of Canadian Heritage's 2002 evaluation report was that the government consider establishing a single bargaining authority for all departments. The Tribunal supports this recommendation, as it would facilitate the bargaining process and make it more cost-effective.

The challenge of operating a small federal agency

Its specific legislation and unique stakeholder base aside, the Tribunal is like any other federal government department: it must exercise care and restraint in the spending of public funds, and provide Parliament and Canadians with transparent and accountable reporting. At its creation in 1993, the Tribunal adopted efficient business practices, with clear statements of objectives, high standards for service delivery, a comprehensive performance measurement framework, and transparent reporting on its activities and results. Its management team embraced this framework at its inception and has been guided by it as it evolves.

As a very small agency, the Tribunal faces a particular operating challenge, with its small staff responsible for a myriad of tasks. This is compounded by the fact that the workload is unpredictable and changing, since parties themselves decide whether to bring cases to the Tribunal. To meet these particular challenges, the Tribunal follows flexible practices such as contracting-out and sharing of accommodation, as described in Section II under Financial Management and Leadership.

Alignment with Government of Canada Outcomes

In encouraging constructive labour relations between self-employed artists and producers in its jurisdiction, the Tribunal expects that artists' income and working conditions will improve, artists will be more likely to pursue their careers in the arts, and producers will have an adequate pool of talented and trained artists. Thus, the Tribunal's single operating program aligns with the Government's intended outcome of a vibrant Canadian culture and heritage.

Overall Performance

The Tribunal has one strategic outcome, constructive professional relations between self-employed artists and producers under its jurisdiction, and one program activity, processing of cases brought before it. Its overall performance is equivalent to its “performance by strategic outcome,” reported in Section II. As will be seen in Section II, the Tribunal continues to make progress in achieving its strategic outcome.

Section II – Analysis of Program Activities by Strategic Outcome

Strategic Outcome:

Constructive professional relations between artists and producers

Part II of the Act, and the collective bargaining regime set up under it, are intended to encourage constructive professional relations between artists and producers in federal jurisdiction. This is the sole strategic outcome under the Tribunal's Program Activity Architecture approved by Treasury Board for 2006-2007.

During fiscal 2006-2007, the Tribunal pursued two priorities in order to achieve this strategic outcome. It continued to focus on dealing with requests under the legislation with prompt and high quality service. And it greatly increased its focus on fully informing and assisting clients. (As noted in Section I, a third priority identified in the 2006-2007 Report on Plans and Priorities, assistance in the preparation of amendments to the Act, was not pursued, as it was beyond the Tribunal's mandate.)

The performance measurement framework for these priorities is presented in the Tribunal's Report on Plans and Priorities and is summarized below. The performance results are reported below and shown in Tables A, B and C.

Priority 1: Prompt and high-quality service

The level of case activity in 2006-2007 was similar to that in 2005-2006. The Tribunal made final decisions in six cases (five of which were resolved without hearings) and made two interim decisions. At year's end, two cases were pending. Details on the cases are presented in the Tribunal's annual report for 2006-2007 and its Information Bulletins, all available on the Tribunal's Web site at www.capprt-tcrpap.gc.ca.

The Tribunal has assessed promptness by looking at the time taken to issue reasons after a hearing, and the time required to process applications. The first of these indicators remains controversial for the Tribunal; an accurate assessment of the promptness of case processing arguably should take account of cases that are concluded without hearings. The Tribunal has decided to continue using this indicator for now, but it is re-evaluating it and may adjust it in the Report on Plans and Priorities for the coming planning period.

In the one case for which it issued reasons for a decision, the Tribunal took 29 days to issue its decision after the hearing, well within its target of 60. On the second indicator of promptness, the average time required to process applications, the Tribunal exceeded its target and significantly improved its performance over the average for the preceding 10 years. These results are set out in Table A.

| Indicator | Target | Results |

|---|---|---|

| Average time to issue reasons for a decision after the hearing in all cases | Maximum of 60 calendar days | 29 days |

| Average time to process all cases (from the date of receipt of the completed application to the date of the decision) | Maximum of 200 calendar days | 73 days |

The second aspect of this priority is high-quality processing of cases. This refers to the work of staff, in preparing cases and providing legal advice, and of members, in deliberating and making decisions.

The indicator that has been used is the proportion of Tribunal decisions that are upheld under judicial review. Pursuant to the Status of the Artist Act, a party may, under specific circumstances, challenge a Tribunal decision by requesting a judicial review by the Federal Court of Appeal.

The Tribunal readily acknowledges that this indicator is not ideal. The decision of a party to seek or not to seek judicial review may be unrelated to the quality of the decision. Moreover, the grounds for judicial review of a Tribunal decision are limited. The Federal Court of Appeal does not assess the correctness of the Tribunal's decisions; it will intervene only if the Tribunal has:

- Acted without or beyond its jurisdiction, or refused to exercise its jurisdiction;

- Failed to observe a principle of natural justice, procedural fairness or other procedure that it is required by law to observe; or

- Acted, or failed to act, by reason of fraud or perjured evidence.

Several labour boards and other administrative tribunals monitor and report on this statistic. Most have not established a target to achieve in this regard, however, and they do not relate this reporting to any evaluation of the quality of their work. The Tribunal will continue to look for alternatives to this indicator.

As indicated in Table B, the Tribunal has met its objectives for this indicator. To date, only three of the Tribunal's 86 interim and final decisions have been challenged in this manner. Two requests for judicial review were dismissed by the Federal Court of Appeal, one in 1998-1999 and one in 2004-2005. The third request was withdrawn.

| Indicator | Target | 1996-2007 |

|---|---|---|

| Percentage of applications for judicial review that have been granted | Less than 50 percent | 0 percent |

Priority 2: Clients fully informed and assisted

The Tribunal has a responsibility to ensure that artists, artists' associations and producers are fully aware of their rights and responsibilities under the Status of the Artist Act. For parties to benefit from the Act, for negotiations to take place and for the long-term objectives of the Act to be realized, the parties must fully understand the legislation.

This priority has always been treated seriously, but its importance has become more pronounced recently, and accordingly it was the Tribunal's principal focus in 2006-2007. The Tribunal recognizes that it needs to improve its relationship with artists' associations and producers, especially in view of the potential impact on the work of the Tribunal of current developments in broadcasting and new media. Broadcasting is one of the principal areas of the Tribunal's jurisdiction, and the challenges of transformations in the broadcasting industry – mergers, changes of ownership, new technologies, and the weakening of traditional business models – for artists' associations and broadcasters require new efforts from the Tribunal to facilitate certification and negotiation under the Act.

Table C shows the targets for informing and assisting clients, and the results. The discrepancies between the targets and the results reflect the change in the Tribunal's priorities and strategy. It should also be noted that the indicators themselves are imperfect.

Two information bulletins were issued, rather than the target of three. Information bulletins are intended primarily to advise the public of developments in the Tribunal's core work of dealing with cases brought before it, and two information bulletins were sufficient to address the number of cases. A client survey to assess the quality of the information would have been of little significance, based on two bulletins, and so was not conducted.

The Tribunal's Web site was updated regularly to ensure that the information on it is timely and accurate. It was also significantly modified and reorganized, to emphasize the services that the Tribunal can make available to artists, artists' associations, and producers. In the first major step in what will eventually be a complete overhaul, the Web site now focuses visitors' attention on what the Tribunal can do for them and on how to do business with the Tribunal, with the information tailored according to whether the visitor is an artist, artists' association, or producer. Information about the Status of the Artist Act and answers to questions about its application and significance are now much more prominent. As the modifications on the website are recent, the client survey to assess the effectiveness of the Tribunal's website was not carried out.

The Act is still relatively recent and parties are still learning how to implement it, and this remains a principal communications objective of the Tribunal. Staff members have in the past held information sessions to clarify the obligations and rights of parties in bargaining under the Act, and to allow organizations to share their information and experiences with each other. The information sessions have been useful and well-received by clients. Because information sessions were held within the last two years with both artists' associations and producers, presentations were not held in the course of 2006-2007. Rather, the Tribunal's Communications Branch put its emphasis on revising the communications strategy, focusing on how the Tribunal can be of service to artists, artists' associations and producers.

The Tribunal receives many inquiries from or on behalf of artists, artists' associations, and producers, concerning, for example, their rights and obligations under the Status of the Artist Act or whether their activities fall within the Tribunal's jurisdiction. The Tribunal has undertaken to respond to each request on a timely basis and to assist parties. Accordingly, a performance indicator for the communications function is accuracy and timeliness of responses to enquiries and requests for information.

The target is that enquiries and requests for information are dealt with within two working days, and that clients, as determined by survey, are satisfied. This indicator will be measured over several fiscal years, through a survey of client satisfaction.

| Indicator | Target | Results 2005 –2006 |

Results 2006-2007 |

|---|---|---|---|

| Quality and timeliness of information bulletins | At least three information bulletins are issued annually. Clients are satisfied (as determined by client survey). | Two bulletins were issued. Clients were not surveyed. | Two bulletins were issued. Clients were not surveyed. |

| Quality of the Tribunal's Web site. | The Web site contains timely and accurate information and meets GOL (Government On- Line) standards. Clients are satisfied (as determined by client survey). | The Web site was made almost completely compliant with GOL standards and contains timely and accurate information. Clients were not surveyed | The Web site was significantly amended to focus on client service. Information is timely and accurate. Clients were not surveyed. |

| Success of information sessions for clients | Clients are satisfied, as determined by survey of attendees. | 2/3 of respondents were pleased to very pleased with the information sessions. | N/A: information sessions were not held, because they had been held recently with all clients. |

| Accuracy and timeliness of responses to enquiries and requests for information. | Enquiries and requests for information are dealt with within two working days. Clients are satisfied (multi-year average determined by client survey). | Few enquiries or requests were received. Prompt and proper responses are ensured by managers and staff. | 65% of enquiries and requests were dealt with within one working day. 85% were dealt with within two working days. |

Other indicators of progress

The Tribunal also uses other indicators, over multi-year periods, to monitor the achievement of constructive professional relations in the cultural sector. One is the proportion of complaints that are resolved without the necessity of a hearing by the Tribunal. Joint resolution of issues fosters cooperation between artists and producers, and saves time and money for the parties and the Tribunal by reducing the need for costly hearings. Accordingly, the Tribunal encourages parties to resolve as many issues as possible jointly before proceeding to a hearing, and the parties frequently find that they can resolve all the issues jointly. The Tribunal Secretariat provides assistance, where appropriate, through investigation and mediation, and in 2006-2007 emphasized augmenting staff's knowledge and skills in the issues facing the arts sector, so that the staff members are better able to meet the needs of clients.

Table D shows the progress against this indicator. It should be noted that, as with many performance indicators, this is an approximate measure. Parties will withdraw complaints for various reasons. For example, sometimes the filing of a complaint will in itself bring the parties together to resolve the issue without any intervention of the Tribunal.

The negotiation of scale agreements is another indicator of constructive professional relations. Again, this is an approximate measure. The Tribunal can facilitate negotiations by granting certification, providing information about the Act's provisions for negotiations, and dealing with complaints of failure to bargain in good faith. It has little influence, however, over whether the parties actually pursue negotiations after certification, or over the results of such negotiations. Moreover, because there is no provision for first contract arbitration in the legislation, parties may be involved in bargaining for years without ever concluding an agreement. As was noted in Section 1, a legislative amendment would help to rectify this deficiency. Until that happens, we are likely to continue to see large numbers of outstanding notices to bargain.

With respect to the negotiation of scale agreements, a lot has been accomplished, if less than hoped for, as shown in Table D. Thirty-five percent of certified artists' associations have negotiated a new scale agreement within 5 years of certification, compared to the expected target of 80 percent. An additional 23 percent have negotiated a new agreement after the five-year target period. Sixty-two percent of certified artists' associations have at least one outstanding notice to bargain a new agreement.

| Indicator | Target | Results 1998 –2007 |

|---|---|---|

| Percentage of complaints resolved without a hearing | At least 50% of all complaints are resolved without a hearing. | 54% were resolved without a hearing. |

| Proportion of certified artists' associations with a first agreement within five years of certification. | A minimum of 80% of certified artists' associations negotiated at least one new scale agreement within five years of being certified. | 35% have negotiated at least one new scale agreement within five years of certification. Another 23% have negotiated a new scale agreement more than five years after certification. |

Financial Management and Leadership

As in previous years, the Tribunal used outsourcing and cost-saving agreements for many services not required on a full-time basis. For example, since the beginning of its operations, the Tribunal has contracted with the Department of Canadian Heritage for human resources services and with Industry Canada for informatics, security and mail services. It has arrangements with two other federal labour boards to use their hearing rooms and library services. It also contracts for the services of a financial analyst. It continues to select multi-skilled, flexible staff capable of handling a wide variety of responsibilities. The Tribunal members are part-time appointees. This is economically efficient on the whole, as they are called on and paid only as needed, although it can make scheduling more difficult. All Tribunal members are currently bilingual, which facilitates scheduling. The agency continues to share accommodation and administrative and financial services with the Environmental Protection Review Committee (EPRC), thereby lowering the overall costs to the government.

The cost of many of these agreements and services increased from the previous year, along with costs for assets and supplies such as software licences and informatics hardware. As a result, the Tribunal's expenditures increased from the previous year by some $259,000.

In order to improve its operational efficiency as well as its capability to measure performance, the Tribunal has continued to modernize and refine its case management database over the course of 2006-2007.

The Tribunal continued to develop its management practices, working in a cluster group with three other small quasi-judicial agencies, the Competition Tribunal, the Copyright Board and the Transportation Appeal Tribunal. The cluster group focused on the implementation of the new Public Service Modernization Act, particularly on developing an Informal Conflict Management System, and preparing for the Management Accountability Framework Assessment scheduled for the fall of 2007.

Section III – Supplementary Information

Organizational Information

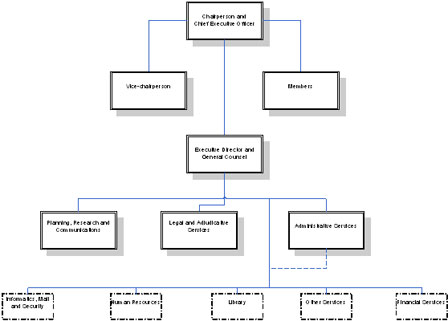

The Tribunal is currently composed of a chairperson (who is also the chief executive officer), a vice-chairperson and two other members. Members are appointed by the Governor in Council. All four members are part-time appointees.

The executive director and general counsel heads the Tribunal Secretariat and reports to the chairperson. Ten staff members (when the Secretariat is fully staffed) carry out the functions of legal counsel, registrar, planning, research, communications, and administrative services. The Tribunal outsources some standard corporate services that are not required full time, such as informatics and human resources. Figure 2 illustrates the Tribunal’s organizational structure.

Figure 2. Organization Chart

![]() Services provided on contract or by other arrangements (Please see Section II, Financial Management and Comptrollership, for more detail)

Services provided on contract or by other arrangements (Please see Section II, Financial Management and Comptrollership, for more detail)

Contact for Further Information

Canadian Artists and Producers Professional Relations Tribunal

240 Sparks Street, 1st Floor West

Ottawa, Ontario K1A 1A1

Telephone: (613) 996-4052 or 1-800-263-2787

Fax: (613) 947-4125

E-mail: info@capprt-tcrpap.gc.ca

Web site: www.capprt-tcrpap.gc.ca

Legislation Administered and Associated Regulations

| An Act respecting the status of the artist and professional relations between artists and producers in Canada (Short Title: Status of the Artist Act) | S.C. 1992, c.33, as amended |

| Status of the Artist Act Professional Category Regulations | SOR 99/191 |

| Canadian Artists and Producers Professional Relations Tribunal Procedural Regulations | SOR/2003-343 |

| ($ thousands) | 2004-05 Actual | 2005-06 Actual | 2006-2007 | |||

|---|---|---|---|---|---|---|

| Main Estimates | Planned Spending | Total Authorities | Total Actuals | |||

| Processing of cases | 1,430 | 1,086 | 1,929 | 1,929 | 1,900 | 1,341 |

| Total | 1,430 | 1,086 | 1,929 | 1,929 | 1,900 | 1,341 |

| Less: Non-respendable revenue | ||||||

| Plus: Cost of services received without charge* | 389 | 397 | 405 | 405 | 405 | 405 |

| Total Departmental Spending | 1,819 | 1,483 | 2,334 | 2,334 | 2,305 | 1,746 |

| Full-time Equivalents | 10 | 10 | 10 | 10 | ||

| 2006-2007 | ||||

|---|---|---|---|---|

| ($ 000s) Program Activity |

Budgetary | Total | ||

| Operating | Total: Gross Budgetary Expenditures | Total: Net Budgetary Expenditures | ||

| Processing of cases | ||||

| Main Estimates | 1,929 | 1,929 | 1,929 | 1,929 |

| Planned Spending | 1,929 | 1,929 | 1,929 | 1,929 |

| Total Authorities | 1,900 | 1,900 | 1,900 | 1,900 |

| Actual Spending | 1,341 | 1,341 | 1,341 | 1,341 |

| ($ 000s) Vote or Statutory Item |

Truncated Vote or Statutory Wording | 2006–07 | ||||

|---|---|---|---|---|---|---|

| Main Estimates |

Planned Spending |

Total Authorities |

Total Actuals | |||

| 15 | Operating expenditures | 1,757 | 1,757 | 1,773 | 1,214 | |

| (S) | Contributions to employee benefit plans | 172 | 172 | 127 | 127 | |

| Total | 1,929 | 1,929 | 1,900 | 1,341 | ||

| ($ 000s) | 2006–2007 Actual Spending |

|---|---|

| Accommodation provided by Public Works and Government Services Canada | 333 |

| Contributions covering employers’ share of employees’ insurance premiums and expenditures paid by Treasury Board of Canada Secretariat (excluding revolving funds) | 72 |

| Salary and associated expenditures of legal services provided by the Department of Justice Canada | 0 |

| Total 2006–2007 Services received without charge | 405 |

Appendix – Financial Statements

Canadian Artists and Producers Professional Relations Tribunal

Statement of Management Responsibility

Responsibility for the integrity and objectivity of the accompanying financial statements of the Canadian Artists and Producers Professional Relations Tribunal (Tribunal) for the year ended March 31, 2007 and all information contained in these statements rests with the Tribunal's management. These financial statements have been prepared by management in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management's best estimates and judgment and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of the Tribunal's financial transactions. Financial information submitted to the Public Accounts of Canada and included in the Tribunal's Departmental Performance Report is consistent with these financial statements.

Management maintains a system of financial management and internal control designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are in accordance with the Financial Administration Act, are executed in accordance with prescribed regulations, within Parliamentary authorities, and are properly recorded to maintain accountability of Government funds. Management also seeks to ensure the objectivity and integrity of data in its financial statements by careful selection, training and development of qualified staff, by organizational arrangements that provide appropriate divisions of responsibility, and by communication programs aimed at ensuring that regulations, policies, standards and managerial authorities are understood throughout the Tribunal.

The financial statements of the Tribunal have not been audited.

Ottawa, Canada

Date: August 14, 2007

| 2007 | 2006 | |

|---|---|---|

| Expenses | ||

| Processing of applications | ||

| salaries and employee benefits | $ 968,681 | $ 901,062 |

| accommodation | $ 332,960 | $ 329,616 |

| professional and special services | $ 218,018 | $ 144,345 |

| transportation and telecommunications | $ 74,925 | $ 74,845 |

| utilities, materials and supplies | $ 35,070 | $ 12,729 |

| rentals | $ 20,351 | $ 24,402 |

| repair and maintenance | $ 19,516 | $ 3,121 |

| information | $ 14,103 | $ 13,861 |

| amortization of tangible capital assets | $ 11,034 | $ 29,304 |

| Net cost of operations | $ 1,694,658 | $ 1,533,285 |

The accompanying notes are an integral part of these financial statements.

| 2007 | 2006 | |

|---|---|---|

| Assets | ||

| Financial assets | ||

| Accounts receivable and advances (Note 4) | $90,069 | $184,015 |

| Total financial assets | $90,069 | $184,015 |

| Non-financial assets | ||

| Tangible capital assets (Note 5) | $39,253 | $20,041 |

| Total non-financial assets | $39,253 | $20,041 |

| TOTAL | $129,322 | $204,056 |

| Liabilities | ||

| Accounts payable and accrued liabilities | $92,945 | $66,168 |

| Vacation pay and compensatory leave | $33,767 | $38,474 |

| Employee severance benefits (Note 6) | $115,354 | $158,426 |

| Total liabilities | $242,066 | $263,068 |

| Equity of Canada | $(112,744) | $(59,012) |

| TOTAL | $129,322 | 4204,056 |

The accompanying notes are an integral part of these financial statements.

| 2007 | 2006 | |

|---|---|---|

| Equity of Canada, beginning of year | (59,012) | (162,131) |

| Net cost of operations | (1,694,658) | (1,533,285) |

| Current year appropriations used (Note 3) | 1,340,909 | 1,086,144 |

| Change in net position in the Consolidated Revenue Fund (Note 3) | (105,423) | 155,524 |

| Services provided without charge by other Government departments (Note 7) | 405,440 | 394,736 |

| Equity of Canada, end of year | (112,744) | (59,012 |

The accompanying notes are an integral part of these financial statements.

| 2007 | 2006 | |

|---|---|---|

| Operating Activities | ||

| Net cost of operations | $1,694,658 | $1,533,285 |

| Non-cash items: | ||

| Amortization of tangible capital assets (Note 5) | (11,034) | (29,304) |

| Services provided without charge by other government departments (Note 7) | (405,440) | (394,736) |

| Variations in Statement of Financial Position | ||

| Increase (decrease) in accounts receivable and advances | (93,946) | 128,241 |

| Decrease (increase) in liabilities | 21,002 | 4,182 |

| Cash used by operating activities | $1,205,240 | $1,241,668 |

| Capital investment activities | ||

| Acquisitions of tangible capital assets | 30,246 | - |

| Cash used by capital investment activities | 30,246 | - |

| Financing activities | ||

| Net cash provided by Government of Canada | $(1,235,486) | $(1,241,668) |

The accompanying notes are an integral part of these financial statements.

Canadian Artists and Producers Professional Relations Tribunal

Notes To The Financial Statements (unaudited)

1. Authority and Objectives

The Canadian Artists and Producers Professional Relations Tribunal (Tribunal) is the independent, quasi-judicial adjudicative tribunal created in 1993 by the Status of the Artist Act. Its mandate is to define the sectors of cultural activity subject to federal jurisdiction that are suitable for collective bargaining, to certify artists' associations to represent independent entrepreneurs working in these sectors, to hear and decide complaints of unfair practices filed by artists, artists' associations and producers, and, to prescribe appropriate remedies for contraventions of the Status of the Artist Act.

2. Summary of Significant Accounting Policies

The financial statements have been prepared in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector.

Significant accounting policies are as follows:

(a) Parliamentary appropriations

The Tribunal is financed by the Government of Canada through Parliamentary appropriations. Appropriations provided to the Tribunal do not parallel financial reporting according to Canadian generally accepted accounting principles since appropriations are primarily based on cash flow requirements. Consequently, items recognized in the statement of operations and the statement of financial position are not necessarily the same as those provided through appropriations from Parliament. Note 3 provides a high-level reconciliation between the two bases of reporting.

(b) Net cash provided by Government

The Tribunal operates within the Consolidated Revenue Fund (CRF) which is administered by the Receiver General for Canada. All cash received by the Tribunal is deposited to the CRF and all cash disbursements made by the Tribunal are paid from the CRF. Net cash provided by government is the difference between all cash receipts and all cash disbursements including transactions between departments of the federal government.

(c) Change in net position in the Consolidated Revenue Fund

The change is the difference between the net cash provided by Government and appropriations used in a year. It results from timing differences between when a transaction affects appropriations and when it is processed through the CRF.

(d) Expenses

Expenses are recorded on the accrual basis:

- Vacation pay and compensatory leave are expensed as the benefits accrue to employees under their respective terms of employment.

- Services provided without charge by other government departments for accommodation and the employer's contribution to the health and dental insurance plans are recorded as operating expenses at their estimated cost.

(e) Employee future benefits

- Pension benefits: Eligible employees participate in the Public Service Pension Plan, a multiemployer plan administered by the Government of Canada. The Tribunal's contributions to the Plan are charged to expenses in the year incurred and represent the total Tribunal obligation to the Plan. Current legislation does not require the Tribunal to make contributions for any actuarial deficiencies of the Plan.

- Severance benefits: Employees are entitled to severance benefits under labour contracts or conditions of employment. These benefits are accrued as employees render the services necessary to earn them. The obligation relating to the benefits earned by employees is calculated using information derived from the results of the actuarially determined liability for employee severance benefits for the Government as a whole.

(f) Accounts receivable and advances

Accounts receivable and advances are stated at amounts expected to be ultimately realized; a provision is made for receivables where recovery is considered uncertain.

(g) Tangible capital assets

All tangible capital assets and leasehold improvements having an initial cost of $3,000 or more are recorded at their acquisition cost. The Tribunal does not capitalize intangibles, works of art and historical treasures that have cultural, aesthetic or historical value, assets located on Indian Reserves and museum collections.

Amortization of tangible capital assets is done on a straight-line basis over the estimated useful life of the asset as follows:

| Asset Class | Amortization Period |

|---|---|

| Informatics hardware | 3 years |

| Other equipment | 5 years |

(h) Measurement uncertainty

The preparation of these financial statements in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities and expenses reported in the financial statements. At the time of preparation of these statements, management believes the estimates and assumptions to be reasonable. The most significant items where estimates are used are the liability for employee severance benefits and the useful life of tangible capital assets. Actual results could significantly differ from those estimated. Management's estimates are reviewed periodically and, as adjustments become necessary, they are recorded in the financial statements in the year they become known.

3. Parliamentary appropriations

The Tribunal receives its funding through annual Parliamentary appropriations. Items recognized in the statement of operations and the statement of financial position in one year may be funded through Parliamentary appropriations in prior, current or future years. Accordingly, the Tribunal has different net results of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled in the following tables:

| 2007 | 2006 | ||

|---|---|---|---|

| Net cost of operations (in dollars) | 1,694.658 | 1,533,285 | |

| Adjustments for items affecting net cost of operations but not affecting appropriations | |||

| Add (Less): | |||

| Services provided without charge by other government departments | (405,440) | (394,736) | |

| Amortization of tangible capital assets | (11,034) | (29,304) | |

| Decrease (Increase) in employee severance benefits liability | 43,072 | (28,041) | |

| Decrease in vacation pay and compensatory leave liability | 4,707 | 3,981 | |

| Other | (15,300) | 959 | |

| 1,310,663 | 1,086,144 | ||

| Adjustments for items not affecting net cost of operations but affecting appropriations | |||

| Add: Tangible capital assets acquisitions | 30,246 | ||

| Current year appropriations used | 1,340,909 | 1,086,144 | |

| Appropriations Provided (in dollars) |

|||

|---|---|---|---|

| 2007 | 2006 | ||

| Vote 20 - Operating expenditures | 1,773,000 | 1,665,000 | |

| Statutory amounts | 126,830 | 128,880 | |

| Less: | |||

| Lapsed appropriations: Operating | (558,921) | (707,736 | |

| Current year appropriations used | 1,340,909 | 1,086,144 | |

| 2007 (in dollars) |

2006 (in dollars) |

|

|---|---|---|

| Net cash provided by Government | 1,235,486 | 1,241,668 |

| Change in net position in the Consolidated Revenue Fund | ||

| Decrease (increase) in accounts receivable and advances | 93,946 | (128,241) |

| Increase (decrease) in accounts payable and accrued liabilities | 26,777 | (28,243) |

| Other adjustments | (15,300) | 960 |

| 105,423 | (155,524) | |

| Current year appropriations used | 1,340,909 | 1,086,144 |

4. Accounts Receivable and Advances

| 2007 (in dollars) |

2006 (in dollars) |

|

|---|---|---|

| Receivables from other Federal Government departments and agencies | 87,051 | 180,997 |

| Receivables from external parties | 2,218 | 2,218 |

| Employee advances | 800 | 800 |

| Total | 90,069 | 184,015 |

5. Tangible Capital Assets

| Cost | ||||

|---|---|---|---|---|

| Opening balance | Acquisitions | Disposals and write-offs | Closing balance | |

| Capital asset class | ||||

| Informatics hardware | 186,670 | 22,430 | 209,100 | |

| Other equipment | 75,391 | 7,816 | 83,207 | |

| Total | 262,061 | 30,246 | - | 292,307 |

| Accumulated amortization | ||||

|---|---|---|---|---|

| Opening balance | Amortization | Disposals and write-offs | Closing balance | |

| Capital asset class | ||||

| Informatics hardware | 186,670 | 186,670 | ||

| Other equipment | 55,349 | 11,034 | 66,383 | |

| Total | 242,019 | 11,034 | - | 253,053 |

| Informatics hardware | 22,430 | - | ||

|---|---|---|---|---|

| Other equipment | 16,823 | 20,042 | ||

| Total | 39,253 | 20,042 | ||

| Net Book Value | ||||

| 2007 | 2006 | |||

Amortization expense for the year ended March 31, 2007 is $11,034 (2006 is $29,304).

6. Employee benefits

a) Pension benefits

The Tribunal’s employees participate in the Public Service Pension Plan, which is sponsored and administered by the Government of Canada. Pension benefits accrue up to a maximum period of 35 years at a rate of 2 percent per year of pensionable service, times the average of the best five consecutive years of earnings. The benefits are integrated with Canada/Quebec Pension Plans benefits and they are indexed to inflation.

Both the employees and the Tribunal contribute to the cost of the Plan. The 2006-07 expense amounts to $126,830 ($95,371 in 2005-06) which represents approximately 2.2 times (2.6 times in 2005-06) the contributions by employees.

The Tribunal's responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the financial statements of the Government of Canada, as the Plan's sponsor.

b) Severance benefits

The Tribunal provides severance benefits to its employees based on eligibility, years of service and final salary. These severance benefits are not pre-funded. Benefits will be paid from future appropriations. Information about the severance benefits, measured as at March, is as follows:

| 2007 (in dollars) |

2006 (in dollars) |

|

|---|---|---|

| Accrued benefit obligation, beginning of the year | 158,426 | 130,385 |

| Expense for the year | (43,072) | 28,041 |

| Benefits paid during the year | - | - |

| Accrued benefit obligation, end of the year | 115,354 | 158,426 |

7. Related party transactions

The Tribunal is related as a result of common ownership to all Government of Canada departments, agencies and Crown Corporations. The Tribunal enters into transactions with these entities in the normal course of business and on normal trade terms. Also, during the year, the Tribunal received services which were obtained without charge from other Government departments as presented in part (a).

a) Services provided without charge:

During the year, the Tribunal received without charge from other government departments, accommodation and the employer’s contribution to the health and dental insurance plans. These services without charge have been recognized in the Tribunal’s Statement of Operations as follows:

| 2007 (in dollars) |

2006 (in dollars) |

|

|---|---|---|

| Accommodation | 332,960 | 329,616 |

| Employer's contribution to the health and dental insurance plans | 72,480 | 65,120 |

| Total | 405,440 | 394,736 |

The Government has structured some of its administrative activities for efficiency and cost-effectiveness purposes so that one department performs these on behalf of all without charge. The cost of these services, which include payroll and cheque issuance services provided by Public Works and Government Services Canada, are not included as an expense in the Tribunal's Statement of Operations.

b) Payables outstanding at year-end with related parties:

| 2007 (in dollars) |

2006 (in dollars) |

|

|---|---|---|

| Accounts payable to other government departments and agencies | 24,864 | 12,052 |

1. Sources: Hill Strategies Research, September 2004: Statistical Profile of Artists in Canada; Hill Strategies Research, March 2005: Arts Research Monitor

2. Available on the Internet at: www.pch.gc.ca/progs/em-cr/eval/2002/2002_25/tdm_e.cfm